Wynnstay has paid an increased dividend every year since 2004 yet its shares trade nearly 40% below net tangible assets. Maynard Paton weighs up whether the agricultural supplier is a value bargain or a value trap.

I am back again looking for ‘value bargains’ and revisiting a screen that identifies companies trading at less than book value.

Importantly, this screen attempts to avoid ‘value traps’ by demanding the shares offer net cash, dividend payments and a history of trading above book value.

The exact filter criteria I redeployed were:

- A price to net tangible assets of no more than 1;

- A dividend being paid during the most recent year;

- A 10-year average price to net tangible assets of at least 1;

- Net borrowings less total leases of no more than 0 (i.e. a net cash position excluding IFRS 16 lease obligations), and;

- A share price denominated in pounds sterling.

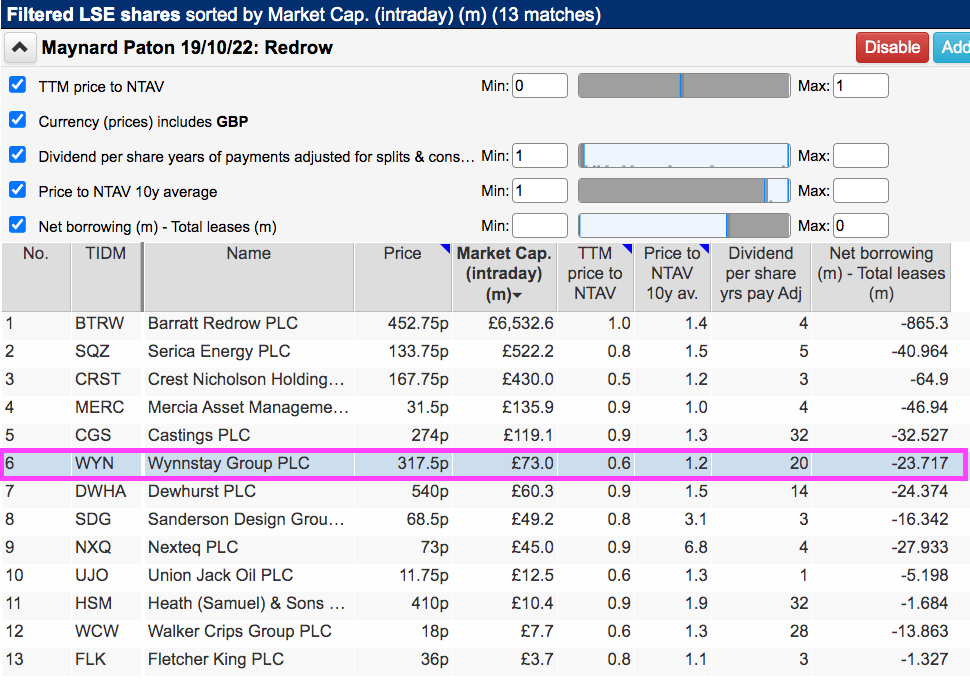

This time SharePad returned 13 companies, including Castings and Crest Nicholson:

(You can run this screen for yourself by selecting the “Maynard Paton 19/10/22: Redrow” filter within SharePad’s wonderful Filter Library. My instructions show you how.)

I selected Wynnstay because the shares were priced at a steep discount versus their ten-year average valuation. I also liked the reassuring 20-year run of dividend payments.

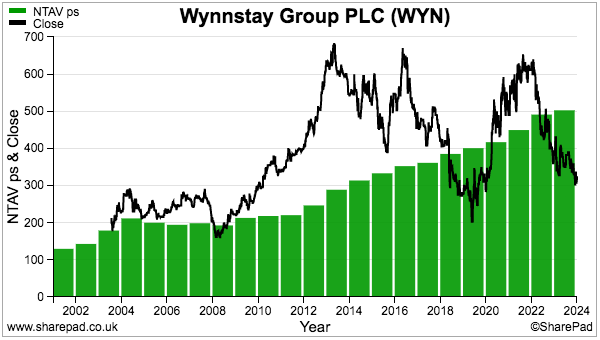

Sure enough, Wynnstay’s 318p shares trade nearly 40% below the group’s 503p per share net tangible asset value:

My filter results indicate the shares have traded at an average 1.2x book value during the last ten years. The rating reached 2.3x during 2013, sank to 0.5x during the pandemic and languishes now at a lowly 0.6x.

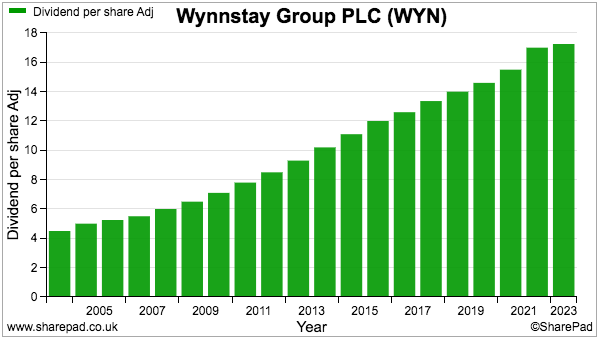

Wynnstay’s net tangible assets have advanced over time, and so has the dividend. The payout has in fact been lifted every year since the group joined AIM during 2004 at 190p:

Given the illustrious dividend, Wynnstay does not seem the type of business that should be valued well below asset value. Yet the shares have effectively moved sideways for years; the recent 318p price was first achieved during 2011 and today supports a £73m market cap.

Let’s take a closer look.

Introducing Wynnstay

Wynnstay was founded during 1918 as a farming cooperative by twelve tenant farmers from the Wynnstay estate in Wales. The organisation’s first depot was opened in Llansantffraid and sold animal feed sourced from Liverpool.

Later years would see the society build its own mills to manufacture animal feed as well as establish facilities to clean seeds, grind limestone, dry grass and pack eggs. Mergers occurred with the Montgomeryshire Farmers Association during 1955 and the Vale of Clwyd Farmers during 1989:

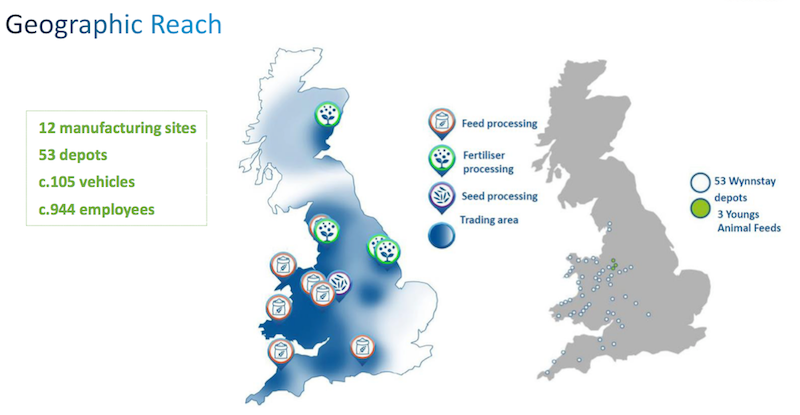

Wynnstay became a PLC during 1992 and, before joining AIM during 2004, was quoted on what is now the Aquis stock-market for nine years. The shift from cooperative to PLC subsequently led to more than 30 (mostly small) acquisitions and built Wynnstay into a prominent supplier of more than 25,000 different products to UK farmers.

The group now claims to be the country’s sixth largest producer of animal feed, with a 9% share of free-range poultry feeds and a 5% share of dairy, cattle and sheep feeds.

The group also claims it is the country’s fourth largest processor of cereal seeds and grass seeds, with a 7% share of the former and a 10% share of the latter.

That first depot in Llansantffraid is now complemented by 52 other stores, big sellers from which include silage sheets, fencing wire, livestock equipment and animal health products such as drenches and wormers.

The depots and manufacturing plants are located mostly in Wales and the annual reports publish the chairman’s statement in both English and Welsh:

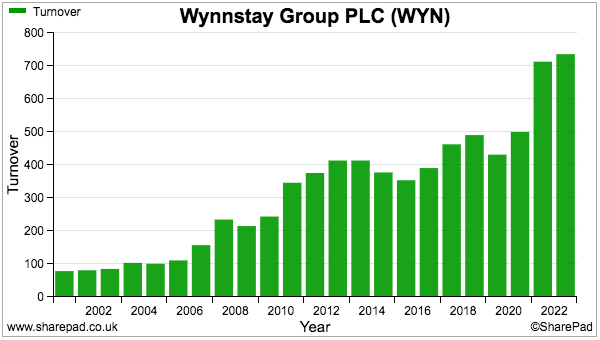

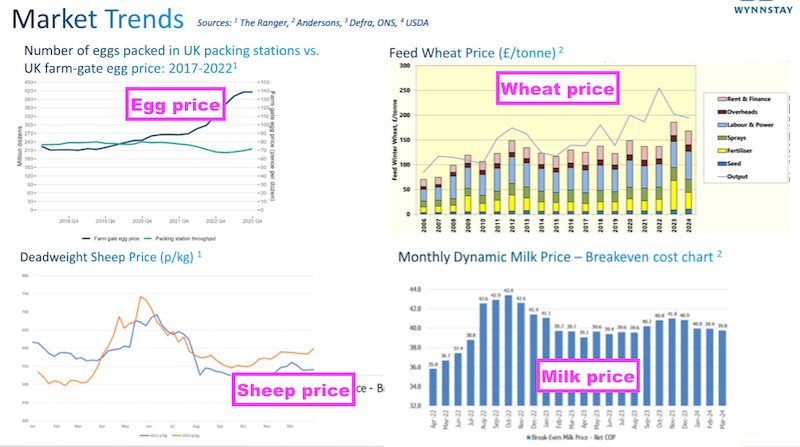

Wynnstay’s financial history is sadly not as polished as the aforementioned 20-year dividend run. Although annual revenue has advanced from £101 million to £736 million following the flotation…

…Operating profit has mostly bobbed between £6 million and £9 million:

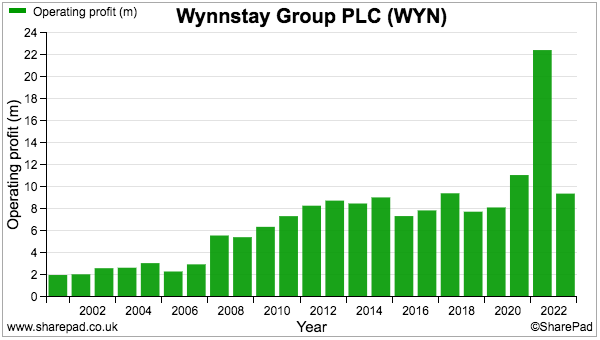

The profit spike during 2022 followed the Russian invasion of Ukraine and the knock-on impact to fertiliser, feed and food prices. Wynnstay’s 2022 figures showed significant commodity-price advances… which then reversed during 2023:

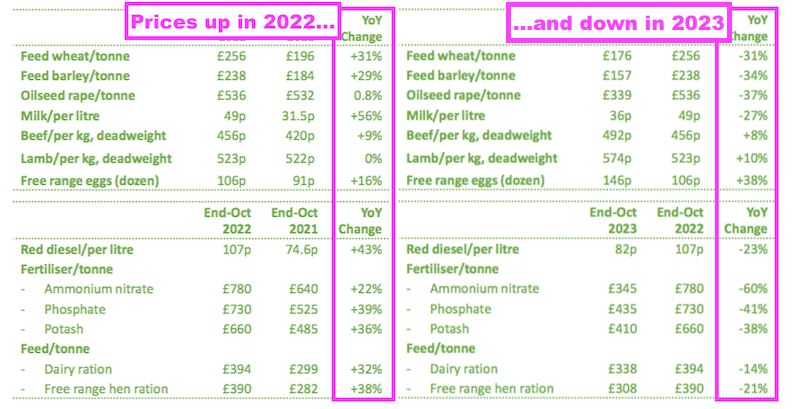

The group’s powerpoints refer regularly to egg, wheat, sheep and milk prices…

…which emphasise this business is dependent on the health of UK farmers. If farmers are not earning as much from their produce, then they will not spend as much on feeds, seeds and silage sheets.

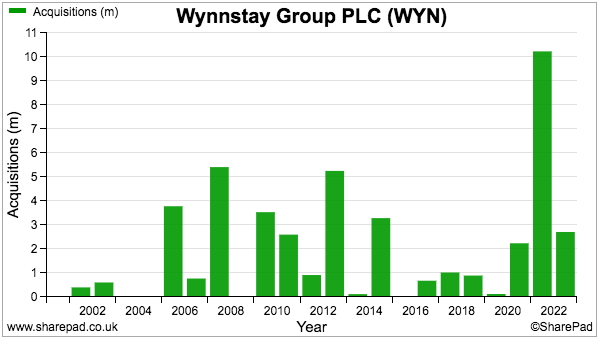

Wynnstay helpfully lists its acquisitions since 2015:

The largest purchase by some distance is Humphrey Feeds and Pullets, which manufactures feeds for free-range poultry and was acquired for a potential £13 million consideration. Other deals have brought the total spent since flotation to approximately £43 million:

Wynnstay’s purchases typically bring lots of sales but little in profit and underline how the group operates in a very low-margin sector. For example, the Humphrey deal came with revenue of £41 million and a profit of £1.6m. Acquired during 2011 for £4 million, grain manufacturer Wrekin Grain brought revenue of £31 million but a profit of only £0.7 million.

The £43 million spent on acquisitions is not insignificant versus the aggregate £151 million operating profit achieved during the same time. The acquisition activity has unsurprisingly led to a few ‘non-recurring’ costs, with £1 million of such expenses incurred during both 2020 and 2022.

Balance sheet

Any potential book-value investment must start with the balance sheet. And Wynnstay scores quite well with its assets.

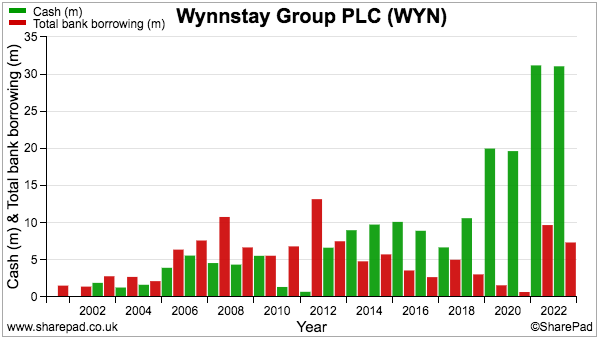

The group has operated with net cash since 2014 and, at the 2023 year end, cash of £31 million amply covered bank debt of £7 million:

Half-year results published during June showed net cash of almost £19 million plus various investments of more than £6 million, which combine to support approximately 33% of the £73 million market cap.

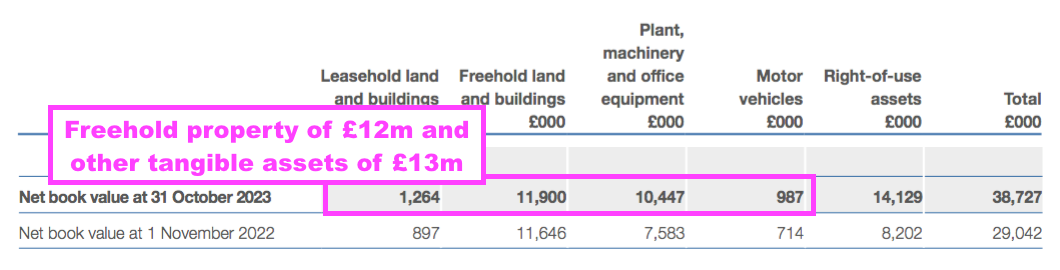

Alongside the net cash and investments is property, plant and equipment with a £25 million carrying value, which also supports approximately 33% of the market cap:

Freehold land and buildings sport a £12 million book value and, as perhaps befits a 106-year-old organisation, the properties are accounted for at much less than their market value:

“In the opinion of the Directors, the current open market value of the Group’s interest in land and buildings exceeds the book value at 31 October 2023 as provided in Note 16 to the financial statements by approximately £9,718,000 (2022: £9,578,000). The director’s opinion is supported by a valuation exercise carried out by BNP Paribas Real Estate in July 2022.”

Whether the other tangible assets are really worth £13 million is difficult to say.

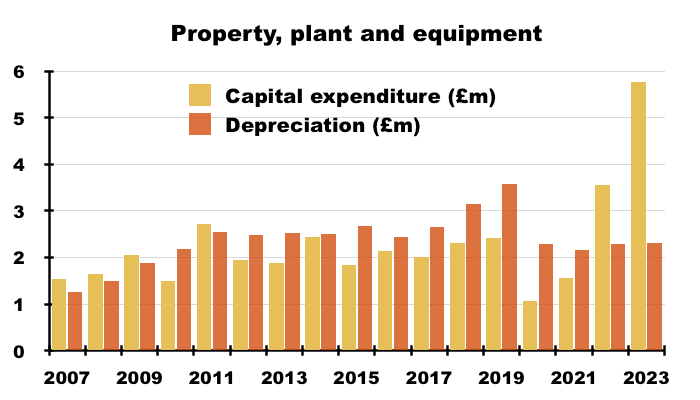

But I get the impression Wynnstay’s tangibles are not ‘under-depreciated’ to enhance their balance-sheet value. I calculate aggregate expenditure on new property, plant and equipment during the last ten years has been £25 million, while the associated depreciation charged against profit has been £26 million:

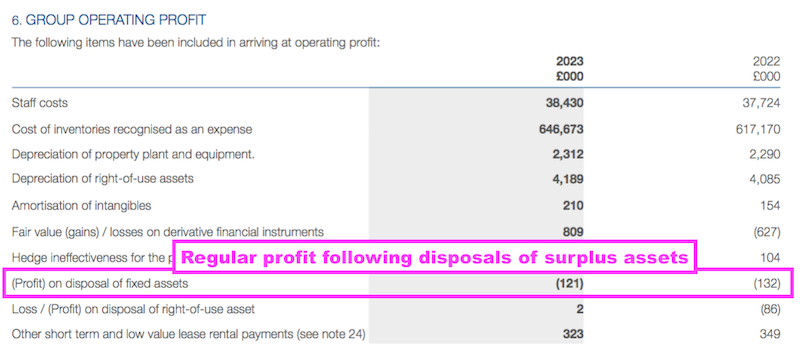

Also underpinning the notion that Wynnstay’s tangible assets are realistically valued are regular ‘profit on disposal’ entries:

Although the amounts are small, such profit items have been recorded every year since the 2004 flotation. In other words, when Wynnstay has sold surplus assets, the price achieved has been greater than their associated accounting value.

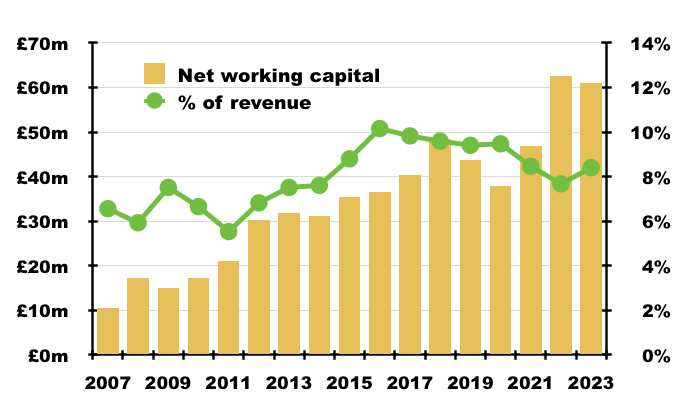

Elsewhere within the 2023 balance sheet, working capital comprised stock of £55 million, debtors of £81 million and creditors of £76 million.

The net working-capital figure of £60 million supports a mighty 82% of the market cap and is equivalent to 8% of revenue:

8% does not seem out of kilter with previous years, and suggests the balance sheet is not temporarily flattered by excess stock and debtors.

I note the stock of £55 million includes provisions of only £330,000, which implies warehouse goods exhibit a low risk of obsolescence. And while customers are not always timely when settling their invoices — at he last count £26 million was ‘past due’ — actual write-offs last year were only £162,000.

The rest of the balance sheet consists mostly of goodwill and acquired intangible ‘brands’, which carry a £20 million book value. With the shares trading below net tangible asset value, these intangibles are presently valued by the stock market at nil.

Boardroom and employees

Wynnstay’s impressive dividend may reflect the long-term loyalty of the group’s top executives. Wynnstay’s previous three bosses each worked at the business for more than 20 years:

- Bernard Harris: joined 1980, managing director 1987-2008;

- Ken Greetham: joined 1997, chief executive 2008-2018, and;

- Gareth Davies: joined 1999, chief executive 2018-2024.

The retirement of Mr Davies was unexpected; he suffered a “serious family matter” earlier this year and a new boss, Alk Brand, was appointed last month:

Note that Mr Brand was recruited from outside Wynnstay. He was previously chief executive of Westfalia Fruit, an avocado supplier, and before that, was chief executive of European Oat Millers before its sale to Richardson Food & Ingredients.

Interestingly, Wynnstay reported Mr Brand as possessing “a highly successful record in business growth and development and in M&A, including acquisition integration and efficiency programmes“.

Wishful thinking perhaps, but I do wonder if Mr Brand might be able to put his M&A skills to good use… by showcasing Wynnstay to a larger group.

Mr Brand’s first task as chief executive was unfortunately drafting a profit warning that was published on his second day in the job.

He admitted the 2024 results would be “materially” lower than City expectations and below the group’s 2023 performance. The profit shortfall was blamed on reduced poultry-feed volumes and decreasing fertiliser prices. At least Mr Brand expected an “improved” performance for 2025.

Whether Mr Brand and his finance director — recruited only a year ago — will be able to maintain Wynnstay’s dividend run remains to be seen. For what it is worth, the two executives between them own 8,500 shares, all of which were purchased last month at 330p.

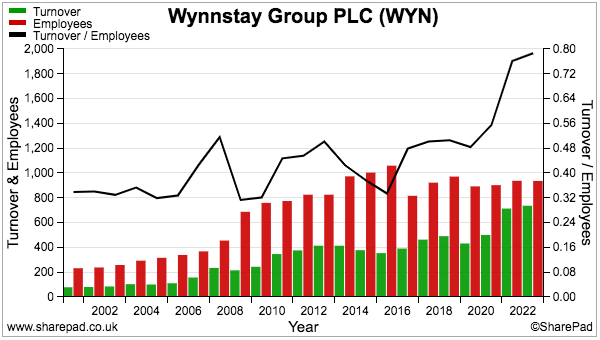

An encouraging feature of Wynnstay’s progress is the ongoing improvements to workforce productivity. Revenue per employee has doubled since 2015 as perhaps acquisitions such as the aforementioned Humphrey Feeds and Pullets might command higher sales from fewer staff:

Total employee salaries have increased by 49% since 2015 — commendably lagging that 100%-plus revenue per employee improvement. The average salary is now £35,000.

Margin, ROE and forecasts

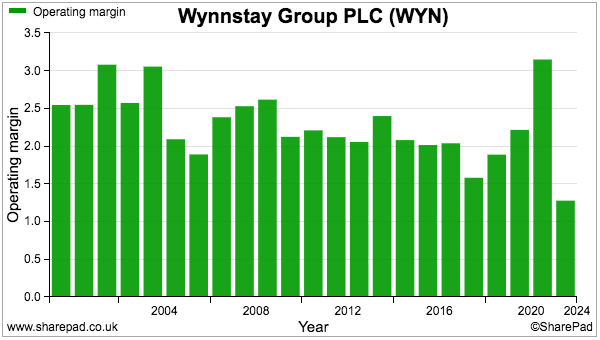

Improved workforce productivity has sadly been unable to improve Wynnstay’s margin. For years the group has converted just 2% of revenue into profit and even the bumper 2022 witnessed only 3%:

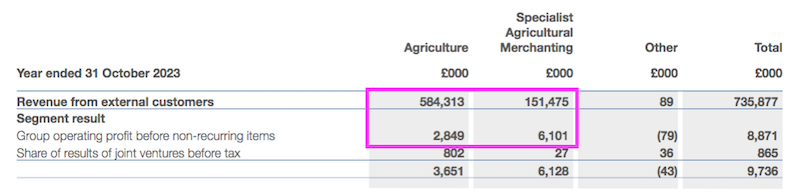

The group discloses the profitability of its two divisions:

- Agriculture, which handles the animal feeds, fertilisers and seeds, and;

- Specialist Agricultural Merchanting, which supplies all the specialist products to farmers.

The Agriculture manufacturing side clearly faces intense pricing competition, given its £3 million profit last year was achieved from revenue approaching £600 million.

Mind you, the group’s specialist retailing arm is hardly a goldmine with a 4% margin last year.

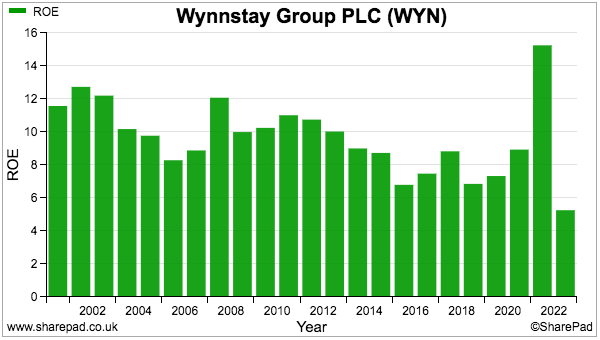

The asset-flush balance sheet plus the low profit margin combine to create very modest returns on equity:

True, Wynnstay has held notable net cash that until recently did not earn a great return from the bank. But the balance sheet is dominated by stocks and debtors, and I get the distinct impression Wynnstay inherently requires a very large working-capital position to earn what is frankly a modest level of profit.

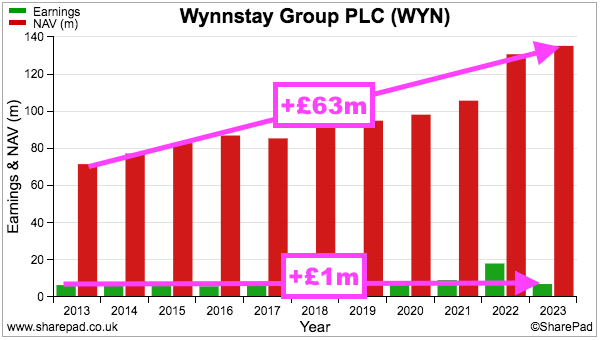

The SharePad chart below is extremely illuminating. Earnings for 2023 were just £1 million greater than for 2013, while net assets have increased by £63 million:

Retaining £63 million in the business for additional earnings of £1 million over ten years certainly explains why the stock market has a poor view of the group’s assets.

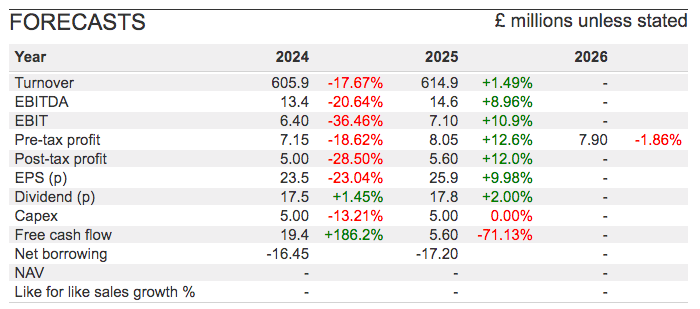

Brokers have translated Mr Brand’s profit warning into the following estimates:

The 2024 projections imply second-half profit could plunge by approximately 50% to less than £2 million and deliver a sub-1% margin.

At least near-term earnings are expected to cover the dividend this year and next, which should extend the illustrious payout run and improve net tangible assets a fraction.

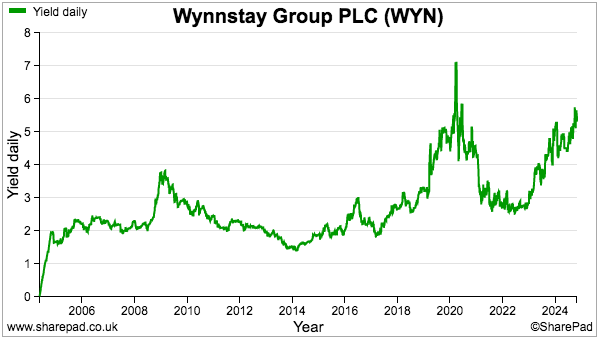

The 5.5% yield is Wynnstay’s highest excluding the pandemic-crash spike:

Summary

Wynnstay has established a resilient asset and dividend record within a very tough industry, but I recognise the market’s doubts towards the business.

In particular, I have a strong feeling Wynnstay has held on to some of its ‘cooperative’ roots. The group’s mission statement — “To help the farmer to feed the UK in a more sustainable way” — does not shout ‘create shareholder value’ while the operational highlights within the last annual report led with ESG matters rather than financial accomplishments.

In fact, cooperatives remain a significant part of the farming industry. Cooperatives UK for example reveals the UK is home to 482 agricultural cooperatives consisting of 235,260 farmers that generated a combined income of almost £10 billion last year.

If so many farmers are part of ‘not for profit’ organisations, maybe farming inherently leaves very little money for outside shareholders. Perhaps that explains why Wynnstay’s profits are stagnant despite retaining £63 million over ten years.

A saving grace perhaps is Mr Brand’s M&A expertise and the chance Wynnstay one day becomes part of a larger group. The annual report states the industry is “undergoing consolidation” and confirms Wynnstay’s ambition to “grow through a combination of organic and acquisition-based means in order to remain competitive and benefit from economies of scale“.

Wynnstay offers decent market shares in various feed and seed categories, and a much larger operator may be able to extract economies of scale far beyond what Wynnstay can achieve with its smaller deals.

I would venture now seems as good a time as any for an opportunistic bid while the cash, freeholds, stock and unpaid invoices can be purchased for about 60p in the pound. This chance of an approach tips the shares more towards ‘value bargain’ than ‘value trap’, but I confess the swing is not huge.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Wynnstay.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.