This month’s fund article maps out why, ironically, European equities have been the big winners after President Trump’s general election victory back in November. We also look at higher-yielding corporate fallen angel bonds that might appeal to income investors, plus the China ETFs that track the local technology sector (which is booming), and finally, why investing in an equal-weight US equities benchmark might be the smart move. Oh, and at long last we have a new IPO on the London funds market!

The Trump effect in reverse

I thought I might start off with an interesting graphic, or more accurately, a heat map and table. Since President Trump was re-elected on November 6th (the day of the official result), which major asset classes defined by benchmarks have done the best? The heat map below gives us the full breakdown.

The Vix measure of volatility is up a whopping 30%, while Bitcoin is up 21%. More importantly, notice the equity benchmarks below these two obvious winners, all of which are European equity markets (Trump was always going to increase US equity volatility and is an ardent fan of Bitcoin). The big winners from the Trump presidency so far are German, Spanish and Italian equities.

As for US equities, since Donald Trump was re-elected, the S&P 500 has gone nowhere; the equal-weight version of the S&P 500 is down 1.68%, and the mid-cap US equity index, the 400, is down a whopping 5.83%, so much for the post-election bounce.

As for UK equities post the Trump result, the FTSE 250 is down again – at a loss of 0.7% – while the FTSE 100 has powered ahead by 8.27%.

The bottom line? US markets have been spooked by Trump, European equities (which were cheap) have powered ahead, and even UK equities have had a positive few months. Note that Japanese equities have had a terrible time—down between 5% and 7% in both tables above.

Fallen Angel Bonds

Looking at most macro charts, especially those focusing on perceived market risk, a noticeable trend emerges: the downside risks are growing. This is especially true in the US, where measures that indicate increased inflation and slower growth are multiplying. This doesn’t mean the US is about to plunge into a recession, merely that the chances of a slowdown are growing.

This doesn’t also mean that we’re two steps away from a massive market sell off – though we may be. It just means that investors are slowly repositioning away from maximum equity market bullishness to a more cautious stance. That’s been accompanied by a noticeable shift of investors’ cash into corporate bonds, where yields are currently decent and confidence in low default rates relatively high (remember that most investors still think we are some way off a recession).

One particular bit of the corporate bond space worth examining in greater detail is what are called fallen angel bonds. Fallen angels are corporate bonds that were investment grade, but their credit rating has been reduced to junk bond status. Investors will typically mark down the bond’s price to reflect the deterioration in credit quality, i.e. go bust. Fallen angel bond investors, though, usually hope that the credit downgrade offers an opportunity to receive a higher-than-expected yield from a firm that used to be a pretty good risk.

According to analysts at Goldman Sachs, the volume of US debt that’s been stripped of its investment grade rating, or fallen angels, has dropped to its lowest level in about 25 years. The good news is that many of those bonds that have fallen into this category are still highly regarded companies likely to benefit from lower interest rates in the US—which will help them rebuild their balance sheets. In my view, these fallen angels are also probably a lower risk than many conventional high yield bonds or junk bonds. These are strong companies, with great brands that have had their challenges. Investors not only get a higher yield – compared to investment grade bonds – but also the possibility that at some stage, the businesses behind fallen angel bonds might be re-rated back up to investment grade, triggering capital gains.

According to Moody’s ratings agency, approximately 27.5% of fallen angels ultimately return to investment grade status. This is higher than the rate for bonds originally issued as high yield. Crucially, the probability of a fallen angel regaining investment grade status increases over time: In the first two years after downgrade, fallen angels face higher default risk than other speculative-grade issuers, says Moody’s. After the second year, fallen angels become relatively less risky and more likely to be upgraded.

Fallen angels have historically outperformed the broad high yield market in 14 out of the last 20 years, partly due to their higher rate of upgrades to investment grade, says fund manager VanEck. Some estimates suggest that the amount of rising stars (bonds returning to investment grade) in 2025 could range from $20-40 billion, indicating ongoing opportunities for fallen angels to recover (again according to fund manager VanEck).

One way of investing in these fallen angels is through Fallen Angel ETFs. iShares has a big one called the iShares Fallen Angels High Yield Corporate Bond UCITS ETF which is a ‘passive’ way of tracking the market. The benchmark index is the Bloomberg Global Corporate ex-EM Fallen Angels 3% Issuer Capped Index. The weighted average yield-to-maturity of the ETF is 5.85% with a weighted average maturity of 5.6 years. There are 183 bonds in the ETF, with the top names in the table below. The top geographic weights in the fund are the US at 57.4%, Italy at 8.5%, Germany at 8.1%, France at 7.9%, the UK at 6.9% and Canada at 3.4%.

According to Gerry Celaya, market strategist at UK research firm Tricio Advisors, “these fallen angel bond funds may be worth considering if the investor is worried about a potential slowdown in global (US) growth leading to a deep recession. We do not favour this to happen, but with key economic policies in flux it is a risk worth keeping in mind.”

Another fund that Gerry Celaya at Tricio thinks is worth considering is the VanEck Global Fallen Angel High Yield Bond UCITS ETF. The ETF tracks the ICE Global Fallen Angel High Yield 10% Constrained Index. The yield-to-maturity was near 6.8% in January. The sector weights favour Energy at 19.9% and then financials at 15.9%. The country exposure is US 29.23%, Mexico 9.74%, France 6.54%, Brazil 5.42%, UK 4.87%, Israel 4.49% and Canada 4.47%. According to Celaya at Tricio, the EM element of this ETF “may appeal to investors comfortable with the additional risk”.

iShares Fallen Angels High Yield Corporate Bond UCITS ETF

| –

Share Unicredit Vodafone VF Corporation Nordstrom Newell Brands Walgreens Boot Alliance ELO ZF Europe Finance Buckeye Partners Seagate HDD |

Weight

3.01% 2.99% 2.99% 2.97% 2.92% 2.87% 2.73% 2.45% 2.31% 2.29% |

China Tech

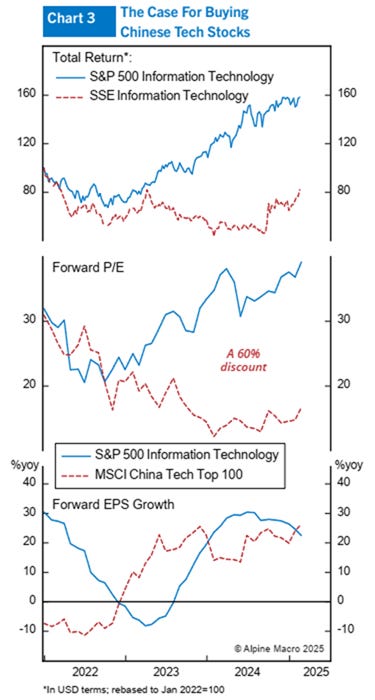

Chinese tech stocks have been on a roll in the last few months. One way to see this is to look at the SSE Information Technology Index, ticker SSEINT, which you can view HERE. This benchmark bottomed out at around 2400 in September last year, then started moving markedly higher in the new year—starting January at 3513, before hitting its current 4359. As I write this, it’s up 24% year to date.

Chinese technology shares have been on a tear in recent weeks as local AI startup DeepSeek’s breakthrough prompted investors to re-evaluate the nation’s leading internet companies. The Hang Seng Tech Index entered a bull market due to enthusiasm for DeepSeek’s AI model earlier this month. President Xi Jinping’s meeting with Alibaba founder Jack Ma and other tech executives recently spurred interpretations that Beijing is more conciliatory in fostering the sector’s development. Chen Zhao, Chief Global Strategist at US-based macro research firm Alpine Macro, reckons there’s more good news to come.

“Chinese tech stocks have massively underperformed their U.S. counterparts for an extended period, making their valuations notably compelling at this juncture. This is particularly so when earnings growth for Chinese tech companies has actually begun to exceed that for the U.S. tech index. Bottom line: We believe the surge in Chinese shares will likely continue, fueled by improvements in China’s economy, government policies, geopolitics, tech growth and valuation. However, Chinese equities are highly volatile. Investors looking to ride the rally should be prepared for sharp drawdowns and dramatic price swings. That said, the potential returns could be substantial within a 6-12 month horizon.”

I’m generally very cautious about anything involving China and equities, but even I’d be wary betting against the Chinese technology sector post-DeepSeek. Take Chinese biotechnology companies, for instance, which now have 6,280 drugs in development – a 1,200 per cent increase over one decade ago and about two-thirds as many drugs in development as in the US – and consistently beat Western companies to clinical trials.

If you can swallow the apparent challenges of investing in Chinese equities – and they are legion – one way of focusing your exposure is to buy into the Chinese technology sector through an ETF. This focused sector approach is possible through a handful of exchange-traded funds or ETFs quoted on the London market, allowing you to track specific benchmarks.

One example is the Invesco ChiNext 50 UCITS ETF, which tracks the most liquid Chinese stocks listed on the ChiNext market, the Shenzhen Stock Exchange innovation segment. You can find out more about this ETF HERE. This new and small fund (by AuM, currently under $3m) has a TER of 0.49% and over the last six months, has increased by 38% in value. The table below shows the varied range of tech stocks in this index – notice that this EF has few of the big tech names we’ve all become familiar with amongst its top holdings.

| Invesco ChiNext 50 UCITS ETF Acc | |||

| Full name | Weight | ||

| CONTEMPORARY AMPEREX TECHN-A CNY 1.0000 | 8.3076% | ||

| EAST MONEY INFORMATION CO-A CNY 1.0000 | 7.1329% | ||

| SHENZHEN INOVANCE TECHNOLO-A CNY 1.0000 | 5.6406% | ||

| SHENZHEN MINDRAY BIO-MEDIC-A CNY 1.0000 | 5.5877% | ||

| SUNGROW POWER SUPPLY CO LT-A CNY 1.0000 | 4.3209% | ||

| ZHONGJI INNOLIGHT CO LTD-A CNY 1.0000 | 3.7489% | ||

| LENS TECHNOLOGY CO LTD-A CNY 1.0000 | 2.9868% | ||

| CHAOZHOU THREE-CIRCLE GROU-A CNY 1.0000 | 2.9528% | ||

| AIER EYE HOSPITAL GROUP CO-A CNY 1.0000 | 2.7976% | ||

| HITHINK ROYALFLUSH INFORMA-A CNY 1.0000 | 2.7449% | ||

| EVE ENERGY CO LTD-A CNY 1.0000 | 2.6897% | ||

Another alternative is the KraneShares CSI China Internet UCITS ETF USD, ticker KWEB, which is much more established and significant in AuM, totalling $282m. Its TER is also much higher than the Invesco fund at 0.75%. The key stocks in this index look much more familiar – this ETF tracks most of the big, established names in the world of Chinese tech, including Alibaba and Tencent.

Top Holdings in KraneShares fund

| Tencent Holdings Ltd. | 10.53% |

| Meituan | 8.34% |

| Alibaba Group Holding Ltd. | 8.15% |

| JD.com, Inc. | 6.24% |

| PDD Holdings | 5.70% |

| Tencent Music | 4.59% |

| Kuaishou Technology | 4.44% |

| Trip.com Group Ltd. | 4.03% |

| NetEase, Inc. | 4.00% |

| Full Truck Alliance | 3.88% |

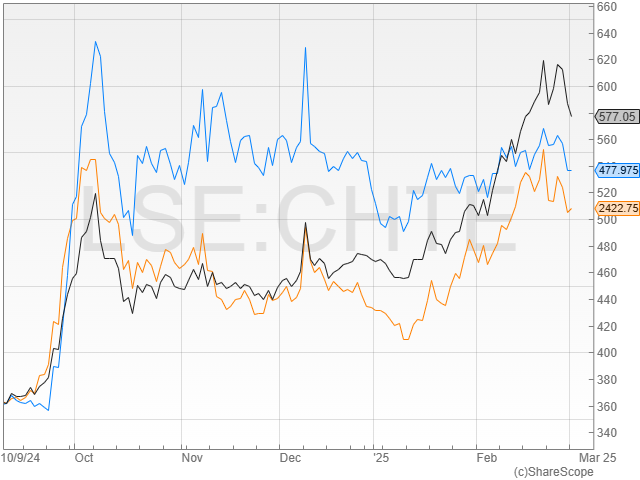

Last but by no means least, UBS also has its own China tech ETF, called UBS ETF (LU) Solactive China Technology UCITS ETF, with a TER of 0.47% and $38m assets under management. The ticker for this fund is CHTE. In the table below, I’ve listed the top ten holdings of this fund –as with the KraneShares ETF, this is mega large cap based with lots of familiar names in the list.

UBS China Technology top ten holdings

| Xiaomi Corp. | 15.24% |

| Tencent Holdings Ltd. | 9.88% |

| Alibaba Group Holding Ltd. | 8.25% |

| BYD Co., Ltd. | 7.74% |

| NetEase, Inc. | 6.83% |

| Baidu, Inc. | 5.09% |

| Li Auto | 3.06% |

| Kuaishou Technology | 2.35% |

| Contemporary Amperex Technology Co., Ltd. | 1.99% |

| Tencent Music | 1.81% |

In the chart below, I’ve mapped out recent returns for these three Chinese tech ETFs: the black line representing the UBS fund has outperformed since late 2024.

- Black Line – UBS Lux Fund Solutions – Solactive China Technology UCITS ETF

- Blue Line – Invesco ChiNext 50 UCITS ETF

- Brown Line – Kraneshares ICAV CSI China Internet UCITS ETF USD

A cracking idea for a new US equities ETF

If you want to invest in US equities, especially larger cap equities, through an ETF, your probable index of choice is the S&P 500. It’s the benchmark index any sensible investor uses – not the NASDAQ (too tech-heavy) or the utterly useless Dow Jones Industrial Average (poorly constructed and pointless in my book).

But there’s an increasingly evident problem with this index: concentration risk. It is constructed by weighting the market capitalisation of constituents (stocks). If I look at the S&P 500 as I write this (Tuesday, February 25th), the top ten stocks comprise around 37% of the index, with an obvious Tech sector bias (running at 31% of the index, although if we include internet stocks in the Communications sector, it’s approaching 40%).

One way of building in more diversification to your exposure is to track not the S&P 500 market cap index but its smaller, less well-known sibling, the S&P 500 equal weight index. This does what it says on the tin: it puts all 500 stocks in the S&P 500 on an equal weighting. This instantly diversifies you by underweighting the large tech names and overweighting smaller-cap stocks. It also dramatically changes the sector mix – tech and communication sectors comprise 17.5% rather than 40%, and the most significant sector is industrials at 15.5%.

It’s also worth pointing out that returns haven’t suffered in the past by switching the weighting system. According to S&P Dow Jones, the index firm behind both, over the last ten years the annualised net total return of the equal weight S&P 500 has been 16.9% versus 15.3% for the ‘normal’ S&P 500. For the last three years, the annualised net return has been 18.39% vs 17.05%. That said, there are years when the ‘normal’ S&P 500 outperforms the equal-weight version – both 2024 and 2023 saw massive outperformance by the ‘normal’ S&P 500. The table below shows you year-by-year total net returns for the Equal Weight S&P 500 and the ‘benchmark index’ peer, the S&P 500.

So, equal weight has its advantages, but it’s also true to say that it has its ‘challenges’. Put simply, it costs more to run this index as an ETF because you have:

a) Trade in more stocks and

b) Trade more in stocks with smaller market caps and probably smaller liquidity with higher bid-offer spreads.

The two statements above only hold true if you are physically buying every one of the 500 stocks. If you use a synthetic fund, this problem vanishes. What do we mean by synthetic tracker or index fund? In simple terms, this involves a big bank issuing an ETF issuer with an IOU that promises to pay the return of the index precisely (trading costs excluded). Many investors generally frown upon these synthetic ETFs because they introduce counterparty risk, i.e., you get what is, in effect, an IOU from a big bank that could go bust. However, the IOU issuer also usually offers up some collateral as insurance.

A synthetic ETF for the 500 stocks in the very liquid US market is potentially much less risky than an ETF for say, emerging markets. It’s not without risk, but I regard it as low or minimal. There’s another very significant advantage: tax. US equities that pay dividends are subject to a US withholding tax, which can be mitigated but not eliminated. A synthetic ETF does away with this tax issue by clever bank structuring. Since synthetic ETFs don’t actually own the stocks in the index they track, they don’t receive dividends directly from US companies, thus avoiding the tax bill. This structuring makes a huge difference.

If you invest in US equities via an S&P 500 tracker, you get some dividends: the current dividend on the S&P 500 benchmark index is 1.27%. The US has a rather draconian withholding tax.

The main rate of US withholding tax is 30%, which could apply to income you receive from US investments, even in a tax wrapper (like an ISA), where assets are exempt from UK taxes. The US-UK tax treaty lets you complete an official form to lower the rate of the US withholding tax. It’s known as a W-8BEN form, and once completed, it’s usually valid for up to three years. This form lets you benefit from the US-UK treaty rates, which lowers the withholding tax for qualifying US dividends and interest from 30% to 15%. But regardless of this treaty and form, you still pay a 15% tax. So on a dividend yield of 1.27% for the S&P 500, you will lose 0.1905% this year based on the current dividend yield. With a synthetic ETF, this loss vanishes.

It’s also worth noting that the Equal-weight version of the S&P 500 pays a higher dividend yield than the ‘normal’ S&P 500 benchmark – currently at 1.85%. So, a synthetic Equal-weight tracker will save you 0.277% in taxes.

So, I think it’s fair to say that an EW synthetic US ETF could be helpful, especially if it’s cheap.

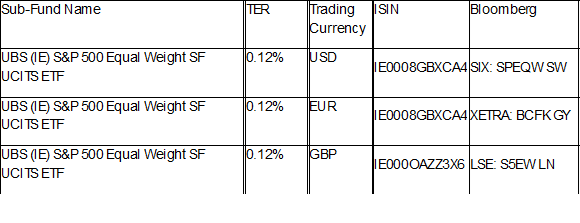

Cue a new ETF from UBS Asset Management, which provides exposure to the S&P 500 Equal Weight Index. The big selling point of this ETF is that its TER is just 0.12% and it’s a synthetic ETF. That’s not as cheap as the cheapest S&P 500 ‘conventional’ tracker, which is from State Street and charges just 0.03%. However, the UBS ETF is the cheapest equal-weight S&P 500 tracker. By comparison, Xtrackers has an ETF that physically invests in US equities in the equal-weight index and charges 0.17%. But that synthetic structure from UBS saves you 0.277% in taxes, which means that you’d potentially save not only the 5 basis points on the Xtrackers product (0.17% vs 0.12%) but you’d also make an extra 0.27% via the tax structure.

The table below provides more details on the ETFs.

Source: UBS AM as of 20 February, 2025

Hold the front page: a new fund IPO gets away with Achilles at long last!

It’s been a very long time (over two years), but we finally have a new investment trust IPO: a new fund called Achilles Investment Company, ticker AIC, has just raised £54m and will shortly launch on the specialist fund segment. The fund says it will be focused on ‘ constructive activism’ to unlock value via board engagement, asset sales, strategic shifts, or corporate restructuring, and the portfolio will be concentrated, probably in 1 to 2 positions. According to Panmure Liberum analysts

“AIC will target discount opportunities in sectors like property, infrastructure, renewables, and possibly private equity”. The key people in the fund are investment trust veterans Christopher Mills (from Harwood) and Robert Naylor (formerly the two music royalty funds Hipgnosis and Roundhill).”

I agree with the Panmure Liberum analysts who think this is a ‘smart strategy’. It’s also exceedingly well timed – most attention has been focused on Saba amongst generalist equity funds, whereas the more significant opportunity seems to be in alternative funds. But it’s not an easy task: these alternative funds have complicated structures, and I wonder what can be achieved with £54m.

According to Panmure Liberum

“It is likely that it will have the support/backing of some of the largest owners of Alternative funds and will therefore be able to represent the views of a large portion of registers in the funds it targets. We think the more good outcomes that can be delivered, the more chances there are for good strategies caught in the crossfires to come back into favour and the more likely it is for the sector to successfully introduce a wider pool of buyers. Between them, Christopher Mills and Robert Naylor were involved in some of the better outcomes on exit, in 2023 and 2024 in SONG and RHM.”

Word on the street is that the fund is probably looking first at the property sector, though I think the renewables space might also offer opportunities. I advise watching its website and especially its holdings list—even a small holding on the share register might prompt other, more active shareholders to join. Watch this space!

~

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.