After rival house builder Bellway decided not to buy Crest Nicholson, Phil asks whether the shares have been treated too harshly by the market or if investors should stay clear of them.

Source: Crest Nicholson

It’s been a rough few years for house-building companies. COVID-19 badly disrupted their businesses while government subsidies and low borrowing costs have disappeared. As a result, making big profits has become a lot harder than it was.

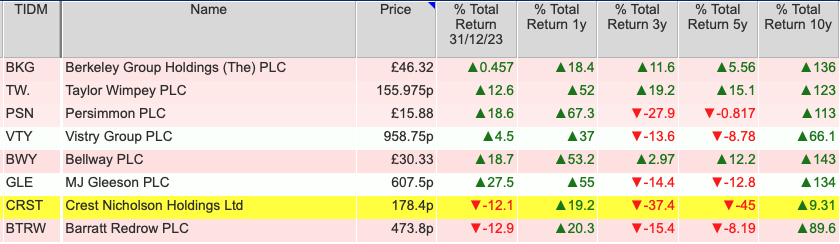

This is reflected in the dire performance of house-building shares over the last five years. However, none have been worse than those of Crest Nicholson which seems to have stumbled from one disaster to another.

Source: SharePad

Since 2018, the company has issued a number of profit warnings which have weighed heavily on its share price. An indicative 273p per share bid from Bellway fell apart over the summer while the company has rejected a proposal to combine with the privately owned Avant as well.

This has left Crest Nicholson shares looking very unloved with the share price way below the 220p it listed at when it returned to the stock market in February 2013.

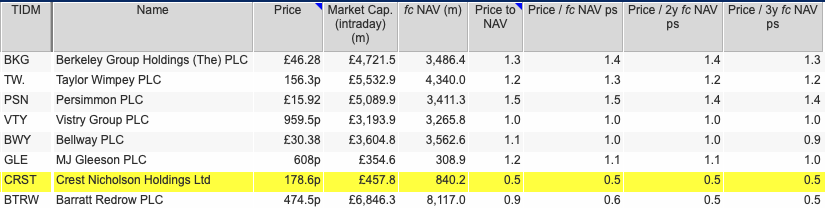

The shares look very cheap when compared with their net asset value (NAV)

Compared with its sector peers, Crest Nicholson looks very cheap. Its current market capitalisation is £382.4m less than its forecast NAV. With the exception of Barratt Redrow, the rest of the sector is being valued in line with or more than their forecast NAV.

If Crest Nicholson was valued at its forecast NAV then its share price would be 328p – 84% higher than it is currently.

Source: SharePad

So why is the discount so big?

Shares trade at a discount to NAV for a number of reasons. Sometimes it is because they have been ignored by investors and are significantly undervalued.

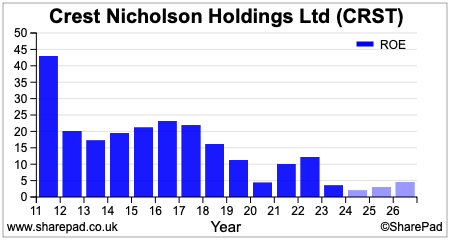

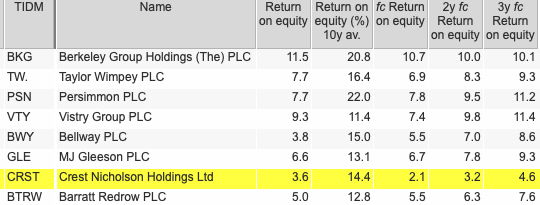

More often than that it is because investors have big concerns about the company concerned. Either they don’t believe the realisable value of the assets on the company’s balance sheet or they feel that the company cannot make enough profit (as measured by its return on equity or ROE) to justify the value of its assets.

Asset values in many – but not all – companies are related to the amount of profit they produce. How much profit they need to make to justify their balance sheet value can quickly become a complicated subject and is highly dependent on things such as interest rates. However, as a very rough rule of thumb, for a business to be worth at least its NAV, it will need to have an ROE of at least 10%.

Crest Nicholson has not done this for a while and is not expected to do so anytime soon. This is one possible reason why its shares have traded at a discount to NAV.

If we look at the rest of the sector, ROE is also pretty subdued due to a sluggish housing market and is not predicted to get to decent levels anytime soon. ROEs are expected to stay much lower than current 10-year averages for the foreseeable future.

Source: SharePad

Is Crest Nicholson’s NAV believable?

When it comes to house-building companies. There is often significant land value on the balance sheet. Land values are shown on the balance sheet at what they cost to buy less any subsequent reductions in value. The value of land can often be understated if the houses that will be built on it are expected to generate big profits.

Land values are very geared to house selling prices – they move by more than the change in house prices – which is why they rise when house prices are going up and fall when they are going down. A rise in value is not shown on the balance sheet but may be reflected in a share price that is more than the NAV. Falling land values are reflected on the balance sheet.

There are strong grounds for thinking that Crest Nicholson’s NAV may be overstated. After all, its management seemed happy enough to consider accepting a discount to NAV bid of 273p on 10th July:

“The Board of Crest Nicholson has confirmed to Bellway that the Revised Proposal is at a value that it would be minded to recommend unanimously to Crest Nicholson’s shareholders”

The fact that Bellway then walked away from the bid in early August after doing some due diligence has got investors asking what have they seen that has put them off.

When it comes to checking out Crest Nicholson’s NAV it seems that there are three main values that need to be considered.

- The value of its land and housing stock. At the last balance sheet date of 30th April 2024, the carrying value of the company’s work in progress, finished properties and part exchange properties was £1182m. These are valued as stocks or inventories which means their balance sheet values are stated at the lower of their cost or net realisable value.

- A provision – which reduces NAV – of £31.4m related to completed sites where the company has an obligation to make good or maintain the land until it is adopted by a local authority or a company.

- Another provision of £145m which is related to the remedial work on buildings completed since April 1992. Much of this is concerned with dangerous cladding similar to the type that was fitted to Grenfell Tower in London which suffered a devastating fire in 2017.

For land and housing stocks, the company says that it has 14,146 owned plots and a further 17,813 in its strategic land bank (land that it has the option to buy but does not usually have planning permission). The 32,959 plots have a gross development value of £11.6bn according to the company which equates to an average selling price per plot of £352,000.

Working out the present value of that gross development value is not easy. It depends on the number of annual units sold and the profit margins they earn.

Crest Nicholson has been troubled by some low-margin land which should be sold off in 2025. Assuming that it got back to a completion rate of 3,000 units a year and it could earn very high operating margins (which takes into account the cost of the land not paid for yet) of 20% then you might just get to valuing the land bank at £1.1bn in today’s money.

A more problematic issue is the value of its provisions. They have significantly increased when it comes to the completed sites and hopefully won’t increase again.

There is far less certainty when it comes to the £145m cladding provision. There has been some concern voiced by investors that this could be on the low side, especially when compared with other builders’ estimates.

Crest Nicholson has also stated that the provision is just a best estimate and could increase if there is future cost inflation:

“If forecast remediation costs on buildings currently provided for are 10.0% higher than provided, the pre-tax exceptional items charge in the consolidated income statement would be £14.5m higher. If further buildings are identified this could also increase the required provision, but the potential quantity of this change cannot be readily determined without further claims or investigative work.”

Is the stock market too pessimistic?

The cladding issue has been cited as a reason for Bellway walking away from its bid. But how bad could it get?

Granted, Bellway might feel that it doesn’t need to be exposed to the risk of a big increase in the provision, but the big gap between Crest Nicholson’s realistic NAV (let’s say the 273p offer from Bellway is in the right ballpark) and its current share price looks like a nice buffer – about £260m – which gives investors a lot of protection.

A new chief executive is going to try and restore the company’s fortunes. However, if another bid came along it would not be a big surprise given how far the shares have fallen.

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select Share Chat or search for the specific share covered in this article.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.