If you are new to private investing, it’s very easy to think “How can I compete with professional fund managers? Surely, I am better off investing my money in their funds and letting them make the decisions”. This article from esteemed investment writer Phil Oakley shows you how.

So, are you better off investing all your money in funds and letting professionals make the decisions?

Firstly, this assumes that professional fund managers are good at their job.

Let’s be clear: there are some outstanding managers running some high-performing funds and investment trusts. Identifying these people before they make most of their gains is very difficult though. It’s also often the case that today’s star fund manager can’t maintain their previous winning run.

For private investors like us, it then becomes quite hard to work out whether a fund manager’s past performance has been due to their skill or just plain luck.

Unfortunately, there are also lots of managers who aren’t doing very well. Many are doing a worse job than a cheap tracker fund – a fund that aims to copy the performance of an index such as the FTSE All-Share rather than beat it – which is mainly run by a computer.

The problem with giving your money over to a fund manager and why you can do just as good a job yourself or better – boils down to two main flaws:

- The fund management industry is set up to serve itself first rather than its customers

- It charges its customers too much money

Like most businesses, fund management companies exist to make money for its owners.

In very simple terms, fund managers make money by charging customers a fee for looking after their money. This fee is usually a percentage of the value of the customer’s investment account. The bigger its value, the bigger the fund manager’s fee.

You might think that this is a good arrangement as it incentivises the manager to pick winning shares that grow the value of your savings. Sometimes it can be, but often it actually leads to a different type of behaviour.

The fund managers know that their income – and their job – is dependent on their customers staying with them (to keep the pot of money and therefore the percentage fee as high as possible) and not switching their money to another manager.

The most common reason for customers choosing to leave is for the fund manager to underperform the stock market they are trying to beat.

In order to avoid this, many fund managers have deliberately built their portfolios to look like the stock market they are benchmarked against (these funds are known as closet trackers in that they are saying they are trying to beat the market but are essentially making sure that they don’t deviate from it too much).

They will often buy what the herd is buying and if they fail then they will not be alone. This is a lot better for their job security than straying from the herd by picking a cheap share that takes time to pay off and leads the manager to underperform the market.

However, this avoids one vitally important point:

To beat the stock market you must invest differently in it

If you are managing your own portfolio, you don’t have to engage in these games. Maybe you shouldn’t even be concerned about beating the stock market too much.

Your focus should be on using a share portfolio to grow the buying power of your money so that it will buy more things for you in the future than it will today.

You don’t need to own dozens or hundreds of different shares like many professional fund managers do. That’s far too many.

I’d argue that you can achieve very acceptable results with 15-20 different shares at most.

You need to spend your time investing in good companies at attractive prices. You’ll struggle to find hundreds of shares that meet these criteria at any one time.

By concentrating your efforts on finding them and avoiding bad ones, you are well on the way to becoming a successful investor. Owning a share just because it is a big part of an index doesn’t make a lot of sense if you will struggle to make money from it.

On your own, you are free to invest in any company. Fund managers, because of the huge funds they manage, can find it difficult to invest in smaller companies.

The minimum stake they might invest could still represent a huge, controlling interest in a small company. Additionally, the size of the trades could excite other market watchers and bid the price up – making it harder for the fund manager to buy shares at a reasonable price.

Professional analysts may not even bother researching companies below a certain size. If there is not enough daily trading volume in the shares, there will not be enough commission available to make it worthwhile following the company.

There can be great opportunities for investors within smaller companies. Because many smaller companies are often ignored, you have a chance to find exciting growth companies before they get onto the radar of the professionals. This is the realm of “ten-baggers” – stocks with the potential to grow tenfold in value.

Another big advantage of the private investor is that they can move their money into cash any time they wish. If you think stock markets in general, or a particular market like bonds, are heading for a big fall you can sell your investments and buy back in when prices are much cheaper.

Many fund managers have to stay fully invested in shares even if they think valuations are too high.

On top of all these issues, there is another big problem – high fees.

There is nothing more damaging to the health of your finances than paying too much money to managers every year. Over the years, these fees add up and eat away at your savings pot. You end up a lot worse off In the future than you should have done.

The fees that professional money managers charge have been coming down but they are still too high. Very few managers share the huge income benefits that accrue to them as their fund gets bigger by lowering fees for their investors.

The recent performance of professional funds

If we look at the performance of the UK All Companies sector of managed funds, it is difficult to argue that its performance has been anything to write home about over the last five years.

Between the end of July 2018 and July 2023, the average total return of 186 funds followed by Citywire was just 9.5 per cent. This compared with the returns of the FTSE-All Share index of 18.1 per cent.

Only 42 funds (22.5 per cent) performed better than the All-Share index. 33 funds actually lost money.

Beating the UK market with a portfolio of UK shares is not easy, However, by freeing themselves from the constraints faced by professional managers and using leading investment software, diligent private investors give themselves a better chance of doing so by managing their own money.

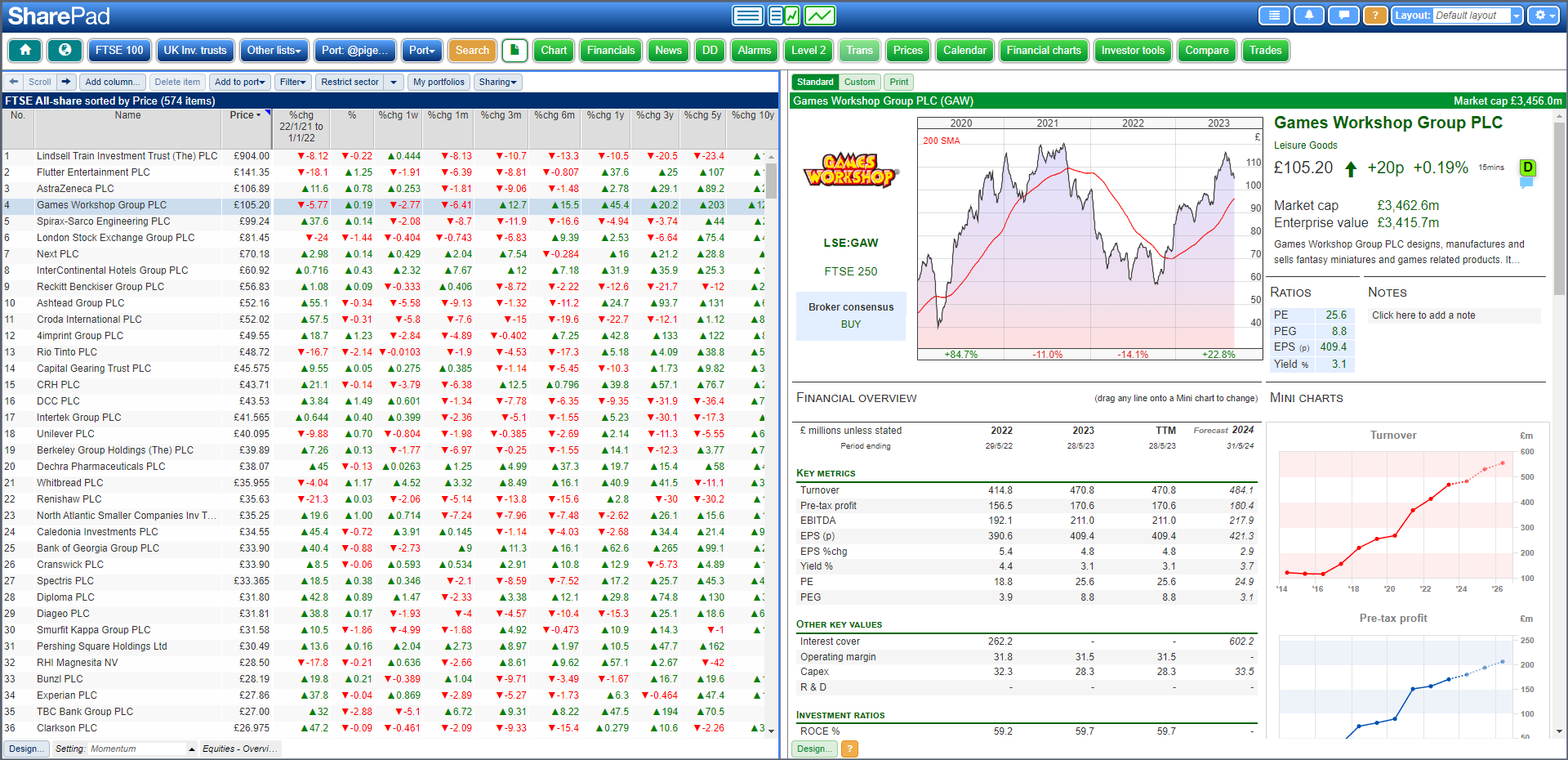

Managing your own money with SharePad

SharePad enables you to be your own fund manager. It’s not easy but if you follow a few simple rules you can beat many professionals and build up the size of your nest egg.

You need to possess a lot of different characteristics to be a good money manager but three are essential:

- Discipline – have a strategy and stick with it

- Patience – it takes time for investments to pay off

- Hard work

The first two are down to you, the third is where SharePad comes in.

SharePad provides you with everything you need to find winning investments. You can search through hundreds of UK, US, Canadian and European shares to fit virtually any criteria you can think of.

If you want to invest in funds, investment trusts, ETFs or bonds then SharePad can help you with that as well.

If you decide to invest in individual shares, with SharePad you can perform an in-depth study of a company’s financial history and its valuation in minutes.

It will work out a lot of useful calculations for you so that you can really understand what makes a company tick. You can also find out what’s been going on with the company recently with SharePad’s news function.

We think you’ll find SharePad an invaluable tool in helping you get the most from your investments.

However, we’ve decided to do more than just provide you with a useful bit of investment software.

On top of that we are providing all users with a Step-by-Step Guide to Investment Analysis to help you understand all the numbers you’ll encounter and how to put them to good use.

We also write lots of helpful and topical investment articles which you’ll find here on our website.

So, if you are a growth investor, value investor, looking for dividend-paying shares or want to buy bonds or funds we’ve got it all covered with SharePad.

Phil Oakley

Not subscribed to SharePad before? Click below to find out how SharePad can make you a better investor.

Got some thoughts about this article? Share these in the comment section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Sharescope Gold was easily accessed from a desktop icon. Can you believe that some (very) senior subscribers find it difficult and time consuming to access New Sharescope?

It would be very helpful if there were a link from Legacy Sharescope to New that avoided the need for going to Ionic Information and from there to login. I have barely used New because of this plus the unfamiliar screens when I get there.

However, I have high hopes of New when I have 2 minutes to rub together.