Phil Oakley takes a look SSE (formerly known as Scottish & Southern Energy), which despite its history of unsustainable growth highlighting the dangers of investing solely on the basis of dividend yield may still be undervalued given long-term potential of its renewable energy portfolio.

The dangers of investing for high dividend yields

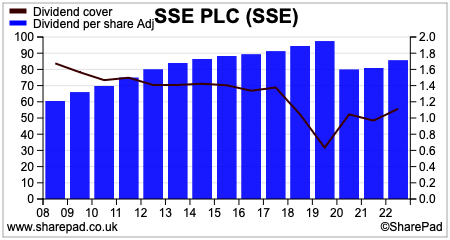

For years SSE (formerly known as Scottish & Southern Energy) was seen as a dependable dividend share with steady growth. The company’s pitch to investors was a business that could grow its dividend every year by more than the rate of inflation.

However, as the annual dividend payout got bigger over time, it became more difficult to keep on doing this.

Profits from its power generation and energy supply business were very volatile whilst investments in renewables had not yet started to mature.

Its regulated electricity and gas distribution networks and its Scottish electricity transmission grid produced steadier profits but were not growing fast enough to support the company’s dividend policy.

This meant that as SSE’s dividend per share was growing, its dividend cover – the number of times its dividend per share can be paid out its earnings per share (EPS) – was getting thinner and highlighted that the dividend was becoming more difficult to sustain.

In 2020, the payout to shareholders was cut. This was explained by the company as a consequence of it selling its energy supply business, but the reality was that the company was arguably paying an unsustainable dividend before this.

SSE is a very good example of the dangers of investing solely on the basis of dividend yield. The main problem with this approach is that a dividend cut can undermine this strategy and lead to disappointing returns.

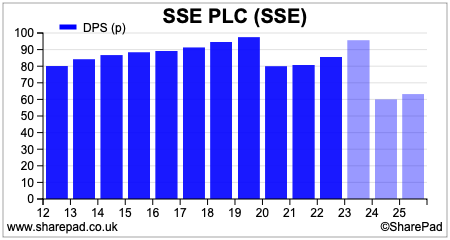

Investors need to be aware that this is about to happen again.

SSE’s forecast dividend yield at the current share price of 1837p is a tempting 5.2 per cent. However, next year, the payout will be cut to 60p per share which reduces the yield significantly to 3.3 per cent.

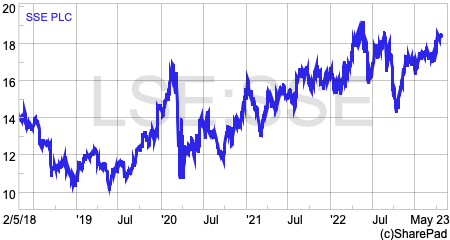

A focus on total returns (the changes in share price over time plus any dividends received) is a better approach. On this basis, SSE has arguably been a modestly successful investment over the last decade.

Total returns of 75.7 per cent are very similar to those delivered by the FTSE-All share Index (80 per cent) but most of this has come from dividends. Over the last ten years, the share price has only increased by just 18.7 per cent.

With lower dividends going forward, investors need to hope for more meaningful share price appreciation if they are going to get satisfactory returns from buying SSE shares today.

The real pain has come from SSE’s significant underperformance compared with similar European utilities. In 2021, US activist investor, Elliott Investment Management took a stake in the company and called for it to be broken up by spinning off its renewable energy business.

It argued that SSE’s renewables business was significantly undervalued by the stock market and that by listing it as a separate company (as Portuguese utility EDP had done) could make shareholders much better off.

SSE management has ignored this advice and is ploughing on with its own strategy.

But will it work?

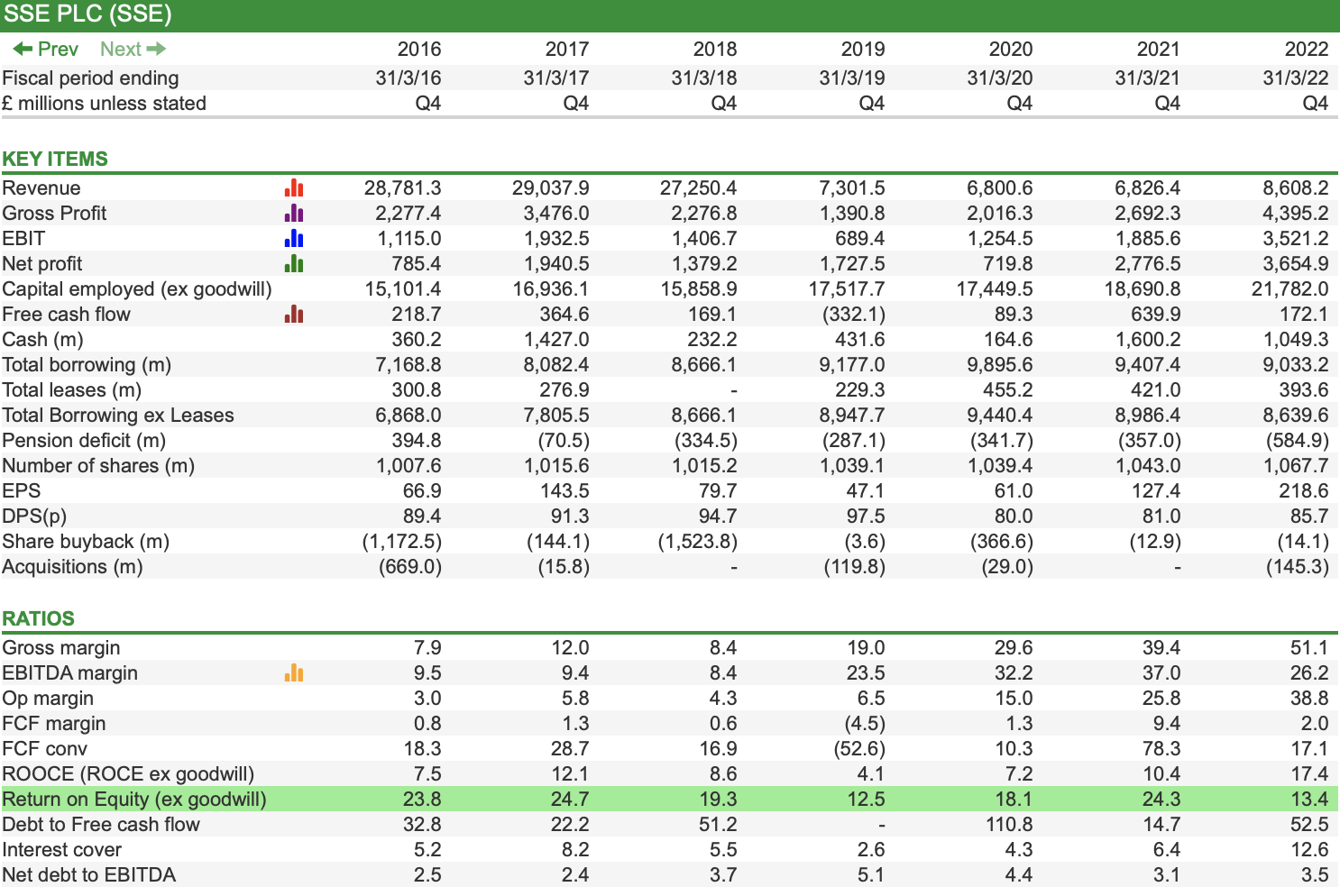

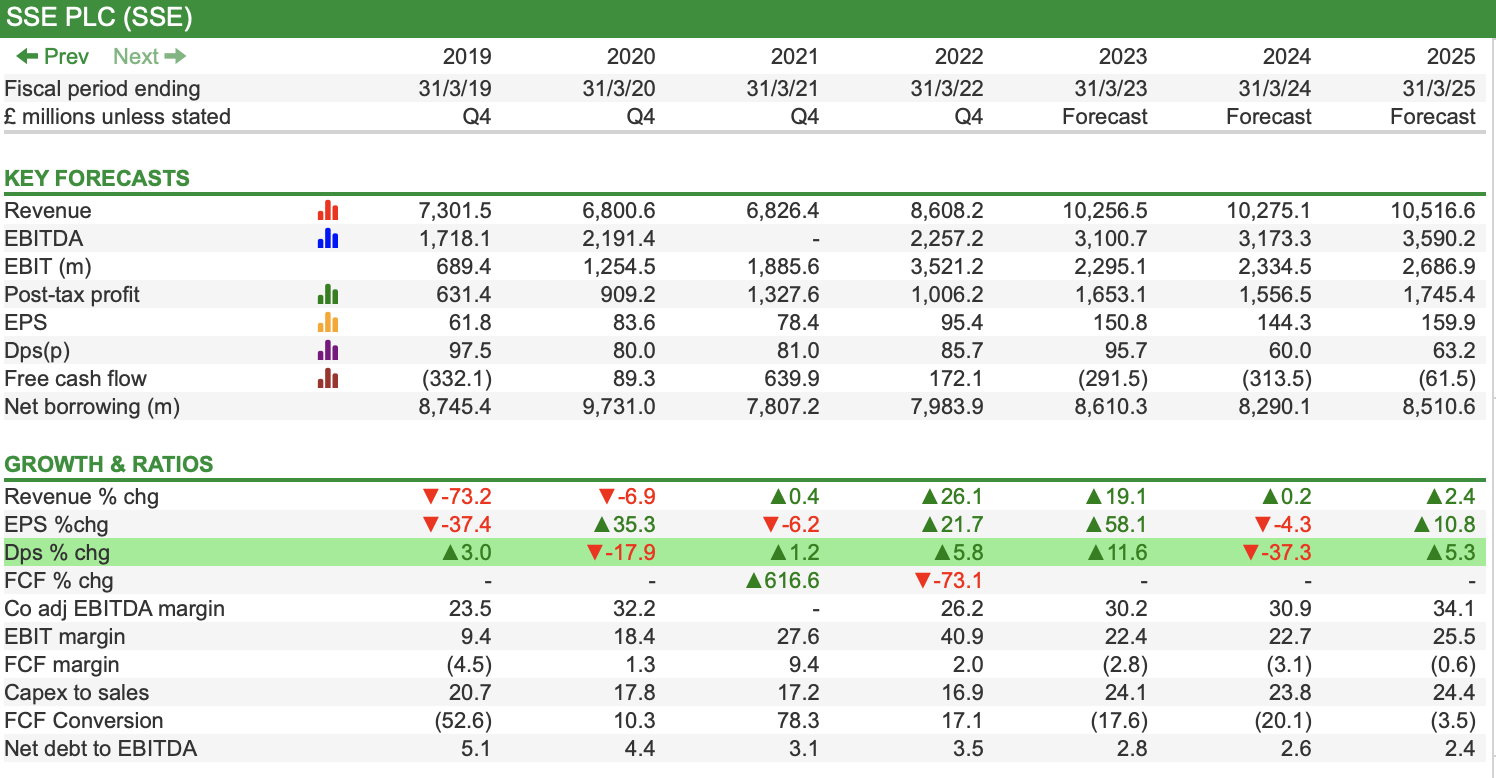

A quick snapshot of SSE’s financial performance

Source: SharePad

If you are looking for companies which make consistently high returns on operating capital (ROOCE) then SSE is not a stock for you.

Its electricity distribution and transmission network business are very asset intensive with returns capped by regulators. Its power generation and wind farms can be very profitable when power prices are high – as they have been recently – but can make very little money when prices are low or when the wind doesn’t blow much.

Large chunks of debt finance are a characteristic of energy networks given their predictable cash flows and this gears returns to shareholders – return on equity (ROE).

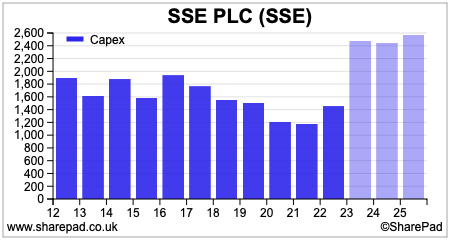

Big investment requirements (capex) mean that free cash flow generation tends not to be very good, but the hope is that SSEs current business strategy might eventually improve this.

Will SSE’s growth strategy pay off?

SSE is pouring lots of money into its renewable energy business and energy networks in order to grow its future profits but not all investors are happy about how it is going about this.

In order to free up cash to invest, the company is slashing its dividend. It is expected to pay a total dividend for the year to March 2023 of 95.7p per share. The cut to 60p per share in 2024 will save it just under £400 million but has drastically reduced the income attractions of SSE shares.

In addition to this, it is selling a 25 per cent stake in its electricity networks businesses. It has already sold 25 per cent of its Scottish Hydro transmission business (the equivalent of the National Grid in northern Scotland) for £1.47bn with the Distribution sale expected later this year.

Without question, SSE’s network and renewables businesses are exposed to very favourable long-term trends.

The move away from fossil fuels is increasing the demand for electric vehicles, electric air source heating systems as well as solar energy and battery storage. To cope with this increased demand, electricity grid networks are going to need to be expanded and upgraded.

SSE is already involved in some very big projects to connect Scottish islands to the main electricity grid.

These substantial investment requirements are likely to lead to very big increases in the regulated asset base (RAB) of SSE’s network business. In turn, this should allow the business to make bigger profits even though regulatory returns (profits as a percentage of the RAB) are capped.

The value of the RAB and the income earned on it is linked to inflation which gives SSE very predictable and secure cash flows and asset values.

Arguably, the bigger attraction for investors right now is the potential growth in SSE’s renewable energy portfolio.

Not only does the UK need more renewable energy to meet its carbon emissions targets, but it also needs more secure sources of energy as evidenced by the disruption in global gas markets since Russia’s invasion of Ukraine in February 2022.

At the moment, SSE has around 4 gigawatts (4000 megawatts) in offshore and onshore wind farms and hydroelectric power plants. The aim is to increase this to 8GW by 2026 and more than 13GW by 2031.

Big growth is expected from new wind farms in the North Sea with projects such as Dogger Bank and Berwick Bank. SSE has also made acquisitions which give a pipeline of renewable projects in France, Italy, Spain and Greece. It is also looking to bid for projects in Japan, Poland and The Netherlands.

As well as renewables, SSE also has a pipeline of 700MW of battery and solar energy projects and has a hydrogen joint venture with Equinor. It also intends to keep its gas-fired power stations and gas storage business.

Capex is set to soar in the coming years and is expected to earn reasonable returns:

- Return on equity (ROE) of 7-9 per cent on regulated networks.

- Offshore wind ROE of at least 10 per cent

- Onshore wind 100-400 basis points above its cost of capital. This suggests a ROCE of around 8-11 per cent.

These kinds of returns are not overly high but with the weight of money earning them they can help SSE deliver many years of reasonable profit growth.

However, there are a few problems to deal with first. Planning delays have been a major problem for wind farm developers in the UK and could result in projects earning revenues later than currently expected.

The price of renewable energy has also been falling rapidly and may not be high enough for big projects to go ahead.

Renewable supply chains have also suffered from shortages and high rates of inflation and could depress returns.

Volatile earnings to continue for a while

Source: SharePad

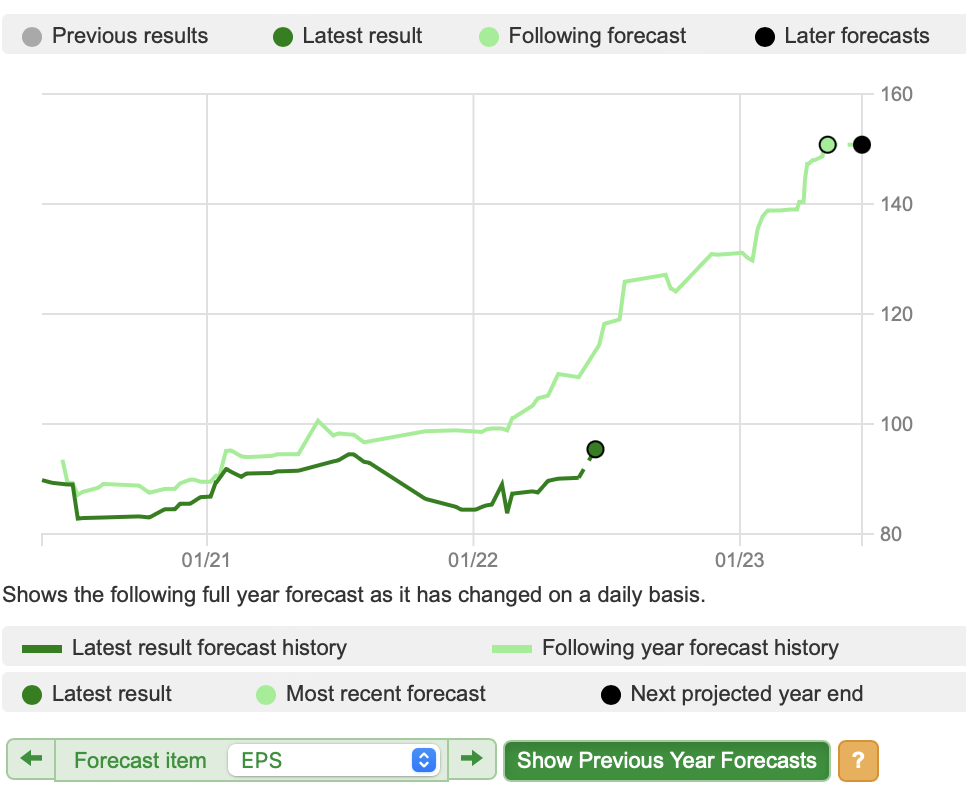

The year to March 2023 will have been a good one for SSE. Its gas power stations and gas storage businesses have made huge profits from the market turmoil. This has seen several profit forecast upgrades over the last year.

SSE: Trend in 2023 consensus EPS forecast

Source: SharePad

This will not be repeated in 2024 and EPS is still not expected to reach 2023’s level until 2025. The hope is that as new investments start to earn money, they will deliver a more stable and predictable form of growth thereafter.

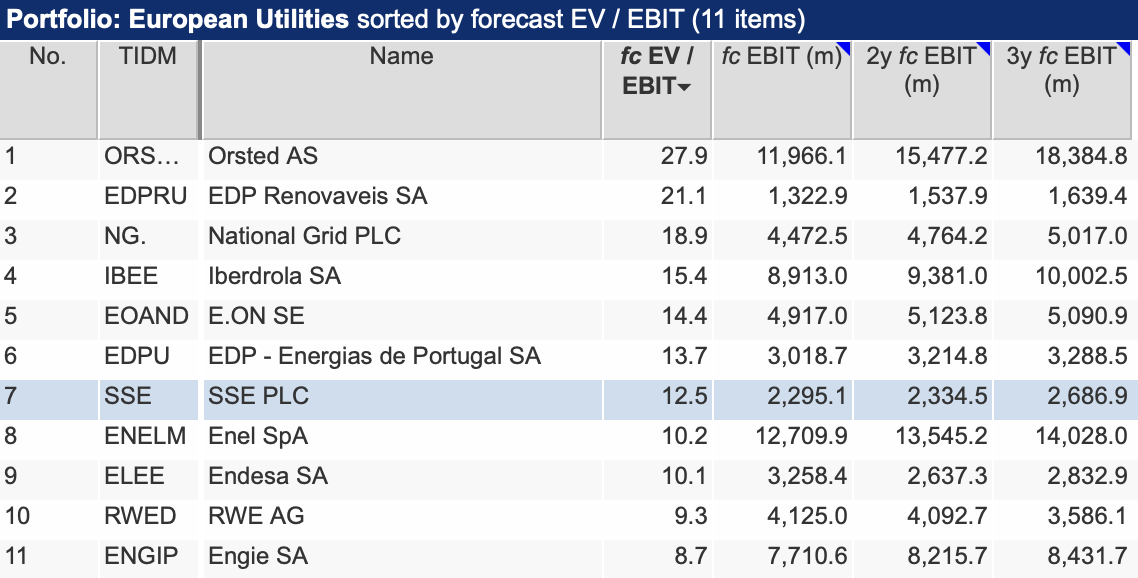

Are SSE shares undervalued?

Source: SharePad

Elliot argued that SSE shares were materially undervalued as separately listed renewables companies such as Orsted and EDP Renovaveis commanded much higher valuation multiples. SSE, in contrast, was valued very similarly to other network utilities despite having an extensive and attractive pipeline of renewable projects.

You can argue that that is still the case today.

However, making investment decisions on the basis of relative valuation differences requires a lot of consideration.

Just because standalone renewable businesses have very high valuations does not mean that SSE is cheap in absolute terms if current valuations are frothy. Most investors would probably agree that the forecast EV/EBIT multiple for Orsted is very punchy and needs a lot of future growth to justify it.

That said, if you were to compare SSE with the Spanish utility Iberdrola – which also has a mix of network and renewables business – then the valuation discount is quite big.

Whether this will be corrected any time soon remains to be seen. It is possible that SSE could be taken over, but without such an event, it is difficult to see what will result in a higher valuation being attached to the shares in the short term.

The reason to be optimistic about SSE is that if all its planned investments pay off, it will not only have bigger profits in the future but they will arguably be more stable and of higher quality than they have been in the past.

Provided we don’t move to a world of much higher interest rates than we have today – which would lead to lower values for all financial assets – then patient investors could be rewarded with a higher share price in the years to come.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.