2023 was the year of AI and we end the year with a deep dive into the handful of AI-specific exchange-traded funds or ETFs listed on the London exchange. They all provide real diversification benefits but have lagged big well-known individual stocks such as Nvidia and Microsoft. We also have a deep dive into a small resources fund that is deeply out of favour but boasts some potentially valuable assets. Lastly, if you are very cautious as an investor and want to only invest in short-duration UK Treasury bills, one of the major online brokers has a new product just right for you! Last, by no means least, we look at a fund merger that leaves a merged listed venture capital fund with a lot more cash and a big new, strategic shareholder.

AI ETFs

The big story of 2023 was AI, ChatGPT and the crises at OpenAI. The sheer quantum of change is remarkable and investors over the world have charged towards the theme en masse. As a result, the share price of Nvidia has risen by a stunning 235% year to date while over the last five years, its share price has risen an astonishing 13-fold. Nvidia is now worth a staggering $1.2 trillion, yet even after this share price increase, its forecast PE is “only” 40 times earnings. I say “only” because in 2024 analysts reckon EPS will increase 4.6 times, followed by a 60% increase in 2025 and a modest 20% increase in 2026. The software giant Microsoft has also been a beneficiary of AI enthusiasm and is up a “mere” 56% year to date and trades at an almost reasonable forward PE ratio of 33 times earnings.

Talk to tech fund managers like Ben Rogoff at Polar Capital Technology and they’ll say that they have fundamentally shifted the whole focus of their diversified portfolio towards firms that directly or indirectly benefit from AI and large language models (LLMs). Given this level of enthusiasm, you probably won’t be surprised to discover that two of the most successful thematic ETFs of 2023 were AI-focused ETFs – one from Wisdom Tree, and the other from L&G ETFs. They were also recently joined by an AI ETF from Global X.

At this point, the cynic might ask why bother with an AI ETF – why not just buy a couple of individual stocks such as Nvidia or Microsoft? Alternatively, investors could also buy into tech funds such as Polar Capital Tech or Manchester and London which are heavily focused on the AI story. The simple answer to this perfectly respectable cynicism is that AI-specific funds give investors a proper focus on a diversified basket of AI-specific companies i.e. laser-like focus. Investing in a handful of large-cap stocks reduces your diversification and increases your company-specific risk levels. By contrast, a broader tech fund does provide diversification between different individual stocks, but you’ll also likely end up with lots of firms, many of them smaller than the tech leviathans, where the AI component of sales isn’t that great.

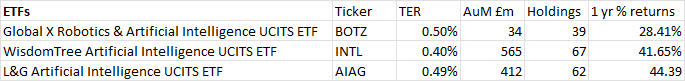

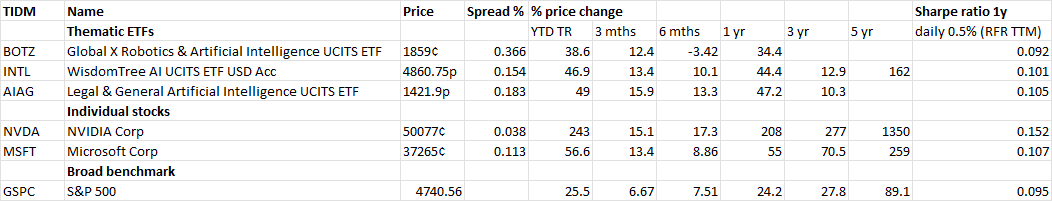

So, the big selling point of AI ETFs is that they do what they say on the tin. They give you a specific basket – usually between 30 and 70 stocks – with a very specific focus on AI trends. There are currently three AI-specific ETFS accessible in the UK: their main details are in the first box below. Between the three funds, there are around a billion pounds invested. Curiously returns vary substantially over the last 12 months – the relative newcomer from Global X is up 28% while the L&G fund is up 44%.

These returns are not to be sniffed at but they pale beside the returns from holding say Nvidia and Microsoft stock: as you can see in the second table below, the former is up over 200% while the latter has increased by 50% in value. That said, all three funds have significantly lower levels of volatility than owning the two individual AI mega leviathans.

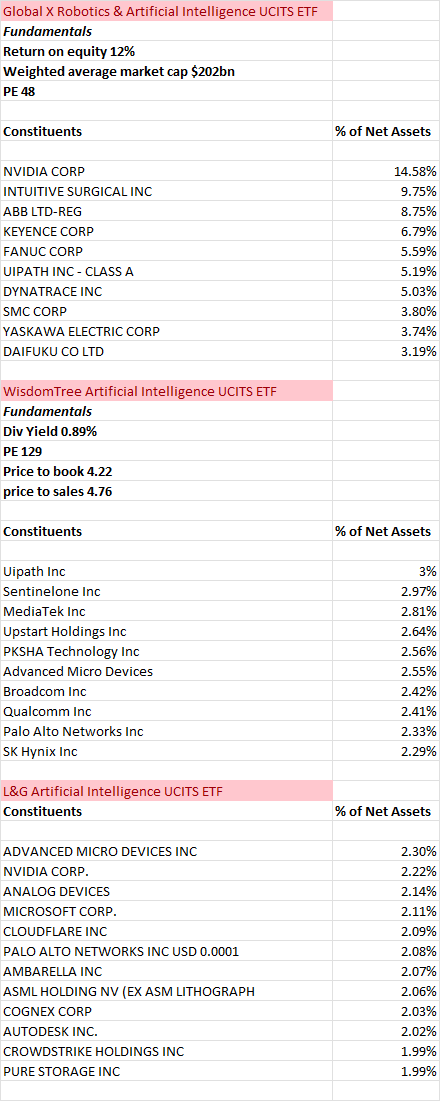

And of course, all three funds own a diversified basket of between 30 and 70 stocks that range from, yes, you guessed it, Nvidia and Microsoft through to minnows and small caps that could be tomorrow’s Nvidia. The next table below breaks out the top ten stocks for each of the three funds.

What I find fascinating about the table above is the sheer variety of different stocks in these three ETFs. The Global X top stock at 14% is Nvidia followed by medical science firm Intuitive Surgical and then the German engineering giant (and automation expert) ABB at number three. Other big holdings in this fund include Japanese robotics firms Keyence and Fanuc. By contrast the top holdings in the L&G fund look more familiar: AMD, Nvidia and Microsoft are in the top five holdings. None of these three mega tech leviathans appears in the top ten holdings of the Wisdom Tree fund – relatively unfamiliar names like UiPath, MediaTek and Upstart top the list. I’d also note that Nvidia is not in the top ten list for the Wisdom Tree fund and not one of the three has a big holding – as measured by the top ten by weighting – for Tesla, which many investors such as Ben Rogoff at Polar Capital think is pushing ahead fast with its AI capabilities.

My point in emphasising the sheer diversity of holdings is that these three AI funds are not very alike – all three are very different and give you a very different basket of stocks. And that of course is a function of the indices which are tracked by the funds. In the last box below, I have pasted up the various index definitions and as you can see each is unique. Apart from my comments above about the sheer variety of holdings in the three funds, I’d make the following observations:

- If you are willing to take on more stock-specific risk, I would suggest that a handful of mega tech leviathans such as Nvidia, Microsoft and Meta are likely to give you ample AI exposure and, in the past, have produced much bigger returns

- These three funds serve a valuable purpose by diversifying that stock-specific risk, but my preference would be for an ETF that equal weights all the underlying holdings – as is the case with L&G and Wisdom Tree. This equal-weight construction provides more diversification between the large-cap, mid and small-cap stocks

- A perfectly respectable argument can also be made for ignoring specific thematic ETFs such as AI ETFs altogether and just buying a broad, very diversified index such as the S&P 500 which has lashings of tech stocks within it. Three AI-heavy stocks in that benchmark US index (Nvidia, Microsoft and Meta) already comprise around 12% of the value of the index. If you include Apple, Amazon, Tesla and Alphabet plus Salesforce, AMD and Accenture – all of whom will benefit mightily from AI – then you get closer to 30% of the value of the index. And bear in mind that many of the other companies in the S&P 500 will likely benefit indirectly from advances in AI.

The indices behind the ETFsL&G – ROBO Global® Artificial Intelligence Index TRThe Index aims to track the performance of a basket of companies that have a distinct portion of their business and revenue derived from the field of Artificial Intelligence, and the potential to grow within this space through innovation and/or market adoption of their products and/or services. The index is comprised of companies which are publicly traded on various stock exchanges around the world that are exposed to the “Artificial Intelligence” theme as defined by ROBO Global®. ROBO Global® created and maintains a unique database of companies across the globe that have a portion of their business and revenue associated with Artificial Intelligence and enabling technologies. The ROBO Global® Industry Classification currently identifies 11 subsectors of the Artificial Intelligence theme that present a suitable level of product and technology maturity to carry high growth and returns potential. A company is only eligible for inclusion in the Index if it is of a sufficient size (determined by reference to the total market value of its shares) and it is sufficiently “liquid” ( a measure of how actively its shares are traded on a daily basis). Within the Index, companies are weighted according to a modified AI-factor weighting scheme. The Index is rebalanced quarterly in March, June, September and December. Global X – The Indxx Global Robotics & Artificial Intelligence Thematic IndexThe index seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles Wisdom Tree – Nasdaq CTA Artificial Intelligence Indexwas designed in collaboration between WisdomTree and technology market experts NASDAQ and the Consumer Technology Association (“CTA”). The index excludes companies which do not meet WisdomTree’s ESG (environmental, social and governance) criteria. Companies in the eligible universe are classified into three groups based on each company’s position in the Artificial Intelligence (“AI”) value chain and its estimated revenue exposure to AI:

Within each group, an AI intensity score is assigned to each company based on factors including:

Then, the companies with the top AI Intensity Score in each group are selected for inclusion. The groups’ total weight is set to 10% for Enhancers, 40% for Enablers and 50% for Engagers. Finally, individual companies within each group are equally weighted. |

Great service for gilt and income investors

The online share dealing platform Freetrade has been introducing some great new features of late – its latest service allows you to buy short-dated 1-month government UK Treasury bills and then keep rolling them over. The obvious attraction is the yield they pay with the low-risk levels. Here’s what Freetrade has to say about the advantages of buying 1 month Treasury bills:

- Competitive yield: You could earn over 5%* annualised yield. The yield is not known until your order is executed.

- Low risk: The UK government issues and backs UK Treasury bills, making them one of the safest investments around.

- Fixed term: Your investment is locked in for a period of 1 month** before maturity.

*The lowest annualised yield as of the 8th of December tender was 5.15% and the average annualised yield was 5.23%. 1 month** investment. Read the DMO weekly report for more information.

**Each UK Treasury bill is a fixed investment for around a month, typically 28 days. However, your money will be tied up for a little longer. It will cease to be available for you to withdraw from the cut-off date, usually a Thursday, on the day before we purchase the UK Treasury bill, usually a Friday. On maturity, your money will become available once we receive the maturity value one business day later. Usually, the maturity date is on a Friday and you receive the money on the following Monday, so your money may be tied up for 31 days or more.

A Closer Look at Baker Steel Resources Trust

If you look down any list of small, deeply unloved closed-end funds, trading on very large discounts, you’ll probably come upon a fund called Baker Steel Resources Trust. It’s one of the favourite funds owned by Nick Greenwood, veteran funds picker at MIGO which is a long-established fund of investment trusts. Bar Greenwood, Baker Steel Resources has few other high-profile friends, which is a pity because if you’re looking for out-of-favour funds with real upside potential, this fund is worth researching in more detail.

If I had to sum up the fund, I’d say it was the commodities equivalent of an early-stage venture capital fund. It invests in a deliberately concentrated handful of largely private companies developing new mines (or cement projects) alongside a longer list of smaller stakes in listed micro-cap mining stocks. That makes it high risk but what makes it even higher risk is that the funding of early-stage mining businesses is a ‘difficult’ business. Over the last few years, there’s been a slowdown in funding new mining projects, for all the obvious reasons: higher interest rates, even more volatile than normal commodity markets, and ESG concerns. To say it is difficult to get a new mine funded if you are not a major commodity leviathan is something of an epic understatement.

Baker Steel tries to derisk this funding as much as it can by building a package of funding instruments ranging from straight equity through secured loans to royalty deals where it is paid from revenues once a mine is operational. Once a new mine is funded there’s still a large number of challenges – a lot can go wrong with new mining projects including cost overruns, aggressive governments trying to snatch more revenues, boycotts by environmental activists, and incompetent management. The list is virtually endless which means that ‘execution’ challenges are legion – and thus the potential returns required need to be very substantial.

Fund Facts

- Baker Steel Resources Trust

- Share price 34.5p

- Fund manager interview with Trevor Steel

- Ticker BSRT

- NAV 65.9p

- 106m shares NAV £69.8m

- The Company’s top 5 investments were as follows as a percentage of NAV: 31 October 2023

- Cemos Group plc 30.2%

- Futura Resources Ltd 28.9% (c. £20m)

- Bilboes Royalty 8.5%

- Caledonia Mining Corporation Plc 6.0%

- Kanga Investments Ltd 5.5%

A difficult niche

The upside is huge but as with any venture capitalist fund, the intervening period between a minimum viable project and the subsequent scaling up of revenues can bring nasty valuation surprises. Earlier this year for instance Baker Steel had to announce a series of write-downs – in one market report it cut valuations for Futura Resources (fair value down c 17% in sterling terms during June 2023), Kanga Potash (down 21%), Caledonia Mining Corporation (down 6%) and Nussir (down 11%). And if all that wasn’t bad enough another major holding Caledonia Mining Corporation (CMCL, NYSE) revealed to the market that it faced technical challenges in Q123.

In retrospect, none of this should come as a surprise especially when you look at its list of micro-cap holdings in the table from Numis below i.e smaller-cap listed stocks that comprise a little under 50% of the portfolio’s value. Microcap miners are a risky bunch at the best of times and it’s absolutely NOT the best of times at the moment.

Numis table on the portfolio from earlier half-year results

So, plenty can and has gone wrong. But there’s also been good news, not least with its key investment in Futura which owns the Wilton and Fairhill metallurgical steel coal projects in the Bowen Basin in Queensland, Australia. These contain Measured and Indicated coal resources of 843 million tonnes. As with many of the companies in the portfolio, Baker Steel invests in this mine using a variety of structures:

- 11,309,005 ordinary shares (26.9%) valued at £6.7 million

- 1.5% Gross Revenue Royalty valued at £11.2 million

- A$600,000 million bridging loan valued at £0.27 million

A few weeks ago there was good news about Futura and its metallurgical coal deposits. The business closed a c A$26.2m funding round (A$21.2m convertible note and A$5m in-kind commitments from contractors and suppliers). This should fully fund the advancement of the Wilton coking coal mine to production.

Futura Resources’ two mines should produce two million tonnes of saleable product after washing and processing. The second unit Fairhill can be advanced to production based on cash generated by the initial Wilton mine within c 24 months. The fund has previously highlighted that A$50m is required to bring both Wilton and Futura to production (A$25m for each)

According to Trevor Steel from Baker Steel, there is a good chance we could see EBITDA for this project in a few years hit A$92m in 2025. Apply a peer group valuation of around 3 times that EBITDA and you get a business that could be worth around A$250/$300m, which implies that Baker Steels’ shares might be worth A$65m or £33m. Currently, these shares are in the books at around £20m. And it is worth saying these numbers are low base case numbers – the eventual numbers could be much bigger.

But there could also be more potential nasty surprises like the recent news that the Queensland government unexpectedly introduced higher royalties at high coal prices. Positively, the Queensland government has expressed support for the development of the mines. One last point on Futura – once the mine is up and running Baker Steel will also hopefully get its loan repaid and those royalty payments should also start coming streaming in.

The other big investment is in a Moroccan firm called Cemos. This is a private cement producer at Tarfaya in Morocco. Cemos completed the construction of a cement plant at Tarfaya in December 2018 and reached full production rate of 270,000 tonnes of cement per annum during 2020. As with Futura, Baker Steel’s investment in Cemos is through a number of structures:

· 24,004,167 ordinary shares (24.6%) valued at £10.0 million

· 1,045 Convertible Loan Units (31.6% fully diluted incl existing holding) valued at £10.9 million

According to Baker Steel in the first half of 2023, the demand for cement in Morocco continued to be subdued due to inflationary pressures in the economy although the sales for the year remained at around 200,000 tonnes, similar to 2022, and efforts are underway to grow and diversify the client portfolio to mitigate the effects of lower overall demand.

According to a detailed Edison note on the fund, “At the end of June, the Board of Cemos gave the go-ahead to construct a compact calcination unit (CCU) to enable it to produce its own clinker the main consumable for Cemos’ operation, subject to the requisite permits which are expected in the second half of 2023. The CCU plant will cost around €10 million to install and is budgeted to increase the overall margin by around 50% or €5 million a year and also provide better security of supply. Cemos continues to investigate the potential for manufacture of ‘green cement’ products by replacing some clinker in the production process with more environmentally friendly supplementary cementitious materials such as pozzolan which would not only reduce the CO2 footprint of the operation but may also have a positive impact on costs.”

The company continues to target a doubling of production capacity to 570k tonnes pa by 2025 based on the second production line acquired in mid-2022, with required expenditure at around €7.0m (which should be financed internally). A new clinker plant is also due to start up very soon and the second production line should be up and running in Q1 next year.

Again according to Trevor Steel at Baker Steel, this business should be on its way to producing $8 to $10m EBITDA in the next few years. Assuming a generous 5 to 7 times EBITDA, this business I suppose could be worth $50m to $70m, implying a valuation potential of $12.5m to $17.5m for the Cemos stake.

Beyond Futura and Cemos (well over 50% of the portfolio in valuation terms) there’s also a sizeable stake via 800,000 shares (4.2%) in Caledonia Mining Corporation valued at £7.4 million. Earlier this year Caledonia bought BRST’s investment in Bilboes Gold Ltd and completed its sale to Caledonia Mining Corporation Plc.

Caledonia is an NYSE, AIM, and Victoria Falls Exchange-listed gold producer whose primary asset is the Blanket Mine in Zimbabwe. Part of the Company’s consideration for its 22% interest in Bilboes was in the form of 800,000 shares in Caledonia. The other payment for the mine consisted of a 1% net smelter royalty (NSR) over the Bilboes properties. The Bilboes’ gold project in Zimbabwe has a Proved and Probable Reserve containing 1.8 million ounces of gold out of a total Mineral Resource of 3.8 million ounces of gold

This last investment in Bilboes royalties highlights an interesting opportunity – income streams. As these investments all come online and start producing revenues, the various royalties and loans should start churning out cash payments. The management reckons these income streams, including dividends from the companies, could hit $10m within a few years. For the Bilboes project alone, Baker Steels’ managers expect an income of around US$2.6m per year (assuming a withholding tax of 15% and a gold price of US$1,800 per ounce).

The Bottom Line?

This small, sub-scale fund is in a difficult market, with a very concentrated portfolio of risky assets. It’s dirt cheap, has a market cap of around £36m, and is trading at a discount of just under 50%. And that discount is before we head into a possible economic slowdown which could knock commodity markets even harder.

But there is real potential in the portfolio, not least from a potential income stream of dividends and royalties which could be kicking in possibly as much as £8m a year within the next two years. That would produce a huge dividend yield for fund investors based on the current market cap and possibly justify a significant rerating of the fund. And there is also the possibility that the two big projects Futura and Cemos could see their valuations increase markedly – they both look to be in sectors where there are a great many active purchasers, including private equity and large multinationals.

Forward Partners and Molten combine

Earlier this month Molten Ventures announced that it has launched an all-share offer to buy rival listed venture capital firm Forward Partners, valuing the company at £41.4m. At the same time, it announced an equity raise of c. £50 million to provide it with additional firepower to capture exceptional investment opportunities in what is increasingly a buyer’s market for venture capital.

Key points from the Molten Ventures announcement:

- Forward Partners has a balanced, well-capitalised portfolio of 43 assets, well positioned in the context of evolving market trends, which will fit well alongside Molten’s existing portfolio of 74 companies

- There is significant momentum in Forward Partners’ top 15 assets, with an average growth of 133% year-on-year, with many on a path to become strategically valuable market leaders in attractive niches, including companies with specialisms in applied AI and other growth areas

- It would provide Molten with a broader and more diverse pipeline (in maturity and market segment) through access to Forward Partners’ early-stage deal flow opportunities and capabilities in attractive segments

- The senior team are well-known to Molten, which has had a small stake in Forward Partners since its IPO and brings with them expertise and an investment philosophy which chimes with Molten’s

- The acquisition is supported by Forward Partners’ 70% shareholder, BlackRock, which will also be acting as the cornerstone for an equity raise for Molten, and with the support of Forward Partners’ second largest investor automatically takes the bid beyond the 75% threshold required for success

- The related fundraise helps Molten pivot away from a strict cash preservation focus to selective investment in a buyers’ market

- It also means Molten gains a strategically aligned and long-term shareholder in BlackRock with a cornerstone investment of up to £25m at a 3.4% discount to the Molten share price, and an 11.9% premium to the Molten 3M VWAP

You can find out more via the links below:

Rule 2.7 Recommended All-Share Acquisition

Proposed Fundraise & Offer for Subscription

My view? I’m a little disappointed that the deal is a nil premium merger although I have recommended both Forward and Molten on my buy list. Forward’s shares have been trading at a huge discount, as has Molten’s, so this is essentially a merger of equally dismal stocks.

Nevertheless, the logic behind the deal does make sense and Molten picks up an interesting AI-infused portfolio of early-stage investments – arguably a riskier bunch of investments than its existing portfolio. The big plus is that Molten raises cash from BlackRock – on quite preferable terms for BlackRock it must be said – which should enable it to continue funding its portfolio of unlisted, private businesses.

It’s obviously not a great time to be running a VC involved in younger businesses, but it is the right time to start making investments at much reduced valuations in these businesses. That cash pile – from the Blackrock equity raise and from Forward’s own cash reserve – should be deployed to maximum effect in the next 12 months. I’m more optimistic about Molten Ventures after this deal.

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.