Games Workshop, Kainos and James Latham pass the 5 strikes test. Richard ponders the future of people-focused businesses in a world in which AI is doing more of the work.

Three companies have passed my minimum quality filter and a cursory evaluation of their financial track records since my last update.

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| Games Workshop | GAW | 29/7/25 | 0.1 | – Holdings | 1 |

| Halfords | HFD | 29/7/25 | 0.8 | – Holdings – Debt ? Growth – ROCE – Shares | 4 |

| Severfield | SFR | 29/7/25 | 0.6 | – CROCI – Debt – Growth – ROCE | 4 |

| Kainos | KNOS | 25/7/25 | 12.7 | – Growth | 1 |

| Ashtead | AHT | 24/7/25 | 0.1 | ? Holdings – Acquisitions – Debt ? Growth | 3 |

| Latham (James) | LTHM | 24/7/25 | 10.5 | – CROCI ? Growth | 1 |

| Speedy Hire | SDY | 18/7/25 | 0.7 | – Holdings ? CROCI – Debt – Growth – ROCE | X |

| Click here for our 5 Strikes explainer | 31/07/2025 | ||||

They are Games Workshop, Kainos and James Latham.

Timber trader

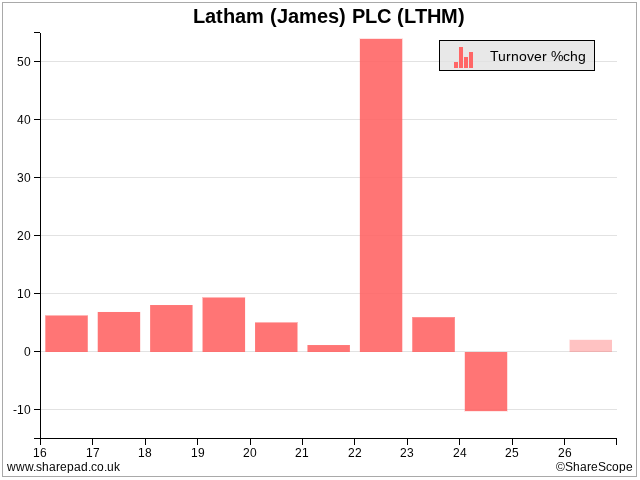

Timber importer and distributor James Latham [- CROCI ? Growth] barely deserves a strike. Its two strikes relate to negative cash flow in 2018 and a contraction in turnover in 2024. Turnover was flat in 2025.

I think this uncharacteristic contraction is excusable. The two years before were years of extraordinary growth. Turnover grew by 54% in 2023 as the economy emerged from the pandemic. Elevated demand and supply shortages sent prices soaring, and turnover grew again in 2024.

A decline in turnover was inevitable as the industry returned to normal. I believe James Latham’s ability to supply at a time of shortages demonstrates the strengths of its supplier relationships, and it almost certainly gained market share.

The company expects a slight improvement in margins in the current year, and the one forecast reported by ShareScope, presumably from the company’s own broker, is for a 2% increase in turnover.

You will be able to read my annual reviews of James Latham and Warhammer gaming and modelling empire Games Workshop shortly on Interactive Investor.

The people versus AI

Turnover at Kainos [- Growth] declined by 4% in 2025, the first decline since the software company floated in 2015. Kainos explained that the change of government in 2024 reduced public sector spending in the UK, its biggest geographical market, and commercial sales were impacted by economic uncertainty.

Perhaps the easiest way to understand the business is to watch this video from 2012, over three years before Kainos floated on the stockmarket. By 2012, Kainos already had a 25-year history and an established business model.

Google can’t tell me who the narrator Paul Coad was; he is not listed in the prospectus from 2015, but I’m guessing he was the chief executive. He describes the firm as a systems integrator. This is a business that knits together the IT organisations’ use (like sales, accounting, and human resources systems) with software to help interoperate and provide new services.

He says the company’s founder, Frank Graham, started with a simple premise: to bring together the brightest graduates and use them to solve complex business problems. The big issue then is still familiar today: Over half of systems integration projects failed because they cost more or took longer to complete than the customer had budgeted for, or they did not complete at all.

Kainos projects, he said, did not fail because of its brilliant people. They ensured they had buttoned down the nature of the problem they were trying to solve, how they would manage the project, and the design of the solution.

“It’s all about the people in the end.”

The unchanging thing about Kainos was its ethos, but the technology was always changing. By 2012, Kainos’ customers were preoccupied with mobile applications and cloud computing, but, Coad said:

“We know that in ten years time… there will be very different technologies around. What I am absolutely confident in saying is that Kainos will be in a leadership position.”

Kainos means “new”, and Coad was articulating the timeless attraction of employee-first cultures: They can adapt to new circumstances.

We are thirteen years on, and on the surface, his vision was true. Mobile and the cloud are no longer new, and customers are preoccupied with artificial intelligence. Judging by Kainos’ recruitment pitch, it still puts people first. It is a much bigger company than it was then, and still very profitable.

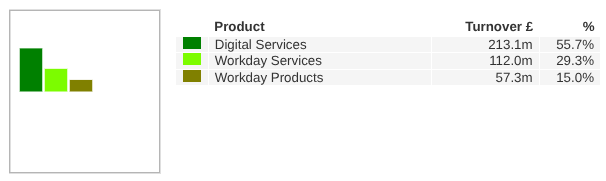

Inevitably, Kainos has jumped on the artificial intelligence trend. The annual report says it earned £41.1 million from AI and related projects, which accounted for 12% of total revenue. It employs more than 200 AI professionals and claims to be the fifth largest supplier of AI to the UK Public Sector through its Digital Services business unit. Three of the 20 AI products available on the Workday Marketplace are Kainos apps.

Digital Services is the original systems integration business.

Workday is an enterprise software platform competing with SAP and Oracle. Kainos developed a second strand to its business in 2011, when it became a Workday partner, configuring and testing Workday implementations. Since then, it has created a third business unit that develops apps for the Workday ecosystem.

Source: ShareScope (Activity Breakdown)

In one sense, AI is just another technology wave, like mobile and the cloud before it. But it may pose a greater challenge to people-focused cultures. Systems integration and bespoke software development, among the core capabilities of Kainos engineers, are done with code. Albeit under the guidance of skilled coders, AI can code more quickly than people. Kainos says it is accelerating more than 50% of its development projects with AI.

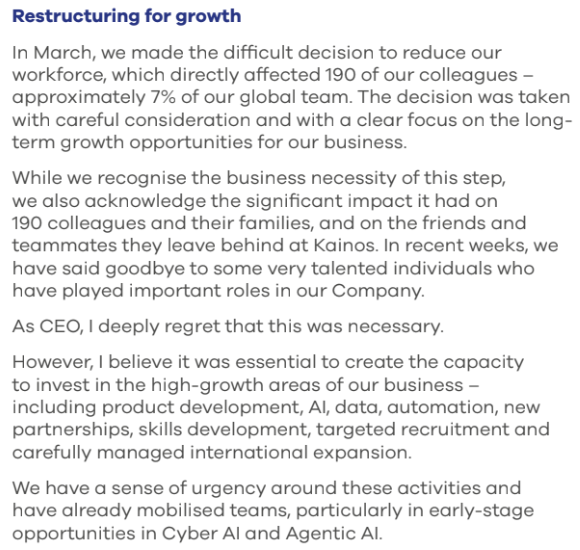

Whether this makes coders redundant or enables them to do more is one of the great unanswered questions of our time, but redundancies featured in Kainos’ annual report. True to its people-first ethos, Brendan Mooney, the chief executive, was more fulsome and contrite than I am used to reading in an annual report, where often lay-offs are brushed under the carpet of cost savings.

Source: Kainos annual report 2025

Elsewhere in the report, the company explains that the weak performance in 2025 contributed to the decision to reduce its workforce, but the emphasis is on re-equipping Kainos for AI.

If this leads to fewer jobs for coders in the long term, it raises two questions.

As Kainos has grown, so has the number of opportunities for engineers, which makes it an attractive place to work. How does the company motivate them when there are fewer opportunities each year? Secondly, if AI is solving more of the complex problems and engineers fewer, what is the impact on Kainos’ competitive advantage? Kainos’ partner, Microsoft, provides the AI.

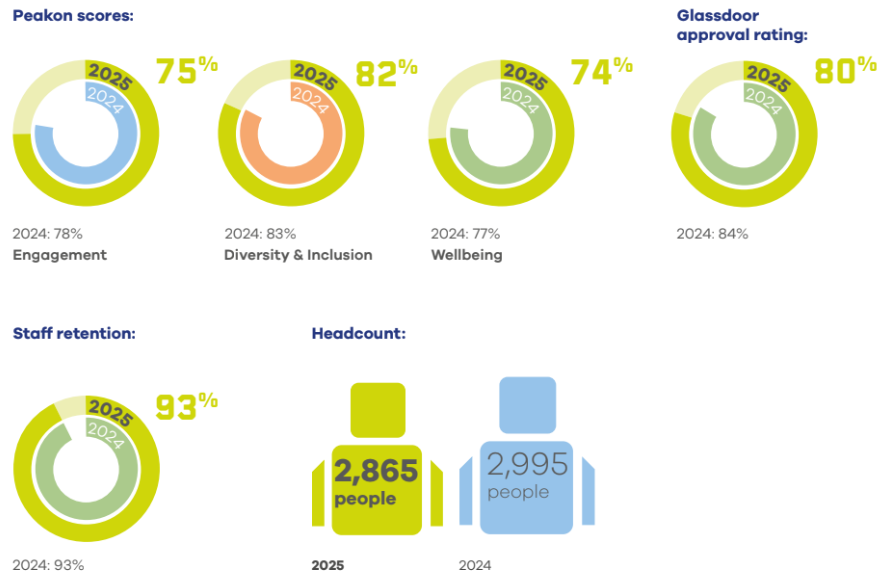

On the face of it, Kainos’ culture remains strong despite a difficult year, according to the many statistics in the annual report (the Peakon scores are from Kainos’ own Workday implementation):

Source: Kainos annual report 2025

Most of the employees who left the business departed just after the year-end, though, so we need to check back next year to confirm there has been no after-effect.

As to whether Kainos will be a leader in ten years time. That’s a question I cannot answer with confidence.

Postscript: A needle in the arm

It is always a good idea to sample the product. I did that unwittingly when I volunteered a blood sample and some vital statistics for Our Future Health last year. Our Future Health is the UK’s largest ever health research programme, and the website was built by Kainos. It handles consent, applicant questionnaires, and appointments. The process was seamless.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.