January is a quiet month for annual reports, so Richard mines the list of shares that passed the 5 Strikes test in 2024 and should pass it again in 2025. Spirax Sarco catches his eye.

Only two shares have published annual reports in the sleepy post-New Year reporting season. That is because the many companies that concluded their financial year-ends at the same time as the calendar year-end have not yet had time to publish preliminary results, let alone their annual reports.

5 Strikes

Following my cursory look at the long-term data only one share, Hollywood Bowl, achieved less than three strikes:

|

Name |

TIDM |

Prev AR |

Holdings (%) |

Strikes |

# Strikes |

|---|---|---|---|---|---|

|

Victrex |

VCT |

6/1/25 |

0.1 |

– Holdings – Growth – ROCE |

3 |

|

Hollywood Bowl |

BOWL |

3/1/25 |

3.3 |

– Debt |

1 |

Hollywood Bowl is a slick operator of tenpin bowling centres that warrants further investigation. It is one of the shares I follow routinely on interactive investor and my next write-up is imminent.

At this time of year, I can give each share that passes 5 Strikes my full attention, a luxury I won’t enjoy in a couple of months time. Then so many companies will be reporting that I will have to be selective and good opportunities will probably be ignored.

To iron out the workload, I am going to predict which shares that achieved less than 3 Strikes in 2024, should achieve less than three strikes in 2025. That way I can get to know them better, while I am kicking my heels.

Naturally, I have used a ShareScope filter.

I chose two criteria that are fundamental to 5 Strikes because they measure profitability. They are:

- Reported EBIT, which is the basis of the ROCE calculation

- Free Cashflow to the firm, which is the basis of the CROCI calculation

For each of these criteria, my filter compares the TTM value to the full-year result.

TTM stands for Trailing Twelve Months. It combines half-year or quarterly results reported so far in the current year with results for the missing quarters from the last reported year. Consequently, TTM data is more up-to-date.

The filter screens out shares that reported TTM EBIT or TTM FCFf which is less than 102.5% of the previously reported result. These companies earned more profit and cash flow over the most recently reported twelve-month period than they did in their last full year (the extra 2.5% accounts for inflation).

The beauty of this filter is its economy. All the companies that passed published annual reports between late February and August 2024, a period that incorporates the reporting season. This is when I am too busy to give all of them my full attention.

It excludes companies that have reported in the quieter Autumn and Winter of 2024 because they have yet to report quarterly or interim results. For them, the trailing twelve months is their last full year.

Here is a table of these more profitable shares that also scored less than 3 strikes in 2024.

|

Ticker |

Name |

TTM EBIT % of EBIT |

TTM FCFf % of FCFf |

Prev AR |

Strikes |

# Strikes |

|---|---|---|---|---|---|---|

|

AUTO |

Auto Trader |

107% |

105% |

1/7/24 |

0 |

|

|

BMY |

Bloomsbury Publishing |

121% |

169% |

17/6/24 |

0 |

|

|

NICL |

Nichols |

103% |

116% |

28/3/24 |

? Growth |

0 |

|

CHRT |

Cohort |

121% |

220% |

21/8/24 |

– ROCE |

1 |

|

POLR |

Polar Capital |

104% |

131% |

5/7/24 |

– Growth |

1 |

|

HLMA |

Halma |

107% |

111% |

24/6/24 |

– Holdings |

1 |

|

SAG |

Science |

116% |

129% |

21/5/24 |

? ROCE |

1 |

|

WINK |

M Winkworth |

110% |

180% |

3/5/24 |

– Growth |

1 |

|

HILS |

Hill & Smith |

109% |

106% |

18/4/24 |

– Holdings ? Acquisitions |

1 |

|

MONY |

Mony |

105% |

113% |

4/3/24 |

– Holdings |

1 |

|

OXIG |

Oxford Instruments |

103% |

110% |

25/6/24 |

– Holdings – Growth |

2 |

|

CMCX |

CMC Markets |

180% |

114% |

20/6/24 |

– CROCI – Growth |

2 |

|

SPX |

Spirax Sarco |

106% |

107% |

2/4/24 |

– Holdings – Debt ? Growth |

2 |

|

ROR |

Rotork |

106% |

112% |

26/3/24 |

– Holdings – Growth |

2 |

|

REL |

RELX |

106% |

104% |

22/2/24 |

– Holdings – Debt ? Growth |

2 |

Since these companies have grown profit and cashflow they are likely to pass 5 Strikes after they publish their annual reports this spring or summer.

Spirax Sarco

Spirax Sarco slipped through a net that caught 26 shares last April, and I have chosen to familiarise myself with it for three reasons.

- The company has a reputation for being a hidden champion. An unflashy but sizable and very successful niche manufacturer of industrial equipment.

- It has fallen a little out of favour.

- Things may not be too bad. Spirax Sarco scored only two strikes in 2024, its TTM EBIT is 6% higher than it was at the end of the last full year, and its TTM FCFf is 7% higher.

Traders appear to have lost some confidence. The share price has fallen 58% from its peak in 2021.

My next exhibit might have some way to explain why:

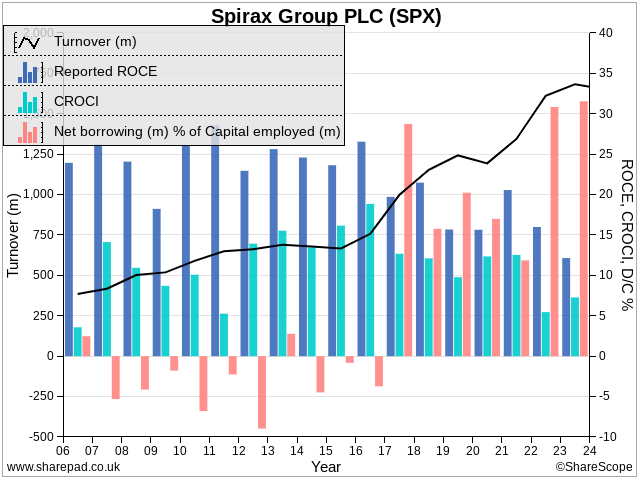

While Return on Capital Employed (blue bars) was above 10% in 2024, my lower threshold for a strike, it is not far above it. Over the last decade, ROCE has fairly steadily fallen.

Cash returns for most businesses are more lumpy than profit and the trend in Cash Return on Capital Invested (CROCI – green bars) is not as obvious. But the company has not earned enough cash to stop it from swinging into net debt (pink bars).

Before 2017, Spirax Sarco generally had more cash than debt on the balance sheet but it has been indebted since then and in 2023, debt and lease obligations reached its highest level at more than 30% of capital employed. I give companies a strike if net borrowings are over 25% of capital employed.

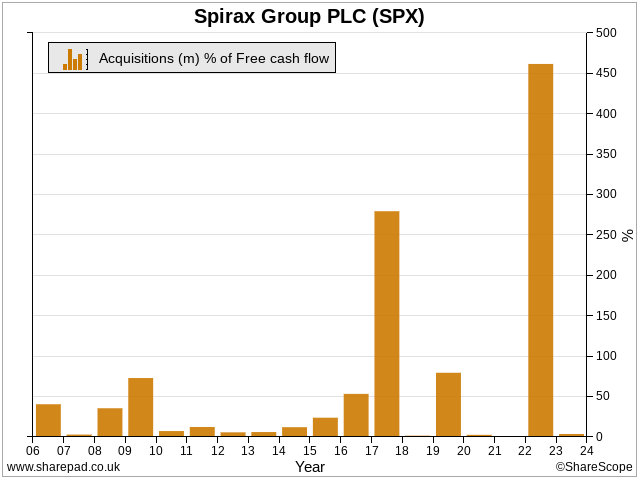

The next exhibit probably goes a long way to explaining why debt has increased:

Spirax Sarco absolutely splurged on acquisitions in 2017, when it spent more than 250% of free cash flow, and again in 2022, when it spent more than 450% of free cash flow.

You might be wondering why I didn’t give Spirax Sarco a strike for acquisitions last April. Perhaps I should have. Generally, I give a company a strike if it has spent more on acquisitions over the last eight years than it earned cumulatively in cash flow.

Spirax Sarco passes this test, but sometimes I will also give a strike if a company spends more on acquisitions than it earned in cashflow in a single recent year. In 2017 and 2022 it blew past those thresholds.

A lot depends on the acquisitions. As well as increasing debt, they will have knocked the stuffing out of reported EBIT and consequently ROCE because the company is required to amortise (depreciate) the historical cost of acquired intangible assets although this has no bearing on the company’s operating profitability or earning power.

To get around this problem Spirax Sarco publishes two versions of Return on Capital, Return on Invested Capital (ROIC), which includes goodwill and acquired intangible assets (and is close to Reported ROCE in my table), and Return on Capital Employed (ROCE), which excludes the impact of goodwill and acquired intangibles.

According to Spirax Sarco, ROCE declined from 49% to 38% in the year to September 2023 (see page 40 of the annual report). The company explains that it invested more during the year, and sales at one of its most profitable businesses, Watson-Marlow, declined due to customer destocking.

For a high-quality business like Spirax Sarco, my default position is that destocking is probably temporary and investment is a cost that will enhance returns in future.

But Alex Sweet’s deep dive into Spirax Sarco last year also revealed a new competitive threat for Watson-Marlow. It is a subsidiary of Ingersoll Rand, which has made acquisitions in the same niche (equipment that moves fluids around, for example, pharmaceutical plants).

Much of the company’s recent acquisition activity has been focused on Watson-Marlow, so its performance in 2025 and 2026 may well be the critical factor in determining whether I decide to lavish more attention on Spirax Sarco when it publishes its annual report.

ShareScope tells me that will happen in April.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.