In this month’s funds overview, we examine two out-of-favour UK-listed investment trusts in a state of flux. We also explore Vietnam as a contrarian play in developing markets. And for income investors, we delve into a charity retail bond that offers a decent income.

Investment trusts and strategic reviews: Syncona and SDCL, funds in transition

The investment trust industry has been very busy in the last few months, inspired in part by US hedge fund Saba’s attempts to narrow chronic fund discounts. More generally, the investment company/trust sector has realised that there are too many small or underperforming funds, and that there’s a need for a strategic rethink. Sometimes that rethink ends up with a merger with another big fund or, in many cases, in a managed wind-down and return of capital. There have been so many strategic reviews, deals, and wind-downs that it’s sometimes easy to miss some interesting opportunities. I’ll concentrate on two in particular: Syncona, a listed venture capital life sciences fund, and SDCL Energy Efficiency Income Trust. Both have been trading at huge discounts, and both have decided to think more strategically about the future.

Let’s start with Syncona. This started off as a listed fund of hedge funds called BACITs that also raised money for research into cancer. Over time, the relationship with the Wellcome Foundation and its cancer research specialists blossomed, and BACITs decided to refocus. It was transformed into a UK-based, first-tier biotech venture capital firm with its own life sciences portfolio of early-stage assets, courtesy of the Wellcome Foundation. After an initial string of successful IPOs, the shares in the VC started to drift and have spent the last three years going nowhere, well, actually down to be more accurate. Some of this can be attributed to a persistent bear market in Biotech stocks, but a larger factor is that investors lost faith in its early-stage investment approach in private businesses, and frankly, some of its portfolio businesses underperformed. For more years than I can remember, Syncona kept pushing on with a strategy that was clearly not working with investors – the discount on the shares kept widening. Change was needed!

It took many months, but we finally have some resolution, not surprisingly, as the shares traded at a colossal discount of over 50% and have declined by 52% over the last three years. Last week, Syncona announced its full-year numbers and a strategy update. Here are some high/low lights, courtesy of the funds’ research team at Peel Hunt :

– a NAV decline of c.9.5% to £1,053m (vs. £1,239m in March 2023), or 170.9p per share (vs. 188.7p in FY24), with the decline in Autolus’ share price being the key driver

– Syncona reported a maturing portfolio of 14 companies, with 78.5% of strategic portfolio value now concentrated in eight clinical-stage and commercial companies, including two late-stage clinical and one with a marketed product

– An orderly realisation of portfolio assets, aiming to balance timely cash returns to shareholders with value maximisation. Syncona reiterated its confidence in the long-term opportunity of its strategy to “create and build companies leveraging world-class research.” The company is working closely with the board to explore the launch of a new fund for interested existing shareholders and prospective new investors. Syncona intends to continue to update the market on portfolio progress and stakeholder engagement outcomes in due course.

Peel Hunt analysts observe that the current discount “ significantly undervalues the portfolio (e.g. the current market cap is c.53% covered by cash alone)” while Numis analysts add that the

“proposed approach should give some comfort to listed fund investors that they will see cash come back as realisations occur, although this may take some years…. The board is also exploring accelerated realisations, which it notes “may include a sale of a small portion of its interests in certain of its portfolio companies at a modest implied premium to the current share price and at a discount to NAV”. If achieved, it would return the net proceeds and cash allocated to support further investment on the assets. The company is seeking to sell the assets to the new fund if it can raise additional capital.”

I suspect that the path to cash returns will be long and winding, but I think there might well be value in the shares, especially given the cash position and the chunky discount.

Next up, we have one of my favourite income ideas – SDCL Energy Efficiency. This invests in a range of energy efficiency and renewable assets, which are frankly rather dull, like CHP (community heat and power). The fund trades at a 42% discount with a covered yield of 12.3%. The fund has done many things right: it has sold assets at book value, bought shares (as has the manager), focused on reducing its debt (which is relatively high for many investors), and attempted to reach out to income-hungry private investors via different comms channels.

The fund also issued its annual update last week, and yet again, plenty of boxes were ticked. The managers released improved performance metrics, and the results were slightly better than I expected. Additionally, the management fee was reduced. That said, I’m still a little nervous about the high level of debt on the balance sheet and would prefer to see this brought down more aggressively. I’m also wary that the dividend is ‘only’ 1.0 to 1.1 times covered – I would feel a lot more confident if that was closer to 1.3 times covered.

Nevertheless, the big development came from the chair’s (Tony Roper) statement, which announced that it is “considering all strategic options to deliver value for all shareholders effectively and efficiently”, whilst also noting that it is “both in the context of the Company’s longer-term plan to drive value for shareholders and in a more wholesale and strategic manner”. The board plans to gather opinions of shareholders on possible outcomes over the coming weeks.

This is excellent news and could result in several outcomes, including a trade sale (possibly involving strategic investor General Atlantic), a take-private approach, or a more focused approach on reducing debt and selling assets. I stick with my long-term buy on the shares, and in the meantime, that generous dividend yield should help!

Income ideas: Retail bonds from charity Belong

I enjoy exploring exotic, often overlooked segments of the market, seeking out investment ideas that are off the beaten path. Some of these adventures involve income-producing bonds, particularly those known as retail bonds. Many moons ago, the LSE promised us a revolution in ‘retail bonds’, making corporate bonds from unusual, private issuers available to all and sundry. A special order book was even created. Finally, the UK would begin to resemble other markets, such as Italy or the USA, where owning single, individual bonds is commonplace.

The reality was dismal. The LSE fumbled the task, and very few issuers turned up to the party – that retail order book of bonds has dwindled into insignificance. That doesn’t mean that this bond market has vanished; it is merely that no one seems to be paying much attention anymore, except me and a handful of wealth managers!

However, issuance continues, with a product known as retail charity bonds taking the lead. The concept is straightforward. Charities and social enterprises continue to engage with the retail and wealth-advised markets through a streamlined issuance programme, which effectively offers a low-cost, standardised issuance process – similar paperwork, just with different names on the biscuit tin. It’s a solid idea, and many of the bonds merit further investigation and research.

The main attraction is that you get bonds issued by sensible issuers who struggle to access the mainstream corporate bond market because they’re either too small or not rated. For investors, you get access to decent yields for lengthy periods from quality issuers with a long track record of making their payments and repaying loans.

Which brings us nicely to a new issue of retail charity bonds by Belong, one of the UK’s top care home operators. In effect, the borrower is rolling over existing bonds and issuing new ones with a longer duration. It will pay fixed income investors a 7.5% rate biannually until its maturity in 2030. This is Belong’s second bond issuance following a £50m raise in 2018.

Like any bond, it’s essential to understand the credit riskiness, or otherwise, of the borrower. Belong pioneered the community village concept, and now serves over 1,000 elderly people in the North East of England. They provide dementia, respite, end-of-life and nursing care in an intergenerational community setting, as well as modern apartments for independent living. Two-thirds of Belong’s customers have a diagnosis of dementia.

Belong describes its model as a positive evolution on traditional, clinical and institutional care settings, promoting wellbeing through homely, smaller group living arrangements, surrounded by amenities such as restaurants, exercise facilities, communal areas, a children’s nursery and entertainment outlets.

Belong says it is less exposed to industry headwinds: 65% of its customers are privately funded, it has an above-average occupancy rate of 96%, and has almost doubled revenue over the past five years to £51 million. It also benefits from being a leading operator in a growing market, with demand for its services reinforced by the UK’s ageing demographics and limited supply of modern, high-quality care facilities.

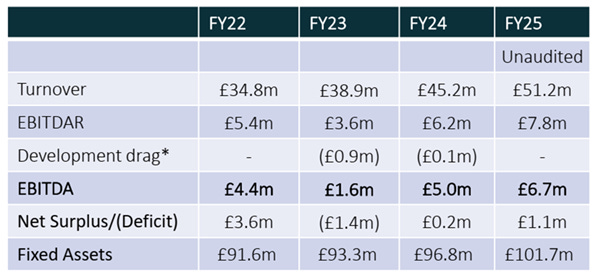

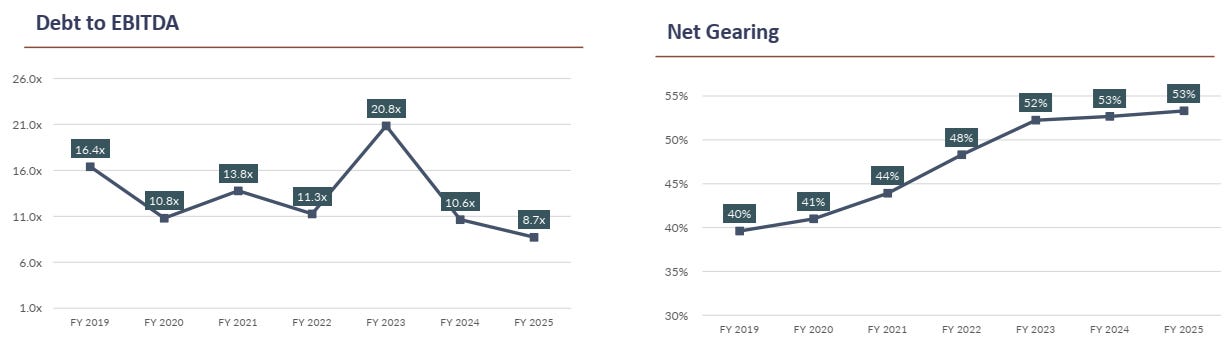

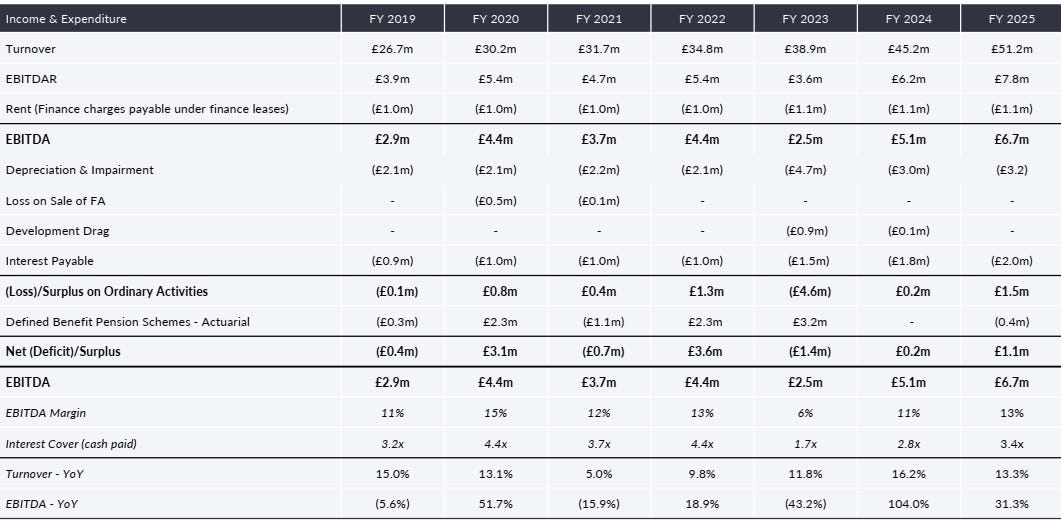

In the three graphics below, I’ve pasted in some key operational financial information from a recent management investor roadshow presentation – if you want more detail, you can see that presentation HERE. I’d make a couple of observations:

1) The loan-to-value ratio is above 50%, whereas many REITs I track tend to be well below 45%. That isn’t necessarily a problem, but it is a yellow flag, I suppose, warranting further investigation. Be aware that if there were a massive drop in property values, say 30%, then that LTV ratio could appear much more concerning.

2) Turnover growth has been very steady, but there has been volatility in the bottom line with a dramatic drop in EBITDA in 2023, partly as a long-term consequence of Covid, but also because of development drag. That said, the EBITDA margin has been fairly solidly in the 11 to 15% range for most of the last six years.

3) I’d be mindful of government regulation and wage costs. I worry that tougher immigration rules, while electorally popular, will add to already increasing wage costs, hurting the bottom lines of all care sectors. As for government regulation, there’s always the possibility that a future government could decide to integrate the NHS and social care and, in effect, nationalise some of the care sector. I think that unlikely, though not impossible.

4) Interest coverage (EBITDA/Interest) appears more than manageable, with a median range of around 3 over the last six years. That said, the new bonds are likely to increase the interest bill.

The first step in understanding these bonds is to examine the comparable yield on other bonds. For instance, the UK 5-year gilt is currently yielding 4.14%. The Belong bond thus offers a near 3.5% uplift at 7.5% compared to that rock-solid investment.

Another comparable comes from corporate bonds trading on various investment platforms, including Hargreaves Lansdown. There’s a bond from HSBC Bank, for instance, maturing in November 2030 with a 5.375% initial yield, priced at approximately £100 mid-price. Additionally, there’s Tesco, which has a bond maturing on 14 December 2029, priced at 6% and currently around £106, implying a yield to maturity of approximately 5% as well.

Looking more broadly at a range of high-yield credit issuance – junk bonds in the old parlance – a rough and ready reckoner is that high-yield credit on terms varying from 2 to 5 years is currently yielding circa 6.7% on average, which I find relatively meagre given the current elevated market and economic volatility.

These data points suggest that a 7.5% yield for a 5-year term from Beyond is not unreasonable, especially if you think, like I do, that interest rates (and gilt yields) will continue to fall back to sub-4 %. That said, there are some obvious risks, some of which I have flagged. I’d also consider the duration risk – these longer-dated bonds might fall sharply in price if UK interest rates rise substantially due to an increase in inflation.

One final thought, sticking to the retail bond theme: Golden Lane is another charity issuer. They have a bond with the ticker MCP3. It matures in 2031 and offers an initial yield of 3.25%. It’s currently priced at around £83.

The yield to maturity is lower than that offered on the Belong bond at around 6.7% (Belong is at 7.5%), but there’s a possibility that if you hold until redemption, you’ll get back the full £100 per bond as well as the interest paid.. If you hold until maturity, any capital uplift (assuming the issuer repays) might be capital gains tax-free. I say ‘might’ because there is some debate among experts about whether retail charity bonds qualify for the CGT exemption point (on capital gains).

Vietnam

When Trump fired his first salvoes in his extensive global trade war, Vietnam found itself firmly in the firing line, not helped by a huge trade deficit, with many goods transhipped from China to its southern neighbour. Investors en masse dumped funds investing in Vietnamese equities, hitting hard the small but competitive niche of listed London investment trusts (three in all). Prices crashed and discounts widened substantially. The contrarian in me always thought this was overdone.

Sure, Vietnam will face a challenging time negotiating with Trump, but a deal was highly achievable, and there are strong reasons to believe that the US government will, strategically, want to maintain close ties with Vietnam. The sell-off also overlooked Vietnam’s clear structural strengths: it is a leading Asian industrial power, with a young, technically skilled workforce progressing up the value-added chain, particularly in technology, with a rapidly growing (over 6% annually) economy, increasingly dependent on middle-income consumers, and a very inexpensive local stock market.

Suppose you’d like to learn more about these long-term structural tailwinds. In that case, I recommend watching a film I recently produced with the assistance of Dragon Capital, which manages the London-listed investment trust Vietnam Enterprise Investments Ltd (VEIL). The short film explores the numerous arguments surrounding Vietnam, its economic history, its political setup, and the increasingly apparent trade challenges.

Watch HERE

In the last few days, a major trade deal has been announced. It’s not an ideal deal, but it should provide some reassurance that the US wants to maintain close ties with Vietnam. The details are still being finalised, but the key features include a reduction of the proposed 46% reciprocal tariffs on US-bound exports to a reported 20% tariff rate (40% for transhipment from China), as well as increased access for US businesses in Vietnam.

I’d note that this deal with Vietnam is important in another respect – it’s happened well before any agreement with Asian rival India. I think rather than compare Vietnam to China, its better to think about the India and Vietnam comparison. If you want to own a part of an Asian growth story, which market would you prefer? And for clarity, I like both !!

But, that said, I would make the following observations:

1. Vietnam has infinitely better infrastructure than India (though India is catching up fast). This matters for an export economy

2. Vietnam is a much more open and export-oriented economy than India, which presents both threats (in the form of tariffs) and opportunities.

3. I would maintain, slightly controversially, that India’s socialist past weighs more heavily on its current economy than Vietnam’s dominant communist party. Vietnam strikes me as thoroughly capitalistic, whereas India still boasts baffling examples of Fabian-style socialism

4. India is younger than Vietnam, with a median age of 28 vs 33, but Vietnam’s workforce is overall better trained and educated. Vietnam also features a much more robust female participation rate.

5. Due to its size, Vietnam is better equipped to avoid the middle-income trap than India.

6. India’s stock market is expensive, whereas Vietnam’s is dirt cheap.

I’ve left the obvious geopolitical issue for last. India does boast a robust democracy, which is fantastic, and Vietnam is self-evidently communist. Vietnam’s CP is also instinctively close to the Chinese CP, but if you are the Trump administration, what do you think is more important: onshoring Vietnam’s low-cost labour industries (making earbuds for Apple and phones for Samsung in Los Angeles for instance) or having a close relationship with a regional power (Vietnam) that is NOT China. As Peter Thiel has noted, Vietnam serves as a non-expansionist hedge against China, one that lacks China’s imperial ambitions.

One final observation: What about Vietnam compared to the MSCI EM index? Would you have lost out if you had chosen Vietnamese equities over an MSCI Emerging Markets (EM) index tracker?

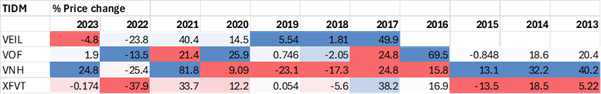

The short answer is that it depends on your timescale. The broader MSCI EM index has significantly outperformed Vietnamese funds in the last year, mainly because Chinese equities (ridiculously cheap) have surged ahead. If we examine ten-year price returns, the two longest-established London-listed funds have outperformed. VinaCapital returned 159%, and Vietnam Holding returned 89%—by comparison, the MSCI EM index returned 46%.

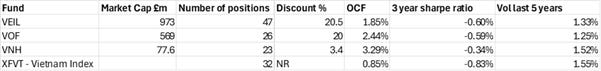

What about the Vietnamese funds? The good news is that there are three actively managed Vietnamese funds and an ETF (which I wouldn’t recommend). Here’s a quick pen portrait of each of the funds:

· VEIL: Vietnam Enterprise Investments Limited is the largest listed fund by assets under management (just under £1 billion) with the lowest cost of ownership, with an OCF of 1.85%. It recently introduced a 100% tender offer to help narrow the discount, which is around 22%. The fund has the largest, most diversified basket of stocks, with 47 holdings. The 10-year annualised NAV return is 9.2%.

· VOF: VinaCapital Vietnam Opportunity Fund is one of the longest-established London-listed funds, with an AuM of just under £700m, which isn’t too far behind VEIL. VOF invests in growth equity opportunities across listed, private equity, and state-owned enterprise (SOE) assets, which are privately negotiated. It boasts a distinctive public-private markets approach, which is very different from its two direct peers. Its discount to NAV is a tad lower than VEILat just over 20%.

· VNH: Vietnam Holding (VNH) invests in high-growth companies in Vietnam, concentrating on domestic consumption, industrialisation, and urbanisation. Launched in 2006, VNH is a closed-end fund listed on the London Stock Exchange. It is the smallest of the funds (under £100m) and has a fairly concentrated portfolio that has experienced some exceptional periods of outperformance. The fund also has the smallest discount to NAV. It is managed by Dynam Capital, whose chairman is Craig Martin. The portfolio focuses on three core investment themes: Industrialisation, Urbanisation, and the Domestic Consumer. Its discount is much lower, in the single digits.

· XFVT: This is an exchange-traded fund: the Xtrackers FTSE Vietnam Swap UCITS ETF. Boasts a low TER of just 0.85% (high for an ETF). The index fund tracks the FTSE Vietnam Index, which largely consists of Vietnamese blue-chip companies listed on the Ho Chi Minh Stock Exchange. The Vingroup (a local conglomerate) and its range of underlying holdings is a prime mover in this index.

The table below looks at some characteristics of each of the funds at the end of last month :

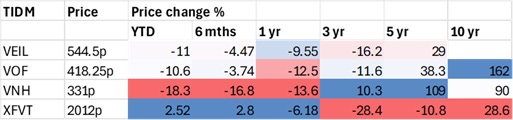

Regarding performance, I’ve added two tables, each built on a heat map. The first shows recent performance along with ten and five-year returns (these are for price returns only and do not include dividends).

The next table shows price returns by year.

I’d be reluctant to draw any hard and fast conclusions from these two performance tables above, as each of the funds has had periods of outperformance. All the funds can point to periods of outperformance— over the very long term (more than 10 years), VinaCapital boasts exceptionally solid 20-year returns of over 445%!

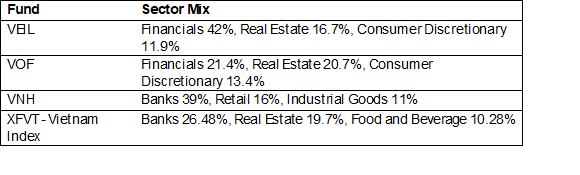

I think it is more interesting to look first at what the funds currently hold in their portfolios. All the active funds appear to be very aggressively focused on banks, with 42% in the VEIL portfolio, 39% in VNH, and just 21% in VOF. In the index, banks are 26%. VOF, by contrast, is overweight real estate (at 20.7%) with VNH very much underweight real estate.

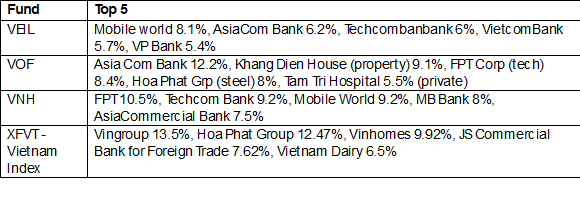

The top five stocks in the portfolio include some well-known names—banks such as Asia Commercial and the tech company FPT. In the consumer space, MobileWorld is the top holding at VEIL, and it’s also a top-five holding at VNH. Notice that none of the actively managed funds have significant exposure to the biggest stock in the FTSE Vietnam index, VinGroup (13.5% of the FTSE Vietnam index), or Vietnam Dairy.

Bottom Line? Let’s start with the top-down asset allocation point.

I would be inclined to ignore the MSCI EM index – GEMs – and focus on individual countries (such as Poland and India) as well as regions (like Latin America). Vietnam is not an emerging market, but a frontier market and I would favour Vietnamese equities over Indian equities, although I would own both!

Despite preferring Vietnam over India, I still recognise that India has huge potential and is simply too big to ignore. In India, I would also avoid the index and use active funds – specifically, Ashoka India Equity Investment Trust and India Capital Growth Trust.

For Vietnam, I would not use an ETF and would go instead for an actively managed fund – I think the risks of being overexposed to the VinGroup are just too great in an ETF. I also generally have a predilection for actively managed funds in less-than-liquid and somewhat opaque developing markets.

Deciding which London investment trust to go for depends on your preferences. VEIL is for you if you want the biggest, most liquid and cheapest fund (in OCF terms) with a high discount. If you want a differentiated approach with both public and private equities, then VinaCapital is a great choice with a long track record. If you want a very long-established fund (20 years), a tight concentrated portfolio which significantly outperforms during some periods, then VNH is a great choice, though its discount is the smallest, and it’s a small fund in terms of AuM.

~

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.