If you already have an Isa or Sipp account, you’ll have access to your broker’s free website. This probably provides you with investment data about funds and shares and will also let you see how your investments are doing.

Why subscribe to SharePad when you can get all that for free?

Well, it is debatable whether these services are free. Most people pay some kind of fee for the Sipp, Isa and trading accounts and receive these as part of the deal.

The information and tools that brokers provide their customers have improved a lot over the years. But are they good enough to manage your own investments in an effective way?

For some people, they will be, but many diligent private investors are looking for more data and more ways to make it useful for them. This is where SharePad and ShareScope come in.

Before we talk about the benefits of SharePad, let’s have a look at the tools and data that many brokers provide to their customers.

Typically, investors have the ability to monitor their portfolios and see how the individual investments have been performing and how much they have invested in each of them. They will often give the ability to analyse their portfolio in terms of sector, asset and geographic allocation.

You will also get some basic financial data in the form of income statements, balance sheets and cash flow statements.

Basic stock screeners and search tools will allow you to identify shares and fund ideas for your portfolio but only based on limited screening criteria.

When it comes to shares, you will often get some forecast data such as revenues, trading profit, pre-tax profit, earnings per share(EPS) and dividends per share (DPS) usually for two years.

Brokers will also offer company news services and regulatory news service (RNS). This will be complemented by in-house articles on shares and funds.

Some brokers may also give you the ability to do some basic technical analysis.

With SharePad you get all of this and a whole lot more.

Award winning software to help you become a better investor

I spent thirteen years earning a living as a professional investment analyst. I can confidently say that the tools and data available in SharePad allow me to perform very effective research into companies and investment funds for a fraction of the price that professional investors pay.

SharePad has huge amounts of financial data which can all be customised for individual use.

A company’s financial history is a vital part of investment analysis. With SharePad, I can go back 30 years and see how a company Fareed over several economic cycles. This gives me an insight into how it might perform when the next recession comes along and how it might recover from it.

Instead of wading through lots of numbers, SharePad can present data in charts, allowing you to quickly see the history of a company on many different measures.

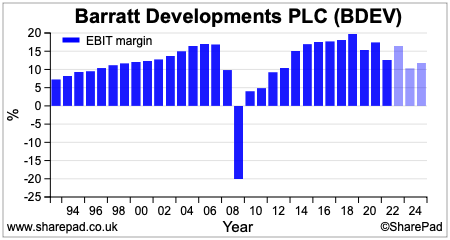

In the chart below, you can see the profit margins of housebuilder Barratt Developments going right back to 1993. You will also see forecasts for the following three years.

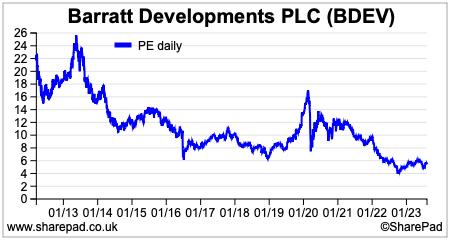

I can also see how the stock market has valued the company over time on measures such as a price-to-earnings (PE) ratio. This allows you to weigh up whether the shares are good value right now or might possibly get cheaper.

SharePad also allows you to compare a company against its sector peers on a huge number of different measures.

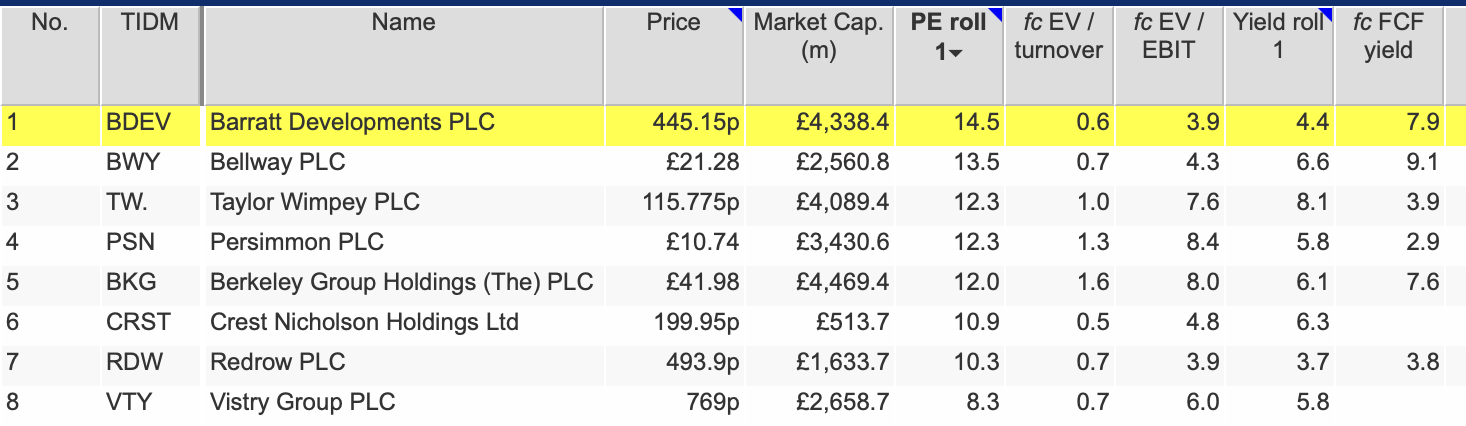

In this case, it is showing you the valuation of Barratt Developments based on forecasts compared with its UK housebuilding peers.

Source: SharePad

With Sharepad, you get data on US, Canadian and European shares included at no extra cost. This means that you can compare UK shares with their US and European quoted competitors to see how they measure up on criteria such as financial performance, valuation and investment returns.

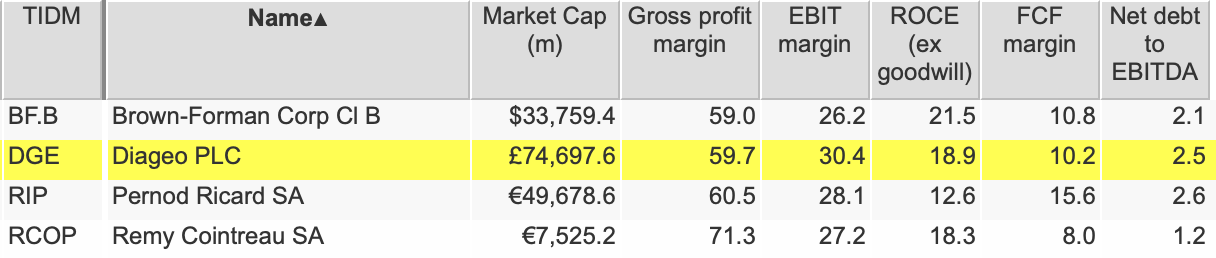

Below is UK spirits giant Diageo compared with its US and European competitors on its profitability and debt levels.

Diageo vs its peers

Source: SharePad

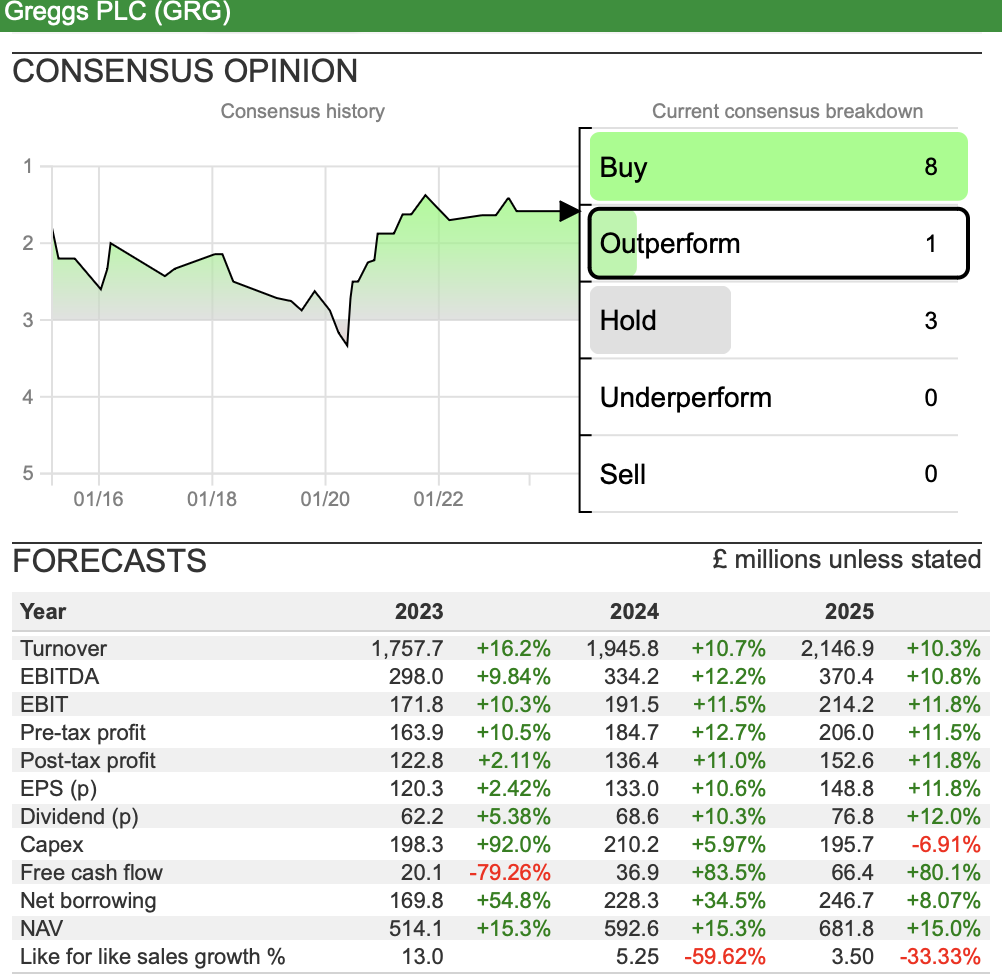

When it comes to company forecast data, we believe that SharePad has the best data available to private investors at a comparable price point. Whilst brokers and competitor products will give headline measures such as revenues, profits, EPS and dividends, SharePad will give important forecasts such as debt levels, free cash flows, capex (investment spending), net asset values and even like-for-like sales forecasts for companies such as retailers.

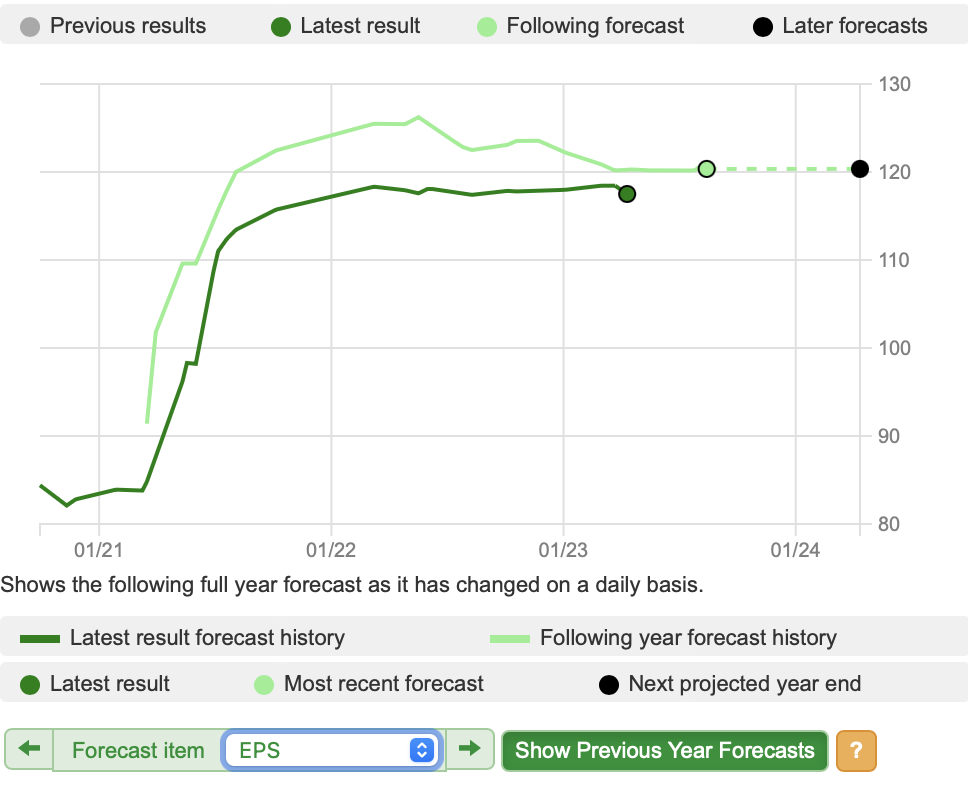

SharePad will also show you how forecasts have changed over time. This is not just available for EPS but every forecast item that is provided.

Greggs EPS Forecast History

Source: SharePad

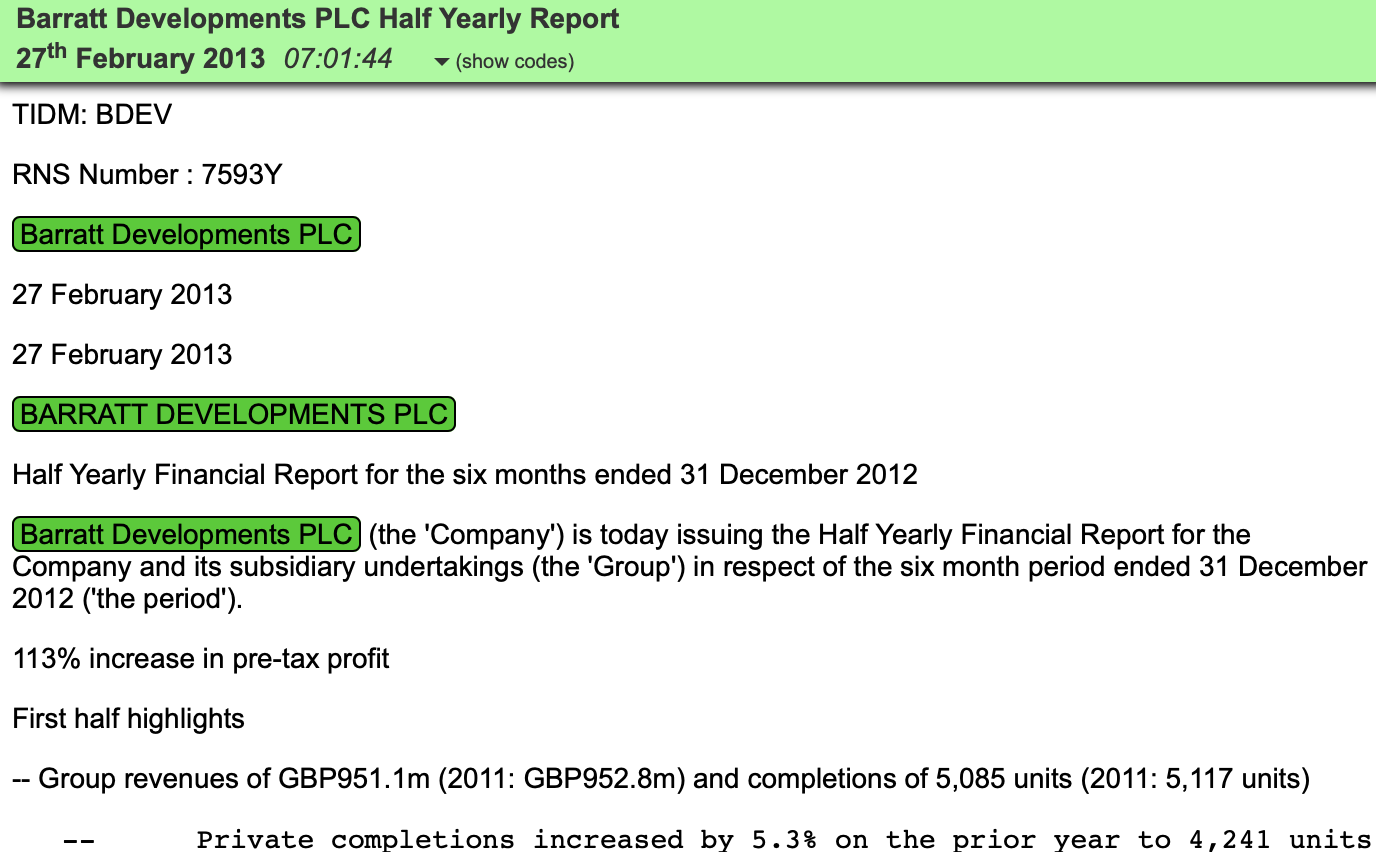

SharePad includes a very comprehensive company news resource. This not only covers recent news but news going back years.

Below is Barratt Developments’ half-year results back in February 2013. Instead of trawling through a company’s investor relations website for this, I can access it quickly and easily in SharePad.

You can also search within the news data. For example, asking SharePad to search for the word “results” is very useful.

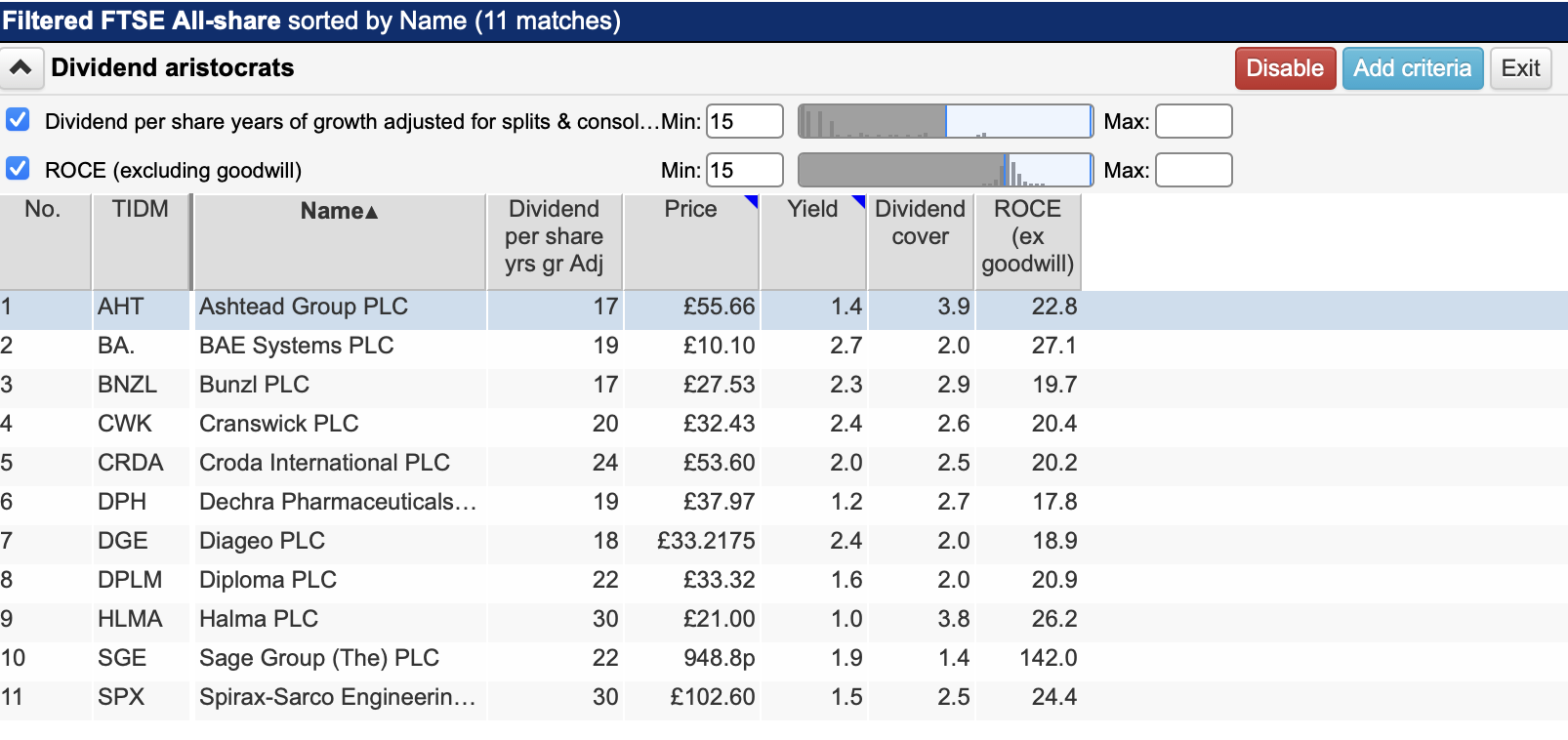

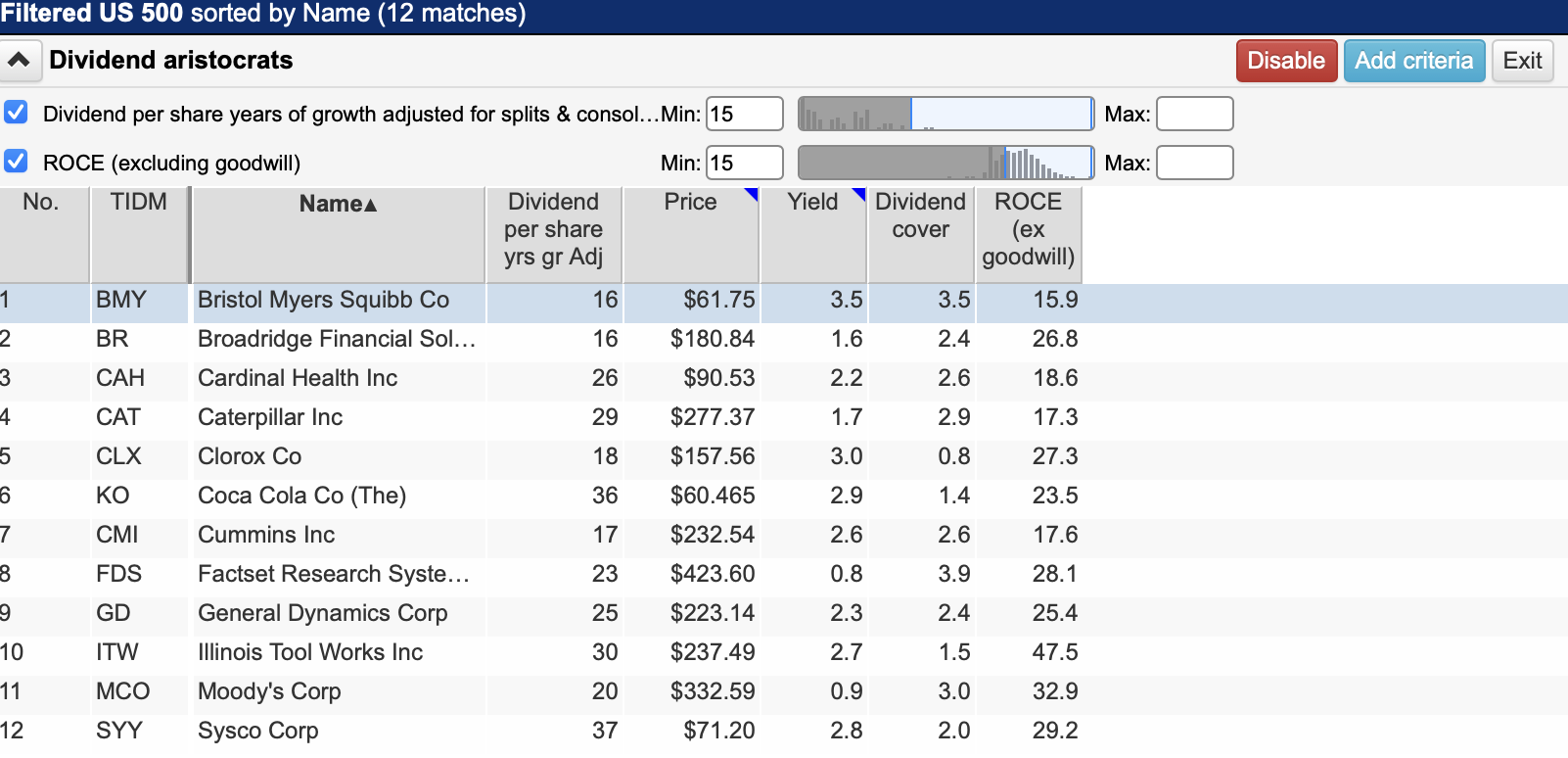

One of SharePad’s greatest strengths is its screening ability. You can literally build hundreds of customisable stock screens depending on what characteristics you are looking for. These screens range from those that are very simple to very detailed ones if that is what you want.

The screen shown above looks for high-quality, dividend-paying companies (as measured by their return on operating capital or ROCE ex goodwill) who have grown their annual dividend per share for at least fifteen consecutive years.

As you can see, there aren’t many UK companies who have been able to do this.

If you want to see how many US companies met this criteria, you simply apply the filter to the list of US shares in SharePad. This gives you an answer in a matter of seconds.

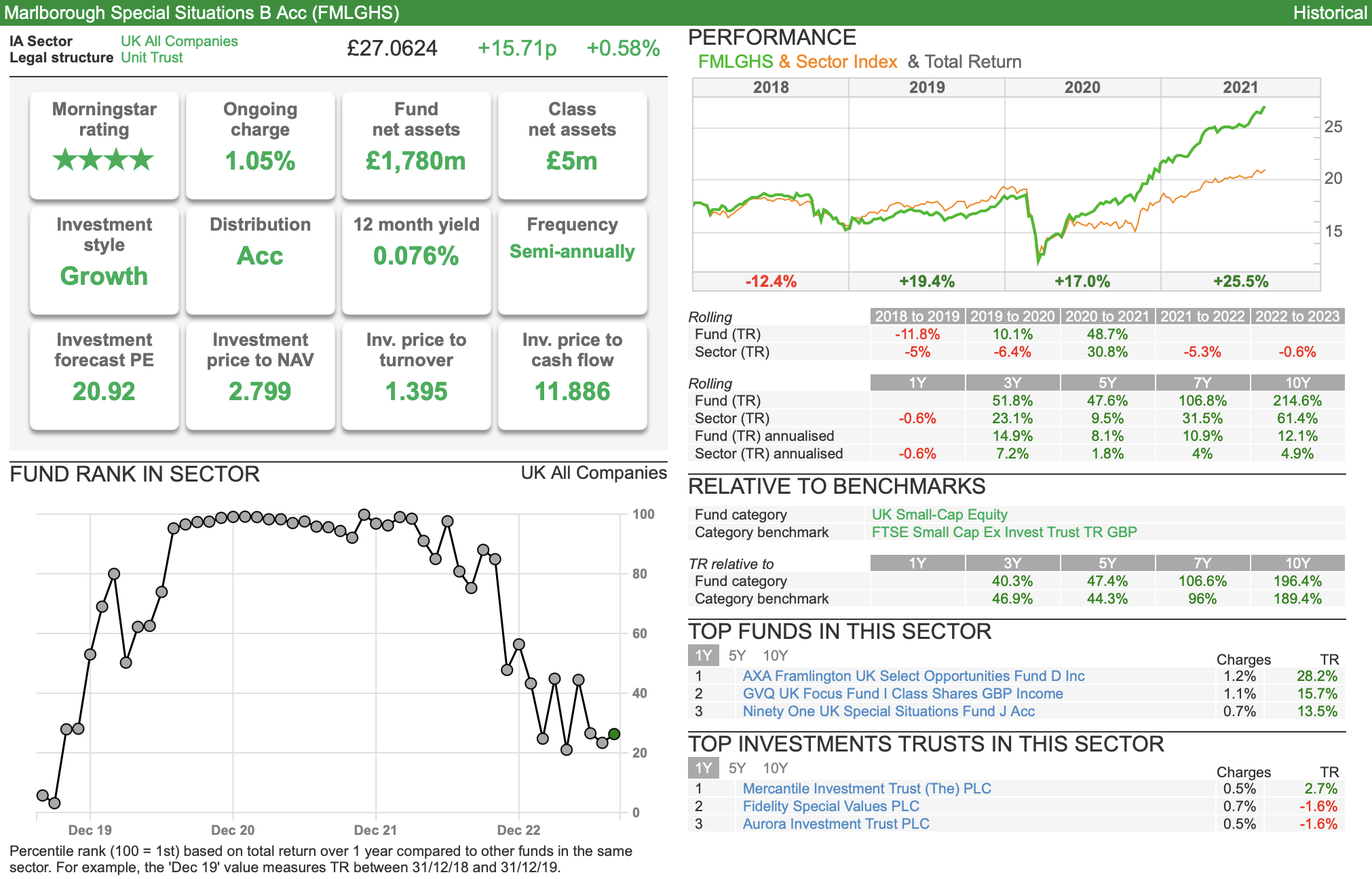

As well as companies, SharePad is great for researching funds, investment trusts(ITs) and exchange-traded funds (ETFs).

When selecting a fund, you not only get lots of data on its performance, holdings, valuation and risk but also what is the best-performing fund in the same sector and the best-performing investment trusts.

If you want to find a fund that owns a particular share or shares in its top 10 holdings you can use SharePad to search for that as well.

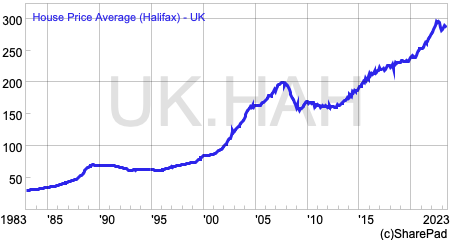

SharePad is not just about shares and funds. It has huge amounts of information on government bonds, corporate bonds, economic data, commodity prices and foreign exchange rates all in one place. This allows you to do so much more research within SharePad.

For traders who rely more heavily on short-term price movements, SharePad has a comprehensive set of technical analysis tools whilst providing Level 2 access to the order book on the London Stock Exchange for more sophisticated traders.

SharePad also offers a host of useful functionality such as downloadable data, alerts sent to your mobile phone or email and the ability to post charts on social media.

The software is backed by a dedicated team of customer support staff and in-house developers with a commitment to continuously improving the product.

Phil Oakley

Not subscribed to SharePad before? Click below to find out how SharePad can make you a better investor.

Got some thoughts about this article? Share these in the comment section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.