The trickle of annual reports in January and February has turned into a stream. It will soon be a flood. Eight companies have achieved less than three strikes. Richard takes a closer look at Dotdigital, which achieved only one strike last November.

Of the 13 companies that published annual reports in the last fortnight, a bumper crop of 8 have achieved less than three strikes.

To my mind, these companies have two virtues. Their decent track records should make them easy to analyse and demonstrate that these businesses know how to make good money over the long-term.

5 Strikes

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| Inchcape | INCH | 4/3/25 | 3.4 | ? Debt ? Growth | 1 |

| SThree | STEM | 4/3/25 | 0.4 | – Holdings – Growth | 2 |

| BAE Systems | BA. | 3/3/25 | 0.1 | – Holdings ? Growth | 2 |

| GSK | GSK | 3/3/25 | 0.1 | ? Holdings – Debt ? ROCE | 2 |

| Indivior | INDV | 3/3/25 | 0.3 | ? Holdings ? Acquisitions – CROCI – Growth – ROCE | 4 |

| Mony Group | MONY | 3/3/25 | 0.0 | – Holdings ? ROCE | 1 |

| Quartix | QTX | 3/3/25 | 22.4 | ? ROCE | 0 |

| Drax | DRX | 27/2/25 | 0.5 | ? Holdings – Debt – ROCE ? Shares | 3 |

| Me Group | MEGP | 24/2/25 | 36.6 | – Growth | 1 |

| Anglo American | AAL | 20/2/25 | 0.1 | – Holdings – Growth – ROCE | 3 |

| Mondi | MNDI | 20/2/25 | 0.1 | – Holdings – Debt – Growth – Shares – ? ROCE | 4 |

| RELX | REL | 20/2/25 | 0.1 | – Holdings – Debt | 2 |

| Rio Tinto | RIO | 20/2/25 | 0.0 | – Holdings – Growth ? ROCE | 3 |

| Click here for our 5 Strikes explainer | |||||

Putting them in a very subjective order of interest:

Quartix (? ROCE) is in the model portfolio I run for Interactive Investor. I believe the telematics business is strong, but its long-term performance has been dented as it has withdrawn from supplying insurers and by a botched acquisition, issues that now appear to be resolved.

I have been getting to know motor vehicle dealership Inchcape (? Debt ? Growth). Research in October and September revealed a reliance on short-term finance that is not obvious in the numbers but that has not put me off. I will examine the annual report this year.

Me (- Growth) has hovered on the edge of my perception for decades but I’ve never investigated it. It’s famous for operating passport photo booths, which have long seemed anachronistic. Me’s track record, though, belies this prejudice, and there is more to Me than photo booths anyway.

Mony Group (- Holdings ? Growth) is the owner of MoneySuperMarket, one of the UK’s leading price comparison sites. It’s a highly profitable business, but I have tried to work out what makes one comparison site better than another and the distinctions elude me. The fact that it has been a long time since I used one may also prejudice me.

BAE (- Holdings ? Growth) is an obvious beneficiary of Europe’s renewed focus on defence. It’s a complex business though, which is code for hard work. The same might be said for GSK (? Holdings – Debt ? ROCE), the pharmaceutical company, and RELX (- Holdings – Debt), the data, publishing and exhibitions business that was Reed Elsevier.

SThree (- Holdings – Growth) is a science, technology and engineering recruiter with a good track record. Turnover fell in 2024, though, and is projected to fall in 2025.

Even though contractions due to economic gloom can be a good opportunity to invest in recruiters cheaply, I am scared off by the potential for artificial intelligence to replace jobs in the markets SThree serves.

Dotdigital – Anatomy of a bubble

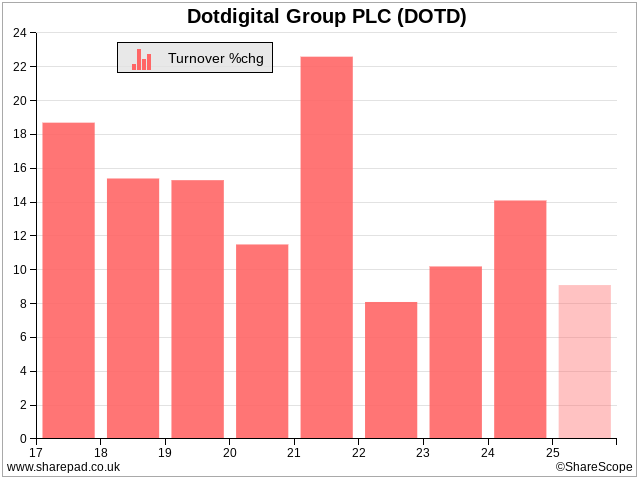

Digital marketing software platform Dotdigital sailed through 5 Strikes last November. It achieved only one strike because the executive directors don’t own impressive amounts of shares (the company’s founder and president does, though).

An acquisition in 2023 added some intrigue, and perhaps some uncertainty, but the most intriguing question of all may be the failure of the share price to respond positively to the company’s growth.

I am not a believer in using trends in share price charts to predict the future. Dotdigital’s share price tells a story, though, if we make connections between the shifting perceptions of traders and the company’s performance and valuation.

Go-go

The long term chart shows Dotdigital was a go-go share until the Summer of 2021. It was a no-no share from then until the summer of 2022. Since then it has become a go-no-go share!

Zooming into that miserable year between the summer of 2021 and the summer of 2022, people were beginning to look past the pandemic and towards the problems that followed in its wake.

The price in the grey arrow on the right axis is the price earlier this month when I made the chart, so all the damage to the share price happened in this period. Peak to trough, the share price fell 80%.

We can ask ShareScope to add Regulatory News Services (RNS) events to the chart to help us find clues about why traders changed their minds about the share:

In July 2021, before the share price peaked, Dotdigital announced it was still performing very well. Companies had spent more on digital marketing in the year since the pandemic had started.

Dotdigital had continued to invest in product innovation, geographic expansion, data and connections from strategic partners. Connections integrate Dotdigital’s marketing platform with the other software companies use.

No-go

By November 2021, when the company published results for the year to June, the price had started to weaken. The results precipitated the first of three sharp falls in share price.

The company delivered 23% revenue growth. As it had anticipated, this was larger than usual because unlike other forms of marketing, digital marketing was still potent during lockdowns.

Adjusted operating profit growth of 3% may not have “comfortably exceeded expectations” as the company had anticipated in July. Dotdigital reported that trading was “normalising” after pandemic exuberance, and gross profit margins had contracted due to the growth of premium message channels.

Dotdigital started life as an email marketing product, but digital marketing channels have proliferated to include SMS (text) messaging, social media, Internet chat bots and apps. The principal reason for the fall in margins was an increase in SMS messaging, which is routed at a cost to Dotdigital, via third parties.

Like all good companies, Dotdigital was adapting. It had acquired “omnichannel” software Comapi in 2017 (and I had my first interaction with a “bot”). In the short-term at least, some other channels were reducing profitability.

Next, we pick up the story in January 2022, when Dotdigital issued a trading update after continuing weakness in the share price. It precipitated the second sharp fall in share price.

The company achieved 10% growth in revenue, more product development, more international growth, and more data connections.

Commendably, it published full year consensus forecasts for the year to June 2022, which it expected to meet:

- Turnover approximately £65.6 million.

- Adjusted EBITDA approximately £20.9 million.

- Adjusted profit before tax approximately £14.5 million.

The biggest one day drop in the share price followed in March, when the half-year results for the year to November were announced.

The results were not at all bad. Dotdigital achieved 10% turnover growth and stronger profit growth in the first half. It reduced expectations for turnover in the current year (2022) and future years as pandemic buying “unwound” and post-pandemic challenges like competition for software developers and strong wage inflation would bite.

It predicted turnover growth of 7-8% and a greater impact on profit.

Go-No-Go

By the time Dotdigital published a trading update in July 2022, the share price had started trending sideways. In terms of turnover, the company said it had delivered what it had promised for the year to June, 8% revenue growth. We would have to wait until the full year results in November to find out that it had also delivered on profit, increasing profit 6% year-on-year.

The share price had crashed, but the company had grown nevertheless

Go or still Go-No-Go?

We last heard from Dotdigital in February 2025, when it provided a trading update for the half year to November 2024. It had a very similar tenor to the updates from three years before.

Revenue increased 10% from the prior half year. The company reported continued product innovations, many related to social media and web channels. It also reported international growth and data connections.

Dotdigital expected to meet the consensus estimates for the full year to June 2025:

- Revenue: £86.2m

- Adjusted profit before tax: £18.1m

- Adjusted EBITDA: £26.7m

Compared to 2022, three years earlier, after the pandemic exuberance had ended:

- Revenue will have grown 37%

- Adjusted profit before tax will have grown 25%

- Adjusted EBITDA will have grown 23%

Some heroic conclusions:

- The rise in Dotdigital shares during the pandemic was mostly due to unrealistic expectations

- The subsequent reassessment, as normal conditions asserted themselves, may be an overreaction based on Dotdigital’s subsequent performance

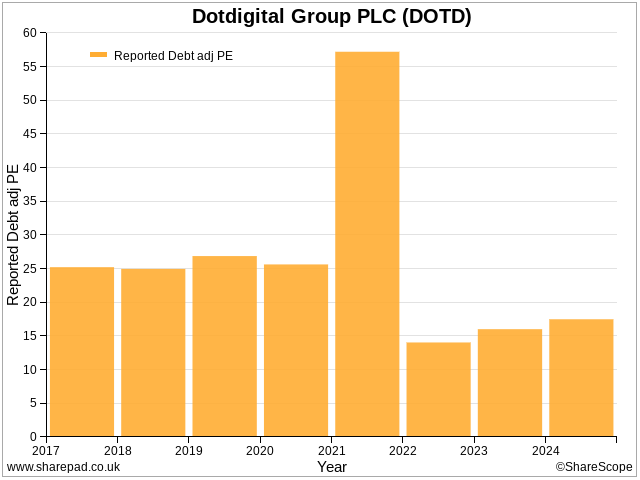

- If that is true, we would expect price-to-earnings ratios to be lower now than before the pandemic.

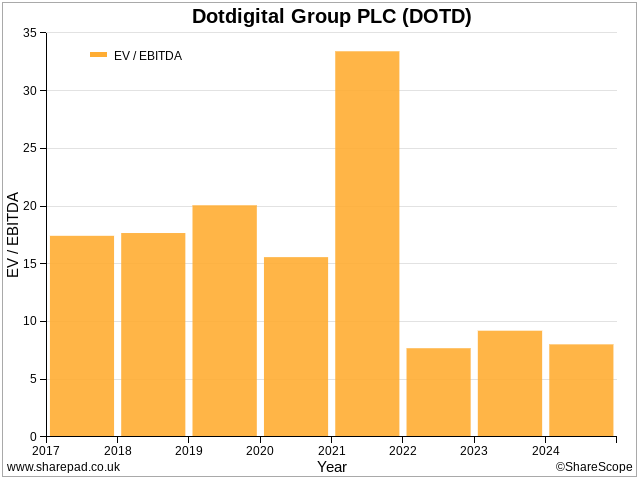

To illustrate this point, I have chosen to compare EV to EBITDA.

EV is enterprise value, market capitalisation less cash (essentially the price of the business). EBITDA is profit before interest, tax, depreciation and amortisation. I have chosen this measure of profit because amortisation from the acquisition of Fresh Relevance in 2023 would distort other versions.

If you had bought the shares in 2021, you might have paid a crazy multiple of profit (nearly 35 times EBITDA). Since then, the multiple has been less than 10 times EBITDA. Before 2021 it was between 15 and 20 times.

If you prefer to see this in terms of the more familiar Price Earnings ratio, the overall picture is the same. Just beware the earnings in 2024 are diminished by the amortisation of acquired intangible assets, which inflates the PE in 2023 and 2024.

No doubt there is more to the story, but I am warming to Dotdigital.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.