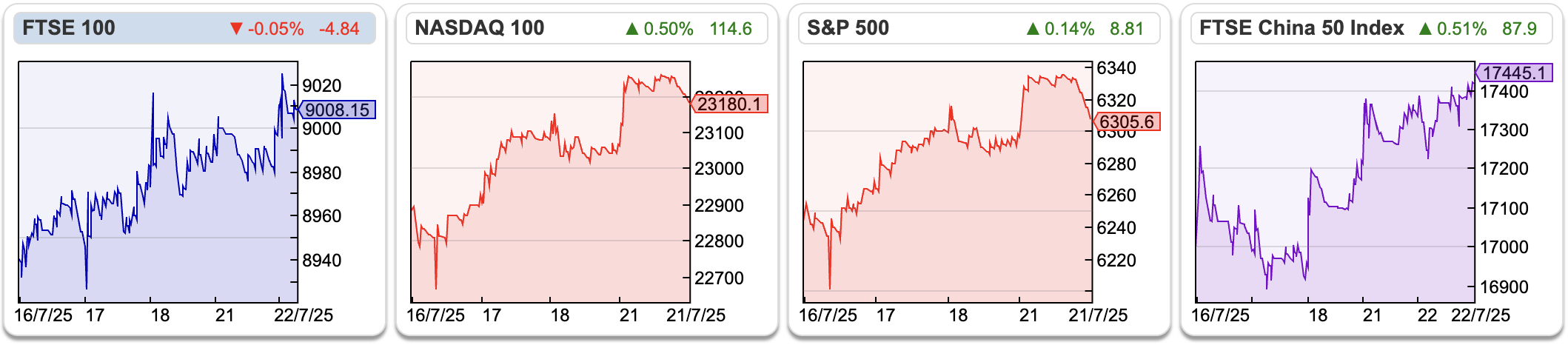

The FTSE 100 rose to just above 9,000, up +0.8% in the last 5 trading days. The Nasdaq 100 was up +1.4% while the S&P 500 was up +0.6% over the same time period. The copper price is up +41% YTD; however, Trump’s tariffs seem to have created distortions as traders have sought to buy up copper and store it in the USA. In contrast, central banks are no longer manipulating the yield curve and are instead reversing quantitative easing. So, government bonds and the yield curve could now improve as indicators of future expectations.

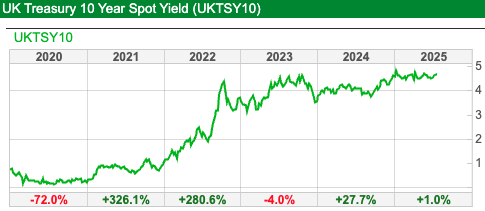

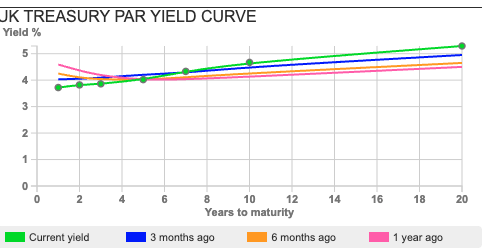

Sharescope shows that after the large rise in yields in 2022, caused partly by rising energy prices and partly by the Truss/Kwarteng mini-budget, yields have been stable. Gilt yields remain at a high level compared to recent history, suggesting recession risk has receded, but another round of inflation is a possibility.

The profile of gilt buyers is changing from UK defined benefit pension funds, which are shrinking and the Bank of England which is reversing QE, to foreign investors. The latter now own a third of the market. That seems important because both pension funds and the BoE were insensitive to price, whereas foreign investors, the new marginal buyers will evaluate the attractiveness of UK gilts relative to other international investments.

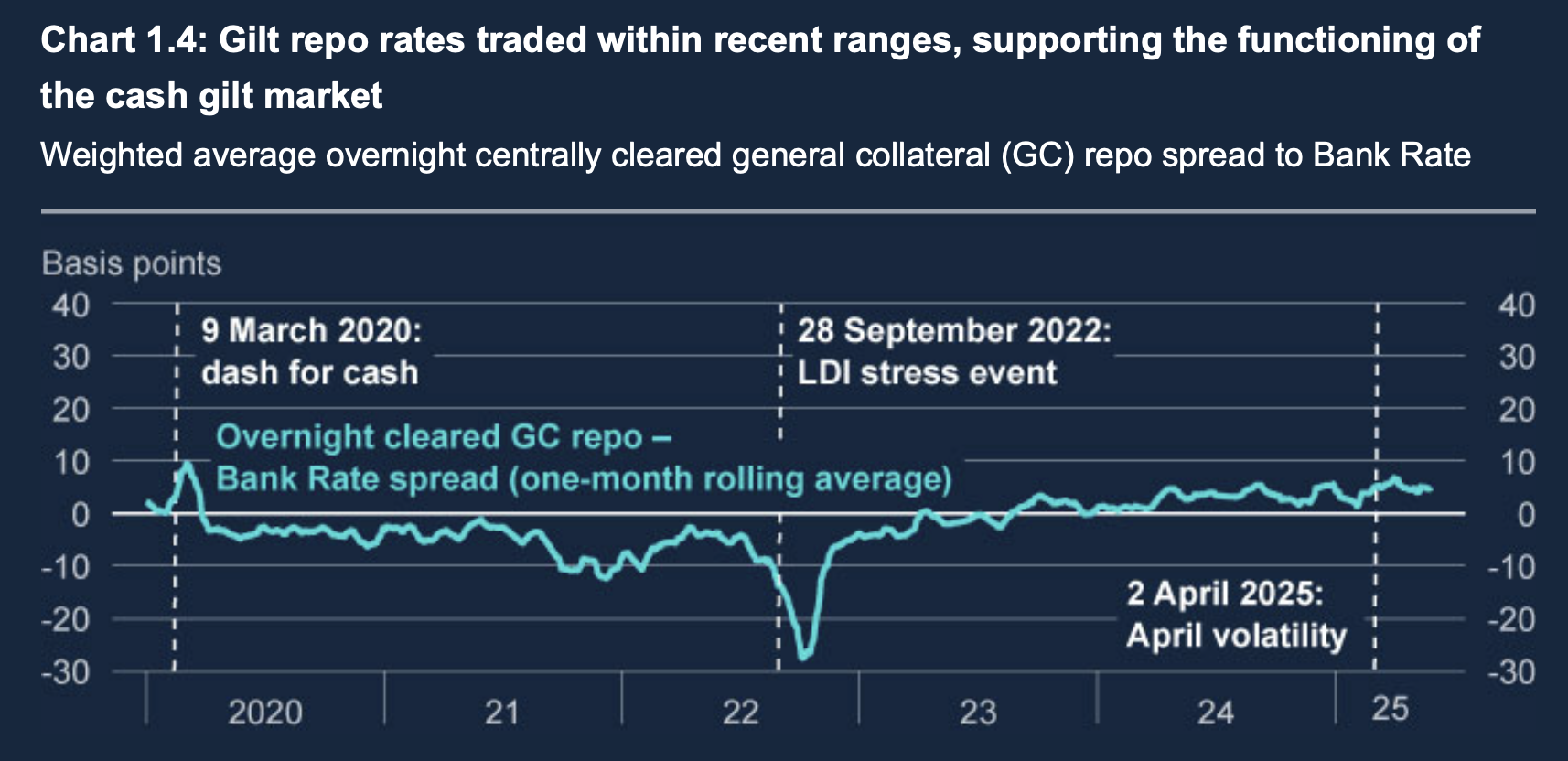

The Bank of England Financial Stability Report was published a couple of weeks ago. I was interested in their chart below showing that the gilt market continues to be orderly, despite 10-year gilt yields rising to 4.64%, above where they peaked in the second half of 2022 under Truss/Kwarteng.

Central Banks can step in to support markets in a liquidity crunch. However, if the fundamental problem is that marginal buyers of UK government debt need to be rewarded with an attractive price (ie higher yield) to compensate them for inflation risk, then that’s not a problem Central Banks should try to fix.

One potential source of finance for government deficits is UK banks. Yet, as yields rise this potentially “crowds out” other forms of debt on bank balance sheets, most obviously mortgages and SME borrowing. That is, if the government turns to UK banks for deficit financing, that may be at the expense of UK individuals seeking finance to buy a house or smaller companies looking for growth capital.

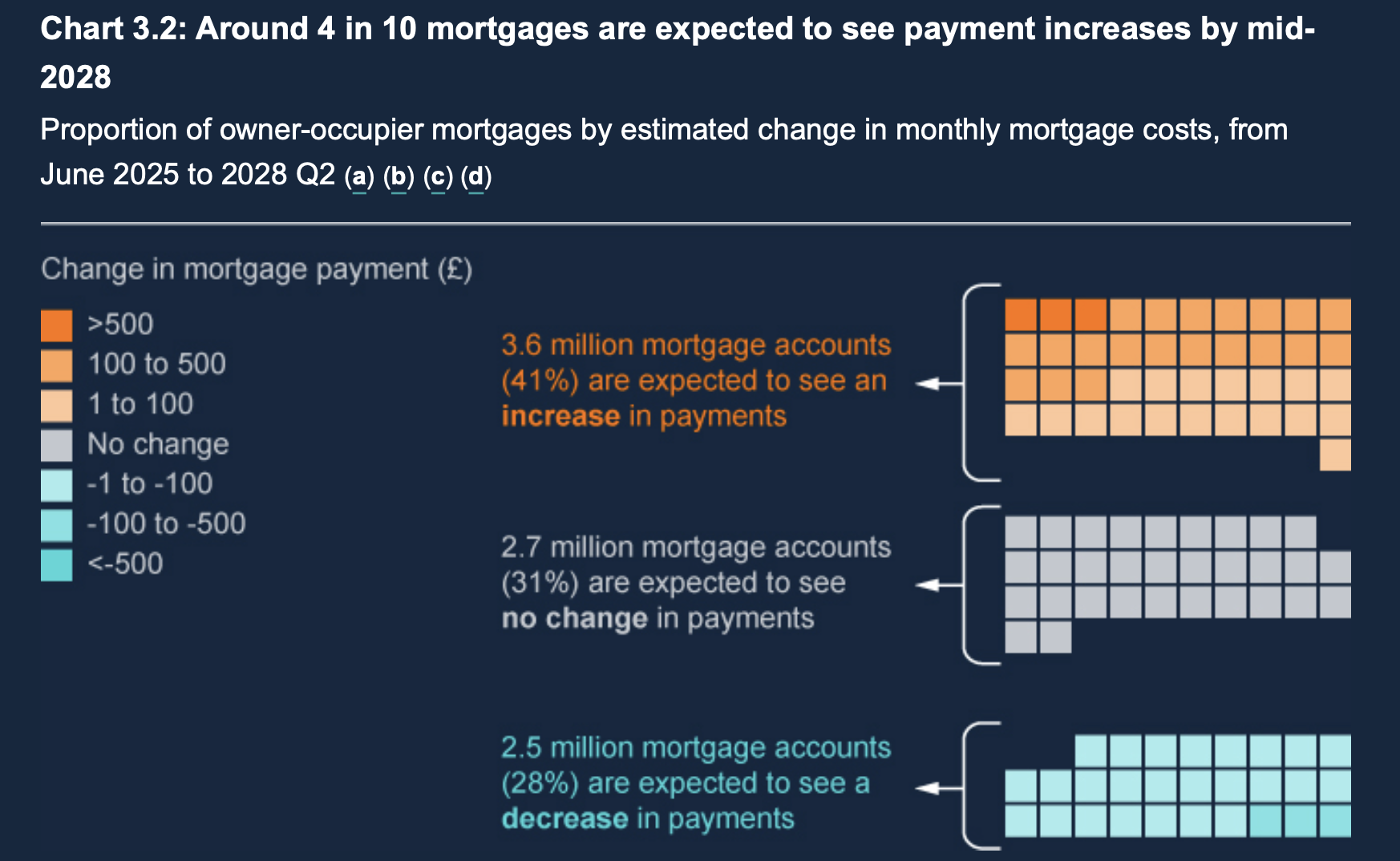

A second thought occurred to me while watching Wimbledon tennis at the start of July. The role of line judge, which carries more responsibility, has been replaced by Hawkeye, while the ball boys and girls remain. I pondered whether that’s an analogy for the economy as a whole, with lawyers, marketing executives, management consultants, more at risk of being replaced by LLMs, compared to bar staff, waiters and nurses? If job security among high-income professionals is under threat, then that also bodes ill for the UK mortgage market. Despite interest rates falling, the BoE says that 40% of UK mortgages are expected to rise in cost by mid-2028, as the low fixed rate deals achieved during the pandemic roll off.

My thinking is that UK equity markets can absorb rising gilt yields; the FTSE and AIM should be the least worst asset class compared to bonds or property. I’ve been negative on UK housing and mortgage markets for years, but one day I’ll be right.

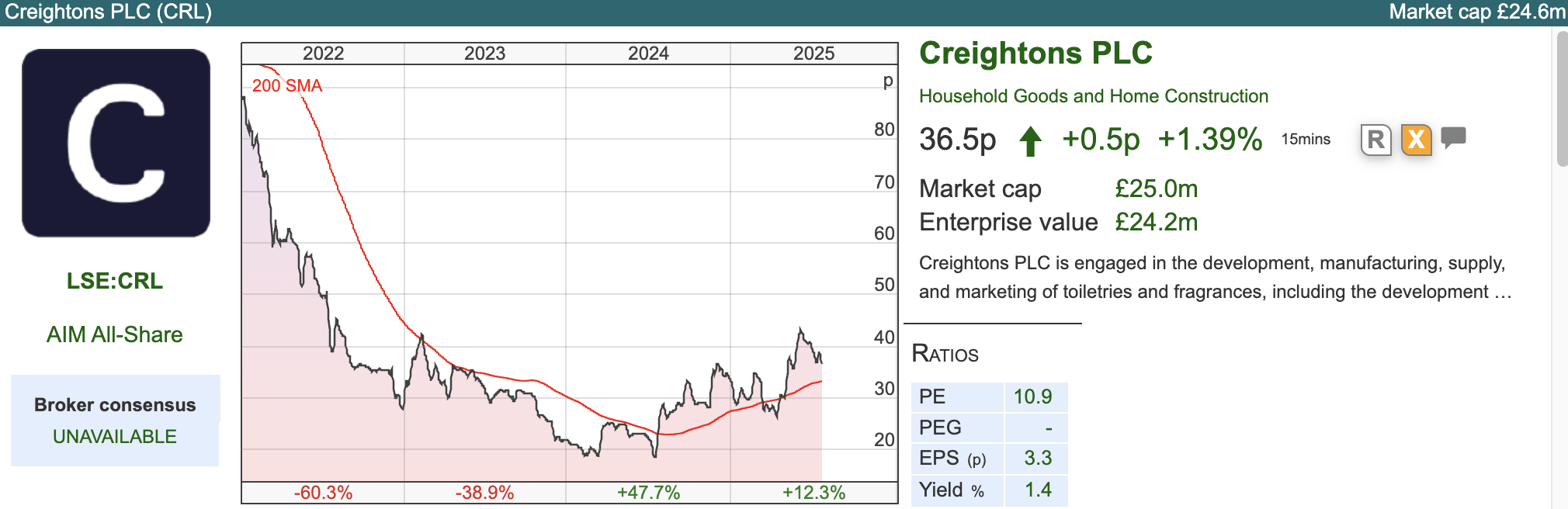

This week, I look at Beeks, Dr Martens and Creigtons. The latter two seem to have formed bowls, and look like they could be good turnaround situations..

Dr Marten AGM Trading Update

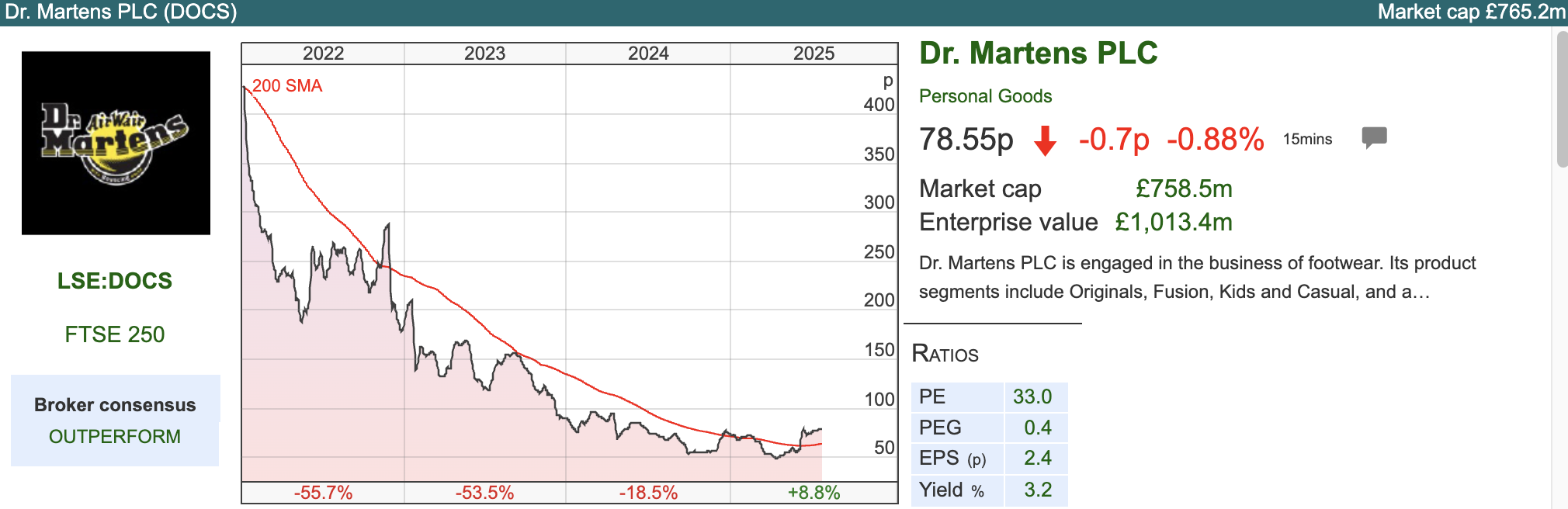

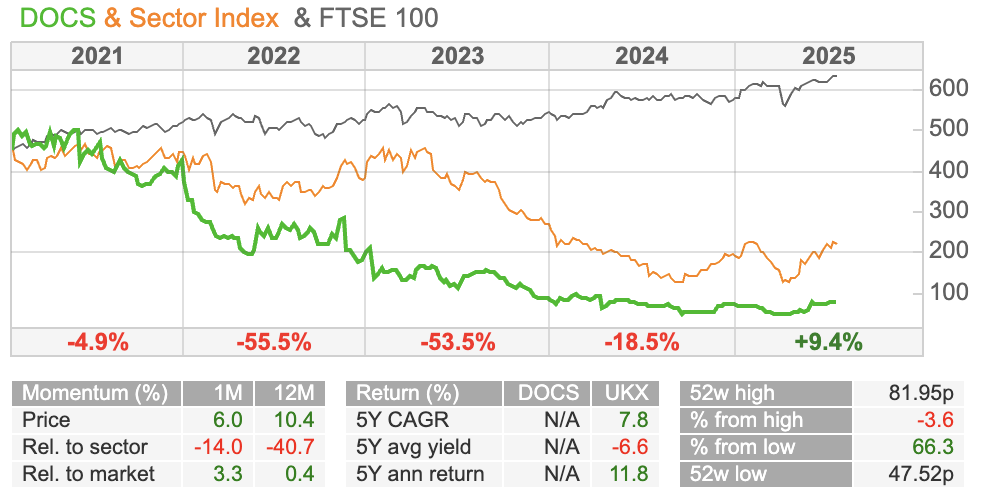

This iconic fashion brand, founded in the 1960’s was a 2021 Private Equity (Permira) IPO. Peak to trough, the shares have fallen -90%. The chart now looks interesting, though, with a bowl forming, and despite the company’s struggles with declining revenues and operational issues with its US distribution centre, there’s been no increase in the share count.

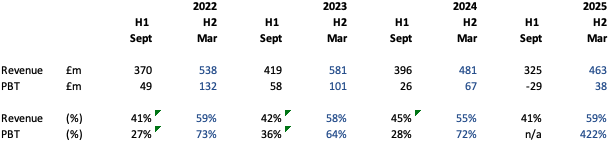

Management put out an AGM trading statement, leaving FY Mar 2026F guidance unchanged, though they did mention an H2 weighting. I’ve used Sharescope to go back and check the historic H2 weighting, in blue in the table below. From a revenue perspective, just under 60% of revenue does fall in the second half, with profits even more weighted to later in the year, as the Excel table below shows.

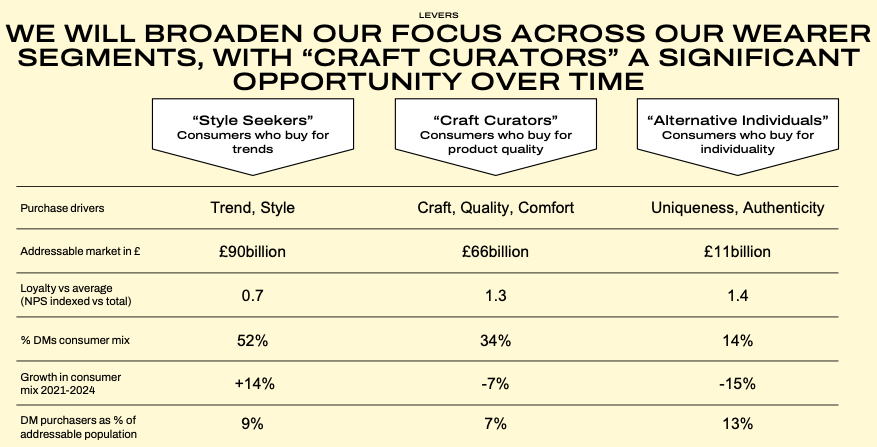

The business has a new Chief Exec, Ije Nwokorie, who started in January and presented a strategy update as well as FY Mar 2025 results in June. As a rule of thumb, I normally wait six months from when a Chief Exec starts at a company before investing, as the new arrival has a tendency to say negative things and come across as downbeat, to rebase expectations down (ahem Antonio Horta Osario at Lloyds). However, in the case of DOCS, the previous Chief Exec Kenny Wilson had already set a low bar of expectations. The new strategy is to be the world’s most desired premium footwear brand. There are some interesting slides in the strategy update, for instance, this one on how management segments their customers.

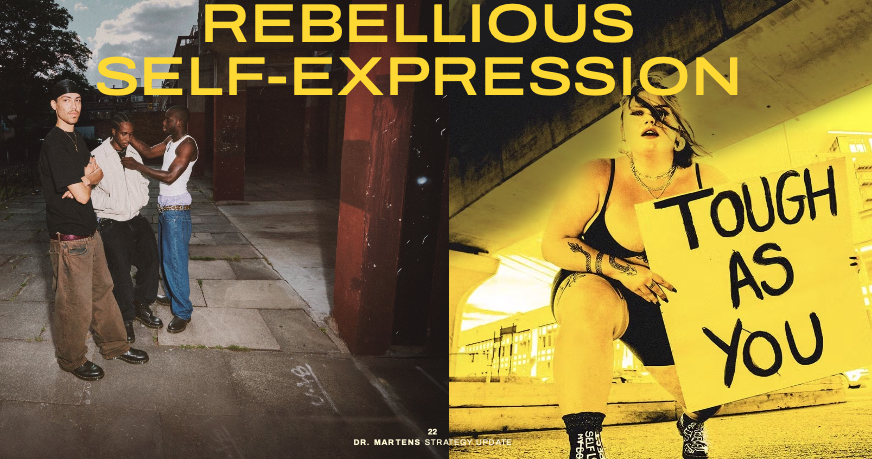

I went clubbing in Berlin at the weekend with a young snowboarder I had met on holiday, and she was wearing Dr Martens. So, while we stood queuing in the rain for over 2 hours, I asked her about the brand, and she thought it became “cool” 5-10 years ago (ie when Permira owned the company) the appeal was “you can wear these boots with anything”, she said. I was tempted to ask her thoughts on Superdry, but I didn’t want to ruin our rapport and that would have been a step too far.

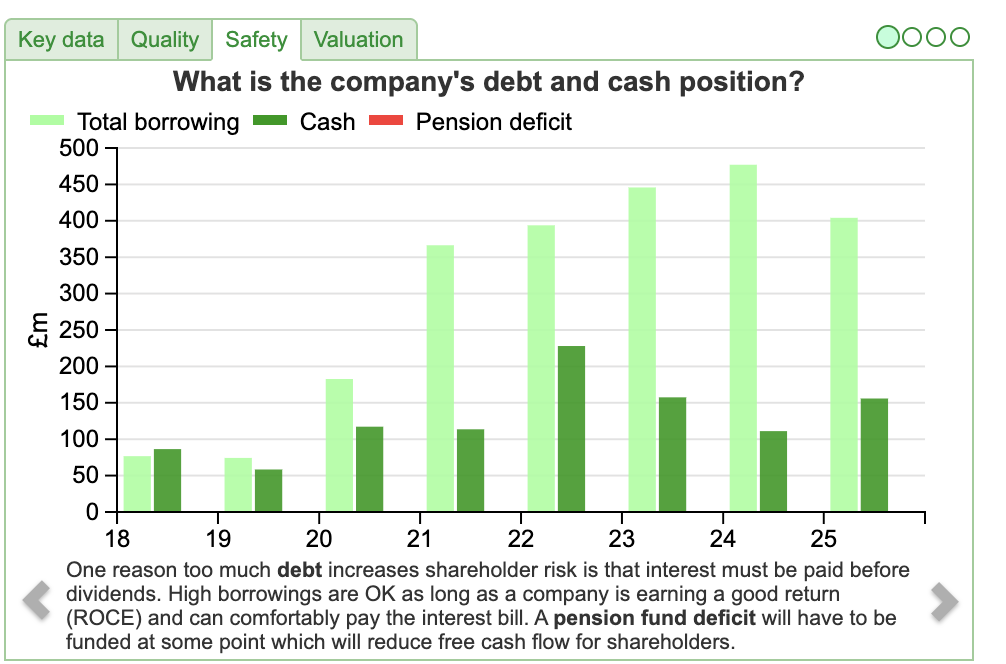

Valuation: The shares are trading on 19x PER Mar 2026F dropping to 14x the following year. On an EV/EBITDA basis, that translates to 5-6x. Net debt has halved to £94m at the March year end, but if you include lease liabilities, which for a retailer I think you should do, that rises to £250m.

Opinion: Investing in fashion brands is hard. For a pessimistic view, see Jamie’s piece for Moneyweek last year: 11 years ago, the brand was unfashionable and worth £300 million, and it has become unfashionable once more. Adjusting for inflation, £300 million in 2013 is £400 million today. As the brand becomes less sought after, its value falls below the level of its debt. In this case, the shares could prove almost worthless, resulting in a highly dilutive rights issue or debt/equity swap.

On the positive side, the brand has been around since the 1960s, so the brand may prove to be more durable than Jamie’s view. The share price is up +66% from its 52-week low, and the chart has formed a bowl, like Capita, which I wrote about a couple of weeks ago. That suggests sentiment is recovering. However, I would not average down if the shares fall through their moving average support levels.

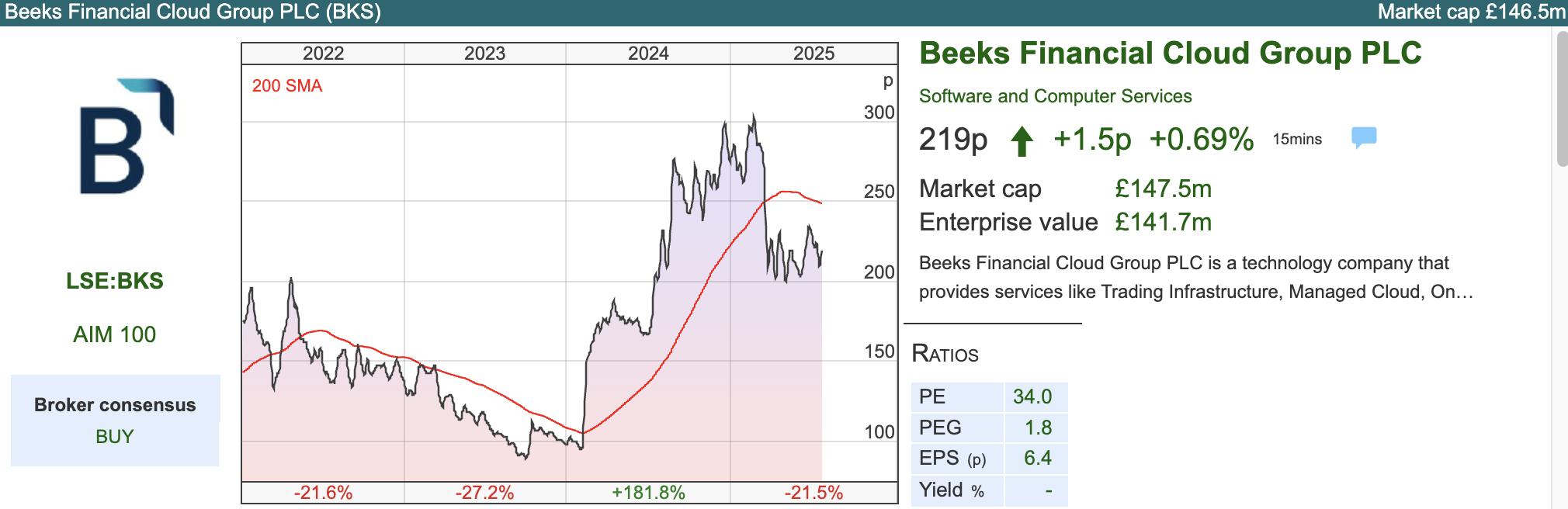

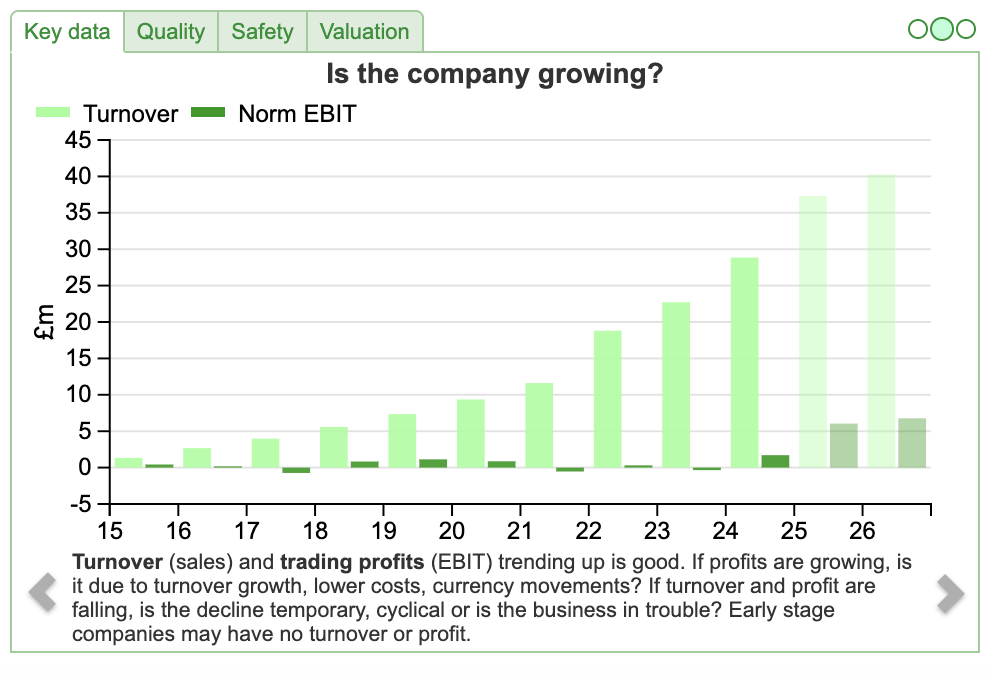

Beeks FY June Trading Update

This cloud computing company for financial markets and exchanges has announced a $10m contract win and a trading update for FY June 2025. Management are expecting FY Jun 2025F revenue to grow +25% to £36m and underlying PBT growth of +41% to £5.5m. That’s important, as historically Beeks had a track record of revenue growth, but struggled to generate profits. Worth noting though that the year-end cash position has only increased by £38K, to £6.96m. Despite rising revenue and profits, the company isn’t forecast to start paying a dividend.

Business model: Beeks customers include banks, FX brokers, hedge funds, crypto exchanges like Kraken and stock exchanges like Johannesburg SE. This is a capitally intensive industry, with ongoing investment in hardware infrastructure required to deliver on contract wins. The question at the back of my mind is how much of a “moat” does Beeks have? They are in competition with hyperscalers such as Amazon Web Services and Microsoft, who has a 10-year strategic partnership with the London Stock Exchange. LSEG has committed to spending at least $2.8bn on MSFT services over the next 10 years.

Business model: Beeks customers include banks, FX brokers, hedge funds, crypto exchanges like Kraken and stock exchanges like Johannesburg SE. This is a capitally intensive industry, with ongoing investment in hardware infrastructure required to deliver on contract wins. The question at the back of my mind is how much of a “moat” does Beeks have? They are in competition with hyperscalers such as Amazon Web Services and Microsoft, who has a 10-year strategic partnership with the London Stock Exchange. LSEG has committed to spending at least $2.8bn on MSFT services over the next 10 years.

Progressive, the paid-for research organisation, says that Beeks’ secret sauce is end market focus – without spelling out exactly what that means. One possibility is that global banks and exchanges are reluctant to outsource their infrastructure to US tech companies, because they fear becoming overly reliant on ‘frenemies’ or future rivals in financial services.

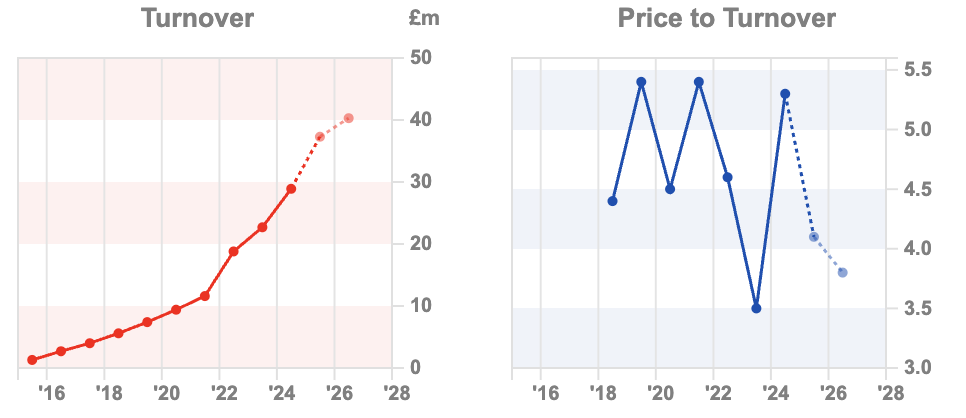

Valuation: Beeks shares are trading on a PER of 25x Jun 2026F, with Progressive not yet publishing Jun 2027F forecasts. That translates to 10x EV/EBITDA Jun 2026F. The chart below shows that although revenue is growing nicely in an upward trend, the chart below (right) shows investors have been reluctant to give this a re-rating.

Opinion: If this is a genuine platform, with rising revenues on fixed costs, then the investment case could be very good. I would imagine that contracts are hard to win, but then customers are locked in and the switching costs are high. The risk is that competition destroys pricing power on new business, so I think investors need to form a view on whether or not there’s a genuine moat.

Opinion: If this is a genuine platform, with rising revenues on fixed costs, then the investment case could be very good. I would imagine that contracts are hard to win, but then customers are locked in and the switching costs are high. The risk is that competition destroys pricing power on new business, so I think investors need to form a view on whether or not there’s a genuine moat.

Creightons FY Mar Results

Good spot from Cockney Rebel, who flagged Director buying at CRL just before the closed period in April and May but after the company’s March year-end. He suggested management would have a rough idea how the business had been doing. Indeed, Creighton’s Directors have a track record of dealing after their year end, for instance selling in October and November 2021, before disappointing results for H1 Sept 2021, which were released between Christmas and New Year. At the time, I suggested that such behaviour was far from best practice.

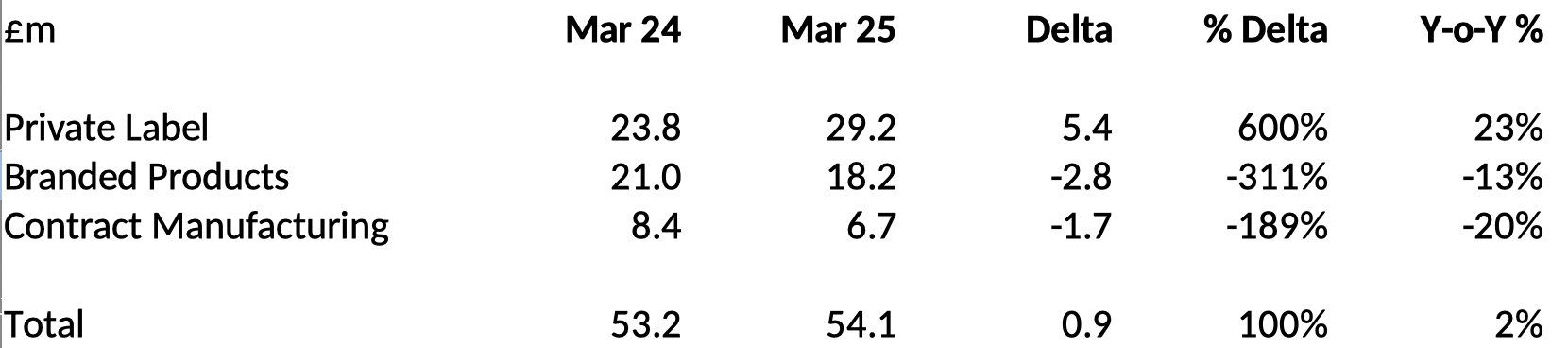

Creighton’s reported revenue up less than +2%, at £54m. The growth came from the Private Label side of the business +23%, while Branded and Contract Manufacturing revenue streams both declined. Private Label means high street chains and supermarket groups are customers, who then sell the products Creighton’s makes under the retailers’ own brand name. Branded Products is Creighton’s own brands, such as Frizz No More and Feather & Down and is higher margin than the other two categories. Contract Manufacturing, which is not a priority for the group, is when a brand owner approaches Creighton’s with their specific product idea and Creighton’s acts as the production partner.

See table below for a summary. For comparison, revenue peaked at £62m in FY Mar 2021 and 2022.

More encouragingly, operating profit increased x2.3 to £3.5m and statutory PBT reversed from a £3.5m loss last year to a positive £2.5m. Cash “on hand” also increased to £3m. Readers’ antenna should immediately pick up when management doesn’t use the standard “net debt/cash” definition; for instance “, net bank debt” often excludes acquisition-related liabilities. In this case, management are excluding long-term debt secured on a property from their definition.

The company has moved from the FTSE to AIM to cut down on compliance costs. That makes sense for a company of this size, and they now have Zeus as NOMAD, rather than Beaumont Cornish, who represented them on the main market.

The RNS also mentions a strategic review, which has concluded that they aren’t very good at making acquisitions, and will concentrate on developing the existing business. They went on a shopping spree a couple of years ago, buying various companies, particularly overpaying for Emma Hardie at the top of the market in 2021 – so I think shareholders could have told them that without the need for a strategic review. Instead, they are going to devote resources to a “fast follow” team, which sounds similar to what Warpaint has done very successfully. The products could be sold under Creighton’s own brands, Private Label or for specific retailers’ brands.

Outlook: Management warns that trading conditions remain challenging. Impact of tariffs is not expected to be material, but they flag National Insurance costs of £0.9m, with customers (ie the supermarkets and high street retailers) facing similar challenges, and they are struggling to raise prices to pass on this increased cost.

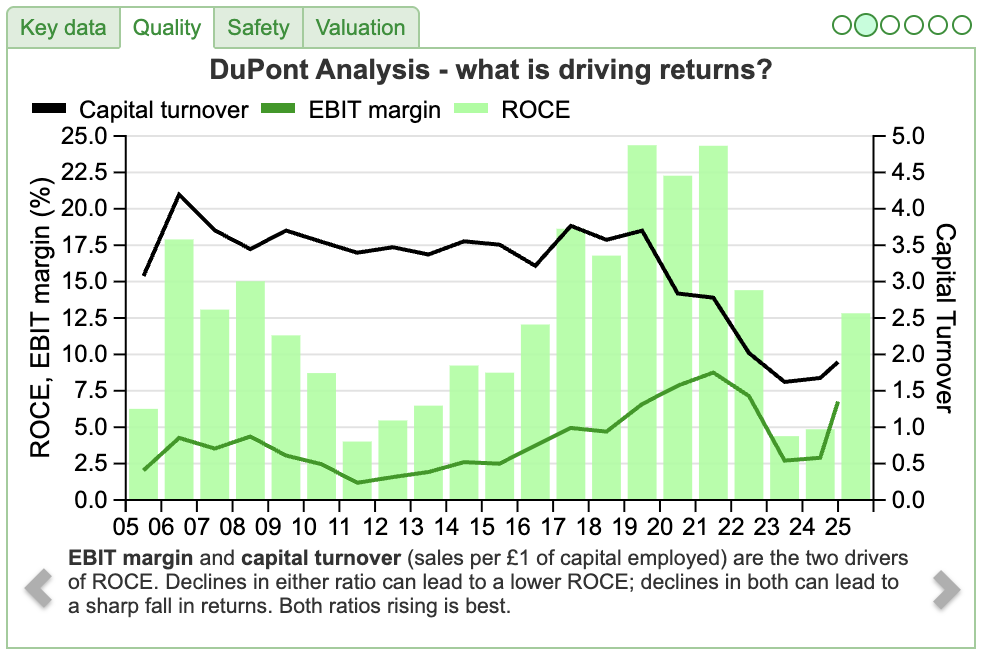

Valuation: There are no forecasts in the market, but the shares don’t look expensive on 10x PER Mar 2025, just reported. This used to be a > 20% RoCE business reporting peak EPS of 5.9p, which would imply a PER of > 6x peak earnings. Some of the decline has come from poor acquisitions, but note too that Sharescope’s DuPont analysis shows both capital turnover and EBIT margins under pressure.

Opinion: One theme I’ve noticed is that consumer brands like Fevertree, Diageo, PZ Cussons and also Creighton’s have all been poor performers over the past couple of years. Recent performance undermines the idea that consumer brands are defensive investments as inflation has returned.

The shares were down -9% on the day of the results. I don’t think there was anything particularly negative in the RNS itself. Instead, the share price may have run ahead of itself, up +63% since April, when Directors were buying. William McIllroy, former Chair, still owns 8%, down from over 20% in 2021. I had been wondering if he would try to sell the whole company to a PE buyer, but it looks like he has sold down his stake as he stepped down from his role as Chair. Possibly management have received approaches, but at a price that they were unwilling to sell out at.

Notes

Bruce Packard

Bruce owns shares in Creighton’s

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.