Investment trusts have rallied in recent days as investors bet on falling interest rates in the coming 18 months, pushing many funds off their 52-week discount highs. That’s left some investors worried they might have missed the big opportunities in funds land but there’s still plenty of very cheap – sometimes for a reason – listed funds out there not far off their historic discount highs. Sticking with investment trusts we also look at a high-yielding infrastructure income fund that is largely free of debt and has a portfolio of high-quality, real asset-backed loans. Plus, a new ETF might appeal to mainstream dividend-oriented investors looking for quality UK stocks.

Deep discounts are still on offer

As many of us have predicted, the possibility that we might have reached peak interest rates – and thus peak government bond rates – has prompted a rush back into real asset-backed alternative income funds. Many REITs for instance have bounced up aggressively in the last few weeks but there are still plenty of interesting funds that are trading at near historic discount highs.

In the box below I’ve used data from fund analysts at Numis to look at those funds – mostly alternative asset-based – that boast discounts of above 40%. I’ve also included their average 52-week discounts and their discount high points. As you can see most of the funds are still trading around their year-long averages and many are just a few percentage points off their 52-week discount highs. I’ve looked in detail at all the funds listed below and can say that all have their upside potential though all face significant headwinds and have their own idiosyncratic challenges.

Some are obviously troubled such as Digital 9 while others are in the middle of a deep bear market for risky, venture capital investments – Augmentum, Chrysalis, Seraphim and Molten especially. I can’t guarantee that we are at the bottom for VC valuations, and more haircuts could be on their way for valuations, but my sense is that we are not far off the bottom.

In the list below you’ll also see a few outliers such as Regional REIT which is suffering from the ongoing challenges of owning non-prime London office assets as well as Georgia Capital, a PE focused on the former Soviet Union state of the same name. Georgia Capital’s share price has actually rallied aggressively in recent months but its discount is still huge, magnified by City scepticism not only about its geography but also its PE focus. Last but by no means least German residential property fund Phoenix Spree is worth a closer look – I’ll return to this fund next month.

| Fund | Current Discount % | Average discount % | Discount High % |

| Molten Ventures | 66 | 63 | 73 |

| Seraphim Space | 63 | 55 | 70 |

| Digital 9 | 60 | 39 | 67 |

| Phoenix Spree Deutschland | 60 | 55.1 | 63.1 |

| Georgia Capital | 55 | 60 | 65 |

| Chrysalis Investments | 49 | 49 | 61.7 |

| Regional REIT | 49.1 | 31.6 | 61.8 |

| Baker Steel Resources | 47 | 41 | 49 |

| Augmentum | 47 | 37 | 51.4 |

| Triple Point Social Housing REIT | 44 | 50 | 61.2 |

| Triple Point Energy Transition | 41.6 | 33 | 45 |

New ETF for high-quality UK dividend equities

I’ve already mentioned in these articles that if you are a defensive investor, then a focus on dividend-paying equities might make some sense. There is though a caveat with that statement, which is that many high-yielding stocks are frequently what analysts would call value traps, or low-quality, deservedly cheap stocks. Talk to quantitative strategists and they’ll tell you that smart money tends to focus on two key pillars in terms of fundamentals: dividends AND quality fundamental measures which look at balance sheet robustness and growth potential. Many fund managers embrace this Quality Dividend approach, and the UK market is one of the best markets for finding these stocks.

If you want to embrace this UK Quality Dividend approach, you usually have to buy into one of the actively managed funds that focus on this strategy. But there’s also a growing array of cheap, index-tracking funds that mimic this approach using what is called fundamental screens i.e. it’s a quant-driven approach with no idiosyncratic manager stock selection issues.

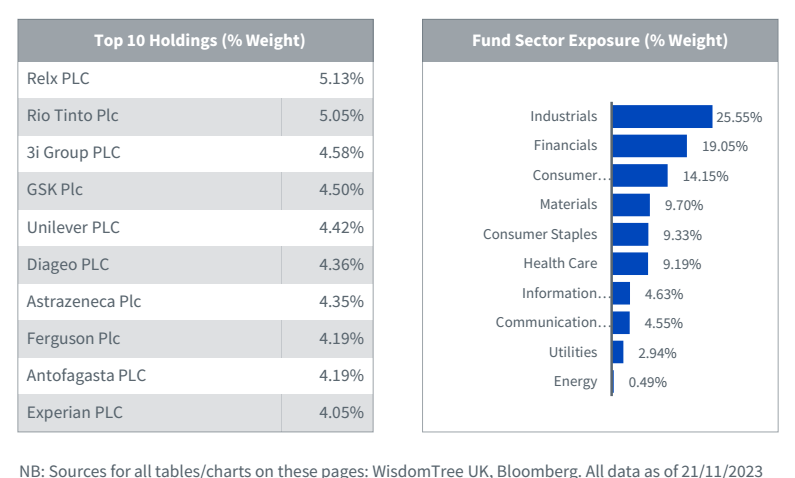

Wisdom Tree is a US-based issuer that has pioneered quant-driven, dividend-focused ETFs and last week they introduced a new product that I think might appeal to many mainstream equity investors. Their new ETF is called the WisdomTree UK Quality Dividend Growth UCITS ETF (UGRW). This tracker fund looks to track the price and yield performance, before fees and expenses, of the WisdomTree UK Quality Dividend Growth Index and has a total expense ratio of 0.29%.

According to Wisdom Tree the underlying index “follows a rules-based, fundamentally weighted approach and is comprised of high-quality dividend paying companies from the UK market with high return on equity, high return on assets and high medium-term earnings growth. By focusing on quality stocks, the index aims to provide both upside participation in bull markets and exposure to leading dividend growers. The index excludes companies which do not meet WisdomTree’s ESG (environmental, social and governance) criteria.”

In the graphic below I’ve highlighted two tables from the latest fact sheet for this new fund which shows the sector bias of these UK stocks – industrials and financials – along with the top stocks in the portfolio which include Relx, Rio Tinto, 3i Group, GSK, Unilever and Diageo. As ETFs go, this is I think a very welcome new issue which taps into a rich vein of stocks beloved by UK active fund managers.

It’s a cheap vehicle – saving you at least 50 basis points compared to most active fund managers deploying the same strategy – and the UK is the right market to pioneer this passive quality dividend approach. That said there are a handful of competitors in this space not least the SocGen-inspired Quality Income ETFs run by Amundi (and formerly Lyxor). The ticker for the global version of the ETF from Amundi is SGQL.

Income fund – Put Sequoia Economic Infrastructure on your radar

I think there’s a growing likelihood that we are close to a peak in interest rates and although I don’t think rates will come down very soon, I do think that by the end of next year, we’ll be on a Lower Sooner trajectory. That doesn’t mean that we won’t see another base rate rise in the UK – maybe one more increase – but I think there’s a growing possibility that interest rates could be below 5% by late 2024, 2-year gilt yields below 4%, and 10-year gilts below 4.5%.

In that scenario we might see a revival of interest in higher-yielding lending income funds – these are specialist infrastructure credit funds that yield above 8% in the current market. A 3 to 5% yield gap over low-risk gilts (3.5% for 10 years and over 4% for 2-year gilts) will be attractive at a certain point, especially if the funds’ managers have navigated their way through the current volatile rates environment with low defaults.

The challenge here is that many of the existing lending funds have either gone into wind down (the latest is RM Infra) or are in a tight spot with very high discounts (GCP Infra).

My preferred stock in this space is the highly specialist life sciences lending fund BioPharma Credit but I’ve now moved up another lending fund into my watchlist (though not a buy yet), Sequoia Economic Infrastructure. This is a large lending fund – a market cap of just under £1.3 billion, whose share price is currently at 77p and is trading at an 8.9% yield and a discount of 17.1%.

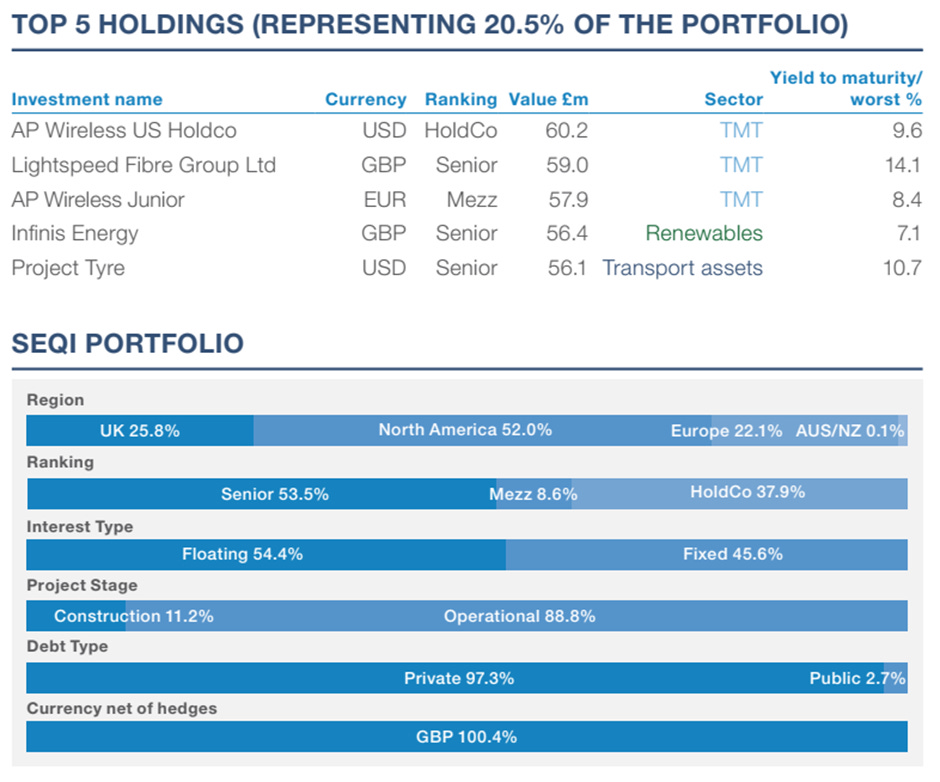

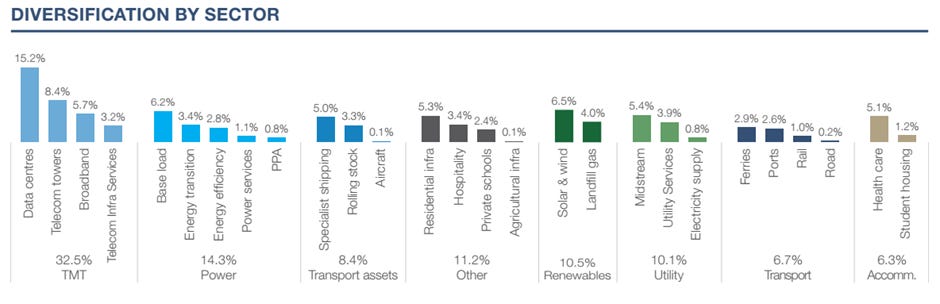

If we cut through the jargon surrounding this fund, its proposition is quite simple. It invests in loans issued to real asset-backed borrowers who build, develop or own everything from data centres to power stations, student housing, and solar and wind projects. That means it’s engaged in what’s called private credit/debt to the private sector, nonstate entities. There is a very real risk of default and some of its loans have already hit the buffers but overall the fund has built up an impressive reputation. The two graphics below flesh out some of the details on the underlying loan book.

Most though by no means all the loans are floating rate structures which means the yield has been rising and the average cash yield is around 7.9%. There’s excellent geographical diversification and the dividend is well covered at 1.21 times cashflow.

There have been some small monthly write-downs in NAVs but there is a possibility that we are nearing the peak of the current interest rate cycle and Jefferies funds analyst Matt Hose notes that the fund is “ currently exploring the implementation of selective interest rate swaps to lock in current high rates and to allow more dynamic management of the portfolio’s fixed-rate exposure. This is interesting as it infers the management team may see interest rates as having peaked, which if true, would be positive for the mark-to-market valuations of the portfolio’s holdings with fixed coupons”.

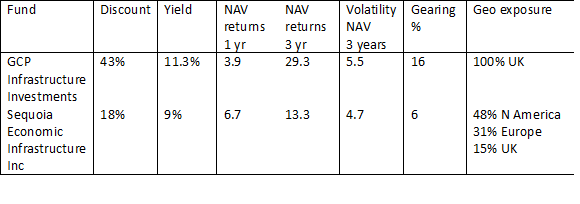

I think it’s also useful to compare this fund with its nearest peer GCP Infrastructure Investments. In the table below I’ve tried to summarise the key metrics for the two funds. Both are asset-backed lenders in the infrastructure space and on paper GCP looks the better value play at the moment. GCP’s discount is very wide at 43% and it boasts a better 3-year NAV return number. It’s also yielding more than Sequoia, at an 11.35% net yield.

But I’m more cautious about the GCP fund on a risk basis. Its shares and NAV boast higher levels of volatility while the average life of the loans in the portfolio is 10.7 years, which is higher than Sequoia i.e there’s greater duration risk. By comparison, the average maturity for Sequoia is 4.2 years.

I’d also cite two other concerns – GCP’s loan book is 100% UK-based and is not internationally diversified and is very heavily exposed to the energy sector, with over two-thirds (68% to be exact) energy-related compared to less than a third of the Sequoia book. I’d also note as an aside that 49% of the GCP loan book is subordinated. As for the debt position at the fund level, Sequoia has lower gearing and doesn’t need to refinance its loans any time soon. Overall, although I concede that GCP is better ‘value’ (a cheaper price with more duration risk which could turn positive if rates fall), I’d prefer Sequoia as the fund vehicle.

My bottom line? I’m not putting this fund on my buy list at the moment as I’m not entirely convinced that :

1) We’ve seen the last of the interest rate rises and

2) We’ve seen the worst of the wave of corporate defaults which are increasing.

Both of these make me slightly wary at the moment and I’d like to see the discount widen out a bit to around 20% or more before I would move the fund to a buy. Nevertheless, the fund is definitely one to watch carefully. It’s a well-managed, liquid, diversified private credit fund with a well-respected management team and a good track record so far in managing defaults and late payments.

Fund details:

- Current NAV 92.88p at the end of September, down 0.10p (0.11%) from the previous month

- 53 private debt investments and 4 infrastructure bonds across 8 sectors and 27 sub-sectors

- an annualized yield-to-maturity (or yield-to-worst in the case of callable bonds) of 10.9% and a cash yield of 7.5%.

- average maturity has recently lengthened from 3.5 years to 4.2 years

- Private debt investments represented 97.3% of the total portfolio.

- 54% floating rate investments

- 52.0% of loans are located across the US, 25.8% in the UK, 22.1% in Europe, and 0.1% in Australia/New Zealand.

- SEQI has £142.6m of cash available

- Two nonperforming loans accounting for c.3.3% of the portfolio

- dividends remain well covered by cash (1.21x vs. 1.06x last year).

- Average investment size £32.5m

RTW Arix deal – a terrible deal for Arix shareholders

A few weeks back, life sciences venture fund Arix announced the conclusion of its strategic review – a merger with RTW Ventures. The details are as follows:

- It is an all-share merger via a scheme of reconstruction and voluntary winding up of Arix

- Arix shareholders will receive 1.4633 new RTW Bio shares for each share held, which implies a value for each Arix share of £1.43

- The 143p implied price represents a 21% discount to Arix’s 30 September NAV of 180p

- A company within RTW will also acquire 33,023,210 shares in Arix, representing Acacia Research Corporation’s c.25.5% stake at £1.43 per share. Acacia is currently Arix’s largest shareholder.

- RTW will get meaningful cash of $60m to deploy in its portfolio which will now include Arix’s mix of private ( worth $86m) and public (worth $68mm) investments.

- It is immediately accretive to NAV for RTW (low single-digit NAV accretion) and makes the fund much more liquid (and meaningfully increases scale).

- A shareholder vote is due in January 2024

So, what to make of the deal? I personally own both stocks and although I think this is an excellent deal for RTW shareholders – as it is NAV accretive, gives it lots of cash, increases its scale, and improves liquidity – I think it’s a terrible deal for Arix shareholders. That said, a reality check is that Acacia, the largest shareholder in Arix, has forced everyone’s hand. It wanted out and it wanted out quickly.

My reading is that it forced the deal and insisted on an immediate cash exit. That’s great news for Acacia who get cash, rather less exciting for the rest of the shareholder base. I had expected a cash distribution to all shareholders – there’s plenty of cash on the balance sheet – but that is now going into Acacia’s pockets and will also be used by RTW (probably to very good effect). The deal is still at a substantial discount to the stated NAV of Arix which implies – not unreasonably – that the private and public assets would not have been worth their stated value in an open market sale process.

Overall I’m perfectly happy to take the RTW shares but I can see why some shareholders may be horrified by these developments. My one caution would be that given Acacia’s position I’m not sure the board – and thus the rest of the shareholders – have much choice.

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.