Canadian 200-bagger Constellation Software has inspired Software Circle to become a serial acquirer of ‘vertical market’ software businesses. Maynard Paton studies the promising early progress of AIM-traded emulator.

Mark Leonard has been described as the “best capital allocator you have never heard of“.

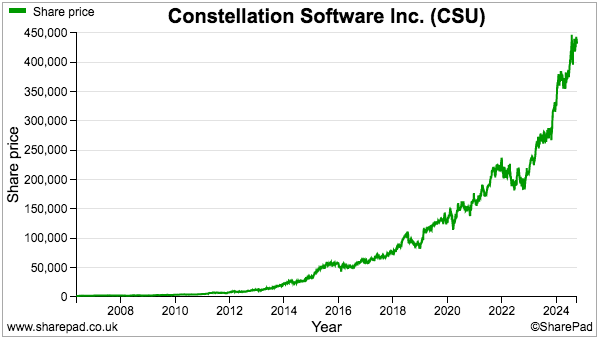

According to Forbes, Mr Leonard is now worth $5 billion after he established Constellation Software during 1995 and listed the group on the Toronto Stock Exchange during 2006. He then watched his shares soar more than 200-fold:

You may not have heard of Mr Leonard because he deliberately maintains an extremely low profile. He appears to have conducted only one public interview while pictures of him online are essentially variations of this particular image:

However, Constellation’s super stock price — currently supporting a £50 billion market cap — has gradually increased the number of investors who have heard of Mr Leonard…

…and the number of investors who have tried to replicate Constellation’s success. By 2018 Mr Leonard had seen enough copycats and decided to give up writing his annual Constellation letter. He lamented:

“For competitive reasons we are limiting the information that we disclose about our acquisition activity. We believe that sharing our tactics and best practices with a host of Constellation emulators is not in our best interest.”

Such has been the enthusiasm for how Mr Leonard created his immense wealth, a Constellation ’emulator’ has even emerged within the lower reaches of AIM.

Software Circle sports an £85 million market cap and is attempting its very own Constellation-like mega-bagger journey.

Let’s take a closer look.

Vertical Market Software

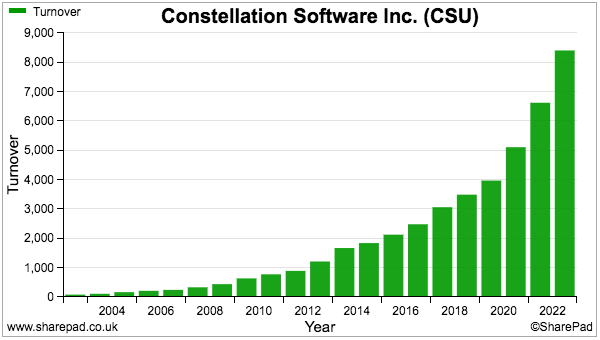

Constellation’s rocketing share price is supported by a history of metronomic growth. Revenue now tops $8 billion and has never suffered an annual setback since the flotation:

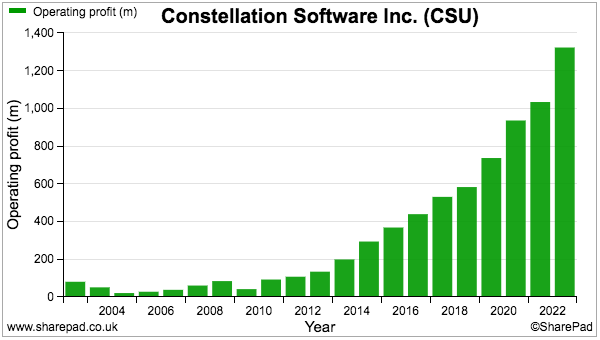

Consistently rising revenue has meanwhile pushed Constellation’s operating profit to more than $1.3 billion:

The strategy that delivered such success — and prompted the ’emulators’ — is buying very small suppliers of ‘vertical market’ software.

‘Vertical market’ software is simply software used only within a particular industry niche.

The attractions of such software for investors are:

- Competition tends to be limited;

- Customers tend to be loyal, and;

- Margins tend to be impressive if development costs are controlled and extra sales convert mostly into profit.

Last year Constellation spent $1.8 billion buying almost 140 software firms, with recent purchases as diverse as service-management software for local authorities, point-of-sale software for retailers, asset-tracking software for miners, flight-booking software for travel agents and loan-application software for financial institutions.

Constellation’s website outlines the group’s buying criteria:

- Number 1 or Number 2 market-share holder;

- Revenue of at least $5 million;

- Hundreds or thousands (not dozens) of customers;

- Unimposing competitors, and;

- An offering price that has been determined.

Constellation looks to offer three broad differences to conventional private-equity buyers:

- It buys small. The average purchase last year was $13 million and prior to the pandemic was approximately $5 million.

- It offers a permanent home to sellers. Some business founders prefer their former company to offer long-term stability to employees.

- It gives autonomy. Constellation does not provide day-to-day management, and the acquired workforce can therefore maintain its existing culture.

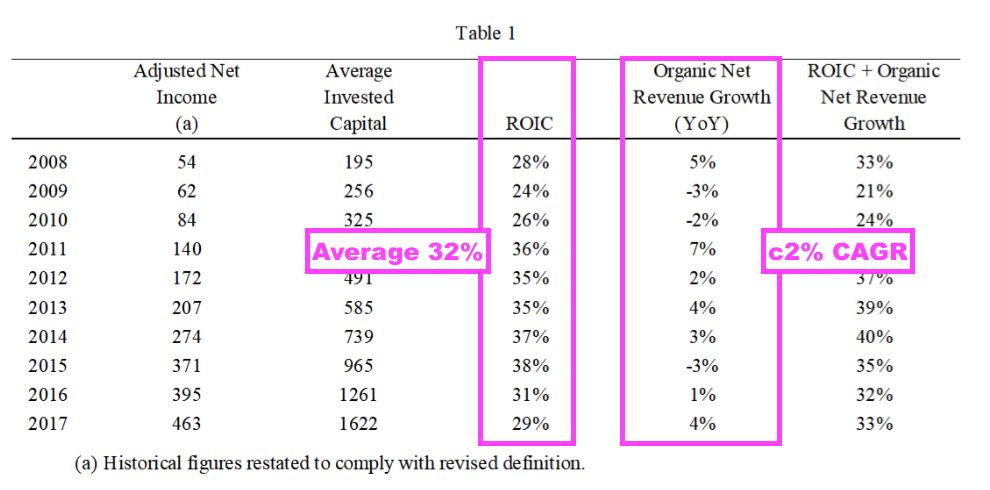

What valuation Constellation applies to its acquisitions is not clear, but Mr Leonard’s last statistics revealed return on invested capital averaged 32% between 2008 and 2017:

A 32% return on invested capital implies Constellation has bought its software businesses on an aggregate P/E of 3.

The table above shows organic growth rates within Constellation’s hundreds of businesses to be approximately 2%, indicating expansion has been driven almost entirely by acquisitions.

Software Circle’s acquisitions

Software Circle has emerged relatively late as a Constellation emulator.

The business used to be called Grafenia, a graphics and signage specialist, which itself used to be called printing.com, which printed promotional leaflets and posters.

Long story short, the graphics, signage and printing operations struggled and were sold during 2022. However, the group decided to keep its Nettl software, which serves small design studios, and become a serial acquirer of ‘vertical market’ software companies.

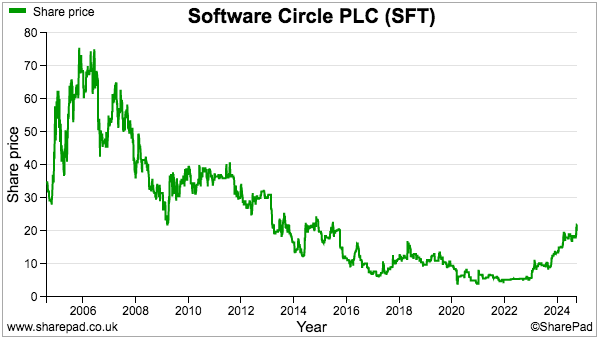

The market has warmed to the new strategy. The share price bottomed at 5p when the legacy operations were sold and has since rallied to 22p:

Software Circle employs the following buying criteria:

- Target is UK/Ireland based;

- Target has a clearly defined niche market;

- Majority of revenues are recurring in nature, a minimum of £500k per annum;

- Valuation multiple ➞ up to 7x (adjusted EBITDA);

- Logo churn < 10%;

- Customer concentration as % of recurring revenue is low, and;

- Number of customers > 30.

Similar to Constellation, Software Circle offers a permanent home for business vendors and generally won’t interfere with how acquisitions are run.

To date, seven purchases have been completed:

- Vertical Plus, a developer of stock-management software for online retailers, bought during September 2022 for up to £2.9 million;

- Watermark, a developer of document-management software for financial advisers, bought during December 2022 for £2.5 million;

- CareDocs, a developer of resident-management software for care homes, bought during January 2023 for £3.5 million;

- TopFloor, a developer of property-management software for landlords, bought during February 2023 for up to €6.2 million;

- Arc Technology, a developer of student-management software for universities, bought during February 2024 for up to £2.0 million;

- Bethebrand, a developer of marketing-workflow software for financial-services companies, bought during May 2024 for £3.5 million, and;

- Link Maker, a developer of adoption-management software for local authorities, bought during July 2024 for up to £4.5 million.

At the time of their respective purchases, Software Circle reported all seven enjoyed annual recurring fees of approximately 90% or more.

Returns on investment

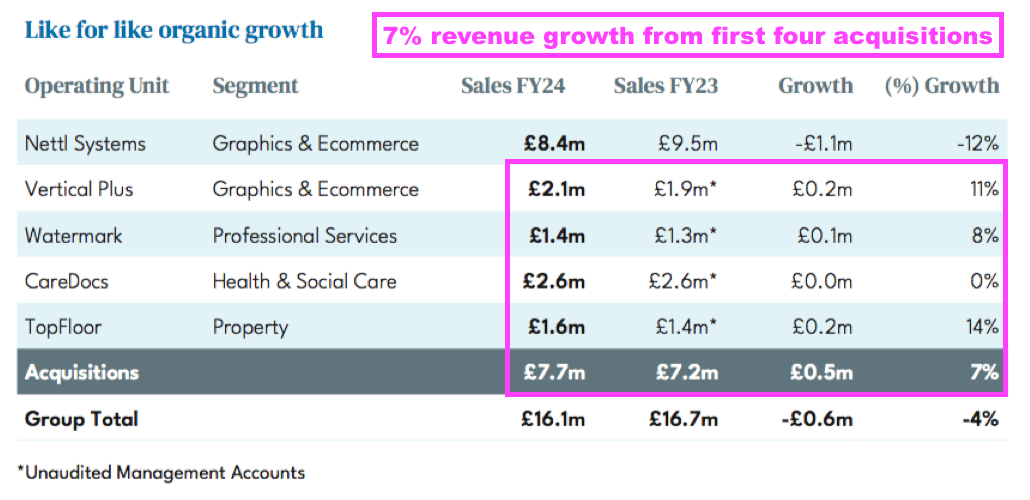

Annual results published during July suggested Software Circle’s first four purchases — Vertical Plus, Watermark, CareDocs and TopFloor — had performed as expected. Their collective revenue gained 7% to £7.7 million during their first full year of ownership:

The same results also noted the first four purchases reported an aggregate operating EBITDA margin of 33%, which translates into an aggregate operating EBITDA of £2.5 million.

The maximum payment for the first four purchases is approximately £14 million, and a £2.5 million operating EBITDA suggests a return of almost 18%…

…which implies Software Circle paid less than 6x EBITDA.

September’s AGM provided the first projection for the group’s latest three purchases: Arc Technology, Bethebrand and Link Maker.

This trio were said to be on course for annualised revenue of £4.2m and an operating EBITDA of £1.5m. Versus a total maximum payment of £10m, an operating EBITDA of £1.5m would give a 15% return.

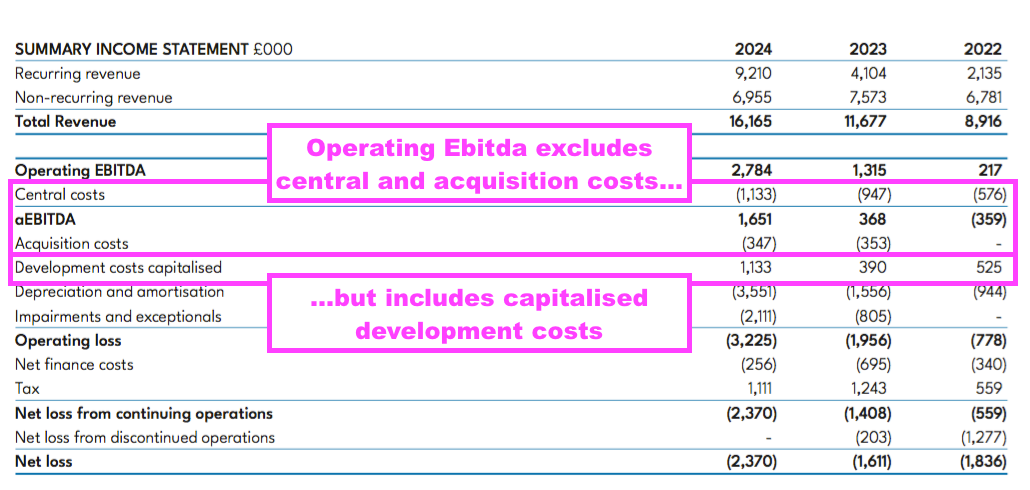

Software Circle’s early returns appear promising, although operating Ebitda does not capture every expense. The group helpfully summarises its different versions of profit:

Operating EBITDA excludes depreciation, amortisation, central costs, acquisition costs and exceptional costs… but importantly includes capitalised development costs.

Deprecation is nothing to worry about given actual cash capex last year was just £70k.

And given operating EBITDA includes development costs that are capitalised onto the balance sheet, the full amortisation charge against intangible assets can be ignored as well (as Mr Leonard once said: “We assume our intangible assets are not diminishing in economic value“).

However, last year’s central costs of £1.1m and acquisition costs of £0.3m can’t really be ignored when calculating returns on investment at a group level. At least all the exceptionals relate to the now-discontinued operations.

Away from the acquisitions, the retained Nettl software has been a poor performer of late. Sales last year fell 12% to £8.4m and the adjusted operating EBITDA was only £0.3m.

All told then, Software Circle’s accounts are not the easiest to interpret.

But for now, the seven acquisitions appear collectively sound, although central and acquisition costs must be considered when judging the group’s overall profitability.

Funding and future purchases

Software Circle’s early acquisitions were funded by bonds issued at steep discounts to par that paid 6% annual interest.

However, a £23m equity placing last year redeemed bonds worth £7 million and will one day redeem the remaining bonds worth another £7 million. Software Circle reckons it can take on debt with more suitable terms when the bonds all disappear.

Cash at the March year end was £15 million, with subsequent acquisitions and possible earn-outs leaving approximately £6 million free to spend on further deals.

September’s AGM claimed the group’s available funding could buy further acquisitions that could take annualised revenue to approximately £25 million and produce an adjusted EBITDA margin that approaches 20%.

I dare say the £85 million market cap is expecting much more than revenue of £25 million and the implied adjusted EBITDA of £5 million.

Adjusted EBITDA of £5 million plus an estimated £6m of surplus cash ought to fund the next three or so purchases, which given the group’s past activity may take another year to occur.

Beyond that, Software Circle will need to take on more debt and/or raise fresh equity to keep the acquisition momentum going beyond the £10 million deployed so far during 2024.

Boardroom

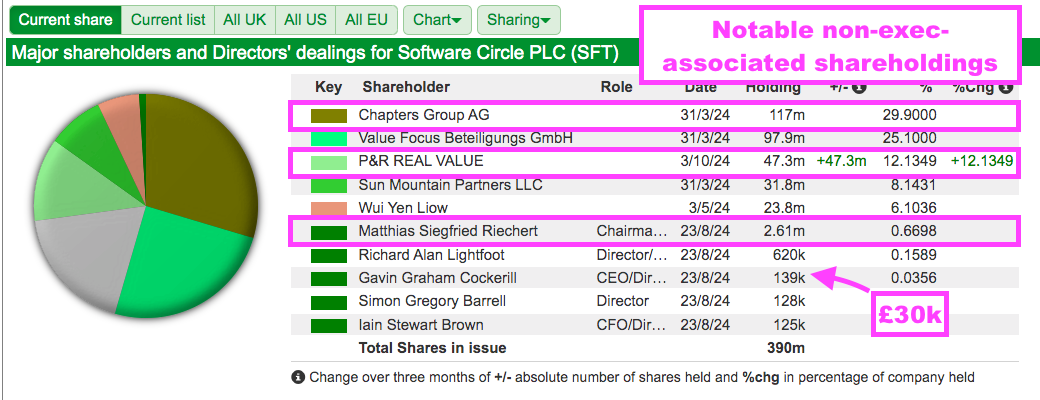

Software Circle employs an unusual board where the non-executives — rather than the executives — appear in charge.

The 2024 annual report talks of an investment committee — comprised mostly of non-execs — that provides “mentoring and leadership” to the executives:

“The Investment Committee provides quality control, mentoring and leadership to the Executive Directors in relation to acquisition opportunities. It is responsible for reviewing deal summaries and valuation models prepared by the Executive Directors and ensuring that investments fall within pre-determined ‘Guardrails'”

I get the impression the executives do the acquisition research work, and the non-execs then make the final purchase decision.

The chief executive is not entirely convincing. He joined the legacy printing.com business more than 20 years ago and his background appears more ‘Nettl operations’ than ‘software capital allocation’. His shareholding is valued at only £30k:

In contrast, the non-exec chairman Matthias Riechert owns shares worth £547k and is connected to the 12%/£10 million stake controlled by P&R REAL VALUE. His bio mentions attending “Columbia Business School where he specialised in value investing“.

Another non-exec is Marc Maurer, who is the chief operating officer of Chapters, the group’s 30%/£26 million shareholder.

Funnily enough, Mr Maurer’s bio says he “previously worked at Constellation Software“. Just so you know, Chapters is a €545 million German acquirer of ‘vertical market’ software businesses with a share price indicating some success:

Perhaps the standout non-exec is Brad Ormsby, who is the long-time finance director of Judges Scientific — the buy-and-build mega-bagger that focuses on specialist instrument manufacturers. Mr Ormsby ought to know a lot about successful M&A.

The question to ponder right now is whether Messrs Riechert, Maurer and Ormsby have the ‘Mark Leonard touch’ to take Software Circle to the big time. I would venture the trio offers a very relevant mix of investing, software and AIM expertise.

Verdict

Mark Leonard once said: “the barrier to starting a ‘conglomerate of vertical market software businesses’ is pretty much a cheque book and a telephone.”

Software Circle has a cheque book, a telephone and a short but so far promising record of acquiring respectable software firms.

If Constellation (and other ’emulators’) can acquire hundreds of small private businesses a year, then Software Circle ought to have more than enough opportunities to grow over time.

Diverging from the buying criteria, adopting inappropriate funding and/or introducing a bureaucratic structure seem the most likely risks from here. The accounts should become clearer over time, too.

The £85 million market cap is not an obvious bargain, but the confident rating is very understandable given the wealth Mr Leonard has created through pioneering his ‘vertical market’ strategy.

A Constellation-type 200-fold return seems extremely unlikely, but should Software Circle continually purchase respectable private companies at 6x Ebitda, its share-price recovery should not stop at the recent 22p.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Software Circle or Constellation Software.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.