With global stock markets in bullish form and the all-important US benchmark, the S&P 500, threatening to crash past the psychologically important 5500 level, our monthly fund’s report spins through some left-field ideas for bears and bulls from the world of ETFs and investment trusts. We look at everything from strategies that benefit from sudden volatility spikes to betting against the relentless surge in Nvidia’s share price. We finish with a more cautious approach – investing in businesses benefitting from increased defence spending.

A strange image for a strange market

An adventurous romp through leftfield ideas for a strange market

I’ve been writing about markets for decades, and I’d say there are two sensible ideas for investing in funds. The first is to stop worrying, go with the flow, and play the ups and downs of the market cheaply and effectively via a well-run investment trust or ETF. Don’t try any of this market timing stuff, as you’ll usually get it wrong. Call this the consensus trade.

The second, much riskier strategy is what I call the anti-consensus trade. Every once in a while, – and less often than you think – the market makes a colossal mistake and gets it wrong. When that consensus cracks, the bears run rampant, and big profits can be made. The problem with this latter approach is that, in effect, you are market timing, and as I said already, this is usually a profitless trade.

But with the US market now romping ahead and the all-important 5500 barriers under daily threat, minds are turning to what I would call the anti-consensus trade. To be clear, the consensus trade is that AI is changing everything, corporates are crowding into AI capex spending, the US economy is slowing down a bit but is still on fire, and we’ll avoid a recession in the US. Call it the soft-landing scenario. What accompanies this consensus trade is cautious but bullish enthusiasm and low levels of market volatility.

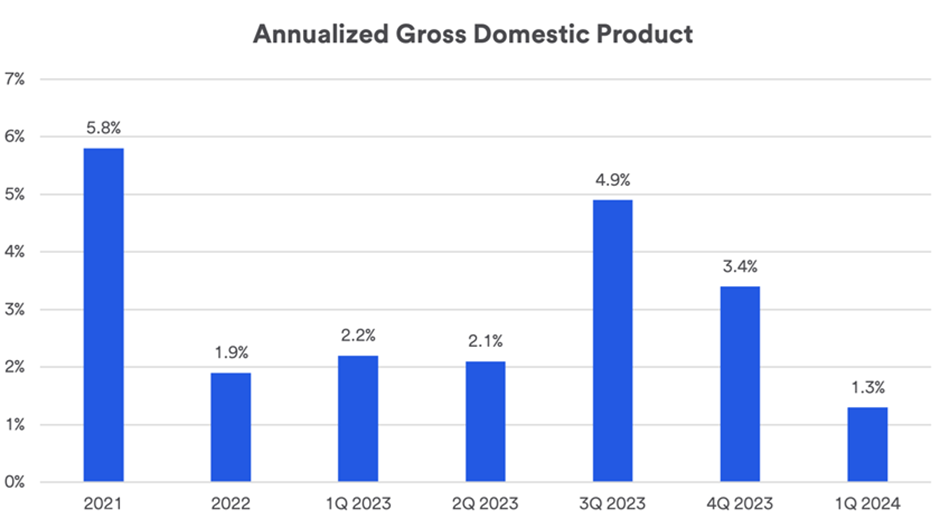

The anti-consensus trade starts with one point from the list above: the economy is slowing down because interest rates are still high. A useful summary of this ‘slow down’ narrative comes from analysts at US Bank, which points out that the US economy is still growing but less fast than it was.

“ The U.S. economy is still growing. Following up 2023’s 2.5% Gross Domestic Product (GDP) growth rate, which included a particularly strong second half of the year, the latest read of first quarter 2024 economic expansion measured 1.3% on an annualized basis.1 While that represents a modestly slower pace than recent quarters, it continues to show an expanding economy despite an environment of higher interest rates and persistently sticky inflation.

“When you have economic growth at a pace under 2%, that can be considered ‘stall speed,’” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “But we’re still seeing solid consumer activity, which has been the most important factor driving the economy to this point.” According to the U.S. Bureau of Economic Analysis (BEA), first quarter consumer spending on goods declined while consumer spending on services grew. However, overall consumer spending growth was slower than in 2023’s fourth quarter. The largest services spending increases occurred in the healthcare, financial services and insurance categories.1

First quarter 2024 economic growth was tempered by decreased federal government spending, declining inventory investment in the wholesale trade and manufacturing sectors, and rising imports, which detract from GDP.

CHART – US GDP growth

Source: U.S. Bureau of Economic Analysis, “Real Gross Domestic Product and Related Measures: Percent Change from Preceding Period,” May 30, 2024.

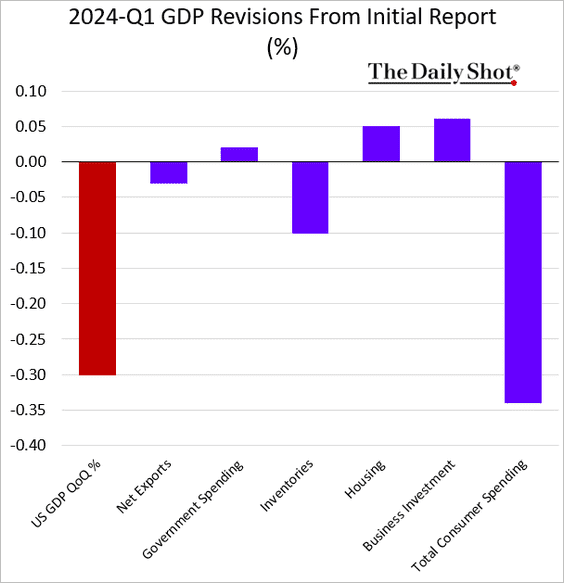

The second chart below fleshes out this slowdown argument. It’s from the excellent Daily Shot website and shows how downward GDP revisions are coming in thick and fast!

CHART – US GDP revisions

At some point, though, the slowdown could turn nasty.

Cue the bear’s argument – the market underestimates a recession’s likelihood. And recessions usually come with a quick, ugly market correction. As usual, one of the most articulate exponents of this bearish point of view is the French investment bank SocGen strategist and perma-bear, Albert Edwards:

‘Proper’ equity bear markets (falls of 30%+) only really occur in recessions and so that is what equity investors fear most – especially against expectations of continued economic recovery. Yes, the US authorities have proved adept at avoiding an archetypal macro triggered recession since the 2008 Global Financial Crisis (GFC), pursuing either easy money (post-GFC) or extreme fiscal expansion (last year). But is investors’ luck about to run out? Even if Armageddon looms, I guarantee the investment air will be filled with the sound of the bulls singing their soft-landing siren songs. And beyond that, I can also guarantee you will hear that any recession will be shallow as the Fed have ample firepower to slash rates… just as they always did in past recessions although that never prevented a collapse in the equity market.”

For the record, I’m not convinced by the bear’s argument, though I think it has some merit. It seems evident to me that there are very real dangers with keeping interest rates above 5% for sustained periods of time where there are huge amounts of outstanding debt, with commercial real estate debt deals rolling over like crazy and smashing into liquidity squeezes and where the poorest 50% of US society are now struggling with increasing credit card delinquencies and car loan defaults. I also think it would be easy for the AI enthusiasm to turn manic and bubble-like. My own position is that I’d be dialling down risk, taking some profits and watching carefully.

However, the anti-consensus trade is perfectly rational; if it’s right, it could yield big profits. One element of the trade would be that volatility levels, as measured by the Vix index, are currently at very low levels. For long periods of time, this closely watched index has stayed anchored below the 15-point level, whereas the long-term average for the index is around 20. Spikes have and do happen, and it would not take much for a sustained spike in volatility if the equity bulls were to be disappointed. Outside of spread betting, it’s tricky to play the Vix cycle here in the UK, but there are some very exotic instruments available for the speculator, although all need to be treated with considerable caution!

For example, there’s an exchange-traded product (not an ETF) called the Wisdom Tree S&P 500 Short Term futures 2.25x daily leveraged ticker VILX for the sterling class, which is down a colossal 90% this year. This will amplify the daily returns by 2.25 times on the Vix, with investors making money on the downside. This is a ghastly trade for anything longer than a few weeks, but if we see a spike in volatility, this could benefit and bounce back aggressively.

Another leveraged tracker product worth keeping a close eye on in an anti-consensus market is also from Wisdom Tree and is called the WisdomTree US Treasuries 10Y 3x Daily Leveraged tracker, with a ticker 3TYL. In a big sell-off, investors will probably flee equities for the safety of longer-dated US Treasuries, calculating that a bear attack might prompt the US Federal Reserve to lower interest rates. In effect, this would crash the whole Higher for Longer interest rate narrative. The Wisdom Tree product would amplify – leverage up – the underlying daily returns from this asset class. A more plain vanilla alternative, with no leverage, comes in the shape of a conventional exchange-traded fund – index tracker – from iShares called the iShares USD Treasury Bond 20+yr UCITS ETF USD (Acc), with an ISIN of IE00BFM6TC58 and a ticker of DTLA. This $2 billion index tracking fund (an ETF) has a total expense ratio of 0.07%.

Another anti-consensus trade would be to short the dollar – US interest rates would start falling – and go long the Japanese yen, the classic safe haven asset (after the US dollar, that is). Back at Wisdom Tree, there’s a product called the WisdomTree Long JPY Short USD 3x Daily leveraged tracker, ticker LJP3. This would amplify or gear up any Yen appreciation in this scenario. For the record, this has been an absolutely terrible product for the last year, so you’d need nerves of steel to make this trade.

The core idea in an anti-consensus trade is that risk would increase, which should/might help gold prices. Counter-intuitively, gold and its less popular peer silver have been having a decent run of late. I say counterintuitively because, in reality, the consensus trade is bullish for risky assets and the dollar, which should be bad news for precious metals. However, gold has been buoyed by heavy Chinese buying – especially by the Chinese central bank – and longer-term worries about the rise of big government, massive fiscal deficits and monetary inflation.

A sudden spike in volatility might be the rocket fuel that gold needs to test at much higher levels, around $2750. And if that happens – a big if –silver might be the leveraged, geared upside investors are looking for. It’s certainly done well this year. And if we follow the breadcrumbs of the anti-consensus trade, we eventually end up with a geared play, on top of another geared play: silver mining equities.

Over the last few years, equities in precious mining firms have lagged gold and silver prices substantially. If we see another sustained push higher, then there is a good chance that silver mining equities could increase substantially. One of the best actively managed mutual funds (unit trusts) in the precious metals space is the WS Charteris Gold and Precious Metals Fund, run by Ian Williams from Charteris (who also runs their very successful bonds fund). His gold fund is the best-performing gold fund. Historically, this Charteris fund was the top performer across all 3000 UK funds from all categories in 2016 and 2019, with discrete one-year gains of 133% and 52%, respectively. His fund has bet big on the divergence trade in precious metals and mining equities closing, focusing on silver. In fact, Williams’s biggest bet is on silver stocks and currently has a near 50% exposure to silver miners, one of the highest positions of any UK fund. According to Williams:“Silver is the absolute pick for Investors wishing to make huge amounts of money if this Bull market does develop into the real deal – Silver has double the volatility of Gold & the GSR ( Gold Silver ratio ) still shows Silver as historically very cheap. How high can Silver go? – well, if history is any guide, it has the potential to rise multiples of the current price. In 1971, Silver was 1.50 USD an ounce – 8 years later, it was 49 USD an ounce, a 36-fold increase. That is an example of this metal volatility of which there is nothing quite like it anywhere (maybe apart from Nat Gas Futures). If this is the real deal, hang onto your hats.”

In investment trust land, the nearest equivalent to the Charteris is Golden Prospect Precious Metals Ltd, with managers Keith Watson and Robert Crawford at CQS. This trades at a 22% discount to NAV, with gold miners accounting for 79% of the portfolio and silver for 14%. The top ten holdings (see below) represent 57% of the portfolio, with precious metals producers accounting for 72% of all holdings.

I’d be remiss if I didn’t quickly mention two ways of playing silver prices in a leveraged ay via commodity prices: again, from Wisdom Tree, there is a range of products, including an index tracking product called the WisdomTree Silver 3x Daily Leveraged, ticker 3SIL, which gears up the daily upside from silver prices three times. Wisdom Tree also offers an unleveraged play on silver – no gearing up or down, just the daily price – via a tracker called WisdomTree Physical Silver, ticker PHAG.

Now, at this point, I must repeat an earlier point. Many of the ideas I’ve cantered through are very high risk, require lots of market timing skills and are only for the very adventurous. As is the nature of anti-consensus trades, this is easy to get wrong and should be treated with extreme caution.

If you are looking for a less problematic alternative to implement the same strategy, I’d point investors in the direction of the Ruffer Investment Company, ticker RICA, and the BH Global listed hedge fund, ticker BHMG. Both of these are hugely popular investment trusts which offer downside protection. I sometimes think of the Ruffer Investment Company as a hedge-like fund for ordinary people who don’t want to pay hedge fund fees! Its portfolio is full of well-constructed hedge options and ideas. Year to date, this cautiously managed fund is essentially unchanged – it’s actually up a smidgeon under 0.5% – but its real power comes in volatility spikes when the manager does very well. It’s a similar story at BH Macro, a real hedge fund with many underlying global macro-led strategies. Again, it’s underperformed year to date – it’s actually down – but I would expect this fund to outperform in a sudden volatility spike (as it has done in the past).

I’ll finish with an uber-bullish counterblast – what happens if the bears are wrong and the bulls are too cautious (the market will meander higher)? Perhaps the US markets are underpriced – not a view I would share – and we are all underestimating the upside potential from AI (a real possibility). Playing into this uber-bullish view is the likely upturn in the Chinese economy, the ending of political uncertainty with the US general election in November 2024, and a possible end to the Israel-Gaza conflict. While we’re at it, let’s throw in a cease-fire in Ukraine. In this scenario, risky assets like tech stocks could seriously overshoot, and AI stocks could slide into rampant bubble-like behaviour.

We might expect copper prices to continue to surge, which could be good news for investors in yet another Wisdom Tree tracker product called Wisdom Tree Copper, tickers COPA and COPB. This product has no upside or downside leverage. By contrast, there’s three times the upside leverage for WisdomTree Copper 3x Daily Leveraged, ticker 3HCL.

And then there are Nvidia shares, of course, which have surged in recent years. Personally, I don’t think they are quite in a bubble yet (ie completely unreasonably valued), but I do think there’s an awful lot of upside already baked into the price. Could it go higher? Absolutely, even after recent falls. If you buy the upside scenario, there’s a range of single-stock leveraged shares from providers such as Leverage Share and Granite Shares. Typical is the GraniteShares product 3x Leverage NVIDIA (NVDA) ETP, ticker 3LNV. Over the last year, this leveraged tracker has risen by an astonishing 1426%. Its downside peer has the ticker 3SNV, and is called the GraniteShares 3x Short NVIDIA (NVDA) ETP. Over the last year, this is down a mighty 99%.

A much less risky way of playing the whole AI trend on the upside is an investment trust called Manchester and London, ticker MNL. This global equities fund makes concentrated bets, mainly on the technology space – over the last 12 months, it’s up 86%. Much of that impressive gain is because the equity portfolio focuses on AI-related stocks: top holdings in the fund include Nvidia at 32.3% of the portfolio, Microsoft 24.9%, AMD 7.8%, Arista 5.6%. According to my calculations, at least 70% of the portfolio is heavily AI-related (including Microsoft). 70% plus AI related

Defence funds

I’ll finish with a more boring notion. Whatever your view of the US economy, stocks and shares and Nvidia, I think we can all agree that the West – including the UK – will probably be spending more money on defence. That means bumper order books for large defence companies, many of whose share prices have done very well in recent months. For instance, the share price of homegrown champ BAe is up just under 40% over the last year and 148% in the previous three years.

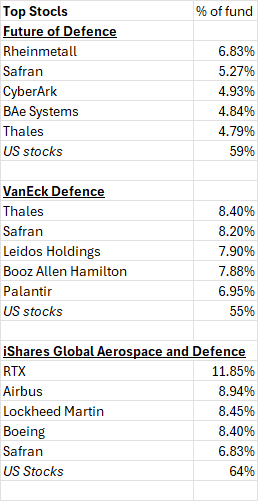

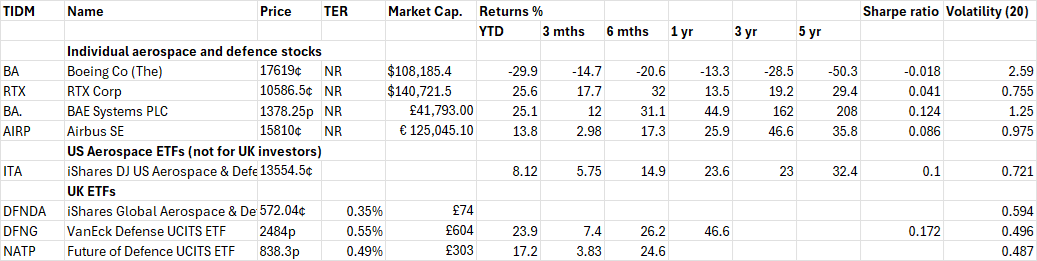

This surging enthusiasm for defence stocks after the invasion of Ukraine hasn’t gone unnoticed in the world of funds, especially exchange-traded funds or ETFs. Over the last few years, we’ve seen two big fund launches, the first from issuer VanEck – their Defence UCITS ETF ticker DFNG – with the subsequent one from HANetf, called the Future of Defence, ticker NATO. Both have had a solid year, with the VanEck fund up 46%, whereas the HANetf fund, ticker NATO, which launched early in June last year, is up 31%. They’ve now been joined by a third ETF, this time from iShares based on their very successful US Aerospace and Defence ETF. This last ETF, ticker DFND, is much more a global sector ETF with less emphasis on defence and more on aerospace, and it’s cheaper with a TER of just 0.35%. This new ETF is also much more conventionally a US-focused, major defence contractor fund. Its biggest holding is the giant RTX business at 11.85% of the fund, followed by Airbus and Lockheed Martin.

Performance-wise, the table below shows a mixed picture when we compare the ETFs with individual mega large-cap stocks such as RTX and our very own BAe Systems. I have one simple test: Would you have been to own the broad ETF or individual stocks such as RTX or BAe?

On a 12-month basis, I’d suggest there was a real benefit from being diversified across stocks, whereas on a year-to-date basis, you might have been better off individually owning BAe. In fact, from my small sample, BAe Systems looks like it has been an excellent investment. I think we’ll see much more defence and aerospace investment over the next few years, so there might be more upside. BAe, for instance, trades on 20.4 times forecast earnings with analysts pencilling in 20% turnover growth – RTX also trades at around 20 times forecast earnings but has lower pencilled-in forecast sales growth. BAe also looks more capital efficient with an ROCE of 12.3%, a decent number for such a capital-intensive business.

~

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.