This month’s funds article explores why the US markets – and funds tracking them – are looking more than a tad top-heavy (think Nvidia and the AI craze). We also explore why investors should probably ignore geopolitics. Plus, we dig around into two very contrasting investment trusts: one that invests in smaller, private British companies scaling up, the other a super concentrated bet on AI stocks.

Where’s the tech market now

Anyone who spends any time looking at market data can’t help but fall over abundant and constantly expanding evidence that the US equity market – tracked by the S&P 500 and the NASDAQ benchmark indices – is looking extremely concentrated in a handful of big tech names, and one in particular, Nvidia. Perhaps that’s why, as I write this note, the US markets have gone through a periodic sell-off, followed by an equally sudden reversal (courtesy of the US Fed signalling lower interest rates).

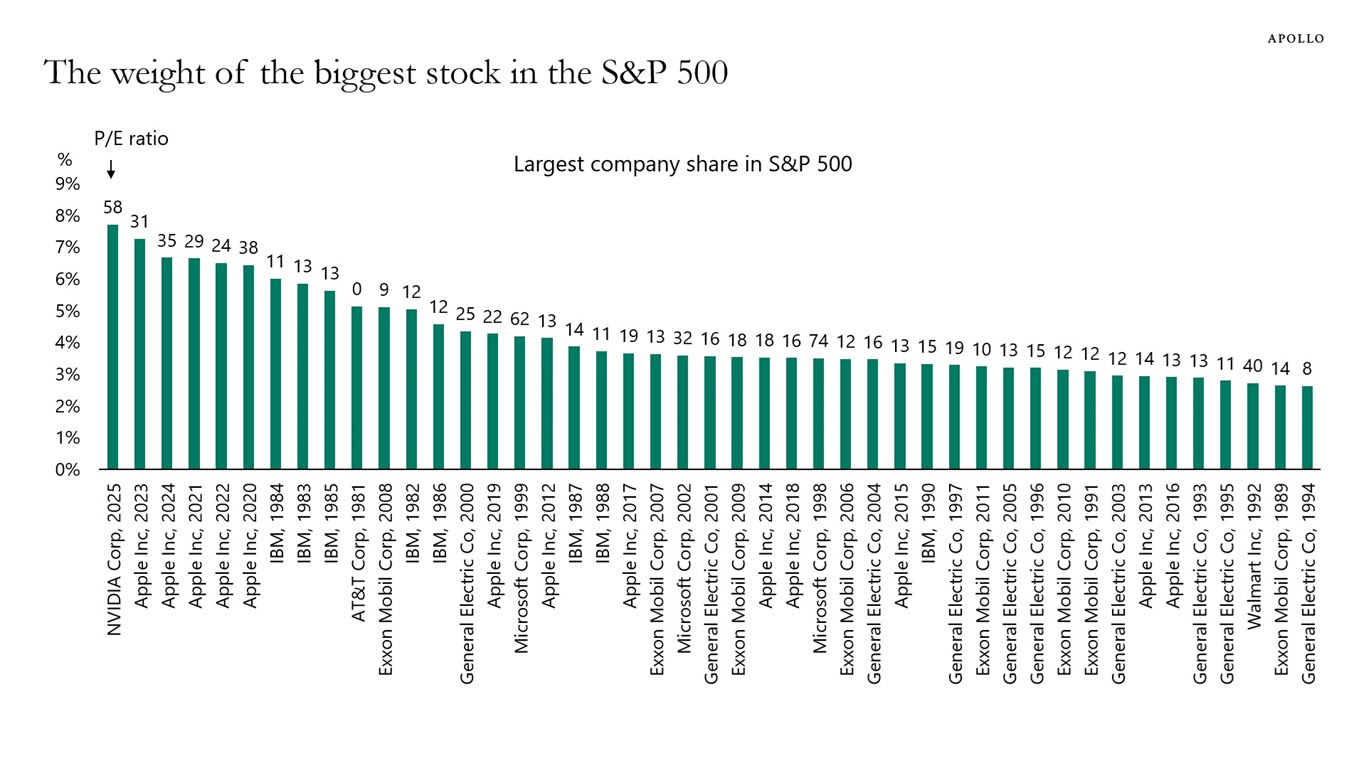

Top of everyone’s list of concerns is whether US markets are now massively over-concentrated on a few Mag7 names, i.e that extreme concentration in the S&P 500 is intensifying. The chart below shows the biggest stock by market cap in the S&P 500, and it confirms the extreme AI concentration in the market today. Nvidia now has the most significant weight in the S&P 500 of any individual stock since the data began in 1981.

Chart: The weight of the biggest stock in the S&P 500

Sources: Bloomberg, Apollo Chief Economist

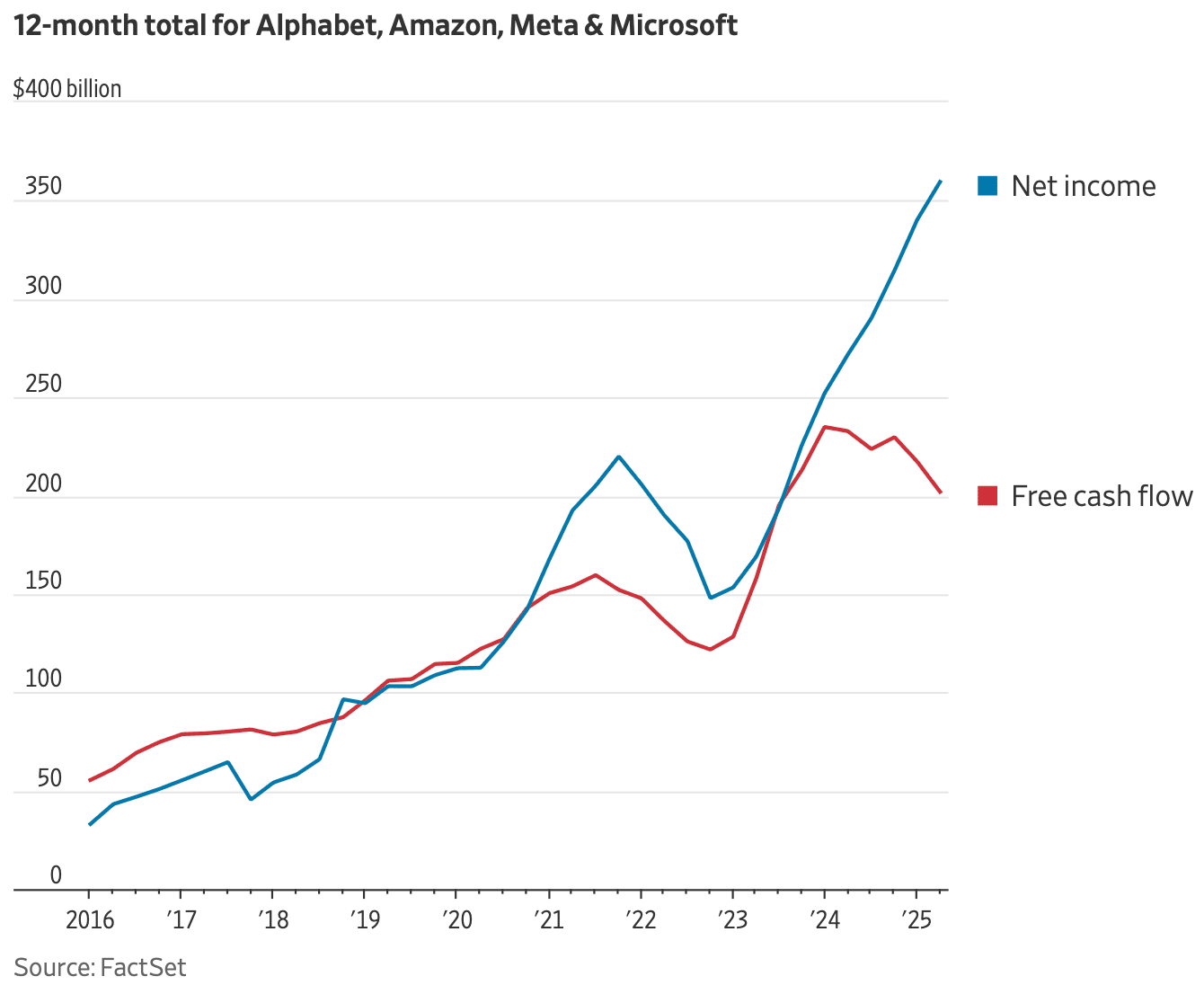

To make matters worse, there’s also the awkward fact that many of the Mag7 are spending vast quantities of money on capex, nearly all of which is AI-related, with a knock-on impact on cash flows. Between 2016 and 2023, Alphabet, Amazon, Meta, and Microsoft’s free cash flow and net earnings were closely correlated. Since 2023, net earnings have increased by 73%, while free cash flow has decreased by 30%, primarily due to the AI buildout.

This massive capex surge has both positives – huge potential for future earnings growth plus a direct impact on the US economy – and negatives: what happens if these firms can’t generate extra profits and they overbuild capacity?

Of particular note is the sheer quantum of growth in earnings – and the wider economy – that’s being driven by AI spending. Market analyst Paul Kedrosky (who’s been warning about a private credit meltdown on AI spending) AI capex drove 20 to 40% of US GDP growth of 3% per annum in Q2, noting “for practical purposes (AI capex) ate Q2 GDP growth.

|

|

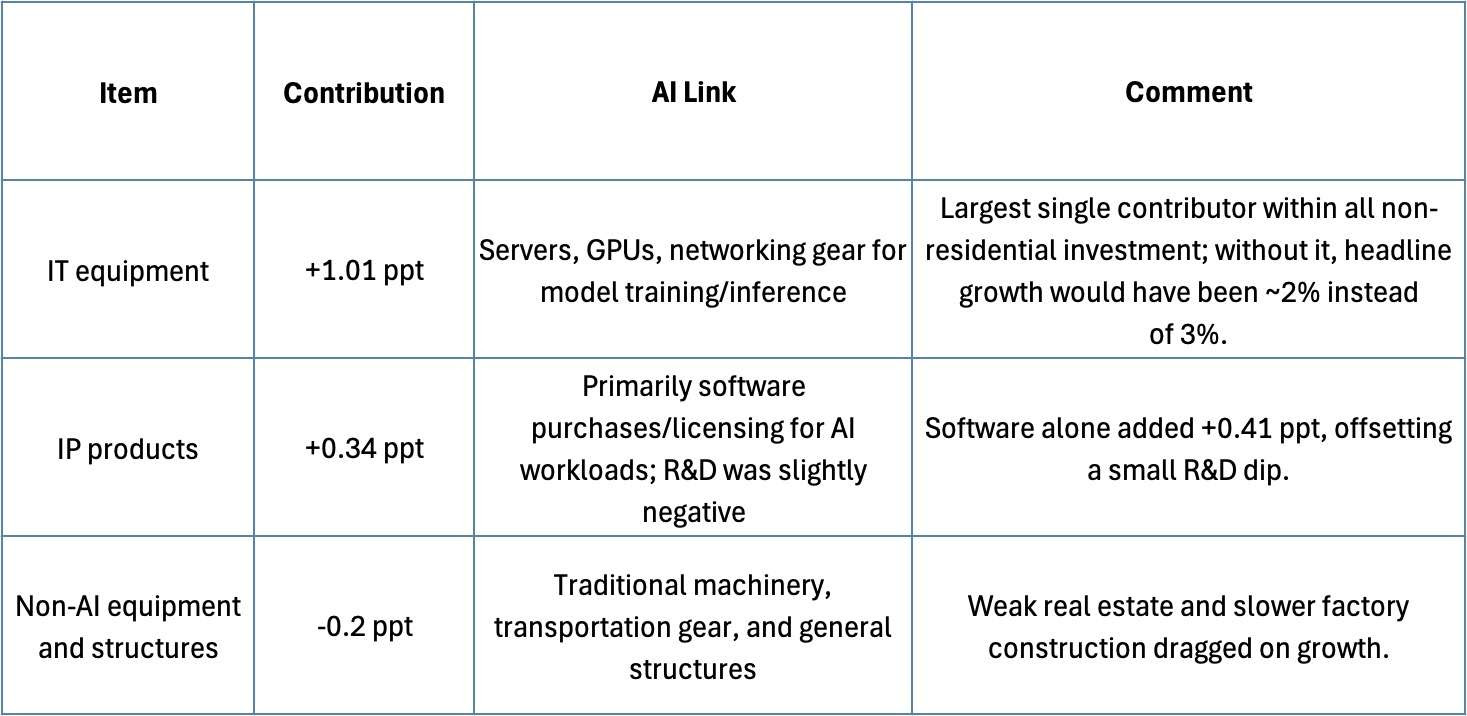

According to Kedrosky, when analysing US GDP figures, investors should concentrate on data relating to IT expenditure (IT equipment and IP products). Examining US GDP data, he suggests that it is a reasonable estimate that AI capital expenditure contributed perhaps 1.3% of the 3% GDP growth in the quarter, roughly 40%.

“ We can back into the estimate another way, bottoms-up from known AI capex at major tech companies spending in the period. Taking just Google, Amazon, Meta, and Microsoft, and their quarterly earnings and published data, they spent around $69B in the quarter, which is $276B annualised. Total IT equipment spending in the quarter was $608B annualised, so the Big Four alone were almost half of the spending, and most of that, we know, was AI capex. Given that information processing equipment spending added 1% to GDP growth in the quarter, from the BEA’s own figures, then AI capex, including both software and equipment, was at least 0.6% in that. We now have a range: AI capex’s contribution to Q2 growth was somewhere between 0.6% (on the low end, undercounting smaller players) and 1.3% (on the high end).”

So, AI spending is keeping the US moving forward at a steady pace, forcing those investors who were worried that the US might slow down after tariffs to eat their words. No recession is imminent, yet US interest rates might be falling! However, valuations seem stretched at the moment. My view is that we could have a situation where the macroeconomic picture remains decent but valuations become overinflated, causing the market to euphemistically ‘pause’ for a breather!

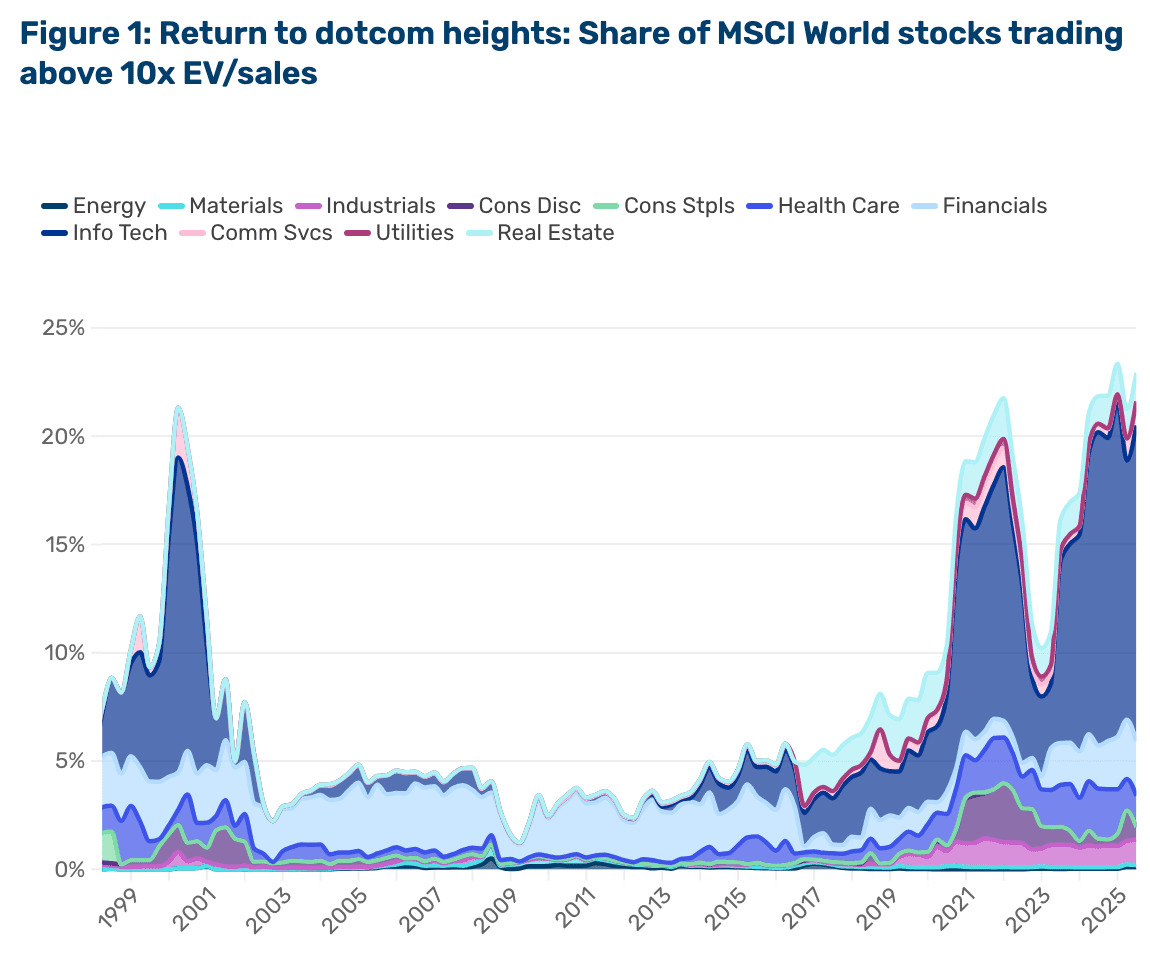

And just in case you think this is a US-specific problem, think again, especially if you invest in global equity funds. This concentration problem has massive relevance not just for US equity index benchmarks but global ones as well. According to the alternatives fund manager Man Group, over 20% of the weight in the MSCI World has an EV/sales ratio greater than 10.

I’ll finish with one final observation. I think it would be unfair to pin these concerns about AI bubbles exclusively on Nvidia (and a handful of AI picks and shovels makers such as Broadcom and Arista Networks). There’s also the case study of AI and software firm Palantir. This stock, beloved of defence hawks and AI fiends alike, is currently trading at extreme levels — 245x forward earnings, far above the software peer median of 41x. After some digging around, I can find no evidence yet of any large-cap stock exceeding a 228x forward P/E, let alone surpassing 245x….not even in 1999.

Geopolitics: Crisis? What crisis? How to navigate a geopolitical crisis like war in Europe as an investor

On the 24th of February 2022, Russian tanks and planes rolled into Ukraine in what was probably the most serious geopolitical event of post-war Europe. As you’d expect, investors ran for the hills. The best benchmark for broader European stocks, an index called the Stoxx 600, plummeted over the next few days, weeks and months, down from a level of around 450 in the days before the invasion to a low of around 385 for the index in October of that year. The economic consequences were, and arguably still are, seismic, yet by January of 2023, this benchmark index was back above its February 22 level and has continued to push higher since (it’s now around 540).

Major geopolitical events do have an immediate impact on investors, but their effects are never quite as persistent as initially presumed. As one strategist (Joachim Klement at investment bank Panmure Liberum) recently put it, when examining the stock market over the long run, it’s hard to pinpoint the start and end of wars, i.e. that over the long term, conflict makes almost no difference over many years.

And in case you think I’m cherry-picking my historical events, consider the UK during World War II. The FT30 index tracked the most prominent blue-chip British names and was launched in 1935. It spent the next few (Depression era) years declining, crashing in 1940 with the defeat of France, and then spent the next five years heading steadily higher, ending the war markedly higher despite the vast devastation wrought on the British economy.

So, given these examples, should investors stop worrying about conflict, geopolitics and war? Not so quick! Geopolitical shifts don’t always lead to wars, nor are these spikes in uncertainty necessarily short-lived. Let’s go back to the Stoxx 600 index and look at a subset of that index for aerospace and defence stocks. It probably won’t surprise you to learn that this index – jam packed full of defence contractors – didn’t fall by as much as the main Stoxx 600 index in spring 2022 but it’s perhaps more surprising that it then spent the next year or so bobbing along going nowhere before erupting in 2023 and beyond, rising two and half times in value over the subsequent years as the Ukraine war sparked a huge transformation in attitudes towards defence spending. As an aside note, I think the whole European defence transformation theme has many more years to run.

Geopolitics isn’t just about wars. Conflict and political tension frequently create uncertainty, which then evolves into significant global transformations. In Ukraine’s case, that uncertainty killed European capital spending, and measures of global economic uncertainty (such as the Global Economic Policy Uncertainty Index ) shot up, pushing growth rates down. In the US, these measures are now flashing red for reasons that require little explanation. Constant 90-day reprieves and an outpouring of Truth Social messages are hardly conducive to discussions on S&P 500 corporate capex strategies.

This uncertainty can then give rise to more profound shifts with huge implications for your portfolio. Many strategists (such as those at BCA in a paper called “New Geopolitical Hardware Detected“) worry that exhaustion with Ukraine in the USA and its more isolationist, transactional policy shift is changing the world from a world where one power dominates to one where lots of global and regional powers jostle for power. That could undermine the case for owning so many richly rewarding US equities long term?

So, how should investors react? I’m fairly amenable to the idea of gently reducing US stock market exposure while increasing exposure to the UK, European, and Japanese markets. I’ll come back to that next week, but those kinds of portfolio tweaks might seem a little like fiddling while (New) Rome burns.

One alternative option is to buy gold, viewed by many as the classic geopolitical hedge. And it’s true that gold spot prices did spike for a few days in February 2022 and have subsequently spent the next three years rising rapidly, to their current level at around $3300 an ounce. But let’s also not forget that gold prices actually spent a large part of 2022 declining sharply after that early spike (down nearly 20% from March 2022 to October 2022). As for the rise since a trough in 2022, most market experts point first to central bank buying as a driver, and then to Chinese (and more generally, Asian) physical gold bar buyers. According to a recent report by Goldman Sachs, China is buying a lot more gold than its central bank is declaring, and, in part on that basis, it is predicting a gold price of $4000 by mid-2026. Gold is a valuable hedge for geopolitical risk, but it’s so much more than that!

Many gold enthusiasts are, in reality, worried about a much broader range of threats. If I can generalise, many gold bugs are concerned about what has been called the “horsemen of the financial apocalypse”. Some are geopolitical, like international conflict, civil war, or government confiscation. Others relate to ‘regime change’, especially a slide into deep deflation (think Japan) or uncontrollable stagflation (think the UK in the mid-70s).

A former US Libertarian presidential candidate, Harry Browne, who also edited a newsletter called Harry Browne’s Special Reports, addressed these fears of financial and political disaster by creating something called the Permanent Portfolio. His straightforward plan was to build a portfolio that protected you against all likely scenarios by investing equally (25% each) in four assets—cash (or short-term bonds), long-term (probably government) bonds, broad global equities, and gold (though other versions included broad commodities. With the emergence of exchange-traded funds or ETFs, it is now incredibly straightforward to implement this plan.

There’s a profusion of money market ETFs (paying a rate usually close to the interbank lending rate), aggregate sterling government bond funds, physical gold exchange-traded commodity funds (Gold ETPs), and broad global equity trackers (likely tracking the MSCI ACWI Index). And what about returns? Various iterations of the Permanent Portfolio have been tracked for years, and returns tend to be in the 5 to 7% range for compound annual growth rate, with a recent uptick due to surging gold prices. That’s not terrible, but doesn’t compare with a simple Global equities strategy. On the upside, nearly all versions of this permanent portfolio have tended to produce lower volatility than, for instance, global equities on their own. Active fund managers have experimented with the underlying principles of this strategy, with arguably the most notable candidates being investment trusts such as Personal Assets and Capital Gearing, both of which have a similar range of assets (gold, bonds, equities) but significantly different levels of exposure to, for example, gold or equities.

In truth, though, volatile global equities on their own have delivered far more impressive returns. Permanent Portfolios might tempt those forever worried about the potential for cataclysmic political change, but for me, the problem is that you’re betting against human ingenuity to solve not just economic and technological challenges but also political transitions. Ignore the wars, the conflicts and the geopolitical shifts and stick with a long-term plan to bet on the best global equities.

Literacy Capital delivers

The listed private equity investment trusts space is full of funds that invest in reasonably big private businesses, many of which operate in interesting technology-related niches throughout Europe. Listed investment trusts such as HgCapital and OCI offer investors a great way into the mid-sized scale-up segment of the private business market, focusing on growth companies.

But there’s a slight snag.

Most private equity funds primarily invest in more mature businesses valued at hundreds of millions of pounds and are typically interested in deals involving tens of millions of pounds. That pushes the fund managers to focus on broader, European-scale businesses.

Below these excellent listed private equity players, there is also a segment of listed venture capital funds, most notably Molten Ventures, which focus on earlier-stage businesses with higher growth rates but lacking in profitability, primarily because they are concentrating on expanding the top line, revenue.

Between these two strategies, I see a gap. This includes businesses that are more established than your typical VC-backed firm, probably less focused on technology, and likely valued at only tens of millions of pounds. They might already be profitable but are aiming to scale, and they probably only need an initial investment in the £5 to £20 million range. Importantly, there is a gap in investing in businesses that are largely UK-based: my main view is that UK investors are too pessimistic about the domestic UK economy, which is actually performing reasonably well. The UK has a large pool of interesting, well-managed businesses that need to scale from valuations in the tens of millions of pounds to hundreds of millions.

This is the niche in which a listed private equity fund called Literacy Capital operates. Literacy Capital has a fairly unique strategy—it’s focused on small to mid-cap private buyouts in the UK, where, typically, the family or owner seeks some realisation event but does not want a ‘typical’ large PE transaction with all that entails, such as cost-cutting, merging businesses, or leveraging. Literacy Capital concentrates heavily on the UK domestic economy, and its usual investment size ranges from £2m to £10m. It also meticulously develops its portfolio companies by bringing in expertise and investing in growth when needed.

The fund joined the Specialist funds segment of the LSE a few years ago and has since established a strong track record, consistently outperforming its peers in NAV growth. For a long time, the fund traded at a premium to NAV, mainly because of a closely held share register where the Pindars are major shareholders and are deploying their own capital – Paul built up Capita.

Crucially, the fund also maintains a close relationship with a charity—also run by the Pindar family—called Bookmark, which offers reading and learning support to children. The fund donates 0.9% annually to the charity, alongside an equally 0.9% management fee. There is no performance fee either, which I consider a significant advantage. Importantly, the fund is not overly eager to issue large quantities of new shares to expand its scale— the founders seem content to hold their investment and use realisations (and leverage) to generate extra cash for investments.

Annoyingly, for recent shareholders that is such as yours truly, that premium to NAV I mentioned earlier has now vanished. The fund has started trading at a discount: the last time I looked, the fund was on a 12% discount, which is not bad for a listed PE fund, but not great either if you bought when the shares traded at a premium. What’s needed now is for the fund to step up the pace and demonstrate new dealflow, i.e., show that its unique approach can yield results.

Last month, we had evidence of that when the company announced the sale and re-investment in its second-largest portfolio holding, Velociti Solutions, alongside CBPE. Velociti Solutions constituted 11% of the portfolio and was sold to CBPE at a 52% uplift to carrying value for a total return of 14.8x MoM (IRR of 70%). The company then used significant portions of the proceeds to reinvest alongside the buyer CBPE, with Velociti Solutions remaining a top-three holding by value. According to analysts at Panmure Liberum, the transaction values Literacy Capital’s stake at £51.4m (vs. a carrying value of £33.8m).

The next day, the fund followed up with a second quarter update :

- On 30 June 2025, net asset value (NAV) was £312.6m, or 519.5p per share. This is an increase in NAV (after costs and donations) of 1.6% since 31 March 2025, a net uplift of £4.8m (8.0p per share).

- In Q2, Velociti again contributed the largest £ uplift to NAV, taking top spot for the fourth consecutive quarter. Velociti’s carrying value for 30 June was held in line with the transaction that was announced yesterday.

Literacy also flagged it will use some of the proceeds from the disposal to reduce the debt facility, declaring that the RCF “at the end of Q3 will be far lower, substantially reducing the cost to BOOK”. Panmure Liberum analysts reckon there could be a £20m reduction in the RCF.

I rate Literacy Capital highly. It has a unique focus on an under-invested part of the UK Private business space. I’m also more optimistic than most about prospects for the UK economy and think Literacy will be ideally positioned to benefit. On that point, I note the comment by CEO Richard Pindar that “there are signs that deal volumes are improving, which would be positive for NAV growth and share price performance.”

Manchester and London Investment Trust is a concentrated AI bet

I have a simple suggestion: if you think that AI is the ultimate technological and business game-changer, why not buy shares in the small, relatively under-the-radar London investment Trust Manchester and London? As we’ll discover, M&L is basically a concentrated stock basket of a handful of stocks that are likely to benefit from the AI revolution. You could, of course, just buy these stocks yourself, but I would argue that M&L does provide some diversification benefits and is certainly inordinately more concentrated than your average thematic AI-oriented ETF.

Now, to be clear, M&L is not without its critics. The respected fund research team at Investec have long been critical of what they argue has been historically poor stock selection and excessive fees. And investors also need to be aware that the fund is essentially a family investor vehicle for the fund manager, Mark Sheppard: his firm owns more than 60% of the shares.

As for fees, the board has tried to address this: the fund has introduced a new tiered fee structure, effective 1 September 2024. Management fees will be charged at 0.7% pa of net assets up to £750m (0.5% pa of net assets between £750m-£1.5bn, and 0.3% pa thereafter). Crucially, the new fee arrangements no longer include a performance fee. This compares to a 0.5% pa of net assets management fee before the change.

Fund details

- Share price 880

- NAV 1053p

- 16.5% discount

- Market cap: £337m

- Largest shareholder: Manchester & Metropolitan Investment Ltd 62.3%

I’ve listed the top ten holdings in the fund below – you’ll instantly see that two very focused AI stocks, Nvidia and Microsoft, comprise over 60% of the value of the portfolio. If we add in AMD, Arista (a personal favourite), Broadcom, Alphabet (think Gemini), and Oracle (think it’s fast-growing AI data centre business), the effective AI sentiment exposure is above 90%. There’s an assorted range of other stocks in the portfolio, but in reality, this is a tech fund with a massive focus on AI. By contrast, if we look at Polar Capital Technology Trust, then the combined weight of Nvidia, Microsoft, Broadcom, Oracle and Alphabet comprises just over 30% (and I would guess if we added Arista, it would be closer to 35%).

Top 10 Holdings:

- NVIDIA Corp 39.9%

- Microsoft Corp 23.2%

- Arista Networks Inc 6.6%

- Advanced Micro Devices Inc 6.1%

- Synopsys Inc 5.2%

- ASML Holding NV 4.9%

- Broadcom Inc 4.7%

- Alphabet Inc Class C 4.1%

- Oracle Corp 3.8%

- Micron Technology Inc 3.2%

So, M&L is a super concentrated bet on AI and a handful of companies. That’s both an advantage—if AI does carry on dragging markets higher—and a disadvantage if AI crashes. It’s not as diversified as Polar Capital Technology or an AI ETF, but maybe that concentration is worth the risk. And of course, nothing is stopping you from buying these stocks individually in your portfolio and mirroring the M&L portfolio.

What about performance? I’ve pulled up two charts from Sharescope below, which give some recent comparative price performance. The first chart shows price performance (in black) since the beginning of 2023. The runaway star is the green line, which is the Nvidia share price.

- Green Line – Nvidia

- Purple Line – PolarCap technology Trust

- Blue line – NASDAQ 100

- Black Line – Manchester and London

The second chart below shows the same comparators but only since the beginning of 2025. Again Nvidia shares on their own have aced it again, but M&L is not too far behind (unlike since 2023). So, one alternative strategy could be just to buy Nvidia shares and forget about the rest of the portfolio!

My bottom line? I think that US tech valuations have got way ahead of themselves – see the Factoids below. But maybe the markets will see through these scary metrics and just keep buying into the AI revolution. If they do a handful of winner-takes-all tech leviathans, dominant in the AI picks and shovels space, will keep capturing the profits to be made. If that optimistic scenario plays out, then the M&L is a super concentrated, one-fund way of buying into the impending revolution. Also, the fund trades at a 16% discount, and the managers have been consistently buying shares back, so there’s a possibility that the fund discount might tighten to say 10% in which case there might be some additional uplift in the share price.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.