Scapa Group has transformed itself over the last few years by following a strategy of offering more value to its customers. It has worked well and has seen a significant boost in profits which has helped to make its shares an exceptional investment.

The business

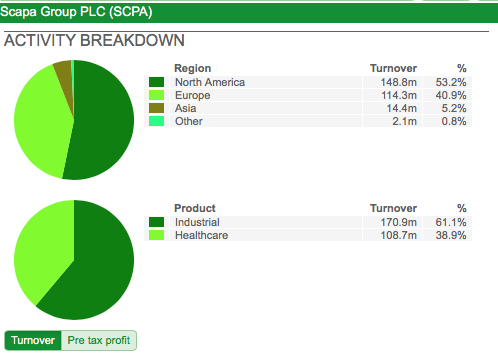

Scapa Group describes itself as a supplier of bonding solutions and manufacturer of adhesives for healthcare and industrial markets. It has manufacturing plants in Europe, US and Asia.

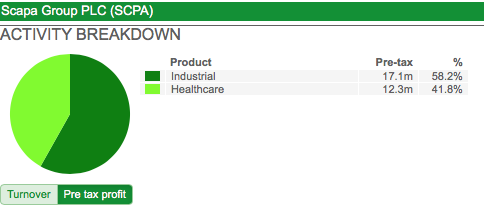

It makes most of its money outside of the UK and has been a big beneficiary from the weakness in sterling over the last year or so. Whilst the Industrial business contributes a larger chunk of turnover and profits at the moment, it is the Healthcare division which is likely to be the main driver of future profits growth.

Let’s look at the two businesses a little more closely.

Healthcare

This business works in partnership with major healthcare companies (such as Johnson & Johnson) to develop, manufacture and deliver to market products in three key areas:

- Advanced Wound Care – dressings with skin-friendly adhesives that can be used in a number of medical applications with high levels of performance and long wear times.

- Consumer Wellness – plasters, bandages, corn plasters and heel cushions sold into consumer markets.

- Wearable Medical Devices – a business with similarities to wound care. It focuses on products with skin-friendly adhesives which can stick medical devices such as monitors, drug infusers and testing equipment to a patient’s skin.

This business has benefitted from the increasing trend of outsourcing by big healthcare companies in recent years. These companies are under lots of pressure to provide their products at the lowest possible price and they need an efficient way of doing that.

One option open to them is to spend a lot of money on research and development, manufacturing plants and logistics. The other option is to give the job to a company such as Scapa.

Scapa’s strategy is to offer itself as a one-stop shop that can fulfill the needs of the big healthcare companies. It does so by offering the following capabilities for products:

- Research and development

- Design

- Manufacturing

- Quality and regulation control

- Cost control

- Delivery to market

With plants across the word, Scapa seems to be well placed to do this for global healthcare companies. It says that it can take a product to market faster than many of its customers can do internally.

In recent years, the company has made a number of acquisitions to boost its product offering. The most recent one is Euromed in 2016 which came with a portfolio of hydrocolloid products that allows Scapa to make inroads into the health and beauty market.

Scapa has many long-term supply agreements with major healthcare businesses and has over £200m of contracted revenue. It has a number of new products in development and is confident that the recent growth rates in sales can continue with the help of some more acquisitions.

By offering complete product solutions from design right through to delivery, the company is aiming to grow both its revenues and profit margins at the same time.

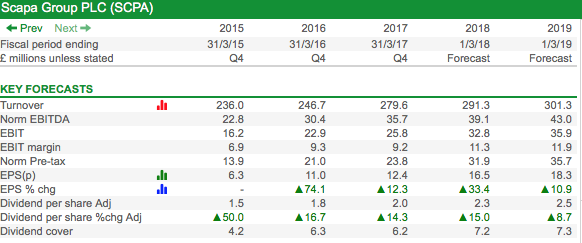

The recent track record of the business is good as shown in the table below.

| Scapa Healthcare (£m) | Sales | Trading profit | margin |

|---|---|---|---|

| 2017 | 108.7 | 16.6 | 15.30% |

| 2016 | 93.3 | 14 | 15.00% |

| 2015 | 73.8 | 9.2 | 12.50% |

| 2014 | 69.2 | 10.2 | 14.70% |

| 2013 | 57.4 | 8.4 | 14.60% |

| 2012 | 39.5 | 5.5 | 13.90% |

Sales and profit growth has been pretty decent whilst the profit margins are a sign that this is a very good business.

A closer look under the bonnet shows that underlying revenue growth was not that stellar in the year to March 2017. If the 10 months’ contribution from Euromed and the benefits from the weaker pound are stripped out then underlying sales actually fell by 4.6% at constant exchange rates.

The good news is that margins are going up as the company offers more complete solutions to its customers. Profit margins during the second half of the year were over 16% and the company is confident that it can maintain that level of profitability going forward.

Industrial

This business specialises in adhesives and tapes that are used in a variety of industrial and specialist applications. Its products are used extensively in the following areas:

- Automotive

- Building

- Insulation

- Data and power cables

- Smartphones and computers

By Scapa’s own admission this business is very mature and is unlikely to grow much faster than the global economy. As with the Healthcare business, sales received a nice boost from the lower pound in 2016/17. Profits growth in recent years has come mainly from cost cutting, efficiency gains and a focus on return on capital employed (ROCE).

| Scapa Industrial (£m) | Sales (£m) | Trading profit (£m) | margin |

|---|---|---|---|

| 2017 | 170.9 | 17.8 | 10.40% |

| 2016 | 153.4 | 10.7 | 7.00% |

| 2015 | 147.8 | 8.9 | 6.00% |

| 2014 | 145.7 | 7.9 | 5.40% |

| 2013 | 140.7 | 7.2 | 5.10% |

| 2012 | 145.9 | 7.2 | 4.90% |

There has been an impressive increase in profit margins in this division and the management are confident of taking them even higher into the mid teens percentage that some of its competitors achieve. The company has been shutting factories – such as the one at Rorschach in Switzerland last year – and is getting some good cost savings and efficiency gains from doing so.

Assuming mid teens means something like 15% then there seems to be good grounds to think that there could be some reasonable profit growth from Scapa’s Industrial business over the next few years even if underlying sales don’t grow much.

Do the numbers stack up? Let’s see how Scapa measures up against some key financial performance measures.

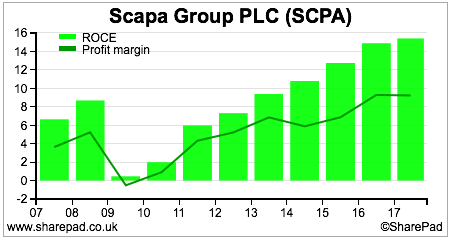

Return on capital employed (ROCE) and profit margins

You can see that the company has made an impressive improvement in ROCE and profit margins since the last recession. ROCE is now at a very good level and could go higher as Healthcare grows, margins improve and assets are taken out of the Industrial business.

A big dip in profitability in a recession would usually put me off a company, but I think Scapa is a different business today than it was back then. Yes, the Industrial business will still be cyclical but the Healthcare business is much bigger than it was back in 2009 and adds more recession resilience to Scapa as a whole.

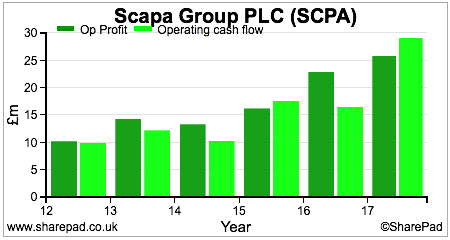

Turning profits into cash

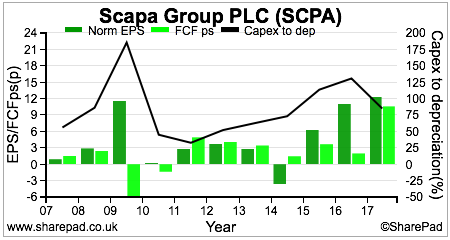

Scapa’s operating cash flow conversion – comparing operating cash flow with operating profits – has not been brilliant in recent years but improved markedly last year.

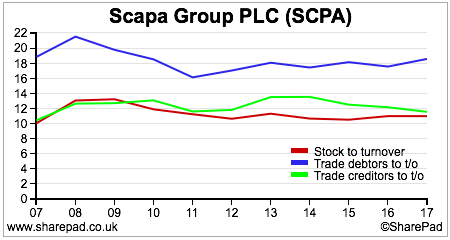

The company does have some working capital requirements as trade debtors and stock levels are using more cash than can be offset by trade creditors. This means that there tends to be a trading cash outflow when sales are growing. Working capital levels look to be under control although there was an increase in the trade debtors to turnover ratio in 2017 (the upper line in the chart below).

I don’t see this as a concern as this was probably due to the closing levels of trade debtors being inflated by a lower value of the pound rather than a relaxation in credit terms to drive growth.

Other operating cash outflows have come from exceptional items and top up payments into the final salary pension fund.

The trends in operating cash conversion are largely mirrored when looking at free cash flow conversion. There have been a few patchy years when conversion has been poor but last year’s performance was decent.

Generally speaking, I’d like to see a slightly better cash conversion performance from Scapa but it isn’t terrible and certainly doesn’t seem to be a sign of any profit manipulation in my view.

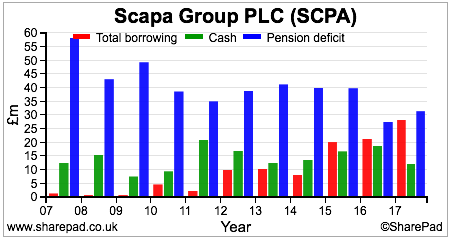

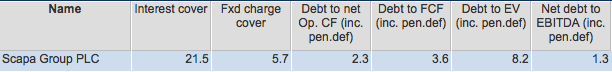

Debt levels

Scapa does have some debt and a pension fund deficit as well. However, a look at various debt ratios and measures such as interest cover and fixed charge cover suggest that the company’s financial position is very strong.

Outlook and valuation

Scapa looks to have very reasonable growth prospects. The Healthcare division has a good pipeline of new products, a significant contracted revenue stream and looks well placed to win more business at higher profit margins. The Industrial business could still see material improvements in profitability from its self help initiatives.

The company did sound a note of caution at its full year results announcement in May that its short term revenue performance is likely to become more volatile as more business moves towards complete solutions rather than specific products. It will also be affected by the timing of new product launches by Healthcare customers.

The other thing to keep an eye on is the tax rate on the company’s profits. It was 20% in 2017 which is low considering that the company makes most of its profits in countries where the corporation tax rate is higher than the UK.

Scapa has been benefitting from unrecognised tax losses in the UK which have kept its tax rate low. But these will be used up as profits grow and there is a chance that the tax rate on profits will increase and lead to EPS growing at a slower rate than trading profits.

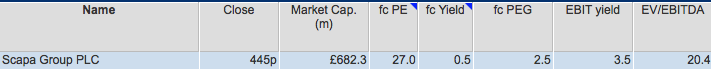

I think Scapa has many of the hallmarks of a quality company that can continue to grow its profits. Unsurprisingly, the market has attached a fairly high valuation to its shares.

This might put some people off. That said, I think that there is a growing recognition amongst investors that high quality businesses are scarce and are worth paying up for if you have a long-term investing horizon. After all you wouldn’t expect to be able to buy a brand new BMW for the same price as a Dacia Duster and the same reasoning increasingly applies to high quality companies and their shares.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.