Richard digs deeper into Spirax’s annual report to discover why its numbers have deteriorated and consider whether the company can re-establish its tremendous long-term track record.

5 Strikes

Only four companies have published annual reports and passed the minimum quality filter since my last article. Only one of them achieved less than 3 Strikes, and warrants further investigation. That’s one more than a fortnight ago!

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| AstraZeneca | AZN | 18/2/25 | 0.0 | – Holdings ? Acquisitions – Debt – Growth – ROCE – Shares | X |

| InterContinental Hotels | IHG | 18/2/25 | 0.1 | – Holdings – Debt | 2 |

| British American Tobacco | BATS | 14/2/25 | 0.0 | – Holdings – Debt – Growth – ROCE | 4 |

| Shoe Zone | SHOE | 10/2/25 | 25.9 | – CROCI – Debt – Growth | 3 |

| Click here for our 5 Strikes explainer | |||||

The victor is InterContinental Hotels. The Hotel Chain piqued my interest last year, and I may well look into it again soon.

Today, though, I want to tell you what I have learned from Spirax’s segmental report.

Spirax: A Curious Case

Last month I identified Spirax as one of 15 quality businesses that are improving. Though revenue and profit contracted in 2023, the company has a good track record and the results published so far for the year to December 2024 indicate Spirax may be returning to form.

Spirax operates three industrial equipment businesses. Two of them make systems that manage heat in industrial processes and the third makes peristaltic pumps. These move fluids in factories and laboratories.

|

|

|---|

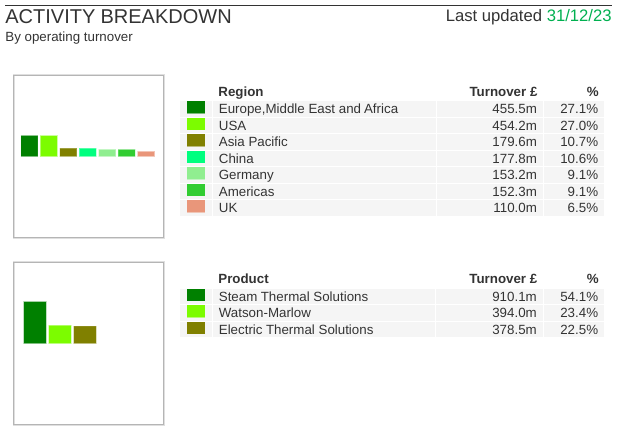

Source: Sharescope. The breakdown on the left shows revenue and the breakdown on the right shows operating profit. The data is for the previous financial year ending in 2023 because the company has yet to publish its annual report for the year to December 2024 (it’s due in April).

Steam Thermal is the most significant business by revenue and profit. It contributed over 50% of revenue in 2023. Watson-Marlow (peristaltic pumps) and Electric Thermal, contributed just under a quarter of revenue each, although Watson-Marlow is much more profitable.

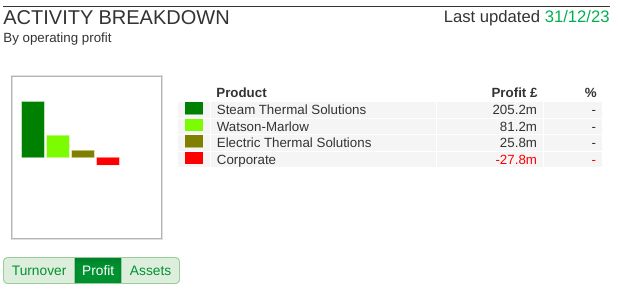

The ShareScope data I investigated last time indicated that 2017 was a pivotal year for Spirax. Since then, its debt-to-capital ratio has switched from negative (net cash) to positive (a high level of debt). You can see this in the pink bars.

Spirax’s profitability, the blue bars (Reported ROCE) has also declined.

I reckoned a big factor in Spirax’s deteriorating numbers was acquisitions. It had borrowed money to buy other companies.

The debt and profitability numbers require some interpretation. The way they are calculated has changed due to the introduction of IFRS 16 in 2019. This accounting standard treats operating leases as debt and adds their capitalised value to capital employed. Other things being equal, companies will look more indebted this decade than they did in the previous one due to the change.

Acquisition accounting also depresses reported profit, due to the creation and amortisation of acquired intangible assets. Adjusting for these factors, though, does not change the overall conclusion. Spirax is less profitable and more indebted than it was.

A new beginning

To better understand what happened, we should take a closer look at the businesses acquired.

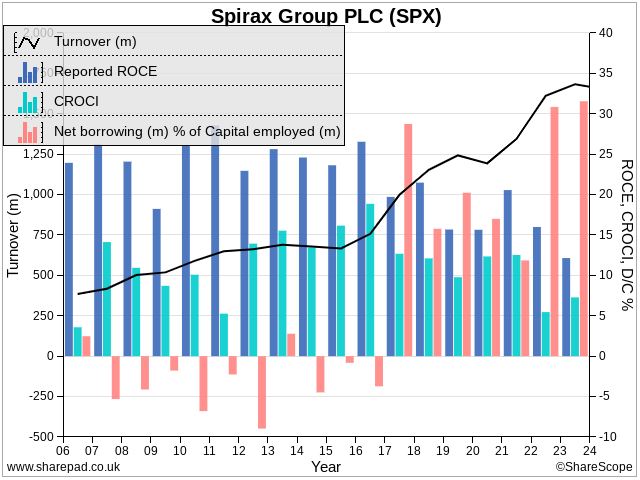

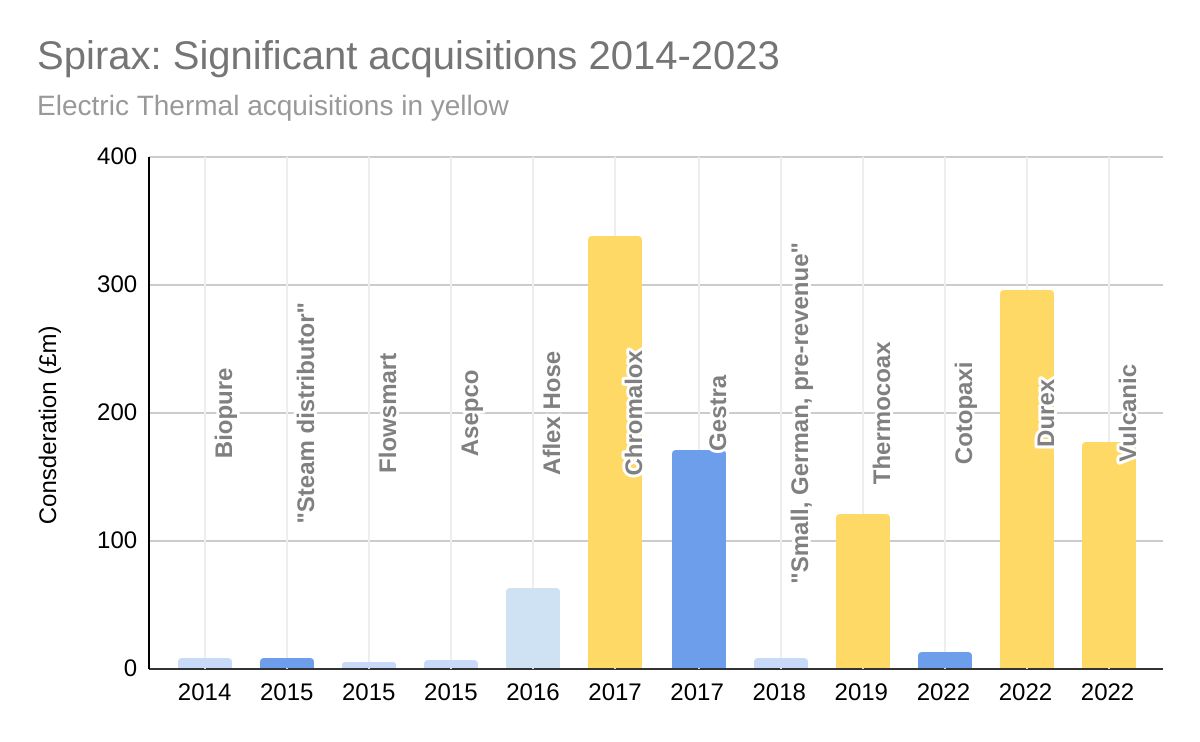

Source: Spirax annual reports. Electric Thermal acquisitions are highlighted in yellow. Steam Thermal acquisitions are darker blue and Watson-Marlow acquisitions are lighter blue. Acquisitions that cost less than £5m are excluded.

2017, the pivotal year, was the year Spirax made its most costly acquisition to date. Chromalox was also its first Electric Thermal business.

Hitherto, Spirax had been in steam at least since it exhibited the Sarco steam meter at the Engineering and Machinery Exhibition, Olympia, in 1906. It had been in peristaltic pumps since it bought Watson-Marlow in 1990.

Source: “Knowledge, Service, Products: The history of Spirax-Sarco Engineering plc” by Nigel Watson

Spirax followed Chromalox, with three more large acquisitions for the Electric Thermal business: Thermocoax, Durex and Vulcanic.

The numbers are not exact, because I have excluded acquisitions of less than £5 million and the disposal of a business loosely aligned with the Steam Thermal division in 2018.

Even so, I can say with some confidence that Spirax has spent more than £930 million acquiring businesses for the new Electric Thermal division since 2017. It has spent less than £200 million on Steam Thermal and less than £100 million on Watson-Marlow since 2014.

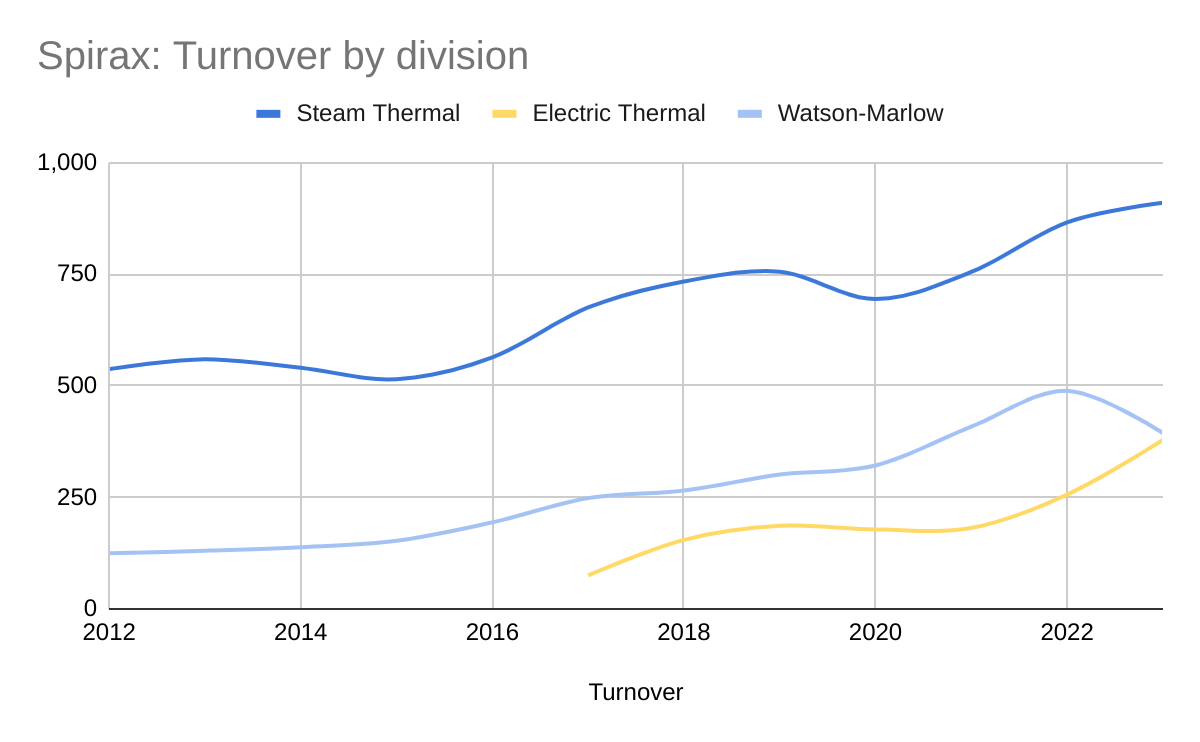

The result has been three growing divisions:

Source: Spirax annual reports

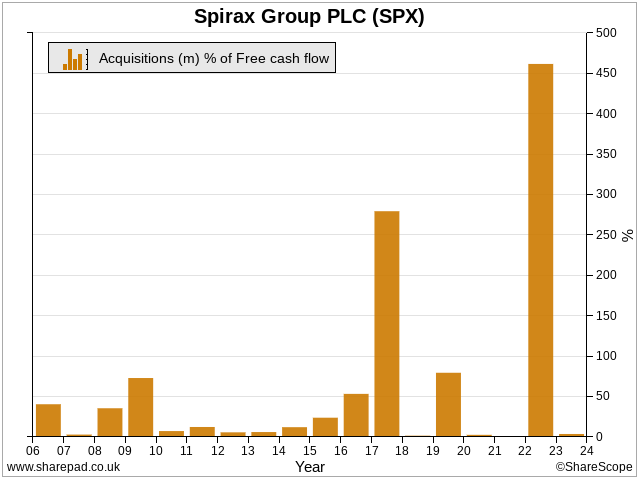

Electric Thermal grew at a Compound Annual Growth rate of 20% over the five years between 2019 and 2023, albeit by acquisition. Steam Thermal grew at a CAGR of 4% and Watson Marlow grew 8% CAGR.

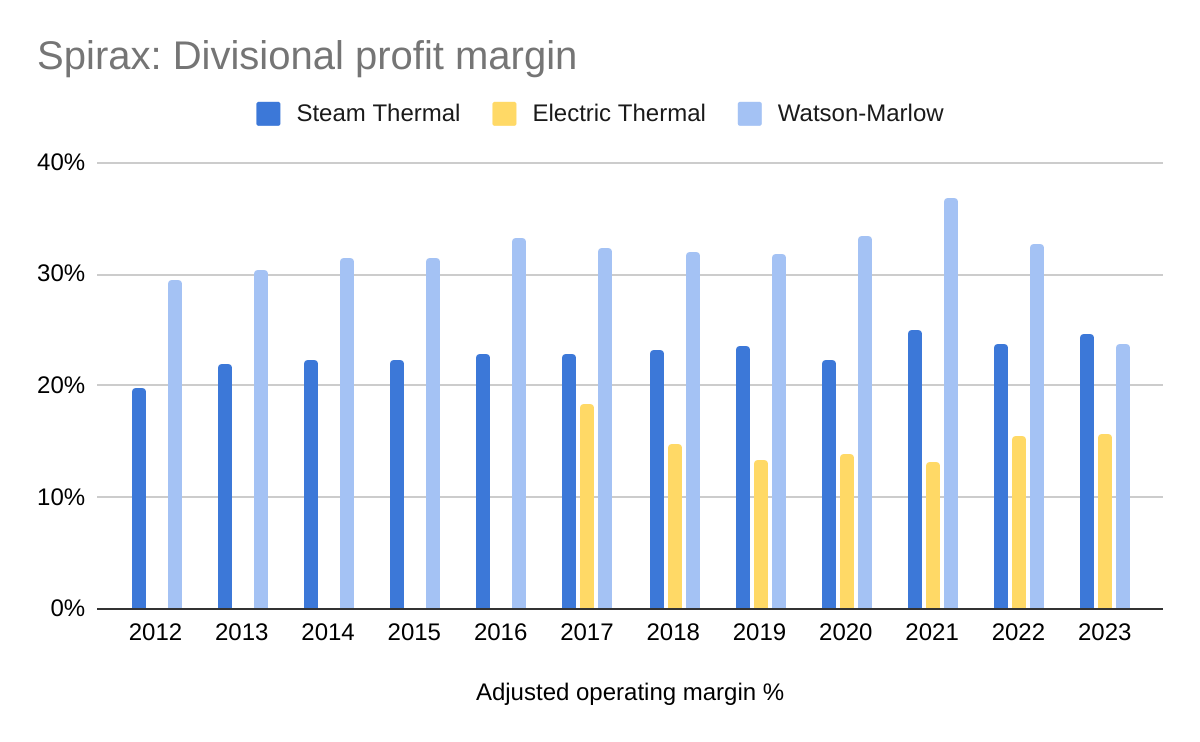

The emphasis on Electric Thermal is interesting because on paper it is the least impressive business. Watson-Marlow, the recipient of least investment, in terms of acquisitions, is the most impressive:

Source: Spirax annual reports

Steam Thermal typically earns a return of more than 20% on sales. Watson Marlow has earned more than 30% profit margin for every year that I have extracted the information from Spirax’s annual reports, except the last one. Electric Thermal typically achieves only mid-teen profit margins.

Why Chromalox?

In the company’s official history, “Knowledge, Service, Products”, then chief executive Nicholas Anderson reportedly described Chromalox as “the most Spirax-like business” he had come across.

Although Chromalox uses electricity instead of steam, it is often used for similar processes. Like Spirax, Chromalox employs a direct sales model and most of its revenue comes from the less volatile operating and maintenance budgets of its customers rather than capital expenditure.

There is little sign of it so far, but perhaps Spirax believes it can use its long experience to lift Electric Thermal margins towards the motherships.

It may also foresee more growth from Electric Thermal than its other divisions, and opportunities to use Electric Thermal know-how to grow or defend the other divisions.

Heat transfer uses energy. Spirax Sarco says electrification is a strategic imperative for customers as they move away from fossil fuels. The Electric Thermal division addresses decarbonisation directly (if the machinery is powered by renewable energy), but it is also collaborating with Steam Thermal to decarbonise steam solutions.

In 2023 Spirax installed a new product, ElectroFit, for Diageo in Turkey. ElectroFit is a retro-fitted electric solution that replaces gas-fired steam-generating boilers.

These rationales might explain Spirax’s enthusiasm for its newest and least profitable division, but I do not yet have the confidence to rule out the possibility it is just diluting two very good businesses by saddling a less good one on them.

The next annual report is due to land in April. That will be a good time to learn more.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.