They say elephants can’t gallop, but Pets At Home is an elephant in UK pet care, and it has been trotting along nicely. Richard takes a closer look at the pet store chain dominating the market.

Of the ten shares to publish annual reports in the last fortnight and pass my Minimum Quality filter, four scored less than three strikes.

5 Strikes

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| Centrica | CNA | 18/3/25 | 0.1 | – Holdings – Growth – ROCE | 3 |

| Howden Joinery | HWDN | 18/3/25 | 0.2 | – Holdings | 1 |

| Mondi | MNDI | 18/3/25 | 0.1 | – Holdings – CROCI – Debt – Growth – ROCE – Shares | X |

| Yu Group | YU. | 18/3/25 | 52.3 | – CROCI – ROCE | 2 |

| Pearson | PSON | 14/3/25 | 0.1 | ? Holdings – Debt – Growth – ROCE | 3 |

| Porvair | PRV | 14/3/25 | 1.6 | ? Holdings | 0 |

| Unilever | ULVR | 14/3/25 | 1.3 | – Debt – Growth | 2 |

| Serco | SRP | 10/3/25 | 0.1 | – Holdings – Acquisitions – CROCI – Debt – Growth ? ROCE | X |

| Smith & Nephew | SN. | 10/3/25 | 0.0 | – Holdings – Debt ? Growth – ROCE | 3 |

| BP | BP. | 6/3/25 | 0.0 | – Holdings – CROCI – Growth – ROCE | 4 |

| Click here for our 5 Strikes explainer | |||||

Porvair (0 strikes) and Howden Joinery (- Holdings) are two of my favourite businesses. Porvair makes filters used in planes, industrial processes and laboratories. Howden Joinery makes fitted kitchens for the building trade.

Both companies have long and distinguished track records, which I evaluate annually on Interactive Investor (The Porvair write-up will be published here on Friday, and Howdens about a month later).

I have not researched Yü (- CROCI – ROCE) or Unilever (- Debt – Growth) before. Yü supplies energy and water to small and medium-sized businesses. Unilever is a gargantuan and highly profitable consumer goods company struggling to grow.

I penalised Yü’s scores for profitability (Cash Return on Capital Invested and Return on Capital Employed) because of its performance towards the end of the last decade, since then it has been highly profitable, so something interesting might be going on.

Pets at Home [-Holdings]

I had a quick look at Pets At Home last June. Four things attracted me to the company:

- After a bit of head scratching, I decided there was only one strike to its name. Directors do not have a particularly large shareholding. It looks like a stable, growing, financially sound firm.

- Pets At Home has a stonking market share, nearly a quarter of the UK pet care market (combining retail and veterinary practices). This indicates past success, but also raises questions about future growth.

- The company’s focus on pet retail and vet practices appears to be unique in the UK, as does its somewhat decentralised vet practices. Most are joint ventures with local vets.

- The Vet segment contributes a relatively small proportion of Pets at Home’s turnover and a much larger proportion of profit. If more growth comes from this segment, profit should grow faster than turnover.

There is a joker in the pack, though. There are six veterinary groups identified as LVGs (L is for large) by the Competition and Markets Authority (CMA). Pets At Home is one of the largest, and the CMA is investigating them.

Today, I plan to put some meat on these bones.

Combining a mammoth retail operation and over 400 veterinary practices, Pet at Home claims to be the only complete pet care provider.

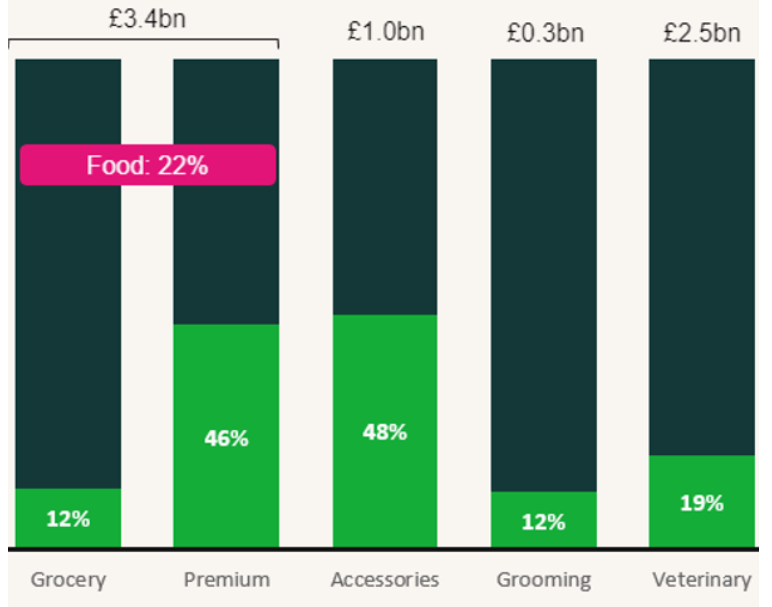

A chart from the company’s corporate website shows how dominant it is in premium food and pet accessories. It has almost 50% of the retail market in these categories. Even in smaller categories like Vet and Grooming, it has between 10% and 20% UK market share.

With 19% of the veterinary market, Pets At Home says it is the biggest branded vet chain. It may not be the biggest chain per se, because other LVGs retain the names of local vet practices they have taken over, rather than brand them with a national logo. Together, the LVGs own over 60% of UK vet practices, so Pets At Home’s 19% of the market by value looks impressive.

One of the CMA’s concerns is that customers may not be aware that they are dealing with a large chain if the practice does not bear its name. Pets At Home practices are all branded, though, and often co-located in stores.

Another is the extent of integration between LVGs and other vet services. Retailing, Pets At Home’s main source of turnover, is not a Vet service, so the company is the least integrated of the big six.

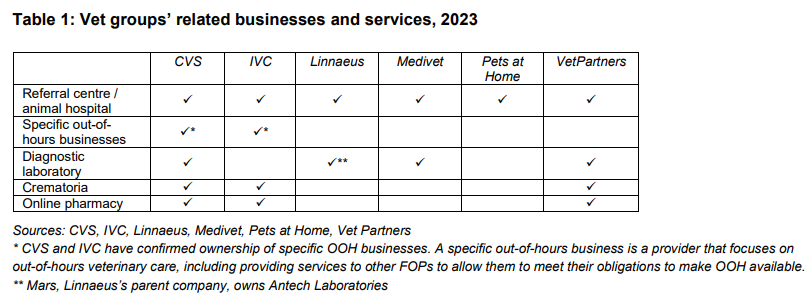

This table from the CMA’s documentation shows that Pets At Home’s Vet group has one category of related vet service: Referral centre/animal hospital.

I wonder how significant this is. The company sold its referral centers in December 2021. They were a small part of the business, and there is no mention of them or an animal hospital in the current annual report.

The CMA’s concern is that integrated LVGs refer sick pets to their own hospitals or dead pets to their own crematoria without making it clear to customers they have a choice.

One further source of comfort for investors concerned about the inquiry may come from the ownership of Pets at Home’s vet practices. It only owns a minority outright. Most are joint ventures with local vets.

In its response to the CMA’s announcement, Pets At Home said its vets have “complete clinical autonomy” and “set pricing at local level”, suggesting that a degree of independence may mitigate some of the risk of an adverse ruling.

This does not address all the CMA’s concerns. It is worried about opaque pricing, local monopolies, and exclusive contracts with related vet services, for example.

But scratching the surface of the investigation has given me an idea: That the differences between Pets At Home and its rivals might make it more competitive if the CMA’s ruling forces LGVs to change their practices.

None of this alters the fact that Vets at Home is basically a massive supplier of pet food! In the year to March 2024 it earned £814 million turnover from food, 55% of its total revenue. This explains the group’s modest profit margins.

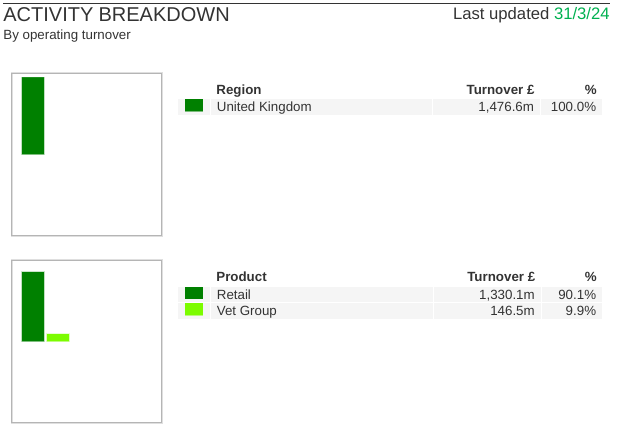

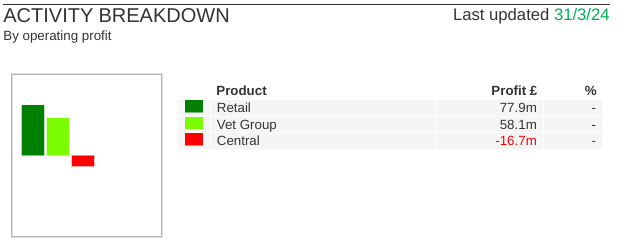

By contrast, vet practices brought in £146.5 million, about 10% of turnover. The reason I have focused on the vet segment is its profitability:

|

|

|---|

Source: Sharescope. The breakdown on the left shows revenue, and the breakdown on the right shows operating profit.

The vet business earned £58.1 million of profit before central costs, compared to £77.9 million for retail. That’s 43% of profit (before central costs) from 10% of turnover.

But this figure is a bit misleading. The vet business is bigger than it looks. In total, it earned £576 million in turnover in 2024. That number is not recognised in Pets At Home’s accounts because it is earned by joint ventures with vets. Those joint ventures pay Pets At Home a fee, which is the bulk of the Vet segment’s turnover.

We can get more information from the company’s segmental reports.

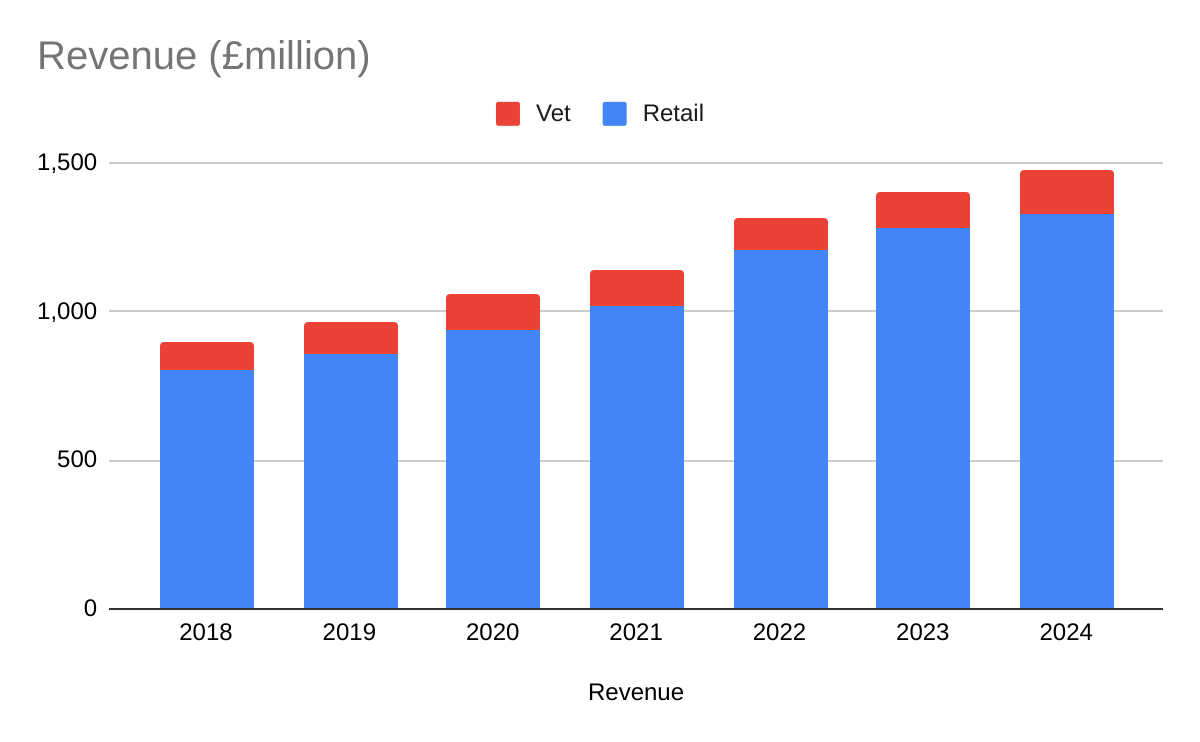

This chart shows turnover as reported since 2018:

Even though it is big, Pets at Home believes it can grow its market share as, among other things, it digitises, younger vet practices mature, and it opens new ones.

It appears to have grown faster than the market. The company typically cites low single-digit growth rates for the retail market and mid-single-digit for the vet market, due in part to the “humanisation” of pets and advances in what vets can do. We spend more on them, basically.

Both Pets at Home divisions have grown turnover at a compound annual growth rate of 7% since 2018, the year after the company adopted its current segmentation.

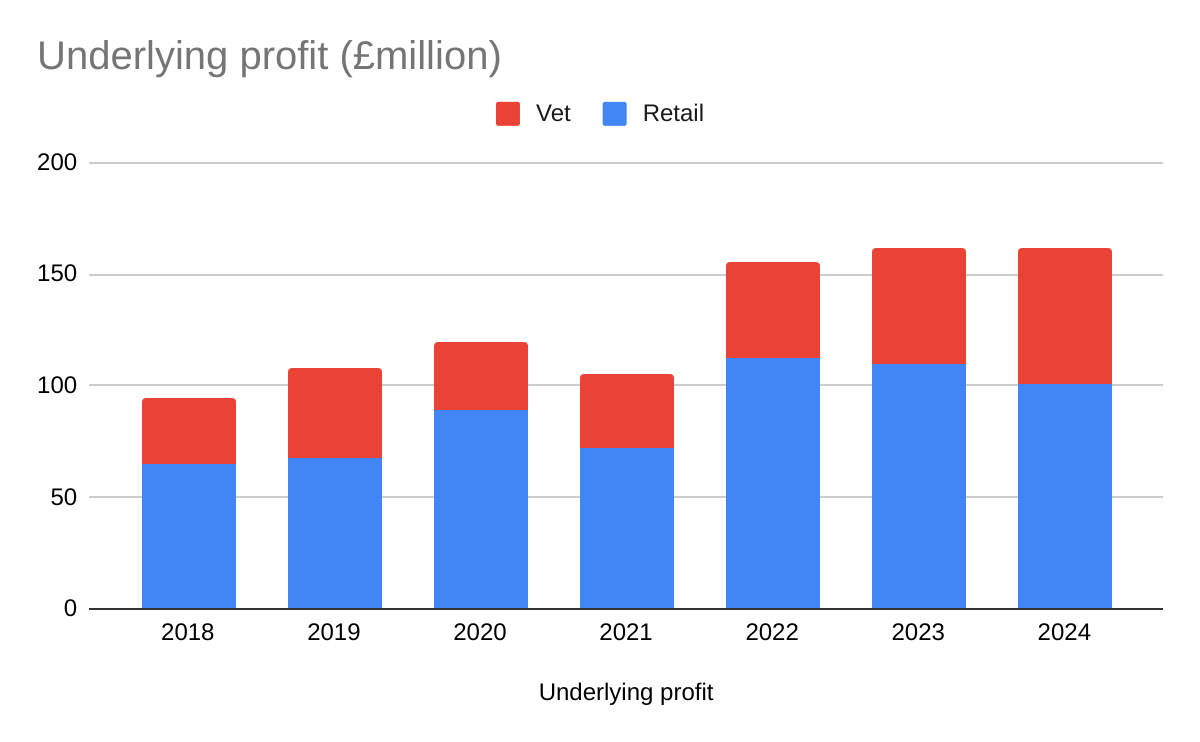

Underlying profit has grown at 6% CAGR in retail, and 11% in the Vet segment. The company contracted due mainly to pandemic restrictions in the year to March 2021, but rebounded dramatically because of all the new pets we bought during the lockdown period.

The CMA publishes its preliminary decision in May or June, around the time Pets at Home publishes its annual report. A final CMA decision will come in September.

I suspect in a year or two’s time I won’t be worrying about the CMA, but I might still be worrying about how Pets at Home can grow its market share when it is already so big.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.