There’s no harm in using fund managers as a source for investment ideas but blindly copying them without doing your own research can be a costly mistake.

Phil looks at the recent purchase of Rightmove shares by two well-known professional investors to see if private investors should consider buying in as well.

Why copying others appeals to some investors

If you are reading this article and are a subscriber to SharePad then the chances are that you are comfortable researching companies and thinking for yourself.

Some investors don’t want to do this.

Instead, they try to identify other investors who have had good results in the past and copy what they are buying. They trust that a person on social media, a bulletin board or a professional investor has done their homework on a company so they don’t have to.

This results in a regular flow of chatter as to what various investors have been buying. It makes good copy for the financial media and fund managers and their public relations advisers are happy to play along.

During the last week or so there has been plenty of press comment surrounding the purchase of Rightmove shares (LSE:RMV) by two very well-known UK fund managers in Nick Train (Finsbury Growth and Income Trust) and Keith Ashworth-Lord (Castlefield UK Buffettology Fund).

They clearly think that the shares are a good bet, but how do you go about working out in your own mind whether this is true?

Reasons why Rightmove shares might be attractive right now

Ask any investor why they are buying a share and it usually comes down to three main reasons:

- The company behind the shares is a very good business.

- It can meaningfully grow its profits in the years ahead.

- Its shares look to be attractively priced.

When it comes to Rightmove, the UK’s leading property website portal, most informed observers would agree that it is a very good, perhaps even an outstanding business.

Rightmove dominates the online UK property advertising market. It has succeeded by providing its estate agency and homebuilder customers with what they need to sell their properties better than anyone else.

It has created one of the most well-entrenched internet brands in the UK which home hunters instinctively visit and return to time and time again. With an 86 per cent market share, the well-versed argument is that any home seller has to be on Rightmove and can’t afford not to be.

In addition to providing access to millions of potential customers, Rightmove has been very good at selling new value-added paid subscription services to estate agents and housing developers to help them sell better and gain more insight into their customers and markets.

As a result, Rightmove has been able to consistently make more money from its customers every year.

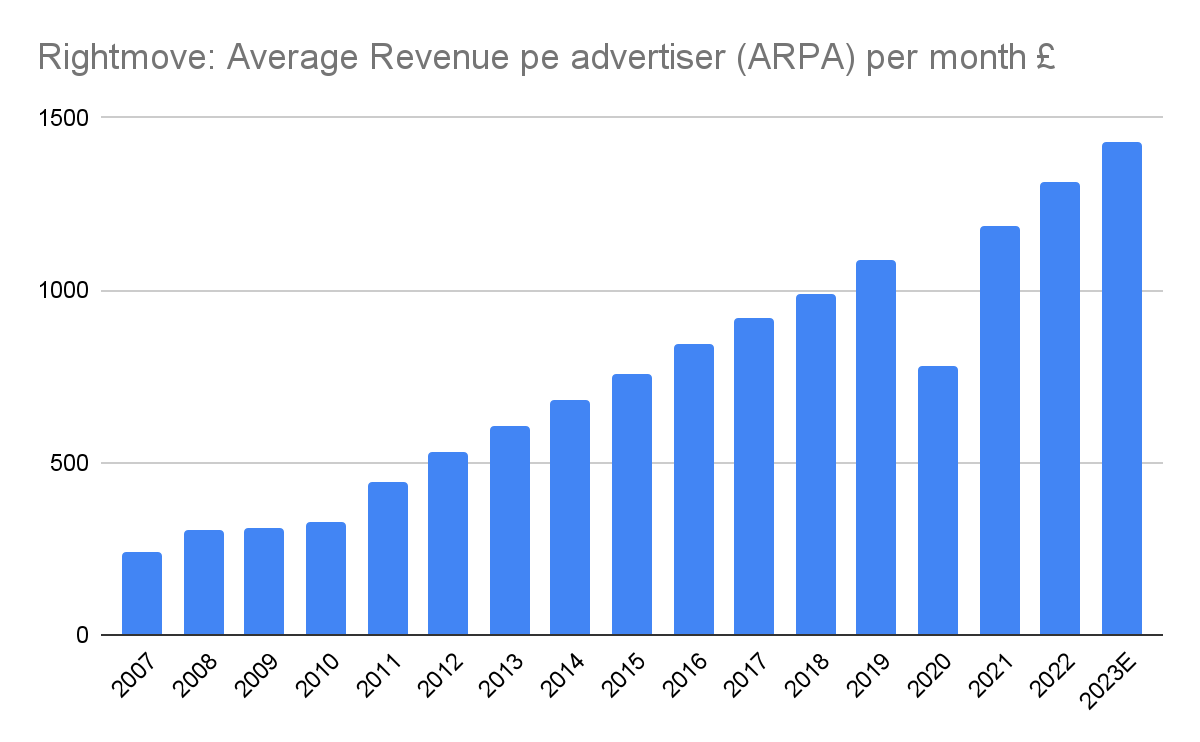

Source: Rightmove

Since 2007, it has grown its average revenue per advertiser (ARPA) at an impressive compound annual growth rate of 11.7 per cent.

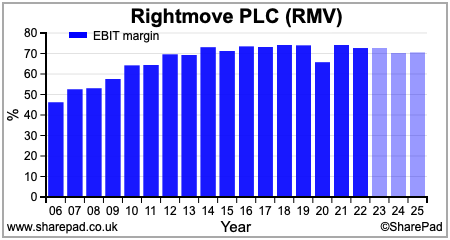

When this revenue growth has been spread over the large amount of fixed costs that come with a website platform business, it has resulted in stunning levels of profitability as evidenced by very high-profit margins and returns on operating capital employed (ROOCE).

Very few UK businesses have profit margins of more than 70 per cent whilst the annual return on the money that has been invested in the business was a phenomenal 378 per cent last year according to SharePad.

When it comes to future growth, Rightmove is very upbeat.

At its investor day this week, it has set itself the target of having more than £600m in revenues and more than £420m in operating profit by 2028. This compares with the respective £361m and £263m that are expected from the company this year. That’s strong growth in anyone’s book.

It intends to hit these targets by continuing to sell more improved products and services to its customers and growing additional revenues from commercial property and mortgage services.

This reassuring backdrop comes at a time when Rightmove shares are some way off their highs. At 523p currently, they are 35 per cent lower than the 800p seen at the beginning of 2022.

Back then, the shares were valued at around 50 times current earnings per share (EPS). Now they are changing hands for just over 20 times the next year’s forecast EPS.

It seems then that the buy case for Rightmove shares is very clear: It looks like an outstanding growth business trading at an attractive valuation.

Why you might not wish to rush in

When you hear about a fund manager buying a share, it pays to look and see if they are any good.

In this case, good means that they have been making money and doing better than the stock market as a whole.

On this benchmark, both Nick Train and Keith Ashwprth-Lord have come up short. Both have underperformed the FTSE-All Share index year to date and over the last one, three and five years. Shares in Rightmove have also been poor apart from a minute outperformance year to date.

If you had never heard of these fund managers and looked at their track records you might wonder whether following their investment decisions is a good idea.

Nick Train, Keith Ashworth-Lord and Rightmove vs FTSE-All Share

| Name | Price | YTD | 1 year | 3 years | 5 years |

|---|---|---|---|---|---|

| Castlefield CFP SDL UK Buffettology Fund Acc | 117.1 | -3.5 | -6.1 | -13.2 | 0.6 |

| Finsbury Growth & Income Trust | 817.5 | -0.8 | -3.6 | 1.4 | 15.7 |

| Rightmove | 519.6 | 3.3 | -5.5 | -12.8 | 23.9 |

| FTSE All-Share – Total Return | 8649.8 | 3.1 | 2.6 | 25.3 | 26.1 |

Source: SharePad

This doesn’t mean that Nick Train and Keith Ashworth-Lord are wrong about Rightmove.

However, good businesses with a good growth outlook don’t usually have a share price chart like Rightmove’s current one. A depressed share price and valuation are usually a sign that there are some concerns out there.

After all, the bull case about the strength of Rightmove’s business and the need for estate agents to be on it, because every customer is (known in investing jargon as a network effect), has not changed for years.

It is unlikely that anyone has a real information edge with this company, but they could make decent money from the shares if the market’s current view on its prospects is too pessimistic.

A new competitive threat on the horizon

Rightmove has effectively seen off the competition for years. That doesn’t mean that it will in the future.

An often-cited rule of business economics is that high profits attract competition. Really good businesses can fend off competition by having some kind of edge. In Rightmove’s case, it comes from its enviable brand recognition.

The company’s chief executive seems to be supremely confident about its competitive strength. He is quoted in The Times newspaper on 27th November as saying that he believes the network effects the company has built are “unassailable”.

History provides the comfort to make such a statement, but Rightmove is arguably facing its biggest competitive threat yet if US property giant CoStar Group (NASDAQ:CSGP) succeeds with its takeover of its UK rival OneTheMarket (LSE:OTMP).

OnTheMarket was set up by a group of estate agents in order to counter the dominance of Rightmove. Whilst high-profit margins and rising advertising revenues are cheered by Rightmove’s investors, they are a source of grievance for its estate agency customers who are struggling to make money in a tough property market.

OnTheMarket has not been a success but CoStar plans to throw huge amounts of money at it – £46m in marketing and internet search optimisation tools in the first year of ownership or three times what Rightmove currently spends – to turn it into a powerful alternative to Rightmove.

Its track record in the US suggests that Rightmove should take the threat seriously.

CoStar is well-practised in taking on established market leaders by purchasing property portals with low market shares and successfully growing their web traffic and profits. It also has experience of the UK commercial property market through its ownership of LoopNet.

It has taken the rental website Appartments.com from fifth to the leading position and has taken the residential business Homes.com from sixth place to second place in terms of website traffic – although this figure is disputed by its competitors.

CoStar doesn’t just throw money at marketing but has effectively built a data and market intelligence service for its customers.

In the US it aims to take market share from competitors who it believes are charging their customers too much by undercutting them on price. Rightmove arguably provides it with the same opportunity in the UK.

There are few free lunches in investing. However, Rightmove is unlikely to be ditched by agents anytime soon and if history repeats, Messrs Train and Ashworth-Lord will have been shown to have bought well.

If CoStar can create a meaningful competitor and threaten Rightmove’s pricing policies – and reduce its future profit forecasts – then current concerns about the company will be well founded.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.