Difficult markets prompt Maynard Paton to search for asset-rich shares with depressed ratings. Screening for low price to books and net cash positions leads to house builder Redrow.

Difficult market conditions have led to depressed ratings for many asset-flush shares.

Hence a new screen to pinpoint companies offering cash-rich balance sheets and market caps below their book value. I have attempted to avoid ‘value traps’ by demanding the shares pay a dividend and offer a history of trading above book value.

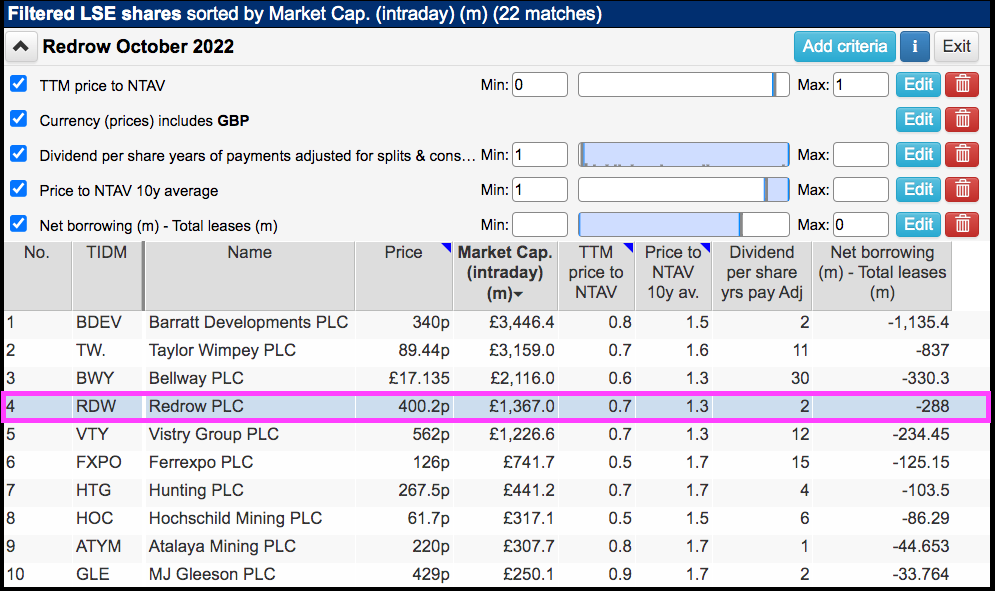

The exact filter criteria I employed for this search were:

- A price to net tangible assets of no more than 1;

- A dividend being paid during the most recent year;

- A 10-year average price to net tangible assets of at least 1;

- Net borrowings less total leases of no more than 0 (i.e. a net cash position excluding IFRS 16 lease obligations), and;

- A share price denominated in pounds sterling.

I applied the screen the other day and SharePad returned 22 matches:

(You can run this screen for yourself by selecting the “Maynard Paton xx/10/22: Redrow” filter within SharePad’s renowned Filter Library. My instructions show you how.)

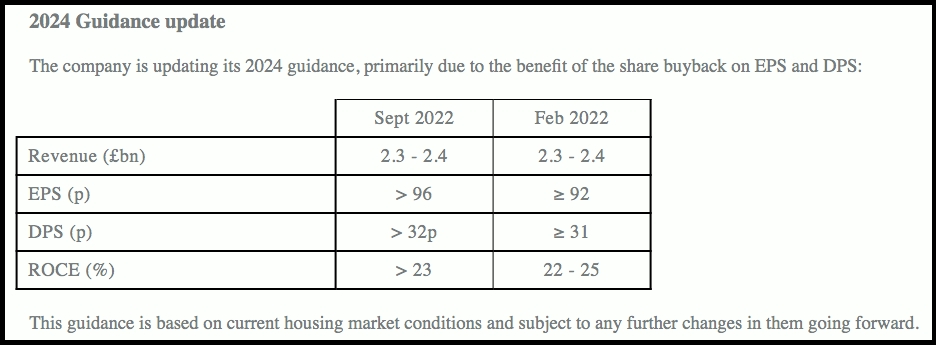

I selected Redrow from the five house builders at the top of the list because the group’s recent results included very clear guidance:

Redrow’s own projections put its 400p shares on a P/E of approximately 4 and a yield of at least 8%.

Combined with a net asset value of 554p per share that gives a price to book of 0.72, the FTSE 250 constituent is very much trading at the ‘deep value’ end of the market spectrum.

Let’s take a closer look.

The history of Redrow

Redrow was founded during 1974 after Steve Morgan borrowed £5,000 from his father and purchased the building sub-contractor he then worked for.

Mr Morgan broadened the firm’s services from drainage construction to house building and landed his first major housing development in North Wales during 1979.

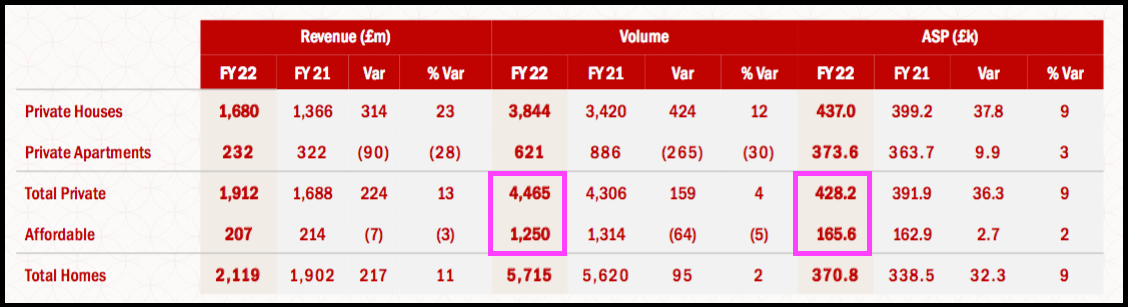

Subsequent expansion has since established Redrow as one of the country’s leading house builders. Last month’s full-year results confirmed the group sold 4,465 private homes for an average £428k, and 1,250 affordable homes for an average £166k:

The Heritage Collection is Redrow’s flagship range and the builder’s website claims:

“We’re dedicated to designing and building homes with character that people are proud to live in. Inspired by the past but designed for the future, the Heritage Collection offers Arts and Crafts homes for sale that bring the best of both worlds.”

The Arts and Crafts reference relates to the 19th-century movement that Redrow describes as “prominent for its focus on re-establishing traditional craftsmanship using uncomplicated forms of build and decoration“.

In practice, that means constructing homes complete with traditional porches, bay windows, hipped roofs, taller doors, higher ceilings, bespoke banisters and quaint finials.

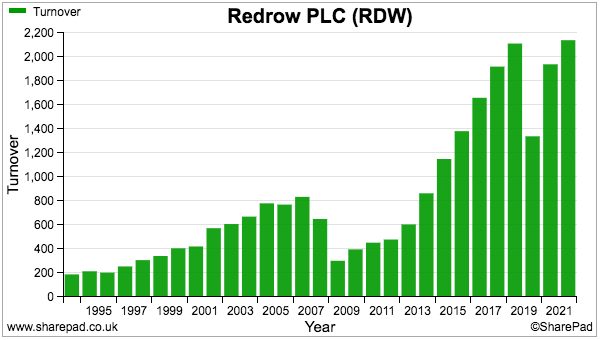

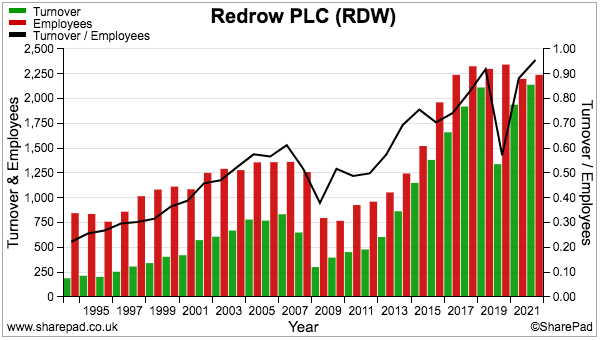

The porches, windows and roofs have certainly attracted buyers after Mr Morgan introduced the Heritage style during 2010. Revenue has since quintupled to beyond £2 billion:

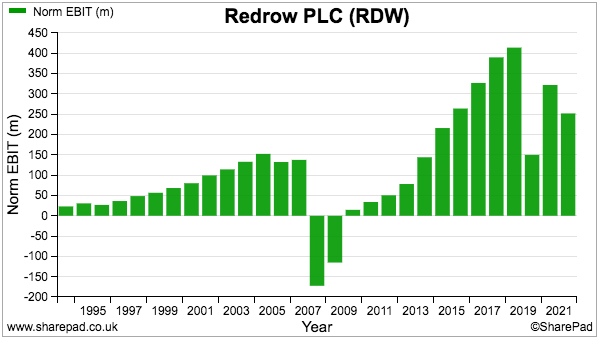

Profit during the same time has zoomed from close to zero to beyond £400 million…

…and would have hit a record £414 million last year were it not for a £164 million charge covering the expected costs of remediating buildings constructed with cladding.

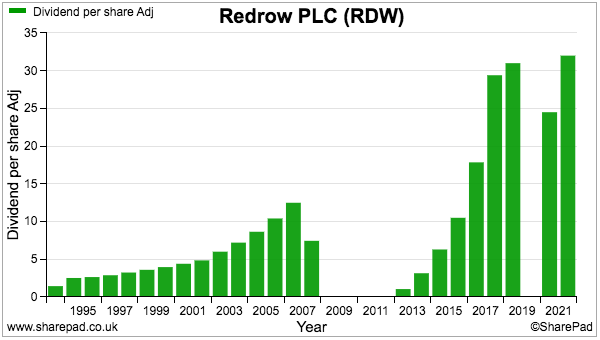

The dividend has followed the profit ups and downs…

…but the payout gaps emphasise Redrow’s sensitivity to adverse economic events.

The banking crash of 2008 in particular created significant operational upheaval, while the pandemic also knocked progress and led to a dividend suspension.

The ‘deep value’ rating of the share price of course reflects the prospect of recessionary times ahead, which could easily cause house prices to drop and Redrow’s momentum to reverse.

Revenue, completions and 2008

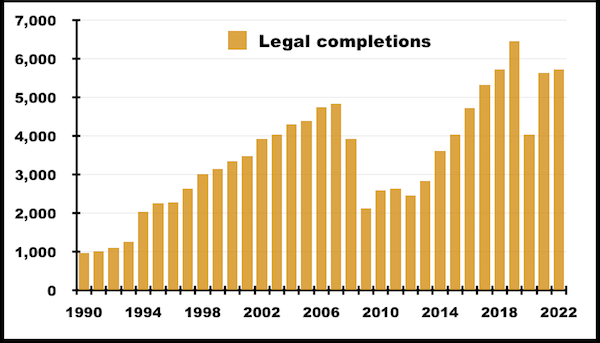

The number of homes Redrow has sold (‘legal completions’) each year has risen almost six-fold during the last three decades:

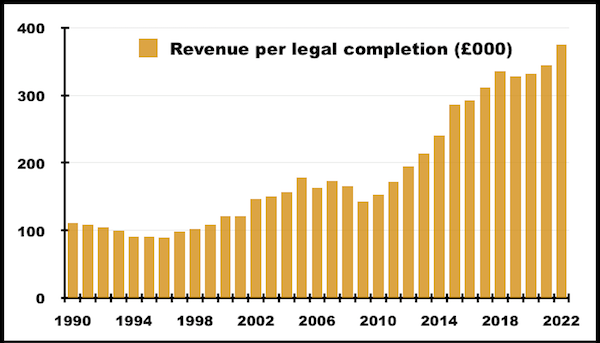

The 2008 banking crash saw completions drop from nearly 5,000 a year to close to 2,000. During that time revenue per completion slid from £173,000 to £143,000 (down 18%):

Mr Morgan lamented Redrow’s pre-crash land-buying within the group’s 2009 results:

“With the benefit of hindsight, mistakes were made in the Group’s land acquisition policy. During 2005 very little land was purchased as it was perceived at that time that the land market had peaked. This proved not to be the case and management embarked on a ‘catch-up’ during 2006 and 2007, resulting in a disproportionate element of the land bank being bought at the peak of the market.”

Fewer homes sold at lower prices but with higher land costs proved an awful combination.

Write-offs totalling £356 million — equivalent to approximately a third of Redrow’s pre-crash stock — blighted the company’s 2008 and 2009 accounts. Rights issues raising an aggregate £228 million were then required to reduce debt.

Mr Morgan was able to bemoan the land-buying mistake because he had rejoined Redrow during 2009 after retiring from the group during 2000.

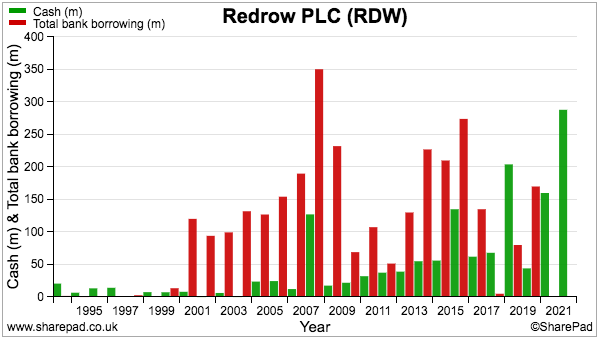

SharePad shows debt moving much higher after Mr Morgan left:

But that sudden debt increase during 2000 in fact funded a £115 million tender offer, which in turn allowed Mr Morgan to reduce his shareholding from 30% to 10%.

Looking back, the additional tender-offer debt as well as the “catch-up” land buying — and perhaps the decision to favour smaller apartments over detached houses — all played their part to exacerbate the 2008 woes.

At least the SharePad chart above shows Redrow having operated without debt for the last two years. Such cash backing ought to place the group on a firmer footing for any downturn versus the 2008 position.

Stocks and plots

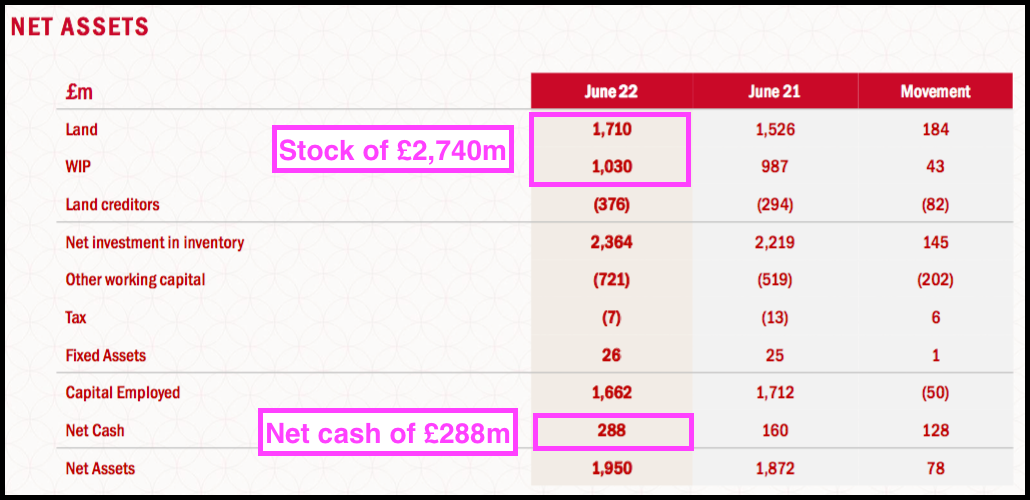

Redrow’s results presentation provides a useful balance-sheet summary:

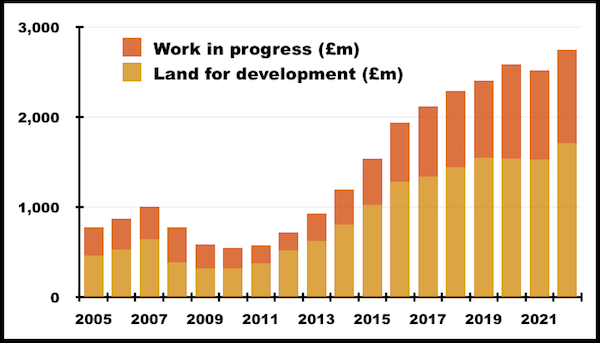

The primary asset entry is stock, which comprises land for development and work in progress. Both are carried at cost and the split between the two has generally been 60:40 in favour of land for development:

Redrow’s liabilities are almost entirely land creditors (i.e. monies owed to land vendors) and ‘other’ working capital, which is predominantly trade payables (i.e. monies owed to suppliers).

The high level of creditors arguably means the net cash position is not truly ‘surplus to requirements’, with the £288 million simply reflecting the group having yet to pay its suppliers.

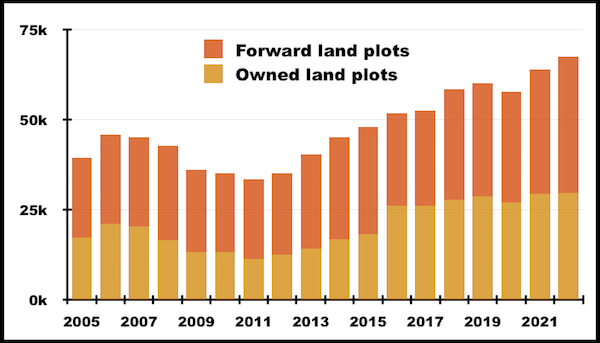

Redrow’s growing stock position reflects its growing plot numbers:

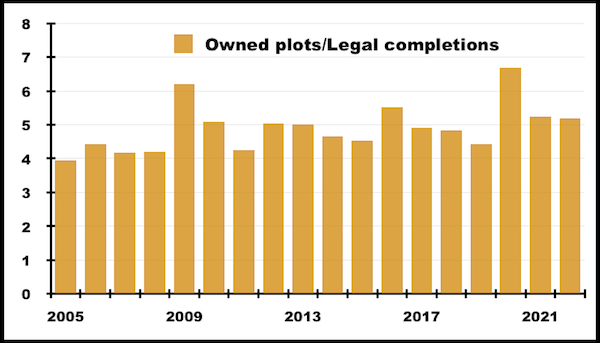

Forward plots are those without planning permission and/or not yet under full Redrow ownership. Owned plots versus legal completions tells us Redrow typically has five years’ worth of land to build on:

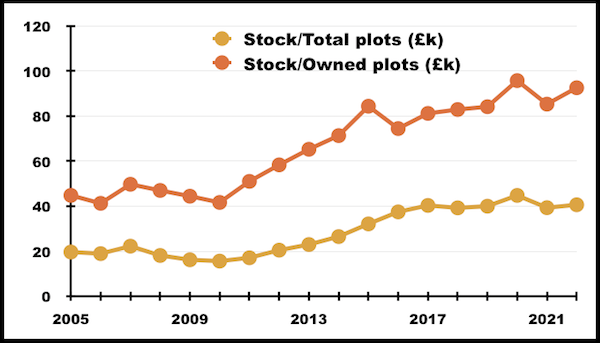

The value of each stock plot has advanced over time as land prices and building costs have increased:

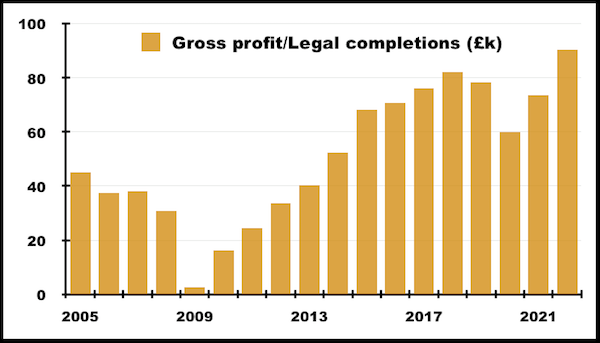

Gross profit per completion last year was a record £90,000, so higher sales prices have compensated for the greater expenses:

Redrow’s gross margin during 2022 was 24%, with the initial cost of the plot typically representing 20% of the property’s sale price.

Management and employees

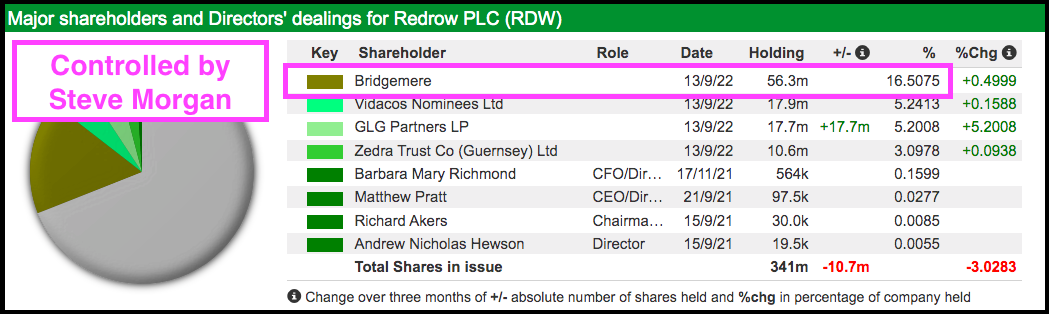

Founder Steve Morgan retired from Redrow for a second time during 2019, although he retains a 17%/£225 million shareholding that ought to keep him alert to company developments:

In charge today is Mathew Pratt, who became chief executive during 2020 after joining Redrow 17 years earlier. Finance director Barbara Richmond has meanwhile served in her role since 2010.

Both executives have not exhibited obvious drawbacks to date, although their remuneration small print is not entirely endearing.

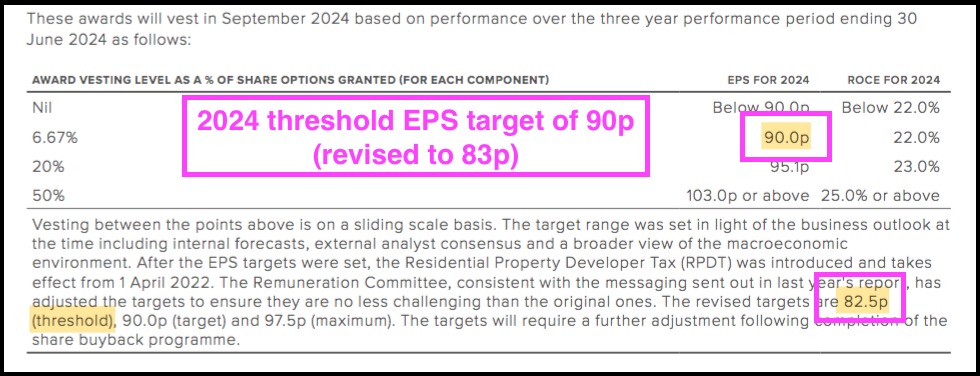

For example, to help the directors collect extra shares, the LTIP that’s set to vest during 2024 requires earnings of at least 90p per share …

… which does not sound too demanding when earnings last year were 96p per share.

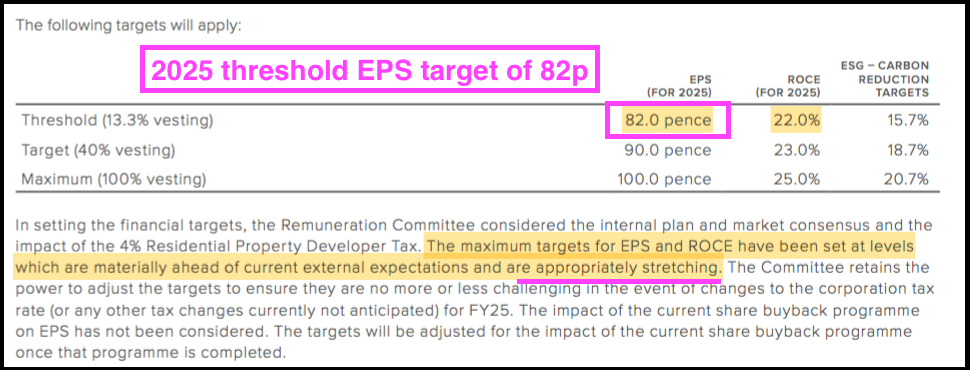

The 90p per share target was subsequently revised to 83p per share following the introduction of the Residential Property Developer Tax, and a similar level was applied for the LTIP that’s set to vest during 2025:

Again, 82p per share (or approximately 90p per share before the new developer tax) does not seem challenging given earnings last year were 96p per share.

Redrow claims the “maximum targets for EPS and ROCE have been set at levels which are materially ahead of current external expectations and are appropriately stretching“.

The minimum LTIP targets are perhaps not as “appropriately stretching”:

Lower earnings could also see the executives enjoy a bonus alongside an LTIP.

Only half of the executives’ bonus payments are dependent upon profit, with the other half relying upon a mix of new sites opened, customer ratings, accident numbers and ESG progress.

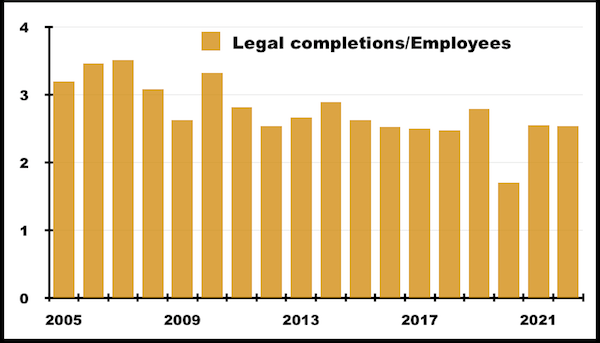

Revenue per employee has impressively improved towards £1 million:

But Redrow’s revenue improvement seems due to rising house prices rather than greater staff efficiency. The number of legal completions per employee has been stable at around 2.6x for some years now:

The 2022 annual report admitted some employees had taken alternative steps to boost their performance:

“Towards the end of the year, the [Audit] Committee were informed about a failure to comply with the Group’s policies and procedures in one of the Divisions. The Committee has reviewed the results of the subsequent investigation which established that, on certain developments, the Division had not correctly accounted for the latest estimates of development profit, including the omission of incurred cost overruns. Whilst the investigation has established that no adjustment was required to the Group financial statements, the Committee is satisfied that the actions taken, including the suspension of certain members of the divisional management team, are appropriate to ensure that this matter has been addressed.”

Valuation and summary

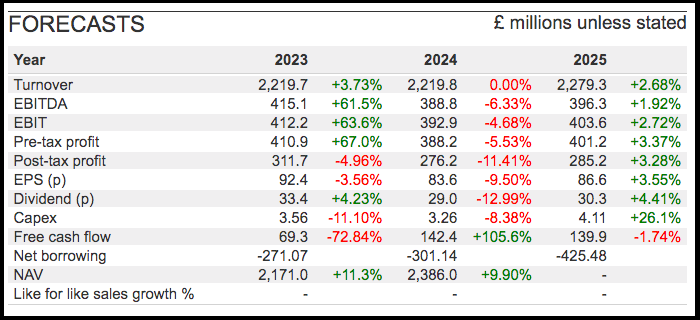

SharePad offers the following forecasts:

The 84p per share earnings prediction for 2024 is much closer to that LTIP target than the 96p per share cited within the aforementioned results guidance

Redrow says its 2024 projections are based on “current housing market conditions“, and those conditions could easily change during the next few years.

Recent economic developments have prompted pessimistic sector headlines:

- UK house prices may fall 20% amid mortgage ‘carnage’, warn experts

- House prices ‘to fall 30%’

- Homeowners warned values could plunge by up to 40% in huge blow

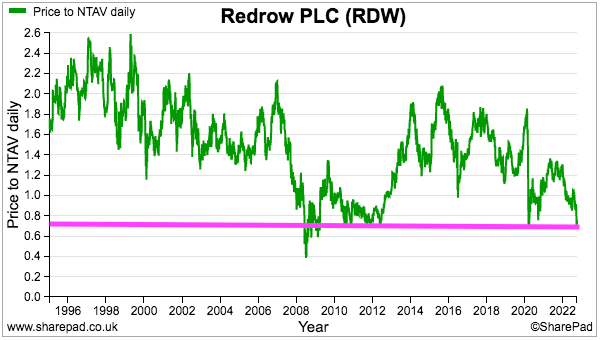

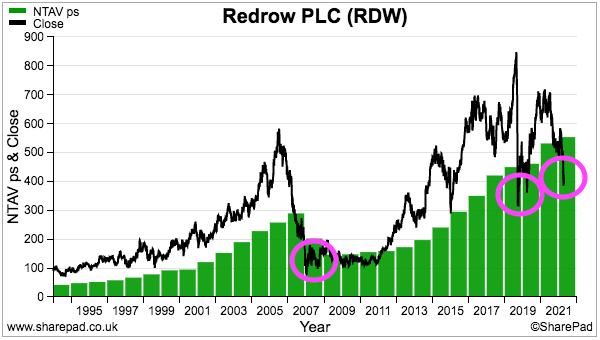

The gloom has pushed Redrow’s price to net asset value to levels last seen during the pandemic crash and the banking crash:

Assuming the balance-sheet stock is written down by 20% to £2.2 billion, net assets per share would fall from 554p to match the recent 400p share price.

Assume a repeat of 2008 and group stock is written down by a third to £1.8 billion, and net assets would fall from 554p to 297p per share.

In contrast, those broker forecasts above show net asset value increasing by 11% during 2023 and 10% during 2024. Prior to the pandemic, such asset growth would have seen Redrow shares trade at perhaps 1.4x book value — or double the present rating.

Famous last words, but I did not discover any alarming weaknesses or discrepancies in Redrow’s accounts that signalled imminent operational trouble.

But exactly what the economy will do and how house prices will perform — and the resultant impact on Redrow’s financials — is hard to predict right now.

The stock market has nonetheless made up its mind, leaving a very intriguing opportunity at 400p that allows contrarian investors to buy £1 of Redrow assets for just 72p.

Remember, Redrow recently reported net cash of £288 million — versus net debt of £178 million heading into 2008. Also helping matters this time are memories of the banking crash being reasonably fresh within the minds of current management.

And don’t forget the now-69-year-old Steve Morgan… and the outside chance of him commencing a third boardroom stint if his £225 million shareholding faces real danger.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Mark Atkinson. He does not own shares in Redrow.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.