The market has become very unhappy with buy-and-hold investor Nick Train. Maynard Paton studies Lindsell Train Investment Trust and reckons Mr Train’s fund-management business could now be valued on a P/E of less than 2.

Could now be the time to back Nick Train?

The buy-and-hold fund manager was for years feted for selecting blue-chip multi-baggers such as Diageo, RELX and London Stock Exchange.

But recent times have witnessed a stark change to market conditions…

…and Mr Train admitted to a “mortifying” underperformance that even necessitated a public apology.

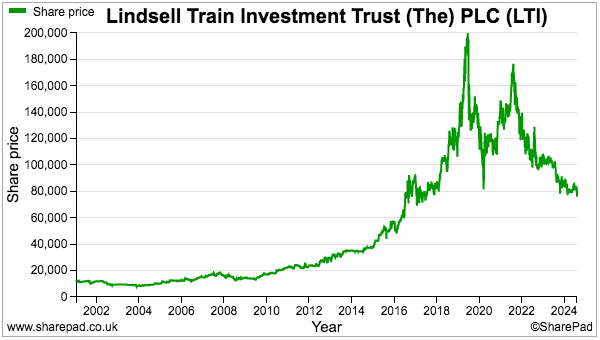

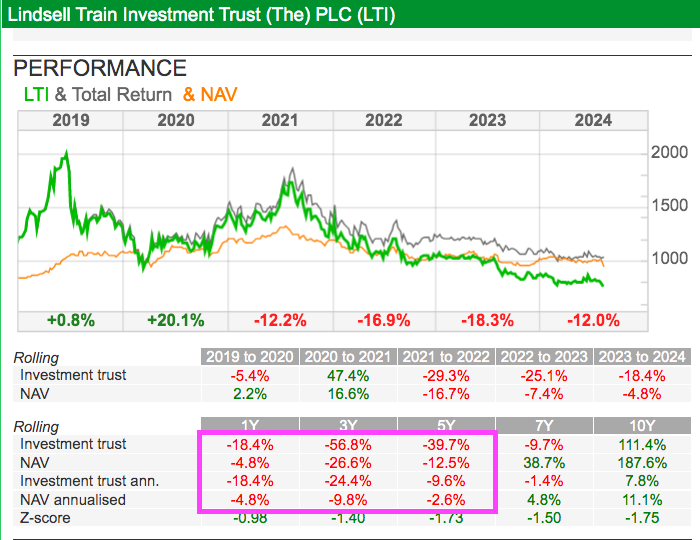

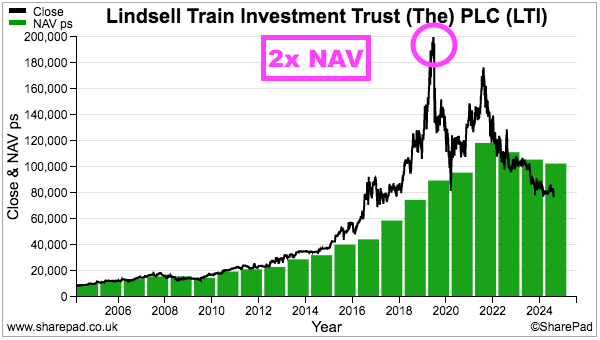

The shares of Lindsell Train Investment Trust, an investment trust managed by Mr Train, have for example lost 60% from their 2019 peak and are now back to a level first achieved eight years ago:

But Mr Train’s supporters may now want to consider this £154 million trust as a way of profiting from his potential comeback.

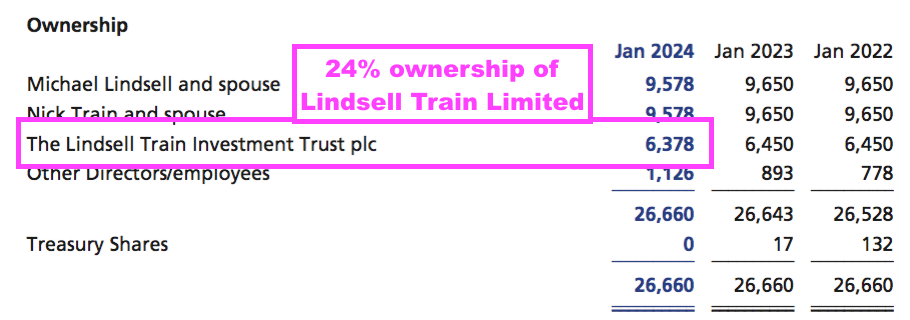

Importantly, this trust owns 24% of Mr Train’s fund-management firm, which last year paid a £39 million dividend split between Mr Train, his colleagues and this trust…

…and yet this 24% stake appears valued by the stock market at less than 2x earnings.

Let’s take a closer look.

Introducing the Lindsell Train Investment Trust

Nick Train explained within Lindsell Train’s first annual report how he and co-founder Michael Lindsell searched for “preferably immortal” companies to buy and hold:

“Our focus is primarily on companies possessed of durable, preferably immortal, business franchises. We like these franchises to be growing, although current rates of growth are not as important to us as confidence in the long-term sustainability of returns on equity.

In our view, low growth, but secure franchises will pay us attractive dividends and may deliver capital gain… while secure franchises, which are growing to boot, should deliver exceptional returns, as their real rate of growth accelerates and real returns on equity rise.”

The strategy has worked well since the trust was launched during January 2001.

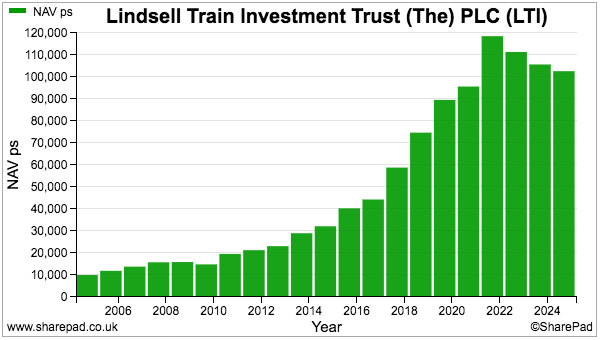

Net asset value has surged from £100 to more than £1,000 per share…

…while the share price had rallied 20-fold to £2,000 by 2019 before tumbling to £770 during the last few years.

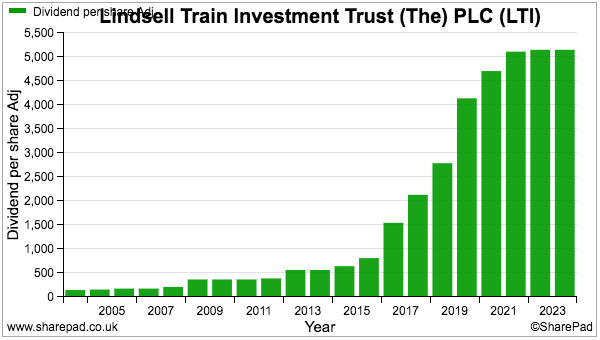

Dividends have been paid since 2003, with the initial 130p payout subsequently advancing to a bumper £51.50 per

share:

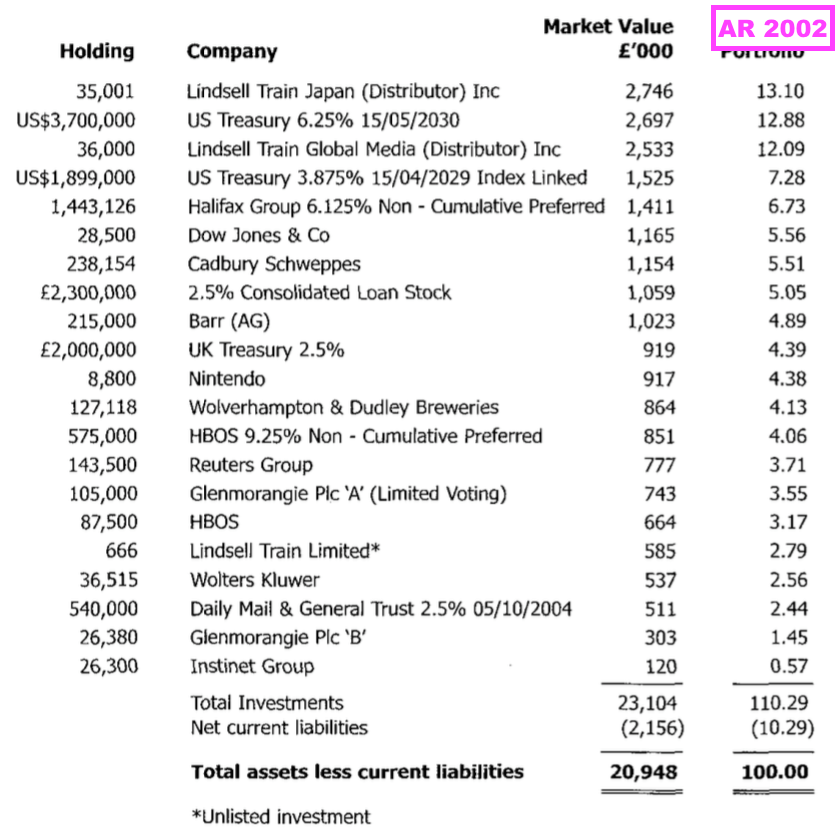

The trust’s portfolio has changed somewhat since that first annual report. Notable initial holdings included various gilts and bonds…

…and eventual M&A targets such as Cadbury Schweppes, HBOS Glenmorangie and Wolverhampton & Dudley Breweries.

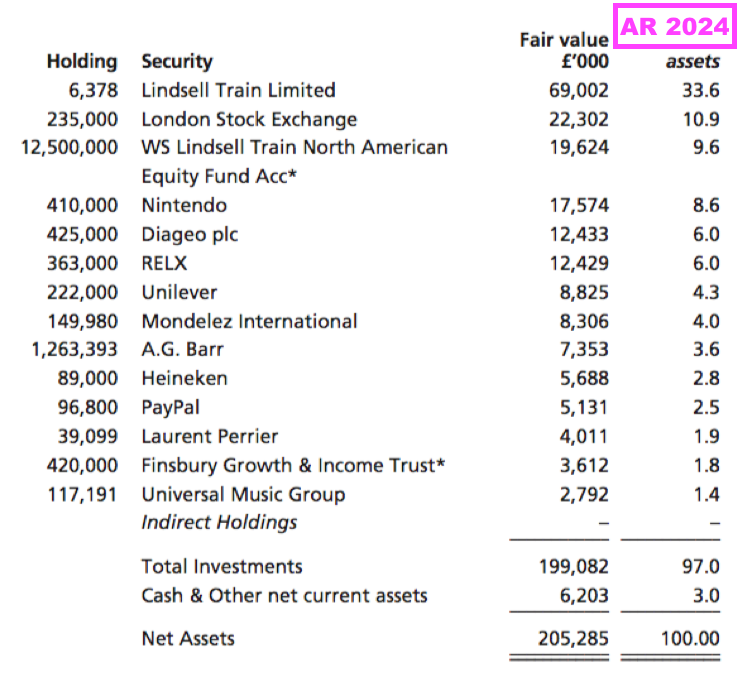

The trust’s 2024 portfolio meanwhile carries no fixed-income investments and a greater range of blue chips:

Evidence of Mr Train’s buy-and-hold philosophy is supported by Nintendo and AG Barr being held every year since the trust’s inception.

Following the trust’s first annual report, the carrying value of the Japanese console specialist has increased from £10 to £43 per share while the carrying value of the Scottish drinks group has increased from 159p to 582p per share.

Notable additions to the portfolio thereafter include the following multi-baggers:

- Diageo: introduced during 2002/3 at 650p, now £29;

- RELX: introduced during 2003/4 at 481p, now £34;

- Heineken: introduced during 2005/6 at £20, now £64;

- London Stock Exchange: introduced during 2008/9 at 561p, now £95, and;

- Unilever: introduced during 2008/9 at £13, now £40.

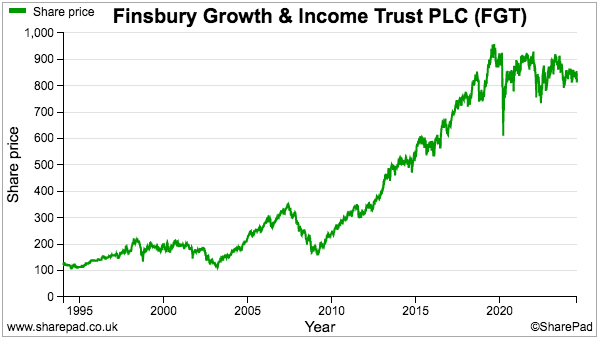

Another multi-bagger holding is Finsbury Growth & Income, which is another investment trust run by Mr Train and managed using the same buy-and-hold approach as this Lindsell Train trust:

Finsbury first became part of this trust during 2004/5 at 235p a share and was valued in the 2024 accounts at 860p a share.

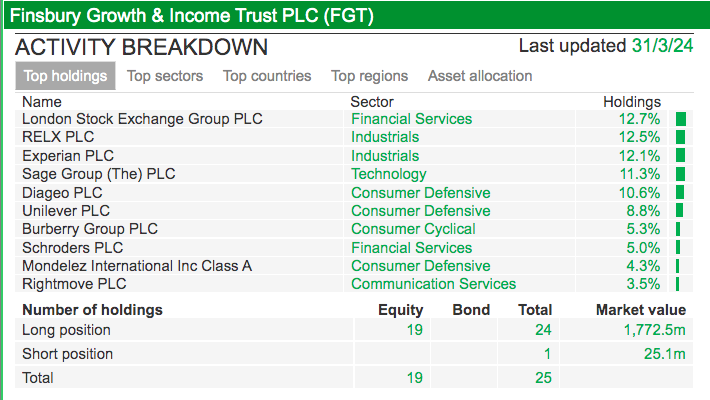

Finsbury gives Lindsell Train shareholders extra exposure to the likes of RELX, London Stock Exchange and Diageo, as well as a small exposure to shares such as Experian, Sage and Schroders:

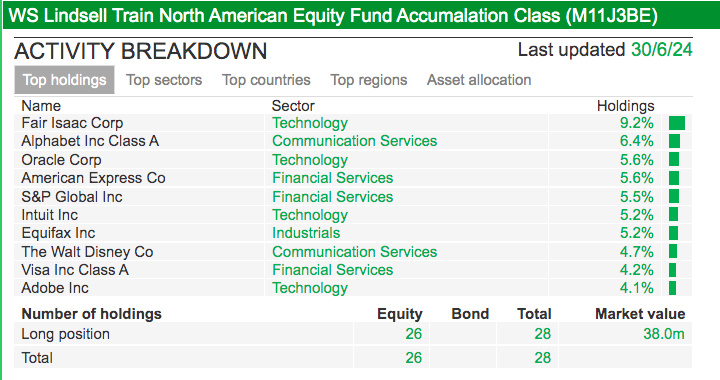

This Lindsell Train trust also enjoys exposure to a number of high-profile US stocks through a holding in a Lindsell Train-managed North American fund:

However, Lindsell Train’s largest holding — and what really differentiates this trust from the rest of the sector — is the Lindsell Train fund-management business.

The trust owns 24% of Lindsell Train Limited…

…which means shareholders of the trust collect 24% of the profits that accrue to Mr Train and his colleagues for managing this trust and more than £15 billion held within other funds.

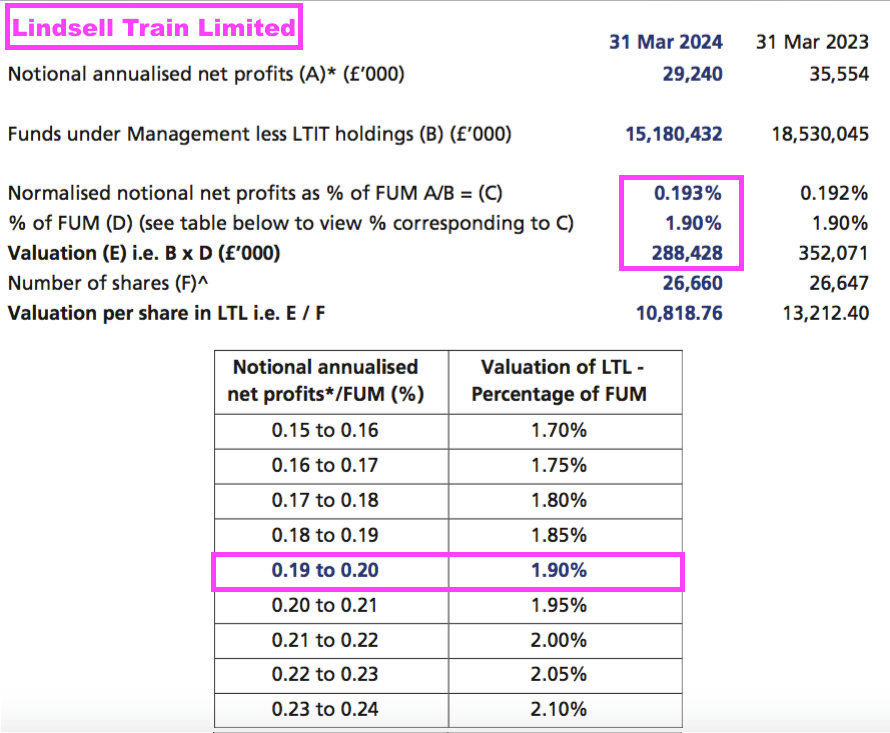

Lindsell Train Limited was valued within the trust’s 2024 annual report at £288 million and the 24% stake was therefore worth £69 million — equivalent to more than 30% of the trust’s net asset value.

To put that £69 million into perspective, the 2024 report showed the trust’s stakes in multi-baggers Diageo, RELX, Heineken, London Stock Exchange and Unilever at a combined £62 million.

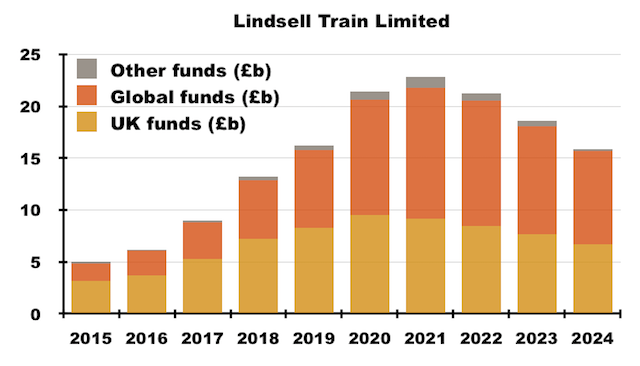

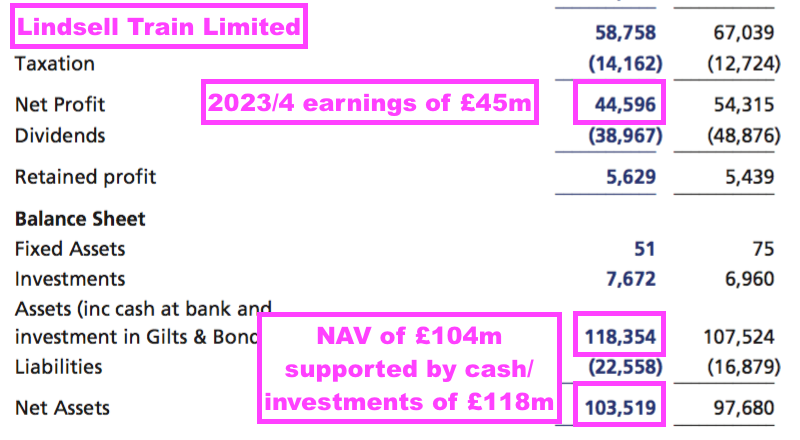

Lindsell Train Limited

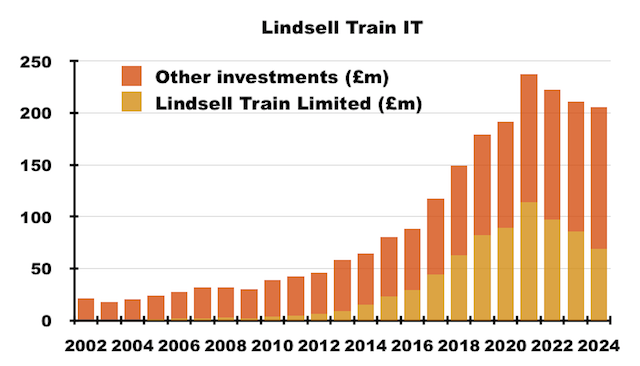

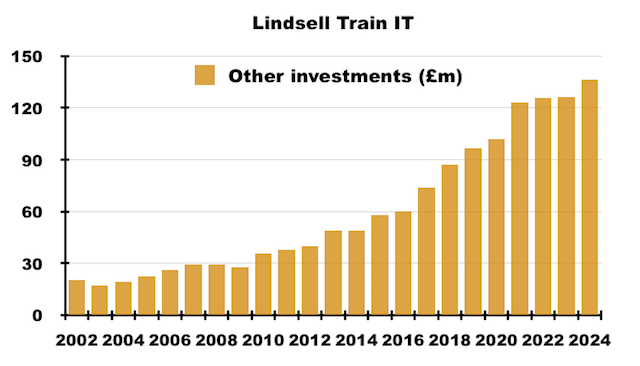

My chart below shows how Lindsell Train Limited has grown to become a much larger proportion of the trust’s net asset value:

Lindsell Train Limited is a private company and therefore its valuation within this trust is supported by estimates. The methodology has changed over time, but for the last few years has been based upon comparing ‘notional’ earnings to funds under management that in turn leads to a valuation based upon a corresponding percentage of funds under management:

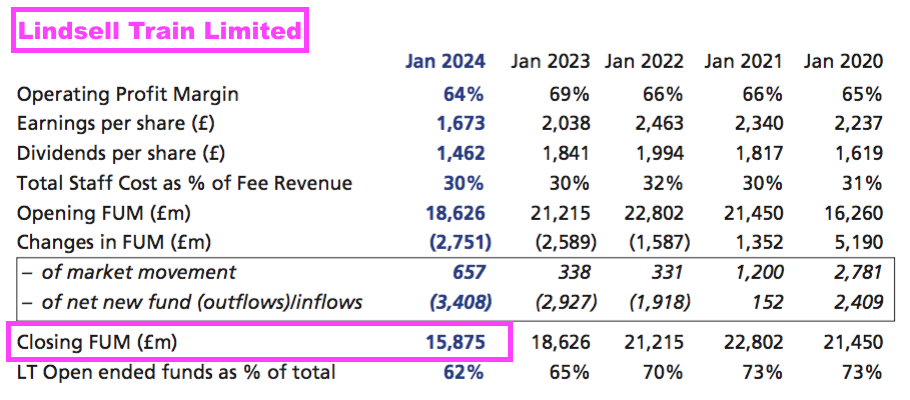

The surging value of Lindsell Train Limited has been driven by the asset manager capturing greater funds under management.

As well as this Lindsell Train trust, the Finsbury trust and that North American fund, Lindsell Train Limited manage a large UK fund and a large Global fund for both retail and institutional investors:

At the last count, total funds under management for Lindsell Train Limited was almost £16 billion…

…versus £5 billion during 2015:

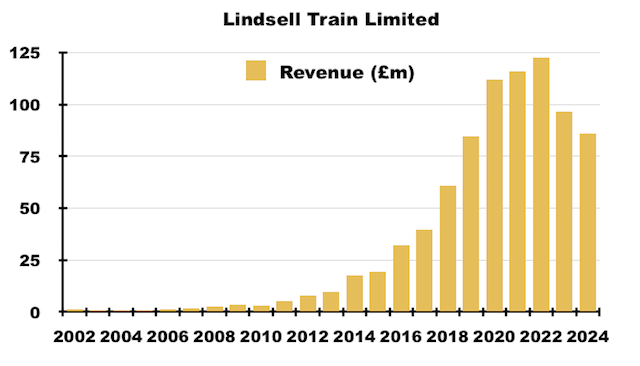

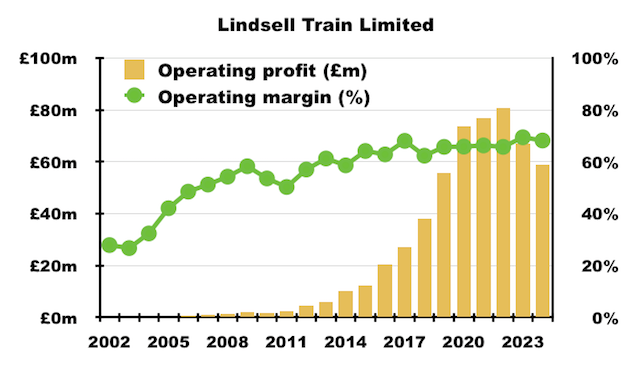

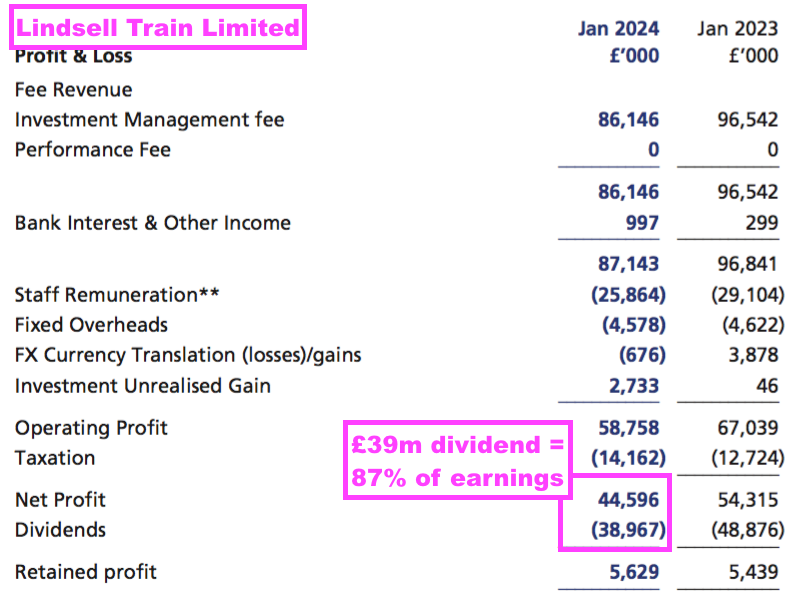

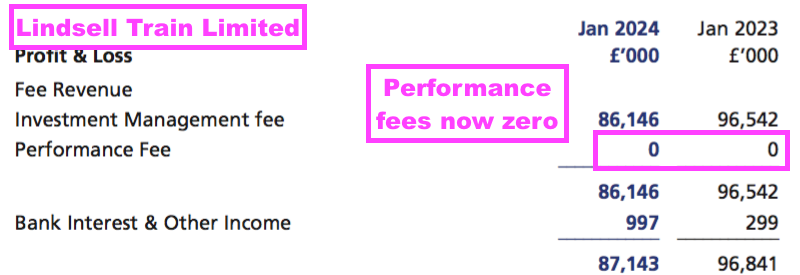

Greater funds under management have propelled Lindsell Train Limited’s revenue to £86 million…

…and operating profit to £59 million:

Lindsell Train Limited has been a very lucrative business for Mr Train and his colleagues… and this trust! An operating margin persistently beyond 60% leaves a lot of profit to collect as dividends:

Last year Lindsell Train Limited distributed £39 million — or 87% of its earnings — as a dividend. Of that £39 million, approximately £9m went to this trust to represent a mighty 80% of all dividends received:

“In the year to 31 March 2024, Lindsell Train Limited’s dividend accounted for 80% of the Company’s revenues, down slightly from 84% a year earlier. Such a significant dependence on Lindsell Train Limited, much more than the 33.6% (2023: 40.3%) which it makes up of the Company’s NAV, means that it has an overwhelming influence on the Company’s dividend paying potential.”

Underperformance

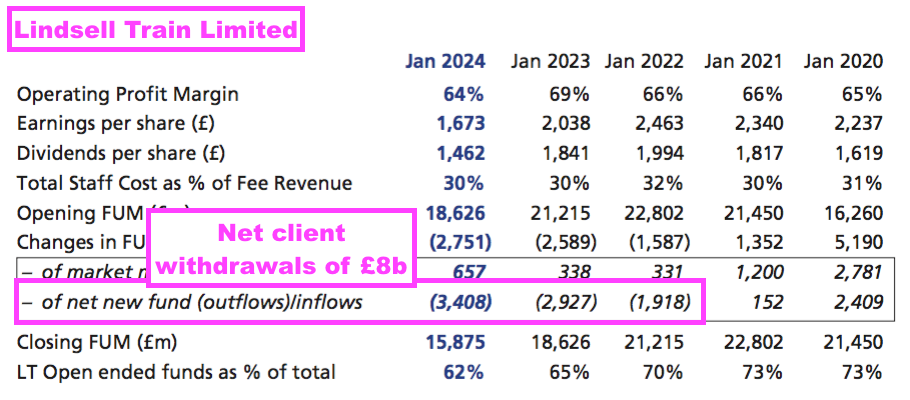

Investors have withdrawn a net £8 billion from Lindsell Train Limited’s stable of funds since 2021/22:

The withdrawals probably boil down to three reasons:

- The greater appeal of cash savings versus equities with the base rate now at 5%;

- The greater appeal of low-cost index trackers versus Lindsell Train Limited charging annual fund fees of up to 0.6%, and;

- The funds of Lindsell Train Limited trailing their associated benchmarks.

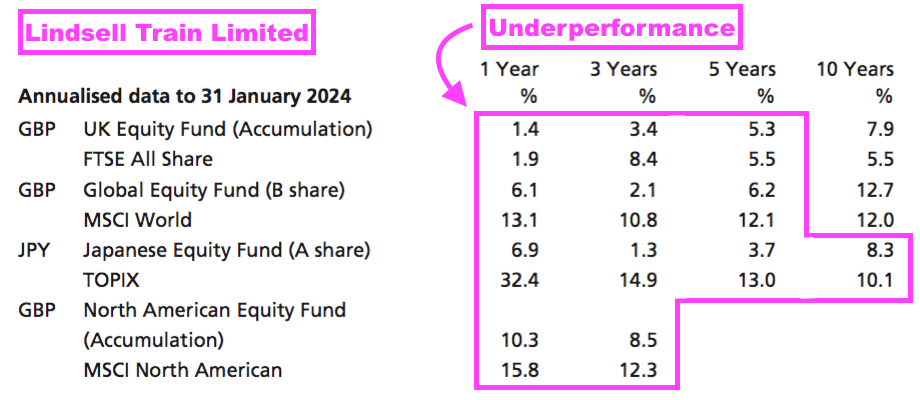

The relative performances of Lindsell Train Limited’s four geographic strategies make for very uncomfortable reading:

Everything has underperformed during the last one, three and five years, and only two strategies have outperformed on a 10-year view.

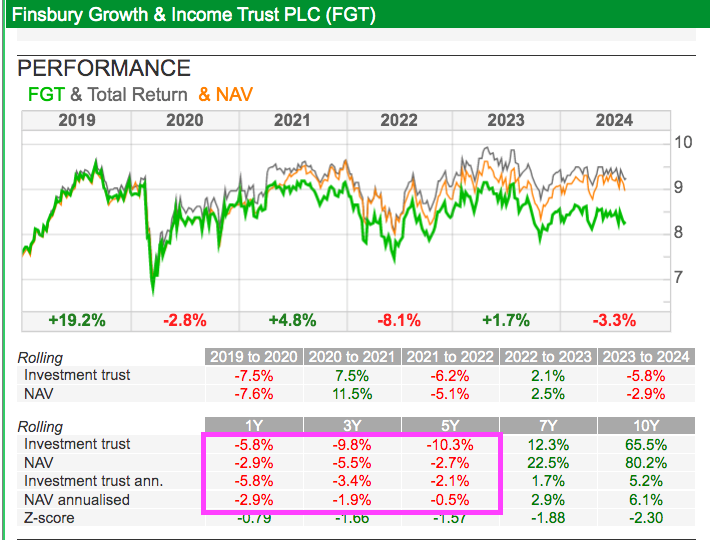

Just so you know, this trust and the Finsbury trust both show lots of discouraging red within SharePad:

Not helping Mr Train of late has been his lack of exposure to:

- ‘Old economy’ banking and resources shares within the FTSE, and;

- The ‘magnificent seven‘ US technology names.

Performance fees for Lindsell Train Limited, which were once collected regularly and had reached a £8 million a year, have in turn reduced to zero:

Mind you, exclude Lindsell Train Limited from the trust’s NAV record, and those other investments — Diageo, RELX, Unilever, and so on — have advanced close to 40% during the last five years:

Nonetheless, these other investments have advanced only 11% during the last three years versus the FTSE 100 gaining 19% and the MSCI World gaining 36%.

Valuation of Lindsell Train Limited

Lindsell Train’s shares spiking to £2,000 is worth revisiting…

… and is perhaps relevant to a potential investment today.

The trust’s then chairman explained why he thought the shares peaked at twice net asset value:

“We suspect that the main reason for the elevated premium is the belief on the part of some shareholders that the Board’s valuation of Lindsell Train Limited is too conservative.”

The board’s valuation of its 24% Lindsell Train Limited holding was at the time almost £90 million.

However, the £2,000 top supported a £400 million market cap for the trust and, with the other investments then carried at a £100 million book value, implied the 24% stake in Lindsell Train Limited was in fact worth £300 million…

…which in turn implied all of Lindsell Train Limited was worth £1.2 billion and approximately 20x the fund manager’s then £60 million earnings.

Fast forward to today, and the £770 share price supports a £154 million market cap for the trust and, with the other investments carried at a £136 million book value, implies the 24% stake in Lindsell Train Limited could be worth as little as £18 million…

…which in turn implies all of Lindsell Train Limited might be worth just £75 million and less than 2x the fund manager’s recent £45 million earnings:

Note that Lindsell Train Limited’s balance sheet is loaded with cash and investments that last sported a £104 million net asset value — which more than covers that £75 million estimate.

True, Lindsell Train Limited has suffered significant client withdrawals as its buy-and-hold strategies have lagged popular indices. A few years of outperformance will now be required before any substantial client money returns.

What’s more, Mr Train and co-founder Mr Lindsell are both in their mid-60s and only time will tell whether their colleagues will be able to replicate the multi-bagger selections from 15-20 years ago.

And on that workforce point, future profitability at Lindsell Train Limited is likely to be hampered by greater employee costs; the trust has for some years assumed the fund manager’s 60%-plus margin will reduce to 55%.

But even with those drawbacks, the stock market effectively valuing Lindsell Train Limited at less than its cash/investment value seems extremely harsh to me.

Discount, yield and verdict

The dissatisfaction with the trust’s recent performance has left the shares trading at 22% below net asset value — a discount wider than the level witnessed during the 2008/9 banking crash and the 2020 pandemic crash:

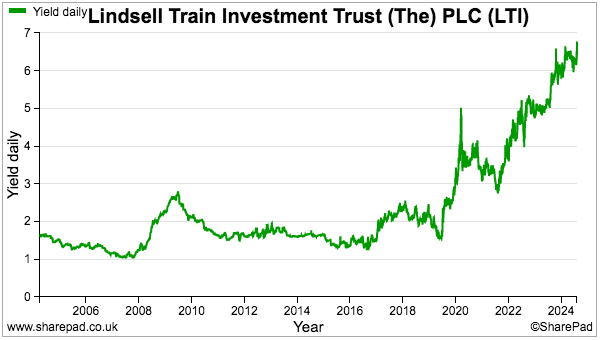

However shareholders keeping the faith are currently rewarded by the aforementioned hefty dividend generated by Lindsell Train Limited. The trust’s yield tops 6%…

…which may support my assertion that Lindsell Train Limited is priced too low by the stock market.

How this trust will perform may actually depend on the likes of Diageo, RELX, Unilever and so on. If these other investments perform well, client money should eventually return to Lindsell Train Limited and the trust could then enjoy a ‘triple whammy’ of:

- The value of the other investments continues to increase;

- The earnings and value of Lindsell Train Limited recovering (possibly very strongly), and;

- The share-price discount narrowed from 22%.

Mr Train and his colleagues continue to manage client investments of more than £15 billion, which suggests many investors believe Mr Train:

- Remains a superior long-term investor;

- Is undergoing only a temporary bad patch, and;

- Will sooner or later return to form.

If that really is the case, then surely Lindsell Train Limited is extremely undervalued by the stock market…

…and Lindsell Train’s shares are therefore undervalued at £770.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Lindsell Train Investment Trust.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.