Sifting through the IPO carnage of recent years leads to high-margin, cash-rich BIG Technologies. Maynard Paton reviews the tagging specialist’s positive progress, entrepreneurial boss, generous options and current valuation.

“It’s Probably Overpriced“

IPOs have suffered badly during the last few years.

Buoyant markets encouraged lots of companies to go public at optimistic valuations…

…only for economic conditions to turn and valuations to quickly deflate.

ShareScope lists 225 shares that joined the stock market since the start of 2020, of which 168 (75%) currently trade below their flotation price — including 66 that have lost 80% or more of their value.

But could the flotation carnage now be hiding good buying opportunities?

I have devised a new ShareScope screen to search among the IPO rubble, seeking companies that have:

- Floated since the start of 2020;

- A market cap of more than £50 million;

- Net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero);

- A positive operating margin (i.e. are profitable);

- Director holdings of 10% or more, and;

- A GBP-denominated share price.

(You can run this screen for yourself by selecting the “Maynard Paton 21/02/25: BIG Technologies” filter within ShareScope’s brilliant Filter Library. My instructions show you how.)

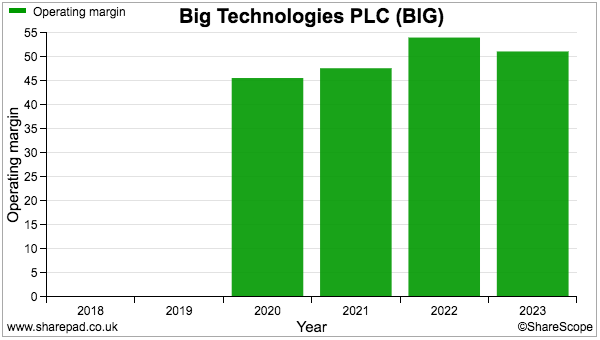

ShareScope returned 11 matches, and I selected BIG Technologies because of its remarkable 51% operating margin and hefty 49% post-IPO share-price dive.

Let’s take a closer look.

Introducing BIG Technologies

“I felt my heart stop for a moment when I thought my daughter was missing…I went running around the shop and thankfully found her in a few minutes.

“But that really got me thinking — with all this modern technology, I should be able to access something to help me find my daughter when I need to.“

So recounted Sara Murray during this interview about why she established what became BIG Technologies during 2005.

Teaming up with technical engineers, Ms Murray launched a GPS wristband called ‘Buddi’ for parents to track the whereabouts of their children.

However, Buddi’s keenest customers were not parents of young children… but actually adult children wishing to monitor elderly parents. Local authorities then saw the GPS wristband as an affordable alternative to residential care.

By 2009, BIG was supplying Buddi to track patients at a medium-secure NHS hospital, while by 2010 was supplying Thames Valley police for domestic-violence and witness-protection purposes.

Working with the police led to the Buddi Smart Tag, which could be used to help rehabilitate offenders by cross-checking their movements against reported crimes.

BIG almost hit the big time when it was deemed a ‘preferred bidder’ for the Ministry of Justice’s national electronic-tagging contract starting in 2014. BIG did not secure the contract, and its website now claims its chances of winning were “limited given the perceived risk of awarding a national contract to a small company“.

But reports at the time imply BIG fell out with the MoJ, with the latter feeling the need to clarify the details. The spat may have influenced the MoJ’s decision to controversially award its latest tagging contract to Serco and G4S, both of which overcharged the MoJ during a previous tagging agreement.

Last year BIG implied the MoJ had ignored its “leading-edge technology”:

“We were disappointed not to be selected by the UK Ministry of Justice for the national contract to supply electronic monitoring services in England and Wales. In this instance, the customer chose to remain with their existing long-term supplier primarily due to up-front cost considerations, despite their admission of over-charging in a previous contract and fine following investigation by the Serious Fraud Office. We will continue to work hard to educate potential customers on the benefits that our leading-edge technology brings.“

BIG in fact claims its “leading-edge” service makes the company a “disruptor in the criminal-justice market“, whereby other suppliers are said to “lack innovation” and utilise “outdated technologies“.

BIG has always been proud of its smaller, lighter and ergonomic tags, which offer comprehensive location data, extended battery lives, short installation times and, crucially, tamper-proof straps. The GPS employed is far more technically advanced than the equivalent used in mobile phones.

Despite the MoJ’s national contract snub, BIG does fulfil a smaller MoJ arrangement and continues to supply 80% of UK police forces.

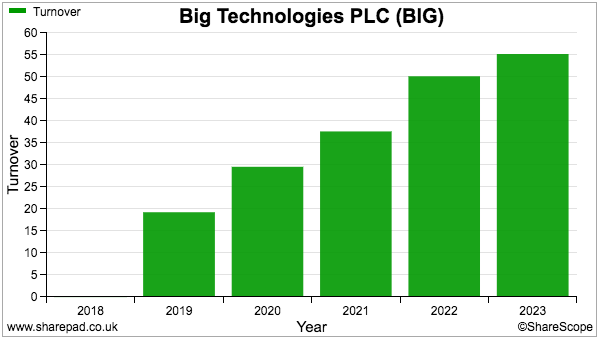

The group has become increasingly recognised abroad. Services are now provided within 13 countries through 100-plus contracts with various national and regional agencies. Such contracts have propelled revenue from £19 million to £55 million between 2019 and 2023:

Note that 75% of BIG’s 2023 revenue was generated by just ten customers, with the largest three supporting a sizeable 55%.

Major overseas customers are located in Australia and New Zealand, with the latter’s Department of Corrections recently agreeing to an eight-year national contract. Typical contracts run for between three and five years and today 98% of total revenue relates to tagging.

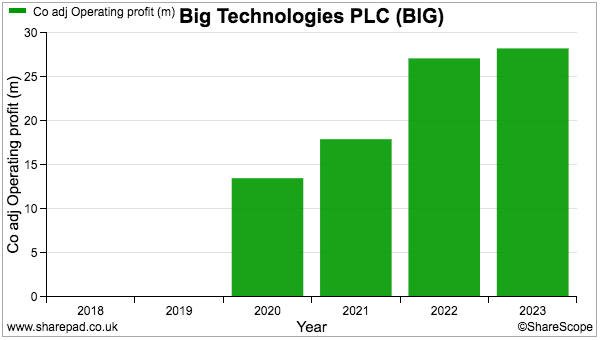

Adjusted profit has followed revenue higher, advancing from £6 million to £28 million between 2019 and 2023:

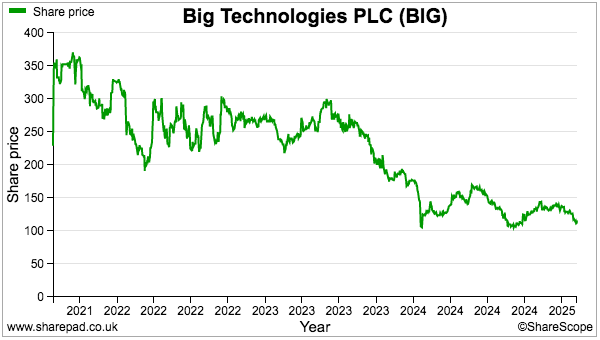

But the shares have declined significantly after joining AIM during 2021:

The 200p flotation price then supported a £577 million market cap — equivalent to a racy 37x that year’s adjusted earnings. Reaching 350p immediately afterwards then gave a £1 billion market cap at a stratospheric 65x earnings.

BIG’s growth story has sadly faltered, with a trading statement last month confirming revenue and profit for 2024 would be lower than recorded for 2023 due in part to the loss of a large Colombian customer.

Operating margin and share-based payments

BIG’s operating margin scored extremely well on my initial filter:

The group’s adjusted margin has in fact topped 45% since the flotation and reached an amazing 51% last year.

BIG’s profitability reflects the economies of scale from employing a single software application to handle those 100-plus customers. The tags are meanwhile leased on a daily or monthly basis and provide recurring income, with revenue from additional tags presumably attracting very little incremental cost.

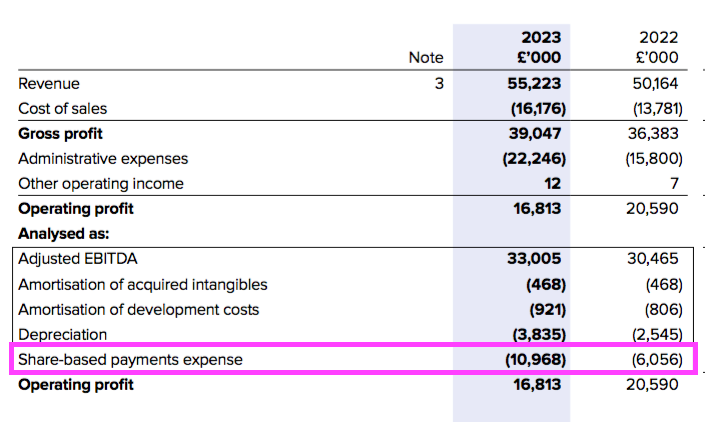

Note that BIG’s adjusted profit does overlook an enormous share-based payment:

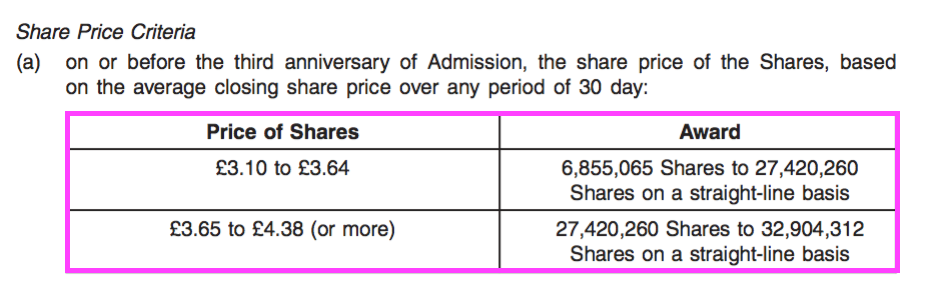

The share-based expense reflects a ‘Growth Share Plan’ (GSP) introduced at the flotation.

This GSP paid out if the share price traded at an average of 310p or more for 30 days within three years of the IPO:

That earlier share-price chart indicated the GSP’s price target was achieved about a month following the flotation…

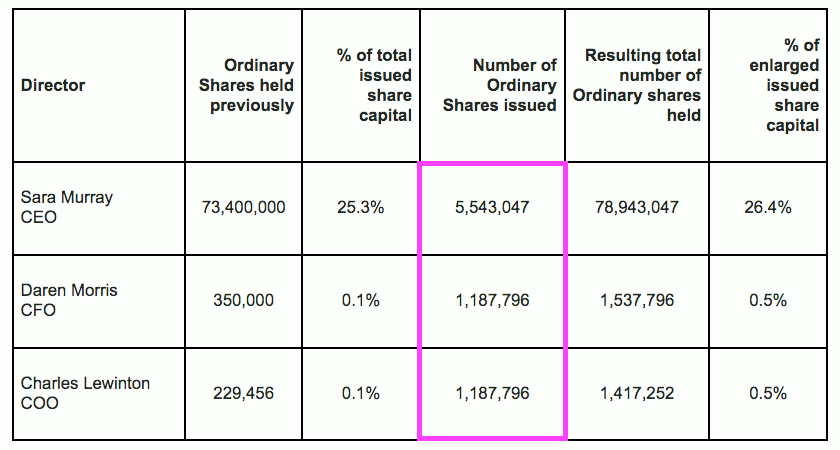

…which prompted 7.9 million shares to be given to the aforementioned Ms Murray and two fellow executives:

Two further batches of 7.9 million shares will be issued during 2025 and 2026, which will increase the current share count by 5%.

An aggregate of £17 million was charged as a GSP share-based payment during 2021, 2022 and 2023, and BIG has estimated another £17 million will be incurred during 2024 and 2025.

Whether the total £34 million GSP charge should be viewed as an underlying expense is debatable.

After all, the GSP could be a one-off scheme and does not incur any direct cash expenditure. Mind you, BIG has spent approximately £10 million buying shares that could be reissued to offset further GSP dilution.

The acid test of any option payout is whether value has been created for all shareholders. BIG’s share-price performance to date suggests the GSP has benefitted only its three participants.

Nonetheless, treating BIG’s share-based payments as a genuine cost would still leave the 2023 margin at a super 30% — suggesting the business does undertake an inherently lucrative activity.

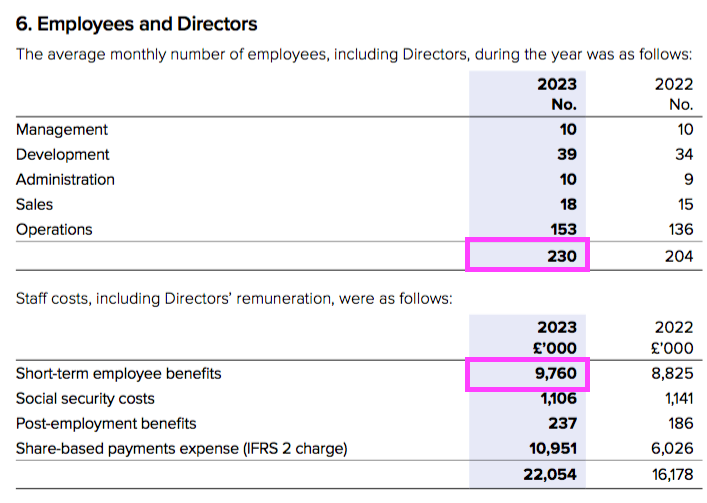

Employees

BIG’s super margin is supported in part by a very productive workforce.

During 2023 for example, BIG’s total salary bill came to £10 million and absorbed 18% of revenue:

Dividing the £10 million by the 230 headcount gives an average £42k salary — which does not seem high given the group supplies “leading-edge technology“.

BIG designs, develops and manufactures its products within the UK, and I can only assume the low-ish average salary is due to the high number of customer-support personnel. Employees are apparently very happy, with staff turnover described as “extremely low” during 2021, 2022 and 2023.

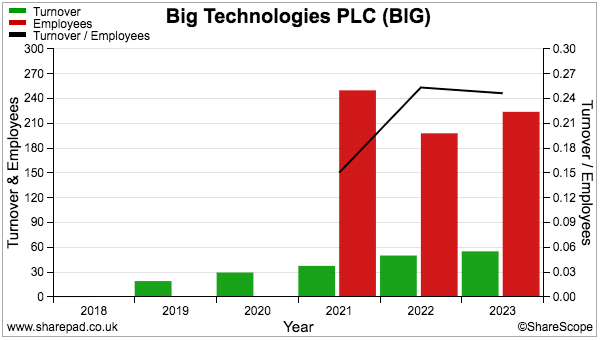

Revenue of £55 million from 230 employees equates to £240k per person, which is a very attractive level given the £42k average wage and leaves shareholders with that strong margin.

BIG’s short quoted history means ShareScope’s employee data is limited, but evidence of workforce efficiencies may have already emerged:

During 2022, BIG managed to improve revenue by £12 million to £50 million despite reducing its headcount by 47 to 204 following “contractual changes in the Americas region“.

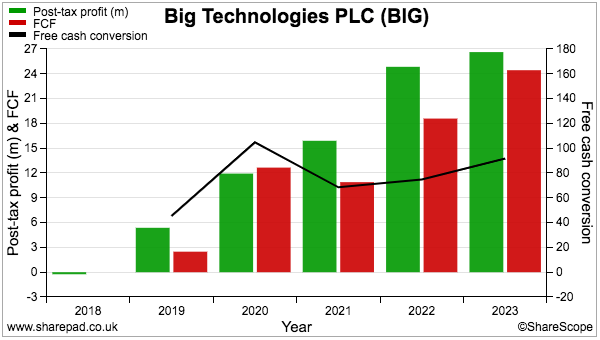

Cash flow and ROE

Other parts of BIG’s accounts appear in very reasonable order.

Cash conversion has improved during the last few years, with 2023 witnessing 91% of adjusted earnings translated into free cash:

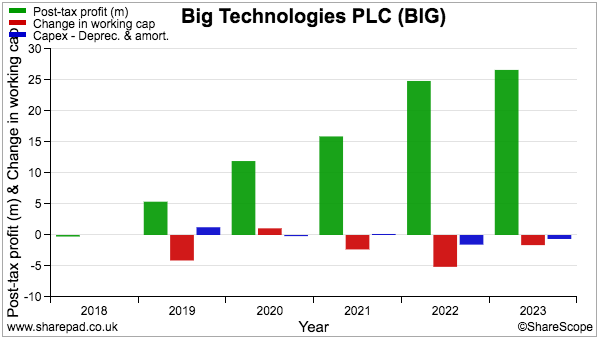

ShareScope reveals £13 million has been injected into additional working capital since 2019 (red bars below)…

…which looks to have been a very sensible investment given how adjusted profit rallied from £6 million to £28 million during the same time.

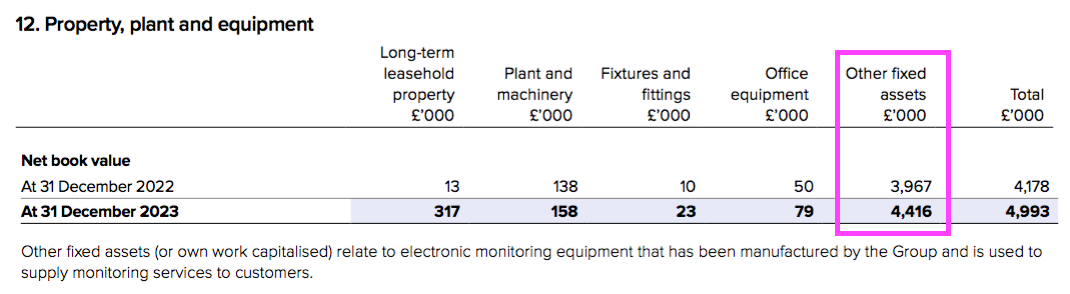

BIG’s tangible assets highlight the impressive economics of tagging contracts.

‘Other fixed assets’ represent tagging equipment manufactured by the group and used by customers, and at the end of 2023 were valued at less than £5 million…

… which is a very low number given revenue from such equipment was £55 million that year.

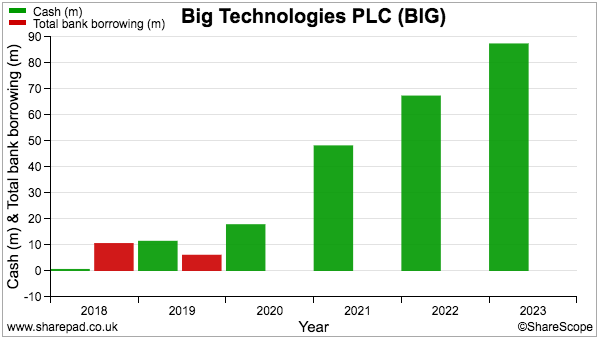

BIG’s cash position has climbed higher:

BIG privately raised £10 million during 2019 (at the equivalent of 67p per share) while the 2021 flotation raised a further £20 million. No dividends have since been paid, and at the last count, the bank balance topped £94 million — equivalent to 27% of the recent market cap — with no conventional borrowings.

Alongside the cash and the aforementioned ‘other fixed assets’, BIG’s balance sheet comprises mostly goodwill of £13 million and working capital of £11 million.

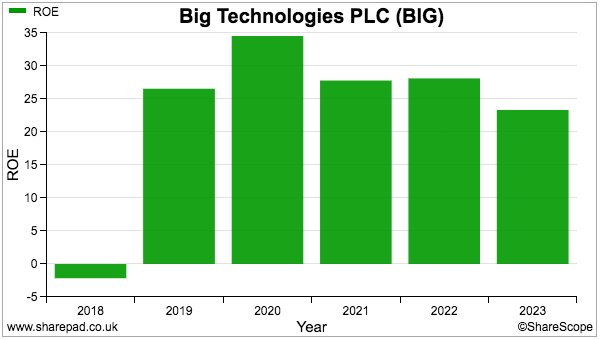

Whether BIG’s bumper cash pile and goodwill (created through a one-off pre-flotation transaction) should really be included in an ROE calculation is debatable.

However, ShareScope’s 20%-plus figures suggest the group is a fundamentally capital-light operation even with every asset included:

Boardroom

The aforementioned Sara Murray remains on BIG’s board as chief executive:

Including those additional shares collected through the GSP, Ms Murray retains the ‘owner’s eye’ with a 26%/£92 million shareholding:

Ms Murray certainly boasts an entrepreneurial CV. She commendably started her first business at age 21 and notably founded what became Confused.com after an insurance client could not see the potential of a comparison website.

However, not everyone is a fan of Ms Murray’s achievements.

In particular, some former shareholders of what became BIG have launched a legal battle citing the “undisclosed interests” of Ms Murray, which the group claims are “wholly untrue“.

Another story then alleged Ms Murray conducted an offshore deal “to acquire Confused.com… for ‘a lowball’ price before sale“.

BIG’s flotation document meanwhile listed two legal disputes in the States, one with a customer and one with an offender tagged by that customer.

The group also pays a company owned by Ms Murray £100k a year to use a patent for R&D purposes. She may then collect 3.5% of any revenue from BIG’s products employing that patent. I don’t know whether this arrangement could one day create a conflict of interest.

Valuation and summary

A trading update published last month confirmed BIG’s forthcoming 2024 results will show revenue down 9% to £50 million and adjusted EBITDA down 18% to £27 million.

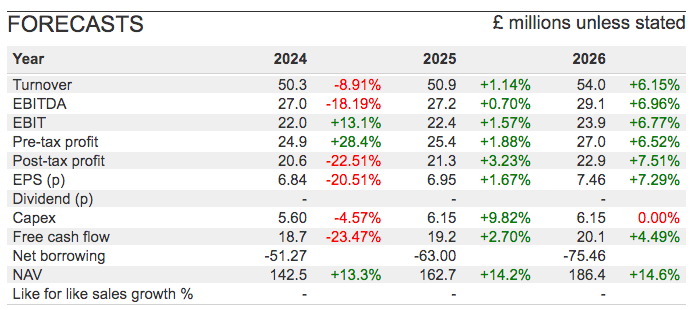

However, brokers reckon the group will experience a modest recovery during 2025 and 2026:

The 117p shares trade at 17x near-term EPS forecasts, although adjust for the bumper cash pile and the underlying business seems valued at nearer 12-13x even with the full GSP dilution.

A 12-13x rating does not seem excessive for an operation that enjoys recurring revenue, high margins and increasingly modest demands on cash flow. A few new contracts, particularly in the priority American market, and IPO may even become IPU: “It’s Possibly Underpriced“

Downsides include relying on a few large clients and, as dealings with the MoJ and the (now former) Colombian customer imply, niggling doubts as to why a “leading-edge” service does not always win tenders.

Future returns will undoubtedly depend on the leadership of Ms Murray, who should be applauded for starting BIG and, according to one source, still “lives and breathes” the business.

But her GSP payouts are not obviously aligned with outside shareholders while that adverse press coverage is far from ideal.

Be aware that BIG does not publish investor presentations on its website nor, from what I can tell, undertake any webinars. A revealing anecdote comes from a BIG AGM attendee, who tells me Ms Murray seemed “a little cold” at the meeting and never spoke to him.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in BIG Technologies.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.