The gold price has been perking up in recent weeks – is now the time to be looking at the wide array of gold-based funds, especially in this era of monetary inflation powered by big government? This month David also looks at whether the private equity market is improving, plus he shines the spotlight again on London’s very successful handful of Georgian-based investments.

Gold ETFs and Funds

Gold as an asset class is always a divisive subject. There are many, many gold bears – for much of the last decade I was probably in that camp – alongside a growing, young army of Bitcoin enthusiasts who deride the shiny precious metal as “so old school”. And it’s true that on the bitcoin argument if we superimpose the bitcoin price since Covid against gold, then the cryptocurrency has shot the lights out (with much higher volatility).

I also can’t help but think there is a generational shift at work. Many younger investors simply can’t see the appeal of gold and are opting for Bitcoin and its peers as a classic hedge against risk. Amongst the wider bears, there’s also a sense of quiet disappointment. We’ve just emerged on the other side of a sustained inflationary surge and yet gold is only up 11% over the last two years and 26% over the last three years. Those positive returns aren’t to be sniffed at but they are hardly the gains promised by some gold bugs.

And yet gold has also remained remarkably stable in price and has only broken past $2100 an ounce in the last few weeks. Over the medium term, it is one of the most stable asset classes of the recent past although it is worth noting that over the last few months, the FTSE ALL share index has actually displayed lower levels of volatility. It’s also worth noting that this price rise has happened despite evidence of significant outflows at the fund levels. Ever since the SEC legalised bitcoin tracker structures, there have been very heavy flows into bitcoin ETFs, whereas for gold funds it’s the reverse. According to the World Gold Council (WGC) at the beginning of March, there had been significant outflows of assets in gold funds, a trend that’s been true for the last nine months.

By contrast gold purchases by central banks have remained impressive. The WGC reported at the end of January that “Central bank demand, a key driver of gold in recent years, maintained its momentum in Q4 as a further 229t was added to global official gold reserves. This lifted annual (net) demand to 1,037t, just short of the record set in 2022 of 1,082t. Global official sector gold reserves are now estimated to total 36,700t. Two successive years of over 1,000t of buying is a testament to the recent strength in central bank demand for gold. Central banks have been consistent net buyers on an annual basis since 2010”.

So, the report card for gold is, I would suggest, mixed. Gold has lost some of its popularity to bitcoin and private investors are less than enthusiastic at the funds flow level. But pricing has remained stable and the price has been breaking through key support levels, helped along by strong institutional buying of the precious metal, especially by central banks.

What might happen next? On one level, the prognosis isn’t positive. Bitcoin continues to grab popular attention, and inflation rates are ebbing away again, removing some support for gold. Equity volatility is also reasonably low, and there’s no sign of an imminent recession. Crucially the dollar remains strong, based on a basket of trade-weighted currencies, which is usually a headwind for gold.

On the positive side, lower interest rates might be helpful to gold – gold tends to underperform in environments where interest rates are rising. There’s also the ever-present chance that geopolitics and especially the US General Election might trip up the equity bulls and push up volatility. I would add another crucial, possible driver – monetary inflation propelled by burgeoning government deficits. It seems to me – and many other observers, including The Economist magazine – that one of the big stories of the coming decade is the problematic fiscal position of governments in the US and the UK.

Debt levels are already high, deficits wide, and demands for more government spending insatiable. As I’ve frequently mentioned, even those of us who hold Keynes in high regard are slightly troubled by this development. Deficit spending makes sense in a downturn, but running a massive deficit even during a strong economy is not something the much-lauded Cambridge economist would have approved.

Yet that’s what we have in much of the Western world – and if we must build up our defence capability, that deficit could go even higher while an ageing population will also intensify the pressure to spend more. I’m not one minute making the argument that this means we will trip into a crisis because, if nothing else, the example of Japan shows us that you can run a massive deficit and still boast a stable fiscal position – it just forces central banks to get ever more involved with buying their own government’s bonds. However, that also implies that increasing monetary inflation and the asset class implications of this shift are worth considering.

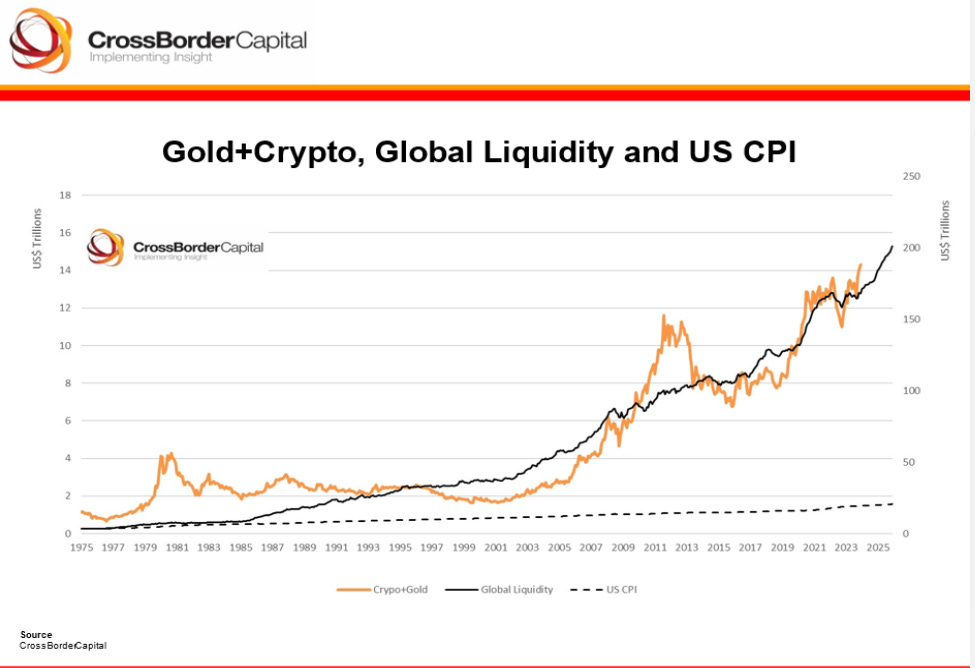

The obvious asset to consider is gold, a classic hedge against some forms of inflation. One of my favourite strategists Michael Howell at Cross Border Capital has run an analysis on this and come out strongly bullish for the shiny, precious metal, based on a global liquidity perspective. Here’s an executive summary from a recent report which I think sums it up nicely:

“The problem is debt. Higher gold and crypto prices may already be spelling out a warning. New debts must be financed, and old debts serviced and re-financed. Global Liquidity (a.k.a. monetary inflation) needs to keep pace. The US debt/ GDP ratio is slated to test 250% by 2050. Public debts can always be financed: the debate concerns at what price? Assuming Global Liquidity rises pari passu, the outlook for monetary inflation hedges looks compellingly attractive.”

I’ve listed his main points below, all of which seem eminently reasonable to this observer:

- The trend rise in the future US public debt/ GDP ratio can be arithmetically justified. Assuming a starting point of 100% debt/ GDP ratio, future relative debt growth depends positively on the size of the primary fiscal deficit plus the average interest rate on debt and negatively on underlying GDP growth.· Fiscal deficits of a whopping 7-8% of GDP look set to rumble on over the 2025-34 period.

- These deficits must be funded, by definition. They can be funded through issuing short-term government liabilities, such as Treasury bills and Fed debt purchases, or through longer-term coupon issuance. They can also be funded domestically or internationally.

- Whereas the overall Fed balance sheet is slated to double in size over the next decade, the liquidity-creating components could actually triple. In other words, Fed liquidity, which currently fuels money markets to the tune of US$3 trillion annually, looks set to climb rapidly to US$9 trillion.

- With something like US$350 trillion of debt outstanding Worldwide, an of average 5-year

maturity, around US$70 trillion must be rolled over each year. This requires balance sheet liquidity across the financial sector. - More financial sector liquidity whether provided directly by the Fed or indirectly via more Treasury bill issuance and bank loans are key sources of monetary inflation. Monetary inflation is not necessarily the same thing as high street inflation, but it is a component alongside cost inflation. Investors need to hedge against monetary inflation.

- Historically, the best hedges have been gold, residential real estate and (assuming not too rapid inflation) equities. The worst hedge is bonds

My own sense is that if gold’s positive upward momentum continues, we could see $2500 tested at some point over the next 12 to 24 months, especially if there is an uptick in geopolitical uncertainty. A sudden unexpected economic slowdown in the US, by contrast, could unnerve investors, and push gold prices lower.

What to buy in gold through funds

OK, so it is perfectly sensible to imagine that gold has some value as a possible hedge against monetary inflation. It’s not a certainty by any stretch, but it’s a real possibility. And it certainly helps explain why many successful multi-asset allocators continue to maintain a healthy exposure to gold. The Personal Assets Trust run by the Troy team for instance maintains a heavy 10% + exposure to gold which compares to 4% for Capital Gearing Trust, a conservatively managed multi-asset fund and 1% at the Ruffer Investment Company.

Building gold exposure into your portfolio is also incredibly easy. There’s the option of buying gold coins directly for instance although this is an expensive way of investing gold – with premiums for physical gold usually above 5%. Online gold services such as BullionVault offer an alternative that has proved very popular but probably the simplest mechanism is to buy a gold exchange traded product or ETP.

In the table below I’ve listed the range of London-listed ETPs. Note these are nearly all structures that own allocated physical gold held in vaults around the world, including in Switzerland.

ETF issuer Invesco currently boasts the biggest product, ticker SGLP, by AuM with a low total expense ratio of 0.12% per annum. It’s not actually the cheapest ETP – that’s from XTrackers with a TER of just 0.11%. Arguably the most well-known structure is called Gold Bullion Securities, run by Wisdom Tree, which has assets under management of £2.1 bn and has been in existence for over two decades.

The other alternative way of buying into gold is through gold mining stocks – this is the focus of a handful of smaller ETFs (exchange-traded funds) from iShares (SPGP), L&G (AUCP) and Van Eck which has two funds, one for large-cap gold miners (GDGB) and one for smaller gold miners (GIGB). Bear in mind that gold equities tend to be leveraged on the gold price i.e. if the gold price shoots up, gold equities have in the past outperformed, and vice versa. That said, gold miners have underperformed in recent years and there’s a sense that if gold prices do push much higher, many junior gold miners might see some big price moves.

It’s also worth mentioning that there are some actively managed, listed investment trusts that have heavy exposure to the gold space – largely through miners although the multi-assets funds (Personal Assets and Capital Gearing) tend to own direct physical gold and not mining equities. The standout play in this space is Golden Prospect which is trading at a 12% discount to NAV and is over 75% exposed directly to junior gold mining stocks.

It’s looking up for private equity

There’s been a great deal of uncertainty about the private equity model in the last few years. Rising interest rates and economic uncertainty have made many question valuations. Another concern has been that too many PE firms have raised too much money and will now struggle to deploy, while those with legacy portfolios funded by expensive loans might struggle to refinance their underlying loans at sensible rates. This uncertainty has impacted the small handful of UK-listed private equity funds, with discounts remaining stubbornly – put simply, many public market investors don’t trust stated portfolio valuations.

But the tide may be turning, especially as investors begin to anticipate lower interest rates – and liquidity concerns have eased. One way of gauging sentiment is to look at the definitive industry survey from management consulting firm Bain. Their annual report is widely read, and Matt Hose who is the alternative funds analyst at Jefferies has provided a useful topline summary :

- Industry ‘dry powder’ (including VC, real estate, infrastructure etc) remains at record levels, now $3.9 trillion, up from $3.7 trillion at the end of 2022, and $3.2 in 2021. Buyouts saw the largest increase in dry powder over 2022 at 16% to $1.2 trillion, with 26% of this now four years or older.

- Average U.S. buyout purchase price multiples for 2023 decreased to 10.8x EV/EBITDA, from 11.9x a year earlier. Average European buyout purchase price multiples were 10.1x EV/EBITDA, having fallen from 10.7x in 2022.

- Global buyout exit transactions fell by 24% in 2023 to 1,067, while by value exits fell 44% to $345bn, highlighting a skew towards smaller exits.

- Over the decade to 2023, an average of 47% of the value created within buyouts was derived from multiple expansions, versus 53% from revenue growth.

I sense that we are probably either at the trough or close to the trough in terms of private equity valuations. Crucially many highly regarded PE funds listed on the London stock market such as HgCapital have seen their discounts tighten sharply – this UK-listed investment trust is now trading at a discount of just over 3%, having averaged 17% over the last year.

But not all of its peers have seen their discounts tighten quite so much – in the table below I’ve used data from funds analysts at Numis to compare their current discount to their 52-week average. In my view, the current discounts of 33% for Oakley Capital Investments and 40% for HarbourVest Global PE look a tad anomalous as both are highly respected in the City with very decent track records. I can quite easily see the discount of both funds tighten by between 5 and 10% over the next 12 months.

| Fund | Current discount % | Average discount for last 1 year |

| Direct PE funds | ||

| Hg Capital | -3.4% | -17% |

| Oakley Capital Investments | -33% | -31.9% |

| Process Private Equity | -24% | -29% |

| Multi-manager Funds | ||

| Harbourvest Global PE | -40% | -42% |

| ICG Enterprise | -36% | -38% |

| Pantheon International | -34% | -36% |

Georgia update

I’ve long been a fan of the London-listed, PE-focused frontier markets fund Georgia Capital. This has flown under the radar for most mainstream investors yet boasts an impressive track record on returns. It’s just announced the final results for the 12 months ended 31 December, which are impressive. This update showed that in the fourth quarter of last year, NAV per share increased 7.7% QonQ in local currency terms and 3.4% in Sterling terms to 2,423p.

According to Numis – the only bank to cover this fund – performance was driven “by the strong share price performance of Bank of Georgia, whose share price rose 7.7%, adding c.5.1% to NAV (GEL 161m). The private portfolio added 1.9% to NAV (GEL 61.8m), driven by the Insurance business (+GEL 42.4m), Retail Pharmacy (+34.4m) and Education (+16.6m). Hospitals (-35.6m), which is undergoing a restructuring and is impacted by regulatory change, and Other businesses (-13.4m) were a drag. “

For 2023 as a whole, NAV growth was an impressive 26.5% in GEL (the local currency) and 20.4% in Sterling, with the estimated NAV at 2,568p, adjusted for listed holdings such as Bank of Georgia, which puts the shares on a c.53% discount.

Last week also brought news that the most significant holding, London-listed Bank of Georgia, is acquiring 90% of Ameriabank, the largest lender and second largest deposit taker in Armenia, for a $304m valuation. The deal is being funded by surplus capital at the Bank of Georgia. Numis analysts estimate that on a proforma basis, the acquisition would have enhanced the 2023 Bank of Georgia group net income c.20%, taking the PE for the bank to 3.4x from 4.2x. The acquisition represents a historic Price: Book multiple of just 0.65x for a bank that generated a 24.9% ROTE in 2023.

Bank of Georgia represents approximately 33% of the value of Georgia Capital, which, as I’ve already noted, is trading at a discount of 53% to its NAV – and that’s after Georgia Capital’s share price increased by 50% in the last year. I still think that Georgia Capital is cheap.

Bank of Georgia was already cheap even before this takeover of an Armenian bank. It is forecast to bump up its dividend in the coming year, with Numis estimating a yield of 9 to 10% per annum on a forecast price-to-earnings ratio, which should drop below 4 times earnings.

~

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.