So small it’s almost invisible | ARC, CHRT, RNWH

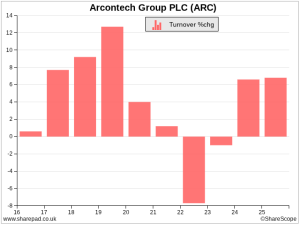

Richard is tempted by a growing business that employs 18 people and only earns £3m turnover. If it were up to him, all firms would disclose their chief executive to median employee pay ratio. Just one company has published an annual report and passed the minimum quality filter since my last update. To pass the