Bunzl shares have proven to be a very solid long-term investment but the last few years have not been very rewarding for investors. Phil takes a look at the company to see if shareholders can expect better days ahead.

Source: Bunzl

Stuck in a rut

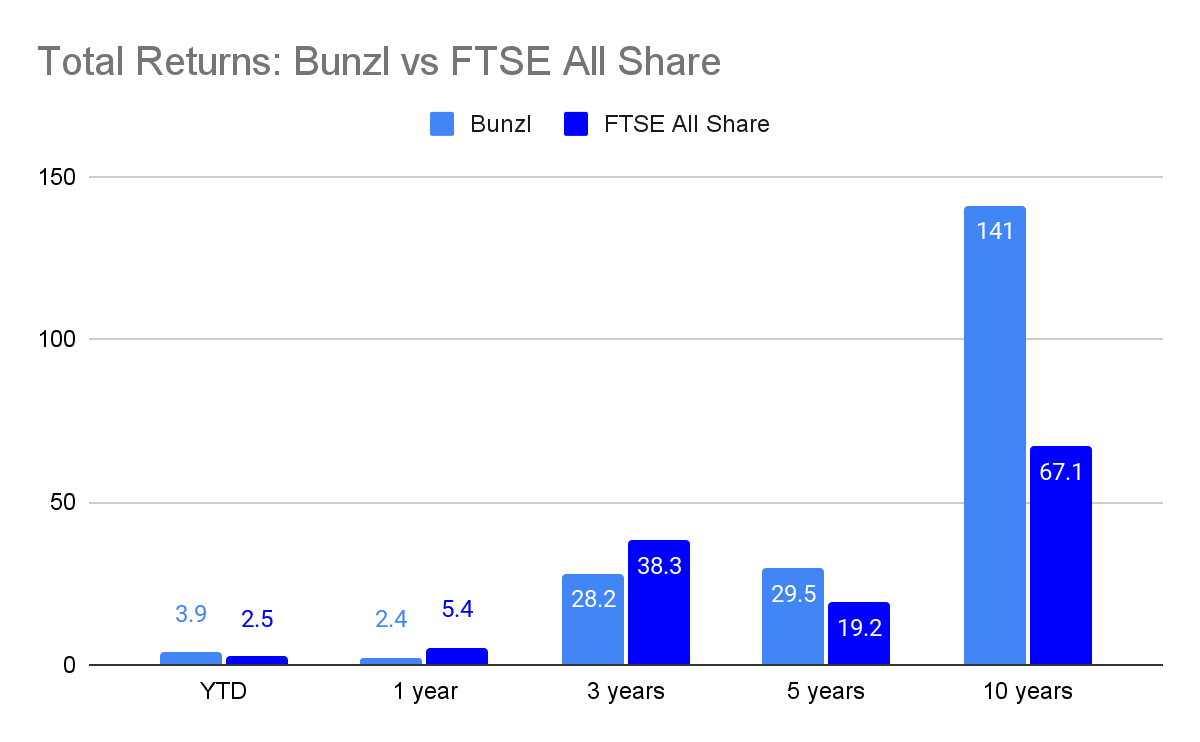

Bunzl is a very well-run business that has served investors well over the long haul. Its shares have comfortably outperformed the FTSE-All Share index over the last decade but over the last few years, returns have been weak.

Source: SharePad

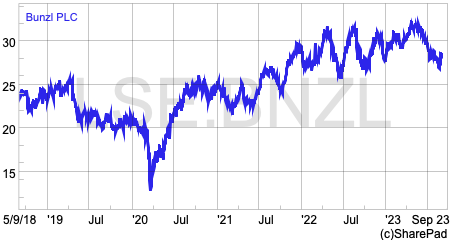

Its share price has also been stuck in a trading range for the last three years and has struggled to move higher.

Can investors expect returns to get better any time soon?

Before we try and answer this question, let’s have a quick look at the business, what it does and how it has been performing.

The business

Bunzl is a distributor. It buys and supplies products that are used every day by its customers in six key sectors and has current annual revenues of £11.8bn.

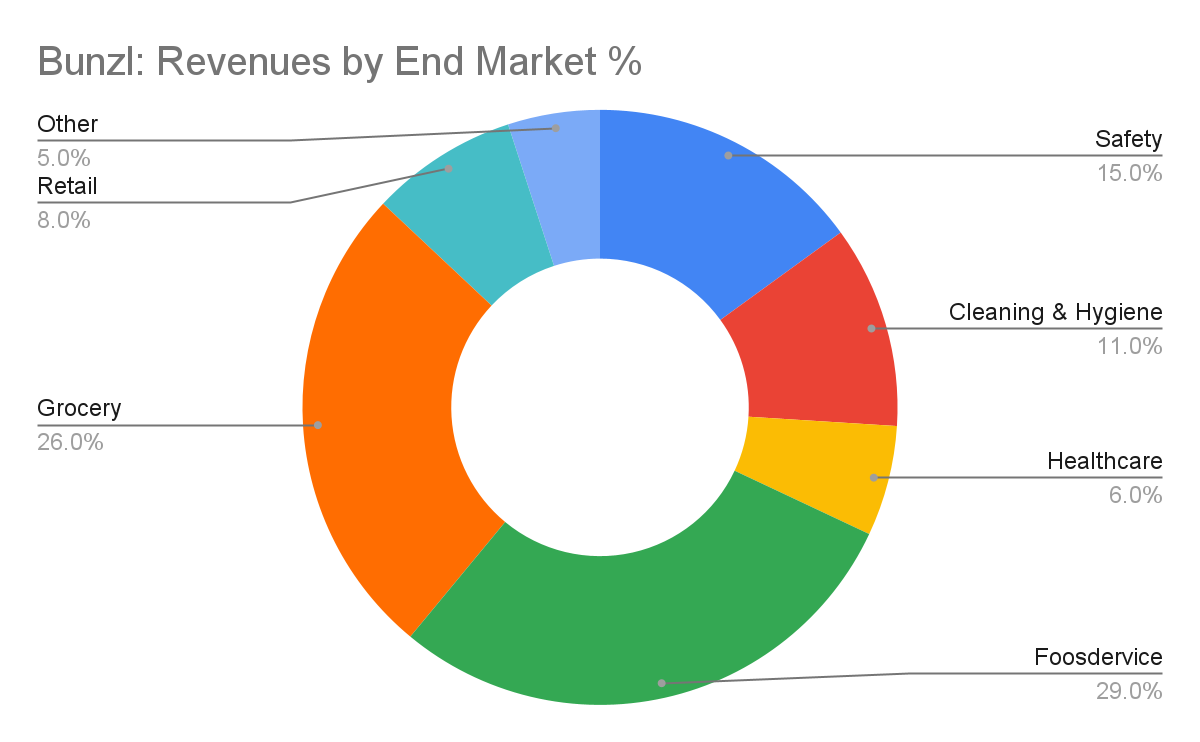

Its business is spread across the following key sectors:

Source: Bunzl

Bunzl sells a huge number of products to its customers. These range from disposable tableware and catering equipment to hotels and restaurants, food packaging to supermarkets and retailers, personal protection equipment (PPE) such as gloves, masks and hats to healthcare and construction companies, cleaning and hygiene products and medical supplies to hospitals and care homes.

Whilst Foodservice and Grocery account for more than half of Bunzl’s revenues, it is a very diverse business selling small consumable items that are used all the time and ordered frequently. This gives Bunzl’s business predictable and defensive characteristics which many investors look for.

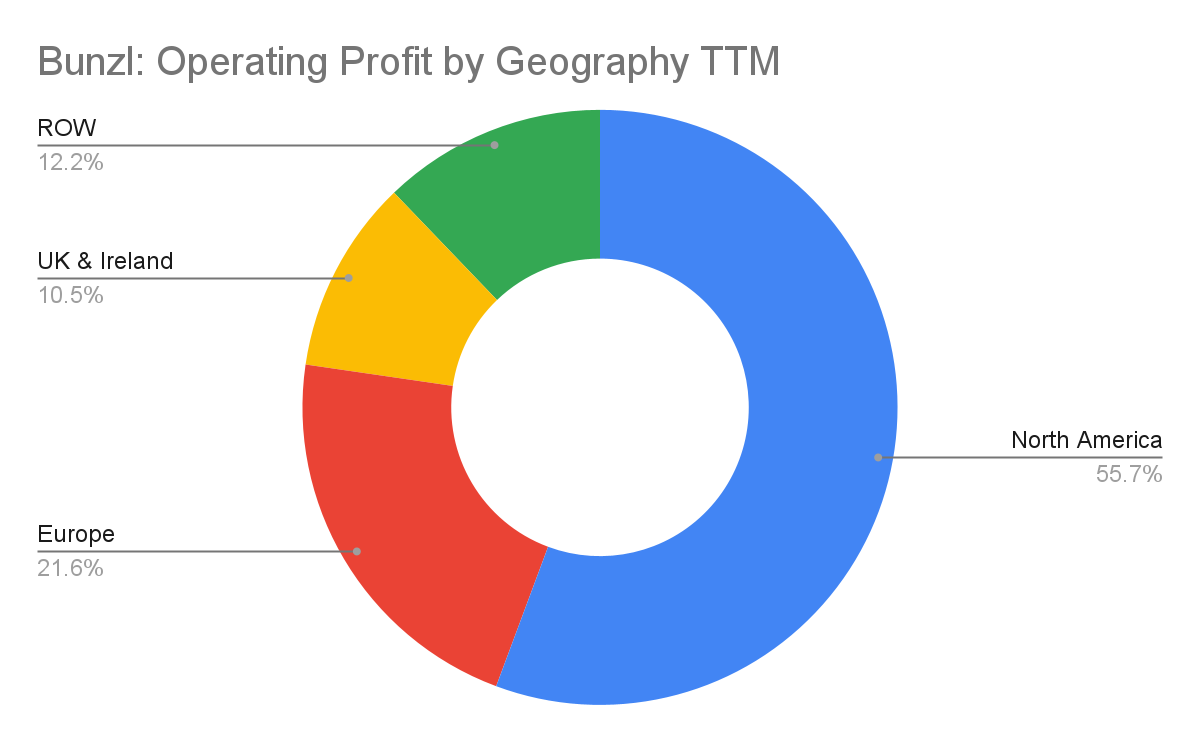

As far as its profitability is concerned, Bunzl currently makes over half of its profits in North America and very little from the UK. It has operations in 32 countries.

Source: Bunzl

Bunzl’s selling pitch to its customers is that it is a problem solver that can help them run their businesses more efficiently..

By investing in warehouses, delivery trucks and IT whilst using its global sourcing power it can give its customers a better and cheaper purchasing solution than if they did it themselves. They do not have to sink money into warehousing and trucks or worry about things such as stock control. Bunzl makes sure that the right quantities of products are delivered to the businesses when they need it.

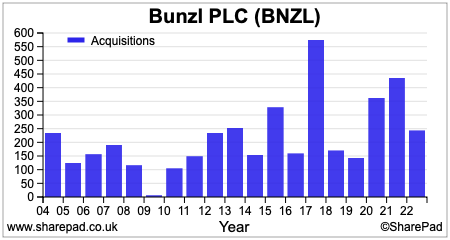

Over the years, Bunzl has persuaded more companies to outsource these key logistics functions to it. It has also spent a lot of money buying companies – £4.9bn since 2004 – in order to enter new countries and markets and to increase its market share in its existing ones. Acquisitions have been responsible for around two-thirds of Bunzl’s revenue growth over the last decade.

Acquisitive companies rightly arouse suspicion amongst investors as so many of them have unravelled in the past and inflicted serious losses.

They can rest easy with Bunzl as it has done a very good job at getting its acquisitions to make its shareholders better off.

When looking at a company which makes a lot of acquisitions you can put it through a series of tests to see if they are working well or perhaps doing harm.

These are:

- Organic revenue growth – Is the existing underlying business still growing or is the business only growing by buying companies?

- Return on operating capital employed (ROOCE) versus return on total capital (ROCE) – the first number tells you about how profitable the actual assets of a business are whilst the second number shows how profitable it is on total money invested which will include goodwill on acquisitions.

- The incremental returns on capital. This tells you how much extra profit has come from additional money invested.

- The impact on cash generation – Is the business generating more free cash flow and are acquisitions being predominantly funded from cash or additional borrowing?

Let’s have a look at how Bunzl stacks up on each of these four criteria.

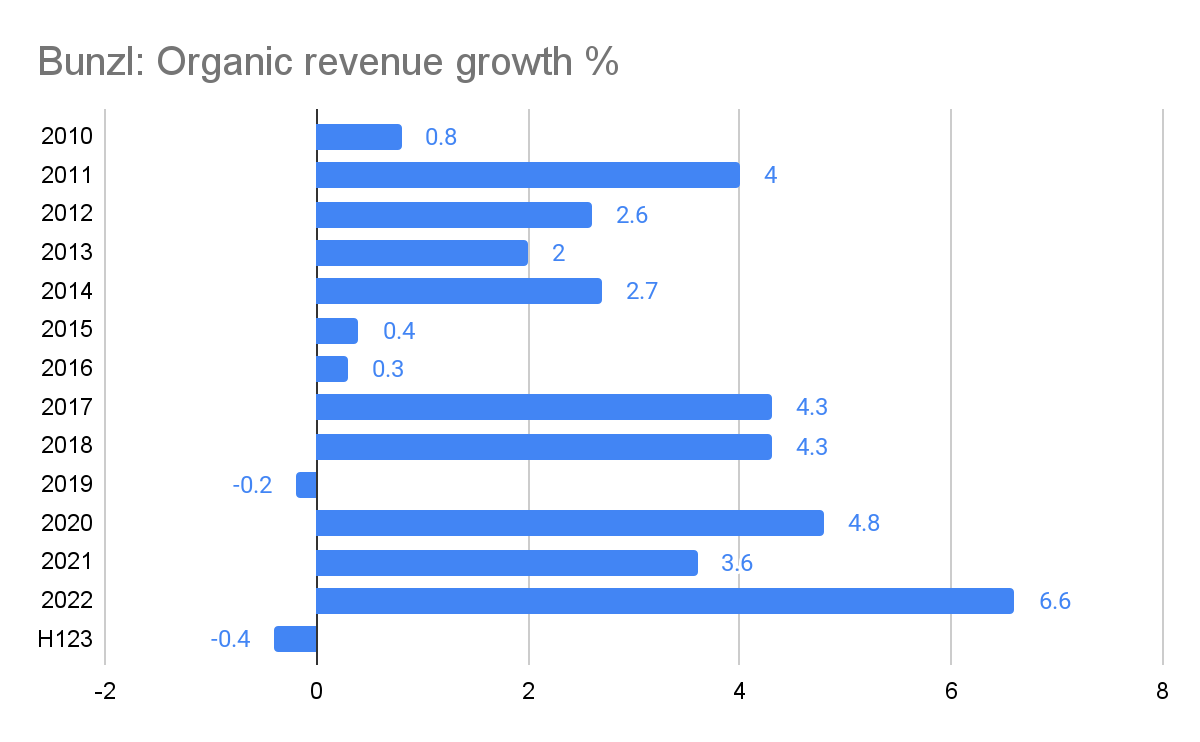

Organic growth

A sign of a very healthy business is one that can increase sales from its existing assets or businesses. It is not uncommon for low-growth companies to make acquisitions to try and hide the fact that its existing business is going nowhere or perhaps declining.

Consistent and positive organic revenue growth is what you should be looking for.

Source: Bunzl

Bunzl scores well here, although the recent slowdown in growth may unnerve some investors. The company performed very well during Covid-19 as sales of hygiene products soared whilst others stagnated or fell. As Covid-19 has fallen away, sales of hygiene products have behaved similarly.

However, during the first half of 2023, US foodservice sales were very weak – particularly in products such as takeaway food boxes – as normalisation of buying patterns continued. This shortfall was not made up from growth elsewhere and hence organic sales declined slightly.

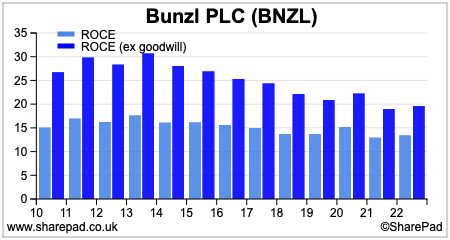

ROOCE and ROCE

Both ROOCE and ROCE are on a downward trend which shows that Bunzl is becoming less profitable. Both numbers are still quite healthy though. A ROOCE of nearly 20 per cent is a sign of a very good business whilst a ROCE of just under 15 per cent which includes the goodwill on acquisitions is also very respectable.

This shows that acquisitions have generally been a good thing for Bunzl investors.

Incremental returns on capital

A little more light can be shed on why Bunzl’s returns have come down by looking at its incremental returns over a period of time.

Bunzl: Incremental Returns on Capital

| £m | Sales | Op Profit | Cap Employed | Op Cap Employed | ROCE | ROOCE |

| 2010 | 4892.6 | 306.7 | 1836.4 | 1047.4 | 16.7% | 29.3% |

| LTM | 11783.5 | 912.8 | 6158.2 | 4258.4 | 14.8% | 21.4% |

| Change | 6890.9 | 606.1 | 4321.8 | 3211 | 14.0% | 18.9% |

Source: SharePad/My calculations

Since 2010, Bunzl has increased its operating capital employed and total capital employed by £3.2bn and £4.3bn respectively. It has added nearly £7bn of annual revenues and over £600m of additional adjusted operating profit. This equates to an incremental ROOCE and ROCE of 18.9 per cent and 14 per cent respectively – a very creditable performance.

Free cash flow generation

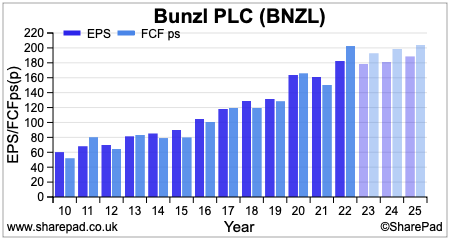

First and foremost, Bunzl has been good at generating free cash flow and has a high conversion rate of net(after tax) profits into free cash flow or earnings per share (EPS) into free cash flow per share(FCFps).

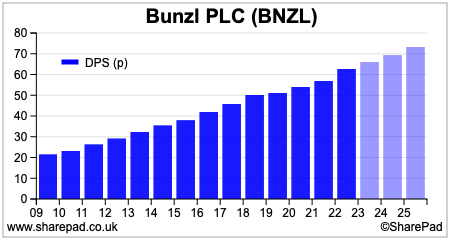

Its strong free cash flow generation has enabled Bunzl to have one of the most impressive dividend growth records out there. It has grown its annual dividend per share for 30 consecutive years and looks likely to keep on growing it for a while yet.

What is almost equally as impressive is that Bunzl has been able to fund a growing dividend payout and pay for acquisitions almost entirely from the free cash flow it has generated.

Bunzl has been able to fund its dividends and acquisitions from free cash flows

| £m | FCF | Dividends | Acquisitions | Cash left over |

| 2010 | 169.5 | -66.1 | -105 | -1.6 |

| 2011 | 261.4 | -68.9 | -149.2 | 43.3 |

| 2012 | 211.7 | -85.7 | -234.5 | -108.5 |

| 2013 | 274.5 | -91.8 | -253.8 | -71.1 |

| 2014 | 261.3 | -105.6 | -154.1 | 1.6 |

| 2015 | 265.1 | -116.1 | -328.5 | -179.5 |

| 2016 | 337.9 | -125.4 | -159.6 | 52.9 |

| 2017 | 397.3 | -138.2 | -574.6 | -315.5 |

| 2018 | 399.8 | -152.2 | -170.3 | 77.3 |

| 2019 | 429.6 | -167.3 | -143.6 | 118.7 |

| 2020 | 556 | -171.5 | -363.2 | 21.3 |

| 2021 | 506.7 | -180.4 | -436.7 | -110.4 |

| 2022 | 684.1 | -190.5 | -243.6 | 250 |

| H1 23 | 262.5 | -57.9 | -72.2 | 132.4 |

| Cumulative | 5017.4 | -1717.6 | -3388.9 | -89.1 |

Source: SharePad

Since 2010, it has generated cumulative free cash flows of over £5bn which has almost matched the amount spent on dividends and free cash flow.

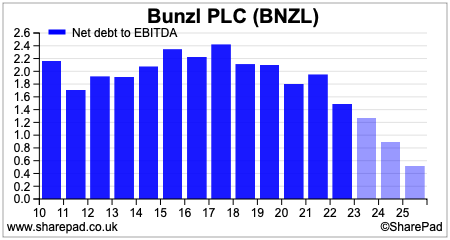

As profits have grown, the company’s indebtedness as measured by its net debt to EBITDA ratio has come down a lot. This has given it the headroom to keep on buying companies without putting its financial position at risk.

What about future growth?

Looking at Bunzl’s operating and financial history shows an impressive performance. However, in order to generate good investment returns going forward it needs to deliver decent levels of profit growth.

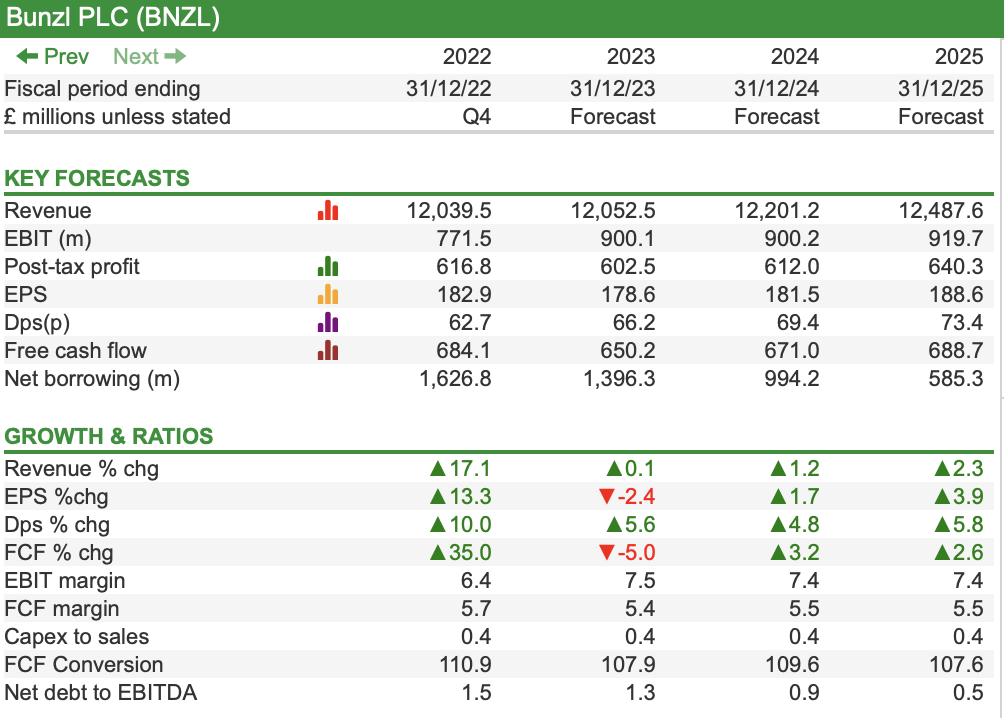

Looking at current City analysts’ forecasts points to a very weak growth outlook in terms of revenue and earnings per share (EPS). Dividend growth is expected to be slightly better as the company has plenty of scope to up its payout and reduce dividend cover from the current comfortable levels.

The growth outlook for revenues is mixed. Healthcare should show some growth due to the continued backlog of surgical operations after COVID. Safety revenues are underpinned by the expectations of growing infrastructure spend during the next decade.

Cleaning, Hygiene and Grocery revenues have been benefiting from the passing on of inflationary costs and boosting margins in the process. This benefit will disappear as inflation comes down.

Foodservice revenues have had a difficult start to 2023 and could take a while to resume growth.

Costs are being well maintained and covered by price increases, but Bunzl’s interest bill will see a reasonable increase in 2023 as higher interest rates will apply to the 30 per cent of its borrowings that are on variable floating rates.

Bunzl: Forecasts and Growth

Source: SharePad

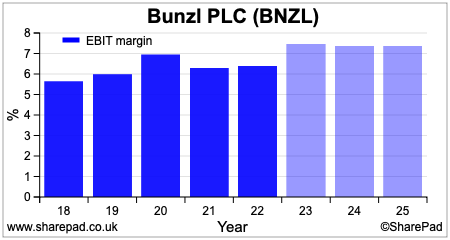

On a more positive note, Bunzl should be able to keep its operating(EBIT) margins above pre-Covid 19 levels.

Management has been working hard to move the business to a higher level of profit margins by adopting a number of business and operational strategies.

One of the key success stories has been the increase in own brand product sales that come with higher margins. Around one-quarter of Bunzl’s sales now come from its own label products.

Price increases from branded product suppliers have given Bunzl the opportunity to sell more own-label products when winning and retaining contracts.

Margins are also being improved with more disciplined contract pricing as well as buying power gains from the company continuing to increase in size.

The company is also being moved towards higher margin sectors through acquisitions such as cleaning, hygiene, safety and digital online distributors.

Bunzl is also becoming more efficient in its warehousing operations. It is consolidating warehouses into bigger units, relocating them and using the space inside them more efficiently. Driving routes for its fleet of trucks are also being optimised to save time and fuel.

Unfortunately, these improvements are only likely to maintain margins rather than grow them. At the moment, the gains made look as if they will be offset by weaker sales volumes and a negative operational leverage effect on profits.

Making money at the current share prices looks difficult

I always find it useful to ask a very simple question when looking at a share: How am I going to make money from it?

Making money from shares is a very simple process. You get a return from any dividend paid along with growth in the share price.

In the long run, share price growth is a function of earnings growth and the valuation multiple attached to those earnings. Really big gains can be made from rapid earnings growth and an expanding valuation multiple.

Source: SharePad

This is where things get difficult for investors in Bunzl shares.

Earnings growth is expected to be low, whilst the shares don’t look to be really undervalued given this backdrop.

The shares have been derated – a lower earnings multiple has been attached to them – in recent times but given current levels of growth and higher interest rates in general (which lower share valuations), betting on a meaningfully higher share price any time soon may lead to disappointment.

This leaves investors with a forecast dividend yield of 2.3 per cent which is nothing to get excited about.

City analysts are lukewarm on the shares with an average rating of Hold and a price target of 3025p, implying 8 per cent upside from the 2795p share price at the time of writing.

Analysts are often wrong, but based on the current evidence it seems that Bunzl could remain a low return share for a while yet.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.