As concerns rise about the outlook for government debt, a look at what could be driving prices in the precious metals sector. Companies covered FTC, GHH and RFX.

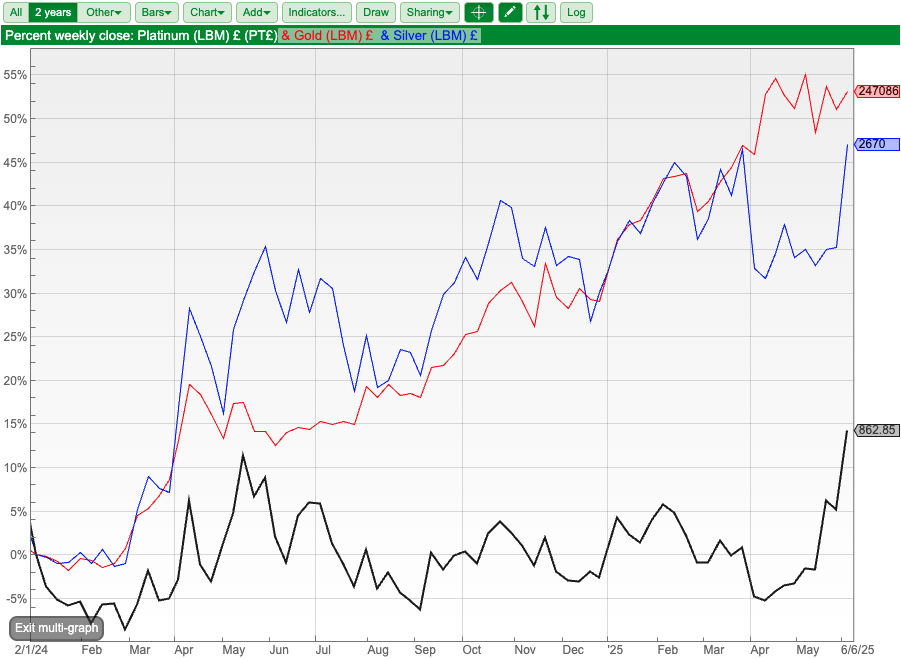

The FTSE 100 was up +1.4% in the last 5 days to 8,862, while the Nasdaq100 and S&P500 were also both up +1.4%. The best-performing index over the last 5 days was the FTSE TechMARK up +6.4%. The best-performing commodities were platinum +13% in the last 5 days, followed by silver +9%. Those two precious metals have lagged the price of gold over the last couple of years, as the Sharescope chart below shows. They now seem to be catching up.

Much of the strong performance of precious metals seems to be driven by concerns about the US Dollar and US Government debt. There’s this fun quote from John Stepek at Bloomberg, saying: “Increasingly, US political policy seems to be similar to the business strategy of a maturing tech company. Having built a network of customers by offering a decent service at a negligible or non-existent price, it’s putting up its subscription fee on the assumption that there is no other alternative.”

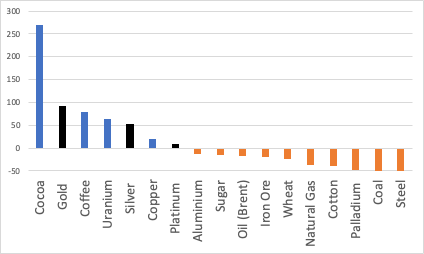

I used Sharescope to download the performance of commodities into Excel, and then create a chart, which shows that since Sept 2021, when liquidity conditions peaked, Gold (in black) has performed well +91%. Central Banks had initially dismissed inflation as “transitory”, then by late summer 2021, it was becoming clear that inflation was a problem. It’s rather ironic for all those goldbugs who feared currency debasement that gold has done well, not when Central Banks were doing QE, but when inflation caused CB’s to cease QE.

However, when Central Banks stopped buying government debt, many switched to gold. This Bloomberg article suggests that Central Banks and Sovereign Wealth Funds (SWFs) have been buying up 1000 metric tons a year, worth $100bn at today’s prices. Most of the current gold buying is secret, likely China accounts for a significant amount, along with other unidentified buyers via Switzerland, according to the same article. At the start of the year, HSBC surveyed 72 Central Banks, more than a third planned to buy more gold in 2025 and none planned to sell.

To put the $100bn into context, it’s less than 1% of US Government debt which is $36 trillion, or 124% of US GDP, and during the pandemic, the Fed alone bought $4.6 trillion for QE. Other precious metals, silver and platinum (also in black in the chart above) have lagged gold, as they are not widely held by Central Banks. These two precious metals are driven by industrial demand, such as diesel catalytic converters in the case of platinum. I’m wondering if there will be a substitution effect and at what price buyers might switch from gold to platinum and silver.

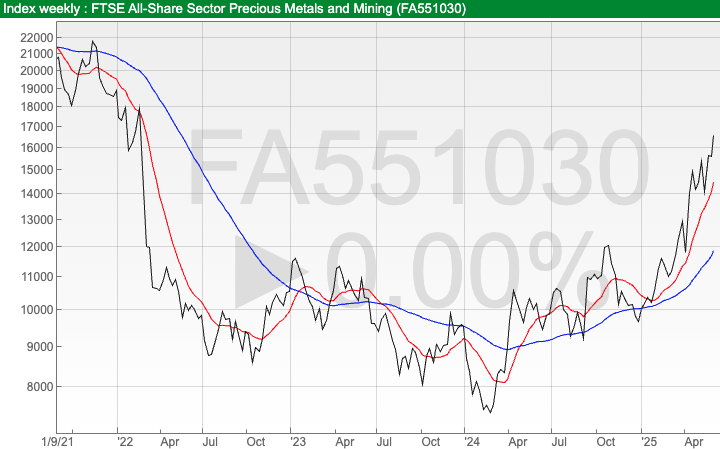

The share price performance of Precious Metals and Mining (PMM) firms listed in the UK have also done well. This sector performed badly after the peak in Sept 2021, but the PMM sector is the best-performing index now up +72% YTD, ahead of even Aerospace and Defence, which was second up +53%.

I would imagine that after a difficult couple of decades, many readers are sceptical of the investment case in small-cap mining shares. I agree, I have only taken a small position in Goldplats and Capital. Neither are gold miners in the strict sense of the word, i) GDP follow a strategy similar to Sylvania (up +52% YTD) of recovering precious metals from mining waste ii) CAPD rent out drilling rigs and assay analysis.

The chart above made me think: “There’s always a bull market somewhere, so …find a bull market!” US government bonds have enjoyed a bull market since the 1980s, is it now time for precious metals and their miners to shine? Interestingly, Anglo American have just spun off its platinum mining division, to create Valterra Platinum, with a market cap of £8bn.

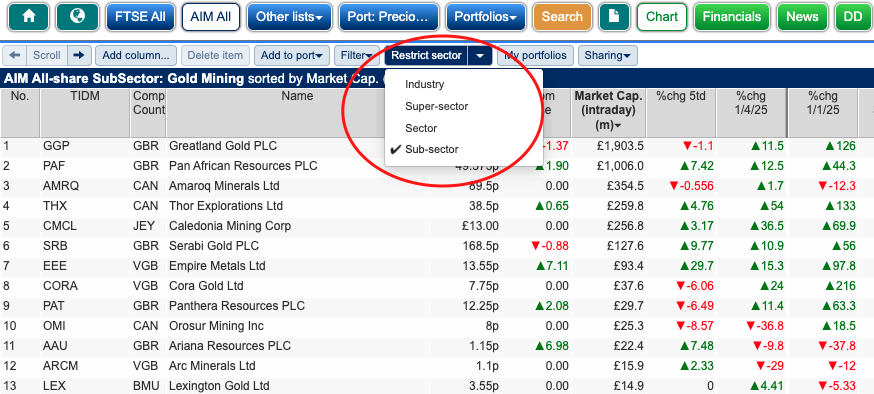

If you would like to fish in the precious metals pond, Sharescope has the “restrict sector” tab. Just select Greatland Gold, which has already done very well, and click on “restrict sector” and select “sub-sector” for all the other gold mining companies. For a broader list of precious metals mining companies, instead, select “sector” rather than “sub-sector”.

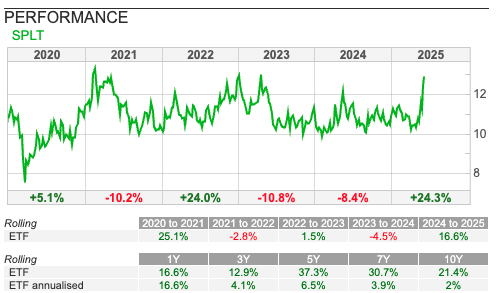

It is also possible to look up precious metal ETFs on Sharescope, I’m pondering whether to keep things simple and just buy some iShares SPLT. The platinum market is expected to record a deficit of 966 koz this year, which follows a similar deficit in 2024. That 966 koz deficit represents 12% of supply. Total supply from mining and recycling is forecast to be 7,000 koz, versus global demand of 7,966 koz, of which 3,052 koz is catalytic converters, according to the WPIC.

That said, this is a speculative area, so it’s important to use Sharescope and other sources as a research tool, and not blindly follow anyone, including me. In other words: DYOR.

I hope everyone had an enjoyable time at Mello. I was sorry to miss the event this year, but I’m sure that there will be opportunities to meet again in person and catch up with everyone. If you haven’t already voted: please click on this link to the Investors Chronicle annual Celebration of Investment Awards 2025. As always, we would be extremely grateful to receive your vote in the Best Investment Software/Data Provider category.

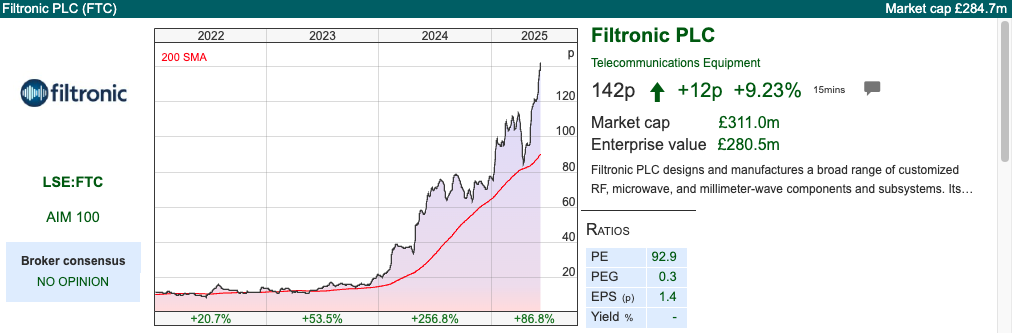

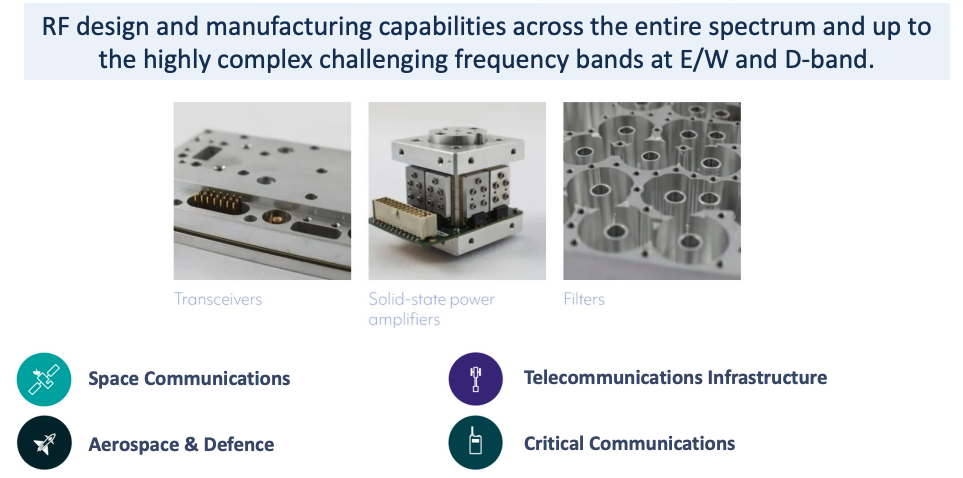

This week I look at the photonics business Gooch & Housego, pawnbroker Ramsdens and Filtronic’s largest-ever contract award from SpaceX.

Filtronic large contract win

Shares in this microelectronics company, with a May year-end, whose largest customer is Elon Musk’s SpaceX were up c. 3.5x in 2024. At the end of last year, they announced ‘significant growth in revenue and profits” and “stronger results for the Full Year than current market expectations”, but the share price reaction was tepid. I suggested that could be because Cavendish, their broker, had left FY May 2026F unchanged.

On Tuesday, Cavendish raised that FY May 2026F revenue forecast for next year by just £4m, or +8% and adj PBT forecast is up less than +0.5%. That follows an FTC RNS flagging their largest contract win to date from SpaceX, worth $32.5m (or £24m) materially fulfilled in FY May 2026F. The entire £24m isn’t reflected in the forecast increase because Cavendish had already been anticipating further contract wins from SpaceX. In other words, 80% of the contract win announcement was already in the broker’s forecasts last year.

SpaceX and FTC structured their relationship with 22m warrants that would vest (strike price 33p, so well in the money) after $60m (£48m) worth of SpaceX orders had been placed. That condition has now been fulfilled, so SpaceX owns just under 10% of the company, with a further 5% unvested and subject to meeting unspecified conditions.

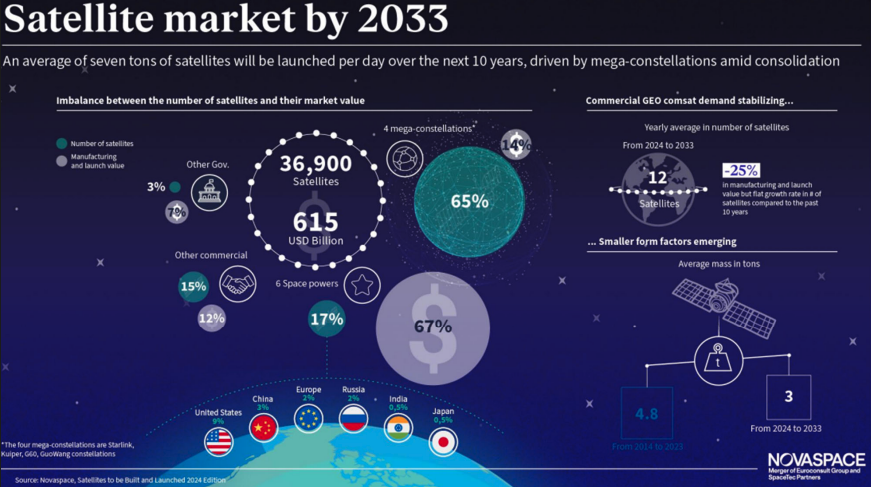

Valuation: The shares are now trading on 5.8x May 2026F sales and a PER of 44x the same year. That translates to 28x EV/EBITDA, so the valuation implies there’s significantly more profitable growth to come. That may be right – management put up a slide at their H1 results saying 7 tons of satellites will be launched PER DAY over the next 10 years. In financial terms, that equates to $615bn of spend, so someone is going to make a lot of money.

Opinion: Well done to holders. I missed this one, so don’t feel qualified to say whether I would take profits or run it as a winner. If I did hold, I would be feeling nervous that contracts are lumpy, plus there’s also the risk of Trump cancelling some SpaceX contracts, after the public “conscious uncoupling” of the President and the tech entrepreneur. Cavendish have yet to publish their FY May 2027F forecast, and if that year is disappointing, perhaps there could be a better entry point in future.

Gooch & Housego H1 March Results

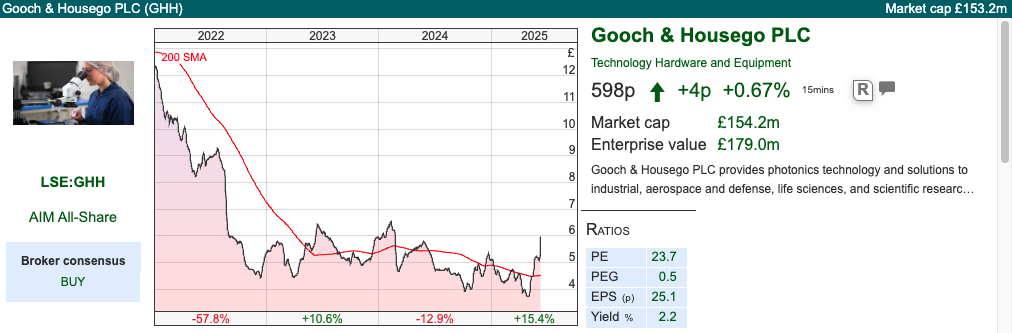

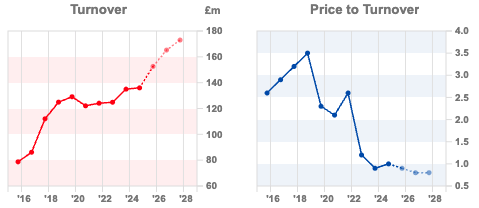

A couple of people had mentioned this as a potential turnaround story in 2025; I own a small starter position but was waiting to see how things progressed before deciding to add more (or exit). The chart does look interesting, breaking out from below £4 and now well above the 200-day moving average.

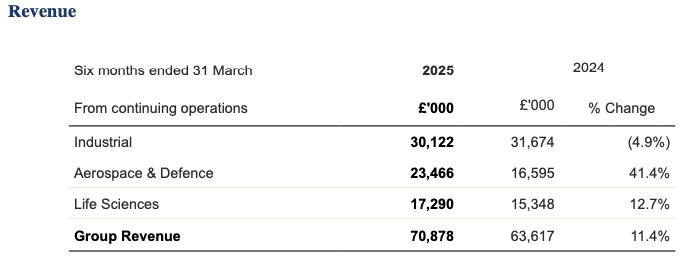

Management had already put out a trading update saying organic growth was up +7.5% to £71m, which translates to +11.4% on a statutory basis. That growth was driven by i) Aerospace & Defence +41% (of which, +30% organic), which now represents a third of group sales and ii) Life Sciences +13% and now a quarter of sales. The two smaller divisions compensated for lacklustre demand in the group’s largest division iii) Industrial, revenue is down -5%.

Industrial is primarily precision lasers and undersea cables, whereas A&D has established positions in periscopes, target designation, laser gyroscope navigation systems and drones. The Life Sciences division mentions that medical lasers are seeing increasing competition from low-cost Chinese suppliers, so GHH are ending the majority of product lines and switching to growing crystals for optical applications.

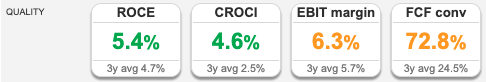

Both statutory PBT and adj PBT have rebounded strongly, to £2.9m and £5.1m respectively. Operating margin improved to 8.7% from below 3% H1 last year. Net debt ex IFRS 16 was £24m at the end of March, an increase of +9% v H1 last year. There’s £3.35m of additional consideration for Global Photonics bought this time last year for $17.5m, not included in the net debt figure. That £3.35m cash falls due over the next 2.5 years, and is valued using fair value accounting (applied discount rate of 14%) at £1.6m on the balance sheet.

Outlook: The order book has increased +16% to £121m, v Sept 2024. On an organic basis order book growth was +4%. Management can’t work out if tariffs are a headwind or a tailwind. First, they warn: “Uncertainty generated by the rapidly evolving tariff environment is damaging confidence amongst many of our customers to make capital investment decisions.” But go on to say later that: “the Group’s considerable US-based manufacturing presence [means that] the new tariffs could over time be a benefit to some parts of our business against their non-US competitors.” Likely, both of those statements are correct. Cavendish have left their forecasts unchanged, implying FY Sept 2026F revenue growth of +8% and EPS growth of +16% the same year.

A decade ago RoCE was in the low teens, but more recently management have failed to achieve returns above their cost of equity. Sharescope’s forecasts imply a return to low teens RoCE in future years.

Valuation: The shares are trading on 14x Sept 2025F dropping to 12.5x PER the following year. That’s a not unreasonable 6.5x EV/EBITDA and 0.9x sales. For comparison, Halma trades on over 20x EV/EBITDA and 5x sales. Spectris has just received an approach from PE firm Advent, at above 13 EV/EBITDA.

Opinion: This does seem to have now turned the corner. I first bought a position in Oct 2023, but then sat on my hands. I am now thinking of adding again, but haven’t done so yet. Like many AIM stocks, if we see revenue growth and margin improvement at the same time this could enjoy a re-rating. In the past, investors have been prepared to pay up to 3.5x revenue, which would imply close to £20 per share.

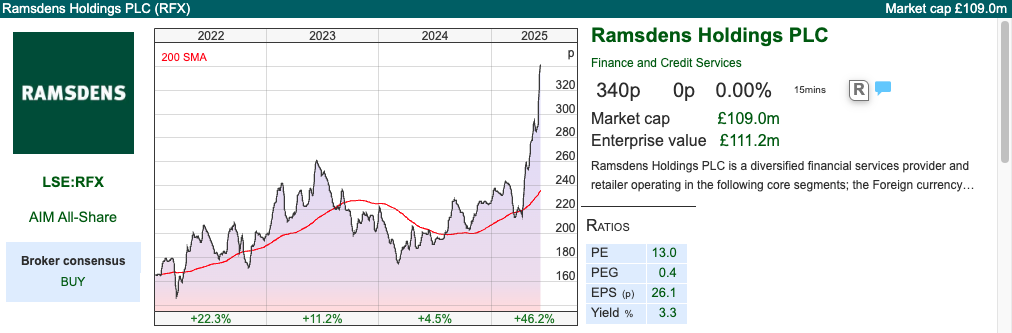

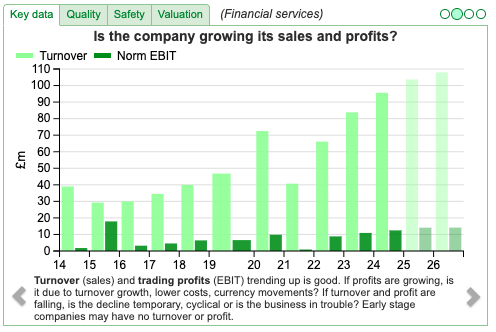

Ramsdens H1 Mar Results

This Middlesbrough-based pawnbroker and jewellery business put out an “ahead of expectations” trading update in early April, suggesting FY Sept PBT of at least £13.0m. Then on the 14th of May, Ramsden’s competitor H&T Group received a takeover approach at 650p per share, a 44% premium to the undisturbed HAT price. That bid values HAT at 11x PER, or 7x EV/EBITDA 2026F. Understandably Ramsden’s share price has been strong as operational performance is improving and there’s consolidation activity in the sector.

Last week’s RNS reported revenue was up +18% to £52m and PBT +54% to £6m. FY expectations were also raised again to exceed £15m. There’s a +25% increase in the interim dividend to 4.5p plus a small special dividend of 0.5p. The thinking behind that special dividend is that the Precious Metals division saw gross profits jump +53% helped by the strong gold price. Presumably, management wants to reward shareholders, without creating problems for themselves if the gold price falls back.

Outlook: Management signalled that they would increase store openings to between 6-8 new stores a year, which is an acceleration from previous years. There are currently 169 stores, including one franchised store. The high gold price is bringing in new customers and momentum in jewellery has continued into H2. May was a record month for pawnbroking loans and their FX services division (£5m gross profit, 20% of group) continues to trade in line.

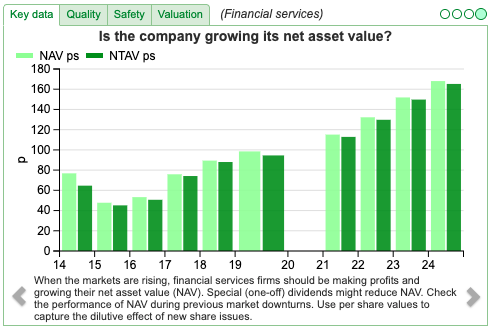

Valuation: The shares are trading on 10.6x PER Sept 2026F. NAV is up +46% since Sept 2021 and now stands at 165p, implying the shares are on 2x book value. Sharescope’s quality indicators look good, though worth noting that this is a cyclical business, revenues fell -40% during the pandemic.

Opinion: I try to avoid paying a premium for financials when things are going well, and instead am more likely to buy into the story when they’re distressed. This is not a foolproof strategy (Close Brothers!) but if you’d bought RFX in late 2020, then you would have trebled your money. Seems a well-run company, and the shares are not expensive. If I held, then would continue to “run my winner”, but I struggle to buy into a story that’s already trebled in value. That’s more an observation on my own process, rather than a criticism of Ramsden.

Notes

Bruce Packard

Bruce owns shares in Gooch & Housego, Sylvania Platinum, Goldplats and Capital Ltd

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.