Phil takes a look at a strategy of identifying unloved shares as a way of generating market beating returns.

In my last couple of articles, I’ve discussed some of the issues that investors face when looking at good companies.

One of the biggest difficulties faced is that the shares of such companies can be highly priced because lots of people know they are good. Buying at a high price can lead to disappointing returns if the company’s profits can’t live up to the high expectations that are baked into the share price.

Value conscious investors will stay away from such shares because they associate high share prices with a higher risk of losing money. Instead, they tend to look for opportunities in shares that the stock market dislikes or has overlooked.

Their reasoning is that the valuations and share prices of beaten up or unloved companies can be so low that there is very little or no expectation of things getting better for them. If this is wrong and profits can increase or the company can be taken over then the returns can be stellar.

This is classic value investing that is associated with legendary investors such as Benjamin Graham, John Templeton, Walter Schloss, Seth Klarman and in his younger days, Warren Buffet.

There are many ways of identifying unloved shares. One of the most popular is to buy shares trading at or close to their one year or 52 week low. This is often a sign that sentiment towards the shares is poor.

The 52 week low approach

As with virtually all investing strategies there is usually plenty of evidence to show that they can work.

Hindsight is the friend of the investment writer where it is much easier to show how things have worked in the past. It is far harder to set out what might work now or in the future.

However, what we can see is that shares can and do post stellar gains from their 52 week lows.

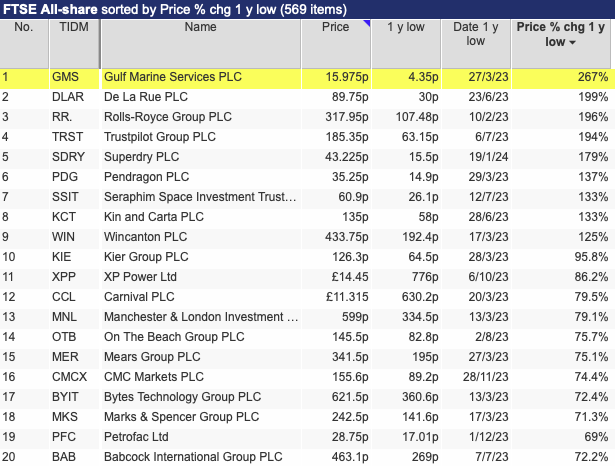

Below we can see some of the bounces from shares in the FTSE All Share index from their 52 week lows during the last year.

The thing is, very few investors would have bought these shares at their lows. This is because shares reaching new lows often come with bad things attached to them such as a fall in profits, too much debt or poor outlook for a company’s markets.

These events make people feel uncomfortable or even fearful. How do you know that things won’t get worse? You don’t, but to buy in with any confidence you have to have good reasons for thinking that the company’s problems are temporary or that another company might come along and buy it for a much higher price.

Many of the companies in this list such as Rolls-Royce, Marks & Spencer, XP Power, Babcock and Trustpilot have seen their trading and financial positions improve with expectations that they will continue to do so.

In many cases, this has created a positive and powerful momentum effect when more investors buy in and produce big share price gains.

Shares that have seen big gains from 52 week lows

Source: SharePad

Other companies such as Pendragon, Wincanton, and recently, Superdry, have seen big gains as they received takeover approaches.

Buying shares at their 52 week lows can be no guarantee of success. In many cases, shares can keep on falling and inflict painful losses on investors.

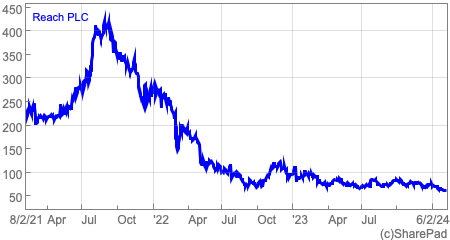

Shares that have kept on going lower

Source: SharePad

Two years’ ago some investors might have looked at the newspaper company Reach and thought its shares might be due a bounce from 245p having fallen from a high of over 400p.

Anyone buying in would have experienced losses of 57 per cent over the next year. Buying in at 97p a year ago would have seen you lose a further 29 per cent as the business continued to struggle.

It is the fear of such big losses which explains why many investors will seek the comfort of owning shares in businesses that are doing well.

To buy at new lows you need to be comfortable going against the crowd, have the confidence that business conditions will improve, and above all else, have the patience to wait for a payoff.

A low risk approach to 52 week low investing

Ten years’ ago, Luke Wiley wrote a book about how to put the 52 week low formula into practice to identify potential winning shares.

It can be summed up as a strategy of buying shares of the right business rather than any business at or near their 52 week low.

The strategy is based on five key filters:

- The company must have a sustainable source of competitive advantage such as a brand, low cost business model or limited competition which allows it to have good levels of profits when business conditions are favourable.

- A high free cash flow yield – this is defined as free cash flow as a percentage of a company’s enterprise value as a buyer of a company takes on its debts as well as all the shares. The free cash flow yield must be higher than the yield on government bonds.

- A high return on capital of more than 15 per cent.

- A low debt to free cash flow ratio – high debts can wipe out shareholders in bad times. Low debts can be paid off quickly if business conditions improve.

- The shares must be at or near their 52 week low.

I have adopted a slightly different filter.

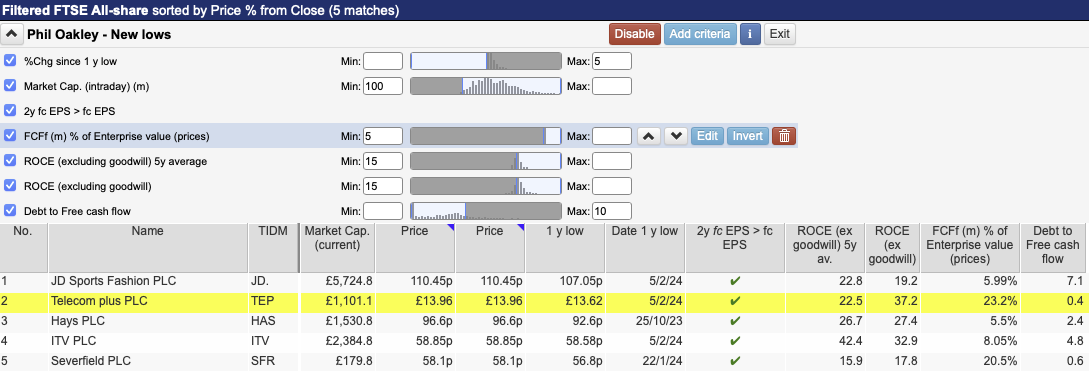

SharePad has looked for shares within 5 per cent of their 52 week low, with returns on operating capital of 15 per cent or more both currently and on average for the last five years. There is a minimum free cash flow yield of 5 per cent whilst debt to free cash flow must not exceed 10 times.

Finally, and most importantly, there must be the prospect of some earnings growth. Earnings per share (EPS) in two years’ time must be higher than the next year’s forecast EPS.

This provides a very small list of five shares.

ITV has been touted as a takeover target for years but is struggling to stay relevant as media viewing and advertising continues to shift online.

One company that stands out is Telecom Plus. Its shares are close to a 52 week low on very little newsflow.

However, a closer look at its cash flow statement shows that its very high free cash flow yield is the result of a one off cash inflow last year. The company does have very low levels of debt.

The company reiterated its full year profits guidance at its half year results in November and is expected to grow its earnings at a reasonable rate over the next three years whilst growing its dividend.

At 1396p, the shares trade on a one year forecast PE of 11.5 times and offer a forecast dividend yield of 6.2 per cent. They look worthy of further research.

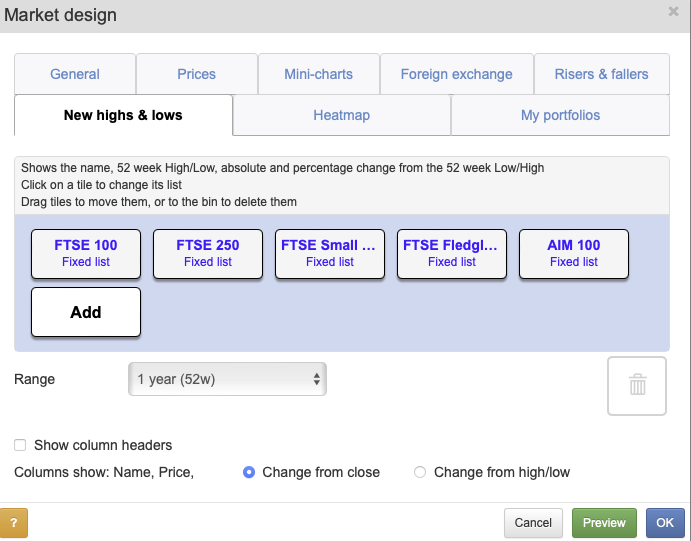

Appendix: Finding shares trading at 52 week lows in SharePad

It’s very easy to find shares trading at or near their 52 week lows in SharePad.

One way is to set up your market overview page which you can access by clicking on the ![]() icon in the top left hand corner of the screen.

icon in the top left hand corner of the screen.

Then click on the Design tab in the bottom left hand corner which will bring up the following screen.

You can then add the indices that you wish to see 52 week highs and lows for.

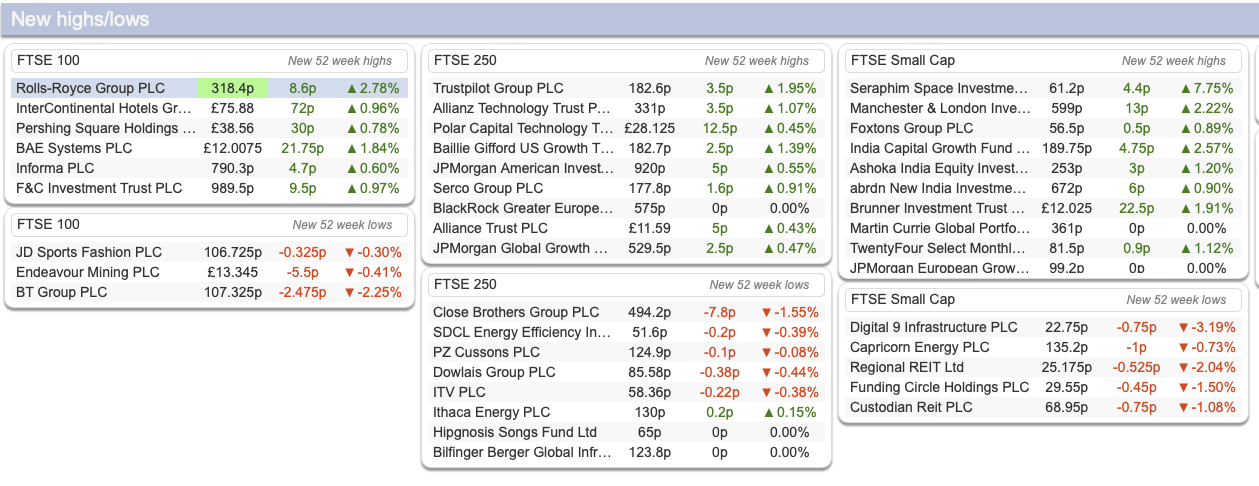

This will then give you an overview page which looks something like this from Tuesday 6th February 2024.

It’s a really quick and useful way of seeing shares that are hitting lows as well as highs.

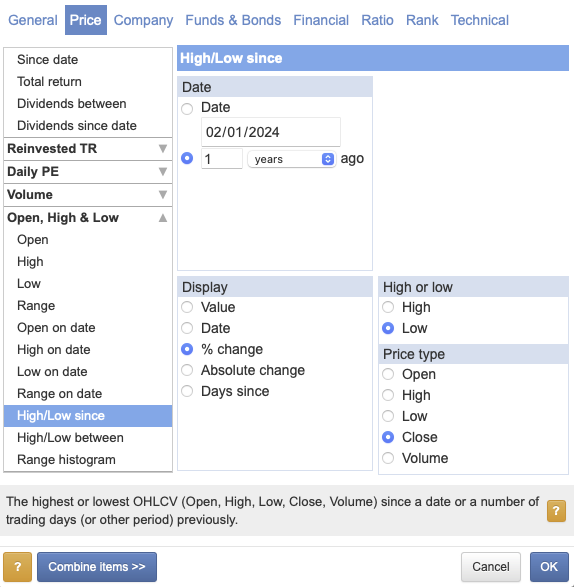

Alternatively you can create a filter in SharePad to find shares that are trading at or close to their 52 week lows.

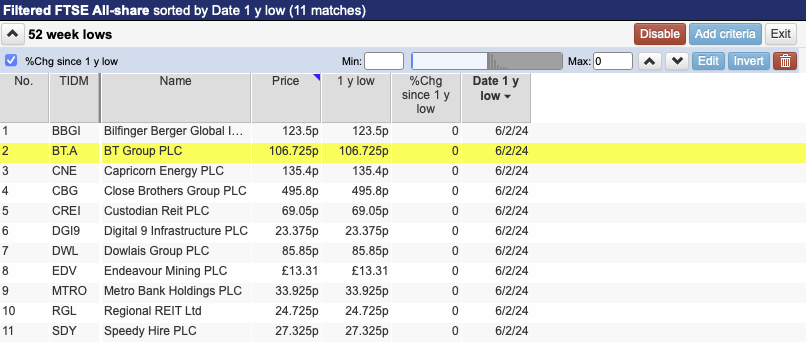

This then gives a list of shares meeting the criteria.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.