Guest author Andrew Latto explains that UK gilts serve as a benchmark for investment returns, offering safety, no capital gains tax, and government backing. While their fixed returns provide certainty, they remain vulnerable to inflation and interest rate fluctuations.

Gilts don’t need a UK government guarantee – gilts are the government. They are also among a handful of UK investments with no capital gains tax (CGT).

Gilt yields act as a benchmark for investors. Investment assets need to deliver a higher return than gilts to be worthwhile.

The UK’s Debt Management Office (UK DMO) states: “The British Government has never failed to make interest payments or principal payments on gilts as they fall due.”

The website Bond Vigilantes highlights two technical defaults: during the First World War (1917) and the Great Depression (1932). Only six nations have never defaulted: New Zealand, Australia, Thailand, Denmark, Canada and the USA.

Nevertheless, UK government debt is considered risk-free in terms of repayment.

Key gilt terms

- Gilt – A UK government liability in sterling, issued by HM Treasury.

- Gilt coupon – The fixed cash payment on a gilt.

- Income yield – The coupon as a percentage of the current gilt price.

- Maturity – The date at which the gilt is paid back to investors.

- Par value – The amount the issuer pays back at maturity.

- Gross redemption yield – The annual return on a gilt when it is held to maturity.

- Gilt spot rate – Annual return on a gilt over a fixed period e.g., five years.

- Modified duration – The % change in gilt price for a 1% change in interest rates.

Why gilt yields are worth watching

Gilts offer a certain return. Low gilt yields (low interest rates) can result in speculative behaviour as people hunt for a return – just as we saw in 2020 and 2021.

John Bull – Unhappy when interest rates are below 2%

Walter Bagehot, the 19th-century English journalist and businessman, famously observed that “John Bull (the national personification of the UK) can stand many things, but he cannot stand two per cent [interest rates].”

This was when Britain operated under the gold standard, which resulted in negligible inflation. The gold standard restricted the supply of money.

John Bull has recently had to put up with gilt yields (one-year spot) below 2% for over thirteen years – from November 2008 to June 2022.

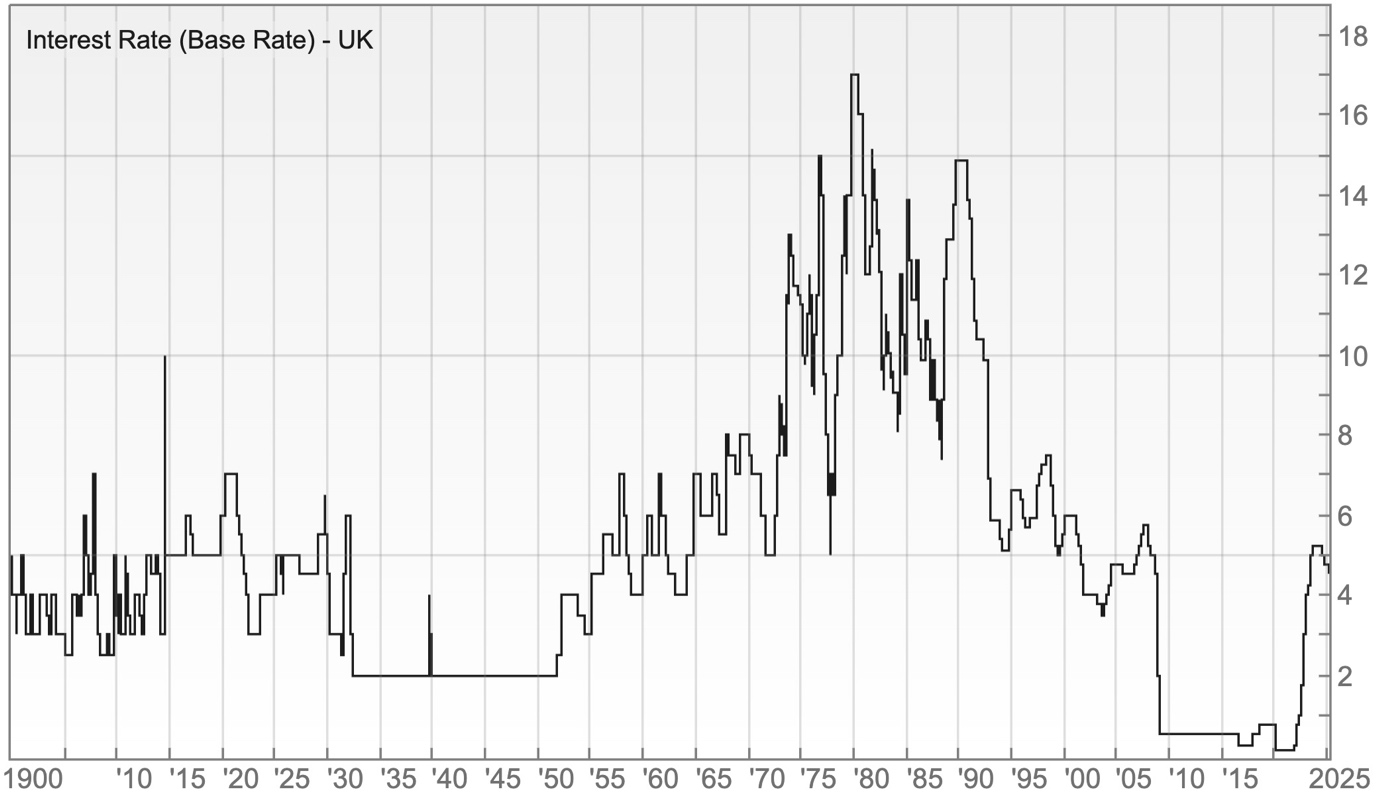

UK interest rates since 1900

ShareScope gives us UK interest rates going back to 1900. The very low rates we saw from November 2008 to mid-2022 appear to be an aberration rather than the norm.

The COVID-19 pandemic saw UK interest rates hit 0.1% in March 2020 and remain there until December 2021. This is the lowest rate in the history of the Bank of England.

Source: ShareScope

The impact of higher gilt yields/interest rates

Warren Buffett notes that higher interest rates act like gravity for asset prices. A recent increase in gilt yields has hit the value of yield-focused assets.

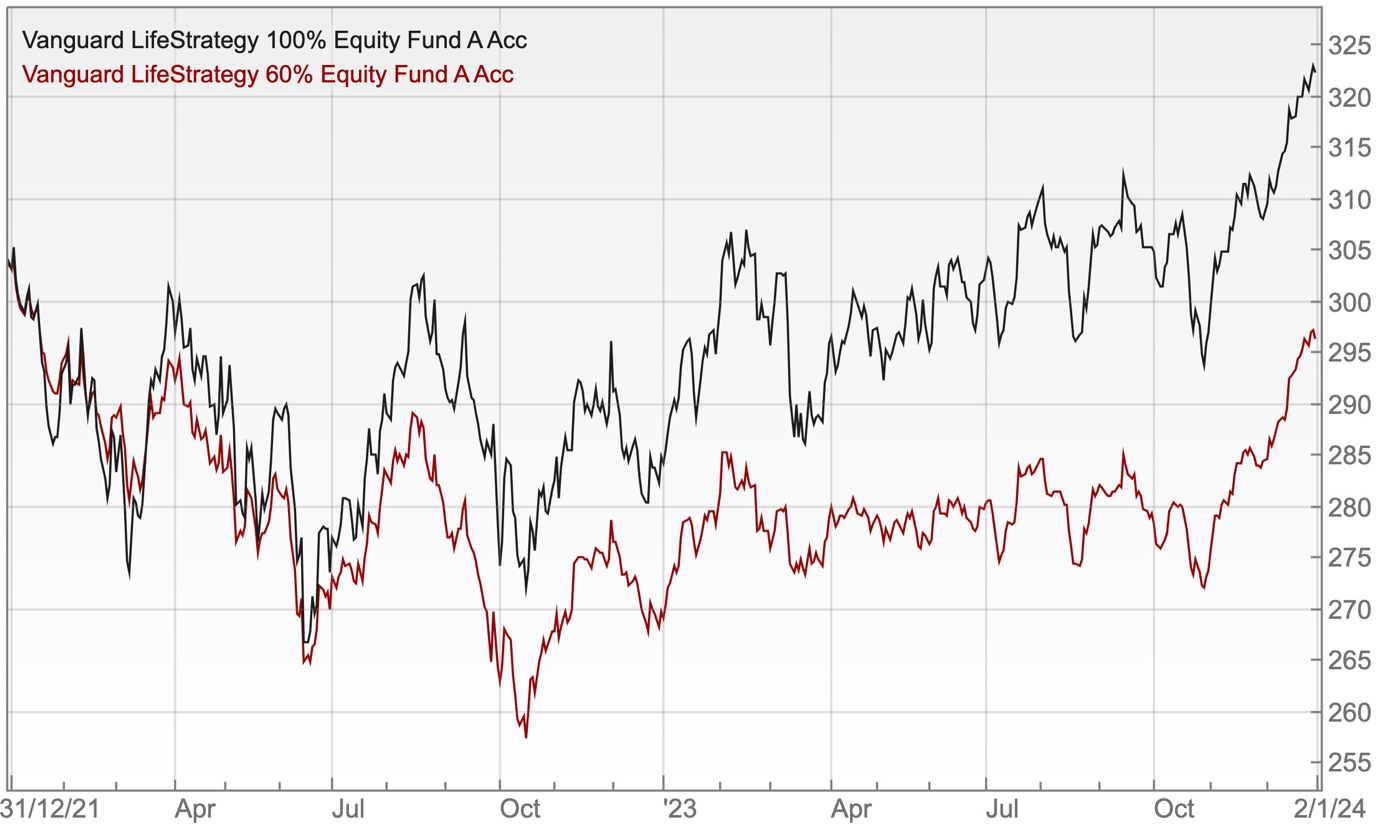

Bonds and so-called alternative investments (typically yield-focused) have seen their valuations take a bath. This hit the 60/40 portfolio with 40% in long-term bonds.

In recent years, a portfolio with 100% equities has been more resilient than the 60/40 portfolio (60% equities and 40% in bonds). As you can see below in the comparison of Vanguard LifeStrategy’s 100% equity versus LifeStrategy 60% equity.

Source: ShareScope

Gilts versus buy-to-let

Gilt yields are also an alternative to property investment, which provides an income and capital return. Both have been lacking in recent years in part due to tax changes.

Property investors used to borrow at a lower interest rate than the rental yield. Mortgage borrowing costs now tend to be higher than the rental yield.

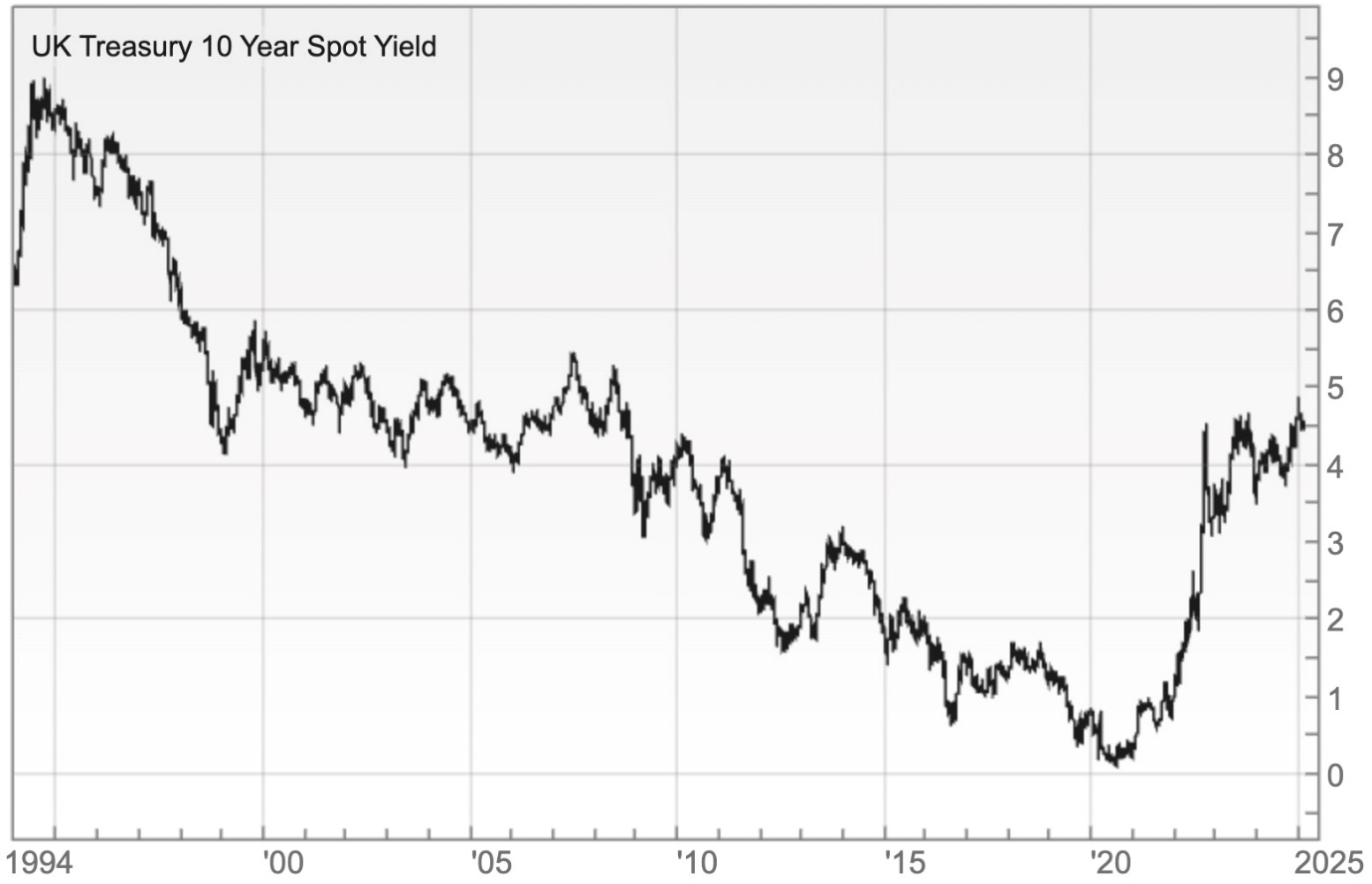

Why take the stress of owning a UK buy-to-let investment when a 10-year gilt offers 4.4% (annual return) and a 30-year gilt offers 5.1%?

Source: ShareScope

The investment pitch for gilts: safety and no CGT

Gilts have two key attractions:

- No repayment risk

- No capital gains tax for UK investors

Knowing we will get our money back is reassuring.

The certainty of gilts means that they will not offer a high return: the current 5-year UK Treasury spot gilt yield is 4.2% (per annum).

Gilts are about safety: the return of capital rather than the return on capital.

What are the mechanics of gilts?

Short-term gilts are not volatile given that they are not far from the repayment date. Longer-term gilts are for investors who want to lock in a fixed return.

If an investor doesn’t hold a gilt until maturity, they are taking on valuation risk. Gilts fall in price when interest rates rise and vice-versa.

Holding long-term gilts when rates are low is a risky endeavour – as we saw in 2022. Buying long-term gilts before interest rate decline can work out well.

For large amounts, gilts are safer than UK bank accounts. Gilts are fully backed by HM Treasury while UK bank accounts only have £85,000 protection.

Which gilts benefit the most from no CGT?

Gilts issued when interest rates were low trade below par (£100) due to subsequent interest rate increases. They provide a coupon return and a capital gain.

The coupon return is taxed at an individual’s marginal income tax rate while the capital gain attracts no tax.

Taking the example of the UK Gilt 0 1/8% Treasury 2026 (T26), it has a coupon of 0.125% and matures in just under one year when it will pay £100.

- Buy the T26 gilt for £96.68 today.

- Receive £0.125 in two interest payments over 1 year.

- Receive £100 at maturity on 30th January 2026.

The bond provides a £3.32 capital gain and £0.125 coupon interest payments. The bulk of the return comes from untaxed capital gains.

How much is the CGT benefit on gilts worth?

The question is: what would the interest rate on a bank account need to be to give the same net (after tax) return on a gilt?

Let us assume a gilt has no coupon (some gilts have low coupons like T26A). Let us also assume that our gilt buyer has a marginal income tax rate of 40%.

We would then take the gilt yield on offer and divide it by 0.6 (1-0.4). This is demonstrated below:

Gilt yield on a zero coupon 4% GRY bond – 4% (no CGT tax).

Bank account interest rate 6.67% – After 40% income tax (4%/0.6) this is 4%.

Our investor would need to find a bank account paying 6.67% to get the same after-tax return as a 4% GRY gilt. Low coupon gilts are more valuable to higher-rate taxpayers.

Are gilts really ‘risk free?’

If we own a gilt until maturity, we know the outcome. However, gilts are nominal assets (paper and not real assets) with inflation risk.

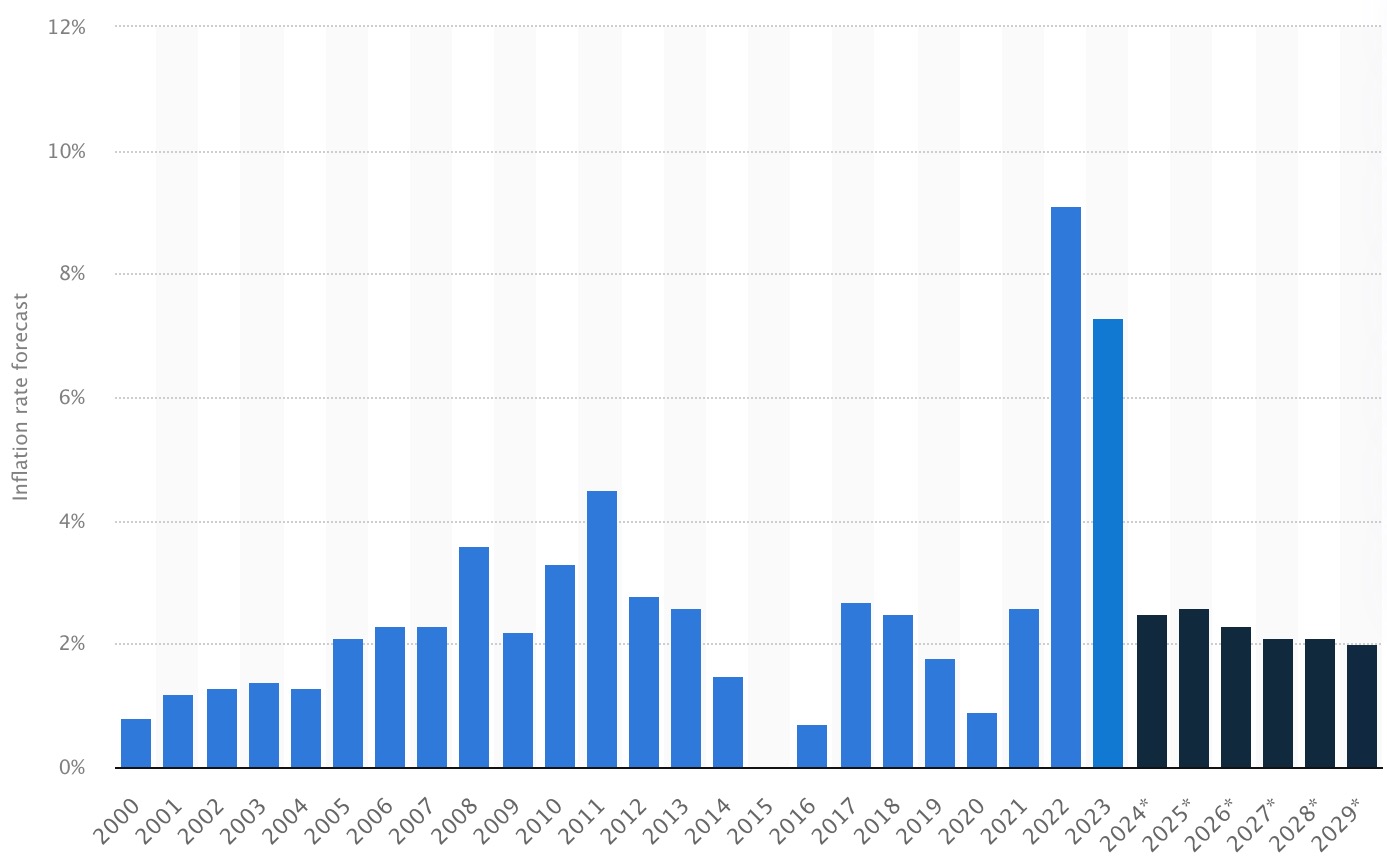

A 5-year gilt bought at the start of 2019 would have delivered around a 0.9% annualised return. However, UK CPI inflation hit 9.1% in 2022 and 7.3% in 2023.

Gilts only deliver a real return if their annual return (GRY) is higher than UK inflation.

UK annual CPI inflation 2000-2029:

Source: Statista

Will gilts make you richer?

The Bank of England targets an inflation rate of 2%. UK inflation is expected to be around this level from 2025 to 2029, but there is always a risk of an inflation spike.

The TG31 gilt has 6.49 years until maturity and provides a gross redemption yield of 4.19%. Most of this is tax-free, with the gilt’s coupon at 0.25%.

Gilts look set to provide a higher return than UK inflation. If this comes to pass, gilts will slowly increase an investor’s purchasing power, i.e. make them richer.

UK CPI inflation index over the last decade: From 100 to 135:

Source: ShareScope, Log chart.

Summary

We have recently seen the return of the ‘risk-free’ return. The five-year spot gilt yield is currently 4.2% versus the 0.13% low it reached in August 2020.

When held to maturity, gilts provide a certain outcome – something most investments lack. However, gilts (non-index linked) do not offer inflation protection.

Andrew G Latto, CFA

X handle: @moneyandmore72

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Great article.

Thank you – clear, well written article