This month, in our regular funds column, we reveal that thematic defence equity exchange-traded funds (ETFs) are cleaning up, what might happen next to small-cap funds, why Coinbase might be a more exciting way into cryptocurrency, and the case for investing in Latin American funds.

Defence funds

Care to guess what the hottest equity theme is right now?

It’s not AI that has lost momentum after Trump imposed export bans on Nvidia and its GPU trades with China—step forward, European defence stocks. In simple terms, European defence ETFs are booming in terms of market flows.

There are now 7 defence-specific exchange-traded funds trading on the London Stock Exchange, with total assets under management well over £4 billion. One fund, a European defence equities fund from WisdomTree – WisdomTree Europe Defence UCITS ETF, ticker WDEP – launched in early March, and has already accumulated over £1.5 billion in assets under management. Since it started, the ETF is up 16%. Using data from ETF Book and based on ARK Invest Europe Megatrend Sub Theme Classification, Defence ETFs saw in April the most net inflows of $4.184 billion, representing 72 per cent of the total net inflows ($5.776bn) to European ETFs in the first quarter of 2025.

My own sense is that this is a multi-year ‘trend’ or ‘theme’. Europe has spent too long fooling itself that there was no threat from you know who and that even if there was the US would ride to the rescue. That illusion has been shattered, the increases in defence spending are real, and a handful of big defence contractors, now including UK companies signed up via last week’s deal, will benefit. More to the point, I sense this defence splurge is part of a wider industrial strategy pivot by Europe with much more profound implications.

UK small-cap funds

UK small-cap equity fund investors have faced tough years. The old adage is that from tiny acorns mighty oaks grow, implying that there’s a big benefit from investing in small-cap stocks over the long term. Academic economists have even given this its term or anomaly (aka risk premium) – the small-cap effect. Sure, small-cap stocks are riskier and more volatile, but over the long term, you’ll reap a greater reward. Except that is, if you’d have invested in a diversified small-cap investment trust over the last five to ten years.

Deutsche Numis has long run a smaller companies’ equity index, and the total return has been 49% over the last ten years and 42% over the last five years. During those same periods, the return from UK smaller company funds was 75% and 49% respectively. By contrast, UK All Companies funds returned just under 100% over each period and Global Equity funds 50% (5 years) and 212% (10 years).

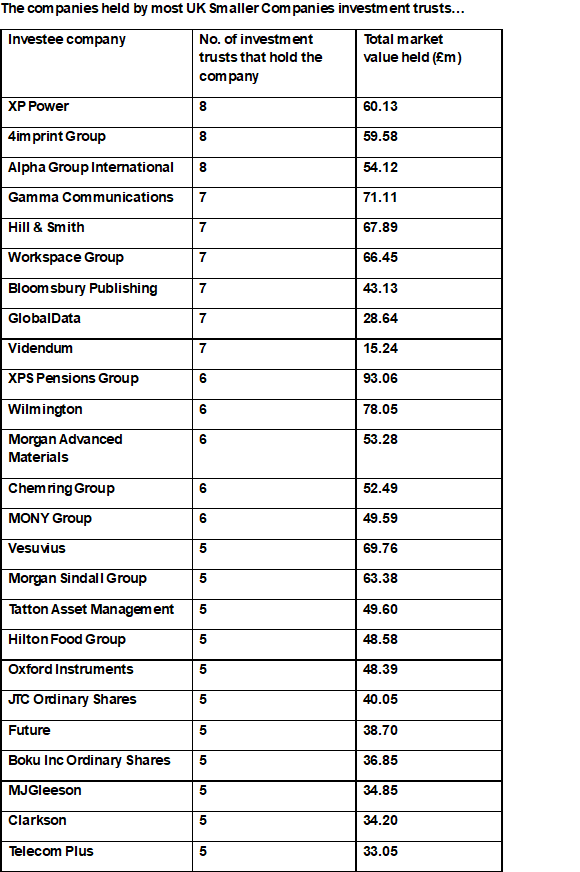

Speak to smaller company fund managers like Gervais Williams at Premier Miton, and they’ll indicate that smaller company stocks have encountered significant headwinds. Quantitative easing has benefited mega large-cap companies through hyper-globalisation and cheap credit. The tech boom also aided those mega large-cap growth stocks in establishing global enterprises, which have subsequently concentrated returns in a handful of Mag 7 names – all global, with substantial margins and ample cash. In this new normal, small-cap stocks have struggled, and small-cap fund managers have faced even greater challenges – they’ve encountered another headwind, namely the rise of passive funds (or ETFs) that have favoured large-cap stocks at the expense of smaller-cap stocks, reducing daily liquidity and making small-cap fund managers even more overlooked. The tide is now turning in a Higher for longer new world order, with globalisation under threat, and Gervais Williams contends that smaller-cap stocks might now benefit from a rotation away from both Mag 7 and US large-cap equities – he asserts that even if just a small percentage of that money diversifying away from the Mag 7 finds its way to UK small caps, the impact could be substantial in simple share price terms. If that is the case, then the table below might be worth contemplating. It’s from the Association of Investment Companies, the industry association and shows the companies held by most UK Smaller Companies investment trusts…

Source: theaic.co.uk / Morningstar (based on the latest available portfolio information as of 09/05/25). Shows all companies held by at least five trusts in the AIC UK Smaller Companies sector.

Coinbase joins the S&P 500

Coinbase Global Inc. will officially join the S&P 500 index. According to fund manager Wisdom Tree, “this is not just a reshuffle – It is the clearest sign yet that crypto has broken into the financial establishment’s inner sanctum. The premier crypto exchange is now entrenched in the very core of the United States (U.S.) financial markets.”

I’m inclined to agree. Coinbase entered the S&P 500 by clearly smashing through all the requirements designed to reflect America’s corporate elite’s strength, stability, and liquidity. These include a market cap of over $20bn, high trading volume, and positive earnings in recent quarters. Now, it’s worth saying that Coinbase, though expensive in stock price terms—trading on a forward PE of 42—is an interesting proposition, both fundamentally and in terms of its relationship (correlation) to the price of Bitcoin.

Its shares currently trade at around $266, with current-year EPS running at 5.39 and likely to increase in FY 25 to 6.16. In the last full year, cash flow was running at $2 billion, with the current cash mountain sitting at $8 billion. It’s obviously had its recent challenges (notably a big hack), but most investors now see it as a proxy for Bitcoin and a profitable one, too.

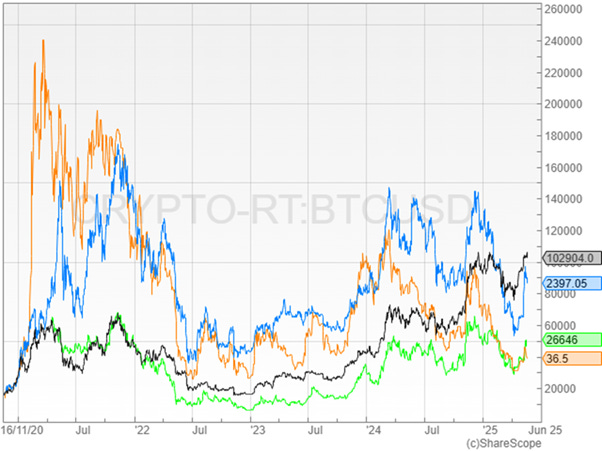

That prompted me to look at the stock technically – is owning shares in Coinbase a better way to play Bitcoin and crypto generally than a straight, direct holding of cryptocurrencies? Let’s look at the first chart below. This shows various securities since late 2020:

Green – Coinbase shares

Orange – UK-listed crypto venture capital fund KR1

Black – bitcoin

Blue – the spot price of Ethereum

For much of the period, both Ethereum and shares in KR1 have provided much higher gearing to the Bitcoin price, but KR1’s beta has steadily declined in recent months. Coinbase, overall, has lagged the Bitcoin price for this period.

Focusing on the period since 2024, the picture changes rapidly, as seen in the chart below. KR1 appears less and less useful as a play on Bitcoin while Ethereum keeps pace with Bitcoin and then starts to fall behind. Notice, however, the green line for Coinbase, which shows that Coinbase has outpaced Bitcoin in some months while generally keeping up with it—though Bitcoin has still outperformed Coinbase overall.

The bottom line? Coinbase is a simple way to play the current crypto theme via a single stock with real fundamentals and a strong trading operation. You’re probably still better off directly owning Bitcoin (or Ethereum), but Coinbase is providing valuable crypto exposure in a single stock form.

Free emerging markets

Investors are typically encouraged not to get too excited about politics and how it affects policy. By and large, advanced economies have their own momentum, and although governments can (and do) make a difference, the real trick is to see beyond the politics into what makes an economy tick (and grow).

That’s fine and dandy except when governments completely shift the economic regime and upend decades-long conventions – I’m thinking here of a certain President Trump.

It also feels a bit off when it comes to emerging markets.

One of the reasons investors – like me – are so ambivalent about China, for instance, is that we are worried about the country’s politics. In fact, I’d go further and say that political structures and relative freedom really do matter when investing in emerging markets – it’s not the only factor, but you can’t ignore it.

Some investment managers go much further and argue that you should reshape your investment portfolio around the idea of economic and political freedom. One of these is in the USA and is called Freedom ETFs – they run something in the USA called THE FREEDOM 100 EMERGING MARKETS ETF. You can find more details of this US-listed ETF (not available in the UK) here: Freedometfs.com.

This investment firm uses “independent third-party quantitative personal and economic freedom metrics as primary factors in country selection and allocations, providing investors with significantly freer country exposures than cap-weighted EM benchmarks.”

Backing up their investment strategy is a review of over 700 academic studies which shows that over 50% link economic freedom to positive outcomes such as faster growth, higher incomes, and improved social indicators* Source: Economic Freedom in the Literature: What Is It Good (Bad) For?, Robert Lawson, August 18, 2022. You can see that paper HERE.

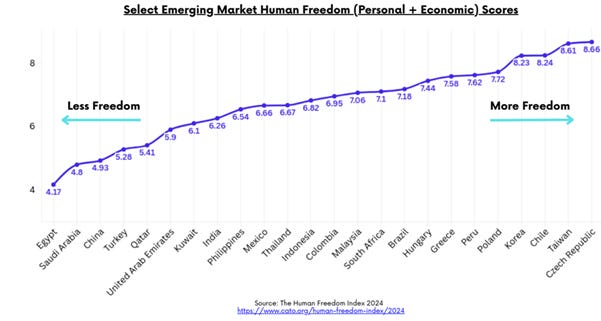

The graphic below nicely shows the spectrum of developing nations’ civic, political, and economic freedoms.

That first graphic is not too surprising, except for how low places like Turkey and India score!

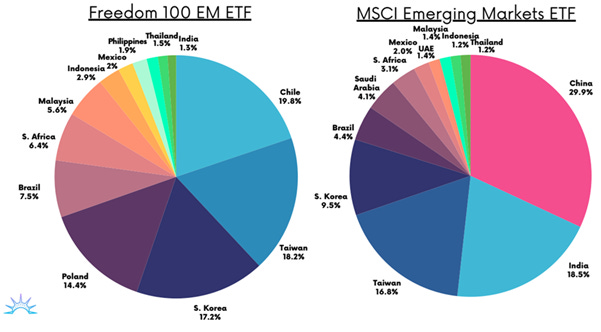

What’s much more interesting is how this analysis impacts the ETF portfolio.

The following graphic compares the Freedom ETF portfolio with a typical MSCI EM index portfolio. Notice the significant differences!!!

The Freedom ETF is overweight in South Korea and Taiwan and very substantially overweight in Poland and Chile—these two markets alone represent nearly 35% of the portfolio against just under 3% for the MSCI EM index. Other overweights include Brazil (7.5% vs. 4.4%). There’s nothing for China (which shouldn’t come as a surprise), and notice the massively smaller exposure for India (1.3% vs. 18.5%).

To be clear, I’m not convinced that economic and political freedoms should be the only basis on which I would choose nations. Nevertheless, I do think that forcing a freedom agenda into an ESG framework is a very valuable exercise, and is largely avoided by most ESG managers.

Latin America – Is it time for Latin America??

Historically, there has been a very good reason why Latin America has been so under-owned: its volatility, with leftist governments pursuing nationalist policies that have not been enormously successful. That’s despite the fact that on many freedom measures, Latin America comes out surprisingly well (notably Chile and Brazil). But over the last few months, the vibe or mood has shifted—suddenly, LatAm is back in favour. Many now argue that LatAm has been a net beneficiary from the Trump trade pivot, and its politics is set to change dramatically.

That change in sentiment has emerged in market data—Latin American stocks have risen 21% in US dollar terms YTD, making the region the top-performing global market this year. Last month, Mexico was the star performer. Next in line was Colombia, followed by Brazil, where markets have risen nearly 20% year-to-date despite sky-high domestic interest rates. Crucially, most of the region is low on President Donald Trump’s tariff target list, making it a haven from trade wars.

Looking forward, there will also be a profound political turn in the next few years. The best summary of this impending political transition comes in a recent Financial Times OpEd piece by Ruchir Sharma, two weeks ago – Sharma is the chair of Rockefeller International. He argues that there’s a big shift about to emerge in Latin America – away from left-wing populist governments towards market-friendly right-wing politicians, typified by Argentina’s Milei. The key catalyst seems to be a possible political shift favouring leaders with more traditional agendas based on free markets and open economies. As Sharma notes, this “ increases the region’s chances of escaping its damaging growth slump and attracting capital in this post-American exceptionalism world.”

LatAm equities have, in fact, delivered substantial long-term nominal returns, although that was often accompanied by significantly higher volatility than developed markets. This volatility has translated into what can only be described as more modest risk-adjusted returns and prolonged drawdown periods. The regional performance is heterogeneous (to put it mildly), with individual national markets exhibiting distinct characteristics driven by local economic policies, political climates, and global commodity cycles.

Sectoral composition remains heavily weighted towards Financials and resource-based industries like Materials and Energy, with a comparatively smaller representation of Technology and other growth sectors. Liquidity has historically been a challenge, and the number of listed companies has not consistently grown, leading to concerns about market breadth and concentration.

What about current valuations? Latin America as a region is currently valued at a forward PE of 8.8 and a yield of around 5.9%, well below the valuations on both EM generally and the MSCI World more broadly.

Brazilian equities look especially cheap at 7.8 times forward earnings on a dividend yield of 7.3%. The downside is that most of these national markets, especially Brazil, proved disappointing in 2024. After this stumble last year, many Brazilian and Mexican stocks are trading on single-digit P/E multiples while offering double-digit dividend yields.

The MSCI Emerging Markets Latin America Index – the main benchmark for regional equities – is dominated by two countries, Brazil (c 62%) and Mexico (c 26%), with minor weightings in Chile (c 7%), Peru (c 4%) and Colombia (c 2%)

A Latin American investment trust

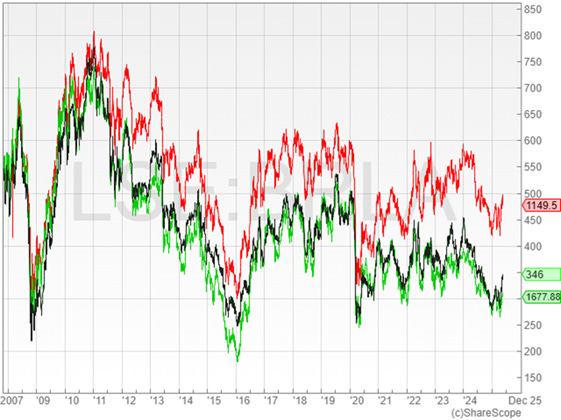

If you decide to invest in Latin American equities, there is an easily accessible fund vehicle on the London market – an investment trust called the BlackRock Latin American Investment Trust (BRLA). This small but respected fund is managed by the highly regarded EM equities desk at BlackRock, headed by Sam Veicht, who also runs the hugely successful BlackRock Frontiers fund (which has a superb track record). In performance terms, the fund’s long-term track record is summed up in the chart below from Sharescope. There are three coloured lines:

- The Black line represents the BlackRock LatAm investment trusts

- The red line represents the long-standing iShares Latin America ETF (ticker LTAM),

- The green line represents the iShares Brazil ETF (ticker IBZL).

The next chart takes a shorter time frame, starting with the pandemic in 2020 and rolling forward – the Latin America ETF has mostly outpaced the investment trust.

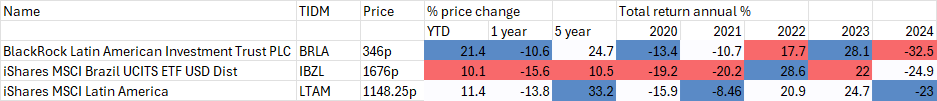

The final table below maps out these returns in more detail, focusing on recent performance. It clearly shows that the investment trust has started to outpace its ETF rivals in the last year (as well as in 2020).

Fund Details: BlackRock Latin American Investment Trust (BRLA)

- Share price: 343p

- Ongoing charge 1.23%

- Market Cap £100m

- Total assets £115m

- Discount 12.2%

- Current Yield 5.2% paid quarterly

- Top holdings: Vale 8.7%, Petrobas 7.3%, Grupo Mexico 5,4%

- Country allocation: Brazil 59.7%, Mexico 31.2%, Argentina 2.6%

- Sector mix: financials 22.3% (benchmark 32%), mining 20.9% (benchmark 17%), Consumer discretionary and staples 27% (benchmark 16%)

- Fund managers: Sam Vecht, Emily Fletcher and Gordon Fraser

In asset allocation terms, I’m inclined to buy the more positive narrative around LatAm equities. In fund terms, in my book, it’s a two-horse race: the BlackRock investment trust (BRLA) versus the iShares LatAm ETF (LTAM). iShares is also owned by BlackRock.

On balance, the lower TER for the LTAM ETF shades it for me—it charges just 0.20%, and that extra 1% in fees is a big boost to returns every year from the passive ETF, making a huge difference long-term. That said, in down markets, I suspect the BlackRock investment trust will probably outperform. There’s also the other upside—the 5% plus dividend from the investment trust.

~

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.