Phil asks whether the latest profit warning from Aston Martin is the final straw for investors or whether a turnaround in its fortunes is still possible.

Since its flotation five years ago, shares in Aston Martin Lagonda have been a disastrous investment. They have lost more than 90% of their value since then. Last year has been the only year when the shares have delivered positive returns. So far in 2024, they have almost halved in value.

The company is trying to create an ultra-luxury car brand that the world’s richest people will want to own. The problem is that this is currently an ambition that is costing shareholders huge amounts of money with little sign of delivery.

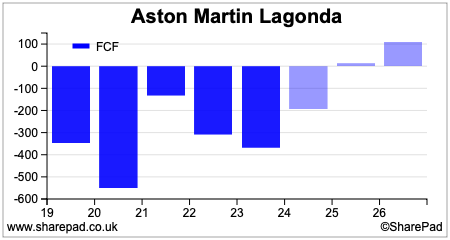

Put simply, the company has not been selling enough vehicles profitably while investing lots of money to turn itself into a predominantly electric vehicle brand by 2030. As a result, the company has been bleeding cash flow as the SharePad chart below shows.

If that wasn’t bad enough, the company’s large debts have meant that it has needed fresh cash injections in order to survive. This has largely come from a consortium led by Canadian billionaire Lawrence Stroll as well as the German car giant Mercedes.

Since 2020, £1.8bn of extra equity has flowed into the business. However, the performance of the company has been so bad that the market capitalisation is currently just £973m which equates to a share price of 118p.

Is the latest profit warning the final straw?

This week has seen further bad news with the announcement of a big profit warning.

The company has said that it has had problems with its supply chain which means that it cannot finish the production of cars that it intended to sell this year. Also, the Chinese market – a key growth area for the business – has seen weaker demand than expected.

As a result, total vehicle deliveries for 2024 as a whole are going to be around 1000 fewer than was expected just a couple of months ago. This suggests around 6100 deliveries compared with 6620 in 2023.

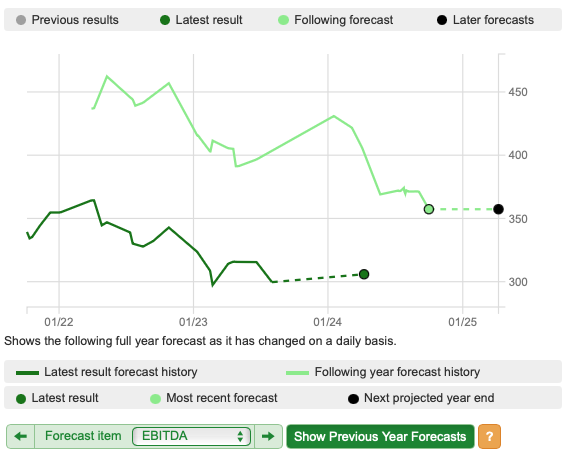

A loss of sales volume is disastrous for a vehicle manufacturer. It needs the volumes and the profit contribution that comes with them to pay the substantial fixed costs that come with car plants. A big shortfall means that profit forecasts get slashed. EBITDA is now expected to be less than last year’s £306m compared with the most recent forecast of £357m.

As you can see from the chart below, EBITDA forecasts from City analysts have already come down a lot this year. A further reduction represents another big dent in the company’s recovery plan.

Is there any way back for the shares?

It’s difficult to see how the credibility of Aston Martin could sink much lower with current and prospective investors. The company has set itself some ambitious targets, which if deliverable, would imply that the shares could be worth many times their current value in a few years’ time.

In short, Aston Martin wants to achieve the following performance targets by 2027/28:

- Revenues of £2.5bn

- Gross profit margins in the low to mid-40s percent range

- EBITDA of at least £800m – a margin of 32%.

- Positive free cash flow.

- Net debt/EBITDA of 1.0 times

Such targets represent a classic strategy by the management of listed companies. By putting numbers out there, they will encourage investors to put a valuation on them which often underpin a very strong buying case for the shares.

Source: SharePad

Note that current SharePad forecasts as of 01/10/24 will not reflect the profit warning of 30/09/24

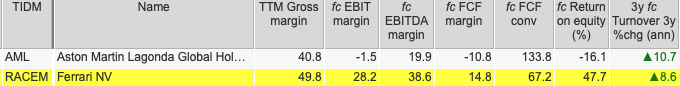

What Aston Martin is asking investors to believe is that it will achieve levels of profitability – at least in terms of margins – that are not far off what Ferrari – one of its biggest rivals – is expected to deliver for its current financial year.

Getting investors to buy into a turnaround strategy requires the necessary confidence that the management team can deliver it. The latest profit warning is a big blow in this respect.

It can be argued that Aston Martin has been the victim of problems beyond its control. Some may be less charitable and see it as bad supply chain management in what is a core competency of any car manufacturer.

It could well be that the 1000 shortfall in deliveries will be in next year’s numbers which assume a big jump to 10,000. Aston Martin’s house brokers are apparently sticking with their view that the company will meet its EBITDA target of £500m next year.

The weakness in Chinese demand might mean that this is too optimistic if it continues, especially if the delay in deliveries results in the loss of customer goodwill towards the brand.

Looking further out, the current consumer indifference to electric vehicles – with the exception of China – raises doubts as to whether the company’s long-term strategy is a good one.

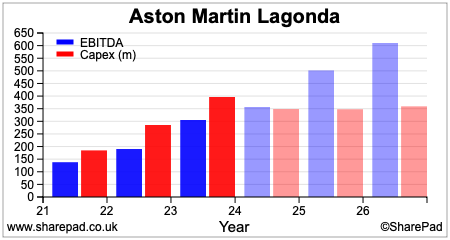

Further downgrades to profit forecasts would put more pressure on free cash flow forecasts as investment spending (capex) remains high on the development of electric vehicles.

The gap between gross cash flow (EBITDA) and capex had been expected to turn positive and get bigger in 2025 and 2026. This is needed to pay the substantial interest bill on the company’s debts (a large chunk of which has been recently refinanced at interest rates of 10% or just over).

If the cash flow falls short of expectation, then debt repayments may be difficult and the company may well be loss-making for longer than people currently expect.

Many readers who have seen the financial carnage in Aston Martin over the last five years will have stayed clear of the shares. It’s difficult to see why they would want to buy in now.

What is the potential upside in the shares?

At the moment, keeping the company off the rocks seems more of an issue than working out how much more valuable its shares could be.

It seems very reasonable to say that achieving anything close to the kind of valuation multiple on profits that Ferrari shares currently trade on (nearly 50 times its next twelve months forecast EPS) would be fanciful.

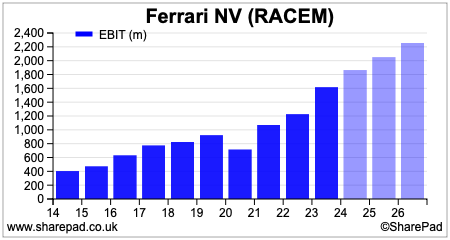

Ferrari’s record of profitability as shown in the chart below is an impressive one which has generated a great deal of credibility and trust from investors. Something that Aston Martin has little of right now.

Forecasting the future profits of car companies is difficult at the best of times as profits tend to be very volatile. Ferrari’s dependability has afforded it a high valuation multiple but mass-volume car manufacturers such as Stellantis, Renault and Volkswagen see their shares valued at very low multiples of around 3 times EPS currently. Investors clearly don’t like them very much.

If Aston Martin can see its profits bounce back in 2025 and increase investor confidence that it can meet its profit targets, then there is an argument for saying that its shares would deserve to trade at a decent premium to the valuation of the volume manufacturers.

The current consensus EPS forecast for 2026 is 9.4p. At the current share price of 118p, this equates to a PE multiple of 12.6 times. The current analyst consensus target price of 238p – from 10 analysts – suggests that the shares could double from here and gives an implied 2026 PE of 25 times.

This looks very punchy given the current backdrop, but given the very high risks right now, such a reward would be fair for anyone brave enough to buy the shares.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select Share Chat or search for the specific share covered in this article.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.