Given the surge in bond yields over the last few weeks, the monthly funds’ article focuses on the opportunities within the bond ETF space, looking first at the universe of cheap UK sterling bond ETFs and then at a wild shot idea, a US Treasury bond ETF that has been an utter dog in recent months but could be set fair if rates do start to come down at some point. There’s also a look at the top 20 investment trusts with the best performance track record AND the biggest discounts.

Bond ETFs

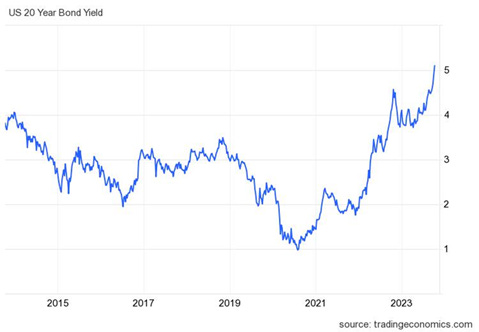

The big story in the markets over the last few weeks has been the aggressive sell-off in government bonds, especially US government bonds, and the consequent rise in yields. The key signal to watch out for is the yield on the US 10-year Treasury bond which has been bobbing around the 5% mark. The old adage is that once this yield goes above 4.5% stuff starts to break i.e. the financial system starts to creak.

One area to watch is the possibility of ever larger losses for banks on their holdings of US government bonds. We in the UK could, I suppose, shrug our shoulders at these developments and say that our situation is different – our economy is nowhere near as strong as the US. But the sad truth is that what starts in the US usually has an impact on the UK, especially as we have a much more persistent inflation problem. Arguably if the US is experiencing a bonds sell-off, our sell-off should be even more aggressive.

What’s powering these big moves in yields? The simplest explanation is that a new narrative has taken hold which we can summarise as the Higher for Longer argument. The outlines of this argument are not difficult to understand. Government bond yields need to head higher because inflation isn’t conquered, wage inflation is still high, the US economy is still running hot, and the US government is still borrowing too much.

There is evidence that inflation rates are slowly deflating, though not on all measures, while wage inflation might be a second-order response to higher food prices and could also fall back over time. There’s also more evidence that the US economy is slowing down though again the evidence is patchy.

The point about government spending is true on one level – the deficit is obviously very high – but large government deficits are sustainable over the long term if the central bank is willing to control the term premia on long-duration bond yields and play an active role in managing bond markets (resume a form of QE). The political argument here is that Big Government is Bad and will result in long-term pain, thus leading to Higher for Much Longer.

Maybe that is true, maybe not.

I’m not saying I think Higher for Much Longer is wrong, just that it’s not a given, or a certainty. I attach an equally large probability to a) Lower (rates), Sooner Scenario as well as a b) Stop-Start scenario. I would also make the argument that keeping interest rates above 5% for many years and allowing long-duration T Bonds to yield above 5 or even 6% for many years hence, will destroy investment, sap growth and complicate an already difficult government fiscal position.

This debate about narratives has very real-world implications – put simply is the sell-off in bonds overdone and is it now time to move back into fixed-income securities? My own gut instinct tells me that a wholesale shift from cash or equities into bonds is probably a little way off but is probably not too far off, assuming inflation doesn’t stage another aggressive rebound.

So, where does that leave UK fund investors?

One modest suggestion is that it might be a good time to start weighing up your preferred bond fund options. There are plenty of actively managed bond funds out there, many of which sit in the multi-strategy category. The simpler alternative is to look at the growing number of index-tracking funds or ETFs (exchange-traded funds) which invest in different parts of the UK sterling-denominated bonds universe.

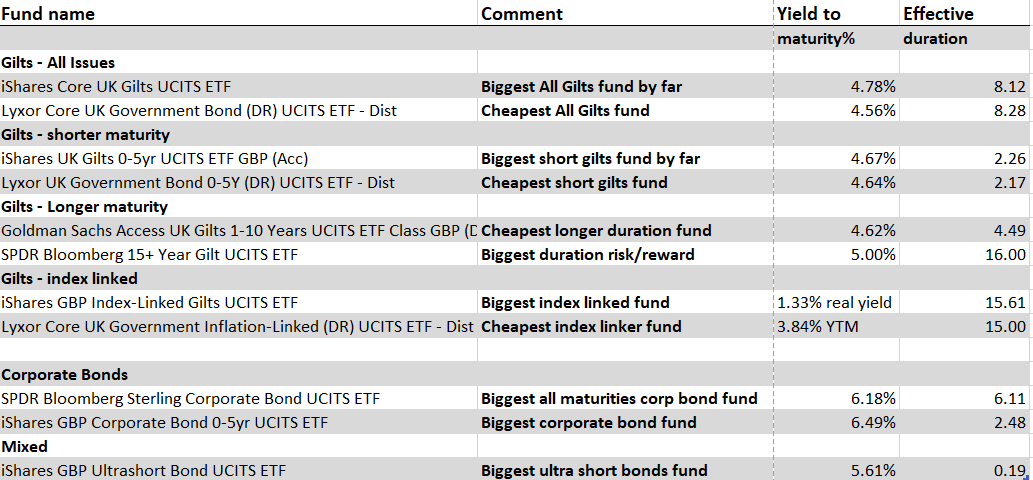

In the table below – I’ve tried to summarise the available universe. As you can see the main distinction is between government securities (gilts) and corporate bonds. Within each broad category, there’s also a range of maturities from short duration (under 5 years) through to long durations (15 years and over).

There’s also a small subgroup of index-linked government securities trackers. If you are really worried about future inflationary surges these might be a safe harbour, though be aware that their pricing can be hugely volatile and are impacted by the general direction of real rates across the bonds universe.

One last category is also worth mentioning – a very popular iShares ETF which invests in (largely corporate) ultra short-duration bonds that look and feel more like a cash plus alternative i.e. there’s probably low default risk.

In each category or niche, I’ve tried to list the biggest (most liquid) and the cheapest fund (by TER) and then plotted them for two key measures. The first is the average yield to maturity of the funds and the second is the effective duration. On this second measure the higher the duration the more volatile the fund price i.e., a high duration could be sold off more violently if interest rates carried on rising.

My own outlook on this asset class – government bonds – hinges on answering two questions. The first is whether you think we are approaching or have reached peak interest rates. If you think there is worse to come (more rate rises), then you should probably avoid bonds altogether. Assuming you answer yes to the first question – we are approaching or have reached peak rates – then your question becomes how long a maturity of bond you want to buy. The biggest opportunities on the upside belong to those with the longest maturity and duration but these are also likely to be most volatile if rates stay high and maybe look like they might head higher. If you are more cautious then head down the maturity and duration spectrum to ultra-short or short-duration (up to 5 years) funds. If you’re looking to maximise income then you should probably be taking on more credit risk by looking at corporate bond funds. As for index-linked bonds, these are offering what I think are generous real yields at the moment, but their pricing is very volatile and is heavily impacted by inflation expectations as well as the level of real yields on conventional gilts. They are a very effective inflation hedge, but I wouldn’t want investors to underestimate the risks.

US Government Bonds

Sticking with the theme of bond investing, let’s switch to the US market. Echoing the points above, my hunch is that as the long end of the US treasury bond curve starts to push above 5% – see the chart below – we are entering a very uncertain environment. That yield could – probably will – head higher in the short term but at some point, that yield might also peak and slip downwards.

And I would also suggest that that point might/possibly be sooner rather than later. At that point the huge losses from owning long-duration US T Bonds will be reversed – the 20-year T bond has lost huge amounts of money in recent years making a mockery of the idea that Treasury Bonds are a low-risk investment.

At some stage adventurous types might want to look at an ETF from iShares called the USD Treasury Bond 20+yr UCITS ETF GBP Hedged (Dist). This is a hedged – against the dollar – tracker fund which is a way of buying that long end of the bond curve in an ETF format. It’s been an absolutely terrible investment to date and as I said, might get even worse as the Higher For Longer consensus strengthens. But at some point, that yield – which is distributed – will look very attractive if interest rates head south and yields weaken. There is a scenario in which we do get Lower Sooner and this ETF will look very appealing and remember that the ETF is hedged against currency risk (which comes at a small cost to the TER of the fund). One to watch

Fund basics

- Ticker IDTG

- Weighted Average YTM 4.97%

- 12-month Trailing Dividend Distribution Yield 3.88%

- AUM £820m

- TER 0.10%

- 1-year volatility 22%

- Maximum Drawdown since inception -50%

Quality funds on big discounts

The industry trade association for the closed-end fund and investment trust sector – the AIC – has recently released what I think is a very useful list. It comprises the top 20 “best-performing investment companies over ten years that are currently trading on double-digit discounts”. According to the AIC, the average investment company is trading on a 16% discount, compared to 12% at the end of December 2022.

Using this data, the AIC reckons that the Allianz Technology Trust is the top-performing investment company on a double-digit discount. It has delivered a near-fivefold return to investors over the past decade and is trading on a 13.5% discount. Second up is India Capital Growth, which has achieved a similar ten-year return and trades at a discount of 11.3%. The third-best performing of the 20 companies on double-digit discounts is Polar Capital Technology, which has generated a return of more than four times investors’ money and trades on a 14.2% discount.

Private Equity is the sector that features most heavily in the list, accounting for eight of the top 20 companies. Six of these eight companies have discounts of more than 30%. The fourth and fifth best performers on discounts wider than 10% are both private equity investment companies, HgCapital on a 22.1% discount and NB Private Equity Partners on a 30.5% discount.

Looking at emerging and frontier markets, funds investing in Vietnam have also done well over the long term despite sitting at deep discounts with Vietnam Holding and VinaCapital Vietnam Opportunity Fund the stand-out stars.

My own observation is that most of the top funds in this list aren’t surprising – they tend to focus on the best-performing bits of the growth equities spectrum i.e. tech stocks or growth-oriented emerging/frontier markets. What’s slightly peculiar is why so many of these funds are trading at such high discounts. I’ve colour-coded in red the funds that I’ve either rated highly in the past or owned myself.

I’d add one final caution relating to private equity – these funds might continue to struggle in this market as investors try and figure out how major corporates will cope with a higher interest rate environment. Like many, I rate Hg Capital and Oakley Capital Investments very highly, but I fear they are stuck in a multi-year bear market where discounts will continue to be above average.

Top-performing investment companies over ten years with double-digit discounts

|

Company name |

AIC sector |

Share price total return % 1 year |

Share price total return % 3 years |

Share price total return % 5 years |

Share price total return % 10 years |

Discount % |

|

All investment companies |

Industry ex VCTs |

1.8 |

13.9 |

74.1 |

140.0 |

-16.1 |

|

Allianz Technology Trust |

Technology & Technology Innovation |

11.4 |

-5.6 |

79.5 |

395.6 |

-13.5 |

|

India Capital Growth Fund |

India/Indian Subcontinent |

29.8 |

117.9 |

89.8 |

390.5 |

-11.3 |

|

Polar Capital Technology |

Technology & Technology Innovation |

13.4 |

0.5 |

79.9 |

366.3 |

-14.2 |

|

HgCapital Trust |

Private Equity |

10.2 |

35.0 |

109.9 |

351.5 |

-22.1 |

|

NB Private Equity Partners |

Private Equity |

2.6 |

69.7 |

75.2 |

321.8 |

-30.5 |

|

VietNam Holding |

Country Specialist |

14.2 |

95.8 |

51.8 |

295.2 |

-14.1 |

|

VinaCapital Vietnam Opp Fund |

Country Specialist |

2.5 |

45.4 |

57.3 |

288.1 |

-21.1 |

|

Scottish Mortgage |

Global |

-13.5 |

-37.6 |

37.4 |

259.1 |

-17.1 |

|

HarbourVest Global Private Equity |

Private Equity |

-3.2 |

24.6 |

54.4 |

246.5 |

-47.3 |

|

CT Private Equity Trust |

Private Equity |

17.2 |

80.6 |

65.2 |

230.5 |

-36.0 |

|

Alpha Real Trust |

Property – Debt |

-3.7 |

-13.7 |

5.9 |

230.5 |

-40.6 |

|

Pacific Horizon |

Asia Pacific |

-3.6 |

-16.6 |

79.2 |

225.2 |

-11.7 |

|

Dunedin Enterprise |

Private Equity |

16.6 |

118.4 |

100.2 |

222.8 |

-15.6 |

|

Oryx International Growth |

UK Smaller Companies |

12.7 |

-1.8 |

31.1 |

213.2 |

-33.6 |

|

Lindsell Train |

Global |

-11.7 |

-17.9 |

-16.7 |

209.2 |

-13.0 |

|

abrdn Private Equity Opportunities |

Private Equity |

8.7 |

51.7 |

50.4 |

204.6 |

-44.4 |

|

3i Infrastructure |

Infrastructure |

0.8 |

11.7 |

40.2 |

193.0 |

-12.7 |

|

Oakley Capital Investments |

Private Equity |

13.6 |

70.9 |

148.2 |

189.3 |

-36.0 |

|

Canadian General Investments |

North America |

15.1 |

27.4 |

61.7 |

179.0 |

-36.4 |

|

Pantheon International |

Private Equity |

19.0 |

39.8 |

40.1 |

178.6 |

-38.1 |

Source: theaic.co.uk / data correct as at 20/10/23

David Stevenson

Got some thoughts on this week’s article from David? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.