Richard is screening for companies that have grown under their own steam. He explains the filter he uses to pick candidates for long term investment and the financial statistics that underpin it.

Since this is my last article before Christmas, I wish you a happy one.

ShareScope is my main tool for discovering shares. 5 Strikes is the system I designed to find them. Every year I document it to accommodate new innovations, perhaps uncover some wrinkles, and hopefully explain it better!

Here goes…

Every two weeks, I follow the same procedure:

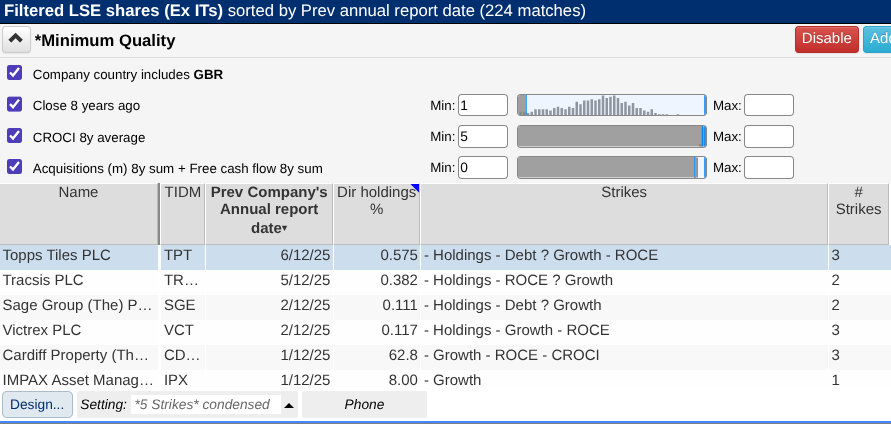

- Apply my Minimum Quality Filter to ShareScope’s list of “LSE shares Ex ITs”. These are all the main market and AIM shares listed in London excluding investment trusts.

- Scrutinise the financial track records of those shares that have also published annual reports in the previous fortnight. I use a custom ShareScope table: “5 Strikes”.

This is the beginning of my stockpicking process. The aim is to find shares that have prospered in the past under their own steam.

We all know that past performance is no guarantee of future returns, but I think businesses that are already generating returns for investors are easier to analyse.

Ultimately, we must understand what could stop these businesses prospering in future, and be confident in their strategies to overcome these risks. But by examining the performance of profitable, growing, financially strong companies over time we have useful data on a selection of businesses with firm foundations.

Minimum Quality Filter

Today, there are 1,208 shares in the “LSE shares Ex ITs” list, and 208 shares pass my Minimum Quality Filter. Here is a screenshot he shares that have passed and published annual reports since my last update:

The first three criteria in the Minimum Quality Filter, country, close, and average CROCI are standard ShareScope data items. I am looking for UK domiciled companies that have been listed for at least eight years and have earned average Cash Return on Capital Invested of 5% over that time.

These numbers are arbitrary. I think eight years is usually long enough for a company to experience good times and bad, so we can see how it has performed in both. I set the CROCI bar quite low at 5%, because I do not want to exclude viable companies that are investing cashflow today to grow in the future.

The fourth criterion combines two data items, the sum of acquisition spending over the past eight years added to the sum of free cash flow over the same period. Free cash flow is the cash earned by the business after it is paid for its operating costs and capital expenditure.

Acquisition spend is negative, cash flowing out of the business. Cash flow is positive, cash flowing into the business. If they add up to more than zero, it means the company has spent less on acquisitions than it has earned.

If the company was earning less than 5% returns, I would wonder whether it is viable. If it had spent more than it had earned on acquisitions, it would not be growing under its own steam, which would lead me to question whether its growth is sustainable.

For more nuance, we can take a closer look at the company’s record, and how it has varied in our eight year period. This is where I award the strikes that 5 Strikes gets its name from.

Custom 5 Strikes table

Victrex manufactures PEEK, a very tough polymer you can find inside much of the equipment that makes the modern world possible, from smartphone speakers to airframes.

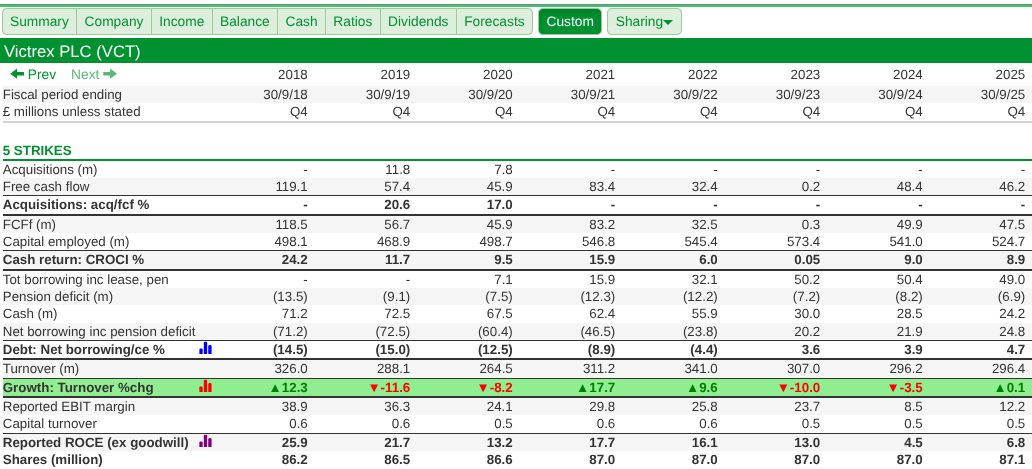

Here is Victrex’s 5 Strikes table, it shows the five performance statistics I examine, and the statistics they are derived from:

If I am not happy with one of those statistics, I award the share a strike. Five strikes instantly rules it out of further investigation, and less than three strikes identifies it as a prospect.

I note these strikes in a note column called “Strikes” in the filter table (see the first screenshot) and tot them up in a second note column called “# Strikes”. These columns enable me to see at a glance why I awarded strikes, and sort the table by number of strikes.

Victrex has 3 strikes, so it is borderline. This is how I awarded the strikes:

Holdings – 1 strike

The proportion of the company owned by directors is not available in custom tables. You can see it in the filter table of the first screenshot. Victrex directors own 0.1% of the company. Since the company’s market capitalisation is about £550 million, the directors’ own shares that are worth about £550,000, much less than they are paid in a single year. It is not a big commitment.

Acquisitions – no strike

Not only has Victrex spent less than it earned on average, it has spent less than it earned in every year of the last eight. Cash flow can be lumpy, and I will often forgive a company if cash flow was particularly low in a year it overspent on acquisitions and the spending was not much greater than cash flow in better years.

CROCI – no strike

CROCI has been positive in each of the last eight years. We might note, though, that CROCI has been markedly lower in the last four years than in the previous four. We can see from the Free cash flow rows that Victrex is earning less cash flow (lower returns). We can also see that it is employing more capital (capital invested). We would hope more investment would lead to higher returns, and the fact that it has not yet is something to investigate.

DEBT – no strike

As Victrex’s performance has deteriorated and capital expenditure has increased, Victrex has used up cash and now has a small net debt position. Net debt would have to be more than 25% for me to award a strike, though. The net debt calculation combines two ShareScope data items. It is Net borrowing (including pension deficit) as a percentage of capital employed.

Growth – 1 strike

Growth is the big conundrum at Victrex. It is investing, but not generating growth. Turnover has been very up and down during the period and it was lower in 2025 than it was in 2018. I can tolerate lumpy growth but do not like to see many or heavily negative years, or a flat or negative trend.

ROCE – 1 strike

Return on Capital Employed is a measure of profitability like CROCI but it is derived from profit not cash flow. Profit is a better measure of how a company has performed in a particular year because it smooths out the impact of investment. Companies should be able to routinely earn a 10% return each year to justify the risks of being in business. Victrex failed to reach this benchmark in 2024 and 2025, though if we investigate the accounts we might find plausible explanations (exceptional costs, for example).

Shares – no strike

There are two ways a company can grow unsustainably. They can get more and more indebted (see above), or they can issue more and more shares, which means shareholders own a proportionally smaller claim on their profits. Because so many companies give away shares as pay, some dilution may be unavoidable. I draw the line if a company’s share count rises by more than 1% a year on average.

These decisions are judgements. If a company has grown most years but contracted by 1% in one year I might forgive it, or I might award a question mark against growth instead of a strike. The logic is fuzzy because sometimes the statistics do not lend themselves to a clear cut decision.

That is the strength of this two stage system. Filters are very good at excluding shares, but sometimes that will be a mistake. Perhaps we can tolerate a little more debt, if everything else about a company checks out. Perhaps we don’t need the comfort of director ownership if the company is highly profitable and a financial fortress.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

I am thinking of investing in your listings. I assume to use it, will buy your new recommendastions and sell when 5 strikes are reached?

Hopefully, it will acheave better relults than my own selection system. I subscribe to Stockopedia, and make my selections from their 85 stockrank list.

Regards,

Alex

Hi Alex, 5/ is not meant to provide tips. It is my method of finding fairly straightforward ideas to research. I think of these as “good ideas” rather than tips. Good luck with your investing.

Richard

I am considering trying their recommendations.

It’s hard for novice people to find the right stocks so I will try to use your suggestions