Richard examines fault after fault in businesses until he can find no more. If the faults should not cause permanent damage, the share is an investment candidate. Currently, Kainos is in the spotlight and Iomart and IG enter the pipeline.

I am compiling a list of all the companies with a few flaws in their financial track records that I have identified over the last six months.

It is the mother of all tables, but I’ve put it aside momentarily because I have received an email from a reader about the company at the top of the table. It is the latest company to achieve zero strikes after going through my preliminary fault-finding system, 5 Strikes.

That company is Kainos.

With no strikes and an August annual report, Kainos is at the top of my very long table!

King Kainos

A reader wrote to me after I reintroduced Kainos to my research list, and it has spurred me to seek some answers from the annual report.

My correspondent is a fan of the company and they’re mystified by the “pathetic” performance of the share price.

Our feelings about performance though, often depend on our perspective.

Here’s a three-year view:

And here’s the story so far (since Kainos listed in 2015):

My correspondent wondered why “the market doesn’t seem to like them [Kainos]”.

I have long given up on second-guessing the stock market. Its consensus is formed by countless trades mostly motivated by different factors from the ones that motivate me. Often they are informed by the short-term prospects of businesses.

Having established that Kainos’ track record stacks up (hence no strikes), I could only imagine the horrors I would investigate next: the things that worry me based on what I already know.

To build up enough confidence to buy shares in a business, I go from worry to worry until I can’t find any more and I am confident none of them should permanently damage the company. If the risks are manageable and the strategy addresses them, it is probably a good investment.

I don’t know Kainos very well, so I could only come up with three worries. There may be more. Investment research is often like pulling a thread.

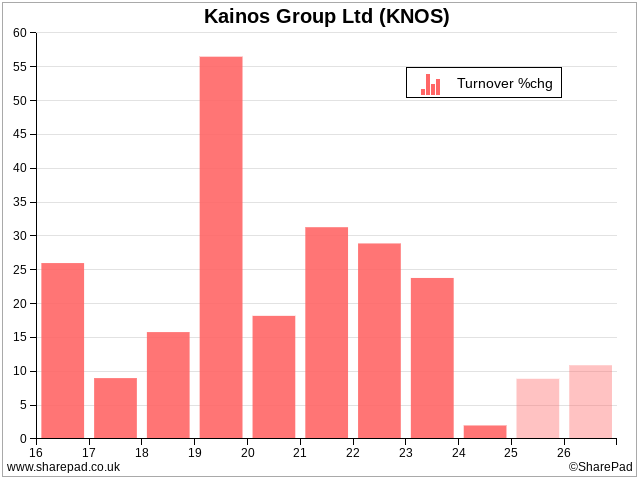

The first worry is growth. Kainos has been a reliable grower, but in the year to March 2024, it only grew turnover by 2%, which is uncharacteristically weak.

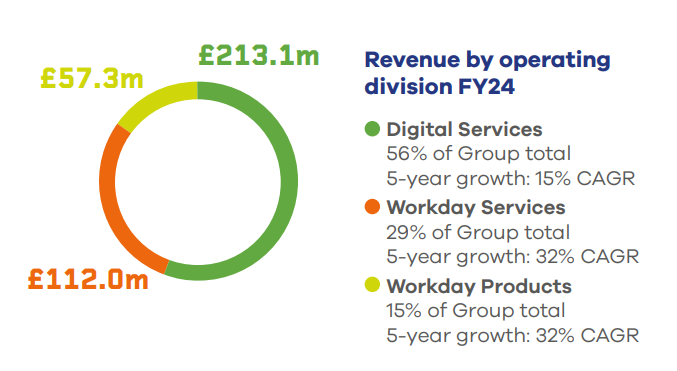

Kainos is a software company. It has three main revenue streams, Digital Services, Workday Services, and Workday Products.

It was the biggest of these, Digital Services, that dragged on turnover in the year to March 2024. Kainos has been instrumental in bringing public services online. In addition, it works for the healthcare sector (principally the NHS), and businesses.

Turnover in Digital Services declined 5% overall, but the smaller healthcare and commercial segments within it were responsible. Healthcare declined because the previous year’s turnover was inflated by pandemic-related spending (non-pandemic-related healthcare turnover grew 28%).

Commercial turnover declined because times were harder and customers invested less in their digital infrastructures.

Analysts are predicting a return to growth, although the rate of predicted growth is at the low end of what Kainos has achieved in the past. That’s probably because commercial turnover will take longer to recover than healthcare.

Worry number one does not look like a dealbreaker to me.

Kainos’ other two divisions relate to Workday, a cloud software platform headquartered in California. It does Enterprise Resource Planning (ERP). Organisations use it to manage their staff and finances.

Workday is the source of my second worry.

Workday Services is a consultancy that implements Workday. Having worked with Workday since 2011, Kainos says it is one of the most experienced practitioners with customers throughout Europe and North America including ASOS here in the UK.

Workday Products makes and sells software that works in the Workday ecosystem. Unlike much of the rest of Kainos’ business, which is ad hoc, products are a source of recurring revenue through subscriptions.

The first product, Smart Test, was launched in 2014. It tests customers’ Workday configurations. Further launches came in 2022, 2022, and the latest, an employee document management solution, in 2023.

Source: Kainos Annual Report 2024

I can see the attraction of Workday, it’s another revenue stream, it’s more international, and the product element is a more stable and scalable source of revenue (within the confines of Workday).

But it also introduces risk.

Long-term Kainos is dependent on the health of the Workday ecosystem.

Trouble could come from outside (competitors) or inside. A platform for other businesses must balance its own profit imperative against the needs of partners. The platform can see what works well and incorporate features innovated by companies like Kainos into the core product. It can also squeeze more money from its partners.

If it’s committed to its own ecosystem, Workday won’t do that, but it happens. Just look at how app makers rail against the fees levied by Apple and Google.

Worry two is not a dealbreaker either. It’s a reminder how competitive the software industry is. If we invest in Kainos, there are at least three of us in the relationship!

Incidentally, Kainos’ willingness to share information about the size of its markets and its competitors impressed me, as I glanced through its annual report:

Source: Kainos Annual Report 2024

Worry three is artificial intelligence.

Ironically, it is very difficult to say anything intelligent about artificial intelligence. I don’t know to what extent it is going to upend business models, but companies involved directly in making software and managing data will be the first to find out.

Kainos seems to be taking AI seriously. It has invested £10 million in generative AI. It has trained up staff and uses AI to speed up development. But AI solutions for clients remain largely experimental because their needs are complex and their data is just not good enough.

Perhaps Workday will show the way. Kainos has launched Spark & Grow, which uses Generative AI to simplify and automate the implementation of a Workday deployment. It says the service can reduce deployment time and effort by 80%, making Workday an option for smaller organisations.

Reassuringly, Kainos has introduced “unsafe use of AI” as a key risk in its risk report. It doesn’t want to get left behind, but it doesn’t want to cause damage either. A newly appointed chief AI officer is treading this fine line.

I believe they are a person.

Is AI a dealbreaker? Probably not. Although it would probably stop me going “all in” on an investment like Kainos because there is so much we don’t know, generally I think companies that have innovated in the past are most likely to benefit from disruptive technologies.

Newly struck!

Only five companies have published annual reports and made it past my Minimum Quality filter since my last update.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Iomart | IOM | 9/8/24 | – ROCE | 1 |

| IG | IGG | 13/8/24 | – Holdings – Growth | 2 |

| Begbies Traynor | BEG | 15/8/24 | ? CROCI ? Growth – ROCE – Shares | 3 |

| NWF | NWF | 13/8/24 | – Holdings – Growth – Debt | 3 |

| Halfords | HFD | 6/8/24 | ? Holdings – Debt ? Growth – ROCE – Shares | 4 |

Note on 5 Strikes: This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version.

Only two of the five achieved less than three strikes:

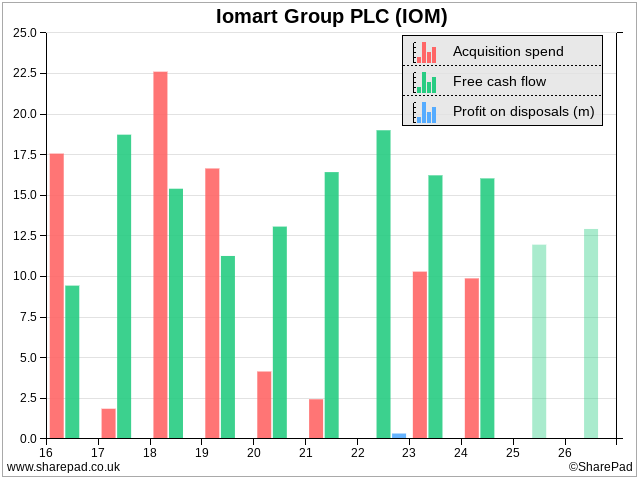

Iomart (- ROCE) supplies cloud computing to We Buy Any Car, Universal Music, The BBC, British Red Cross and other famous organisations. It runs software on Microsoft’s cloud computing platform, Azure, that helps these customers manage their data, communicate and collaborate.

Profit (EBIT) has been less than 10% of capital employed since 2020, which requires some explanation. It relates in part to sizable acquisition spending before and in 2019 (and more modest spending since then).

The amortisation of acquired intangible assets will be reducing profit, obscuring the underlying profitability of the company’s operations.

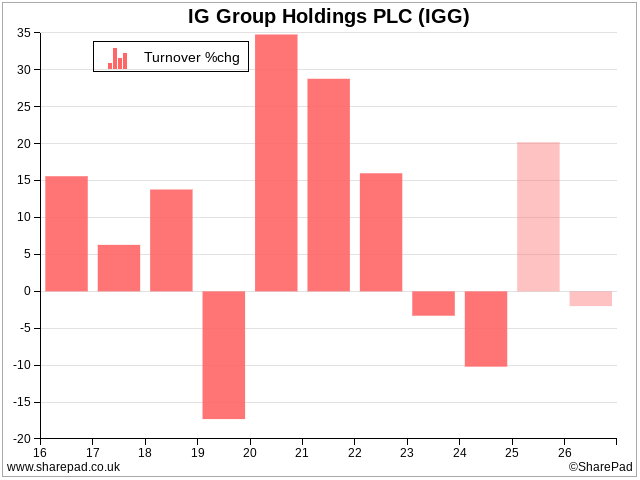

IG (- Holdings – Growth) will be well known to some readers, particularly those occupying a position closer to the short-term trader end of the trader/investor continuum than I do. It’s a leading spread betting and contracts for difference (CFD) trader.

The company’s finances are in pretty good shape, but although IG has grown revenue from £488 million in 2016 to £852 million in the year to 2024, it has contracted in three of the last eight years including the year to May 2024.

This appears to be an occupational hazard. Traders are excited by volatile share prices, and when the market is behaving it makes less money.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.