Our regular monthly funds column looks at the bidding battle at music royalties fund Hipgnosis, the new ETF platform from Cathie Woods Ark Invest for UK investors, a new rare earth equities tracker, and the potential for a rebound in the listed private equity funds space. Plus, a think tank takes aim at ISAs.

Hipgnosis – a bidding battle

Over the last few months, we’ve seen an acceleration of the trend towards corporate activity in the listed funds space via mergers, takeovers and wind-downs. In my view, this trend has only just started, and we should expect to see many, many more deals and wind-downs. One obvious area of strategic focus will be the still substantial number of sub-scale listed funds or investment trusts. To state the obvious any investment trust with a market capitalisation of under £100m is probably struggling in terms of fund economics. Care to guess how many funds there are with a market cap of less than £50m? At least 40 by my count (ignoring funds with different classes). If we widen that net out to £100m, there’s at least another 35 funds with a market cap of between £50m and £100m. So, there are still something like 75 funds with a market cap below £100m, a number which I can see dropping by at least 50% over the next few years.

Another area where we’ll see more transactions is in funds that have the right scale but where the public markets are uncomfortable owning private assets which are difficult to value. I’ve mentioned the music royalty fund Hipgnosis many times in these articles. After the buzz of its launch and subsequent fundraisings, the fund fell into the City’s bad books – and mine to be honest – with its valuation methodology. It clearly owns a valuable catalogue of music rights, which generate a decent income. That’s the easy part – work out the income, then work out a valuation based on that income versus the risk-free rate (gilts). The more difficult part is then cross-referencing that with market transactions in a thinly traded, opaque market in music royalties i.e. there’s only a small handful of buyers for these assets and they tend to be secretive about deal structures and prices.

This concern about valuations wasn’t helped by the fact that there was, initially, only one independent valuer of these assets. Add up all these concerns and you can understand why the fund found itself in the doghouse, trading at a cavernous discount. But there’s a ‘sensible’ discount for caution and a plain silly one when you have high-quality assets in the portfolio that are worth serious money to the right (private equity backed) buyers. And so it has come to pass at Hipgnosis. Last week it received an offer from a PE-backed player Concord valuing the shares at $1.14. This week there’s talk of a new bid from Blackstone (who back the fund manager) for $1.24. These numbers are well above the level when I started writing about the fund. Take the profit and accept!

As for the next candidates for M&A activity? Watch this space – I will come back with a shortlist next month. But for now, I’d keep a beady eye on the real estate investment trust (REIT) sector where the pace of deal flow is accelerating, especially in the industrials and logistics warehouse space.

Private Equity

Let’s stick with this theme of valuing private assets and switch focus instead to the listed private equity funds. This small handful of London investment trusts trade at very substantial discounts to their net asset value. One of the reasons for those big discounts is that investors don’t really trust the current valuations of private businesses in the funds’ portfolios. Investors reason that because interest rates are much higher, debt will cost more, and the rates of return needed to justify an investment will also increase, just as national economies start to slow down (because of higher interest rates). But there’s a growing body of evidence that private equity valuations have probably – not certainly – bottomed out and in some cases are starting to rise again.

Matt Hose, a funds analyst at investment bank Jefferies, runs a quarterly review of key PE trends and his latest note indicates that we have probably hit a trough in valuations and that things are beginning to look up! Here’s his take on valuation trends:

- “Data points: Q1 saw positive performance from most equity indices. Of the key benchmark indices we use to assess the direction of private equity buyout valuations, the Russell 2000 Value Index was up 2.3%, while the Stoxx Europe Small 200 Index was up 4% (both in local currency terms). For venture/growth equity exposure, the tech-heavy Nasdaq 100 Index was up 8.5%, while the FTSE Venture Capital Index was up 12.2% (both in USD terms). Elsewhere, EV/EBITDA valuation multiples moved little higher in most sub-sectors during the quarter, with some notable strength in software indices. Lastly, industry bellwether Blackstone (BX) has reported its largely buyout focused private equity portfolio increased in value by 3.4% during the quarter.

- Closing the gap: Turning back to Q4, we note how the buyout marks materially lagged the strength in equity indices. The marks from the six U.S. GPs we track increased by 2.6% on average, against a 14.9% increase from the Russell 2000 Value Index. … We expect that as equity indices recover further and the gap continues to close, this will ease any lingering (and, in our view, unjust) concerns over the validity of the marks, in turn helping to support the partial re-rating of the listed funds.”

One way of seeing these trends in action is to recognise that many private equity-backed investments are in the technology space, and many of these larger businesses are thriving. Take the example of TikTok owner Bytedance. This business recently released reported EBITDA of $40bn for 2023, up 60% from the $25bn of EBITDA reported for 2022. Based on Bytedance’s $268bn valuation implied by the recent share buyback and ignoring the company’s likely net cash position, this represents an EV/EBITDA multiple of 6.7x.

That multiple isn’t crazy even after allowing for the obvious risks with its business model (China, political pressure in the US, China and China!). In reality, its valuation could be much higher and if that was the case then it could benefit many listed UK private equity investment trusts such as The Schiehallion Fund (MNTN), Scottish Mortgage (SMT), and HarbourVest Global Private Equity (HVPE) which are holding stakes equivalent to 5.2%, 2.4% and 0.3% of their NAV respectively.

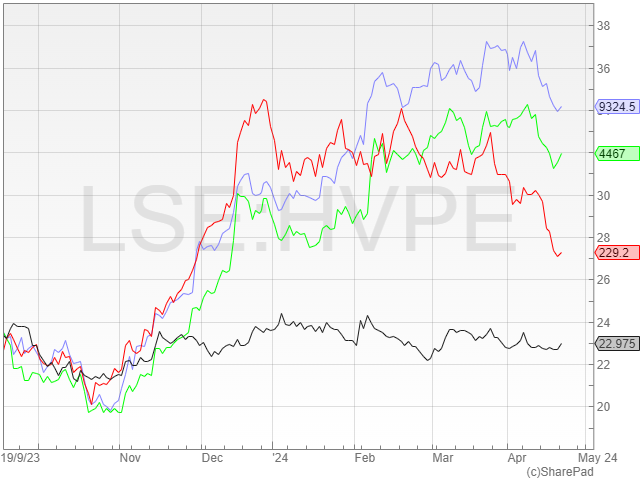

I’d also highlight one of the most heavily discounted listed private equity funds on the London market – Harbourvest, mentioned above, ticker HVPE which trades at a 45% discount to NAV. It’s worth noting that technology businesses represent 33% of HVPE portfolio. Tech-focused equity funds like Allianz Technology Investment Trust and the Polar Investment Trust have had a cracking run in recent months whereas Harbourvest’s share price has stalled. It’s also worth noting that listed private equity managers (not funds) such as KKR, Carlyle and Bridgepoint, have all experienced bouncebacks in their share prices: again, Harbourvest share price hasn’t. In the chart below Bridgepoint is in red, KKR is in purple, Carlyle Group is in green and Harbourvest is in black.

Harbourvest is an interesting vehicle in that invests in numerous underlying funds (it’s a fund of funds) spanning the whole spectrum of private equity and venture capital. I’d also highlight the following features relevant to the fund:

- NAV resilient with growth of 4% over the past year

- Discount remains at historic wides at c.45%, granting investors access to the world’s fastest-growing private companies at essentially half price.

- City analysts Peel Hunt, Jefferies and Stifel all recommend investors Buy HVPE Jefferies and PE

I’d rate it a strong buy at the current 45% discount and reckon that ignoring any NAV growth, the discount could narrow to something in the 30 to 40% range over the next year.

ETF update: ArkInvest lands in the UK plus a new transition metals tracker

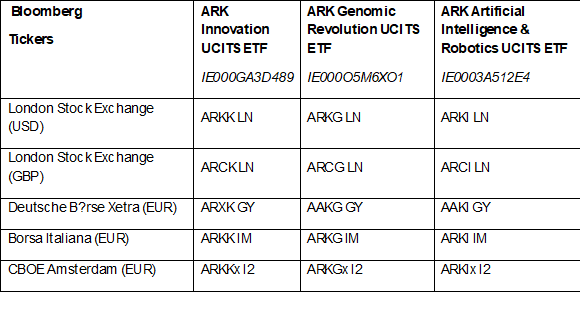

Love her or hate her, US investor Cathie Woods has built a huge following stateside with her actively managed exchange-traded funds or ETFs. There’s a whole stable of funds that aim to track everything from fintech through to the genomics revolution. In tech sell-offs, her funds plummet in value but she’s also had a stellar last year, with many of her funds massively rebounding. I have absolutely no idea whether the next 12 months will be as positive but if you do buy into her rampant tech bullishness, then I have some good news for you: she’s launched a handful of her US funds here in the UK, following ARK Invest’s acquisition of Rize ETF in 2023. The headline launch is her $14 billion dollar flagship strategy—the ARK Innovation UCITS ETF—as well as the ARK Genomic Revolution UCITS ETF. Crucially, the manager has introduced a purpose-built strategy tailored specifically for the European market: the ARK Artificial Intelligence & Robotics UCITS ETF.

So, the new exchange-traded funds are (with tickers):

- ARK Innovation UCITS ETF (ARKK)

- ARK Genomic Revolution UCITS ETF (ARKG)

- ARK Artificial Intelligence & Robotics UCITS ETF (ARKI)

Each ETF carries an OCF of 0.75%.

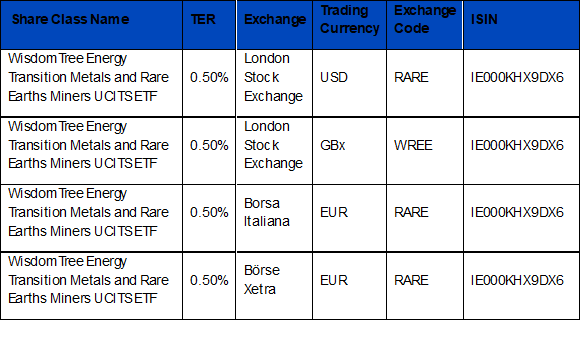

In a very different space, ETF issuer Wisdom Tree has just released the ninth tracker fund in its energy transition range: the new fund is called the WisdomTree Energy Transition Metals and Rare Earths Miners UCITS ETF (RARE), with a total expense ratio of 0.50%.

This exchange-traded fund invests in stocks of companies involved in the energy transition metals value chain including the exploration and processing of rare earth elements. The underlying index was built in partnership with Wood Mackenzie, a leading energy transition research and consulting firm. The stock selection for the Index is informed and driven by market intelligence from Wood Mackenzie. Specific technologies in this fast-moving space include:

- electric vehicles, transmission, and charging,

- energy storage, solar, wind, and hydrogen

- In terms of materials, the index and the fund will invest in businesses providing metals such as lithium, nickel, cobalt, copper, iridium, aluminium, zinc, tin, silver, platinum and rare earth elements as well as sub-sectors such as mining, refining or smelting.”

Product information

|

The top ten holdings in the brand-new fund are as follows:

– Alumina Ltd 3.62%

– Northam Platinum Holdings Ltd 3.50%

– Ecolab Inc 3.44%

– Pilbara Minerals Ltd 3.37%

– MP Materials Corp 3.35%

– Norsk Hydro ASA 3.33%

– Anglo American PLC 3.21%

– Lynas Rare Earths Ltd 2.92%

– IGO Ltd 2.81%

– Boliden Ab Red 2.79%

How safe is your ISA?

The UK think tank Resolution Foundation, which is very close to Labour leaders, has published research attacking the trusty old ISA structure. It has three arguments against the flagship long-term savings policy.

Firstly, the policy is getting increasingly expensive: in 2023-24, ISAs cost £6.7 billion in foregone tax revenue compared to just £3.5 billion in 2018-19.

Secondly, ISAs overwhelmingly benefit the already better-off: in the lowest income bands, around two-thirds of ISA holders have less than £5,000 in savings. The same applies to just 18% of ISA holders earning £150,000 or more. Indeed, 48% of those on the highest incomes hold over £50,000 in their ISAs.

Thirdly, ISAs have done almost nothing to household savings rates, indicating that they are not generating new saving behaviour but simply shifting the timing and form of savings.

You can read more HERE. Based on my reading, I think a future Labour government will unlikely do much about ISAs. Extensive tinkering would be a surefire vote loser and the wrong thing to do. But I do think they might put a future cap on the total value of an ISA i.e. a lifetime limit.

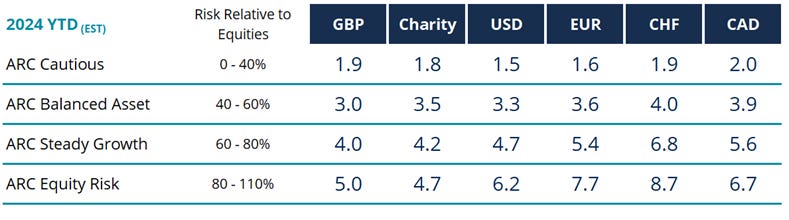

How has your portfolio manager performed in the first quarter?

One final note – many readers will have managed portfolios alongside their own self-directed broking accounts. How have these managed accounts performed over the first quarter of 2024? Cue year-to-date data from Asset Risk Consultants which takes in the estimated returns up until March of this year. The average return of the ARC Steady Growth Index (based on the most common risk profile run by discretionary investment managers), rose 4 per cent.

What are these managers investing in? According to ARC’s Market Sentiment Survey of around 100 CIOs of investment firms in mid-March, private client investment managers have become positive on most ‘risk assets’ compared to a year ago, except for cash. The big gainers in positive sentiment compared to a year ago are Japan, healthcare and IT, and gold. The biggest negative sentiment belonged to commercial property, which continues to struggle amid lower occupancy rates and tighter lending conditions.

~

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.