Six shares achieve less than three strikes. Among the haul of heroes are card shop or “celebrations destination” Card Factory, a software provider to the construction industry, and cosmetics brand Warpaint. Meanwhile, Richard’s pursuit of Spirax continues, even though traders are losing confidence in it.

First off 5 Strikes, and six companies with good track records.

5 Strikes

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| Warpaint London | W7L | 20/5/25 | 19.2 | – Shares | 1 |

| Card Factory | CARD | 19/5/25 | 0.3 | – Holdings – Debt | 2 |

| Metals Exploration | MTL | 19/5/25 | 2.9 | – CROCI – ROCE – Shares | 3 |

| Concurrent Technologies | CNC | 16/5/25 | 0.9 | ? Holdings – CROCI ? Growth ? ROCE – Shares | 3 |

| London Security | LSC | 16/5/25 | 0.2 | – Holdings | 1 |

| Andrews Sykes | ASY | 15/5/25 | 3.3 | – Holdings – Growth | 2 |

| Spirent Communications | SPT | 15/5/25 | 0.5 | ? Holdings – Growth – ROCE | 2 |

| Eleco | ELCO | 12/5/25 | 0.1 | – Holdings ? Growth | 1 |

| Click here for our 5 Strikes explainer | 23/05/2025 | ||||

Andrews Sykes (- Holdings – Growth) and London Security (- Holdings) torture me because their numbers are almost perfect but for one. Family trusts hold more than 75% of the shares in each company – enough to pass a special resolution at a general meeting. Though both companies have long been listed, I can’t bring myself to invest alongside shareholders that could delist them in the blink of an eye.

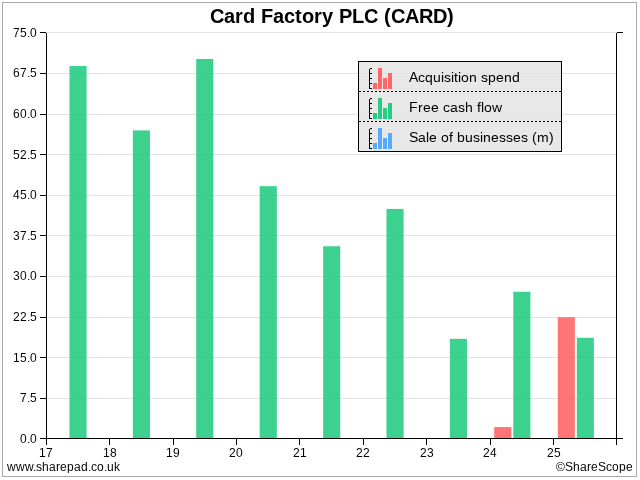

Card Factory (- Holdings – Debt)

Unlike Andrews Sykes and London Security, Card Factory, a greetings card and gift retailer, scores a strike because the directors own too few shares. There is a happy medium between total control and not having enough skin in the game.

Two interesting developments falling out of the 5 Strikes data are a mini-surge in acquisitions and a decline in debt and lease obligations as a proportion of capital employed.

I am not sure how the company managed to reduce gearing marginally in the year to January 2025, while spending more than it earned in free cash flow on acquisitions. The lower gearing is welcome, but not low enough for me.

The free cash flow was invested in toe holds in overseas markets: South Africa, Ireland, and the USA.

Overseas acquisitions are more risky than rolling out an already successful format in the UK, which may mean the company believes its UK business is maturing. A well-presented annual report says Card Factory plans more UK stores, but it focuses on selling more through them by continuing to evolve from a chain of card shops to a “celebrations destination”.

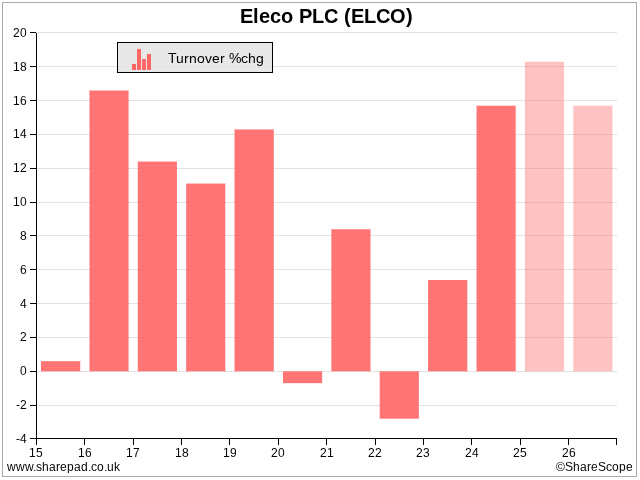

I don’t think two minor bumps in the road in 2020 and 2022 are sufficient to put me off Eleco (- Holdings ? Growth). Although turnover declined marginally in those pandemic years, there is probably a pandemic-related explanation.

Eleco provides software as a service to a wide range of companies and organisations involved in building and managing property. Its customers include construction companies, contractors, landlords, and property owners like manufacturers and transport companies.

Most of its revenue comes from “Building Lifecycle” software that helps with project management, portfolio management, maintenance management and estimates. Unsurprisingly perhaps, the company is busy integrating artificial intelligence into these products.

Like Card Factory, Eleco has been acquiring lately, mostly adding to the Building Lifecycle software portfolio.

Spirent (? Holdings – Growth – ROCE) is in the process of being acquired by Keysight, a larger and more diversified US provider of testing and measurement equipment, software, and services. Unless that deal falls through, it is of no further interest.

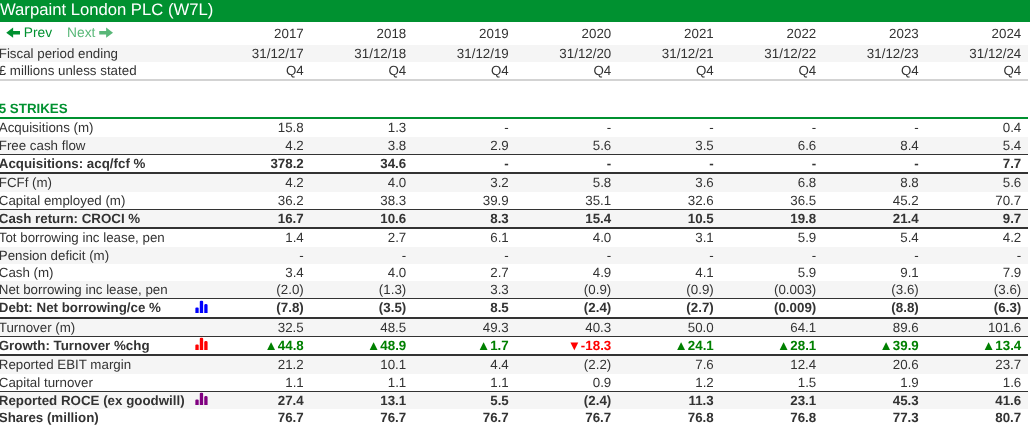

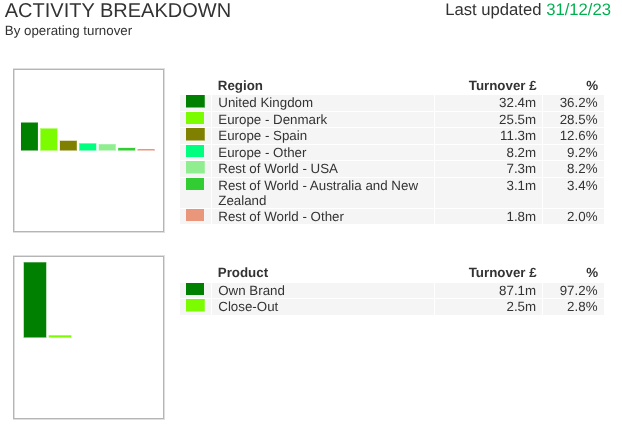

Although Warpaint’s record [- Shares] since the cosmetics company floated in 2016 has been very impressive, next year’s results will bear the gloss or the scars of a significant acquisition completed in February 2024, after the company’s December year-end.

Source: ShareScope custom table

Warpaint has acquired Brand Architekts, another challenger beauty brand. The £14 million cash cost was funded by a placing in December. The consideration was significantly more than Warpaint’s free cash flow in 2024, and brokers’ forecast for a combined free cash flow of £11 million in 2025.

I wonder if Warpaint’s sourcing could become an Achilles heel in this era of more fractious trading relationships. All manufacturing is outsourced to third-party suppliers, predominantly in Asia. The company’s biggest supplier is in China. That supplier was responsible for 17.5% of revenue in 2024.

Warpaint is addressing the risk, though. Its risk report stresses that revenue from its biggest supplier fell for the first time (from 19%) in 2024. It holds four to six months in stock, perhaps giving it time to find alternative suppliers in an emergency, and “the sourcing of new suppliers in a wider geographic location is ongoing”.

While the trade war is largely being waged between the US and China, it would appear the risk is limited by the high proportion of Warpaint sales in Europe and the UK and a modest 8% of sales in the US.

Spirax: Two big “ifs”

My previous article on industrial equipment manufacturer Spirax ended on something of a cliffhanger. After a period of acquisitive growth, its focus now is on knitting together two of its divisions, Steam Thermal and Electrical Thermal. This will help industries electrify their processes, for example, by electrifying gas boilers, increasing Spirax’s addressable market and maybe improving its profitability.

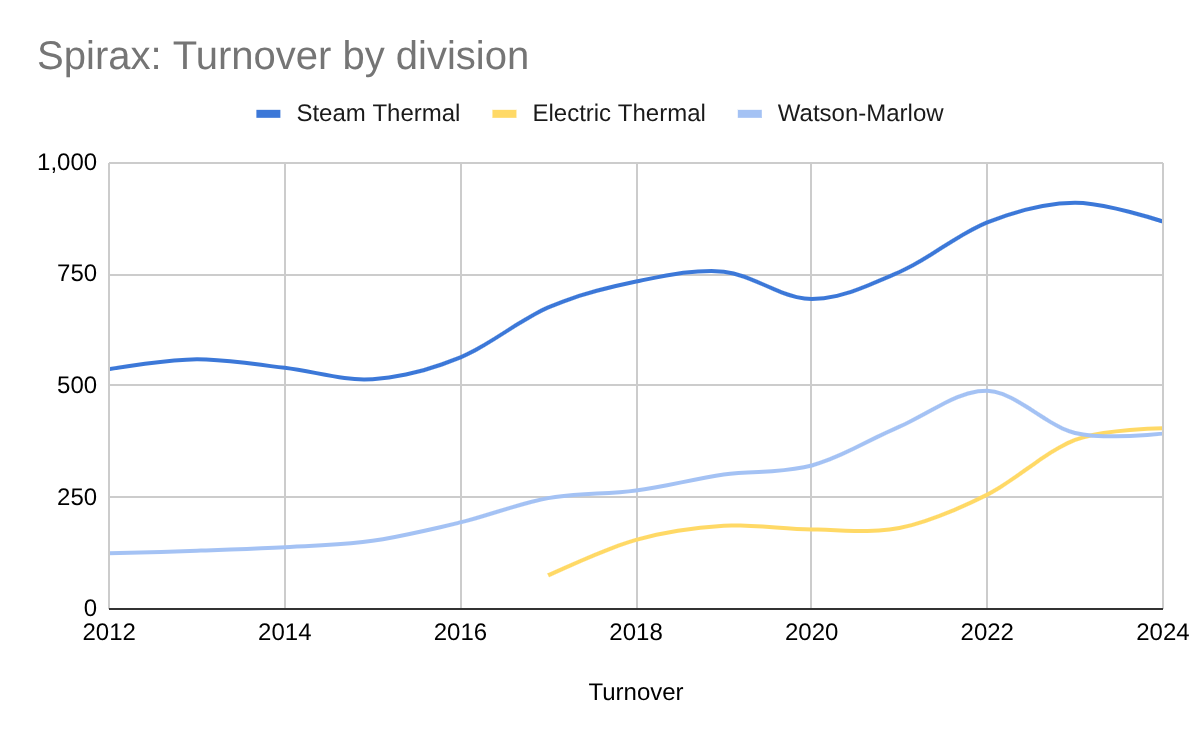

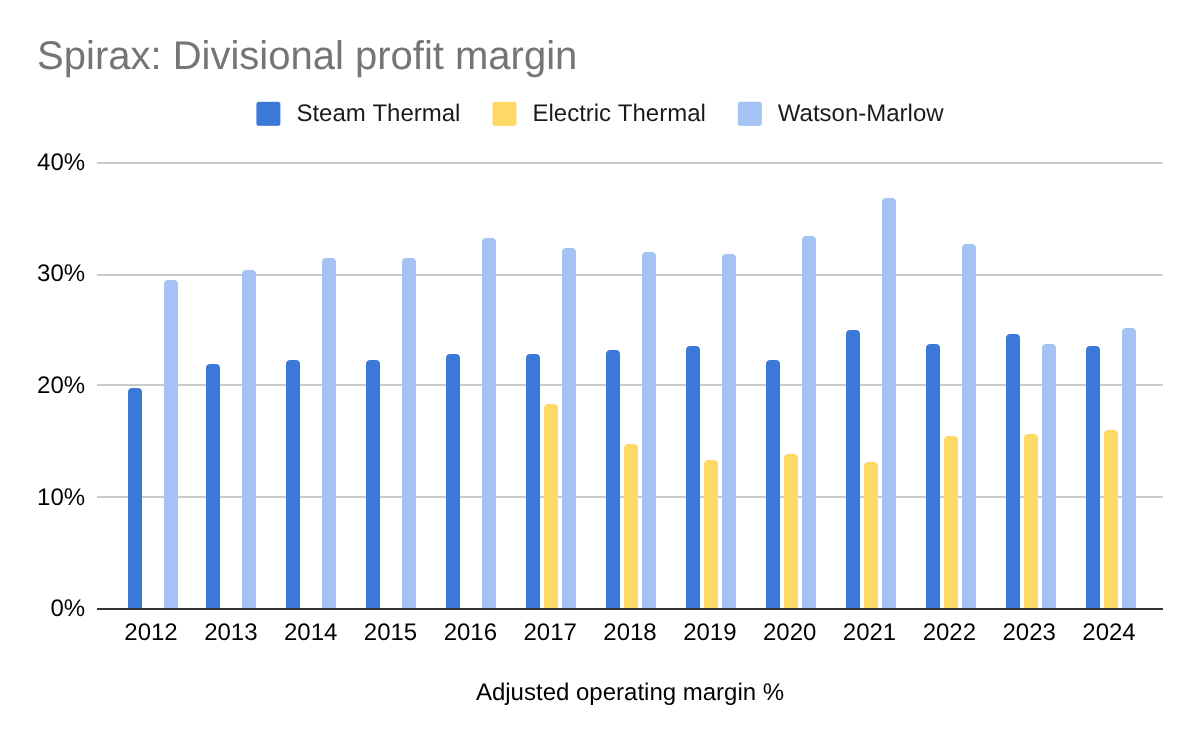

I have updated my divisional performance charts with the data from the 2024 annual report, to see whether there is evidence of improvement in the numbers:

Source: Spirax annual reports

The good news is Electric Thermal grew by 7% in 2024, and since Spirax’s last acquisition was in 2022, the result was organic.

Organic growth in the Electric Thermal division is important because Spirax is much more heavily in debt than it was and adding acquisitions at the rate it has been would be unsustainable.

It is also time to demonstrate that Spirax can grow under its own steam because the Electric Thermal division has not grown much since 2018, the year after Spirax started to divert resources into Electric Thermal.

Aided by a small acquisition, Steam Thermal turnover is 18% higher over the six-year period. Watson-Marlow, Spirax’s third division, has grown faster, by 48%, although as we shall see, its growth has been distorted by the pandemic.

Electric Thermal profit margin (yellow bars) remains stuck in the mid-teens, though, unlike Steam Thermal’s profit margin of between 20% and 25%. Consequently, the jury is still out on Electric Thermal.

A second successive year of subpar profitability at Watson-Marlow (light blue bars) also raises questions.

Watson-Marlow has experienced a Covid hangover. Revenue in 2024 was flat after a big drop in 2023, the result of customer overstocking during the pandemic. You can see the spike in the light blue line of the “Turnover by division” chart above.

Watson-Marlow manufactures peristaltic pumps, and other equipment used in industrial processes to control fluids. At the height of the pandemic, pharmaceutical companies developing and manufacturing vaccines used the company’s products to pump, dose and fill vaccines.

The share of Watson-Marlow’s revenue from Biopharma (a contraction of biotechnology and pharmaceutical) firms peaked at 60% in this period.

Overstocking explains lower demand and revenue since the pandemic abated. It may also explain lower margins because Watson Marlow added capacity to meet the extraordinary demand. It may be operating less efficiently now volumes have fallen.

Spirax was a feted “quality stock”, valued at a premium share price. If it is to achieve that status again, it needs profitability at Watson Marlow to recover as volumes do. This is what Sprirax thinks will happen “over the medium term”.

It also needs customers to electrify their industrial processes, which depends on their desire to decarbonise and the availability of green electricity. I don’t think Spirax has offered us a timescale on the greening of industrial processes.

With the shares 66% below their post-pandemic peak, it seems traders think Spirax will make slow progress.

Gut feeling, having consumed all these facts: Spirax is still a pretty good business, and might well reward a bit more patience!

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.