Phil uses SharePad to examine the impact of share buybacks on shareholder returns. Do they make shareholders better off and should investors focus on growing companies instead?

Do share buybacks really make shareholders better off? Should they prefer dividends instead?

Opinion is divided on this subject.

The great thing about a dividend from an investor’s point of view is that once it has been paid it cannot be taken away. It is a return from owning a share that is independent from what is happening on the stock market.

The only other way to make a positive return from owning a share is for the share price to go up. How do share buybacks help with this?

How share buybacks work

Share buybacks describe the process when a company buys its own shares. When the shares bought are cancelled they reduce the number of shares outstanding.

This is often seen as a positive thing to do as it means that the company’s profits are spread over a fewer number of shares and earnings per share (EPS) and any dividend per share can increase. The remaining shareholders’ ownership stake in the business also increases.

Buybacks are also popular because they can sometimes be seen as a sign that a company’s management views its shares as being undervalued. It can also ease the worries of some shareholders who are concerned that the company might waste its money by buying a bad business.

But are buybacks really good for investors?

Not always is the short answer.

Just as individuals can pay too much for shares, companies can as well. If a company buys shares at too high a price a buyback can deliver very poor returns to shareholders.

There’s also a view that buybacks are just a form of financial engineering, as the value of a company’s operating profits – the main driver of company value – and its assets do not change at all because of it.

Buybacks also don’t treat all shareholders equally. Whereas every shareholder receives a dividend, the cash spent on buybacks only goes to shareholders who sell their shares to the company. Those shareholders could have raised the cash anyway by selling their shares to anyone.

Company management often like buybacks, especially if their bonuses are linked to increasing EPS. Yet, rising EPS might not be the same as creating value for shareholders and making them better off.

For example, a company with falling after-tax profits can increase EPS if the shares in issue fall at a faster rate than profits. The value of the business will have fallen as profits have fallen even though EPS would have gone up.

Usually when profits are falling – and that fall is expected to be permanent – the valuation multiple attached to the shares will usually fall. Even with a higher EPS, the share price can go lower and shareholders will have had no benefit from the buyback.

It is also important not to consider a buyback on its own. Could shareholders have been made better off if the cash spent on buybacks had been used in a different way such as:

- Paying a dividend

- Paying down debt

- Investing in new projects

- Making acquisitions

Sceptics of buybacks will point to the studies which cite a very weak correlation between them and making shareholders better off.

They will argue – quite rightly in my view – that the real drivers of improved company valuation over the long haul are revenue growth, higher profit margins, improved returns on capital employed (ROCE) and increased free cash flow generation.

Looking at some of the evidence – US and UK markets

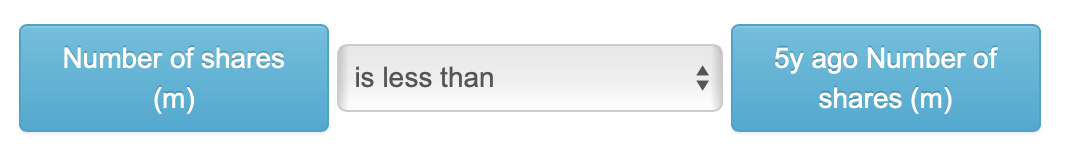

I’ve used SharePad to look at what’s been going on with buybacks over the last five years. To do this, you can create a filter using the combined items feature which will search for companies where the current number of shares in issue is lower than it was five years ago.

You can then specify what proportion of shares from five years ago you want to filter for. So if you want to look for companies where the number of shares is 10 per fewer, set this filter for a maximum of 90 per cent.

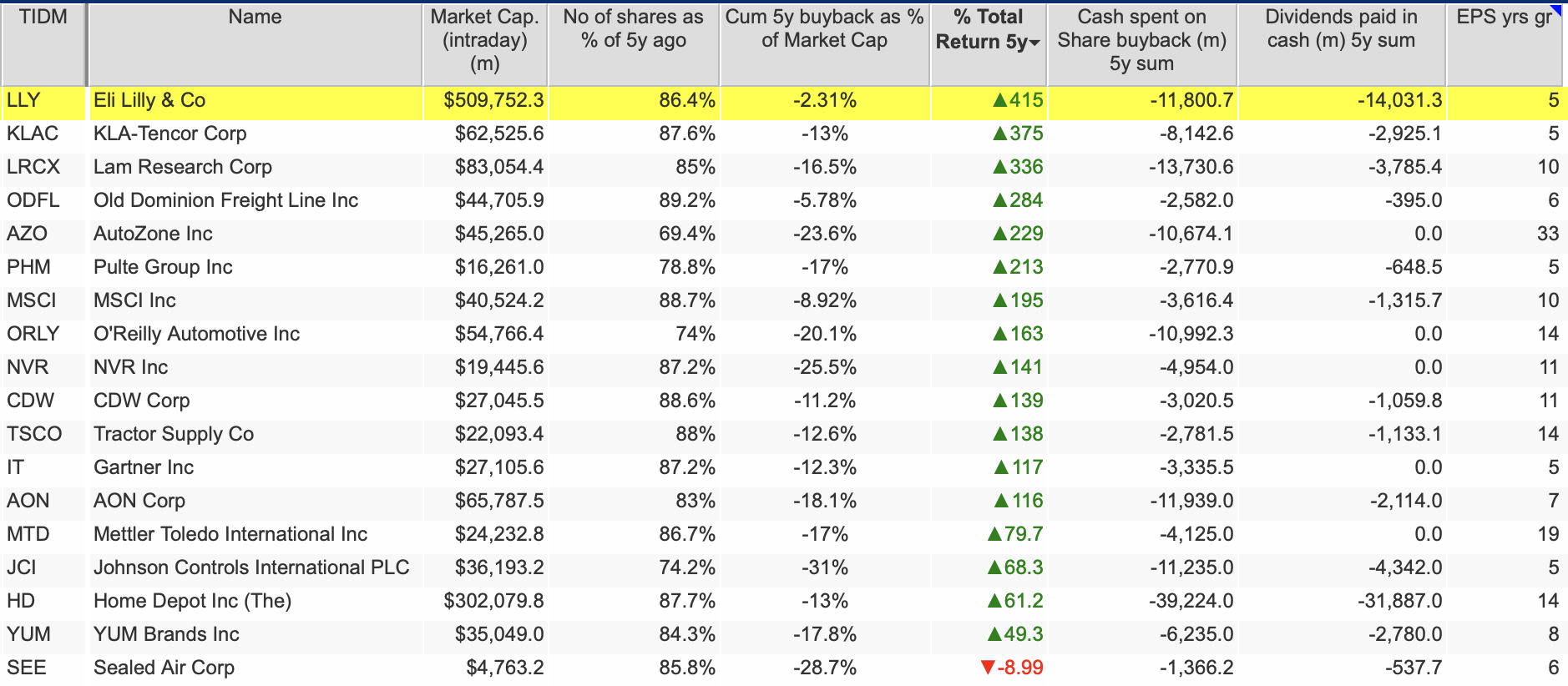

In the US, 141 companies in the current S&P 500 have reduced their share count by 10 per cent or more. Of these, 49 of them have delivered total returns greater than the 59.9 per cent delivered by the S&P 500.

Interestingly, 280 companies in the current S&P 500 have spent more on buybacks over the last five years than they have on dividends.

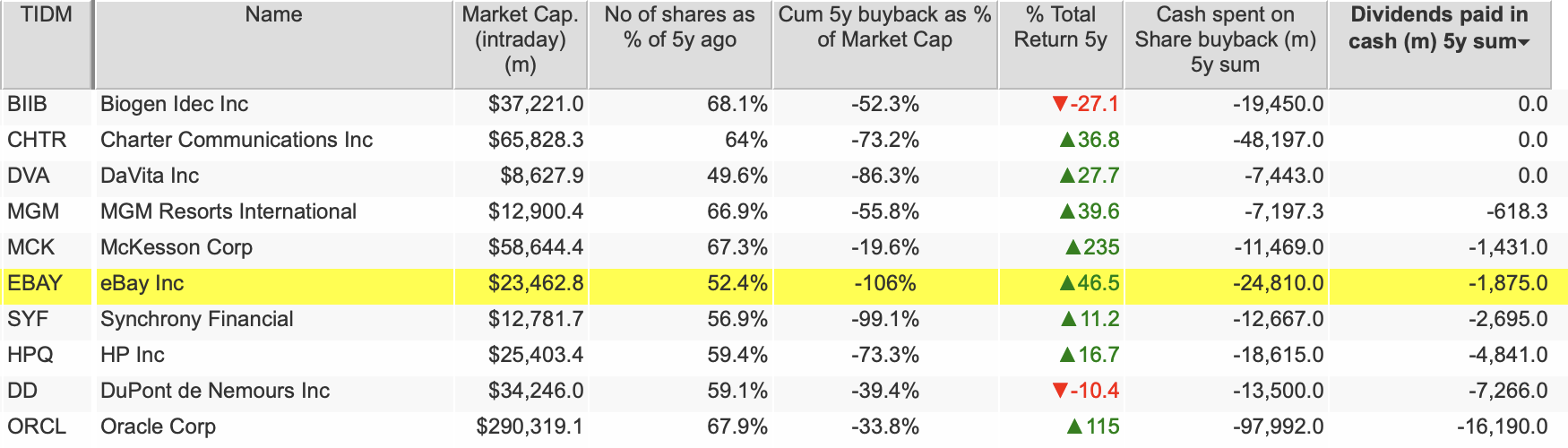

Some companies such as eBay (NASDAQ:EBAY) have spent more on buybacks than their current market capitalisation. However, its shares have still underperformed the index as it has struggled to grow its profits.

US Shares with the biggest buybacks

Source: SharePad

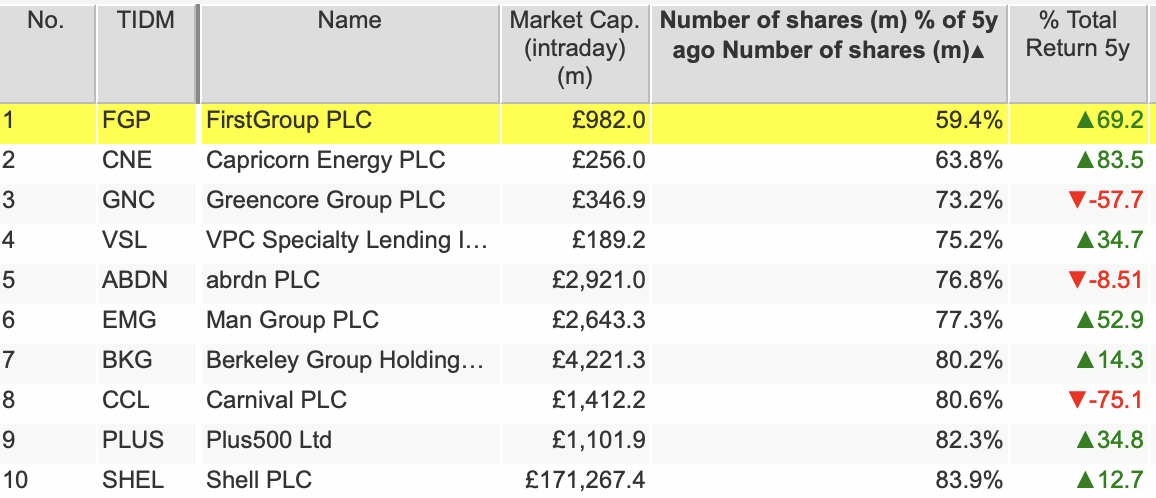

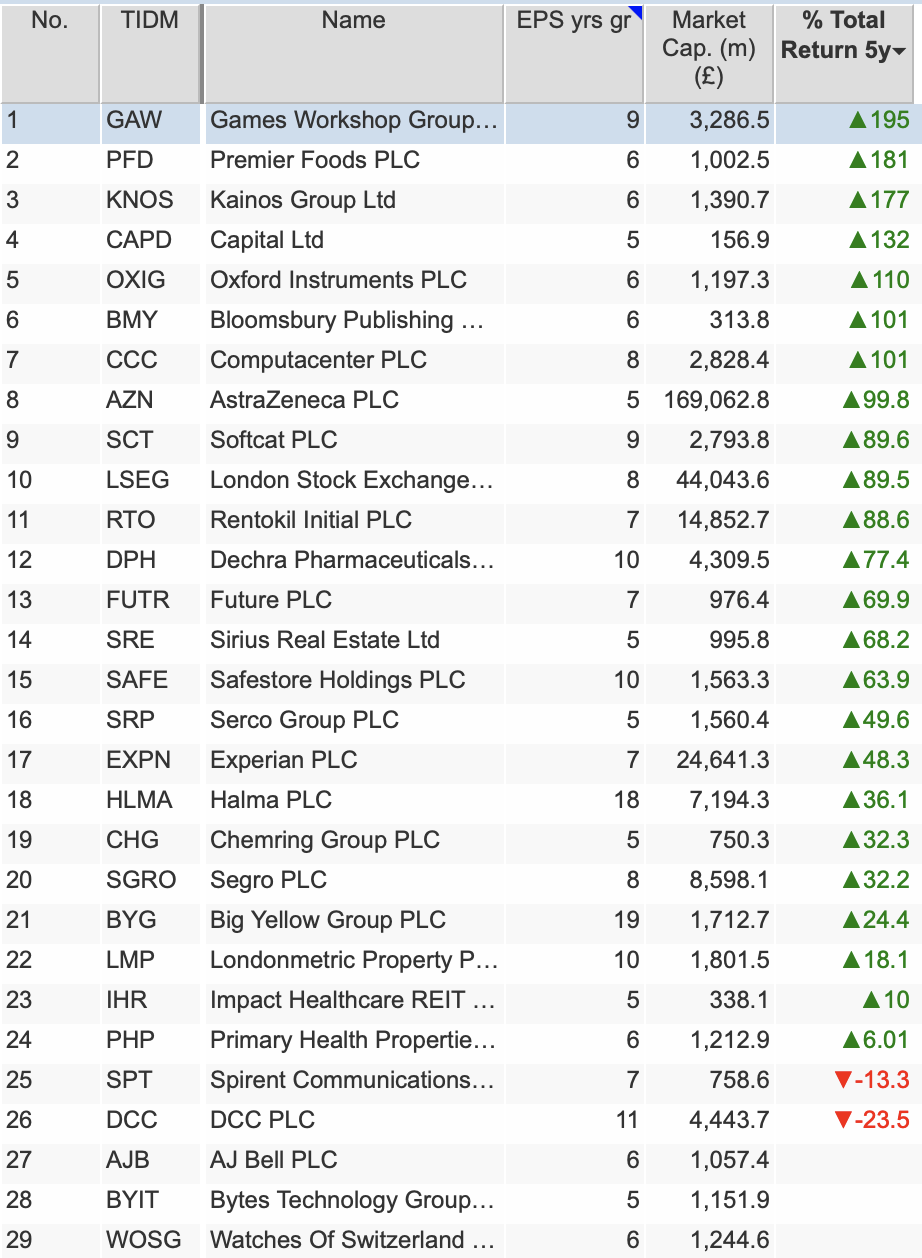

In the UK, only 31 companies in the FTSE All Share Index have decreased their share counts by 10 per cent or more over the last five years. 18 of these have outperformed the returns from the FTSE All Share of 19.8 per cent.

103 companies have spent more on buybacks than they have on dividends.

UK shares with the biggest buybacks

Source: SharePad

Some companies with buybacks have outperformed the index handsomely. But was it because of buybacks or profit growth?

There are grounds for thinking that the combination of profit growth and buybacks doesn’t do shareholders any harm, but if profits are falling buybacks may not help that much.

Top 10 performing UK shares with buybacks of 10 per cent or more

Source: SharePad

US shares: Buybacks with five consecutive years of EPS growth

If we change the SharePad filter to also include companies that have grown their EPS for at least the last five years – no mean feat given that this includes the Covid-19 period – then you can see that there have been some stunning performances.

Again this is arguably due to profits growth rather than buybacks.

US Shares: Buybacks with consistent earnings growth

Source: SharePad

This may be a very telling feature of the UK stock market, but if you repeat this filter for the UK it returns no qualifying companies with five years or more of consecutive earnings growth with meaningful share buybacks.

If you were just screening for five years or more of consecutive earnings per share growth in the FTSE All Share index it would return 29 companies.

Of the 26 shares that have been listed on the stock exchange for that time, 21 outperformed the FTSE All Share index – more than the number of companies buying back shares.

If you are looking to screen for good companies that might outperform, a record of consistent profit growth looks like a better filter than share buybacks.

UK companies with 5 or more consecutive years of EPS growth

Source: SharePad

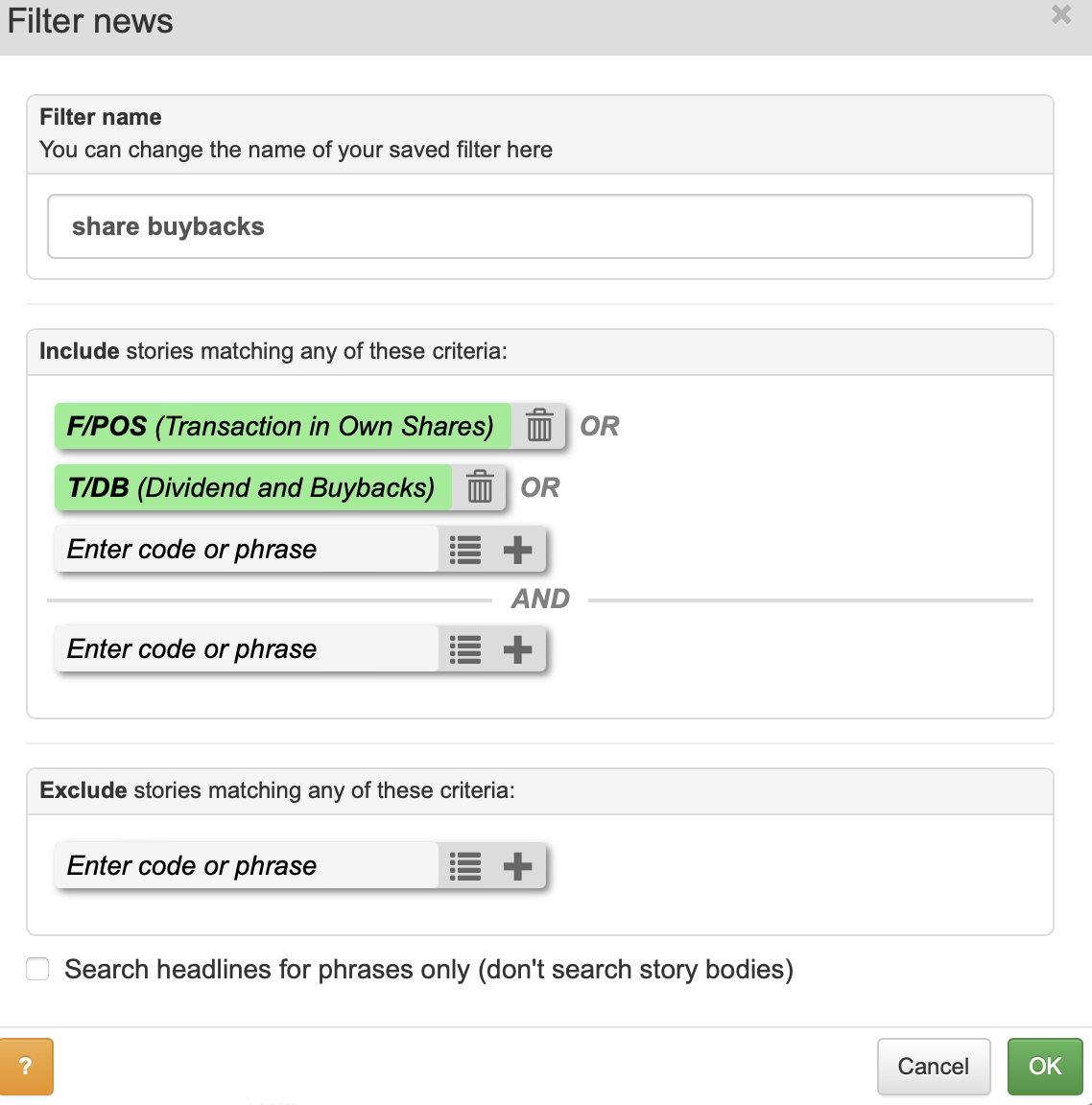

Using SharePad to find companies with ongoing buybacks

You can find companies that are currently buying back their own shares by setting up a filter in the news section. This is shown below by looking for news announcements which contain “Transactions in Own Shares”

When you come across a company that is buying back its own shares, you can quickly use SharePad to weigh up whether it is a good use of money or not by asking some very simple questions:

- Are profits or EPS expected to grow?

- Are the shares cheap or expensive?

- Does the company have excessive debts?

These questions can be answered very easily and quickly in a SharePad table.

UK Companies with ongoing share buybacks in October 2023

Source: SharePad

Generally speaking, you want to see companies buying back shares when they are cheap and when their profits are growing without taking on excessive amounts of debt.

Calculating the equivalent rate of return (ERR) from a share buyback.

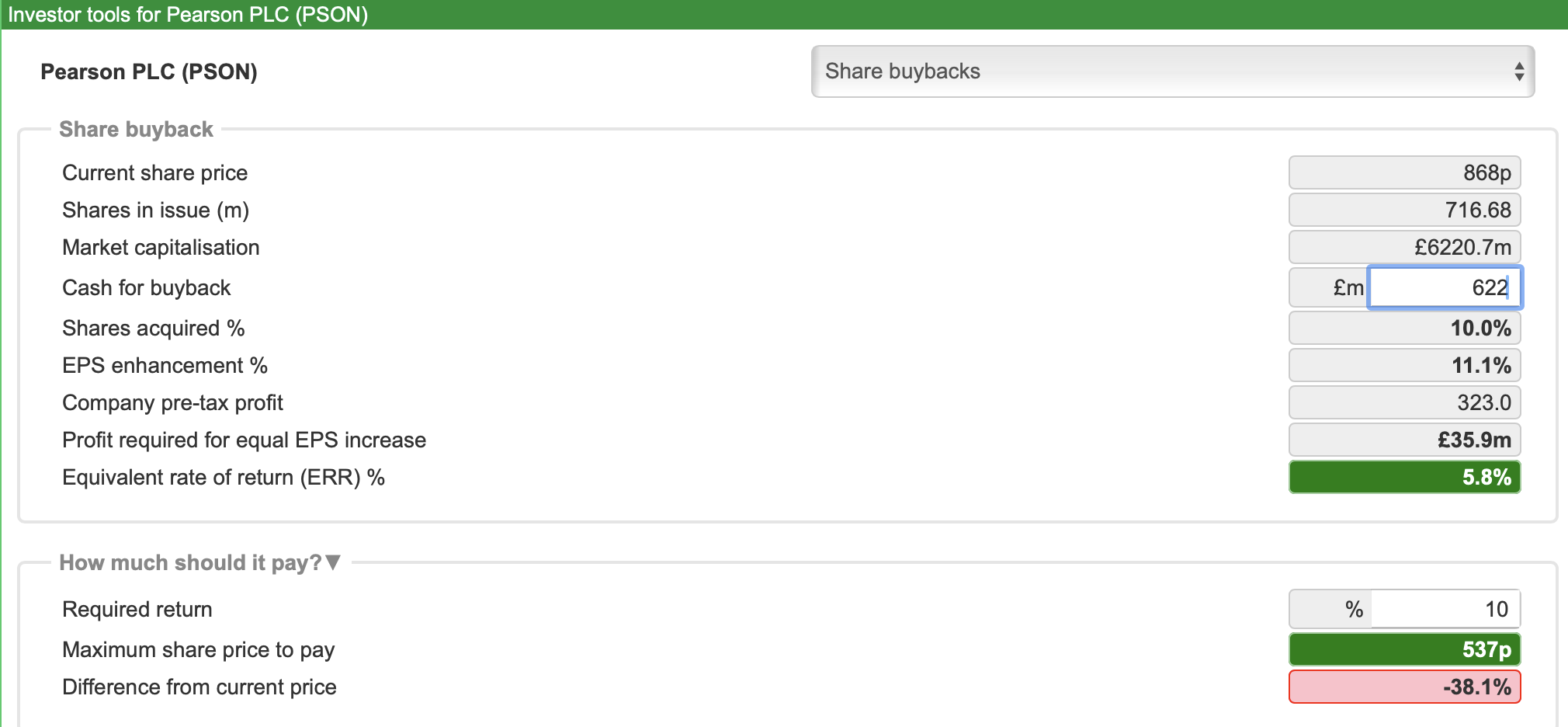

Next(LSE:NXT) has been one of the best examples of a company using share buybacks in the best interests of its shareholders. In its 2012 annual report, it explained how it uses buybacks by calculating the equivalent rate of return(ERR from them).

We’ve built Next’s buyback model into SharePad so that you can apply it to any share.

When a company announces a buyback, just put the amount it intends to spend on it into the white cash for buyback box and the rate of return you want from owning the share (default rate is 8%).

SharePad will then give you the maximum price a company should pay to buy back its own shares and compare it with the current share price. It will also give you the ERR of the buyback. Ideally, you want to see as high a return as possible.

If the maximum price is below the current share price, the box at the very bottom will be red, suggesting that a buyback is bad for shareholders. If it is above the current share price then the box will be green, suggesting that a buyback might be a good thing to do.

SharePad Share buyback tool

Source: SharePad

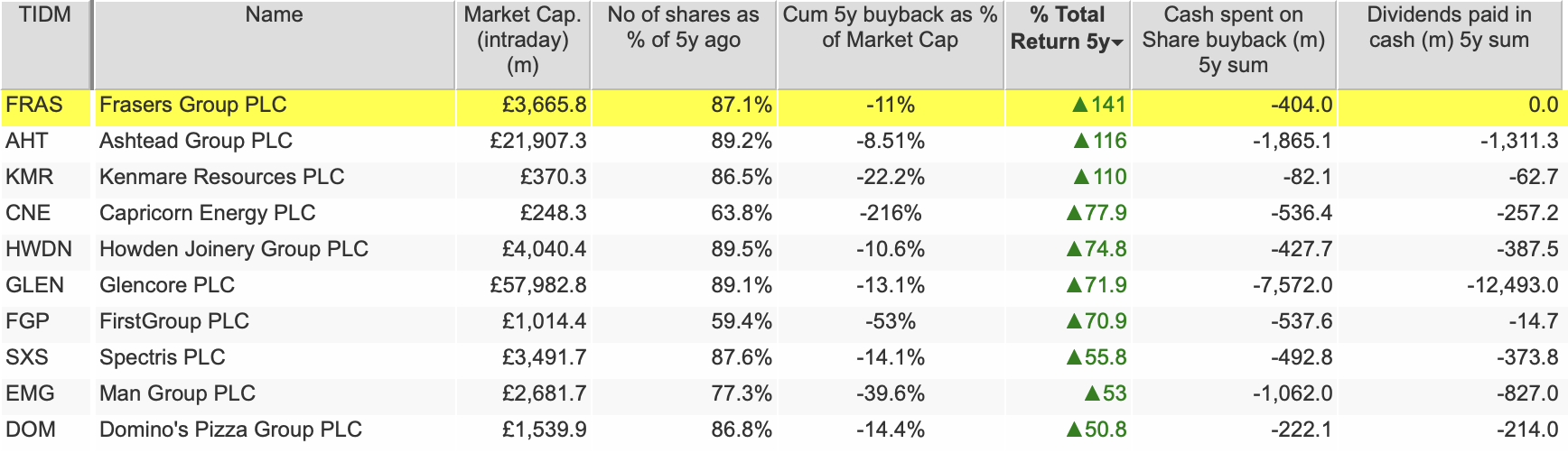

ERRs of ongoing UK share buybacks

To keep things simple, I’ve assumed that all the companies currently buying back shares buy back 10 per cent of their shares at their current share prices.

The ERRs are shown in the table below.

|

Company |

ERR % |

|

Frasers |

19.4 |

|

Ashtead |

9.3 |

|

First Group |

11.0 |

|

Future |

19.4 |

|

Spectris |

5.0 |

|

Domino’s Pizza |

8.7 |

|

Pearson |

5.8 |

|

Burberry |

10.4 |

|

Kingfisher |

16.7 |

|

Whitbread |

6.3 |

Source: SharePad

–

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.