The conventional wisdom that stocks deliver the best returns for investors is generally true, but only if you can ignore the wild ups and downs that come with them and stay invested. Phil looks at whether a popular and lower-risk approach to investing is worth considering at the moment.

Shares deliver the best returns if you can cope with the ups and downs of stock markets

There is bucketloads of evidence which confirms that investing in shares has been the best long-term strategy for wealth creation. This comes with a proviso that it only works if you can cope with the wild ups and downs – commonly known as volatility – that is part of the deal.

Volatility can play havoc with people’s emotions. Big gains in share prices make them feel good. Big losses on the other hand can cause them to panic, fearing further losses and to sell.

It is this fear factor – and the selling that it triggers – which explains why many private investors do not experience the long-term returns from stock markets that are shown in books and articles. Many would be happier and stay the course with an approach which gives them a smoother ride through the markets.

While the past is not always a good predictor of what will happen in the future, there is no doubt that shares have performed better than other investments over most time periods.

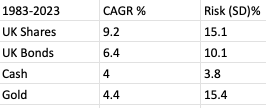

In the 40 years between 1983 and 2023, UK shares comfortably outperformed most other UK investments.

Source: Equity/Gilt Study, World Gold Council, SharePad, My calculations

However, in order to benefit from these superior returns, investors had to be able to cope with higher levels of volatility.

Volatility is not the same as the risk of losing money and is measured by calculating the standard deviation (SD) of returns. In simple terms, the standard deviation tells you how much something has bounced around its average value over time. The bigger the standard deviation, the bigger the volatility.

Some argue that lower volatility means a lower risk for investors. There is some sense in this, as the returns from bonds and cash savings accounts tend to be safer and are less volatile.

It is interesting to note that over the last 40 years, the price of gold has been more volatile than the prices of shares whilst delivering much lower returns. This suggests that it has not been a very good long-term investment.

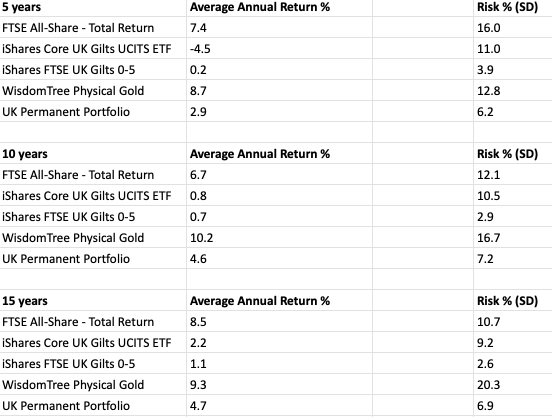

Over shorter time horizons, the results are more interesting. The emergence of exchange-traded funds (ETFs) has made it much easier for individual investors to gain exposure to different investment asset classes.

Source: SharePad, My calculations

What we can see is that for a UK investor, owning gold over the last 5, 10 and 15 years has been the best strategy for making money but that comes with higher levels of risk. Bonds and cash have been terrible.

Some investors don’t want to be exposed to high levels of volatility. This is particularly true if their investing time horizon is short and they don’t have the time to recover from downturns in the markets.

Others just don’t have the temperament to cope with the big ups and downs of having lots of money invested in shares and gold. This is why asset allocation investing strategies which spread money across different asset classes evolved.

These strategies range from very simple ones to highly sophisticated plans which can include asset classes such as property, commodities and private equity as well as shares, bonds and gold.

The most well-known strategy has been the 60/40 portfolio with 60 per cent invested in shares and the remainder in government bonds. Another simple strategy is something known as the permanent portfolio (PP).

What is the permanent portfolio?

After living through the terrible investment markets of the 1970s, US financial advisor Harry Browne set about devising a strategy that was intended to be simple, safe and stable. He wanted to put together a portfolio that could cope with most of the things that the world could throw at it – recessions, inflation, deflation – as well as making reasonable money when times were good.

What he came up with was a very simple portfolio which was invested in the following way:

- 25% in US stocks

- 25% in US Treasury bonds

- 25% in cash

- 25% in gold

Browne believed that investing in just these four assets would help most investors achieve their goals with a lot less worry. He reckoned that an event that damaged one part of the portfolio would be good for one or more of the other parts of it and limit the damage.

Also, because each investment only accounted for 25 per cent of the total portfolio, anything bad that happened to one part of it would not devastate the whole plan.

This portfolio became known as “the permanent portfolio”. Browne wrote about it in a book called “Fail-Safe Investing: Lifelong Financial Security in 30 Minutes”.

According to Browne, an investment in shares would provide good returns when an economy and company profits were growing. He argued that bonds also tend to do reasonably well when the economy is calm and growing steadily.

Recessions or periods of deflation (falling prices) were bad for shares but good for high-quality bonds and cash because the buying power of these investments increased.

Periods of high inflation, whilst being bad for bonds – and in some circumstances shares – were good for gold.

Not only was the portfolio simple in theory, but it was also simple to run too.

At the start of every year, the investor would start off with their portfolio spread equally across the four different investments. At the end of the year, the portfolio would be rebalanced back to equal weightings (25 per cent in each investment).

Annual rebalancing is the closest thing to a free lunch in investing. By doing this it means that you automatically sell a bit of the investments that have gone up and reinvest the money back into the ones that have done less well.

Rebalancing means that you are selling high and buying low whereas many investors do the exact opposite. Studies show that rebalancing is a good way to boost the returns of your portfolio whilst reducing risks at the same time.

This might not be a good idea if your investments are held outside tax-sheltered accounts – such as Sipps or Isas – where capital gains tax liabilities could be triggered by rebalancing. It also means that you can miss out on some of the gains in assets that continue to rise in price for many years.

How well has a Permanent Portfolio worked for UK investors?

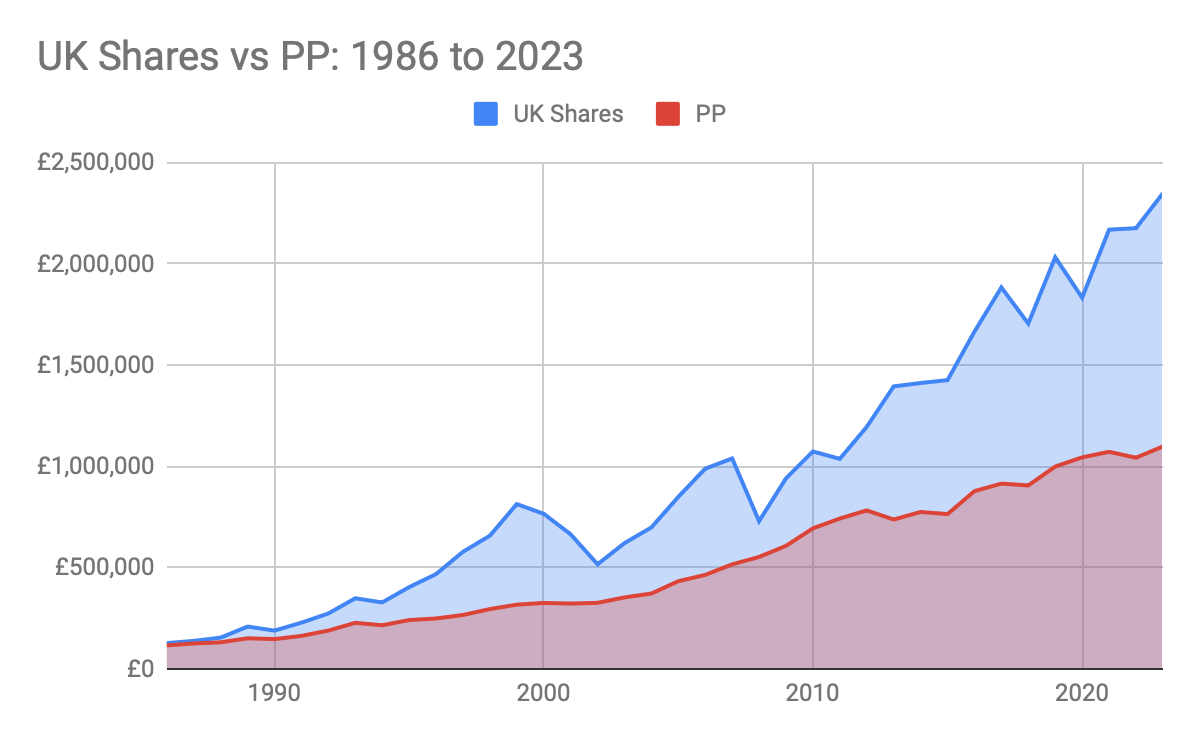

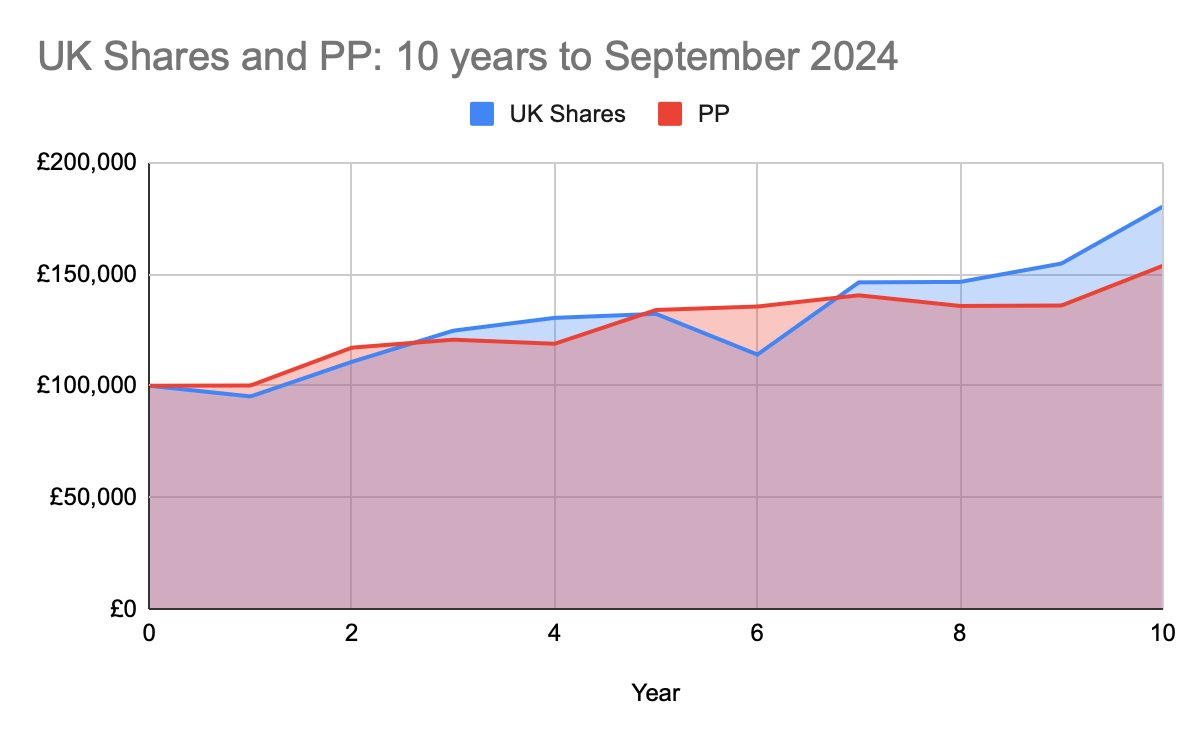

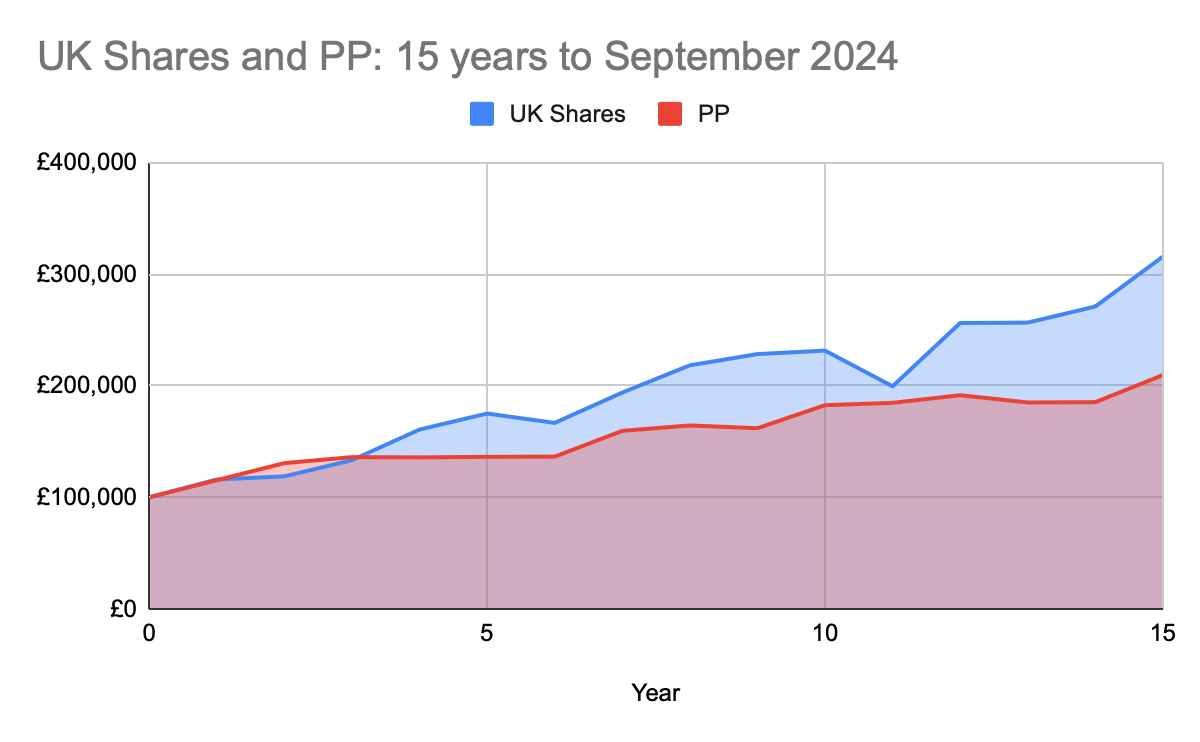

While an all-share portfolio has delivered very impressive results over the long haul, the PP approach has delivered quite respectable results.

Source: Equity/Gilt Study, World Gold Council, SharePad, My calculations

Between 1986 and 2023, investors would have turned an initial £100,000 investment into £2,348,292 with an all-share portfolio compared with £1,098,290 with a PP rebalanced annually.

The all-share portfolio delivered compound annual growth rates of 8.7 per cent but with a standard deviation of 15 per cent. It lost money in 9 years with the biggest annual loss of 29.8 per cent and the biggest annual gain of 35.5 per cent.

The PP had a compound annual growth rate of 6.5 per cent with a much lower standard deviation of 6.4 per cent. It lost money in 7 years but its biggest annual loss was only 5.8 per cent, while its biggest annual gain was 20.2 per cent.

The amount of money made has been much lower than an all-share portfolio but the much lower levels of volatility suggests that investors following this strategy may have found it easier to stick with than having their nerves tested by having all their money invested in shares.

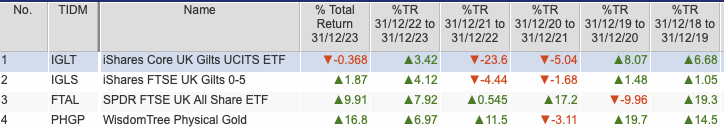

ETFs make it a very easy strategy to follow. An example PP portfolio could be put together with 25 per cent invested in the following ETFs:

- Shares – a FTSE All Share ETF such as SPDR All Share ETF (LSE:FTAL)

- Bonds – iShares Core UK Gilts UCITS ETF (LSE:IGLT)

- Cash – a savings account or short maturity gilts ETF such as iShares FTSE UK Gilts 0-5 (LSE:IGLS)

- Gold – WisdomTree Physical Gold (LSE:PHGP)

However, using these ETFs to follow a PP approach has not been that fruitful over the last 15 years.

Source: SharePad/My Calculations

Source: SharePad/My Calculations

Source: SharePad/My Calculations

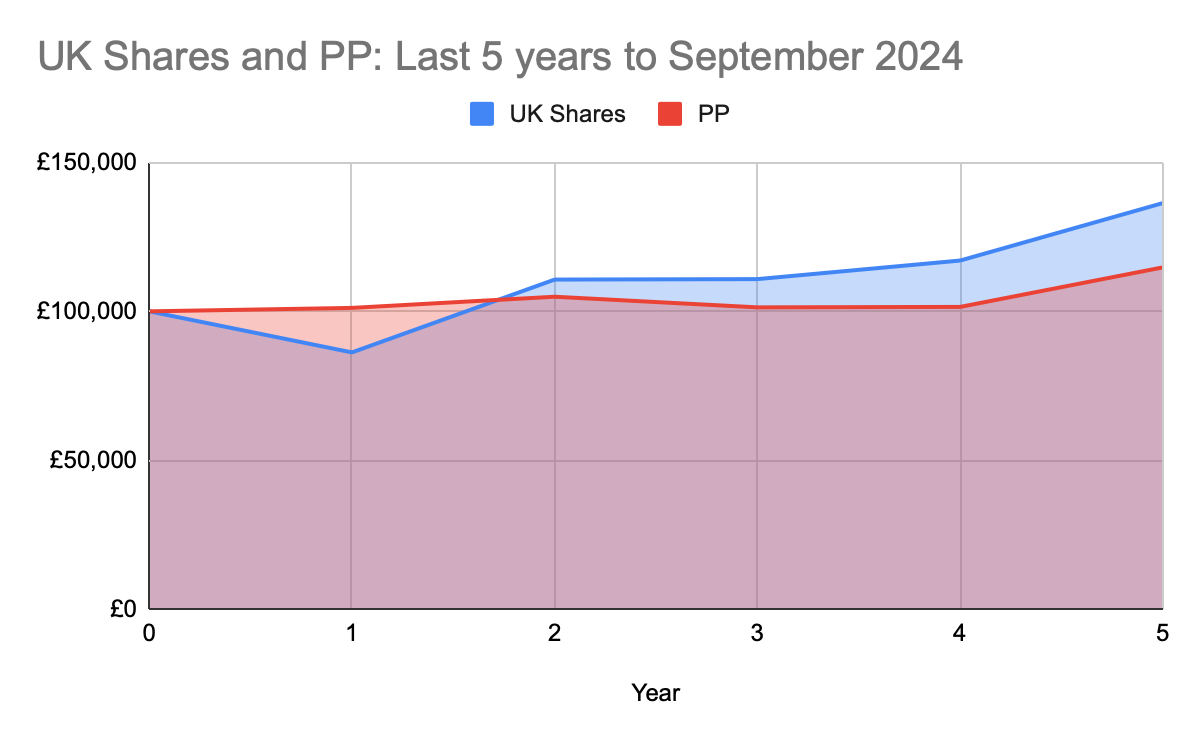

Over 5, 10 and 15 years an all-share portfolio has been the best strategy where the higher volatility has paid off.

The PP has suffered from the very low interest rates that were paid on cash savings accounts for most of this time and the terrible performance from UK government bonds.

Could better times be ahead for the Permanent portfolio?

Possibly.

Many savings accounts are paying interest rates of 4 per cent or more, and while UK government bonds continue to disappoint, strong returns from UK shares and gold have seen a permanent portfolio deliver a return of 7 per cent year to date compared with 9.9 per cent for a FTSE All Share ETF.

Source: SharePad

There is no guarantee that gold and shares will continue to move higher, but UK shares remain cheap relative to other stock markets while gold may find further support if US interest rates fall.

The buffer provided by cash interest rates on savings and the yields on government bonds – a 10-year UK government bond offers a yield to maturity of 3.95 per cent at the time of writing – is currently much better than it has been which suggests that a PP approach looks more appealing than it has done for some time – particularly for more risk-averse investors.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.