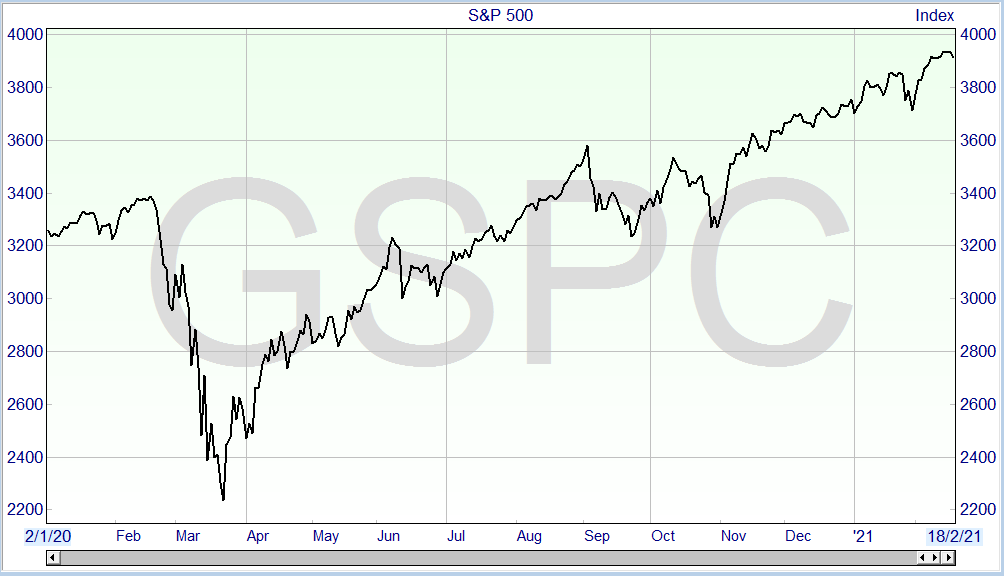

After a dip caused by the COVID-19 pandemic in March of 2020, the US stock market rallied back and closed out the year at an all-time high. This has continued throughout the start of 2021, with the Dow Jones Industrial Average now at over 31,000 points. But despite the vaccine rollout, unemployment and economic disruption still remain high, which begs the question: what exactly is going on?

Source: ShareScope

Does the Buffet Indicator Suggest a Stock Market Crash?

The “Buffet Indicator” has long been known in Wall Street circles as a stock market valuation metric worth paying attention to. It’s a straightforward ratio that takes the total market capitalisation of U.S. stocks and divides this by the nation’s GDP. In early February, this hit 195%, which may cause alarm among US investors.

It should be remembered that the Buffet Indicator is a heuristic, and as such, it isn’t a certainty that it can foretell a crash as it did in 2008. Because it compares the current value of stocks to the previous quarter’s gross domestic product, it fails to account for the portion of the Dow Jones value involved in business overseas. However, when added to other sets of observations, it’s an indication that US stocks are at least overvalued.

Is the US Stock Market in a Bubble?

Concerns that the US stock market is in a bubble have been floated for some time. However, there is very little consensus on this. One thing is for sure: last year, the US economy suffered one of the most significant shocks in its history, which resulted in an unprecedented stimulus package to stave off economic collapse.

The Case For A Bubble

There are a few arguments put forward to suggest a stock market bubble. Since the financial crisis, the market has had a bull run for about a decade. This, coupled with very optimistic predictions from US investors, has led people to believe the bubble must burst at some stage. But, the most convincing case is found in the analysis of the cyclically adjusted PE ratio.

The PE ratio is the investment price divided by its profits or earnings. Because each year brings about its own ups and downs, the Shiller PE ratio — also known as the CAPE index — takes a long view and calculates the rate by earnings over the last decade, adjusted for inflation. The current Shiller PE rating suggests the US stock market has been this overvalued twice before: the 1929 stock market crash and the 90s Dot Com bubble.

While long term market pessimist David Tice has identified the Job Biden administration as a factor in what he fears will be a 2-year bear market that will wipe 30% off the index. Tice believes that further stimulus packages, a rise in the minimum wage and a host of “anti-capitalist” policies by the Biden administration will hurt the market in 2021.

The Case Against A Bubble

While there are elements of the market that have the hallmarks of a bubble, not everyone believes there is anything to worry about yet. Sharmin Mossavar-Rahmani, Goldman Sachs Wealth Management CIO, suggests that there is no bubble and equities aren’t as overvalued as people claim. Instead, she suggests a period of low and stable inflation leads to higher market values. Additionally, she quotes a metric her Investment Strategy Group uses called the “explosive price behaviour” that needs to exceed 90% before signifying a bubble. It currently stands at around 26%.

Which Parts of the Stock Market are Overvalued?

However, even inside Goldman Sachs, there are warnings that all might not be well in the market. Goldman’s U.S. equity chief David Kostin believes that the S&P 500 will reach 4,300 by the year’s end, but warns that there are parts of the market that are overvalued.

Source: ShareScope

Kostin singled out 39 stocks that he felt were due for a market correction, and the bulk of them are in tech. Tech recovered far quicker than other stocks during 2020, and with investors ploughing into the sector, he feels that reality will set-in when these companies underperform on their potential.

Will the Market Crash?

That’s the big question. No one can say for sure, but anyone with a memory of the dotcom bubble from the 90s will undoubtedly be feeling a sense of deja vu. Back then, little-understood tech stocks’ prices were soaring as investors sought the next big thing.

Tesla has joined Twitter CEO Jack Dorsey and PayPal in investing big in Bitcoin. Some are calling this a hedge against the dollar; others feel that it is a sign that cryptocurrency is now seen as a legitimate option. Time will tell, but with regulatory difficulties faced by the coin — and the strong suspicion that its price is being inflated by Tether Inc, a shady offshore player — there is plenty of reason to be cautious about the upcoming year.

While no one can predict the future, those investing or trading should be conscious of the potential of a market crash and adjust their strategy accordingly. I offer my insights into investing during a bubble, which focuses on buying reliable stocks versus their more speculative counterparts.

What Could Cause the Crash?

While there are many ways a crash might happen, it would take a combination of a few events.

Continued COVID-19 Problems

Though things are looking positive, we’re not entirely out of the woods yet. The vaccine rollout has been encouraging, but further mutations or variants could render that mute. Were that the case, additional lockdown measures could push the economy to a breaking point.

The unprecedented stimulus packages were all that kept the market from destruction in 2020, and a failure to get this right during further waves would be catastrophic. However, all in all, this outcome is remote.

Loan and Credit Delinquencies

While the market has performed well since March, out on the ground things are far from normal. A series of loan, mortgage and credit delinquencies could hurt US financial stocks badly. And with government funds already being hoovered up by covid stimulus packages, the financial markets could find themselves unable to receive the assistance needed.

Shiller Is Right

If the Shiller index is correct — and the market is overvalued — that will hit at some point, and will lead to some panicked and erratic behaviour as consumer confidence evaporates. As long as the market continues to perform, people will ride the wave. But a few poor quarterly earnings reports from tech stocks, in particular, could see sentiment change quickly and violently.

Alpesh Patel OBE

Founder of Alpesh Patel Special Edition of ShareScope

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.