Ben Hobson takes a look at market moves this week, including the highest risers, director and City dealing and upcoming results.

I’ve got a bit of a soft spot for seasonal stock market anomalies. Making connections between price trends and the calendar has always been a popular pastime for some. And despite the acres of academic studies that reject most of them, the research always seems to leave the door open to the possibility that one or two might actually ring true.

I mention this now because if you are a believer (and that’s a big ‘if’) there are a couple of calendar effects to watch out for at the moment. The first is the turn-of-the-month effect. The second is that April is thought to be the last of the strongest months in the stock market year. After that, the old adage to “sell in May and go away” would have you steering clear of stocks until the autumn.

Sounds spurious? Well, the turn-of-the-month effect – the observation that shares tend to perform particularly well in the first few trading days of the month – is one anomaly that apparently stands up to scrutiny. A study (here) by researchers at the asset management firm Robeco, found that, together with the Halloween Effect, the turn-of-the-month effect is one of very few that has merit.

As for selling in May, I think there could be cause for more scepticism. Last year it did work and could have saved you from a large slice of the downward pressure on prices through the middle of the year. But the general view is that trying to time the market at any point is difficult, psychologically bruising and potentially very costly.

That said, later this week we’ll have the first of two four-day weekends that are just over a month apart. So it’s certainly possible that things will quieten down as investors go in search of the sun after the rainiest March in 40 years.

Talking points from recent market moves

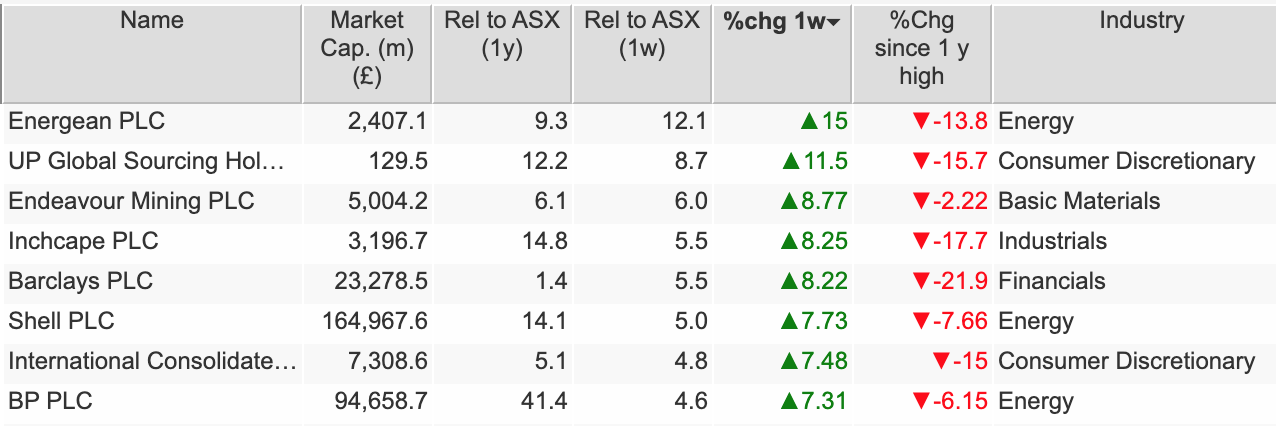

A solid set of results and glowing write-ups in the Investors’ Chronicle and The Times helped propel oil and gas producer Energean to the highest one-week riser in the FTSE All Share as the week got underway.

Highest 1-week risers on the FTSE All Share – 3/4/23 – SharePad

A bigger story here is the surprise news of plans by Opec+ to start constraining supply. From an inflation standpoint, that doesn’t feel like a positive move. But it’s good news for oil firms, with BP and Shell featuring among the top risers. Note that these energy shares are all trading fairly close to one year-highs, suggesting the market likes the sector for now.

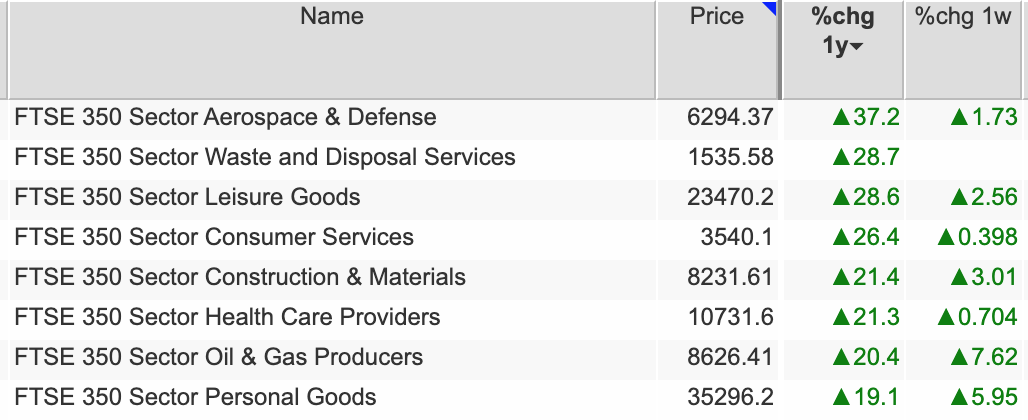

Checking out SharePad’s FTSE 350 sectors table, oil and gas has certainly been a winner over the past week, up 7.6%, and is among the top performers over one year, up 20.4%. Aerospace & Defence remains the best-performing sector on a one-year basis, up 37.2%.

Top performing FTSE 350 Sectors over 1-year – 3/4/23 – SharePad

For the biggest action in markets over the past week you had to be watching the Alternative Investment Market. First came news of a possible major deal on North Sea acreage for Jersey Oil and Gas, which has propelled the shares by nearly 80%.

Highest 1-week risers on the Alternative Investment Market

Next and arguably more impressive, was news of a major legal win for litigation finance group, Burford Capital (which Bruce has covered in detail). The £2.4 billion market cap company saw its shares soar, taking them to a 1-week rise of 58%.

Director dealings and City trades

Screening for director dealings and disclosable buying and selling by City firms and major shareholders always needs care. You can never be exactly sure what drives the share dealing decisions of insiders. Sometimes there is no signal, but nonetheless, it’s interesting to see these moves. Here are a few that caught my eye recently:

At the speculative end of the market, SharePad’s insider dealing data shows some buying at energy and utility supply firm Yu Group. It’s a punchy micro-cap with eye-catching financials. Mid-March saw buying by Jonathan Taylor’s private investment company Bayford & Co. Buying just over half a million shares took his holding to 3.2%. Shares in Yu rose by 125% last year and are up 12.3% in 2023.

Another small-cap move was at Litigation Capital Management, another litigation finance firm. There, chairman Jonathan Moulds spent nearly £1.2 million on 1,675k shares at 71p to take his holding to 4.4%. At the same time, CEO Patrick Moloney bought 157k shares at 71p in a £112k deal that took his stake to 8.76%. Shares in LIT are up 12.9% in 2023, helped by news of the big win at Burford Capital.

Finally, Chris Gillespie, the CEO of pawnbroking business H&T spent £107k on 25,000 shares at 428p at the end of March. That was followed this week by CFO Diane Giddy buying 7,500 shares at 431p. Shares in H&T had a solid year in 2022, rising 62.7%, but they are trading down 10.1% in 2023.

Upcoming results to watch

Before the end of the week* we’ve got preliminary year-end results coming up from AIM shares including Burford Capital and Next Fifteen Communications (both scheduled for Wednesday) and healthcare company EMIS on Thursday. EMIS has been in takeover talks with UnitedHealth since last summer but the shares slumped last week on news that market authorities are looking much closer at whether to give the deal the green light.

On the FTSE All Share, Hilton Foods is pencilled in to report preliminary results on Thursday. Shares in the company collapsed last September on a profit warning and a dividend cut, but they’ve staged a minor recovery in 2023, so investors will be watching for better news.

Hilton, of course, is a supplier to supermarket giant Tesco, which reports its full-year results a week on Thursday (13 April). They will be followed by J Sainsbury on 28 April. Shares in both supermarkets have had a strong start to the year (Tesco up 17% and Sainsbury up 27%), so they could be ones to watch.

*Precise publication dates can be subject to change

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.