Six years after selling Science, a share that today has no strikes to its name, Richard looks at the consultancy’s last annual report to see where the company’s strategy took it.

Since last time, only three companies have published annual reports and made it past my minimum quality filter. I assigned all of them 4 strikes, which means they are of no immediate interest.

5 Strikes

|

Name |

TIDM |

Prev AR |

Holdings (%) |

Strikes |

# Strikes |

|---|---|---|---|---|---|

|

Diales |

DIAL |

3/2/25 |

4.8 |

– CROCI – Growth – ROCE ? Shares |

4 |

|

Watkin Jones |

WJG |

31/1/25 |

0.9 |

– Holdings – CROCI – Growth – ROCE |

4 |

|

IDOX |

IDOX |

28/1/25 |

0.7 |

? Holdings ? Acquisitions – Growth ? ROCE – Shares |

4 |

Generally, it takes zero, one or two strikes to catch my attention so instead of taking a closer look at these shares, I am delving into the archive of shares I overlooked last year.

Science

When I scored Science in 2024, it achieved zero strikes. It is also one of 15 shares that have achieved higher Return on Capital Employed (ROCE) and Cash Return on Capital Invested (CROCI) on a Trailing Twelve Month (TTM) basis than it achieved in its last full year (to December 2023).

That suggests to me that Science is likely to pass 5 Strikes again when it publishes its next annual report (in May according to ShareScope).

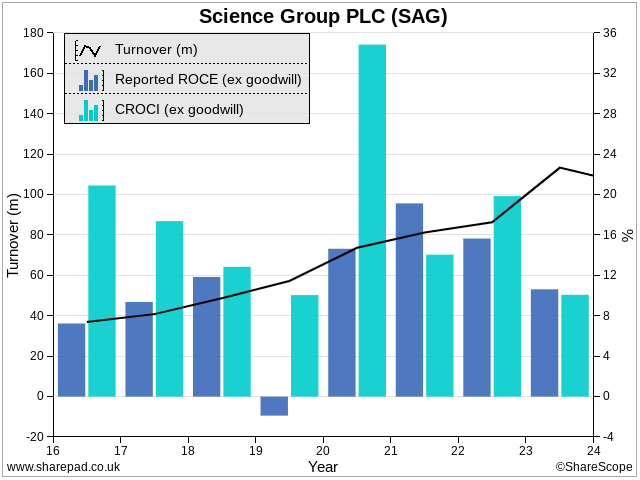

Over the past eight years, Science has been profitable. In only two years, 2016 by a smidgen and 2019 by a lot, did report ROCE fall below my 10% benchmark. Throughout the period, it has generated strong cash flow.

In 2019, Science reported a loss. We’ll talk about the acquisition of Frontier that year later because it represented a change in direction. But the transaction was the reason for the loss, resulting in substantial one-off and acquisition-related costs. Frontier also made a small loss that year. After adjusting out the impact of Frontier, profit declined only very slightly.

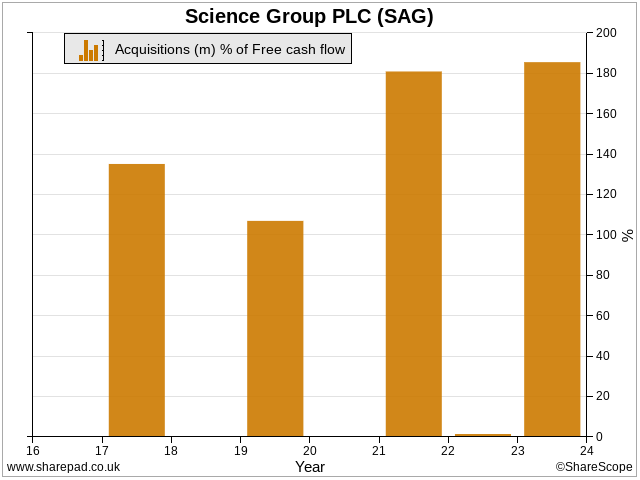

Science has chosen to spend much of its earnings on acquisitions. In four of the last eight years, it spent more than it earned in free cash flow, but because this activity has fluctuated from year to year, it has not exceeded my limit, which is a cumulative acquisition spend of 100% of cash flow.

Despite this spending, Science generally remained debt-free. It has issued a relatively modest amount of shares. The revenue growth you see in the first chart, from less than £40m in 2016 to more than £100m in 2023 was, therefore, almost entirely self-financed.

There is not much to worry about in the numbers, but Science and I have history. I lost confidence in the business in 2019 and sold a position I had held for five years or so.

The chart shows buys and sells in interactive investors’ Share Sleuth model portfolio

Science is primarily a group of consultancies. It employs scientists, engineers and technicians across a wide range of industries to help clients with product development and regulatory compliance.

Gun for hire

This “gun for hire” business model means Science gets paid whether the innovations it works on succeed in the market or not, which may explain the relatively steady profits. However, it is not the kind of business that scales easily.

Growing a consultancy means hiring highly trained staff. Often, they are scarce and expensive. Science has an appeal for scientists and technicians. Its headquarters and one of its two main Research & Development hubs is near Cambridge, home of Silicon Fen and the newly revived Oxford-Cambridge Arc. Science, though, found the most effective form of recruitment was acquiring other consultancies, which also brought new customers in new industries.

I felt this was a strategy I could buy into until Science announced the outcome of a strategic review in 2019. The review revealed a potential conflict of interest between the company’s executive chairman and majority shareholder Martyn Ratcliffe and minority shareholders. Perhaps as a result, it increased Science’s focus on acquisitions.

Specifically, Science ruled out using surplus cash for special dividends because these were “unattractive to some shareholders,” and with cash flow to spare it ruled in “larger acquisitions… which may or may not have any synergies with the Group’s existing operations”.

At the time, I thought this was an “anything goes” strategy. Because I examine a company’s strategy as a way of peering into the future, I felt that “anything goes” did not give me much of a steer.

Six years later, we can see where Science went.

Martyn Ratcliffe is still executive chairman and still owns a large stake in the business, although at 21% it is smaller than it was in 2019.

The Segmental Report in Science’s Annual Report for the year to December 2023 shows us what has changed since 2019. The company now provides revenue and adjusted profit for four business units. The summary table below contains slightly different values for adjusted operating profit because I have added share-based payments (pay) back in.

|

Science – Segmental results |

||

|---|---|---|

|

Consultancy Services |

2023 |

2022 |

|

Revenue |

81,282 |

58,242 |

|

Adjusted operating profit |

18,798 |

14,951 |

|

Margin |

23% |

26% |

|

Systems – Submarine Atmosphere Management |

||

|

Revenue |

21,265 |

|

|

Adjusted operating profit |

3,542 |

|

|

Margin |

17% |

|

|

Systems – Audio chips and modules |

||

|

Revenue |

9,975 |

24,979 |

|

Adjusted operating profit |

-1,656 |

3,424 |

|

Margin |

-17% |

14% |

|

Freehold properties |

||

|

Revenue |

4,217 |

4,093 |

|

Operating profit |

553 |

90 |

|

Margin |

13% |

2% |

Source: Science Annual Report 2023

The company owns its impressive headquarters near Cambridge and a site in Epsom. It charges the consultancy businesses rent and earns a modest income from third-party tenants. The revenue and profit from this activity is reported separately in the smallest segment: “Freehold properties”.

A more complex business

Consultancy is the original business, Sagentia, augmented by acquisitions – most recently TP Group (formerly AIM listed Corac), a defence and aerospace consultancy. Consultancy is by far the biggest segment and the most profitable judging by the last two years.

The two Systems segments relate to two technology businesses, CMS2, a supplier of submarine atmosphere management systems, and Frontier, a supplier of DAB radio chips and WiFi and Bluetooth audio solutions.

These businesses differ from the consultancies. They own their intellectual property. They make and sell hardware and software. Frontier was Science’s first Systems acquisition in 2019. The second, CMS2, was part of TP Group. Since TP Group was acquired fully in January 2023, we only have one year of results for it.

The performance of Frontier in 2023 may illustrate the greater risk in supplying systems rather than expertise. In 2023, Frontier was kicked by circumstances that impacted many hardware suppliers. Customers had overstocked DAB radio chips during the pandemic and ran down that stock in 2023 rather than buy more from Frontier. This coincided with weaker demand for consumer electronics generally. Revenue declined by 60% and the subsidiary made a loss

If systems are successful in the market, these businesses may be more scalable than the consultancy. Science describes the systems businesses as “satellites” of the core consultancy business. They share some of the same back-office services as the consultancies, sharing costs, and the Annual Report says the “Consultancy Division’s science, technology and engineering expertise,” provide “R&D breadth and depth far beyond what would typically be available to operations of their scale.”

A combination of consultancy and systems has worked well enough at some of my investments. As businesses acquire more subsidiaries, though, they become more complex, putting more strain on the head office to manage them while also nurturing their independence and entrepreneurialism.

Cohort, a defence technology mini conglomerate, has grown this way, but it is focused on one market and still its growing complexity gives me the heebie-jeebies. Science’s consultancy businesses, and its satellites, serve disparate markets, and I doubt the rationale for them being together is as compelling.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.