In this week’s Market Moves, Ben takes a look at some of the biggest winners and sector trends over the past week, including significant moves in travel and leisure stocks, plus a look ahead to a bumper week of financial results and updates.

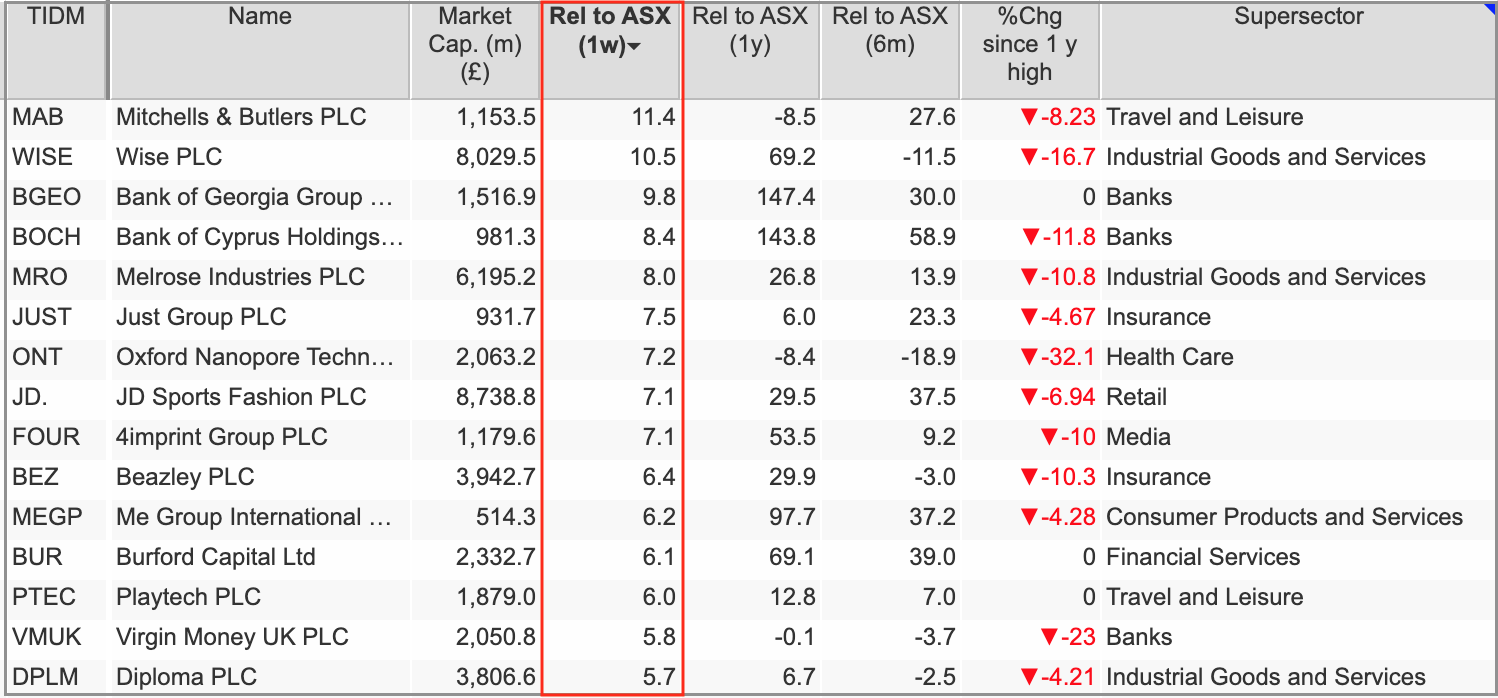

Among mid and large-cap stocks, pubs group Mitchells & Butlers was the one-week market leader versus the FTSE All Share heading into the end of last week.

M&B is scheduled to issue half-year figures this Wednesday, and it seems the market is expecting promising things. Shares in the company have had a hard time since early 2021 and fell by 46% last year alone. But on a six-month basis, M&B’s price momentum is picking up. Q1 figures, which it issued in early January, were solid but cautious.

Note that some of the other strong risers over the past week are also set to update the market in the coming days. Among them are JD Sports, Burford Capital and Diploma.

For the most part, these are stocks that have resisted the lacklustre conditions and delivered decent momentum over the past year. But even so, there’s perhaps a sense here that the market is warming to the idea that some firms may soon start to beat their earnings forecasts.

Wise, the money transfer business, also had a strong week. That seemed to be down to news last Wednesday that chief executive Kristo Kaarmann would be taking a sabbatical from September to December this year, with CTO Harsh Sinha standing in.

Among the small-caps (sub £500m market cap) there were some big price pops among more speculative shares over the past week. When looking at recent price moves in this part of the market it’s worth examining the ‘% change since 1 year high’. That can give you an instant view of whether the recent move has come from a very low base (ie. they are still well off their one-year highs). This explains several of the top movers this week:

Much of the noise was in the story-led and exceptionally risky areas of cleantech and mining. But if that isn’t of interest, there were also strong price moves in building contractor T Clarke, hostel operator Hostelworld, and professional services business Christie, where market-beating results sent its shares soaring.

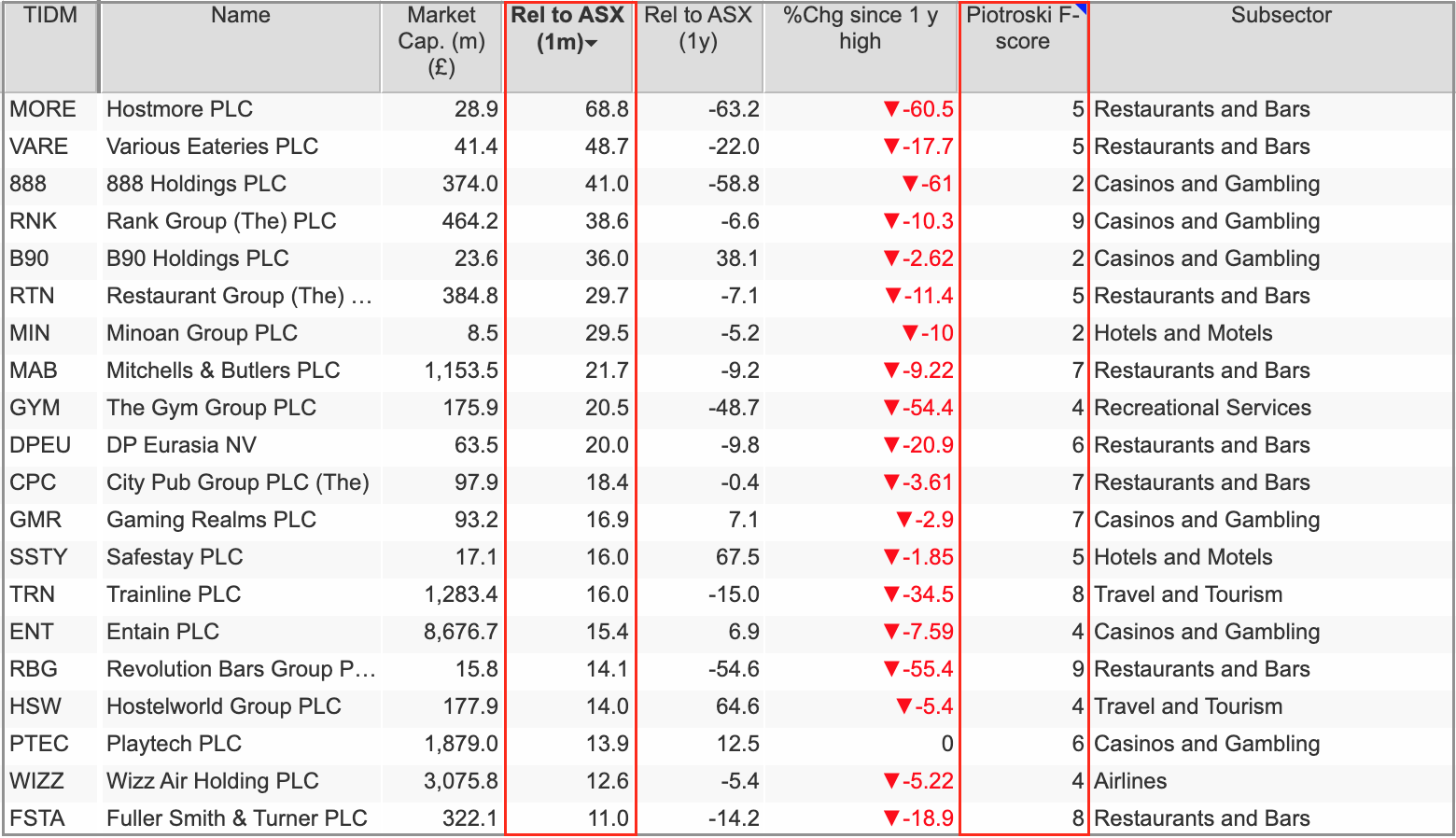

Trending sectors – early momentum for travel and leisure shares

I’ve mentioned in recent weeks that the Travel & Leisure sector has been consistently showing up towards the top of the best-performing sectors on a near-term basis, both on the Main and AIM markets. This could be an interesting sector to watch because it’s very much in recovery mode after a few years of absolutely terrible conditions.

First, there was Covid and the shocking impact it had on both travel and leisure businesses. Latterly, the cost of living crisis and the looming threat of recession have presumably piled on even more pressure to embattled firms.

Looking at the 12-month momentum across the sector, you can see that most are still underperforming the FTSE All Share, and in some cases by quite a wide margin. But more recent momentum suggests that the market is starting to take interest.

While travel and leisure take in a wide range of sectors, from bingo halls to airlines and restaurants to gyms, all of it rests pretty heavily on consumer confidence. So the “will there/won’t there be a recession” question really does matter for this industry group. The answer so far seems to be that the future isn’t entirely that bleak.

Note that I’ve included the 9-point Piotroski F-Score as a general measure of financial health trends in the table above. On that spectrum, 9 is excellent, but anything less than 6 really needs a closer look. For an industry getting back on its feet, those scores ought to start improving as financial results come in, and balance sheets are strengthened. It’s a mixed picture at the moment, but it seems that the market is starting to anticipate better news.

Results to look out for

This week is a big one for full and half-year results and trading updates. Note that precise dates are never certain, so it pays to keep an eye out for changes – and what follows is not a comprehensive list.

Monday kicks off with a trading update from mid-cap electricals retailer Currys, where shares are currently trading at multi-year lows. We’re expecting full-year results from small-caps like CentralNic and Instem, half-year figures from Cerillion and Diploma and a trading statement from Equals.

Tuesday is set to see full-year numbers from Burford Capital, Boohoo, DCC and Vodafone (plus small-cap Angling Direct). Interim updates are due from Britvic, Imperial Brands, Marston’s, On the Beach and Renew. Trading statements are pencilled in for Greggs and Essentra.

Wednesday will see full-year results from British Land, Experian and JD Sports. We’ll also get annual figures from tech fund giant Scottish Mortgage Investment Trust, which should be interesting given the dire price performance there over the past 18 months (down from around £16 to £6 per share). Half-year numbers come from Mitchells & Butlers, Shoe Zone, Auction Technology, Redx Pharma and Sage, with trading updates from Bank of Georgia (Q1 results), Keller, TC ICAP (Q1 results) and Watches of Switzerland.

Thursday gets full-year numbers from BT, Burberry, National Grid, Premier Foods and Premier Miton, among several others. Half-year reports are due from easyJet, Future and Tritax Eurobox, with other updates scheduled from TheWorks, Tyman and Vesuvius.

By Friday we’ll all need a lie down after such a hectic week of results, but there will also be figures from International Distributions Services (Royal Mail) and Young & Co’s Brewery.

Have a great week.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.