Richard updates us on Pets at Home, the ubiquitous pet store is hiding a fast-growing vet practice and incubating a pet insurance business. He also takes a closer look at Eleco’s major shareholders, which unlocks the company’s storied history.

5 Strikes

Pets at Home is the only company to publish its annual report since my last article, pass my minimum quality filter, and score less than three strikes.

For more details on how the system works, please see the explainer linked under the table. The basic idea is to find companies that have been successful in the past in the expectation that they are more likely to be successful in future.

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| RS | RS1 | 9/6/25 | 0.1 | – Holdings ? Debt – Growth | 3 |

| Vodafone | VOD | 6/6/25 | 0.1 | – Holdings – Debt – Growth – ROCE | 4 |

| CMC Markets | CMCX | 5/6/25 | 62.5 | – CROCI – Growth – ROCE | 3 |

| Anglo Asian Mining | AAZ | 4/6/25 | 39.7 | – CROCI – Growth – ROCE | 3 |

| JD Sports Fashion | JD. | 2/6/25 | 0.0 | – Holdings ? Acquisitions – Debt | 3 |

| Marks & Spencer | MKS | 2/6/25 | 0.1 | – Holdings – Debt – Growth – ROCE | 4 |

| Anglo-Eastern Plantations | AEP | 30/5/25 | 0.0 | – Holdings – CROCI – Debt – Growth ? ROCE | 4 |

| NAHL Group Ltd | NAH | 30/5/25 | 2.0 | – Debt – Growth – ROCE | 3 |

| Braemar | BMS | 29/5/25 | 3.2 | ? CROCI ? Debt – Growth – ROCE | 3 |

| Burberry | BRBY | 29/5/25 | 0.0 | – Holdings – Growth – Debt – ROCE | 4 |

| Touchstar | TST | 29/5/25 | 1.3 | – CROCI – Growth – ROCE – Shares | 4 |

| Pets at Home | PETS | 28/5/25 | 0.2 | – Holdings | 1 |

| Logistics Development | LDG | 22/5/25 | 1.8 | – Acquisitions – CROCI – Debt – ROCE – Shares – Directors holdings | X |

| Click here for our 5 Strikes explainer | 11/06/2025 | ||||

Further examination is required to give us confidence that these companies are building on their strengths and not succumbing to any weaknesses.

PETS [- Holdings]

Pets At Home is high up on my research list. I wrote about the ‘big obvious risks’ last March. There may be others, I hasten to add, but until I can imagine them, limits to growth and a Competition and Markets Authority investigation are my focus.

Pets At Home is the UK’s dominant pet store chain, and it is also one of the country’s largest vet chains (the annual report says it is the “clear #2”).

Since the pet stores supply almost half of the pet food consumed in the UK by value, Pets at Home is in a good position to compete not only with other pet stores, but supermarkets and other retailers. It is a respected brand, so it should be a resilient business, but I wonder how much more it can grow.

Although the more profitable veterinary business has a smaller market share, it is one of the big six Large Veterinary Groups (LVGs) identified by the CMA in an investigation into the industry.

Having extended its investigation, the CMA aims to publish its preliminary findings in September 2025 and to publish a final decision by February 2026.

The CMA investigation is unsettling, but Pets at Home argues that its practices are different and less monopolistic than many of its rivals. Most of the practices are structured as joint ventures with local vets who have “complete operational and clinical freedom,” according to the annual report.

Vets at Home supplies support services like branding, promotion, professional development, and property, legal, and administrative support, for which it receives a fee.

In March, I thought limited growth potential was the greater risk. Now that the annual report has been published and we have learned more about the investigation, that remains my view. But I am warming to the growth story…

Growth story

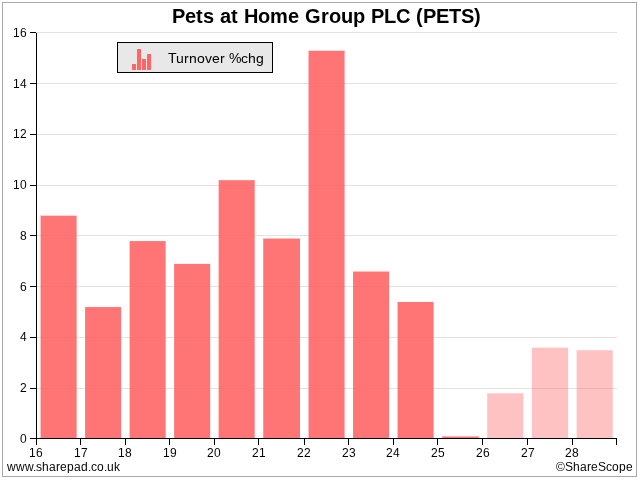

While Pets at Home remains highly profitable, in the year to March 2025, the firm barely grew turnover. Analysts forecast subpar growth for the next three years.

Pets at Home says revenue from stores declined by 2% due to weak consumer confidence and a mild pandemic hangover. Many of us bought pets in the early 2020s, and fewer of us are buying them now.

The company also transitioned to a new webshop and app, building functionality throughout the year. It relocated online sales to a new distribution centre that serves the entire business. These initiatives temporarily reduced online sales.

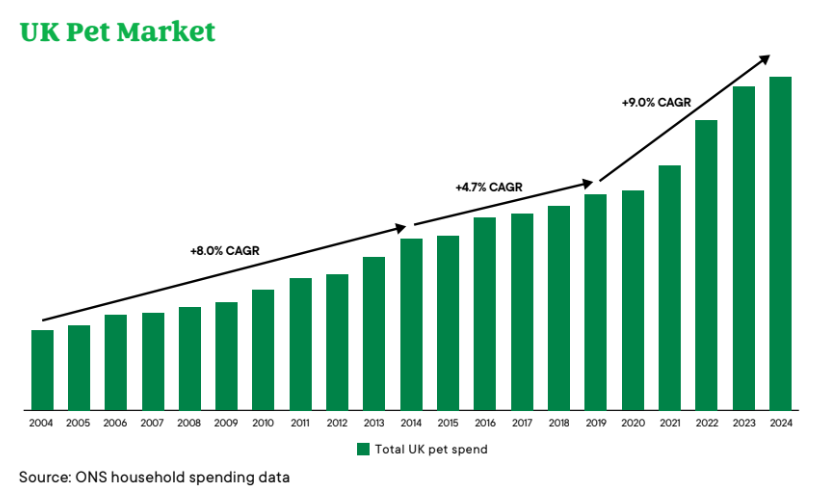

In future, Pets at Home expects the UK pet population to remain stable, but the company expects to outpace a market that continues to grow due to long-established trends. We are spending more on pets as we seek better diets and treatments for them, and the range of healthcare options increases.

Source: ONS data, in Pets at Home’s 2025 Annual Report.

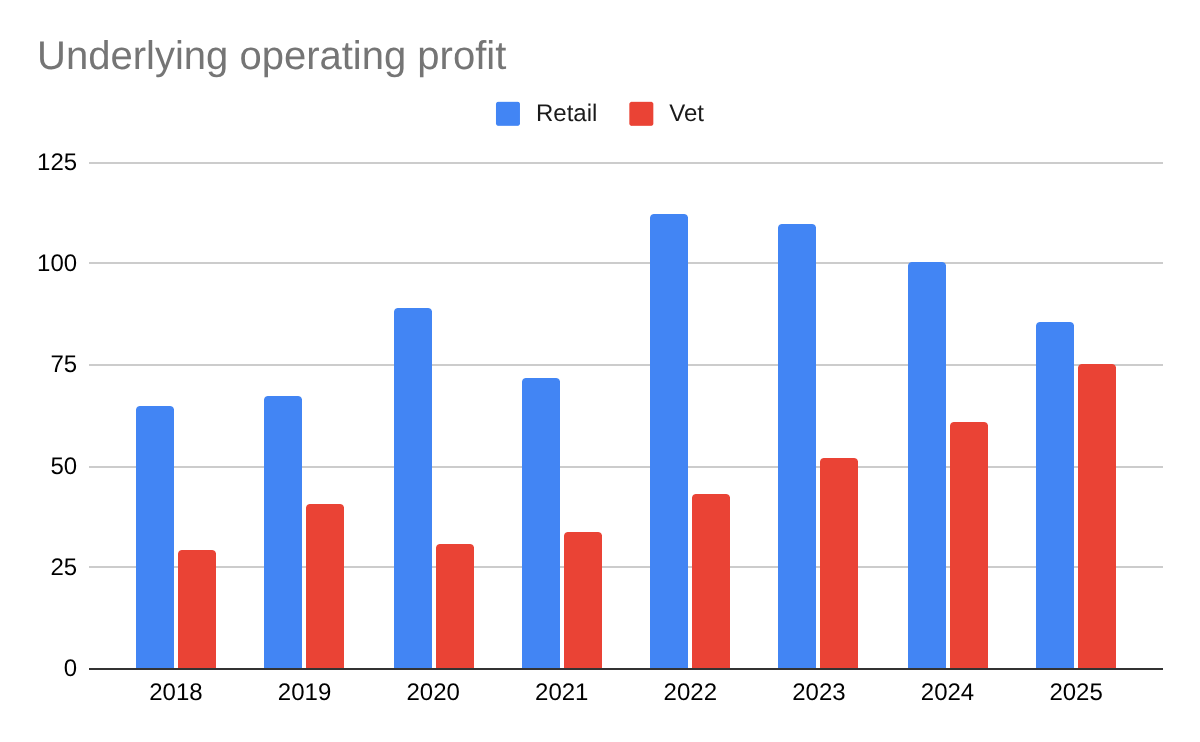

Focusing on revenue and aggregating the retail and vet segments hides an important detail though.

The vet segment continues to be Pets at Home’s engine for profit growth:

Source: Pets at Home annual reports

Since 2018, the first year Pets at Home broke down profit in this way, underlying operating profit in the retail segment has grown slowly and irregularly at a compound annual growth rate (CAGR) of 4%. This is the profile of a mature business.

Except for the two pandemic years of 2020 and 2021, profit from the vet business has grown much more strongly at 12% CAGR, and also much more reliably.

In terms of profit, Pets at Home is likely to become a veterinary business with a complementary pet store chain attached in the not-too-distant future. In 2025, the company says the vet chain earned more free cash flow than the retail stores.

Despite its position as the number two vet chain in quite a concentrated industry, Pets at Home does not foresee limits to its veterinary expansion.

The company plans to implement ten new practices in 2026 and a hundred over the medium term. That would take the total to about 473. Meanwhile, practices opened in the last 10 years are still maturing, and the company says it is growing older practices through expansion and the introduction of new capabilities.

It is also moving into pet insurance. Pets At Home believes that this new division will grow to contribute 10% of total profit “over time”.

Echoing the vet partnerships, where vets are joint venture partners, Pets At Home says it has recruited an experienced team and given it a 20% minority stake in the insurance business.

Instinctively, I like this setup. Giving the team a stake in the business should foster entrepreneurship, and the projected start-up cost is a modest £3 million in 2026 (projections for 2027 are not disclosed, but the company anticipates break-even in 2028).

While it is impossible to know whether Pets at Home will succeed, it may well develop a distinctive insurance business. The company already has a massive customer base to work with, and plans to use AI to ease us into its product.

As to whether the CMA’s rulings will stymie revenue and profit growth, Pets at Home’s annual report continues to assert that its joint venture model insulates it from “many areas of the CMA’s concern.”

ELECO [- Holdings ? Growth]

In my last article, I introduced Eleco, which supplies building lifecycle software as a service. The software that helps property owners, construction companies, and developers with activities like project management, portfolio management, maintenance management and estimates.

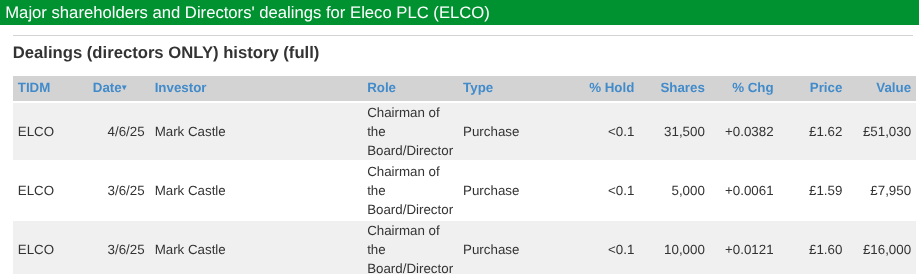

The only full strike against the share is the absence of significant director holdings. Chief executive Jonathan Hunter owns just 49,000 shares worth about £83,000 despite having served on the board since 2016 and as chief executive officer since 2020.

He took over from John Ketteley, who retired in 2023 after 23 years as executive chairman. Mr Ketteley is a major shareholder. He owns over 10% of Eleco shares.

Jonathan Hunter, though, is credited with a “fundamental role” in the transformation of the business, which shed its building systems and precast concrete division in 2013 to focus on software, which it had been developing since the 1990s.

The company has quite a storied history for a business that only makes £32 million turnover today. Founded as the Gilbert Arc Lighting Company in 1895, it renamed itself the “Engineering Lighting Equipment Company” (ELECO) in 1921.

Director ownership took a small step forward on 5 June, when non-executive chairman Mark Castle bought 46,500 shares, raising his holding from zero:

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.