In this week’s Market Moves, Ben takes a look at some of the biggest winners and sector trends over the past week, including a dramatic price surge in the US tech sector (and encouraging moves in UK tech shares) plus a look-ahead to a quieter week of financial results and updates.

Semiconductor specialist Alphawave IP (now Alphawave Semi) has been on a rollercoaster of late. Shares in the company were actually suspended for a few days in early May after it made a mess of publishing its full-year accounts. While there doesn’t seem to be any malice involved, some downward (non-cash) revisions to the profit numbers were enough to see CFO Daniel Aharoni walk with immediate effect.

Last week the stock led the leaders board, with a jump of just over 20%. That said the one-year performance has been weak, and the results muddle won’t add to confidence.

Results from Marks & Spencer last week were good enough to send the stock soaring towards a 13.6% gain. Retailers are being closely watched because of worries about inflation and the cost of living. M&S has struggled in recent years with its clothing and homeware sales, but it was here where the really big improvements came. Together with another decent performance from food sales, profits easily beat expectations, triggering a rash of broker upgrades.

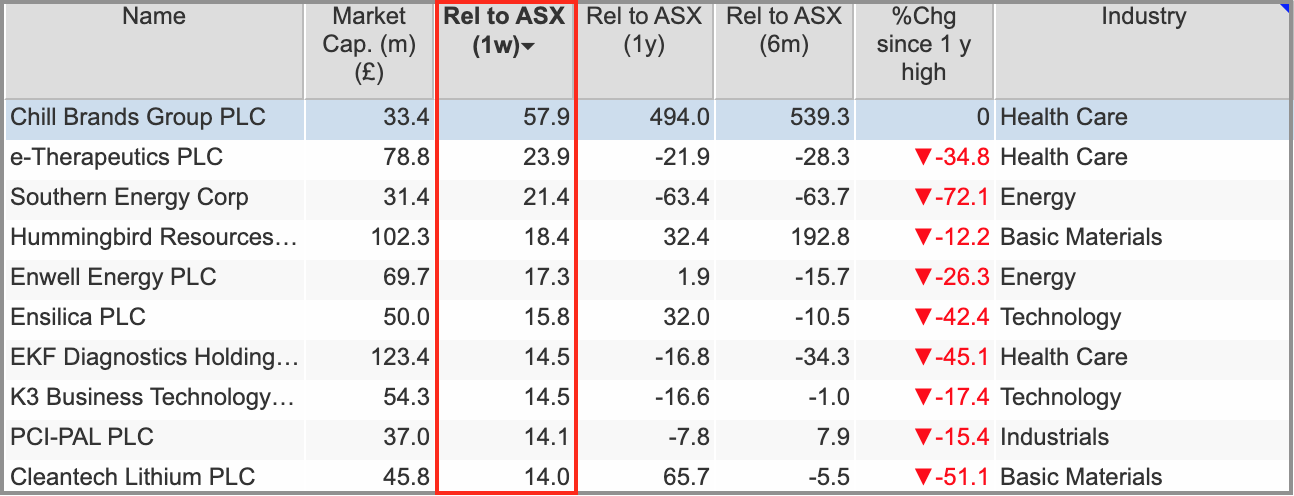

Elsewhere, small-caps have generally continued to struggle so far in 2023. The Numis Smaller Companies (plus AIM) Index is down by -2.1% in 2023. After a tough year in 2022, the anticipated rebound for smaller stocks has yet to arrive.

That said, there have been some strong individual moves, and last week it was Chill Brands that led the way. Shares in the CBD products company saw a massive surge of 57.9% versus the market on news of a distribution deal with The Vaping Group to launch nicotine-free vapour products.

Another stock classified in the Health Care sector to see a sharp rise last week was e-Therapeutics. The small-cap genetics specialist reported wider losses in its full-year results in early May. But a heavy focus on the use of AI (artificial intelligence) in its medical development could be catching the attention of the market. On that subject…

Trending sectors – Tech stocks are on the move again

It’s not often that you see a company with a multi-billion dollar market cap jump by more than 25% in one day, but that’s what US tech giant NVIDIA did last week.

Take a look at this breathtaking five-year chart. On Thursday the stock soared by $184 billion, taking NVIDIA’s market cap to just short of $1 trillion. According to SharePad, that puts the stock on a P/E of 184x.

Some will see this as a bubble, but others will see companies like NVIDIA being in the right place at the right time. After all, the chip maker’s products are powering AI, which is undoubtedly one of the biggest themes in tech at the moment.

Last year, America’s big seven technology stocks had a terrible time. NVIDIA shares fell by 50.3%. There were varying double-digit declines in the likes of Meta, Amazon, Alphabet, Microsoft, Tesla and Apple. Their combined price falls drove down the entire market.

This year the opposite is happening. Efficiency savings have been enacted, projects have been streamlined, attention is on profits and cash flow and the economy is looking up. Now the big seven are driving the market higher.

Of course here in the UK, technology doesn’t have the same presence in the stock market. We only really have 10 or so £1 billion-plus companies in the sector, followed by a small army of small-caps. But even so, the FTSE 350 Software and Computer Services Index has been trending higher in recent weeks – it’s up by 10.6% year to date.

Among the stocks in the tech sector, Moneysupermarket currently leads year to date with a gain of nearly 30% – but it’s a broadly encouraging picture. Note that Auto Trader and Softcat have both got updates due next week (see below).

Results to look out for

Spring Bank Holiday makes this a short week, and the flood of results we’ve had recently is starting to slow down.

As always, precise dates are never certain so keep an eye out for changes – and what follows is not a comprehensive list.

Tuesday gets off to a slow start, with half-year figures from Hollywood Bowl and food producer Greencore. Tech group Softcat is due to issue a trading update and advertising technology business Tremor International will have Q1 results out.

Wednesday kicks off with full year figures from large-cap retailer B&M European Value Retail. Shares there have taken a knock recently after a decent start in 2023. So all eyes will be on what management has to say about the outlook. Harry Potter publisher Bloomsbury – where the shares really didn’t get the memo about the sell-off last year – is also due to publish full-year numbers. We’ll also get interims from fund managers Impax Asset Management, and Premier Miton and trading statements from WH Smith and NWF.

Thursday sees full-year results from online motor sales platform Auto Trader. Car sales are in some ways a barometer of consumer confidence, and for what it’s worth SMMT figures suggest that the used auto sales sector got off to a solid start in 2023. Full-year numbers are also due from Dr Martens, where momentum has really suffered since the IPO in early 2021. Likewise, Pennon, the utility group, is also due to report.

Friday is clear.

Have a great week.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.