Richard looks beyond Morgan Sindall’s excellent numbers to find any Big Obvious Objections (or Boo’s) to investing in the business. Meanwhile, 11 shares make it through the 5 Strikes filters.

In the last fortnight 21 companies have published annual reports and passed my minimum quality filter. Eleven of them achieved less than 3 strikes.

5 Strikes

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| PageGroup | PAGE | 14/4/25 | – Holdings – Growth | 2 |

| Tullow Oil | TLW | 14/4/25 | – Holdings ? CROCI – Debt – Growth – ROCE – Shares | X |

| Vistry | VTY | 14/4/25 | ? Acquisitions – CROCI ? Growth – ROCE – Shares | 4 |

| Hill & Smith | HILS | 11/4/25 | ? Holdings ? Acquisitions | 1 |

| Ibstock | IBST | 11/4/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| Macfarlane | MACF | 11/4/25 | ? Holdings – Growth – Shares | 2 |

| Ferrexpo | FXPO | 10/4/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| Alliance Pharma | APH | 9/4/25 | – Acquisitions – Shares – CROCI/PROFIT | 3 |

| Computacenter | CCC | 9/4/25 | 0 | |

| Next | NXT | 9/4/25 | – Debt ? Growth | 2 |

| Vesuvius | VSVS | 9/4/25 | ? Holdings – Debt – Growth ? ROCE | 3 |

| FDM Group | FDM | 8/4/25 | – Growth | 1 |

| Keller | KLR | 8/4/25 | – Holdings – CROCI – ROCE | 3 |

| Spirax | SPX | 8/4/25 | – Holdings – Debt ? Growth | 2 |

| Savills | SVS | 7/4/25 | ? Holdings – CROCI ? Growth ? ROCE | 3 |

| Mortgage Advice Bureau | MAB1 | 4/4/25 | – Shares | 1 |

| Balfour Beatty | BBY | 3/4/25 | – Growth – CROCI – ROCE | 3 |

| Centaur Media | CAU | 3/4/25 | – Holdings – Growth – ROCE | 3 |

| Marshalls | MSLH | 3/4/25 | – Holdings – Debt – Growth – Shares | 4 |

| Michelmersh Brick | MBH | 3/4/25 | – Holdings – Growth – ROCE – Shares | 4 |

| Clarkson | CKN | 2/4/25 | ? ROCE | 1 |

| GlobalData | DATA | 2/4/25 | ? Acquisitions ? ROCE – Shares | 2 |

| M&C Saatchi | SAA | 2/4/25 | – Holdings – CROCI – Debt – Growth – ROCE – Shares | X |

| Click here for our 5 Strikes explainer | ||||

One wonders how trade war might affect shipbroker Clarkson [? ROCE] in 2025. Turnover is forecast to decline modestly for the first time since the pandemic, a period during which geopolitical instability has increased considerably.

Revenue at Computacenter [0 strikes] flatlined in 2024, but its long-term track record as an IT reseller and provider of managed services is very strong.

FDM [- Growth] has only one strike, but it’s a big one. Turnover fell by more than 20% in 2024 and forecasts anticipate a similar fall in 2025. The company recruits, trains and deploys programmers and IT consultants.

FDM’s annual report references economic and geopolitical uncertainty, which is no doubt a big part of the story. It only makes one reference to the risk posed by AI, though, which can dramatically reduce coding time and consequently work for its recruits. Its promise to get “external input” to understand the impact of AI and adjust its strategy is underwhelming.

Judging by its annual report PageGroup [-Holdings – Growth], a more typical recruiter that experienced a 13% contraction in turnover in 2024, is more concerned about AI supplanting recruitment consultants than job candidates.

There is nothing much to dislike about the track record of engineer and galvaniser Hill & Smith [- Holdings ? Acquisitions], which earns over 50% of revenue and over 75% of profit in the USA these days.

One of the off-putting things about Globaldata [? Acquisitions ? ROCE – Shares] before 2024, was the extraordinary level of debt it had built up buying data providers. It wiped that out last year when Inflexion, a private equity firm, acquired a 40% stake in its health business. Since 2014, the company has assembled a global industry data platform used by businesses and investors.

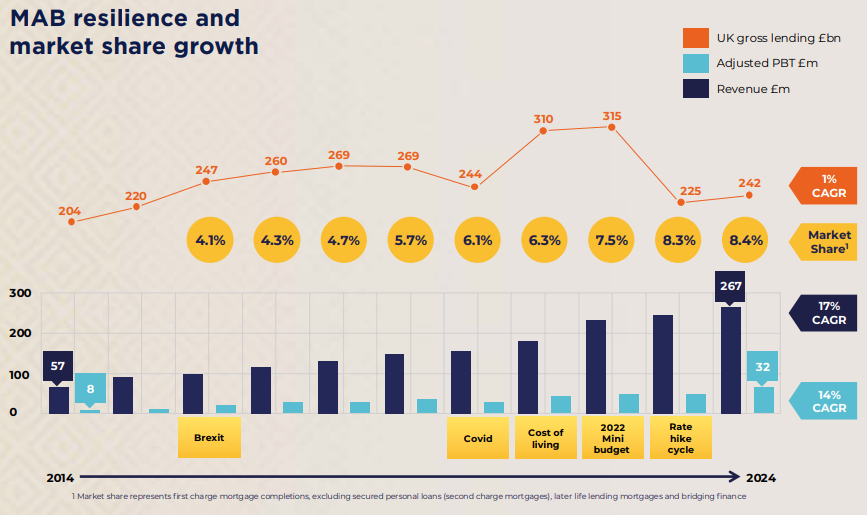

Mortgage Advice Bureau [- Shares] supports independent mortgage brokers by providing them with a mortgage and insurance platform. It receives a portion of the fee for each mortgage or insurance policy they sell through it, which has been a lucrative business. Judging by the growth in its market share, it is an attractive proposition for brokers.

Source: Mortgage Advice Bureau annual report 2024

Macfarlane [? Holdings – Growth – Shares], a packaging distributor, contracted modestly for the second year running.

Old faithful Next [-Debt ? Growth] is still staring the death of the High Street in the face, and laughing.

I already have my beady eye on Spirax [- Holdings – Debt ? Growth], an industrial equipment manufacturer.

Focus on Morgan Sindall

Today I am focusing on one of the four companies that has achieved zero strikes this year. It is Morgan Sindall, an improbably profitable construction company. It published its annual report on 24 March.

My objective is to look for Big Obvious Objections to investing in the shares. Objections that are not obvious from a cursory inspection of the numbers.

I chose Morgan Sindall because I own shares in two of the others, and have already written about them this year. I wrote up Porvair on 21 March, and Quartix on 4 April.

I will look at the fourth company, Nichols, a soft drinks business that owns the Vimto brand, in a forthcoming article.

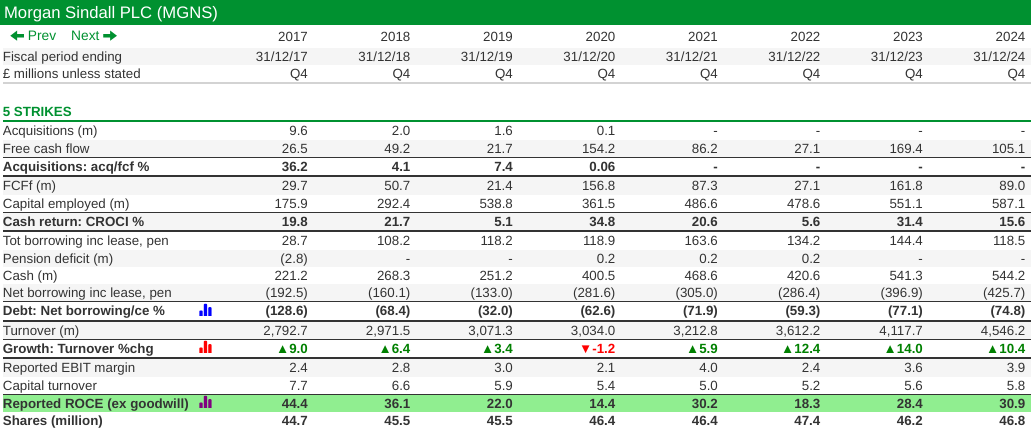

Source: ShareScope custom table showing the 5 Strikes criteria

Morgan Sindall has grown revenue, profit and cashflow under its own steam for at least eight years. It knows how to grow profitably, so I can move on to my Big Obvious Objection, which is that Morgan Sindall is complicated.

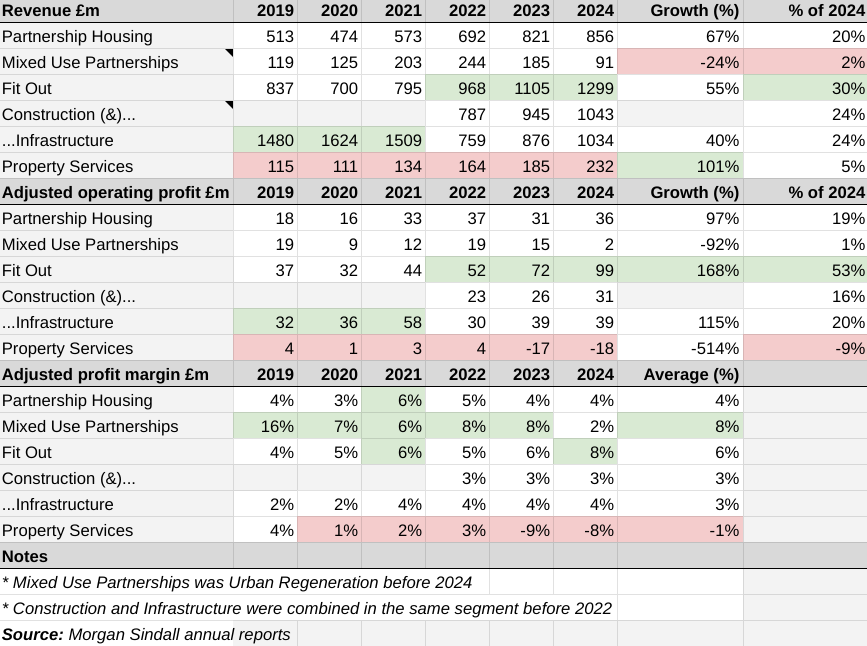

It operates six autonomous business units. You can see their revenues and profits in ShareScope’s “activity breakdown”, but here I have gathered the information from the company’s segmental reports so we can see adjusted profit, and I have calculated the adjusted profit margin of each unit for every year since 2019:

The pink highlights show which business unit performed least impressively in each year, and the green highlights show which did best.

The highest margin business over the last six years, Mixed Use Partnerships operates as Muse. It has contracted substantially over the last two years and reported the second worst profit margin in 2024.

Muse is a property developer, partnering with local authorities and landowners to redevelop urban areas. It builds homes, offices, shops, and amenities, an activity it describes as placemaking.

Its recent reversal of fortune is due to the timing of project completions and build cost inflation. Morgan Sindall says Muse has many projects in its pipeline and expects profitability to recover.

A larger sister business, Partnership Housing, which trades as Lovell, partners with local authorities and housing associations to build homes. It has been less profitable over the whole period but profitability has been stable, and it has grown consistently.

These two businesses contributed 22% to revenue in 2024, but they are the company’s investment focus. The money is invested in working capital, land and developments in progress, often through joint ventures. Returns come from property sales and contracting revenue.

One thing that distinguishes the partnership approach from other housebuilders, is that Morgan Sindall does not buy up land and bank it, which limits its exposure to the UK property market.

The remaining less capital intensive fit out and construction businesses are run for cash to fund the partnerships. The partnerships, in turn, make work for the construction, infrastructure and fit out businesses.

Fit Out, trading as Overbury and Morgan Lovell, has earned most revenue and profit since Construction & Infrastructure demerged in 2022.

It has been the fastest growing segment, as the nature of offices changes to accommodate flexible working practices, make offices more attractive to employees and improve energy efficiency. These trends continue, although Morgan Sindall expects some “normalisation”. In 2024 it contributed more than half of total adjusted profit.

Morgan Sindall Construction is a builder, and Morgan Sindall Infrastructure and BakerHicks are civil engineering businesses that work on road, rail, aviation, energy and industrial projects.

The smallest and least profitable division is Morgan Sindall Property Services. This business repairs and maintains property, mainly residential property owned by local authorities and housing associations. Due to cost inflation, it has lost money in the last two years, requiring it to renegotiate or exit onerous contracts.

Can complexity be a virtue?

Although the picture I have painted is complex, perhaps complexity can be a virtue.

Morgan Sindall’s construction businesses fund the partnership projects, which in turn generate work for the construction businesses. Diverse sources of revenue from the public and private sectors, investment and contracting, dampen the cyclicality of house building and construction.

But joint ventures, long contracts and big projects, features of some of the businesses, are Big Obvious Objections, because they add to accounting complexity, and they may be less profitable than expected.

Maybe we can trust Morgan Sindall’s extremely experienced chief executive to have built a resilient company. Sixty-nine year-old John Morgan co-founded Morgan-Lovell in 1977. It merged with William Sindall in 1994 to become Morgan Sindall.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.