Investing in small and micro-cap stocks can be a risky exercise at the best of times, which is probably why funds and especially actively managed investment trusts have proved so popular. But there’s been a weight of academic research into small-cap investing, and it’s increasingly suggesting that small caps, especially in the UK, might not be such a rewarding exercise. Our monthly fund’s article digs a bit deeper whilst also pointing to a small UK fund that might be worth looking more closely at. Plus, we have a view on the Saba saga, currently roiling the world of investment trusts and my favourite funds for 2025.

Small cap investing: A long-term winner?

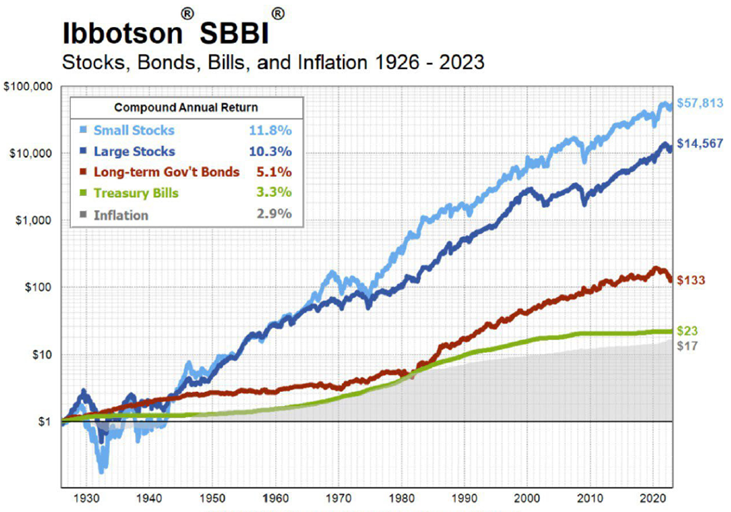

We all know the adage: from tiny acorns, mighty oaks grow. It’s the tagline applied to small-cap stocks that are supposed to outperform large-cap stocks in the long run. Cue some big headline stats: first, one dollar invested in US small caps in 1926 has grown to $57,813 in 2023. One dollar invested in US large-cap stocks has grown to $14,567! Back in the UK, data from Deutsche Numis shows that £1,000 invested in UK small-caps for a new-born in 1955 would have grown to £9m by the time he or she reached retirement, aged 67, in 2022 – assuming all dividends were reinvested. The same amount invested in UK large-caps would have grown to just £1m.

According to Panmure Liberum strategist Joachim Klement, over the 24-year period since 2000 (the longest period for which we have comparable data) small-caps globally have done relatively well compared to large-caps. Of the 13 countries compared, only one (Taiwan) did not record a positive annualised size premium. The world small-cap size premium over the period is 2.9%, just behind the UK at 3%. Over the longer, 69-year period since 1955, the UK size premium has been 3.1%.

FTSE does have its own small-cap index, but most investors I talk to tend to prefer the Numis Smaller Companies Index. It is one of the most venerable stock market indices in the UK, having been first published in 1987 but with a back-history dating from 1955. The Index has become the leading benchmark for UK small-cap investing, covering over 750 companies which make up the bottom 10% of the UK market by value (market capitalisation cut-off last year c.£1.5 billion).

US small-cap stocks outperform large-caps in the long run

Source: Financial Fitness Group

Unfortunately, more recent trends tend to suggest that small-cap investing has become much tougher – and less rewarding. Let’s start with the UK. According to Mark Niznik, co-manager of the Artemis UK Smaller Companies fund, ever since the UK voted to leave the European Union in June 2016, the small-cap effect seems to have ground to a halt. He points to data via Bloomberg based on the renamed Deutsche Numis Smaller Companies (ex-investment companies) index which shows that it made a total return of 47% between the date of the referendum result and the end of March 2024 – well below the 65% made by the FTSE All-Share. He also echoes recent notes from Peel Hunt, which suggests that the FTSE Smallcap index might eventually cease to exist: “While it now only numbers 114 companies, there are more than 1,000 to choose from in the Deutsche Numis Smaller Companies index, including those quoted on the AIM market.”

As you’d probably expect, given the volatility of small-cap share prices, there’s been a huge variation in returns over the last decade. The heat map below from Sharescope shows returns for a bunch of benchmarks here in the UK as well as for long-term returns from a handful of small-cap-focused investment trusts. The big message is that small caps have outperformed in some years but overall the FTSE Small Cap index has provided deeply disappointing returns. Niznik at Artemis echoes this point on variability: “The Numis Smaller Companies (ex ICs) index made 73% across 2003 and 2004, and 107% across 2009 and 2010. These two-year periods followed the bursting of the dotcom bubble and the end of the global financial crisis – periods when the point of maximum pessimism had been reached.”

I think we’re not far off that point of maximum pessimism again.

Nevertheless, a series of studies by financial historians over in the US calls into question the inevitability of a bounce back in small caps – perhaps small caps don’t really provide the superior returns we’ve long believed. Back to Joachim Klement at Panmure Liberum again, quoting from one research paper by Edward McQuarrie, a US academic.

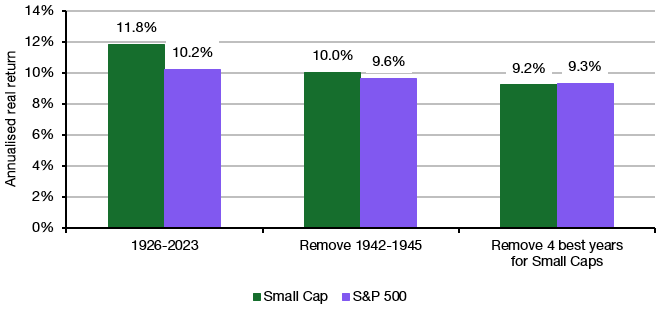

“But what’s easy to miss is that, over the early decades of the examination period, large and small stocks produced about the same returns. That is also true over the last 40 years. If we take out the essential period from the mid-1970s to the mid-1980s, when small stocks roared ahead, there was no return advantage to holding small stocks (which, incidentally, had more risk). There was also a very strong period for small stock performance in the 1940s. Inasmuch as finance is all about weighing risk and return over different and possibly indeterminate time horizons, this is an absolutely critical nuance.” McQuarrie could do even better and remove the small cap outperformance altogether by cutting out just four years from the last 98 years of historic returns:

Source: Edward McQuarrie

Klement suggests that amongst many market strategists, there is growing scepticism that there “is such a thing as a small cap premium in the US stock market. Others are not so sure. “

His message, echoing that of the US academic Edward McQuarrie: Do small caps outperform? Sometimes yes, sometimes no

The Saba saga: Opportunists in our midst

I’ve tended not to comment extensively on the US hedge fund Saba and its increasingly vocal and active attempts to shake up the UK investment trust market. In truth, I’m no expert on any of the trusts involved, knowing only one, the UK tech fund Herald, in passing. There will be lots of noise and emotion generated.

The Saba saga is a test for the investment trust sector and, more specifically, the increased role of the private investor. Many institutions and wealth platforms have stopped investing in investment trusts or reduced their allocations. That means the whole sector has had to rely increasingly on private investors. That is a net positive, but focusing on private investors only works if they make their voices heard. If Saba effectively gets its way by relying on the apathy of private investors (who tend not to vote) and convincing a few large institutional shareholders (who might like the liquidity for more mundane reasons), we collectively have a problem. Saba’s proposals may well make sense for many private investors (or not as the case may be), but private investors need to carefully scrutinise them, make their own minds up, and then make sure they vote one way or the other.

I’d also say that Saba has probably done the whole investment trust sector a big favour, with many of the seven trusts now showing big share price gains. Take Herald Investment Trust, for instance. Run by Katie Potts, this fund has seen its discount narrow to around 8.5% the last time I looked, which was a big advance on the near 15% discount earlier last year. Saba says it will try to get that discount close to 0%, but given the underlying holdings in less-than-liquid UK stocks, I doubt this is realistic. More to the point, Saba’s efforts have prompted huge media coverage of Herald and its track record, which is impressive over the last decade or so (the last few years less so). That news coverage probably helped boost turnout at the recent meeting which decisively rejected the Saba offer.

It’s also become obvious that Saba’s track record managing funds in the US, including ETFs, is less than stellar. So, voting for Saba’s proposals is a big leap in the dark and on balance I’d not vote for the proposals.

The risk now is that if you are a shareholder of one of the seven funds and Saba’s proposals fail, the fund’s share price might fall quite sharply – all those scavengers buying into the fund following Saba’s move might decide to sell out. That places shareholders in an invidious position. If I held shares in any of the seven – which I don’t – I wouldn’t be minded to hand control to Saba’s directors. But if you vote against their actions and Saba sells, you could be out of pocket.

Investment Trust ideas

I’d highlight four investment trusts for 2025. All have significant upside potential, and they should provide diversified exposures to tech, shipping, and UK small-cap stocks.

1. Augmentum Fintech. This is a specialist venture capital team led by a highly respected management team that has built a solid track record of nurturing good firms and then selling them on. My sense is that the key catalyst to value accretion will be what happens to digital business bank Tide (around 20% of the portfolio) and digital consumer bank Zopa (around 15% of the portfolio). Zopa has talked about an IPO, while Tide seems to be growing solidly.

2. Taylor Maritime Investments. The shares trade at just below a dollar on a discount of around 33% and a well-backed dividend yield of 8.1%. After we get past the inevitable trade wars of H1, we should be in a much more positive environment for global shipping, which should have some impact on ship valuations. After the Grindrod transaction, the fund (soon to be an Opco) has steadily reduced its debt burden, while disposals have been running at around 3% less than booked asset values. My hope is that rates are now stabilising after having fallen for much of 2024. I’d set a target price of $1.15 for the end of 2025, and you’ll also get that dividend payout.

3. Seraphim Space is in a sweet spot regarding technological trends. The roaring success of SpaceX and its likely IPO has kindled the meme brigade to look more loosely at commercial developments in the space market. Take the example of AST SpaceMobile (mobile phone networks via satellite). This is now worth $6.2 bn as its share price has risen from $5 earlier last year to its current (inflated and overvalued) current level of $21. AST represents around 4% of the portfolio at Seraphim. The biggest investment is in ICEYE (20.2% of NAV), which won a five-year contract with NASA to provide satellite data to support NASA’s Earth Science Division. ICEYE also announced a multi-satellite deal with the Greek government.

The other big stake is in D-Orbit (14.6% of NAV), which reached a final close on its €150m Series C funding round. The round will allow D-Orbit to continue developing its ION Satellite Carriers, with seven launches planned for 2025. Additionally, the funding will accelerate its collaborations with governments and space agencies and be used to make strategic acquisitions to broaden the company’s product set.

Overall portfolio valuations have held up as VC interest in this segment has accelerated: in the last quarter, the fund announced a small 2% decline in NAV (to 94p) versus a but also disclosed that “71% of the portfolio by fair value has a robust cash runway, with 58% fully funded and 13% funded for 12 months or more from 30 September 2024, based on management projections and including raises completed post the quarter end”. The shares remain at a 40% discount with the current share price at 54.50p. I’d look to see that increase to above 70p if SpaceX does go for an IPO in 2025.

4. Onward Opportunities is a small-cap UK equities fund run by Laurence Hulse, which is quietly building a solid reputation – in a small fund – for investing in unloved, high-growth potential UK stocks. The last fact sheet back in September highlighted solid progress both in the portfolio and in growing the fund AuM: according to Onward in September, the fund has had an encouraging “first 18 months of investment performance (NAV growth) for the company of +25.5% since inception and means that the portfolio has outperformed the UK AIM All-Share by 30.8% since launch. This performance was in spite of a very difficult September for some of our best performing (and largest) holdings, where Capital Gains Tax speculation saw material profit taking on a number of good performing investments”.

I’m much more bullish than the mainstream consensus on UK equities, and I think focused, small-cap stockpickers in the UK market like Onward, Strategic Equity Capital and Rockwood have the best chance to make gains from what I think will be a more buoyant 2025 UK economy.

~

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.