One of the questions I am frequently asked is: “How do I value loss-making companies?”. The short answer is that it can be really quite difficult.

It is so much easier to try and value profitable businesses with an established financial history. However, the value of any business is based on how much money it will make in the future which means that even the most sophisticated analysis and valuation models will contain a reasonable amount of educated guesswork.

Loss-making companies are much more common on the stock market these days. Years ago a company had to have a number of years of reported profits before it could list its shares on the stock exchange. Many young, loss-making companies were also financed by venture capitalists who would wait for them to become profitable before cashing in their investment.

Now many loss-making businesses try to finance themselves by listing on the Alternative Investment Market (AIM). Lots of these companies will fail due to them being poor businesses but some will go on to be outstanding success stories and make shareholders a lot of money.

The problem for private investors is that it is very difficult to know with certainty if a business will be a long-term winner let alone know what price to pay for its shares. City analysts and professional investors will spend weeks trying to understand the profit potential of a business model. Most private investors do not have the time, expertise or inclination to go through this process.

But this does not mean that there are not things you can do or questions you can ask to help you understand a company better and make a buy or sell decision on a loss-making business.

Some of this process is quite simple; some of it requires a little bit more work and number crunching. In this article, I am going to give you a few pointers as to how you might go about valuing a loss-making business.

A loss-making business – Purplebricks

As an example of a loss-making business I am going to use online estate agency Purplebricks (AIM:PURP).

Just to make things clear right from the start, I am not intending to do a detailed analysis on this company or pass a judgement as to whether its shares are cheap or expensive. I have chosen this company because it is a relatively simple business for readers to understand which lends itself nicely to some of the analysis tips I will show you.

To do a thorough analysis of this business can take days and weeks – something I haven’t got time to do at the moment. This means some of the number crunching will be very rough and ready rather than trying to be accurate.

What I am trying to do here is show you how to get a feel for the important issues which can help you make a more informed decision about a company and its shares. These are equally applicable to profitable companies as well as loss-making ones.

Step 1: Get hold of some information on the company

Before you start trying to weigh up the value of a company it’s a good idea to learn something about it as this will help you later on. Go to the company’s website and get hold of the following useful documents:

- Annual report

- Investor presentations

- Admission document – a goldmine of useful information for investors wanting to learn how a business works.

With these documents you can gain some great insights into how a business works and how it might grow its sales and profits in the future – as well as what the major risks facing the company are. Time spent reading these is time very well spent when researching any company.

Step 2: Build a quick snapshot of the company’s recent financial performance

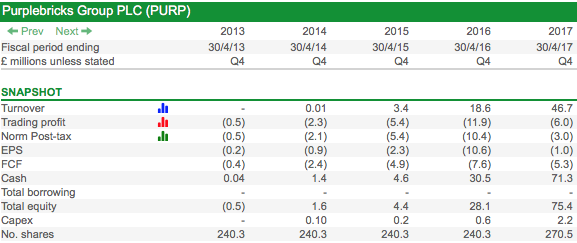

Before you start digging into a company’s accounts build yourself a very quick snapshot of a company’s key financial performance. This will quickly tell you a great deal about a company’s recent past and help focus your research efforts so that you concentrate on what’s important.

Here’s a quick financial snapshot of Purplebricks.

We can quickly see that this is a relatively young business with only five years’ reported results. Sales have grown rapidly and losses have been coming down. The company’s financial position looks strong – it has a rising cash balance, no borrowings and increasing amounts of shareholders’ equity. Investment in assets (capex) has been rising but is not a large chunk of sales – perhaps indicating that this is not a business that requires a lot of additional investment in assets to grow.

Note that the number of shares in issue has increased. This is a sign of raising fresh money from shareholders – as the cash balance has increased as well – and/or new shares being issued to employees. This is an important development to keep an eye on with growing companies as existing shareholders can be at risk of seeing their ownership stake being diluted by large new share issues.

Step 3: Work out the sources of potential growth of the business

This is your first key step in weighing up the value of a loss-making company (or most companies for that matter). As virtually all the value of the business – except the current cash balances – is based on its future profits you have to be convinced that the company is capable of growing otherwise there is no point investing in it.

To get a feel for the growth opportunity you have to take some time to understand the business and the markets it operates in.

Purplebricks is a hybrid estate agency – a cross between a high street estate agent and a low-cost online one. Its customer proposition is that people selling their houses can save a lot of money and have more control and transparency over the selling process compared with using a high street agent.

Instead of charging customers commission based on the selling price achieved it charges a fixed fee which is payable whether the property sells or not. On top of this it aims to offer great customer service provided by a team of local property experts (LPEs) and a centrally-based customer service team and website that is available 24/7.

In a nutshell it is trying to offer people the best of both worlds. A low cost like an online estate agency but with the service of a high street agent. This places the company with what seems to be an attractive proposition for customers and one that has a lot of potential to disrupt an established market. In other words, it seems to have a business that can grow.

Step 4: The type and costs of growth

The type of growth of a company is a very important consideration for investors. Growth is much easier to achieve in a market which is also growing. It is more difficult to grow by taking business from existing companies in a market – because the incumbent operators can fight back.

Purplebricks is going to try and grow by taking market share – the number of selling or letting instructions – in the UK estate agency which is the more difficult route. The UK housing market is sluggish at the moment and is unlikely to result in more people selling their homes according to most property experts.

The company also wants try and take market share in Australia and the USA. The key to the valuation of the company will be ultimately determined by how big a slice of the market it can take.

As well as the type of growth the other crucial consideration is how much it will cost to grow. The cheaper it is to grow, the more profitable and successful a company – and possibly an investment in its shares – is likely to be.

The first point to acknowledge is that losses in themselves are a cost of growth. The longer it takes to make a profit, the less valuable a business tends to be. You then need to see whether costs are revenue costs (expensed against revenues e.g. staff costs and advertising) or capital costs such as new IT systems. You then need to try and understand whether the costs are variable – move in relation to revenue – or are largely fixed.

You can get some help with answering these questions by looking at the company’s recent financial performance and doing a few simple calculations.

Let’s take a look at the income statement of Purplebricks’ UK business.

| UK Business (£m) | 2015 | 2016 | 2017 |

|---|---|---|---|

| Revenue | 3.4 | 18.6 | 43.2 |

| Gross profit | 2 | 10.6 | 24.2 |

| Admin costs | -3.9 | -9.6 | -9.6 |

| Sales & marketing | -3.5 | -12.9 | -14.4 |

| Operating profit | -5.4 | -11.9 | 0.2 |

| Gross margin | 58.8% | 57% | 56% |

| Operating margin | -158.80% | -64% | 0.50% |

| Admin % of sales | 114.70% | 51.60% | 22.20% |

| Marketing % of sales | 102.90% | 69.40% | 33.30% |

We can learn quite a lot from just a few numbers here.

The first thing to note is that the gross profit margin (gross profits as a percentage of revenue) has been relatively stable. This is telling us that the cost of sales – a large chunk of which will probably be the commissions paid to LPEs for getting sales instructions – is not changing that much and is rising in line with revenues.

Let’s look at revenue costs first.

Admin costs such as the central costs of running the business have not changed between 2016 and 2017 and fallen significantly as a percentage of sales. Marketing costs are also growing at a much slower rate than sales.

These two costs have a significant fixed element and are likely to grow at a much slower rate than revenues as the company grows. This allows a greater chunk of the growing revenues to feed through to extra profits. More on this shortly.

The company also has reasonably significant share-based payment expenses. I’ve seen some analyst reports on Purplebricks that add this expense back (on the basis of it being non-cash) but I’m not a fan of doing this. Other shareholders lose out because of them and so I think treating them as an expense is the right thing to do. This cost is likely to be a feature in the future as more LPEs receive shares as part of their pay.

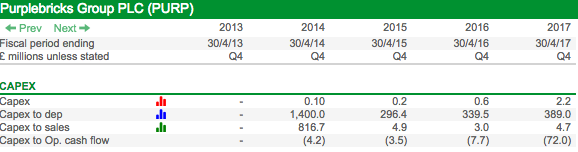

Now let’s turn our attention to capital costs.

The main cost here is the investment in IT infrastructure and the development of the company website. This should not be a big underlying cost going forward – mainly replacement of old systems when needed – as the IT platform can cope with growing numbers of customers. The increases will come from setting up systems and websites in Australia and the USA.

Given the lack of high street offices this is a business that should be very asset light when it matures. This means that capex should not be too big an issue and that there should not be too big a difference between profits and free cash flow for shareholders.

Step 5: Estimate the steady state profit margin

As well as trying to figure out the potential for sales growth, you need to try and work out how much of future sales will turn into profits – the profit margin. After all, profits are what determine the value of the business.

Growth and profit margins go hand in hand with each other for a business like Purplebricks. We have already seen that a large chunk of the cost base is fixed or will grow at a slower rate than sales growth. This operational gearing will result in profit margins increasing as sales grow.

You can see how powerful this operational gearing is by looking at the changes in revenues, costs and profits at the UK business between 2016 and 2017.

| Changes (£m) | 2017 vs 2016 |

|---|---|

| Revenue | 24.6 |

| Gross profit | 13.6 |

| Admin costs | 0 |

| Sales & marketing | -1.5 |

| Operating profit | 12.1 |

We can see that just under half the increase in revenue flowed through to extra profits. That’s pretty encouraging.

Your task is to try and work out what the level of sales, profits and margins could be. You can have a go at this by building a simple profit forecast in a spreadsheet.

This kind of exercise is subject to the usual rules of garbage in, garbage out. However, I am going to have a go by taking a reasonably optimistic stance and making some assumptions about the future.

These are likely to be wrong in some way as I am not analysing this company full time and will possibly miss something out (hopefully nothing too major). However, the point of this exercise is to get a feel of what profits could be and ultimately what the current share price is already factoring in. Here goes:

- The company eventually gets 10% of a flat UK residential estate agency market by 2022. This is around 140,000 sales instructions per year.

- Revenue per instruction increases by around 3% per year. This assumes some price increases and some extra revenue from conveyancing and other add ons.

- Gross margins stay at 56%. This will contain an assumption of share-based payments to a growing number of LPEs but there is some uncertainty as to what effect this will have on gross margins.

- Admin costs increase very modestly at £0.5m to reflect growth in the business but growth is much slower than revenue growth.

- Marketing revenue steps up again in 2018 and then grows by £1m per year as the business matures. How realistic this is remains to be seen as it depends on how competitive the market ends up being and whether higher levels of advertising are needed to defend the business and keep it growing.

| UK Business (£m) | 2015 | 2016 | 2017 | 2018F | 2019F | 2020F | 2021F | 2022F |

|---|---|---|---|---|---|---|---|---|

| Revenue | 3.4 | 18.6 | 43.2 | 80.3 | 100.6 | 122 | 144.7 | 168.6 |

| Gross profit | 2 | 10.6 | 24.2 | 44.9 | 56.3 | 68.3 | 81 | 94.4 |

| Admin costs | -3.9 | -9.6 | -9.6 | -10.1 | -10.6 | -11.1 | -11.6 | -12.1 |

| Sales & marketing | -3.5 | -12.9 | -14.4 | -18.4 | -19.4 | -20.4 | -21.4 | -22.4 |

| Operating profit | -5.4 | -11.9 | 0.2 | 16.4 | 26.3 | 36.8 | 48 | 59.9 |

| Gross margin | 58.80% | 57% | 56% | 56% | 56% | 56% | 56% | 56% |

| Operating margin | -158.80% | -64% | 0.50% | 20.50% | 26.20% | 30.20% | 33.20% | 35.50% |

| Admin % of sales | 114.70% | 51.60% | 22.20% | 12.60% | 10.50% | 9.10% | 8.00% | 7.20% |

| Marketing % of sales | 102.90% | 69.40% | 33.30% | 22.90% | 19.30% | 16.70% | 14.80% | 13.30% |

| Revenue per instruction | 702 | 901 | 1035 | 1070 | 1102 | 1135 | 1169 | 1204 |

| Estimated instructions | 4,843 | 20,644 | 41,739 | 75,000 | 91,250 | 107,500 | 123,750 | 140,000 |

This results in significant growth in profits and profit margins. By 2022, this model has Purplebricks UK earning margins of over 35% and trading profits of nearly £60m. To put this into perspective, Foxtons was making 33% in 2013 although this was in a different market with a different revenue and cost structure.

Ideally, you would then go through a similar exercise for the Australian and US businesses. I am not going to do this. For the sake of brevity, I will take an optimistic guess that Australia will do well and make operating profits of £35m by 2022. I will ignore the US for now.

Step 6: Estimating the value of the business in a mature state

One way of estimating the value of any business is to work out what it would be worth as a steady state (say growing only by the rate of inflation annually) and then put that value in today’s money with a present value calculation.

There is a very neat and simple formula for valuing a steady state business based on its post tax profits or free cash flow.

Value = (Profits or FCF) / (Required return less growth rate).

If you want to you can avoid all this and keep this simple by putting a multiple on the profits instead. Just make sure it is reasonable and reflects a mature rather than rapidly growing business.

Using a 2% growth rate and 8% required return on the profit estimates gives me a value for Purplebricks UK and Australian businesses combined of £1,254.5m. I then get that back to a value in September 2017 by discounting this value by 1.08 to the power of 4.5 years). This gives a value in today’s money of £887.3m. The £71.3m of cash is added to this to give a present value of the business of £958.6m or 328.1p per share with no value given to US opportunity.

| Purplebricks (£m) | Profit | Tax | After tax profit |

|---|---|---|---|

| UK | 59.9 | -10.2 | 49.7 |

| Australia | 35 | -9.45 | 25.6 |

| Total | 94.9 | -19.6 | 75.3 |

| Business Value | 1,254.50 | ||

| Value today | 887.3 | ||

| Cash balance | 71.3 | ||

| Enterprise value | 958.6 | ||

| Shares | 271.8 | ||

| Options | 20.3 | ||

| Fully diluted shares | 292.2 | ||

| Value per share (p) | 328.1 |

This valuation also ignores the £100m or so of profits that could be made between 2018 and 2022 or another 34p per diluted share which would take the valuation up to just under 363p per share excluding any value for the US business.

As I said earlier, this is a rough and ready exercise and is not meant to be an opinion on the investment merits or otherwise of Purplebricks shares. But it does give some insight as to what the business – excluding the US – would be worth based on a given set of assumptions.

Your job as a private investor is to work out what assumptions are reasonable but I have given you some kind of steer as to how to calculate the value of them. This is moderately advanced analysis but it is great for getting you to think about different scenarios and what they might mean for a company’s valuation.

Step 7: Don’t ignore the risks

When you come across a business that you like the look of and think has good growth prospects there is a danger that you become too optimistic about it and let it cloud your judgement. This can lead you to overvalue a business. Try and keep your assumptions about the future of a business conservative and realistic if you can.

As well as focusing on the upside you should make yourself aware of the risks facing a young business such as:

- Will it survive? Will it need to raise more cash?

- Is its business model sustainable? For example, bears of Purplebricks point out that customers pay regardless of whether their home is sold or not. In a falling housing market, customers might baulk at paying a fixed fee if a sale will be hard to achieve. They might prefer to sell with a traditional estate agent who is incentivised to earn commission from a sale instead.

- How will competitors react? Could a price war take place and make your profit assumptions unrealistic?

- Will your shareholding get diluted by the aggressive use of share options? The use of options is quite common in young companies. Purplebricks has over 20 million of outstanding options with an exercise price of virtually nothing so these are likely to be turned into shares in the future and dilute other shareholders.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.