Filtronic’s shares have defied AIM’s doom and gloom by rocketing 10-fold within three years. Maynard Paton reviews the multi-baggers announcements and asks whether we could have foreseen the huge gain.

“London Stock Exchange boss warns AIM is under threat of collapse“

“London AIM market should be axed for failing to win tech floats, say think-tanks“

“Why AIM is in danger of becoming a self-fulfilling doom loop“

Despite all the gloomy headlines, AIM can still deliver amazing returns for investors prepared to unearth revitalised companies the crowd has dismissed.

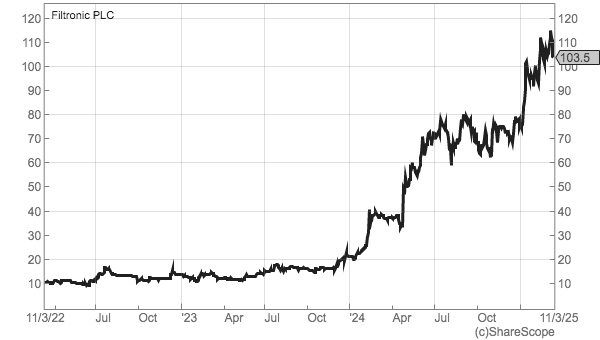

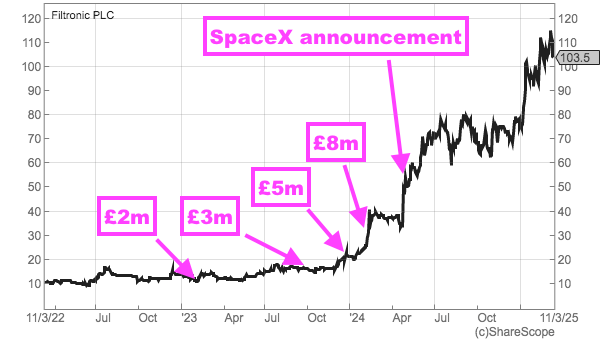

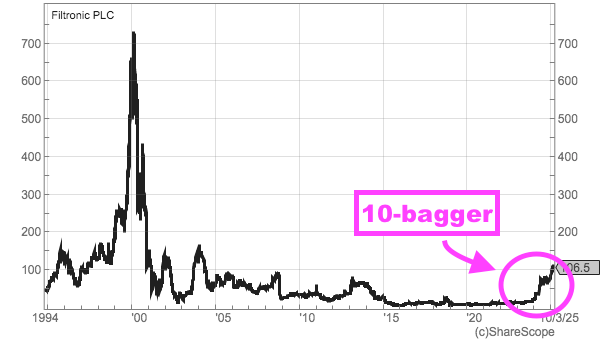

The shares of Filtronic in particular have defied the junior market’s negative press, recently topping 100p to deliver a ten-bagger for anyone lucky enough to purchase at just 10p only three years ago:

But just how did this specialist developer of communications equipment manage to deliver such wonderful gains?

And could any of us have spotted this AIM multi-bagger opportunity beforehand?

Let’s take a closer look.

Take off with SpaceX

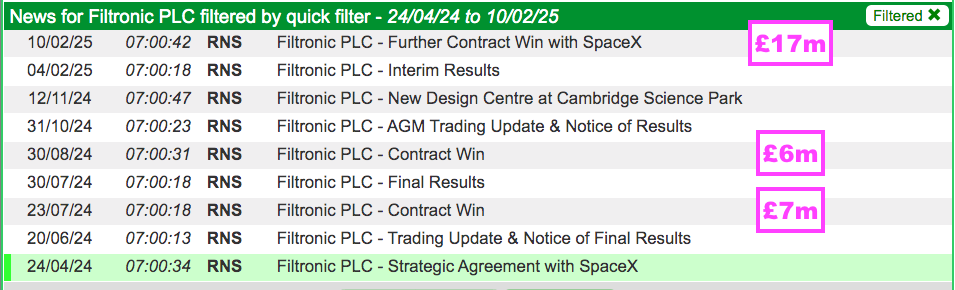

Filtronic began writing its own headlines during April 2024 following a ‘strategic partnership’ with SpaceX:

“The Strategic Partnership contract was executed with an initial irrevocable purchase order of $19.7m (£15.8m) to supply E-band SSPA modules, scheduled for delivery in FY2025, with further order flow expected to continue thereafter to support the ongoing deployment of SpaceX’s Starlink constellation, which provides high-speed, low-latency high-speed internet to users all around the world.”

Filtronic’s shares rocketed 48% to 49p on the day of the announcement.

Investors were unsurprisingly enthused by:

- The £16 million contract value, which matched the £16 million revenue reported within Filtronic’s preceding annual results;

- The gold-standard validation of Filtronic’s equipment by SpaceX, the pre-eminent next-generation satellite business controlled by Elon Musk, and;

- A warrants arrangement, which essentially encouraged SpaceX to place further orders during the next five years in exchange for up to a potential 10% Filtronic shareholding.

The icing on the SpaceX cake was an accompanying trading statement that confirmed Filtronic’s 2025 revenue and EBITDA ought to be “significantly ahead” of then-market expectations.

Just so you know, the E-band Solid State Power Amplifiers (SSPAs) ordered by SpaceX are devices that support the high-speed, large-scale, long-range transmission of data:

For various technical reasons, Filtronic’s “pioneering” SSPAs offer superior reliability, greater longevity, lower power consumption and easier manufacturing versus the established alternatives for satellite communication.

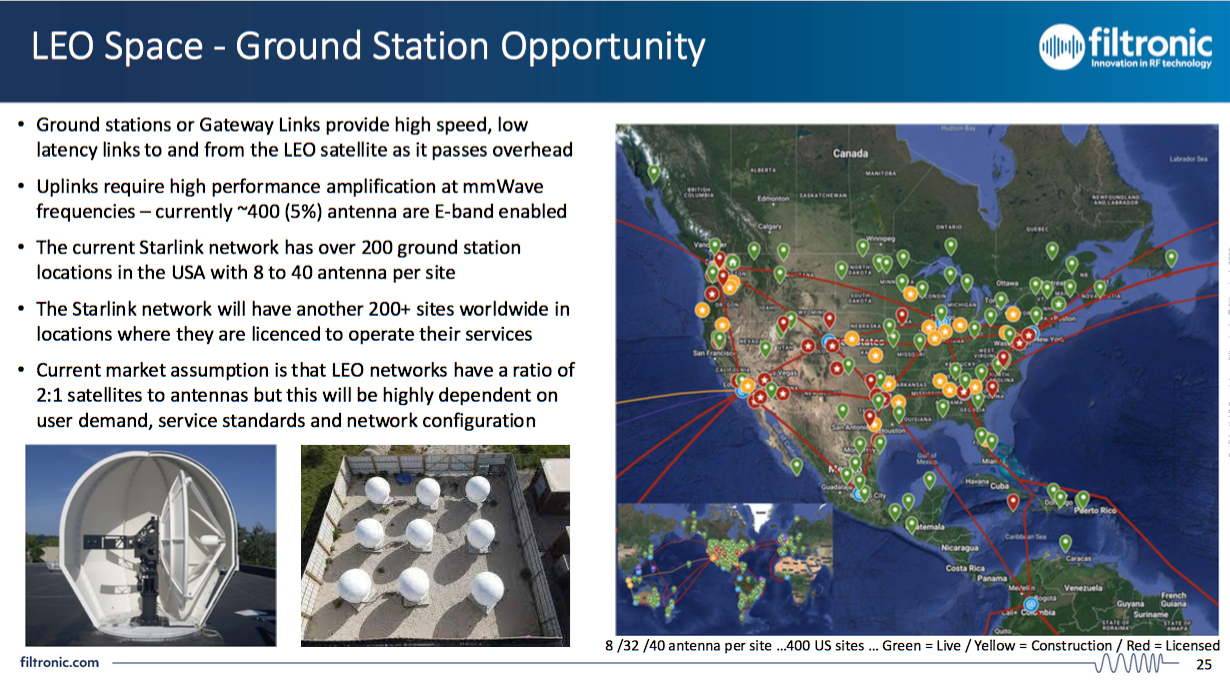

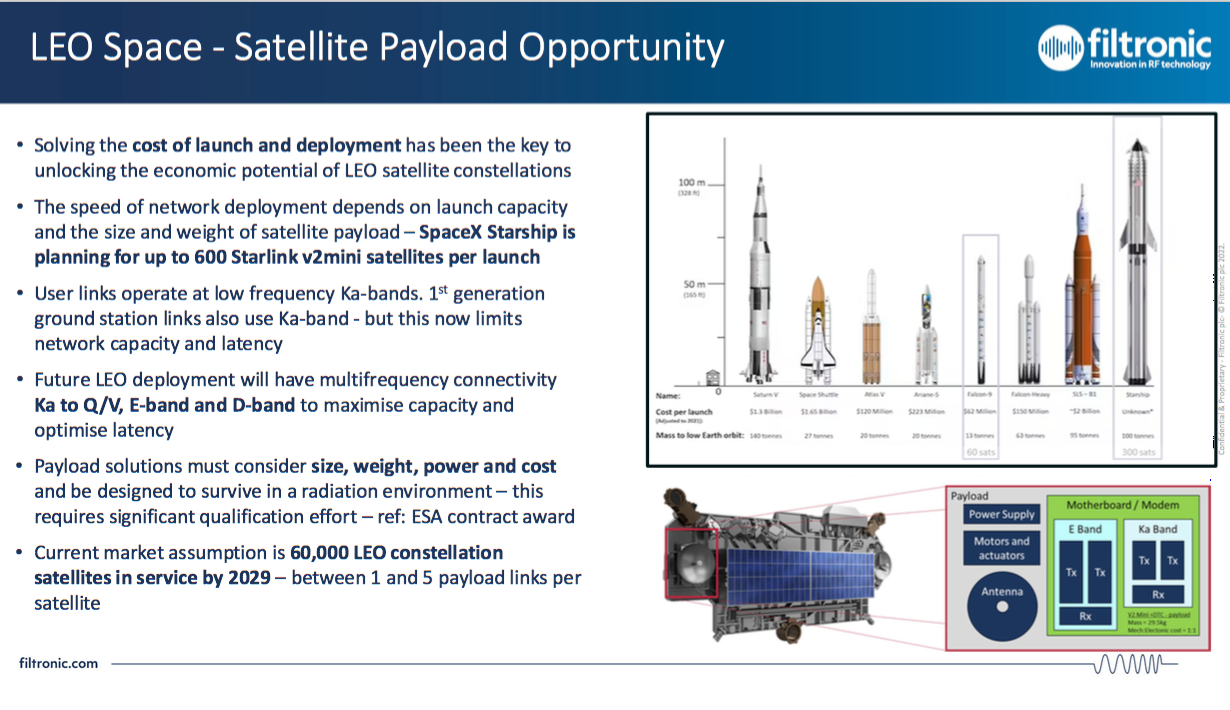

And importantly, the SSPAs can now be used within the higher-frequency ‘E-band’, which SpaceX’s low-earth orbit (LEO) satellites inherently require to support super-fast data connections. The SSPAs will be installed within SpaceX’s ground stations while Filtronic’s E-band transceivers should at some point be included within new SpaceX satellites:

The initial SpaceX announcement was then followed by further SpaceX contracts totalling £30 million:

Last month’s bumper £17 million order unsurprisingly prompted further icing on the SpaceX cake:

“Consequently, the Board is now confident the business will exceed current market expectations for revenue and profit in both FY2025 and FY2026.”

Even more SpaceX contracts plus additional work from other LEO operators are certainly anticipated. Filtronic reported the following industry assumptions last year:

- 60,000 LEO satellites in service by 2029;

- Each LEO satellite carries up to five E-band transceivers, and;

- LEO networks require one E-band ground-station antenna for every two LEO satellites in orbit.

The upshot is a ‘total addressable’ LEO opportunity of $3 billion, as thousands of E-band SSTAs and transceivers could be required by SpaceX and other LEO operators during the next few years. At present, only a few hundred ground stations seemingly possess E-band antennas while just a handful of satellites have Filtronic’s E-band transceivers installed:

Importantly for shareholders, Filtronic may now be establishing some sort of technological ‘moat’. Interim results last month notably suggested the company’s “leading-edge” E-band equipment could be “widely adopted” within the LEO sector:

“Commercial engagements, not only with SpaceX, have demonstrated to us the relevance of our technology to the wider satellite market serving a multitude of missions. This enables us to bring forwards leading-edge high-performance technology that we anticipate could be widely adopted“.

Identifying the LEO opportunity

That 48% one-day price surge does imply that Filtronic’s initial SpaceX announcement was a bolt from the blue.

But we can now look back and conclude the deal had been building for some time before the full details emerged.

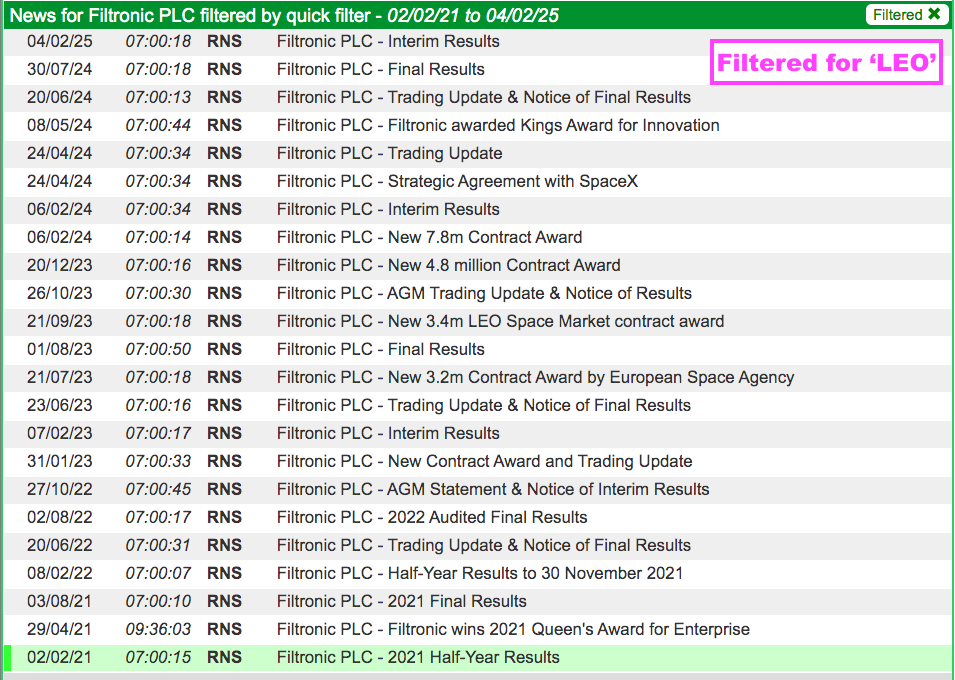

For starters, ShareScope lists several RNSs mentioning ‘LEO’ during 2021, 2022 and 2023:

The August 2021 RNS referred to “successful engagements” with US LEO “pioneers“:

“Having undertaken several successful engagements with US technology companies that are pioneers in this field, we now believe that we have a strong portfolio for both stratospheric and LEO space platforms and will look to capitalise on this IP as the applications evolve.“

The August 2022 RNS then claimed “strong potential” within the LEO sector:

“Approximately 60 to 70 percent of space-company investment is now directed at LEO endeavours. Filtronic has products and know-how derived from our high-altitude pseudo satellite (“HAPS”) projects that offer strong potential for us to play a significant role in these important communications sectors for both ground and flight platforms.“

The January 2023 RNS — revealing the first sale of the E-band SSTAs to a LEO operator — now appears pivotal:

“The contract, valued in excess of £2.0m, with revenue expected to be recognised in calendar year 2023, requires customisation and delivery of Filtronic’s Cerus solid state power amplifier (“SSPA”) module. The modules, and the related control boards, will be installed in selected ground stations for commercial trials of the E-band earth station antenna links to and from the LEO satellite. This is the first time that high bandwidth E-band frequencies have been used in an operational LEO application.“

Filtronic described the buyer as a “highly respected new customer at the leading edge of LEO space communications“…

…which shareholders could/should have identified as ‘SpaceX’. By the way, Filtronic’s shares closed that day at 11p.

By June 2023, Filtronic was “engaged with the leading players” within the LEO sector — which must have included SpaceX:

“Of our four core markets, it is the low earth orbit (“LEO“) space opportunity that has exceeded our expectations in terms of both the size of the opportunity and the speed of deployment. We are engaged with the leading players in this segment, where there is increasing demand for high bandwidth and high-frequency backhaul communications between the satellite and the ground station.”

The E-band SSPA work increased with a £3 million contract during September 2023 (share price: 17p):

“The contract, valued at $4.25m (£3.4m), with revenue expected to be recognised in FY 2024, is for the supply of Filtronic’s innovative Cerus32 solid-state power amplifier (“SSPA”) module combined with a customised control board. The SSPA modules will be installed in selected ground station locations for the second phase of the customer’s earth station antenna deployment which is designed to provide full E-band connectivity to recently launched E-band enabled LEO satellites. This programme is the first time that high bandwidth E-band frequencies have been successfully utilised, in volume, in a commercial global LEO space application.”

Then came a further £5 million SSPA contract during December 2023 (share price: 20p):

“The contract, valued initially at $6.0m (£4.8m), with revenue expected to be recognised within calendar year 2024, is for the delivery of production volumes of the second generation of Filtronic’s innovative Cerus32 solid state power amplifier (“SSPA”) module. The SSPA modules will be installed in selected ground station locations as part of the customer’s earth station antenna deployment which provides full E-band connectivity to the growing number of E-band enabled LEO satellites.”

And then an £8 million SSPA contract arrived during February 2024 (share price: 30p):

“The production order contract, valued at $9.9m (£7.8m), with revenue expected to be recognised within calendar year 2024, is for additional demand of Filtronic’s innovative Cerus32 solid-state power amplifier (“SSPA”) module. This is the third and largest production order to date for the Cerus32 SSPA and it represents increased customer confidence in Filtronic technology following initial field deployment.“

Looking back, not only was the frequency of the LEO contracts very encouraging…

…so was the increasing value of those contracts. The initial £2 million SSPA deal from January 2023 was followed by purchases of £3 million, £5 million and then £8 million within the following twelve months.

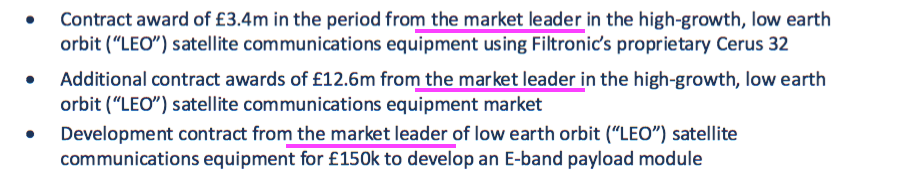

In short, contract momentum was building while the results powerpoints repeatedly referred to the LEO “market leader“…

…which must have been SpaceX.

The share price puts these contract awards into some perspective:

EBITDA-margin target

By February 2024, anyone following Filtronic had a high chance of surmising:

- SpaceX was Filtronic’s mystery “market leader” LEO customer behind all the new contracts, and;

- SpaceX was only part-way through establishing its LEO network, and so would be ordering much more of Filtronic’s E-band equipment.

Plus… anyone following Filtronic may have argued the then 30p shares presented a speculative buying opportunity.

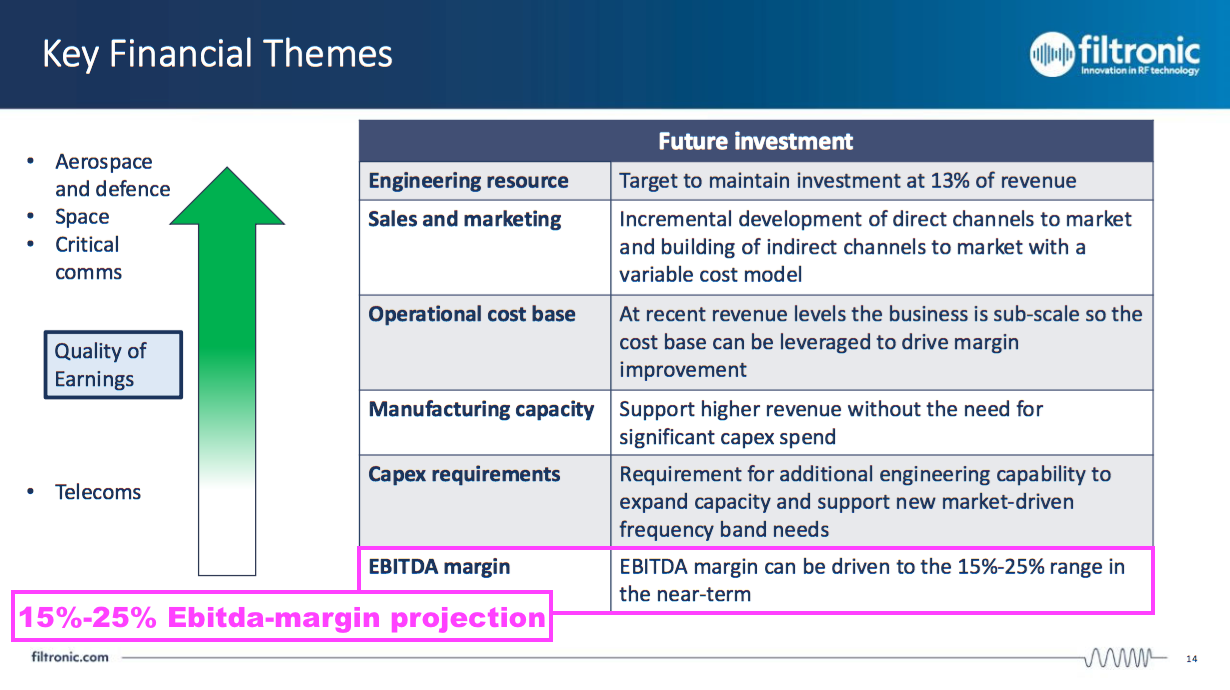

As well as that aforementioned £8 million LEO contract, February 2024 also witnessed Filtronic’s first indication of the 15%-25% EBITDA margin that could be achieved following the E-band sales:

Revenue at the time from defence, aerospace and telecoms clients was running at £16 million while the incoming LEO work could have plausibly added another £16 million to the top line.

As such, the total possible near-term revenue of £32 million multiplied by Filtronic’s mid-range 20% Ebitda-margin target gave a potential Ebitda of £6.4 million.

The 30p share price then supported a £64 million market cap, which therefore valued the business at 10x that potential £6.4 million EBITDA…

…and which, with the benefit of hindsight, did not look stratospheric given near-term revenue looked set to double.

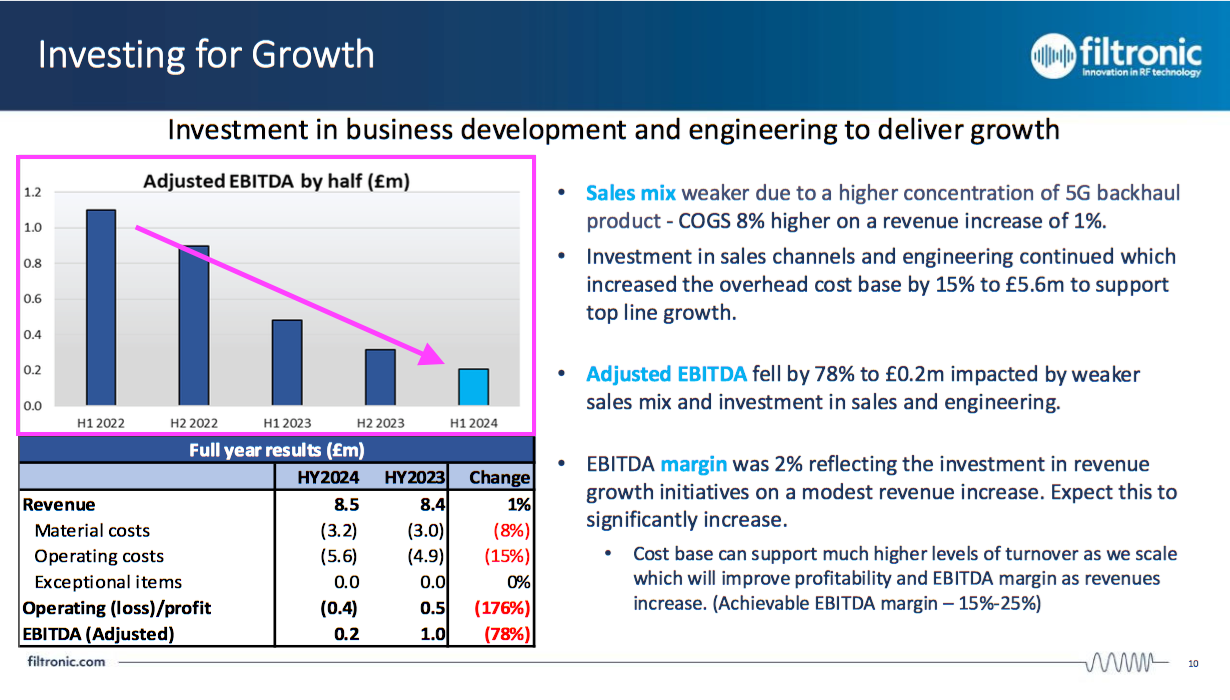

Still, a lot had to be taken on trust. The PowerPoint showing the upbeat Ebitda-margin guidance also revealed past EBITDA on an alarming downward slope:

And here is where spotting this multi-bagger opportunity with hindsight becomes somewhat less straightforward…

A decade of disappointment

Anyone studying Filtronic twelve months ago would have been hard-pushed to ignore the company’s difficult history.

Sure, the LEO contracts had started to roll in and the new margin guidance was tantalising.

However, the accounts at the time provided ample grounds to be sceptical.

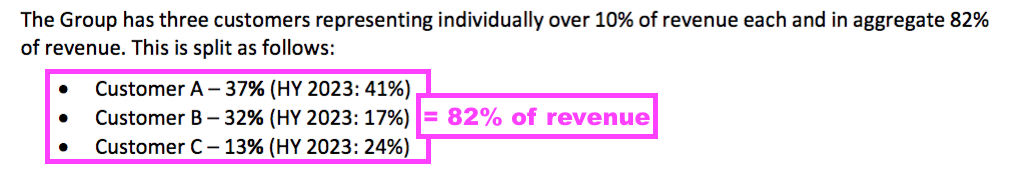

Ebitda was heading towards zero, net cash was just £2 million and a mighty 82% of revenue was supported by only three customers:

Filtronic’s financials a year ago were in fact quite similar to those published during the previous decade.

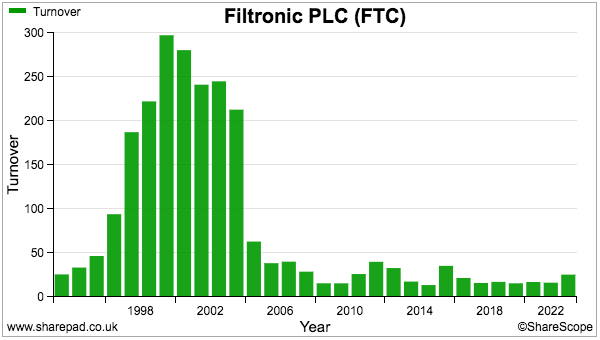

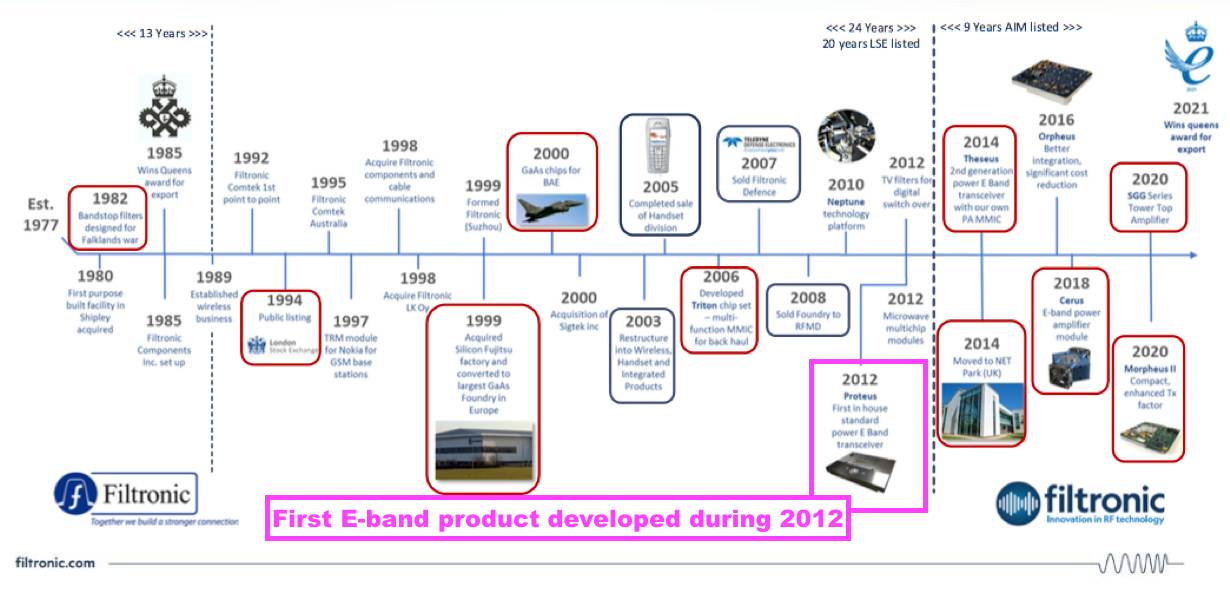

Long story short, the business floated during 1994, undertook some bold acquisitions during the late-1990s tech bubble and then suffered long-term consequences.

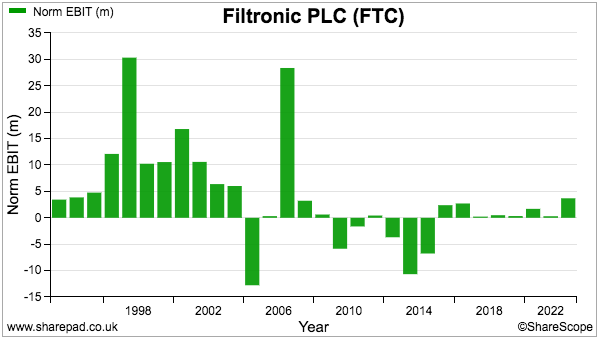

Since 2010, revenue has bobbed around the £25 million mark while profit was often very elusive:

Long-time shareholders would have required immense endurance to stay invested and eventually enjoy the recent ten-bagger performance:

Following the retirement of company founder Prof. J David Rhodes in 2006, Filtronic has employed seven different executive leaders:

- Charles Hindson (2007-08);

- Hemant Mardia (2009-12);

- Alan Needle (2013-14);

- Rob Smith (2015-18);

- Reg Gott (2019-20);

- Richard Gibbs (2021-23), and;

- Nat Edington (2024-present).

An obvious conclusion from the poor history and boardroom reshuffles is that Filtronic’s innovative communications technology struggled to establish a sizeable commercial market…

…until LEO satellites came along and faced a technical problem that just so happened to need a Filtronic solution.

Buying at 10p, 13p, 30p or 49p?

Could you have bought Filtronic three years ago at 10p really knowing what was to come?

Given Filtronic’s poor long-term history, even the most bullish of shareholders during 2022 would have struggled to imagine the bumper SpaceX contracts that would soon arrive.

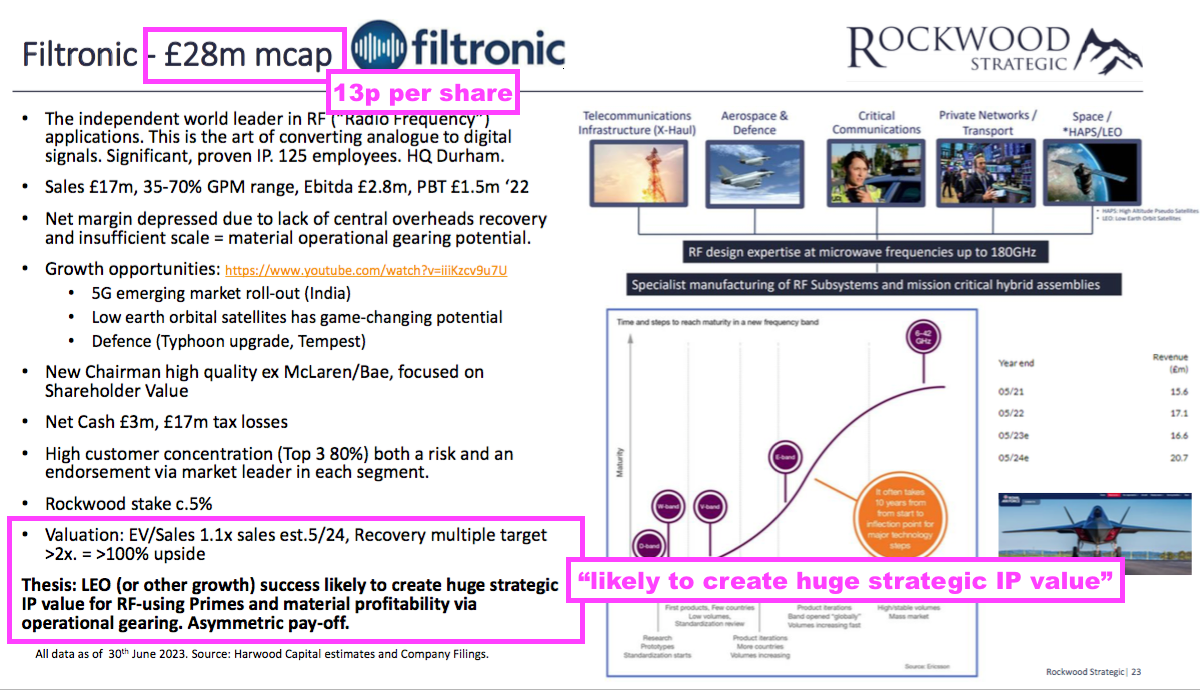

But buying around 13p during 2023 was a genuine possibility… assuming you were an investing expert. Richard Staveley of Rockwood Strategic for instance highlighted the upside potential at that time within his Q2 2023 presentation:

Mr Staveley was able to see beyond the poor history at 13p, and was projecting “LEO (or other growth) success likely to create huge strategic IP value” that could lead to “=>100% upside“. With Rockwood remaining a near-5% Filtronic shareholder today, no wonder this investment trust has trounced the indices during the last few years.

For us less accomplished investors, Filtronic in retrospect offered intriguing appeal at 30p during February 2024 — when the LEO momentum was clear and the Ebitda-margin target was first unveiled. If you could overlook Filtronic’s poor history (admittedly not easy!), a superb three-fold return to 100p was on the table within a year.

And of course, the blockbuster April 2024 SpaceX announcement provided the ultimate validation of Filtronic’s products — and buyers at 49p would have still doubled their money after further contracts rolled in.

Do you want to find ‘the next Filtronic’?

Filtronic just goes to show investing on AIM has not died just yet.

Just because the crowd is fretting about the junior market’s future, companies have not just ‘downed tools’ and given up.

Instead, new products continue to be developed, new markets continue to open up, new strategies continue to be employed…

…which will in turn create new opportunities to enjoy Filtronic-type returns over the next few years.

You will of course have to do the work yourself to unearth the really huge winners. You will have to examine companies written off as basket cases…

…in the hope a handful are quietly building up to their own breakthrough ‘SpaceX’ announcement.

Are they developing innovative new tech? Are they winning extra contracts? Are they hinting at top-tier clientele? Are they serving a huge emerging industry? Are they suddenly issuing confident margin guidance?

Find the overlooked AIM shares doing just that, and you may well own ‘the next Filtronic’… and all without the benefit of hindsight!

Until next time, I wish you safe and healthy multi-bagger investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Filtronic.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.