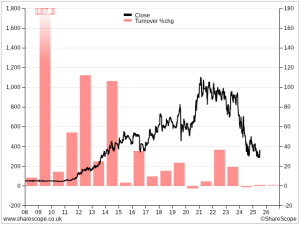

5 Strikes: Getting Tracsis (TRCS) back on track

With no new companies making it past his 5 Strikes filter, Richard examines transport software house and consultancy Tracsis’ rise and fall. To rise again, he thinks it must navigate a strategic minefield. 5 Strikes Since my last update, three big and ugly looking companies have published annual reports and passed my minimum quality filter.