This months’ focus on funds explains why a peak in short-term government bond yields might presage a sudden turnaround in sentiment towards the listed infrastructure fund space. We also look at a stockmarket listed venture capital fund that is full of AI early-stage businesses but is valued at well below its book value by a sceptical City. And we highlight why one of the leading digital infrastructure funds, Cordiant, looks almost ridiculously undervalued.

But first, let’s think big picture and understand how rising rates impact a key bit of the funds market, the real assets investment trust space comprising infrastructure funds – as well as lending funds. It’s no understatement to say that this hugely popular segment of the investment trusts market has endured a torrid 18 months. The sector sold itself as what was in effect a bond proxy. You received a stable, and growing income yield which was running at between 4 and 6.5% per annum plus some promise of capital appreciation – usually in the 1 to 3% NAV appreciation per annum range. These assets would also boast inflation protection and would largely consist of real, hard assets such as buildings or at the very least government contracts backed by regular cash flows (PFI contracts).

The problem with bond proxies is that when bonds sell off because of rising inflation and interest rates, no one should be surprised to discover that the bond proxies also sell-off. The mechanisms are varied but rely on two key processes. The first is that as risk-free government bonds sell-off as a result of rising interest rates, the yield on short-duration – say two-year – gilts rise rapidly and has in fact recently pushed past 5%. In this scenario if you get 5% from zero-risk lending to the government for two years but only get the same rate from investing in an infrastructure fund with all the market risk, why bother with a bond proxy? Buy the real thing and lend some money to HMG.

The other mechanism is less obvious but arguably more dangerous. Most infrastructure funds base their net asset values (NAVs) on financial models which take the incoming cashflows (from owning real assets), work out a sensible valuation and then apply a discount based in turn on the risk-free rate of return (owning gilts). As that risk-free rate of return increases – produced by lower bond prices – the discount to those cash flows also increases which, in turn, reduces the NAV of the fund. The discount can vary across funds and depends on a best guess as to the volatility of the underlying business model. If it’s regarded as very low-risk operating model then the discount rate is probably more in the 5 to 7% range whereas higher-risk stuff comes in closer to (and sometimes above) 10%. However, the risk-free rate acts as a base level, pushing up all discount rates.

This double whammy has been dramatic in the listed funds space and produced a massive de-rating of infrastructure and lending funds. Many popular names have switched from a handy premium (to NAV) all the way to a deep discount of as much as 40% in some cases. That kind of share price decline – more than 40% in many cases – is brutal for a supposedly lower-risk asset and helped push net yields above 8% in many cases.

But we also need to remember that interest rates move up and then frequently move down again. We are currently in a rising rate environment because the BoE has rightly decided that it needs to cool down the economy. That has pushed up those crucial 2-year rates to levels of around 5% that are painful for many funds. But I think it reasonable to argue that we are fast approaching peak interest rates. Amongst most economists, there’s a consensus that rates of much above 6% for more than a few years – given our burden of debt – is probably a dangerous policy stance for the Bank of England. It will permanently dampen investment, crush housing markets, and send government finances into a tailspin. If one thinks that consensus is right, then it’s reasonable to expect interest rates at some point to come down again. Perhaps not to zero but certainly closer to a 3 to 4% range.

If you think that scenario possible, even likely, and that by the end of 2024 2 year gilt rates will be heading back towards 3.5%, then suddenly a whole bunch of income-producing real asset funds churning out net yields in the current 8 to 10% range look quite attractive again, especially as their discount rates might also start to fall again.

Even better, that 3.5% interest rate scenario is entirely consistent with inflation at a still 3 to 5% elevated level – and these funds tend to benefit from higher than expected inflation because of the preponderance of inflation-linked leases, contracts and deals. So, sentiment could turn very suddenly for many income-producing assets when we reach peak short rates. My guess is that peak rate scenario is much, much closer than we all think – the next six months – and the flight back to Bond Proxies might start as early as Q1 in 2024.

Cordiant Digital Infrastructure

The big picture explanation I have explained above has one crucial wrinkle – some funds are prioritising NAV growth alongside dividend growth .i.e. they aren’t really bond proxies at all! One such example is Cordiant Digital Infrastructure. It invests in data centres, mobile phone towers, digital broadcast infrastructure, and fibre cable businesses. In effect, it’s a private equity fund that invests in infrastructure assets that are run as operating businesses. This makes it a hybrid PE/infrastructure fund which has set dividend expectations at a reasonable 4% plus per annum level but is targeting total NAV returns of more than 9% per annum – which implies a capital gain of around 5% per annum. That 9% target total return is possible because of the operating assets it is investing in – growth businesses that are benefiting from strong secular growth alongside fairly constant price deflation.

Unlike its nearest competitor Digital 9, Cordiant has largely avoided self-inflicted mishaps such as the manager leaving, (in D9s case) and not covering the dividend (also D9), yet the discount has shot up to 38% (last NAV was at 115p) with the dividend yield now running at 5.6% – that dividend is fully covered.

That discount would be fair if one of three things were true:

- Its core business is undergoing a cyclical slowdown

- Its core cashflows were stable and not growing and thus should be linked to gilt yields i.e it was in effect a straight bond proxy

- Its core businesses were purchased with expensive debt that will now throttle returns

It’s clear to me that the first challenge is not relevant – in fact, business demand is speeding up helped along by the implementation of AI into corporate data decision-making. That follows through into the second point which is that despite the constant price deflation – this is IT after all – the core businesses (largely in central and Eastern Europe) are experiencing steady top and bottom-line growth. This suggests that comparing these businesses to the gilt yield is not sensible – better to compare them with other peers in the listed digital infrastructure operating business space, one that is dominated by major US businesses. These publicly traded peers frequently trade at many multiples to Cordiant’s value. It’s also worth noting that PE deal activity in the digital space is speeding up, not slowing down. As for the last challenge, Cordiant has been notably careful with its debt profile kept interest costs under control and lengthened out loan maturities.

One last point. Cordiant has, so far at least, a decent track record at buying businesses. Its latest purchase I would argue demonstrates its cautious approach. Its just bought a big Irish business called Speed Fibre DAC, which is Ireland’s leading open-access fibre infrastructure provider. The deal is worth €190.5m and comprises an equity consideration of €97m which will be funded by €68m in cash and €29m through a vendor loan note with an initial interest rate of 6% and a maturity of four years. Cordiant says the business being acquired generated turnover of c. €80m and EBITDA of c. €23m in 2022. The deal also includes outstanding gross debt of c. €111m as of December 2022 which matures in 2029. Fund analysts at Numis calculate that the purchase price is 8.3x EV/EBITDA which compares to a portfolio average of 10.6x EV/EBITDA at 31 March. If Cordiant were valued closer to its listed US peers such as Equinix, that earnings multiple would be a quantum higher.

Given Cordiant’s conservative approach to debt and the quality of its management, I think the current discount of 38% is excessive and is close to an all-time high. If sentiment on short-term rates does switch – as I think it will – Cordiant will be in a sweet spot. It’s been hit hard by the infrastructure sell-off but its assets are more likely to grow sustainably over time compared to more boring, defensive infrastructure assets with limited growth potential.

US equities play – Pershing Square

Everyone has a view on the value of US equities. My own is that they look a tad expensive compared to their developed world peers, but I wouldn’t want to bet against them in the short to medium term.

By and large, I think the best way of playing the US stock market is in one of three ways. The first is to accept that none of us have any idea which sector will do well in the next few years and buy an S&P 500 tracker. Keep it simple and cheap.

The next option is to buy a handful of key, mega large-cap US stocks such as Microsoft, Alphabet and perhaps Nvidia, and forget about the rest of the market. This has been a successful strategy but does leave you open to subtle switches in mood between sectors i.e a focused tech sector sell-off.

The last choice is to trust an actively managed fund to somehow beat the market via clever stock selection. I have my severe doubts that many actively managed funds can pull off this strategy consistently over the long term but one fund I would choose to focus on is called Pershing Square, the listed hedge fund run by Bill Ackmann.

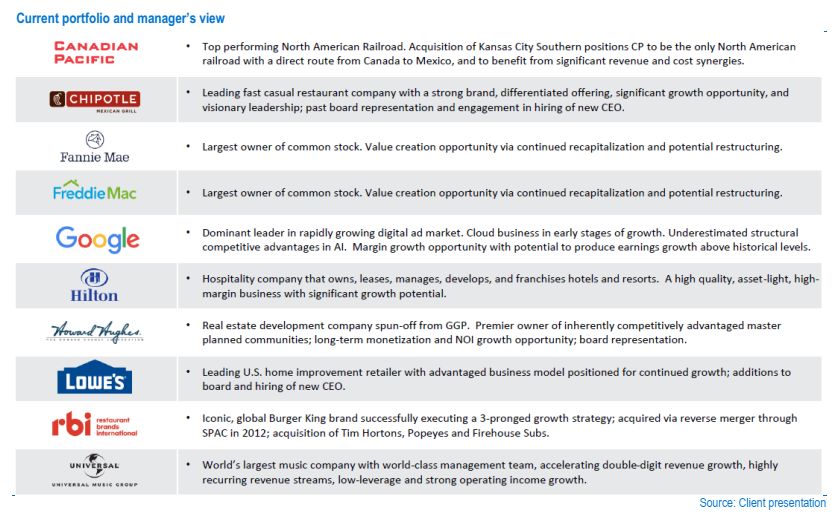

I own shares in this London listed fund because Ackmann quite simply has an excellent track record – and you can pick up shares in his concentrated portfolio of US quality stocks at a bargain discount of 34%. I could explain in great detail why I own Pershing shares, but a recent research note by analysts at Investec sums it up brilliantly:

“It’s now more than five years since the manager embarked on a strategic pivot and the results have been spectacular. Pershing Square Holdings is ranked 1st out of 141 strong peer groups consisting of the AIC North America and IA North America sectors, and the margin of the outperformance of both this peer group and the S&P Composite is simply staggering. The manager has a clear and straightforward investment approach to portfolio construction, and this incorporates a range of constructive engagement strategies and is complemented by opportunistic asymmetric hedging strategies. At a time when actively managed US large-cap funds are continuing to struggle to beat the S&P Composite, we firmly believe that Pershing Square Holdings is a unique and compelling investment proposition and that strong fundamentals are enhanced by the current rating.”

My take – I agree with Investec and own shares in Pershing and continue to buy shares on a regular basis. The graphic below shows the current main holdings in the portfolio.

In-depth: Forward Partners

I’ve talked fairly frequently in the past about the VC cycle and how we need to have sensible valuations on private, fast-growth businesses. My preferred metric is to slice between 80 and 90% off the peak 2021 valuations – this, I think, gives us a reasonable margin of safety.

I’m also not entirely convinced that we have reached the trough of VC valuations, especially in the early stage, Series A and seed deals. I think more pain is to come. But I’m also willing to accept that maybe bits of the VC ecosystem are beginning to turn a corner and that valuations might have, in some cases, bottomed out. One possible case study is Chrysalis which recently announced a NAV uplift of 5,3% in Q2, following a 1.4% rise in Q1.

Fund analysts at Numis reckon the most significant write-ups in that Chrysalis portfolio were to Wefox (insuretech), Starling (UK bank), and Brandtech (marketing technology). So, maybe, just maybe, we’re at peak pessimism for listed VCs though I’m not quite convinced of that yet.

Still, despite my caution, I have started buying shares in another, less well-known VC called Forward Partners. This is run by an ex-Molten Ventures veteran and is involved in much earlier-stage private growth businesses. Whereas Chrysalis is more pre-IPO focused (still no sign of those emerging any time soon) and Molten more late-stage, post-Series A ventures, Forward is much more focused on the really early-stage businesses – Series A and seed.

That makes the fund much more vulnerable to the haircut problem.

Pre-IPO businesses have their challenges but by and large, these are well-established businesses, many of them profitable like Starling Bank (in the Chrysalis portfolio). So, although valuations will see-saw around, these are more mature investments. Next up we have the Molten Ventures of the world who focus on slightly less mature businesses but their investment is usually structured around preference shares which give them some (not a lot in my view) downside protection. These are also businesses that while maybe not deeply profitable are still growing solidly – and no one is quite so worried about running out of cash to grow.

At the bottom of the ecosystem are the earlier-stage businesses which are dependent on cash runways, may still have to prove their business USP and are more vulnerable. In any revaluation exercise we need to treat any 2021 valuation with a massive pinch of salt – and maybe apply my 80 to 90% haircut. Whatever number you use, you have to accept that this part of the ecosystem is more vulnerable to capital squeezes and will paradoxically take a bit longer to see valuations adjusted.

Forward operates in this space and its shares have taken an absolute kicking. But I would argue that your margin of safety is now half decent and as I mentioned earlier I have started buying the shares. The 2021 accounts showed NAV per share of 139.6p (up from 61p) – lets be kind of Forward and cut that peak NAV by 50%. That gets us to around 70p which is, by coincidence not far off the NAV estimate that analysts at Liberum come to (75p) via a more convoluted process.

The current share price by contrast is around 27p, which is in effect an 80% haircut from the peak valuation. And half of that (£17m) is in cash. Crucially the fund is getting serious about cost cutting and is aiming to reduce Net Operating Expenses by circa 40% compared with the £7.7m incurred in 2022. That gives us a forecast year-end net cash of £8.5m. As for the businesses in the portfolio, according to Forward, the top 15 portfolio companies grew revenues by 144% on average – the company also says that 82% of those top 15 companies have 18 months or more cash runway, are on the path to break even without the need for further fund-raising or are profitable.

So, what’s in the portfolio at these much-reduced numbers? According to Liberum “52% of its companies by fair value are now classified as AI, being businesses that are either applying AI or have generative AI product in market or near launch; and portfolio companies including Baseline, Sonrai and Sourcery have recently announced AI products.” In the section below I’ve outlined not only some key fund facts but also the main portfolio businesses.

Fund Facts

– Mkt Cap £33m

– Share price 24.5p

– NAV per share 72p

– Prem/(disc) -66.0%

– Venture portfolio value £80m as at 31st December 22

– Active portfolio companies 43

– Focuses on pre-seed and seed-stage investments. Investing early means smaller investments with significant ownership stakes, and a naturally diversified portfolio. We grow with our businesses, participating in follow-on rounds up to Series A.

– Also includes Forward Studio, an incubator-style hands-on project/studio

– last year’s valuation haircut: Portfolio Fair Value decline of 39.0% for the full year

– Top 15 portfolio companies grew revenues by 144% on average

– 82% of businesses have 18+ months runway

– Deployed £9.7m in 2022 in new investments

Portfolio split– Applied AI 40% – Marketplace 29% – eCommerce 13% – Other tech 18% By Company– Gravity Sketch 10% (other tech – a leading innovator in the digital design industry, offering intuitive 3D design software for cross-disciplinary teams to create, collaborate, and review in an entirely new way.) – Robin 8% (AI-enabled – a legal-tech company that provides companies, scale-ups and funds with a solution to improve contracts through software, machine learning and a team of world-class legal professionals) – Spoke 8% (eCommerce – Spoke is a direct-to-consumer eCommerce company that provides better-fitting, better-looking men’s clothes.) – Makers 6% (marketplace) – OutThink 6% (AI) – Ably 5% (other tech) – Apexx 5% (AI-enabled – Apexx’s platform allows merchants to connect via a simple API to the world’s payment ecosystem). Completed a $25m series B funding round in March – Forward invested a further £0.7m, taking its total investment to £2.3m. PocDoc raised £2.4m in March with Forward investing £0.3m, taking its total investment to £1.6m; – Breedr 5% (marketplace – Breedr is a platform that helps farmers to manage, buy and sell livestock. their solution boosts efficiency, output and returns whilst reducing the carbon footprint of farms by up to 28%) – Juno 5% (AI) – Koru Kids 4% (Marketplace) – SnapTrip 4% (marketplace) – Koyo (a loans business) faced difficulties in raising new capital in the wake of SVB. A wind-down of the company has begun and this is expected to result in a write-down of £2.3m for Forward at the interims |

The good news is that despite an increasingly meagre cash pile for future investments, the fund is still making some interesting investments, many of them in generative AI. Forward has, for instance, invested £0.5m in an AI platform focused on predictive analytics for industrial machinery – the company will be named on completion. Another new investment is in a business called Baseline which is developing the tools that companies need to confidently adopt ‘serverless’ technology. Its technology offers greater scalability, high flexibility, and faster releases at a reduced cost. Then there’s Sonrai which is an analytics platform that leverages AI to speed up drug and healthcare developments. The company has successfully placed its platform with key healthcare businesses across the EU and the US, counting Roche and the NHS among its partners.

So, let’s sum up the argument.

– In effect, the market has already applied an 80% haircut to the peak valuation which seems sensible

– As Liberum analysts rightly observe “Forward had limited protection from preference share structures as valuations fell, meaning that its write-downs were more aggressive than for peers investing at later stages.”

– But there’s a flipside to that downside risk – Forward’s NAV will be more geared towards the upside as markets recover

– I am concerned about the cash or absence of it. The fund needs to salvage expenses, raise some cash, and continue investing

– The fund’s focus on AI seems to have gone unnoticed by the wider market. Then again, if the markets at some point go cold on AI, the fund could find itself in an awkward spot

– The big macro risk is that the current tech bull run comes badly unstuck and Forward stays in the dog house

My take? On balance, I’m willing to take the risk and have started drip-feeding into the stock at the margins of my speculative portfolio.

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.